How Irrationality Works in Indonesia:

A Case of Fake Investment

Tri Hendro Sigit Prakosa

STIE YKPN Yogyakarta, Jalan Seturan, 55281 Yogyakarta, Indonesia

Keywords: Optimism Bias, Overconfidence, Representativeness Bias, Confirmation Bias, Framing, Herding, Ponzi

Scheme, Investment Decision.

Abstract: In the conventional economic perspective, people or investors are assumed to behave rationally when

choosing investment alternatives to maximize their profits. Shiller (2000) showed that the Ponzi scheme is a

form of irrational exuberance in which people or investors act irrationally. This study was aimed to

investigate the impact of psychological biases (optimism bias, overconfidence, representativeness bias,

confirmation bias, framing, and herding) to investors’ decisions to get involved in a Ponzi scheme.

Regression analysis was employed to see the impact of these biases on the investment decisions. Data was

collected through questionnaire from 38 investors (victims) who lived in several rural areas in Yogyakarta.

The results of this study revealed that optimism bias, overconfidence, representativeness bias, confirmation

bias, framing, and herding behavior have significant impact on investment decisions. However this study

still has some limitations and needs further research.

1 INTRODUCTION

In the conventional economic perspective, people or

investors are assumed to behave rationally when

choosing investment alternatives to maximize their

profits. However, several studies noticed that human

decisions often depend on their nature, intuitions,

and habits, which formed their behavioral biases,

and in the financial context, these biases could lead

them to engage in financial frauds (Lewis, 2012,

296). According to Alan Greenspan, former

Chairman of the Federal Reserve, someone who get

involved in a financial fraud has ‘the foolish act.’

Greenspan (2009, p. 22) defined the foolish act as

“an act where someone goes ahead with a socially or

physically risky behavior in spite of danger signs, or

unresolved questions which should have been a

source of concern for the actor.”

Reurink (2016, 7) has divided financial fraud

into three categories: financial statement fraud,

investment scams (cons/swindles), and fraudulent

financial mis-selling. Investment scams are different

from financial statement frauds in which scams are

built on visible lies and completely fabricated facts.

A lot of scholars often use terms such as ‘investment

frauds,’ ‘Ponzi scheme,’ and ‘consumer scams’ to

depict investment scams. Shiller (2000) showed that

the Ponzi scheme is a form of irrational exuberance

in which people or investors act irrationally. A Ponzi

scheme is a fake investment scheme that offers

abnormaly high returns to investors providing that

these returns are not from actual investments or

products sales but by paying out the principal of

other investors (Gornall, 2010, 3). Royal Canadian

Mounted Police (RCMP) has identified some

characteristics of a Ponzi scheme that will

differentiate this scheme from a legal investment

plan: high-pressure sales tactics, closed-door

(secretive) information sessions and/or promotion

meetings, emphasis on recruitment rather than the

sale of a product or service, very high-yield return

within a short period of time, vague or non-specific

explanations as to the core nature of the business and

exactly how it makes money, and word-of-mouth

referrals (www.rcmp-grc.gc.ca/scams-fraudes).

This kind of financial fraud was named after

Charles Ponzi for his swindle in 1920 which

defrauded investors up to $15 million at that time.

During 2008-2013 there are more than 500 types of

Ponzi schemes in the U.S. which have collected

funds of more than $50 bilion from investors

(victims). One of the biggest frauds was done by

Bernard L. Madoff Investment Securities (BMIS),

which was regulated by the Securities and Exchange

314

Prakosa, T.

How Irrationality Works in Indonesia: A Case of Fake Investment.

DOI: 10.5220/0008492403140319

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 314-319

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Commission (SEC) as a Registered Investment

Adviser (RIA). To keep this scheme working, the

schemer (promoter) will always looks for new

investors (victims) to ensure a steady cash inflow to

fund the schemer’s lifestyle and expenses from that

scheme.

