Global Trade War: On the Efficiency of US Steel and Non-US Steel

Companies

Yuan Ekananda Muhammad Adikara and Dr. Sri Herianingrum, SE., M.Si

Postgraduate School, Universitas Airlangga, Jl. Airlangga No. 4-6, Airlangga, Gubeng, Surabaya, Indonesia

Keywords: US Steel Companies, Non-US Steel Companies, Global Trade War, Efficiency, Data Envelopment

Analysis.

Abstract: This study aims at analyzing the efficiency of steel companies in the United States and outside the United

States to measure their comparative strengths to confront the global trade war based on Data Envelopment

Analysis. Quantitative approach was employed by means of Data Envelopment Analysis by the assumption

of Variable Return to Scale. The respondents were four US based steel companies and non-US based steel

companies. Intermediation approach was used in measuring the inputs and outputs. Input variables

comprised the assets and labor cost; while the Output variables consisted of operational profit. This study

has found that no steel company was efficient during the observation period. It has been revealed that there

was significant difference in efficiency performance between US based steel companies and Non-US based

steel companies.

1 INTRODUCTION

The Trump tariffs are a series of tariffs imposed

during the presidency of Donald Trump. In January

2018, Trump imposed tariffs on solar panels and

washing machines, and later the same year, he

imposed tariffs on steel and aluminum. Beginning

on June 1st, 2018, Trump administration imposed a

25% tariff on imports of steel, and a 10% tariff on

aluminum, on the European Union, Canada, and

Mexico. The tariffs angered U.S. allies, who planned

retaliatory tariffs on U.S. goods, and heightened

chances of a trade war. China said that it will

retaliate for the tariffs imposed on $50 billion of

Chinese goods that come into effect on July 6. India

is also planning to hit back to recoup trade penalties

of $241 million on $1.2 billion worth of Indian steel

and aluminium. Other countries, such as Australia,

are concerned of the consequences of a trade war

(Long, 2018).

2 LITERATURE REVIEW

A trade war is an economic conflict resulting from

an extreme protectionism in which states raise or

create tariffs or other trade barriers against each

other in response to trade barriers created by the

other party. Increased protection causes both nations

output compositions to move towards their autarky

position. For example, if a country were to raise

tariffs, then a second country in retaliation may

similarly raise tariffs. An increase in subsidies,

however, may be difficult to retaliate against by a

foreign country. Many poor countries do not have

the ability to raise subsidies. In addition, developing

countries are more vulnerable than developed

countries in trade wars. Thus, in raising protections

against dumping of cheap products, a government

risks making the product too expensive for its people

to afford.

Trade wars and protectionism have been

implicated as the cause of some economic crises, in

particular the Great Depression (Irwin, 2017).

Efficiency and effective use of resources are the

main goal of every company manager. When a

company cannot effectively produce their goods and

services, it results in the failure in the competition of

using their fund as well as distributing the fund to

divisions in needs of business capital. Conceptually,

the more efficient the operations of a company, the

easier the optimum profit will be achieved.

Subsequently, the easier addition of fund will be

distributed, the more competitive the fund. It all

eventually leads to the better the quality of goods

Adikara, Y. and Herianingrum, S.

Global Trade War: On the Efficiency of US Steel and Non-US Steel Companies.

DOI: 10.5220/0007553608930897

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 893-897

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

893

and service given to clients, as well as the safer and

healthier the company will become.

Every organization certainly needs to be

effective. In general, efficiency means to avoid

every possible waste. Bear in mind that the ability of

an organization to acquire and possess operation

infrastructures, also known as source of fund and

resources essential for the operation of the

organization, is limited – while the objectives are

infinite, there is no justification for extravagance.

Efficiency is the answer for difficulties in

calculating the measurement of performance such as

allocation, techniques, and total efficiency (Hadad,

2003). According to Bastian (2009), efficiency is the

capability to complete tasks correctly or

mathematically. It is defined as the calculation of

output and input ratio or the amount of output

obtained from certain amount of input used.

