Analysis of Macro Fundamental and Micro Fundamental Effect on

Ownership Structure, Auditor Opinion and Value of the Firm in

State-Owned Enterprises Companies in Indonesia Stock Exchange

Hwihanus

1

, Tri Ratnawati

1

and Indrawati Yuhertiana

2

1

Economic Faculty, University of 17, Agustus 1945, Surabaya, Indonesia

2

Economic and Business Faculty, University of Pembangunan Nasional Veteran Jawa, Timur, Indonesia

Keywords: Macro Fundamentals, Micro Fundamentals, Ownership Structure, Auditor Opinion, Value of the Firm.

Abstract: The State-Owned Enterprise is a company that was unique and in demand by the public because the stock

price and value of the firm was high enough to give investor confidence in buying shares. High value of the

firm made researchers keen to test and analyze the causal relationships that affect fundamental value of the

firm in the form of micro and macro fundamentals of the ownership structure, financial performance, as

well as the value of the company of the State Owned Enterprises listed on the Indonesia Stock Exchange.

The research population was in 20 state-owned enterprises listed on the Indonesia Stock Exchange. This

research method uses purposive sampling with 12 companies in 2010 - 2015. Data of analysis techniques in

this study using Partial Least Square consists of Inner model, Outer model and Weight relations. The test

results show that all hypothesis tested are influential. This includes micro fundamentals influencing auditor

opinion (H2) and ownership structure (H4) and ownership structure (H7) and auditor opinion (H8) affecting

the value of the state-owned enterprise.

1 INTRODUCTION

State-Owned Enterprises (SOEs) are companies

established by the government for the welfare of the

Indonesian people and the SOE attracts the attention

of researchers where all leadership policies are

always related to the Ministerial Decree (SKM) so

that the managerial activities of SOEs become

independent. This lack of independence reduces the

provision of information on its activities to

investors.

Researchers are interested in observing SOEs

that are prospective for investors compared to

private companies, especially regarding the share

prices of SOEs and Joint Stock Price Indexes in the

capital market experience fluctuations in accordance

with the country's economic conditions and

government decisions that provide sentiment for the

stock market. In addition to fluctuating stock prices,

decisions taken by management are always related to

government instructions through ministerial decrees

including in giving opinions by public accounting

office regarding the company's operational activities.

Share prices as a representation of the value of

the firm are determined by internal and external

factors of the company. Internal and external factors

of the company are fundamental factors that are

often used as a basis for investors in the capital

market to make investment decisions (Pater et al.,

2014). In addition to fundamental factors, technical

factors are also important factors that can affect

stock prices that are technical and psychological.

Established companies including SOEs have the

goal of optimizing the value of the firm which is

reflected to the welfare of the owner. If the higher

value is reflected in the stock market price, it gives

prosperity to the owner (Fama, 1978; McConnell

and Muscarela, 1985). Unification of the interests of

shareholders, debt holders, and management which

in fact are parties who have an interest in the

company's objectives often causes problems (agency

problems) or conflicts of interest known as agency

theory (Jensen and Meckling, 1976).

Some researchers believe that the ownership

structure can influence the course of the company

which ultimately affects the company's performance

in achieving the company's goals, namely

214

Hwihanus, ., Ratnawati, T. and Yuhertiana, I.

Analysis of Macro Fundamental and Micro Fundamental Effect on Ownership Structure, Auditor Opinion and Value of the Firm in State-Owned Enterprises Companies in Indonesia Stock

Exchange.

DOI: 10.5220/0008490802140219

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 214-219

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

maximizing the value of the company (Khlif, 2015,

Farooque et al., 2010; Masulis, 1983).

Increasing the value of the firm is a goal for the

welfare of shareholders for the company's financial

performance in managing the organization's

operations effectively and efficiently for decision

making. The maximum value of the firm is derived

from the ownership structure and auditor opinion of

the accounting firm which states that a company is

based on macro and microeconomic fundamentals.

In this research model, researchers conducted

research by discussing empirically about how much

influence the macro fundamentals and micro

fundamentals, the structure of shared ownership and

the auditor's opinion of a public accounting firm in

the value of SOEs.

2 LITERATURE REVIEW

2.1 Agency Theory

Jensen and Meckling (1976) stated that owner as an

authority (principal) and management as the

recipient of authority (agent) have different interests

in the employment relationship. The interests of

each party will try to increase profits for themselves.

The owner wants the maximum return of investment

as soon as possible, while management wants its

interests to be accommodated as much as possible

for its performance.