In 2014, Otoritas Jasa Keuangan (OJK)

Indonesia (Indonesia Financial Services Authority)

has reported huge financial losses of Rp45 trillion

due to the fake investments, and these losses are

estimated to grow on the following years. Several

business formats or companies which have

organized Ponzi schemes are Dua Belas Suku,

Dream for Freedom, Panen Mas, Raihan Jewellery,

Lautan Emas Mulia, Golden Traders Indonesia

Syariah, Bina Sinar Sejahtera dan Virgin Gold

Mining Corporation. We can also find these kind of

scams on the internet which are classified as High

Yield Investment Programs (HYIPs). HYIPs usually

come with the attractive websites that promise very

high return to investors who are willing to invest

their funds into the HYIP providers. Data from

Google Trends (January 2004-January 2017) showed

that people are most likely to find HYIP providers in

Nigeria, Indonesia, Malaysia, Pakistan, Philippines,

South Africa, and Ukraine.

The main purpose of this study was to identify

the factors that are influencing investors to get

involved in the fake investment in Indonesia. As

there are limited studies about behavioral finance in

Indonesia, this study was expected to contribute

significantly to development within this field.

2 LITERATURE REVIEW

There are some psychological factors that predispose

a person to invest in this kind of scheme: optimism

bias, overconfidence, representatives bias,

confirmation bias, framing, and herding.

Optimism bias is a person's tendency to

overestimate the probability that good things will

happen and underestimate the potential for

unpleasant events. In the stock market, most

investors tend to be overly optimistic about the

markets, the economy, and the potential for positive

performance of the investments they make

(Pompian, 2006, p. 63). Then we propose the first

hypothesis (H

1

) as optimism bias influences

investment decisions.

People who have overconfidence tend to follow

their intuition and ignore some potential risks behind

the Ponzi schemes. Camerer and Lovallo (1999)

found that high risk investment instruments are most

likely to be learnt and conducted by overconfidence

investors. People who read a lot of books, read

numerous investment articles on the internet, and

even get a tip from a financial advisor often

overestimate their own predictive abilities and the

precision of the information they’ve been given to

make an investment decision. They were sure that

certain things will happen to them based on their

perceived knowledge and abilities (Pompian, 2006,

51). According to Shiller (1998), most active traders

believe that they know much more than others do,

and they, in turn, become overconfident and will

trade their stocks excessively. Pressman (1998)

stated that the main factor that drives investors to

fall down into financial fraud is overconfidence. He

also underlined that success of a Ponzi scheme was

contributed to by asymmetric information available

to investors when confronted with uncertainty or

risky situations. Based on these statements above,

we propose the second hyphotesis (H

2

) as

overconfidence bias influences investment decisions.

The representativeness bias happened to

investors (victims) because of analogical reasoning:

judging events and processes by their similarity to

other events and processes (Baddeley, 2015, 903).

Johnson (2002) said that the interpretation of new

information may use heuristic rules or stereotyping.

Some people who have received the return from an

investment scheme will be considered representative

of the conditions that will be experienced by all

investors. New members of a fake investment tend

to believe that this investment deals with ‘the law of

small numbers,’ an assumption that small samples

truly represent the whole populations (Pompian,

2006, 63). The we propose the third hypothesis (H

3

)

as representativeness bias influences the investment

decisions.

Representatives bias then bring up confirmation

bias, the tendency of a person to seek information to

support his opinion or rule out information that does

not support his opinion. Several studies proved that

people tend to put more emphasis on confirmatory

information, that is, positive or supportive data

(Pompian, 2006, 189). We propose the fourth

hypothesis (H

4

) as confirmation bias influences

investment decisions.

Framing is a tendency to make decisions based

on the information presented. A decision frame will

influence someone’s conception of the acts,

outcomes, and contingencies associated with a

particular choice (Pompian, 2006, 237). A Ponzi

scheme is often presented in a positive tone, and

provide good information to potential investors

(victims). Many Ponzi schemes were informed in

How Irrationality Works in Indonesia: A Case of Fake Investment

315

visible ways, e.g., through a website or mass media

like newspapers. In everyday life, framing bias can

influence a loss aversion feeling, and vice versa.

Suppose that a person has suffered losses, or felt

‘broke’, he/she would likely to seek risk with his/her

investments, but someone who has already gained

are more likely to invest in a sure thing. For our fifth

hyphotesis (H

5

), we propose framing bias influences

the investment decisions.

