Motivations, Classification and Model Trial of Conversational Agents for

Insurance Companies

Falko Koetter

1

, Matthias Blohm

1

, Monika Kochanowski

1

, Joscha Goetzer

2

, Daniel Graziotin

2

and Stefan Wagner

2

1

Fraunhofer Institute for Industrial Engineering, Nobelstr. 12, 70569 Stuttgart, Germany

2

University of Stuttgart, Universit

¨

atsstr. 38, 70569 Stuttgart, Germany

joscha.goetzer@gmail.com, daniel.graziotin@iste.uni-stuttgart.de, Stefan.Wagner@iste.uni-stuttgart.de

Keywords:

Conversational Agents, Intelligent User Interfaces, Machine Learning, Nlp, Chatbots, Insurance.

Abstract:

Advances in artificial intelligence have renewed interest in conversational agents. So-called chatbots have

reached maturity for industrial applications. German insurance companies are interested in improving their

customer service and digitizing their business processes. In this work we investigate the potential use of con-

versational agents in insurance companies by determining which classes of agents are of interest to insurance

companies, finding relevant use cases and requirements, and developing a prototype for an exemplary insur-

ance scenario. Based on this approach, we derive key findings for conversational agent implementation in

insurance companies.

1 INTRODUCTION

With the digital transformation changing usage pat-

terns and consumer expectations, many industries

need to adapt to new realities. The insurance sector

is next in line to grapple with the risks and opportuni-

ties of emerging technologies, in particular Artificial

Intelligence (Nordman et al., 2017).

Fraunhofer IAO as an applied research institution

supports digital transformation processes in an ongo-

ing project with multiple insurance companies (Ren-

ner and Kochanowski, 2018). The goal of this project

is to scout new technologies, investigate them, rate

their relevance and evaluate them (e.g. in a model trial

or by implementing a prototype). While insurance

has traditionally been an industry with very low cus-

tomer engagement, insurers now face a young gener-

ation of consumers with changing attitudes regarding

insurance products and services (Pohl et al., 2017).

Traditionally, customer engagement uses channels

like mail, telephone and local agents. In 2016, chat-

bots emerged as a new trend (Guzmn and Patha-

nia, 2016), making it a topic of interest for Fraun-

hofer IAO and insurance companies.

With the rise of the smartphone, many insurers

started offering apps, but success was limited (Power,

J. D., 2017), which may stem from app fatigue (Schip-

pers, 2016). App use has plateaued, as users have too

many apps and are reluctant to add more (Gartner,

2015). In contrast, conversational agents require no

separate installation, as they are accessible via mes-

saging apps, which are likely to be already installed

on a user’s smartphone. Conversational agents are an

alternative to improve customer support and digitize

processes like claim handling.

The objective of this work is to facilitate the cre-

ation of conversational agents by defining the traits

of an agent more clearly using a (1) classification

framework, which is based on current literature and

research topics, and systematically analyzing (2) use

cases and requirements in an industry, shown in the

example insurance scenario. The applicability of this

approach is shown by implementing a prototype (3)

including an evaluation. Furthermore, we derive key

findings for conversational agent implementation in

insurance companies and open points for research.

2 RELATED WORK

In this section we investigate work in the area of con-

versational agents, dialog management, and research

applications in insurance.

McTear et al. (2016) offer detailed explanations

about background and history of conversational in-

Koetter, F., Blohm, M., Kochanowski, M., Goetzer, J., Graziotin, D. and Wagner, S.

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies.

DOI: 10.5220/0007252100190030

In Proceedings of the 11th International Conference on Agents and Artificial Intelligence (ICAART 2019), pages 19-30

ISBN: 978-989-758-350-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

19

terfaces as well as techniques to build and evaluate

own agent applications. Another literature review

about chatbots was provided by Cahn (2017), where

common approaches and design choices are summa-

rized followed by a case study about the functioning

of IBM’s chatbot Watson, which became famous for

winning the popular quiz game Jeopardy! against hu-

mans.

Many chatbot applications have already been built

nowadays with the goal to solve actual problems. One

example is PriBot, a conversational agent, which can

be asked questions about an application’s privacy pol-

icy, because users tended to skip reading the often

long and difficult to understand privacy notices. Also,

the chatbot accepts queries of the user which aim to

change his privacy settings or app permissions (Hark-

ous et al., 2016).

In the past there have already been several studies

with the goal to evaluate how a conversational agent

should behave for being considered as human-like as

possible. In one of them, conducted by Kirakowski

et al. (2009), fourteen participants were asked to talk

to an existing chatbot and to collect key points of con-

vincing and unconvincing characteristics. It turned

out that the bot’s ability to hold a theme over a longer

dialog made it more realistic. On the other hand, not

being able to answer to a user’s questions was re-

garded as an unsatisfying characteristic of the artifi-

cial conversational partner (Kirakowski et al., 2009).

In another experiment, which was done by

S

¨

orensen (2017), eight users had to talk to two differ-

ent kinds of chatbots, one behaving more human-like

and one behaving more robotic. In this context, they

had to fulfill certain tasks like ordering an insurance

policy or demanding an insurance certification. All

of the participants instinctively started to chat by us-

ing natural human language. In cases in which the

bot did not respond to their queries in a satisfying

way, the users’ sentences continuously got shorter un-

til they ended up with writing key words only. Thus,

according to the results of this survey, conversational

agents preferably should be created human-like, be-

cause users seem to be more comfortable when feel-

ing like talking to another human being, especially

in cases in which the concerns are crucial topics like

their insurance policies (S

¨

orensen, 2017).

Dialog management strategies (DM) define the

conversational behaviors of a system in response to

user message and system state McTear et al. (2016).

In industry applications, DM often consists of a

handcrafted set of rules and heuristics, which are

tightly coupled to the application domain (McTear

et al., 2016) and improved iteratively. One problem

with handcrafted approaches to DM is that it is chal-

lenging to anticipate every possible user input and

react appropriately, making development resource-

intensive and error-prone. But if few or no recordings

of conversations are available, these rule-oriented

strategies may be the only option.