Conflicts of interest between agents and

principals in achieving prosperity can occur from the

existence of information asymmetry. This

information asymmetry occurs when managers have

relatively more and faster internal information than

external parties. This condition gives managers the

opportunity to manipulate financial reporting in an

effort to maximize their prosperity (Cheng et al.,

2012; Wasiuzzaman, 2015).

2.2 Macro Fundamental

Macro fundamental factors originating from outside

the company can be in the form of economic,

environmental, political, legal, social, cultural,

security, education, and other factors that cannot be

controlled by the company, but the influence is very

large for change. This study discusses

macroeconomic conditions that are of serious

concern for analysts and capital market players in

deciding to invest by looking at the movements of

inflation, interest rates, exchange rates, and

economic growth (Claude et al., 1996; Eduardus,

1997).

2.3 Micro Fundamental

The fundamental micro factor comes from within the

company and is controlling and used in the

development of the company in the future. The

development of this company, management requires

several policies, namely investment decisions,

funding decisions and dividend policies that can

facilitate the company's operational activities.

2.4 Ownership Structure

The ownership structure is the percentage of the

company's shareholding which can reflect the

distribution of power and its influence on the

company's operational activities. Ownership

structure can be seen from the agency approach and

asymmetric information approach. Agency approach,

ownership structure is a mechanism to reduce

conflicts of interest between managers and

shareholders. The asymmetric information approach

views the ownership structure mechanism as a way

to reduce information imbalances between insiders

and outsiders through information disclosure in the

capital market.

The researcher uses all ownership structure

factors as indicators, namely managerial share

ownership, institutional share ownership, public

share ownership, government share ownership and

foreign share ownership in determining the influence

of company value.

2.5 Auditor Opinion

The auditor's opinion is part of the audit report

provided by the auditor through the audit stage. The

auditor's report (Boynton and Raymon, 2005) is a

formal tool used by auditors in communicating

financial reports to interested parties, namely the

owner of the company and investors.

Communication of financial statements by

auditors concerning the implementation of

management in daily activities is in accordance with

Indonesian accounting standards that have been

established, organizational structure including

division of tasks and operational activities that lead

to the company's vision and mission.

Type of auditor opinion, namely: (1) Unqualified

opinion, (2) Unqualified opinion with explanatory

language; (3) Reasonable opinions with qualified

opinions; (4) Opinion is not fair (Adverse Opinion)

Analysis of Macro Fundamental and Micro Fundamental Effect on Ownership Structure, Auditor Opinion and Value of the Firm in

State-Owned Enterprises Companies in Indonesia Stock Exchange

215

and (5) Opinion does not provide opinions

(Disclaimer of opinion).

An audit report related to going concern is called

a going concern opinion, which is used to provide an

initial warning to shareholders in order to avoid

making wrong decisions. This decree is regulated in

PSA 29 paragraph 11 which states that great doubt

in the ability of business units to going concern and

the auditor must add an explanation paragraph in the

audit report even though it does not affect

unqualified opinions.

Going concern audit opinion is an opinion that

shows significant uncertainty over the company's

ability to continue the business and must be stated

explicitly by giving code 1 and code 0 if the auditor

does not doubt the company's ability to continue the

business. Giving opinions to KAP (Public

Accounting Firm) has a good reputation for

conducting a quality audit process that is

independent and objective by issuing modified

opinions on companies that experience financial

distress. KAP affiliates that are used and trusted by

SOEs are known as the big four, namely

Pricewaterhouse Coopers KAP, Deloitte Touche

Tohmatsu, Ernst Young Global and KPMG

International.

Researchers use the going concern opinion audit

indicator, big four KAP, Return on Assets (ROA)

and Return on Equity (ROE).

2.6 The Value of the Firm

The book value in the financial statements is a

limitation of measuring company value and used in

investment. Investors use the perception based on

stock prices, the higher the stock price will make the

value of the firm become high or vice versa. The

main purpose of the company (Sirmon et al., 2007)

is to maximize the value of the firm that has a

broader meaning, not only to maximize the

company's profits but by considering the effect of

time on the value of money, considering various

risks to the company's revenue stream and the

quality of cash flow is expected to be received in the

future.

The value of the firm as a stock market value

(Bowman and Ambrosini, 2007; Luo, 2013) that can

provide maximum shareholder prosperity if the

company's stock price increases. Firm value is an

important concept for investors, because it is an

indicator for the market to assess the company as a

whole (Wang et al., 2009; Bokpin, 2013; Joshi and

Hanssen, 2010). Or it can be said that the company's

value is the price paid by prospective buyers if the

company is sold.