Another bias is herding behavior: a person who

follows others or mimics the behavior of groups in

making his decisions rather than decide for

him/herself. Hong et al. (2008) found that mutual

fund managers are more likely to buy stocks that

other managers in the same area are buying, which

means that social interaction among them would

create a powerful word-of-mouth effect while

selecting and choosing stocks for their portfolios.

The number of people in the neighborhood who

have already joined illegal investments will persuade

someone to join because he/she would be a part of

the ‘successful people.’ Then the Ponzi schemers

will build ‘false-trust’ to persuade participants who

are more likely to trust them. Fairfax (2001, 70)

noted that someone will pay more attention and get

attracted to somebody else if both of them are close

and have frequent contact with each other,

sometimes share values and tastes, and decide to

build an affinity link. According to Deason et al.

(2015), common religion is one of the most common

reason for people to join in the affinity links. These

links will be used by the schemers to persuade others

to engage in less-than intelligent ventures with their

emphasis on: (1) reciprocation (people tend to help

others for returning a favor); (2) commitment and

consistency (people tend to honor their

commitments); (3) social proof (people tend to

follow the lead of others they trust); (4) authority

(people tend to obey authority figures), and liking

(people can be persuaded by individuals they like)

(Jacobs & Schain, 2011, 42). Previously Granovetter

(1985, 491) reminded that “the trust engendered by

personal relations presents, by its very existence,

enhanced opportunity for malfeasance. ” We

propose the sixth hypothesis (H

6

) as herding bias

influences investment decisions.

3 RESEARCH METHODOLOGY

3.1 Sampling and Questionnaire

We did a field research on the 42 investors (victims)

who lived in some rural areas in Yogyakarta,

Indonesia during September 2016-January 2017. 38

of them agreed to answer every question that we

asked to in our questionnaire, and they were also

interviewed by us. There are two objectives of

asking questions in our study: (1) to indicate their

level of agreement with some statements using

Likert scale (strongly agree, agree, neutral/neither

agree or disagree, disagree, and strongly disagree),

and (2) to indicate their opinion about an investment

scam using completely unstructured question (What

is your opinion about the investment scam?). For

operationalization of the independent variables, we

have scored answers on the ordinal data with the

following criteria: strongly agree = 5, agree = 4,

neutral = 3, disagree =2, and strongly disagree = 1.

We developed our questionnaire based on the

study of Athur (2014) with some modification. In his

study, Athur analyzed behavioural financial factors,

both cognitive and emotional factors, and their

effects on stock investment decisions by individual

investors. Our study emphasized phenomenon on the

financial fraud, not stock market, so we need to

modify some questions and/or statements in his

work so that it would fit into our study.

3.2 Data Validity and Reliability

Before we conducted the research, we did a pretest

for our questionnaire to selected samples. This

pretest was done to ensure the relevance of the items

to the study and to test the validity and reliability of

the instruments. To ensure the reliability of the

instruments, we used the Cronbach alpha measure,

and the results are as follows: optimism bias: .678;

overconfidence bias: .753; representativeness bias:

.621; confirmation bias: .791; framing bias: .724,

and herding bias: .778. We can conclude that all

instruments meet the recommended values (>.5)

(Widodo, 2006).

3.3 Regression Equation

Y = α + β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ β

4

X

4

+ β

5

X

5

+ β

6

X

6

+ ε

(1)

Notes: Y: the dependent variable, represents the

investor decision to get involve in a fake investment;

α: the constant (intercept); β

1

X

1

….…X

n

: the

predictors; ε: the error term; X

1

: optimism bias; X

2

:

overconfidence bias; X

3

: representativeness bias;

X

4

: confirmation bias; X

5

: framing bias, and X

6

:

herding behavior.

Regression analysis was done using Statistical

Packages for Social Scientists (SPSS). The β

coefficients represent the strength and direction of

the relationship between the independent (X

n

) and

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

316

dependent (Y) variables. Assuming that the error

term in the linear regression model is independent of

x, and is normally distributed, with zero mean and

constant variance, by testing the null hypothesis that

β = 0, it will be realized that there is a significant

relationship between x and y, at a 0.1 significance

level.