As opposed to the rule-oriented strategies, data-

oriented architectures work by using machine learn-

ing algorithms that are trained with samples of di-

alogs in order to reproduce the interactions that are

observed in the training data. These statistical or

heuristical approaches to DM can be classified into

three main categories: Dialog modeling based on re-

inforcement learning, corpus-based statistical dialog

management, and example-based dialog management

(simply extracting rules from data instead of manually

coding them) (McTear et al., 2016; Spierling, 2005).

Spierling (2005) highlights neural networks, Hidden-

Markov Models, and Partially Observable Markov

Decision Processes as possible implementation tech-

nologies.

The following are common strategies for rule-

based dialog management:

• Finite-state-based DM uses a finite state machine

with handcrafted rules, and performs well for

highly structured, system-directed tasks (McTear

et al., 2016).

• Frame-based DM follows no predefined dialog

path, but instead allows to gather pieces of in-

formation in a frame structure and no specific or-

der. This is done by adding an additional entity-

value slot for every piece of information to be col-

lected and by annotating the intents in which they

might occur. Using frames, a less restricted, user-

directed conversation flow is possible, as data is

captured as it comes to the mind of the user (Rud-

nicky and Xu, 1999).

• Information State Update represents the informa-

tion known at a given state in a dialog and up-

dates the internal model each time a participant

performs a dialog move, (e.g. asking or answer-

ing). The state includes information about the

mental states of the participants (beliefs, desires,

intentions, etc.) and about the dialog (utterances,

shared information, etc.) in abstract representa-

tions. Using so-called update moves, applicable

moves are chosen based on the state (Traum and

Larsson, 2003).

• Agent-based DM uses an agent that fulfills con-

versation goals by dynamically using plans for

tasks like intent detection and answer genera-

tion. The agent has a set of beliefs and goals

as well as an information base which is updated

throughout the conversation. Within this informa-

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

20

tion framework the agent continuously prioritizes

goals and autonomously selects plans that max-

imize the likelihood of goal fulfillment (Nguyen

and Wobcke, 2005).

Chu et al. (2005) describes how multiple DM ap-

proaches can be combined to use the best strategy for

specific circumstances.

A virtual insurance conversational agent is de-

scribed by Yacoubi and Sabouret (2018), utiliz-

ing TEATIME, an architecture for agent-based DM.

TEATIME uses emotional state as a driver for ac-

tions, e.g. when the bot is perceived unhelpful, that

emotion leads the bot to apologize. The shown exam-

ple bot is a proof of concept for TEATIME capable

of answering questions regarding insurance and react

to customer emotions, but does not implement a full

business process.

Kowatsch et al. (2017) describe a text-based

healthcare chatbot that acts as a companion for

weightloss but also connects a patient with healthcare

professionals. The chat interface supports non-textual

inputs like scales and pictorials to gather patient feed-

back. Study results showed a high engagement with

the chatbot as a peer and a higher percentage of auto-

mated conversation the longer the chatbot is used.

Overall, these examples show potential for con-

versational agents in the insurance area, but lack sup-

port for complete business processes.

3 CLASSIFICATION OF

CONVERSATIONAL AGENTS

The idea of conversational agents that are able to

communicate with human beings is not new: In

1966, Joseph Weizenbaum introduced Eliza, a virtual

psychotherapist, which was able to respond to user

queries using natural language and which could be

considered as the first chatbot (Weizenbaum, 1966).

Nowadays, the idea of speaking machines has experi-

enced a revival with the emergence of new technolo-

gies, especially in the area of artificial intelligence.

Novel machine learning algorithms allow developers

to create software agents in a much more sophisti-

cated way and in many cases they already outper-

form previous statistical NLP methods (McTear et al.,

2016). Additionally, the importance of messaging

apps such as WhatsApp or Telegram has increased

over the last years. In 2015, the total number of peo-

ple using these messaging services outran the total

number of active users in social networks for the first

time. Today, each of these app has about between 200

million and 1.5 billion users (Inc, 2018).

As a highly popular topic in 2016 (Guzmn and

Pathania, 2016), a great variety of different chatbots

evolved together with an equally wide range of ter-

minologies. For being able to draw a big picture of

the current trends in the area of conversational agents,

we divide them into the following four common cate-

gories:

• Chatterbots: Bots with focus on small talk

and realistic conversations, not task-oriented, e.g.

Cleverbot (Carpenter, 2018).

• (Virtual, Intelligent, Cognitive, Digital, Per-

sonal) assistants (VPAs): Agents fulfilling tasks

intelligently based on spoken or written user input

and with the help of data bases and personalized

user preferences (Cooper et al., 2008) (e.g. Ap-

ple’s Siri or Amazon’s Alexa (Dale, 2016)).

• Specialized digital assistants (SDAs): Focused

on a specific domain of expertise, goal-oriented

behavior (Dale, 2016).

• Embodied conversational agents (ECAs): Vi-

sually animated agents, e.g. in form of avatars

or robots (Radziwill and Benton, 2017), where

speech is combined with gestures and facial ex-

pressions.