In this study, the researchers used Earning per

Share (EPS), Price Book Value (PBV), Tobin's Q

and Price Earnings Ratio (PER) indicators.

3 RESEARCH HYPOTHESIS

The research hypothesis can be done as follows: (1)

Macro fundamentals have a significant effect on

ownership structure, (2) Micro fundamentals have a

significant effect on auditor opinion, (3) Macro

fundamentals have a significant effect on auditor

opinion, (4) Micro fundamentals have a significant

effect on ownership structure, (5) Macro

fundamentals have a significant effect on company

value, (6) Micro fundamentals have a significant

effect on company value, (7) Ownership structure

has a significant effect on company value (8)

Auditor opinion has a significant effect on company

value and (9) Ownership structure has a significant

effect on auditor opinion

4 RESEARCH METHODS

4.1 Research Sample

The sampling technique uses a purposive sampling

method with 12 of the 20 state-owned enterprises

listed on the Indonesia Stock Exchange with

observations from 2010 - 2015.

4.2 Variables and Indicators

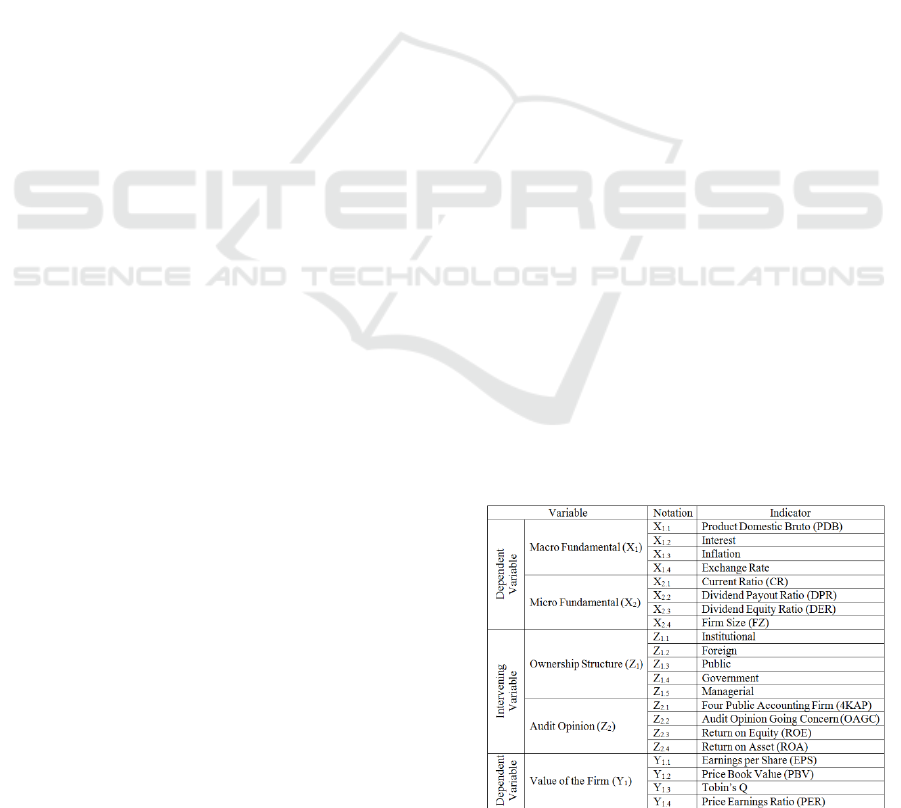

The variables and indicators used in this study are:

Table 1: Variables, Notation and Research Indicators.