4 DATA ANALYSIS AND

FINDINGS

4.1 Descriptive Statistics

Our respondents has been grouped into the following

categories, age 20-25 years old: 5 respondents

(13.2%); 26-30 years old: 8 respondents (21.1%);

31-35 years old: 12 respondents (31.6%); 36-40

years old: 9 respondents (23.7%), and above 40

years old: 4 respondents (10.5%). Respondents of

this study accounted of male (M): 29 respondents

(76.3%), and female (F): 9 respondents (23.7%).

From this study we found their highest degree of

education: graduate from High School: 1 respondent

(2.6%); Bachelor: 24 respondents (63.2%); Master:

12 respondents (31.6%), and Doctor/PhD: 1

respondent (2.6%).

The respondents were asked to indicate what

encouraged them to purchase their investments.

From our study we found that the respondents were

encouraged by their friends: 36 respondents (95%),

and by themselves: 2 respondents (5%). When the

respondents were asked what the purpose of their

investment was, we found their purpose on

investment was to achieve financial freedom: 19

respondents (50%); to receive additional income: 8

respondents (21%); to have growth in income: 8

respondents (21%), and to satisfy their curiosity: 3

respondents (8%). Finally, the respondents were

asked to indicate what duration they would like their

investment to be, and we found that they would like

their investment to be maximum 6 months: 11

respondents (29%); between 6 months to one year:

15 respondents (39%), and more than one year: 12

respondents (32%).

4.2 Some Findings

4.2.1 Analysis of Investment Decision

In this study, we used the investor annual expected

return as a dependent variable. The respondents

were asked what their annual expected return from

their investment would be. We classified the

expected return based on the work of Athur (2014).

From our study, we found that their annual return

would be expected to be: between 5% and 10%: 3

respondents (8%); between 11% and 15%: 3

respondents (8%); between 16% and 20%: 15

respondents (39%), and above 20%: 17 respondents

(45%).

4.2.2 Analysis of Irrational Aspects

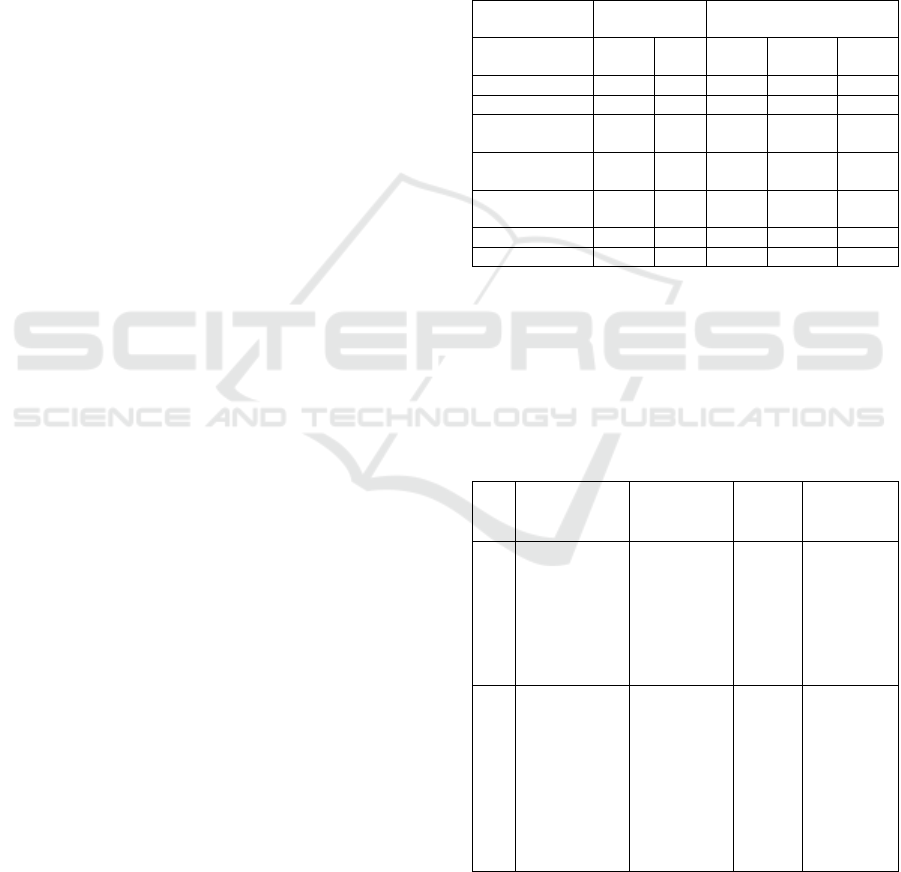

Table 1: The Result of Regression Analysis.