According to Kurnia (2005), DEA is one of the

non-practical analyses which is used to measure

relative efficiency. Practically, either profit-oriented

or non-profit oriented business organizations, their

production and activities use certain amount of

inputs in order to achieve certain amount of outputs.

The analysis tool also measures the efficiency basis

and is also a tool for policy making in aiming at

efficiency improvement. Sutawijaya and Lestari

(2009) add that DEA can be used in many fields,

including: health care, education, transportation,

manufacturing, and also banking.

3 RESEARCH METHOD

This was a quantitative research which devised

quantitative analytical tools and Data Envelopment

Analysis (DEA) method. The variables in the

research were divided into two, namely inputs and

outputs. Input variables comprised assets and labor

cost; while output variables were in the form of

operational profits. Aside from that, the research

used secondary sources obtained from the annual

financial reports of these selected US based and non-

US based steel companies within the period of 2013-

2016.

The populations of this research were steel

companies registered in the World Steel Association

in the period of 2013-2016. The sampling method in

this research was done through purposive sampling

method which meant the samples were chosen based

on the judgement, showing that samples were not

chosen randomly and the information about the

samples was obtained in certain ways. The sampling

criteria were the largest steel producer by volume

located in United States and the largest steel

producer by volume based in the country outside of

United States affected by trade war during the same

period of time and steel companies delivering

financial reports during the observation period

(2013-2016) which have been publicized.

According to the criteria, the US largest steel

producers by volume were AK Steel, Nucor

Corporation, Steel Dynamics and US Steel

Corporation, consecutively. On the contrary, non-US

steel producers by volume affected by trade war

meeting were ArcelorMittal, China Baowu Steel

Group, Maanshan Iron and Steel Company, and

ThyssenKrupp.

3.1 Data Envelopment Analaysis

(DEA)

This research used Data Envelopment Analysis

(DEA) method with Variable Return to Scale (VRS)

model. DEA is a mathematical program optimization

method which measures the technical efficiency of

an Economic Activity Unit (EAU) and compares the

units with others (Sutawijaya and Lestari, 2009).

DEA is a non-parametric approach which is linear to

programming-based supported by technical

efficiency software packages. Specifically, OSDEA

is used for this study .

DEA assumes that each Economic Activity Unit

will have weight which maximizes its efficiency

ratio (maximized total weighted output/total

weighted input) (Muharam and Pusvitasari, 2007).

Maximization assumption of efficiency ratio had

made this DEA research to employ output

orientation in calculating the technical efficiency.

Another type of orientation was the minimization of

input, however from both two assumptions the

similar results will be achieved (Sutawijaya and

Lestari, 2009). Each EAU used combination of

different inputs to achieve different output

combinations, this way each EAU would choose a

set of measurementwhich reflect those diversities.

An EAU is said to be relatively efficient when

the dual value equals to 1 (efficiency value at 100

percentile); when the dual value is less than 1, it

means that the EAU is considered to be relatively

inefficient or suffering from inefficiency (Huri and

Susilowati, 2004). Technical efficiency in steel

company was measured using ratio between output

and input. DEA will calculate steel company which

use input n to reach output m which is different

(Sutawijaya and Lestari, 2009).

ICPS 2018 - 2nd International Conference Postgraduate School

894

3.2 Normality Test (Shapiro-Wilk Test)

Normality test was conducted as the requirement to

conduct independent sample t-test. Normality test

could be performed by doing non-parametrical

statistical analysis Shapiro-Wilk. This research used

Shapiro-Wilk difference testing because this

research only recruited less than 50 subjects or

respondents. Shapiro Wilk test was considered to be

more accurate when the subject is less than 50.

3.3 Independent Sample t-Test

Statistical technique was used as data processing for

the research in the form of knowing the difference of

two averages (independent t-test). The formula to

acquire the standard deviation of average calculation

difference (

̅

̅

). This hypothesis testing in the

form of difference testing of two averages aimed to

verify the accuracy of the hypothesis. In other

words, it aimed to determine whether the hypothesis

is rejected or accepted. The significance was 95%.