Source: data processed

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

216

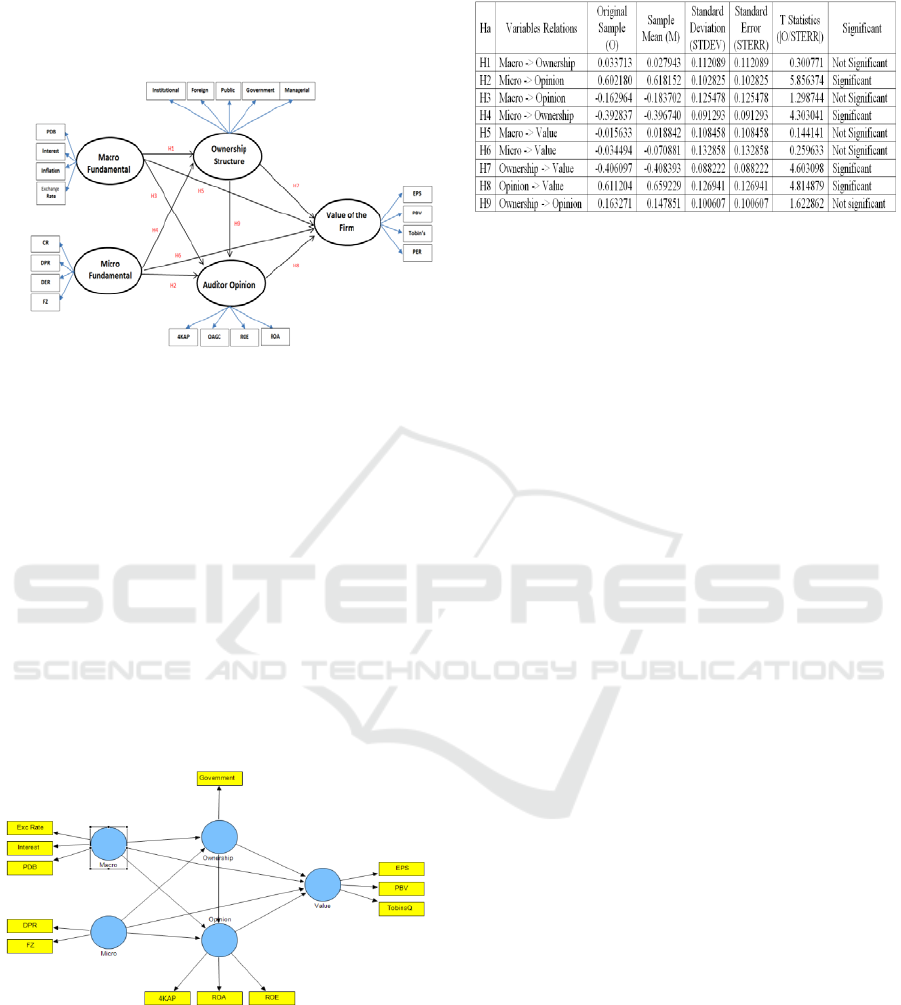

4.3 Conceptual Frameworks

The relationship between research variables can be

described as follows:

Source: Data processed

Figure 1: Framework for Research and Indicators.

5 RESULTS AND DISCUSSION

5.1 Research Model Testing

This study uses the loading factor limit by reflecting

indicators based on the relationship between each

score item with a construct score with a

measurement scale that is considered sufficient at

the loading value of 0.5 so that the measurement

scale that does not meet the requirements is

dropping.

Inner model test results can be shown with the

following picture:

Figure 2: Test Results of the Structural Model (inner

model).

Statistical testing in the relationship between

variables required a significance level of 95% (α =

0.05) and the t-table value was 1.96 to accept the

alternative hypothesis. The results of the overall

hypothesis testing can be seen in the following table.

Table 2: PLS Analysis Test Results.

Source: Data processed

5.2 Discussion

Hypothesis verification results and relationships

between variables in SOEs listed on the Indonesia

Stock Exchange with observations in 2010 - 2015 as

follows:

From the analysis above, maximizing the value

of the firm does not directly affect the macro and

micro fundamentals, therefore it is necessary to have

a connection in determining the maximum

determination of the value of the company which is

shown t-table below 1.96. The maximum value of

the company is influenced by the ownership

structure and audit opinion which is the trust for the

shareholders, namely the investor indicated by the t-

table 1.96.

Ownership structure is significantly influenced

by micro fundamentals, but it is not significantly

affected, which is shown significantly by macro

fundamentals, even though the government has been

regulating the economic conditions of the country,

and the government owns most of the shares with t-

statistics of 1.96. Audit opinion is significantly

influenced by micro fundamentals where

management plays a role in decision making and is

not significantly influenced by macro fundamentals.

And the ownership structure does not affect the

auditor's opinion, the government's decision and

action as the holder of ownership control will not

destabilize the audit decision in giving an opinion as

indicated by t-statistics below 1.96.

5.3 Theoretical Implications

The company's goal is to increase net income

generated from operational activities including SOEs

by optimizing the company's value and the welfare

of shareholders. Share prices represent a company

value. Internal factors and external factors of the

company are often used as the basis for investors in

the capital market in making investment decisions.