Unstandardized

Coefficients

Standardized Coefficients

Model B

Std.

Error

Beta t Sig.

(Constant) 4.339 .319 13.592 000

Optimism bias .288 168 .297 .714 .095

Overconfidence

b

ias

.189 .088 .241 2.157 .034

Representativene

ss bias

.044 .074 .078 .589 .552

Confirmation

b

ias

.144 .086 .218 1.677 .099

Framing bias .149 .077 .198 1.939 .055

Herding bias .021 .257 .006 .022 .938

*Note: dependent variable: investment decisions

The following is the regression equation:

Y = 4.339 + .288 X

1

+ .189 X

2

+ .044 X

3

+ .144 X

4

+ .149 X

5

+ .021 X

6

(2)

4.2.3 Hypotheses Testing

Table 2: Hypotheses Testing and Their Results.

No

Null

Hypothesis

Statement/Q

uestion

Sig. Result

H

1

Optimism

bias

influences the

investment

decisions

I believe

that bad

investment

will not

happen to

me

.095 Supported

H

2

Overconfiden

ce bias

influences the

investment

decisions

When it

comes to

trust my

judgments, I

can usually

rely on my

intuitive

feelings

.034 Supported

How Irrationality Works in Indonesia: A Case of Fake Investment

317

Table 2: Hypotheses Testing and Their Results. (cont.)

No

Null

Hypothesis

Statement/Q

uestion

Sig. Result

H

3

Representativ

eness bias

influences the

investment

decisions

I believe

that past

history

influences

present

investment

decisions

.552 Supported

H

4

Confirmation

bias

influences the

investment

decisions

I believe in

making my

investments

because I

have

informed

about all the

fundamental

s of the

company

.099 Supported

H

5

Framing bias

influences the

investment

decisions

The

previous

returns

generated

by the

company

made it very

attractive to

me to invest

in it

.055 Supported

H

6

Herding bias

influences the

investment

decisions

I follow an

investment

because of a

person that I

know or I

like has

joined this

investment

.983 Supported

*Note: significance level: .1 (10%)

4.2.4 Model Summary

Table 3: Model Summary.

Model R R Square

Adjusted

R Square

Std Error of

the Estimate

1 .589 .345 .48 987.5444

*Notes: predictors: Constant, Optimism Bias, Overconfidence

Bias, Representativeness Bias, Confirmation Bias, Framing Bias,

and Herding Bias

.

A multiple regression analysis of the influence of

psychological biases in the investor decisions was

made to determine the extent to which such biases

explained the investment decisions. Output of SPSS

shows that the R

2

= .345 which means that 34.5% of

the variance in investment decisions was explained

by the regression model.

5 CONCLUSIONS AND

RECOMMENDATIONS

5.1 Conclusions

This study was aimed to investigate the impact of

psychological biases (optimism bias,

overconfidence, representativeness bias,

confirmation bias, framing, and herding) towards

investor’s decisions in getting involved in a Ponzi

scheme. Regression analysis was employed to see

the impact of these biases on the investment

decisions. Data was collected through a

questionnaire given to 38 investors (victims) who

lived in several rural areas in Yogyakarta. The

results of this study revealed that optimism bias,

overconfidence, representativeness bias,

confirmation bias, framing, and herding behavior

have significant impact on investment decisions. In

other words, people who are getting involved in a

kind of investment scam i.e. Ponzi scheme has no

doubt acted irrationally, both logically and

emotionally.

5.2 Suggestions

We are still continuing this study to gain deeper

insights on the Ponzi scheme. We realize that our

study still has some limitations. First, the sample

used in our study is too small for generalization of

results. For the upcoming research we need to

include more respondents and also investigate other

psychological biases and their impacts towards

investment decisions. Second, we do not treat male

respondents and female respondents differently.