Where:

If

>

then

is accepted

If

<

then

is rejected

4 RESULT AND DISCUSSION

This research aimed to compare the efficiency

values which currently become an important aspect

in measuring the performance of steel companies.

Steel companies as Economic Activity Units are said

to be relatively efficient when their dual value shows

the value of 1 (efficiency value equals to 100

percent). In contrast, when the dual value is less than

one, then the respective EAU can be considered as

relatively inefficient (Huri and Susilowati, 2004).

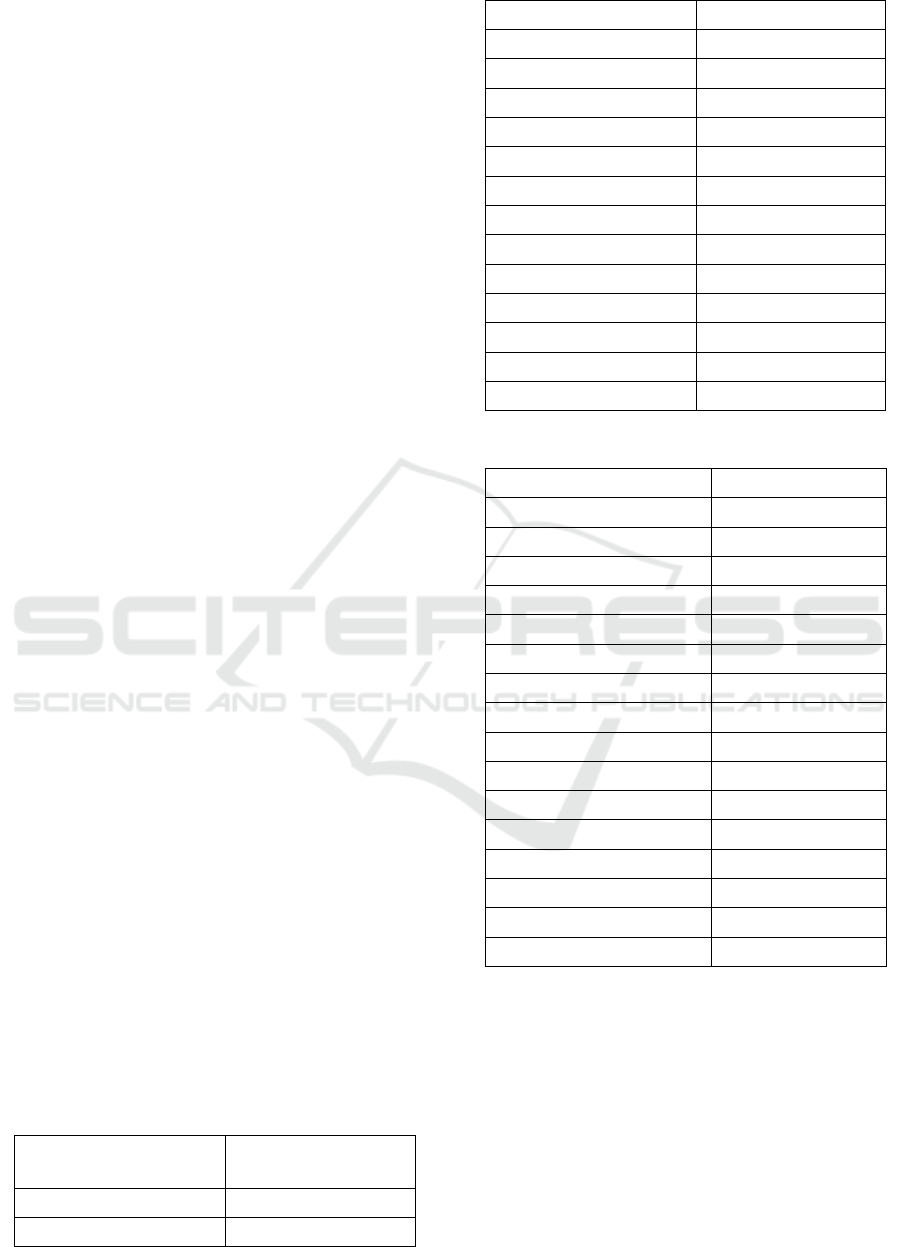

Based on the calculation using DEA method with

the assumption of Variable Return to Scale (VRS)

using OSDEA software, it is seen from the table that

the level of efficiency achieved by all of US based

and non-US based steel companies in 2013-2016

tended to fluctuate over the years.