Analysis of Macro Fundamental and Micro Fundamental Effect on Ownership Structure, Auditor Opinion and Value of the Firm in

State-Owned Enterprises Companies in Indonesia Stock Exchange

217

Maximizing company value is influenced by

management controls that regulate the activities of

companies in paying dividends for company profits.

Determination of the value of the firm is influenced

by the ownership structure and audit opinion factors

as well as several other factors outside the object of

research, so there needs to be more in-depth

discussion.

5.4 Managerial Implications

Policy implications in accordance with the priorities

that can be given as input for management in state-

owned enterprises are as follows: (1) Economic

exposure does not affect the ownership structure and

value of the company where the government as the

holder of state control can determine policies and

roles for SOEs in the welfare of the Indonesian

people; (2) Economic exposure does not affect the

value of the firm which is indicated by the risk in

managing finances through the provision of audit

opinions to increase the value of the firm and

investment decisions; and (3) The value of the firm

in the eyes of investors as consideration for the

company's operational activities reflected on the

financial statements for the future survival of the

company and accountability of management

performance as shown by the auditor's opinion on

SOEs.

5.5 Implications for Economics

The implication in the development of economics is

to contribute to the study of corporate value that

connects ownership structures, auditor opinions, and

macro and micro fundamentals in economic decision

making by management, government and investors;

the value of the firm can meet the needs and welfare

of investors, government and community welfare

and the value of the firm determines the

development of the Indonesian economy in

accordance with the objectives of the established

SOEs.

5.6 Research Limits

This study has limitations in the usage of secondary

data, not all state-owned enterprises are owned by

the public, only a few companies are listed on the

Indonesian stock exchange and managerial decisions

are based on the finance minister's decree

.

6 CONCLUSIONS AND

SUGGESTIONS

6.1 Conclusion

Based on the formulation of the problem, the

literature and data analysis that have been done

previously, it can be concluded that not all

hypothesis testing studies were accepted which

showed a significant level of influence of 5% with t-

table 1,960. The accepted hypotheses are that micro

fundamentals affect auditor opinion (H2) and

ownership structure, (H4) and ownership structure

(H7) and auditor opinion (H8) affects the value of

the state-owned enterprise. The rejected hypotheses

are the macro fundamentals of ownership structure

(H1) and auditor opinion (H3), micro fundamentals

(H5) and micro fundamentals (H6) of the firm's

value and ownership structure on auditor opinion

(H9) as indicated by the t-table below 1.96.

2.1. Suggestion

The suggestions that can be conveyed to the next

researcher is that they can examine the continuity of

the value of the company outside the State-Owned

Enterprises company, which can use variables that

are different from indicators regarding the value of

the company, (3) use different variables that can

affect the value of the company and (4) make

reference given the limitations of research.

ACKNOWLEDGMENTS

Directorate of Community Service Research

(DRPM).

Ministry of Research, Technology and Higher

Education (Kemristekdikti).

REFERENCES

Arvianto. Rivan Andrie Sabi., Suhadak dan Topowijono.

2014. Pengaruh Faktor Fundamental Makro dan Mikro

Terhadap Nilai Perusahaan (Studi pada Saham

Perusahaan Sektor Perdagangan, Jasa dan Investiasi

yang Terdaftar di BEI Periode 2010-2012). Jurnal

Administrasi Bisnis (JAB). Vol. 13. No. 1 Agustus

2014. Hal. 1 – 10.

Bokpin, Godfred A. 2013. Determinants and Value

Relevance of Corporate Disclosure: Evidence from the

Emerging Capital Market of Ghana. Journal of

Applied Accounting Research Vol. 14, Issue 2. Pp. 127

– 146.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

218

Bowman, Cliff and Veronique Ambrosini. 2007. Firm

Value Creation and Levels of Strategy. Management

Decision Vol. 45. No. 3. Pp. 360 – 371.

Boynton, WC dan Raymond, NJ. (2005). Modern

Auditing: Assurance Services and the Integrity of

Financial Reporting. Eighth Edition. New Jersey:

Wiley

Cheng, C.S. Agnes., Bong-Soo Lee and Simon Yang.

2012. The Value Relevance of Earnings Levels in the

Return-Earnings Relation. International Journal of

Accounting and Information Management Vol. 21,

Issue 4. Pp. 260 – 284.

Claude B. Erb., Campbell R. Harvey, and Tadas E.

Viskanta. 1996. Political Risk, Economic Risk, and

Financial Risk, Financial Analysis Journal, Nov-Dec,

pg. 29-46

Eduardus Tandelilin, 1997. Determinants of Systematic

Risk: The Experience of Some Indonesian Common

Stock, Kelola, Gadjah Mada University Business

Review, No. 16/VI/1997.