Third, we do not specifically describe cultural

impacts on the investor decisions. Fourth, since the

author has limited time and costs to do this study,

results of this study tend to look too simplistic, and

insufficient to give more insights about investment

scams in Indonesia to the readers. However, we

hope this study provides a threshold for upcoming

researchers to investigate investment scam practices,

as well as provide views on psychological and

cultural aspects on investor decision making in

Indonesia.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

318

REFERENCES

Athur, A. Dakane. 2014. Effect of Behavioural Biases on

Investment Decisions of Individual Investors in Kenya.

Master Of Science In Finance Thesis, School Of

Business, University Of Nairobi, pp. 1-75.

Baddeley, Michelle. 2015. “Herding, Social Influences

and Behavioural Bias in Scientific Research.” EMBO

Reports, Vol 16, no. 8, pp. 902-905.

Camerer, C., and D. Lovallo. 1999. “Overconfidence and

Excess Entry: An Experimental Approach.” The

American Economic Review, Vol. 89, no.1, pp. 306-

318.

Deason, S., S. Rajgopal, and G.B. Waymire. 2015. “Who

Gets Swindled in Ponzi Schemes?” Available at SSRN

2586490.

Elan, Seth L. 2010. Behavioral Patterns and Pitfalls of

U.S. Investors. Federal Research Division, Library of

Congress, Washington DC., pp. 1-10.

Fairfax, L. 2001. 'With Friends Like These...': Toward a

More Efficacious Response to Affinity-based

Securities and Investment Fraud.” Georgia Law

Review, no. 64, pp. 63-119.

Gornall, William J. 2010. Financial Fraud: A Game of

Cat and Mouse. Master Thesis, University of Ontario,

Waterloo, Canada.

Granovetter, M. 1985. “Economic Action and Social

Structure: the Problem of Embeddedness.” American

Journal of Sociology , Vol. 91, no.3, pp 481-510.

Greenspan, Alan. 2009. “How Bernard Madoff Made off

with My Money or Why Even an Expert on Gullibility

Can Get Gulled.” Skeptic, Vol. 14, no. 2, pp. 20-25.

Hong, H. K. 2005. “Thy Neighbour's Portfolio: World-of-

Mouth Effects in the Holdings and Trades of Money

Managers.” Journal of Finance, Vol. 60, no. 28, pp. 1-

24.

Hong, H., J. D. Kubik, and J. C. Stein. 2008. “The Only

Game in Town: Stock-Price Consequences of Local

Bias.” Journal of Financial Economics, Vol. 90, no. 1,

pp. 20–37.

Jacobs, Pearl, and L. Schain. 2011. “The Never Ending

Attraction of the Ponzi Scheme.” Journal of

Comprehensive Research,Vol. 9, pp. 40-46.

Johnson, M. L. 2002. Behavioural Finance: And the

Change of Investor Behaviour During and After the

Speculation Bubble at the end of the 1990s. Master's

Thesis in Finance, Lund University.

Lewis, M.K. 2012. “New Dogs Old Tricks. Why do Ponzi

Schemes Succeed?” Accounting Forum, no. 36, pp.

294-309.

Pressman, Steven. October 1998. “On Financial Frauds

and Their Causes: Investor Overconfidence.”

American Journal of Economics and Sociology, Vol.

57, no. 4, pp. 405–421.

Reurink, Arjan. 2016. Financial Fraud: A Literature

Review. Cologne: Max Planck Institute for the Study

of Societies, pp. 1-80.

Shiller, Robert J. 1998. “Human Behavior and the

Efficiency of the Financial System.” National Bureau

of Economic Research Working Paper: W6375.

Shiller, Robert. J. 2000. Irrational Exuberance. UK:

Princeton University Press.

Widodo, P.B. 2006. “Reliabilitas dan Validitas Konstruk

Skala Konsep Diri untuk Mahasiswa Indonesia.”

Jurnal Psikologi, Universitas Diponegoro, Vol. 3, no.

1, pp. 1-17.

How Irrationality Works in Indonesia: A Case of Fake Investment

319