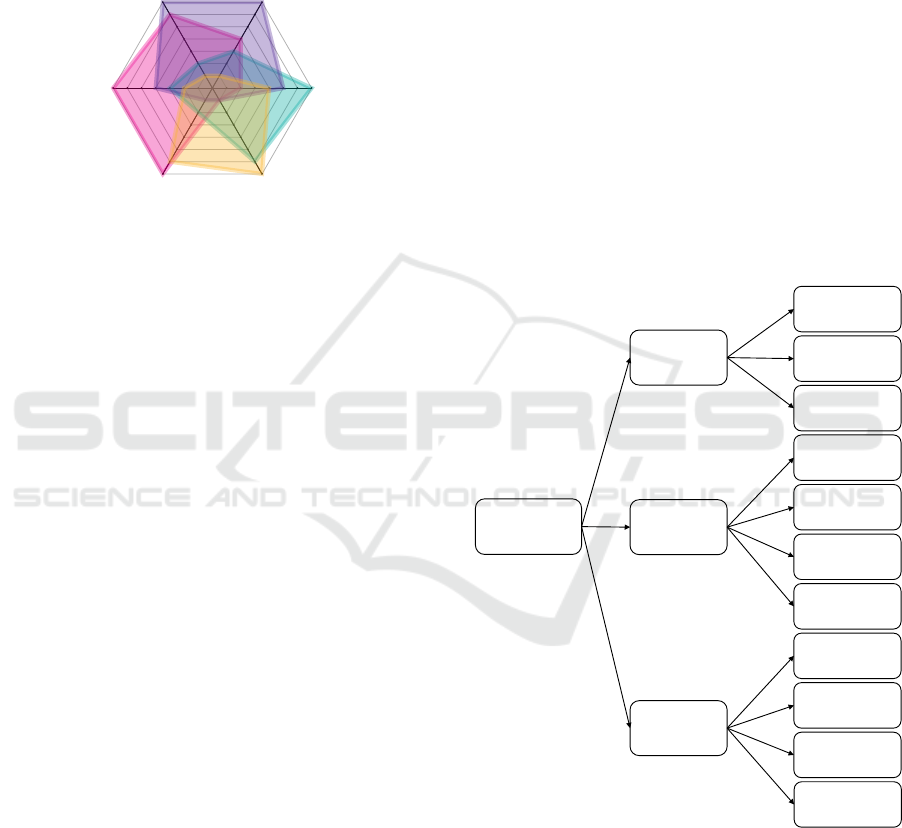

Figure 1 shows the results of evaluating these four

classes in terms of different characteristics such as re-

alism or task orientationbased on own literature re-

search. Chatterbots provide a high degree of enter-

tainment since they try to imitate the behavior of hu-

man beings while chatting, but there is no specific

goal to be reached within the scope of these conversa-

tions. In contrast, general assistants like Siri or Alexa

are usually called by voice in order to fulfill a specific

task. Specialized assistants concentrate even more on

achieving a specific goal, which often comes at the

expense of realism and user amusement because their

ability to respond to not goal-oriented conversational

inputs like small talk is mostly limited. The best feel-

ing of companionship can be experienced by talking

to an embodied agent, since the reactions of these bots

are closest to human-like behavior.

When looking at these classification results, a

broad spectrum of various possible agents is offered.

Therefore, a restriction depending on the specific use

case has to be made first, before the realization of

a prototypical chatbot can be tackled. Since Fraun-

hofer IAO aims to investigate solutions supporting

processes in the insurance domain, creating a proto-

type with the properties of a SDA is necessary, be-

cause the main purpose in this scenario is to perform

and successfully complete a certain task (e.g. report-

ing a claim). Furthermore, adding additional chatter-

bot features such as the ability to do small talk in a

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies

21

limited goal-oriented scope could lead to a more re-

alistic and human-like user experience. However, be-

fore considering detailed design and implementation

choices, it is helpful to take a general look at the role

of chatbots within the special environment of insur-

ance companies for identifying essential issues and

needs.

Companionship

Realism

Entertainment

Textual

Task Or ientation

Spoken

Chatterbots

General

Digital Assistants

Embodied

Conversational Agents

Specialized

Digital Assistants

0

1

2

3

4

5

6

7

Figure 1: Classification of conversational agents with their

characteristics (own presentation). Values between 0 and

7 indicate how strong a characteristic applies for the given

type of agent.

4 CHATBOTS IN INSURANCE

Insurance is an important industry sector in Germany,

with 560 companies that manage about 460 million

policies (Schwark and Theis, 2014). However, the in-

surance sector is under a high cost pressure, which

shows in a declining employee count and low mar-

gins (Stange and Reich, 2015). The insurance market

is saturated and has transitioned from a growth mar-

ket to a displacement market (Aschenbrenner et al.,

2010). For the greater part, German insurance com-

panies have used conservative strategies, caused by

risk aversion, long-lived products, hierarchical struc-

tures, and profitable capital markets (Zimmermann

and Richter, 2015). As these conditions change, so

must insurance companies.

Insurance is an industry with low customer en-

gagement, as an insurer traditionally has basically

two touch points to interact with customers: selling

a product and the claims process. A study found that

consumers interact less with insurers than with any

other industry, so the consumer experience with insur-

ers tends to lag behind others (Niddam et al., 2014).

Many insurance companies have heterogeneous

IT infrastructures incorporating legacy systems

(sometimes from two or more companies as the result

of a merger) (Weindelt, 2016). These grown architec-

tures pose challenges when implementing new data-

driven or AI solutions, due to issues like data qual-

ity, availability and privacy. Nonetheless, the high

amount of available data and complex processes make

insurance a prime candidate for machine learning and

data mining. The adoption of AI in the insurance sec-

tor is in early stages, but accelerating, as insurance

companies strive to improve service and remain com-

petitive (Nordman et al., 2017).

Conversational agents are one AI technology at

the verge of adoption. In 2017, ARAG launched

a travel insurance chatbot, quickly followed by bots

from other insurance companies (Gorr, 2018). While

these chatbots are still experimental and implement

narrow use cases, these first implementations prove

public interest and feasibility.

To identify areas of possible chatbot support, we

surveyed the core business processes of insurance

companies as described in Aschenbrenner et al.

(2010) and Horch et al. (2012). Three core areas

of insurance companies are customer-facing: market-

ing/sales, contract management and claim manage-

ment. Figure 2 shows the main identified processes

related to this area.

marketing/

sales

sales talk

underwriting

sell policy

contract

management

contract

change

change of

personal data

customer-

facing

processes

claim

management

damage claim

reporting

claim

assessment

cancellation

claim

settlement

claim

adjustment

billing

Figure 2: Customer-facing insurance processes (based

on Aschenbrenner et al. (2010) and Horch et al. (2012)).

We identified all these processes as possible use

cases for conversational agent support, in particular

support by SDAs.

Furthermore, we investigated general require-

ments for conversational agents in these processes:

Availability and Ease-of-use Conversational agents

are an alternative to both conventional customer sup-

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

22

port (e.g. phone, mail) as well as conventional

applications (e.g. apps and websites). Compared

to these conventional solutions, chatbots offer more

availability than human agents and have less barri-

ers of use than conventional applications, requiring

neither an installation nor the ability to learn a new

user interface, as conventional messaging services are

used (Derler, 2017).

Guided Information Flow. Compared to websites,

which offer users a large amount of information they

must filter and prioritize themselves, conversational

agents offer information gradually and only after the

intent of the user is known. Thus, the search space is

narrowed at the beginning of the conversation without

the user needing to be aware of all existing options.