Table 1: US based steel companies.

US based Efficiency value

AK steel 2013 1

AK steel 2014 0,833365887

AK steel 2015 0,882797963

AK steel 2016 1

Nucor 2013 0,693475868

Nucor 2014 0,776181594

Nucor 2015 0,492737385

Nucor 2016 0,740671037

Steel dynamics 2013 0,93340913

Steel dynamics 2014 0,761457273

Steel dynamics 2015 0,624471496

Steel Dynamics 2016 1

US Steel 2013 1

US Steel 2014 0,496787074

US Steel 2015 1

US Steel 2016 0,827619804

Table 2. Non-US based steel companies.

Non-US Based Efficiency Value

ArcelorMittal 2013 0,138189787

ArcelorMittal 2014 0,317495912

ArcelorMittal 2015 0,625406565

ArcelorMittal 2016 0,63958895

Baowu Steel 2013 0,635874753

Baowu Steel 2014 0,624412882

Baowu Steel 2015 0,081815492

Baowu Steel 2016 1

Maanshan Steel 2013 0,216192461

Maanshan Steel 2014 0,156617197

Maanshan Steel 2015 1

Maanshan Steel 2016 0,240326323

ThyssenKrupp 2013 0,17941338

ThyssenKrupp 2014 0,240090524

ThyssenKrupp 2015 0,216271204

ThyssenKrupp 2016 0,260972677

There were no steel companies remained

efficient during observation period. Hence, it can be

assumed that neither US nor non-US steel company

has succeed in maximizing their inputs and outputs.

This means that the value of inputs and outputs

achieved by the companies was said to be less

efficient and could not achieve their targets.

Inefficient steel companies cannot maximize

their inputs and outputs. This means that the inputs

and outputs achieved by the steel companies cannot

meet their targets (Muharam and Pusvitasari, 2007).

Global Trade War: On the Efficiency of US Steel and Non-US Steel Companies

895

According to the calculation of DEA, US based steel

companies and non-US based steel companies

suffered from inefficiency rooted from the input

variables (assets and labor costs) and the output

variables (operational profits). The measure of steel

company efficiency tends to be limited to the

correlation between technical and operational system

in the process of converting the input to become

output (Sutawijaya and Lestari, 2009). Therefore,

what is needed is an internal micro policy, which

means optimum control and allocation of inputs in

order to gain maximum outputs.

The use of the first input, total asset, by the steel

companies suffered from inefficiency because the

value of total asset was bigger than the target. The

allocated inputs were bigger than the target and

could not be maximized in order to produce outputs.

The suggested solution is by allocating input total

asset surplus to other input so that it can be more

productive assets. Aside from that, in order to fix

management of productive asset proportion, either

credit or financing distributed to the organization’s

many operational divisions should be properly

adjusted by their relative size, so that the operational

function of the steel companies can be improved.

The use of the second input, labor costs, is not in

accordance to or bigger than what the steel

companies have needed to pay their employees’

salaries. This is supported by the fact that there is an

increase in the number of employees which is not

balanced with the needed skills, causing the steel

companies to suffer from the decrease of

productivity (Sutawijaya and Lestari, 2009).

Output inefficiency in this current research has

been caused by operational profits. It has been far

too small than its potential. An improvement

proposed for the companies is to increase the value

of credit distribution/financing to the organization’s

many operational divisions properly adjusted by

their relative size.