Fama, Eugene F. 1978. The Effect of a Firm Investment

and Financing Decision on The Welfare of Its Security

Holders. American Economic Review Vol. 68. Pp.

272-280.

Farooque, Omar Al., Tony van Zijl, Keitha Dunstan and

Akm Waresul Karim. 2010. Co-Deterministic

Relationship between Ownership Concentration and

Corporate Performance: Evidence from an Emerging

Economy. Accounting Research Journal Vol. 23 Issue

2. pp. 172 – 189.

Jensen, M.C. and W.H. Meckling. 1976. Theory of the

Firm: Managerial Behavior, Agency Costs and

Ownership Structure. Journal of Financial Economics

Vol. 13, pp. 305-360.

Joshi, Amit and Dominique M. Hanssens. The Direct and

Indirect Effects of Advertising Spending on Firm

Value. Journal of Marketing Vol. 74 (January 2010),

20–33.

Khlif, Hichem. Khaled Samaha and Islam Azzam. 2015.

Disclosure, Ownership Structure, Earnings

Announcement Lag and Cost of Equity Capital in

Emerging Markets: The Case of the Egyptian Stock

Exchange. Journal of Applied Accounting Research

Vol. 16, Issue 1. Pp. 28 – 57.

Luo, Xueming. Jie Zhang and Wenjing Duan. Social

Media and Firm Equity Value. 2013. Information

Systems Research Vol. 24, No. 1, March 2013, pp.

146–163. ISSN 1047-7047 (print). ISSN 1526-5536

(online).

Masulis, Ronald W. 1983. The Impact of Capital Structure

Change on Firm Value: Some Estimates. The Journal

of Finance. Vo. XXXVIII. No. 1. March 1983. 107 –

126.

McConnell, John J. and Chris J Muscarela. 1985.

Corporate Capital Expenditure Decisions and the

Market Value of the Firm. Journal of Financial

Economics 14, 1985 pp. 399-422.

Pater, Andrew Darminto dan Muhammad Saifi. 2014.

Faktor Internal Dan Eksternal Yang Mempengaruhi

Pergerakan Harga Saham (Studi Pada Saham - Saham

Indeks LQ45 Periode 2009 – 2013). Jurnal

Administrasi Bisnis (JAB)| Vol. 11 No. 1 Juni 2014|

Putra, Nyoman Wedana Adi. 2014. Pengaruh Faktor

Fundamental Pada Nilai Perusahaan Sektor

Telekomunikasi Di Bursa Efek Indonesia. E-Jurnal

Akuntansi Universitas Udayana. 8.3 (2014):385-407

Sirmon, David G., Michael A. Hitt and R. Duane Ireland.

2007. Managing Firm Resources in Dynamic

Environments to Create Value: Looking Inside the

Black Box. Academy of Management Review Vol. 32,

No. 1 273 – 292.

Sugiharto, Tri Ratnawati dan Srie Hartutie Moehaditoyo.

2016. Risk Management Mediates the Influence of

Good Corporate Governance, Managerial Shareholder,

and Leverage on Firm Value. IOSR Journal of

Business and Management (IOSR-JBM). E-ISSN

2278-478X p-ISSN 2319-7668. Vol. 18. Issue 11. Ver.

VI (November 2016). Pp. 62 – 70.

Syahib Natarsyah, 2000, Analisis Pengaruh Beberapa

Faktor Fundamental dan Risiko Sistematik Terhadap

Harga Saham (Kasus Industri Barang Konsumsi yang

Go-Publik di Pasar Modal Indonesia), Jurnal Ekonomi

dan Bisnis Indonesia, Vol. 15, No. 3, Hal. 294-312.

Wang, Wen-Hung. Chiung-Ju Liang and Kishwar Joonas.

2009. Customer Relationship Investments, Value to

the Customer, and Value to the Firm: Integrating

Attributes and Benefits. Southwest Business and

Economics Journal.

Wasiuzzaman, Shaista. 2015. Working Capital and Firm

Value in an Emerging Market: International Journal

of Managerial Finance Vol. 11. Issue 1. 2015. Pp. 60

– 79.

Analysis of Macro Fundamental and Micro Fundamental Effect on Ownership Structure, Auditor Opinion and Value of the Firm in

State-Owned Enterprises Companies in Indonesia Stock Exchange

219