Smartphone Integration. Using messaging services,

conversational agents can integrate with other smart-

phone capabilities, e.g. making a picture, sending a

calendar event, setting a reminder or calling a phone

number.

Customer Call Reduction. Customer service func-

tions can be measured by reduction of customer calls

and average handling time (Guzmn and Pathania,

2016). SDAs can help here by automating conver-

sations, handling standard customer requests and per-

forming parts of conversations (e.g. authentication).

Human Handover. Customers often use social me-

dia channels to escalate an issue in the expectation of

a human response, instead of an automated one. A

conversational agent thus must be able to differenti-

ate between standard use cases it can handle and more

complicated issues, which need to be handed over to

human agents (Newlands, 2017). One possible ap-

proach is to use sentiment detection, so customer who

are already stressed are not further aggravated by a

bot (Guzmn and Pathania, 2016).

Digitize Claim Handling. Damage claim handling

in insurance companies is a complex process in-

volving multiple departments and stakeholders (Koet-

ter et al., 2012). Claim handling processes are

more and more digitized within the insurance com-

panies (Horch et al., 2012), but paper still dominates

communication with claimants, workshops and ex-

perts. (Fannin and Brower, 2017) defines maturity

levels of insurance processes, defining virtual han-

dling as a process where claims are assessed fully dig-

itally based on digital data from the claimant (e.g. a

video, a filled digital form), and touchless handling as

a fully digital process with no human intervention on

the insurance side. SDAs help moving towards these

maturity levels by providing a guided way to make

a claim digitally and communicate with the claimant

(e.g. in case additional data is needed).

Conversational Commerce is the use of Conversa-

tional Agents for marketing and sales related pur-

poses (Eeuwen, 2017). Conversational Agents can

perform multiple tasks using a single interface. Ex-

amples are using opportunities to sell additional prod-

ucts (cross-sell) or better versions of the product the

customer already has (up-sell) by chiming in with per-

sonalized product recommendations in the most ap-

propriate situations. One example would be to note

that a person’s last name has changed during an ad-

dress update customer service case and offer appro-

priate products if the customer has just married.

Internationalization is an important topic for large

international insurance companies. However, most

frameworks for implementing conversational agents

are available in more than one language. To the best

of our knowledge today the applied conversational

agents in German insurance are optimized only for

one language. So this topic is future work in respect

to the prototype.

Compliance to privacy (GDPR) is usually guaranteed

by the login mechanisms on the insurance sites, there-

fore the topic is out of scope for our research proto-

type. For broader scenarios not requiring identifica-

tion on the insurance site and the usage of the data for

non-costumers, this is an open area of research.

5 PROTOTYPE

Based on the work presented in the last sections and

our talks with insurance companies, we arrived at the

following non-functional requirements that the chat-

bot prototype ideally should fulfill:

• Interoperability: The agent should be able to

keep track of the conversational context over sev-

eral message steps and messengers.

• Portability: The agent can be run on different

devices and platforms (e.g. Facebook Messen-

ger, Telegram). Therefore it should use a unified,

platform-independent messaging format.

• Extensibility: The agent should provide a high

level of abstraction that allows designers to add

new conversational content without having to deal

with complicated data structures or code.

Additionally, the following functional require-

ments should be regarded in the implementation:

• Report a Claim: The system must provide the

possibility for a user to report a damage claim us-

ing the conversational agent (prototype scenario).

• Human Language Understanding: The system

should be able to understand and process the

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies

23

user’s inputs and intents given in form of written

natural language (German).

• Response Generation: The system should be

able to generate an answer sentence in written

human language (German) according to the user

queries.

For dialog design within the prototype, experi-

menting with machine learning algorithms was the

preferred implementation strategy. For this purpose,

discussions with insurance companies were held to

assess the feasibility of receiving existing dialogs

with customers, for example for online chats, phone

logs or similar. However, such logs generally seem to

be not available at German insurers, as the industry

has self-regulated to only store data needed for claim

processing (GDV, 2012). As a research institute rep-

resents a third party not directly involved in claims

processing, data protection laws forbid sharing of data

this way without steps to secure personal data. During

our talks we have identified a need for automated or

assisted anonymization of written texts as a precon-

dition for most customer-facing machine learning use

cases, at least when operating in Europe (Kamarinou

et al., 2016). However, these issues go beyond the

scope of our current project, but provide many oppor-

tunities for future research.

To still build a demonstrator in face of these chal-

lenges, dialogs for the prototype were manually de-

signed without using real-life customer conversations

and fine-tuned by user testing with fictional damage

claims. As this approach entails higher manual effort

for dialog design, a narrower scenario was chosen to

still allow for the full realization of a customer-facing

process. The chosen scenario was a special case of

the damage claim process: The user has a damaged

smartphone or tablet and wants to make an insurance

claim.