In order to be able to significantly see the

difference of efficiency value between each period

group, independent sample t-test testing was

conducted. This required normal data distribution.

Data normality test in this research was acquired

using Shapiro-Wilk test.

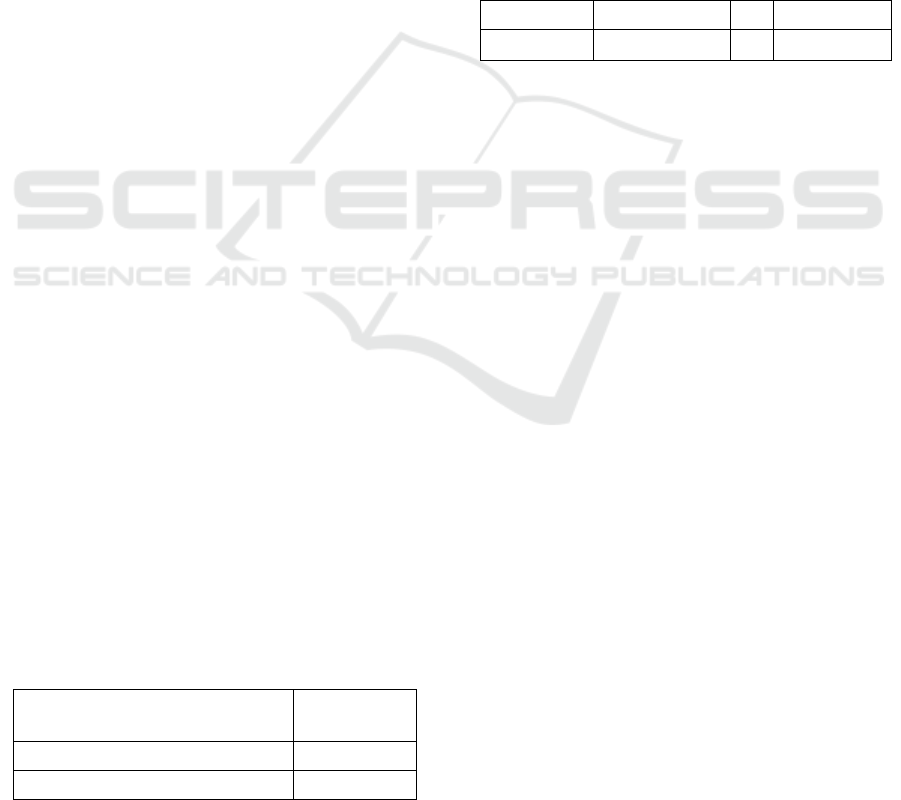

Table 3. Shapiro-Wilk test.

Bank

Normality

test result

US based steel companies 0.561

Non-US based steel companies 0.851

The result of Shapiro-Wilk normality test using

SPSS 16 has shown that overall efficiency acquired

from DEA method during the post Eurozone crisis

period in 2013-2016 has possessed normal data

distribution because it has bigger value than the

alpha (0.05).

After conducting analytical testing by means of

t-test or Independent Sample t-test, the result gained

was the difference of efficiency performance using

DEA-VRS approach. In the following table, the

value of t calculation is 4.474; while the value of t

table with α = 0.05 and Df = 3 is 2.353. It can be

concluded that t calculation > t table; therefore,

is

accepted. Based on the achieved probability value,

the value is 0.004. Since the value is smaller than the

alpha (0.05),

is rejected.

Table 4. Independent sample t-test.

Model t calculation df Probability

DEA-VRS 4.474 3 0.004

Based on the comparison of the t value and the

achieved probability, it can be concluded that there

has been significant difference in the value of

efficiency between the US Based Steel Companies

and non-US based steel companies.

The obvious contrast of different inefficiency

between the US Based Steel Companies and non-US

based steel companies could be explained by

Chinese based steel companies that is dominated by

a number of large state-owned groups owned via

shareholdings by local authorities, provincial

governments and even the central authorities. Profits

are low despite continued high demand due to high

debt and overproduction of high end products

produced with the equipment financed by the high

debt. The central government is aware of this

problem but there is no easy way to resolve it as

local governments strongly support local steel

production. Meanwhile, each firm aggressively

increases production (Hogan, 2000).