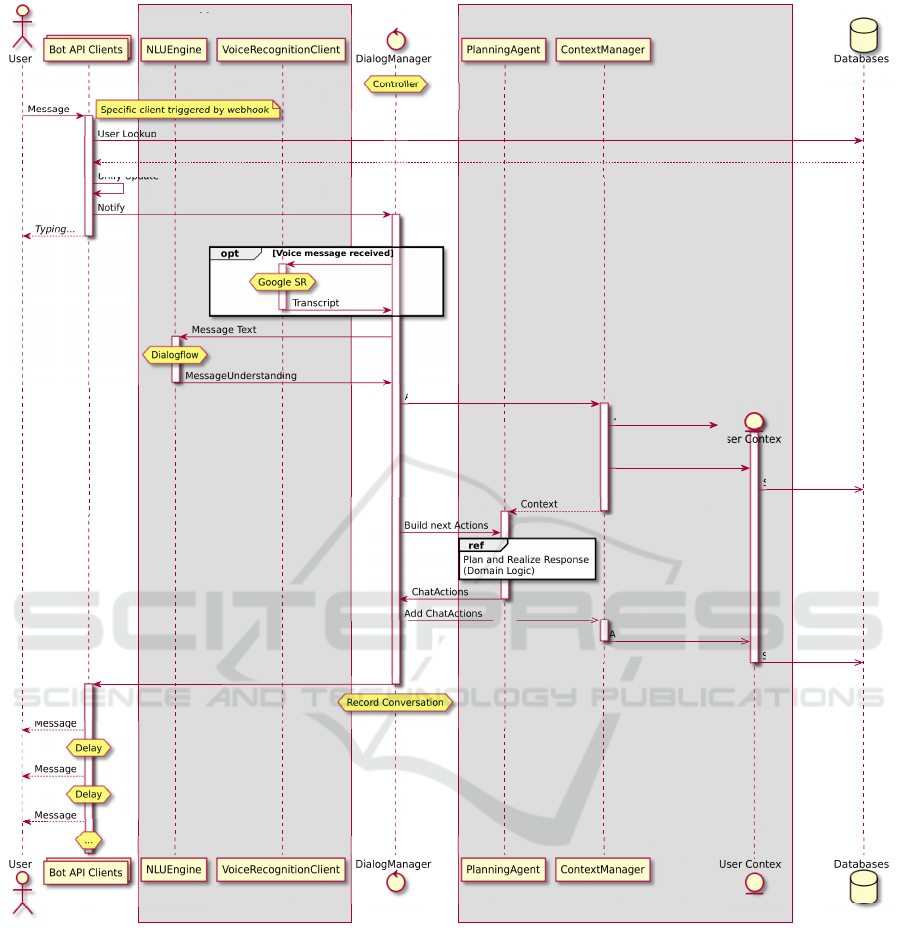

Figure 5 shows the main components of the pro-

totype and their operating sequence when processing

a user message. To provide extensibility prototype

architecture strictly separates service integration, in-

ternal logic and domain logic.

The user can interact with the bot over different

communication channels which are integrated with

different bot API clients. To integrate a different mes-

saging service, a new bot API client needs to be writ-

ten. The remainder of the prototype can be reused.

Once a user has written a message, a lookup of

user context is performed to determine if a conversa-

tion with that user is already in progress. User con-

text is stored in a database so no state is kept within

external messaging services. Afterwards, a typing no-

tification is given to the user, indicating the bot has

received the message and is working on it. This pre-

vents multiple messages by a user who thinks the bot

is not responsive.

In the next step, the message has to be understood

by the bot. In case of a voice message, it is transcribed

to text using a Google speech recognition web ser-

vice.

For natural language understanding, we com-

pared four possible frameworks (Microsoft’s LUIS,

Google’s Dialogflow, Facebook’s wit.ai and IBM’s

Watson) regarding important criteria for prototype

implementation. A comparison table for these criteria

is shown in Table 1. As a result of the comparison,

Dialogflow was chosen as a basic framework.

Table 1: Comparison of Microsoft’s LUIS, Google’s Di-

alogflow, Facebook’s wit.ai, and IBM’s Watson (based

on Davydova (2017)).

LUIS

Dialogflow

Wit.ai

Watson

Python bindings no yes yes yes

German language yes yes in Beta yes

Free service no yes yes no

Remember state yes yes yes yes

Service bound yes yes yes yes

Simple training with effort yes yes yes

Dialogflow is used for intent identification, which

determines the function of a message and based on

that a set of possible parameters (McTear et al., 2016).

For example, the intent of the message “the dis-

play of my smartphone broke” may have the intent

phone broken with the parameter damage type as

display damage, while the parameter phone type

is not given. Together, this information given by Di-

alogflow is a MessageUnderstanding

As soon as the message is understood, the user

context is updated. Afterwards, a response needs to

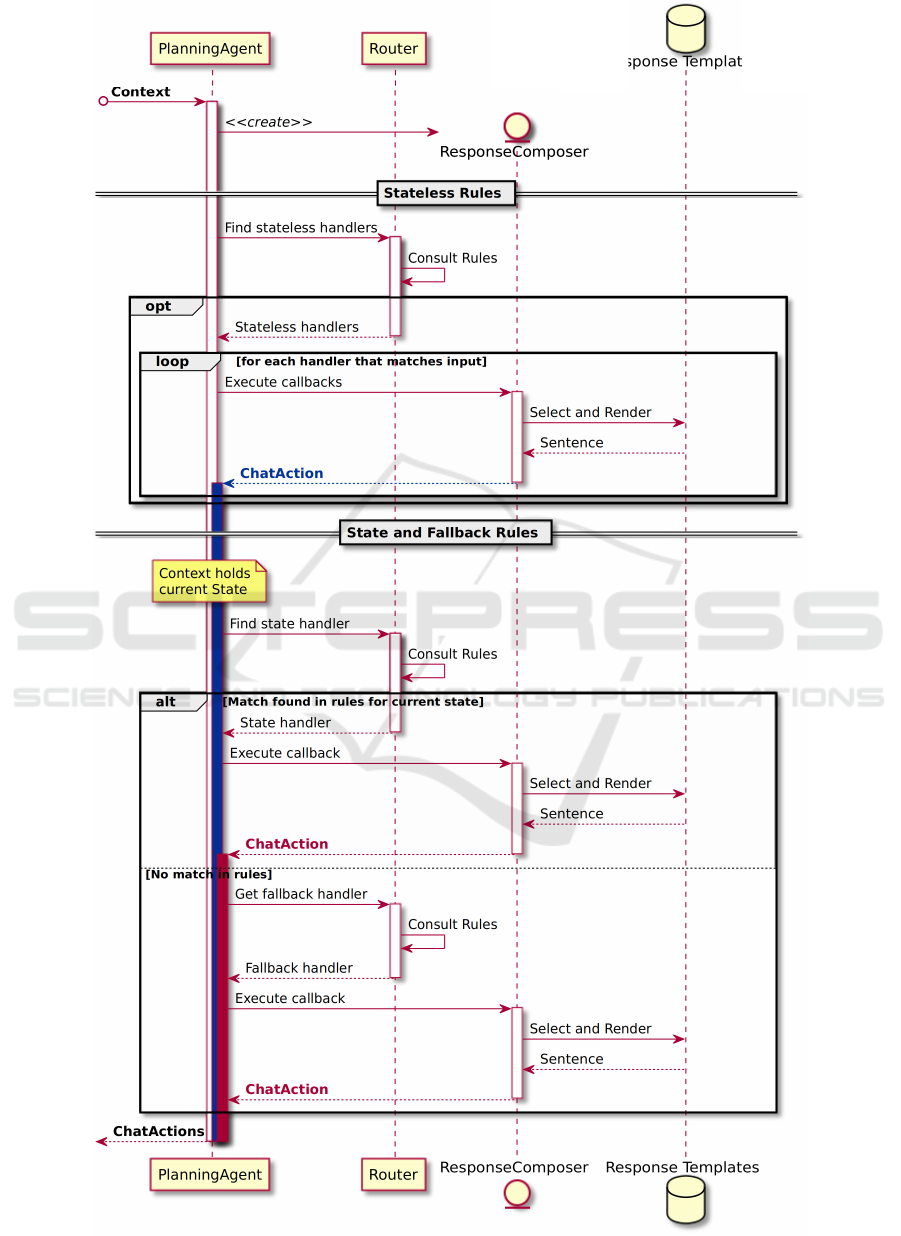

be generated. This process, which was labeled with

Plan and Realize Response in Figure 5, is shown in

detail in Figure 6.

In the prototype, an agent-based strategy was cho-

sen in order to combine the capabilities of the frame-

based entities and parameters in Dialogflow with a

custom dialog controller based on predefined rules in

a finite state machine. This machine allows to de-

fine rules that trigger handlers and state transitions

when a specific intent or entity-parameter combina-

tion is encountered. That way, both intent and frame

processing happen in the same logically encapsulated

unit, enabling better maintainability and extensibil-

ity. The rules are instances of a set of *Handler

classes such as an IntentHandler for the aforemen-

tioned intent and parameter matching, supplemented

by other handlers, e.g. an AffirmationHandler,

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

24

Figure 3: Dialog excerpt of the prototype, showing the pos-

sibility to clarify the phone model via multiple-choice in-

put).

which consolidates different intents that all express

a confirmation along the lines of “yes”, “okay”,

“good” and “correct”, as well as a NegationHandler,

a MediaHandler and an EmojiSentimentHandler

(to analyze positive, neutral, or negative sentiment

of a message with emojis). Each implements their

own matches(MessageUnderstanding) method.

Rules (handlers) are used within the dialog state

machine:

1. Stateless handlers are checked independently of

the current state. For example, a RegexHandler

rule determines whether the formality of the ad-

dress towards the user should be changed (Ger-

man differentiates the informal “du” and the for-

mal “Sie”)

2. Dialog States map each possible state to a list

of handlers that are applicable in that state.

For instance, when the user has given an an-

swer and the system asks for explicit confirma-

tion in a state USER CONFIRMING ANSWER, then an

AffirmationHandler and a NegationHandler

capture “yes” and “no” answers.

3. Fallback handlers are checked if none of the ap-

plicable state handlers have yielded a match for

an incoming MessageUnderstanding. These

fallbacks include static, predefined responses

with lowest priority (e.g. small talk), as well as

handlers to repair the conversation by bringing the

user back on track or changing the topic.

At first, the system had only allowed a single state

to be declared at the same time in the router. How-

ever, this had quickly proven to be insufficient as users

are likely to want to respond or refer not only to the

most recent message, but also to previous ones in the

chat. With only a single contemporaneous state, the

user’s next utterance is always interpreted only in that

state. In order to make this model resilient, every

state would need to incorporate every utterance that

the user is likely to say in that context. As this is

not feasible, the prototype has state handlers that al-

low layering transitions on top of each other, allowing

multiple simultaneous states which may advance indi-

vidually.

To avoid an explosion of active states, the system

has state lifetimes: new states returned by callbacks

may have a lifetime that determines the number of di-

alog moves this state is valid for. On receiving a new

message, the planning agent decreases the lifetimes of

all current dialog states by one, except for the case of

utter non-understanding (“fallback” intent). If a state

has exceeded its lifetime, it is removed from the pri-

ority queue of current dialog states.

Figure 6 contains details about how the system

creates responses to user queries. Based on the ap-

plicable rule, the conversational agent performs chat

actions (e.g. sending a message), which are generated

from response templates, taking into account dialog

state, intent parameters, and information like a user’s

name, mood and preferred level of formality.

RuleHandlers, states and other dialog specific im-

plementations are encapsulated, so a new type of di-

alog can be implemented without needing to change

the other parts of the system.

Generated chat actions are stored in the user con-

text and performed for the user’s specific messenger

using the bot API. As the user context has been up-

dated, the next message by the user continues the con-

versation.

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies

25

Before the user utters an intent to make a damage

claim, the prototype explains its functionality and of-

fers limited small talk. As soon as the user wants to

make a damage claim, the conversational agent gath-

ers the required information using a predetermined

questionnaire. Questions concern type of damage,

damaged phone, phone number, IMEI, damage time,

damage event details, etc. Answers are interpreted us-

ing dialog flow (e.g. determining a point in time). In-

terpretation results have to be confirmed by the user.

In case the answer is not understood, not correct or

not confirmed, the question is repeated. Alternatively,

for specific questions domain specific actions for clar-

ification are implemented. For example, a choice for

specific phone model is shown in Figure 3. For each

question, users may ask for details or for an example

answer. A skip intent is recognized and causes the

dialog to advance to the next question if the current

question is optional.

After the questionnaire is concluded, the bot

thanks the user and stores the data. In a real-life ap-

plication, claim management systems would be inte-

grated to automatically trigger subsequent processes.

6 EVALUATION

To evaluate the produced prototype’s quality and per-

formance, we conducted a model trial with the goal

to report a claim by using the chatbot without having

any further instructions available.

Of the 14 participants (who all had some techni-

cal background), 35.7% claimed to regularly use chat-

bots, 57.1% to use them occasionally, and only 7.1%

stated that they had never talked to a chatbot before.

However, all participants were able to report a claim

within a range of about four minutes, resulting in an

overall task completion rate of 100%.

Additionally, the users had to rate the quality of

their experiences with the conversational agent by fill-

ing out a questionnaire. For each question they could

assign points between 0 (did not apply at all) and

10 (did apply to the full extent). The most impor-

tant quality criteria, whose choice was oriented on the

work of Radziwill and Benton (2017), are listed with

their average ratings in Figure 4 and are discussed in

detail.