5 CONCLUSION

In conclusion, among US US Based Steel

Companies and non-US based steel companies, there

were no steel companies remained efficient during

the period of observation. The influence of input and

output variables in each bank was shown to be

different towards the efficiency. Furthermore,

according to the independent sample t-test testing, it

could be concluded that there has been significant

ICPS 2018 - 2nd International Conference Postgraduate School

896

difference in the efficiency value of the US Based

Steel Companies and non-US based steel companies,

can be calculated from the comparison of t value and

the achieved probability (

is rejected)

Referring to the results and the conclusion, some

suggestions have been proposed for involved parties

and further researches. In order to improve their

efficiency, steel companies need to allocate surplus

in the use of inputs to other inputs. For further

researches, it is recommended that further

researchers use bigger samples in order to achieve

optimum results and can describe steel companies

efficiency in the world in broader sense.

ACKNOWLEDGMENT

This research was supported by Sekolah Pasca

Sarjana Universitas Airlangga. We thank our

colleagues from Sekolah Pasca Sarjana who

provided insight and expertise that greatly assisted

the research, although they may not agree with all of

the interpretations/conclusions of this paper.

We also thank Dr. Sri Herianingrum SE., M.Si.

for comments that greatly improved the manuscript.

We would also like to show our gratitude to our

colleagues from MSEI 2016 for sharing their so-

called insights and their pearls of wisdom with us

during the course of this research.

REFERENCES

A. Bastian, 2009, “Analisis Perbedaan Asset dan Efisiensi

Bank Syariah di Indonesia Periode Sebelum dan

Selama Program Akselerasi Pengembangan Perbankan

Syariah 2007-2008 Aplikasi Metode DEA (Studi

Kasus 10 Bank Syariah di Indonesia),” Unpublished

thesis, Faculty of Economics Diponegoro University

Semarang.

A. Sutawijaya and E.P. Lestari,, “Efisiensi Teknik

Perbankan Indonesia Pasca Krisis Ekonomi: Sebuah

Studi Empiris Penerapan Model DEA,” Jurnal

Ekonomi Pembangunan, Vol. 10 No.1.

A.S. Kurnia, 2005, Data Envelopment Analysis Untuk

Pengukuran Efisiensi, Workshop Modul, Semarang:

Diponegoro University.

D. Irwin, Peddling. 2017. Protectionism: Smoot-Hawley

and the Great Depression, Princeton University Press.

p. vii-xviii,.

H. Long, Trump has officially put more tariffs on U.S.

allies than on China, (retrieved on June 27, 2018 from

https://www.washingtonpost.com/news/wonk/wp/201

8/05/31/trump-has-officially-put-more-tariffs-on-u-s-

allies-than-on-china/?utm_term=.27c69b17e815),

2018.

H. Muharam & R. Pusvitasari, 2007, “Analisis

Perbandingan Efisiensi Bank Syariah dengan Metode

Data Envelopment Analysis (Periode tahun 2005),”

Jurnal Ekonomi dan Bisnis Islam, Vol.2 No.3.

M.D. Hadad, 2003, Pendekatan Parametrik Efisiensi

Perbankan Indonesia. (retrieved on May 23, 2017 from

www.bi.go.id),.

M.D. Huri and I. Susilowati, 2004. “Pengukuran Efisiensi

Relatif Emiten Perbankan Dengan Metode Data

Envelopment Analysis (DEA) (Studi Kasus: Bank-

bank yang Terdaftar di Bursa Efek Jakarta Tahun

2002),” Jurnal Dinamika Pembangunan, Vol. 1 No 2

W.T. Hogan, 2000. The Steel Industry of China,

Lexington Books.

Global Trade War: On the Efficiency of US Steel and Non-US Steel Companies

897