With an average of 8 points for Ease of Use, the

users had no problems with using the bot to solve the

task. In the same way, 8.3 points for Appropriate For-

mality indicate that the participants were comfortable

with the formal and informal language the bot talked

to them. Only one user stated that he felt worried

about permanently being called by his first name af-

ter he told it. Fewer points were given for the bot’s

degree of human-like behavior: The rating for con-

vincing Natural Interaction with 7.9 points may be

due to the fact that the conversation was designed in

a strongly questionnaire-oriented way, which might

have restricted the feeling of having a free user con-

versation. Also, the satisfaction with given answers to

users’ domain specific questions was considered quite

(but not totally) convincing with 7.6 points. The least

convincing experience was that chatbot’s Personality,

which was rated with only 5.2 points on average. This

is not surprising, since during this work we put com-

paratively less efforts in strengthening the agent’s per-

sonal skills as it does not even introduce itself with a

name, but instead mainly acts on a professional level,

always concentrating on the fulfillment of its task.

With 7.2 points, talking to the chatbot was experi-

enced as quite Funny & Interesting, but still with a

lot of room for further improvement. Similarly, the

agent’s Entertainment capabilities, which are at 7.7

points on average at the moment, could be upgraded

by extending the conversational contents with addi-

tional enjoyable features not related to the question-

naire. For the future we plan to do another larger eval-

uation on a bigger and more heterogeneous group of

participants.

Ease of Use

Appropriate Formality

Natural Interaction

Response Quality

Personality

Funny & Interesting

Entertainment

0

2

4

6

8

10

8

8.3

7.9

7.6

5.2

7.2

7.7

Average rating points

Figure 4: Survey results: average user experience ratings

(fourteen participants, 0..10 points).

7 CONCLUSIONS AND

OUTLOOK

In this work we have investigated the potential of us-

ing conversational agents in insurance companies by

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

26

Service Wrappers

Internal System

User text

User

User

text

Databases

Databases

Message

User Lookup

User

Unify Update

Add Update

<<

get or create

>>

Us t

Add Update

Store Update

Context

Build next Actions

dd ChatActions

Store ChatActions

Perform Actions

Message

g

g

Figure 5: Sequence diagram of the conversational agent prototype.

general research and implementing a prototype. We

determined which classes of conversational agents are

useful for insurance companies, which insurance pro-

cesses can be supported, and what the requirements

and motivations for using conversational agents in in-

surance are. These findings can be used to facilitate

the development of conversational agents. We found

a need for Specialized Digital Assistants in customer

facing processes.

Based on these findings we formulated require-

ments for conversational agents in insurance and se-

lected the smartphone damage claim as an example

scenario. We implemented this scenario in a proto-

type, using machine learning for intent recognition

but relying on manual dialog design. Instead of a sin-

gle dialog state, we implemented a system of multiple

conversational states enabling more flexible conversa-

tions. We evaluated our prototype with real users and

gathered their reactions with a questionnaire. Overall,

we found that the prototype is able to handle the ex-

ample scenario to the user’s satisfaction. Possible im-

provements in the prototype scenario are a better de-

termination of the desired degree of formality as well

as defining a consistent persona for the agent (a first

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies

27

ResponseComposer

Response Templates

Figure 6: Detailed sequence diagram of the response generation in the conversational agent prototype.

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

28

step would be to provide a name).

The findings indicate technology is ready to im-

plement conversational agents for insurance customer

service scenarios. However, as real-life scenarios are

broader than the example scenario, considerably more

effort is necessary to design the dialogs. One area not

covered by the prototype is human handover in case

the conversational agent cannot complete and interac-

tion to the user’s satisfaction.

Data protection and privacy remain open areas for

research. Legal and practical questions regarding data

collection, storage and processing must be worked

on alongside technical requirements, as they tend to

be complex and have limited precedent (Smart-Data-

Begleitforschung, 2018).

In future research, we would like to extend the

prototype to different scenarios as well as perform a

real-life evaluation with an insurance partner to quan-

tify the benefits of agent use, e.g. call reduction, suc-

cess rate, and customer satisfaction.

REFERENCES

Aschenbrenner, M., Dicke, R., Karnarski, B., and Schweig-

gert, F. (2010). Informationsverarbeitung in Ver-

sicherungsunternehmen. Springer.

Cahn, J. (2017). Chatbot: Architecture, design, & develop-

ment.

Carpenter, R. (2018). Cleverbot.

https://www.cleverbot.com/.

Chu, S.-W., O’Neill, I., Hanna, P., and McTear, M. (2005).

An approach to multi-strategy dialogue management.

In Ninth European Conference on Speech Communi-

cation and Technology, pages 865–868.

Cooper, R. S., McElroy, J. F., Rolandi, W., Sanders, D.,

Ulmer, R. M., and Peebles, E. (2008). Personal virtual

assistant. US Patent 7,415,100.

Dale, R. (2016). Industry watch: The return of the chatbots.

Natural Language Engineering, 22(5):811–817.

Davydova, O. (2017). 25 chatbot platforms: A compar-

ative table. https://chatbotsjournal.com/25-chatbot-

platforms-a-comparative-table-aeefc932eaff.

Derler, R. (2017). Chatbot vs. app vs. website chatbots

magazine. https://chatbotsmagazine.com/chatbot-vs-

app-vs-website-en-e0027e46c983.

Eeuwen, M. (2017). Mobile conversational commerce:

messenger chatbots as the next interface between busi-

nesses and consumers. Master’s thesis, University of

Twente.

Fannin, T. and Brower, B. (2017). 2017 future of claims

study. Technical report, LexisNexis.

Gartner (2015). Market trends: Mobile

app adoption matures as usage mellows.

https://www.gartner.com/newsroom/id/3018618.

GDV (2012). Verhaltensregeln f

¨

ur den Umgang mit

personenbezogenen Daten durch die deutsche

Versicherungswirtschaft. http://www.gdv.de/wp-

content/uploads/2013/03/GDV Code-of-

Conduct Datenschutz 2012.pdf. Datum des Aufrufes

des Dokumentes: 11.02.2015.

Gorr, D. (2018). Ein Versicherungsroboter f

¨

ur

gewisse Stunden. Versicherungswirtschaft

Heute. http://versicherungswirtschaft-

heute.de/schlaglicht/ein-versicherungsroboter-fur-

gewisse-stunden/.

Guzmn, I. and Pathania, A. (2016). Chatbots in customer

service. Technical report, Accenture.

Harkous, H., Fawaz, K., Shin, K. G., and Aberer, K. (2016).

Pribots: Conversational privacy with chatbots. In

Twelfth Symposium on Usable Privacy and Security

(SOUPS 2016), Denver, CO. USENIX Association.

Horch, A., Kintz, M., Koetter, F., Renner, T., Weidmann,

M., and Ziegler, C. (2012). Projekt openXchange:

Servicenetzwerk zur effizienten Abwicklung und Opti-

mierung von Regulierungsprozessen bei Sachsch

¨

aden.

Fraunhofer Verlag, Stuttgart.

Inc, S. (2018). Most popular messaging apps 2018.

https://www.statista.com/statistics/258749/most-

popular-global-mobile-messenger-apps/.

Kamarinou, D., Millard, C., and Singh, J. (2016). Machine

learning with personal data. Queen Mary School of

Law Legal Studies Research Paper, (247).

Kirakowski, J., O’Donnell, P., and Yiu, A. (2009). Estab-

lishing the hallmarks of a convincing chatbot-human

dialogue. In Maurtua, I., editor, Human-Computer In-

teraction, chapter 09. InTech, Rijeka.

Koetter, F., Weisbecker, A., and Renner, T. (2012). Busi-

ness process optimization in cross-company service

networks: architecture and maturity model. In SRII

Global Conference (SRII), 2012 Annual, pages 715–

724. IEEE.

Kowatsch, T., Nißen, M., Shih, C.-H. I., R

¨

uegger, D., Vol-

land, D., Filler, A., K

¨

unzler, F., Barata, F., Hung, S.,

B

¨

uchter, D., et al. (2017). Text-based healthcare chat-

bots supporting patient and health professional teams:

Preliminary results of a randomized controlled trial on

childhood obesity. In Persuasive Embodied Agents for

Behavior Change (PEACH2017). ETH Zurich.

McTear, M., Callejas, Z., and Griol, D. (2016). The Con-

versational Interface, volume 6. Springer.

Newlands, M. (2017). 10 ways ai

and chatbots reduce business risks.

https://www.entrepreneur.com/article/305073.

Nguyen, A. and Wobcke, W. (2005). An agent-based ap-

proach to dialogue management in personal assistants.

In Proceedings of the 10th international conference on

Intelligent user interfaces, pages 137–144. ACM.

Niddam, M., Barsley, N., Gard, J.-C., and Cotro-

neo, U. (2014). Evolution and revolution:

How insurers stay relevant in a digital future.

https://www.bcg.com/publications/2014/insurance-

technology-strategy-evolution-revolution-how-

insurers-stay-relevant-digital-world.aspx.

Nordman, E., DeFrain, K., Hall, S. N., Karapiperis, D., and

Obersteadt, A. (2017). How artificial intelligence is

changing the insurance industry.

Motivations, Classification and Model Trial of Conversational Agents for Insurance Companies

29

Pohl, V., Kasper, H., Kochanowski, M., and Renner, T.

(2017). Zukunftsstudie 2027 #ichinzehnjahren (in

german). http://s.fhg.de/zukunft2027.

Power, J. D. (2017). 2017 u.s. auto claims satisfaction

study. http://www.jdpower.com/resource/jd-power-

us-auto-claims-satisfaction-study.

Radziwill, N. and Benton, M. (2017). Evaluating quality of

chatbots and intelligent conversational agents. arXiv

preprint arXiv:1704.04579.

Renner, T. and Kochanowski, M. (2018). Innovationsnet-

zwerk digitalisierung f

¨

ur versicherungen (in german).

http://s.fhg.de/innonetz.

Rudnicky, A. and Xu, W. (1999). An agenda-based dia-

log management architecture for spoken language sys-

tems. In IEEE Automatic Speech Recognition and Un-

derstanding Workshop, volume 13.

Schippers, B. (2016). App fatigue.

https://techcrunch.com/2016/02/03/app-fatigue/.

Schwark, P. and Theis, A. (2014). Statistisches Taschen-

buch der Versicherungswirtschaft. Gesamtverband der

Deutschen Versicherungswirtschaft (GDV), Berlin.

Smart-Data-Begleitforschung (2018). Smart Data

- Smart Solutions. https://www.digitale-

technologien.de/DT/Redaktion/DE/Downloads/-

Publikation/2018 06 smartdata smart solutions.pdf.

S

¨

orensen, I. (2017). Expectations on chatbots among

novice users during the onboarding process.

http://urn.kb.se/resolve?urn=urn:nbn:se:kth:diva-

202710.

Spierling, U. (2005). Interactive digital storytelling: to-

wards a hybrid conceptual approach. Worlds in

Play: International Perspectives on Digital Games

Research.

Stange, A. and Reich, N. (2015). Die zukunft der deutschen

assekuranz: chancenreich und doch ungewiss. In

Change Management in Versicherungsunternehmen,

pages 3–9. Springer Gabler, Wiesbaden.

Traum, D. R. and Larsson, S. (2003). The information state

approach to dialogue management. In Current and

new directions in discourse and dialogue, pages 325–

353. Springer.

Weindelt, B. (2016). Digital transformation of industries.

Technical report, World Economic Forum and Accen-

ture.

Weizenbaum, J. (1966). Eliza - a computer program for

the study of natural language communication between

man and machine. Commun. ACM, 9(1):36–45.

Yacoubi, A. and Sabouret, N. (2018). Teatime: A formal

model of action tendencies in conversational agents.

In ICAART (2), pages 143–153.

Zimmermann, G. and Richter, S.-L. (2015). Gr

¨

unde f

¨

ur

die ver

¨

anderungsaversion deutscher versicherungsun-

ternehmen. In Change Management in Versicherung-

sunternehmen, pages 11–35. Springer.

ICAART 2019 - 11th International Conference on Agents and Artificial Intelligence

30