Gap Distributions for Analysing Buyer Behaviour in Agent-based

Simulation

Andreas Ahrens

1

, Ojaras Purvinis

2

and Jelena Zaˇsˇcerinska

3

1

Hochschule Wismar, University of Technology, Business and Design, Wismar, Germany

2

Kaunas University of Technology, Kaunas, Lithuania

3

Centre for Education and Innovation Research, Riga, Latvia

Keywords:

Buyers’ Burstiness, Gap Processes, Binary Customer Behaviour, Exponential Distribution, Weibull Distribu-

tion, Wilhelm Distribution, Agent-based Simulation.

Abstract:

Simulation models allow predicting the development of real situations in various technical, business and so-

cial systems. However, many real situations in business environment are of bursty nature. Buyers often appear

concentrated or, in other words, bursty. Different approaches for analysing buyers’ behaviour have been de-

veloped. One of these approaches focuses on analysis of gaps between buyers, and the buyers’ scenario is

completely described by the sequence of gaps. The present research is interdisciplinary, namely telecommuni-

cations and business management. The methodology of the present contribution is built on adaptation of gap

distribution functions from data transmission theory in telecommunications to bursty business process in busi-

ness management. The aim of the paper is to demonstrate inter-connections between different gap distribution

functions such as Weibull, Exponential and Wilhelm as well as to compare different gap distribution functions

for their suitability when analysing bursty processes. Furthermore, this contribution provides the mathematical

description of gap processes. The comparison results of different gap distribution functions are presented. The

theoretical results are confirmed by practical implementation in agent-based simulation environment.

1 INTRODUCTION

Phenomenon’s simulation or, in other words, imita-

tion of a situation or process, allows predicting the

development of real situations in various technical,

business and social systems. Many real situations in

business environment are of bursty nature as shown

in telecommunication systems by Gilbert and Elliot

in the 1960s (Gilbert, 1960; Elliott, 1963). Contem-

porary computers and information and communica-

tions technology (ICT) facilitate phenomenon simu-

lation. When the mathematics is intractable, agent-

based simulation provides an efficient solution to sim-

ulate the bursty process of buying by taking decisions

of individual buyers, so called agents, into account

(Axelrod, 2006; Albanese, 2006; Tesfatsion, 2006).

Thus, in business process, agent-based simulation as-

sists in analysing buyers’ behaviour.

Different approaches for analysing buyers’ be-

haviour have been developed. One of these ap-

proaches focuses on analysis of gaps between buyers,

and the buyers’ scenario is completely described by

the sequence of gaps. However, in many situations,

buyers appear concentrated or, in other words, bursty.

Bursty processes are described by gap distributions

in data transmission theory in such a research field

as telecommunications. In such scenarios the classi-

cal Bernoulli model, also known as memoryless sce-

nario in data transmission theory, cannot be applied.

Mostly the Weibull gap distribution is usedto describe

bursty processes. Unfortunately, the parameters of

the Weibull gap distribution are notdirectly connected

with the process of buying.

A promising approach was formulated by Wil-

helm. Wilhelm described the distribution of bit-errors

(i.e. gaps between bit-errors) in data transmission

by defining a bit-error probability as well as a bit-

error concentration (Wilhelm, 1976). The Wilhelm

approachwas adapted by Ahrens to the bursty process

of buying by defining a buyer probability as well as a

buyer concentration (Ahrens et al., 2015; Ahrens and

Zaˇsˇcerinska, 2016). Both gap distribution functions,

namely Weibull as well as Wilhelm, can be applied

to describe bursty and non-bursty business processes.

Whereas the Bernoulli approach is well established in

statistical theory, in this paper we are going to show

Ahrens, A., Purvinis, O. and Zaš

ˇ

cerinska, J.

Gap Distributions for Analysing Buyer Behaviour in Agent-based Simulation.

DOI: 10.5220/0007308900230029

In Proceedings of the 8th International Conference on Sensor Networks (SENSORNETS 2019), pages 23-29

ISBN: 978-989-758-355-1

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

23

that the Wilhelm gap distribution function is an ex-

tension of the Bernoulli model (the same as for the

Weibull gap distribution).

The present research is interdisciplinary, namely

telecommunications and business management. The

methodology of the present contribution is built on

adaptation of gap distribution functions from data

transmission theory in telecommunications to bursty

business process in business management.

The novelty of this paper is the demonstration of

inter-connections between different distribution func-

tions as well as a comparison of different distribution

functions for their suitability when analysing bursty

processes. The paper provides the mathematical de-

scription of gap process and presents the comparison

results of different gap distribution functions. Practi-

cal implementation in agent-based simulation is used

to confirm the theoretical results.

The remaining part of this paper is structured as

follows: In section 2 the mathematical description of

gap processes is presented. In section 3 the proba-

bility of arbitrarily buyer’s patterns is demonstrated.

The comparison results of different gap distribution

functions are shown in section 4. Finally, the practical

implementationin agent-based simulation is shown in

section 5. Some concluding remarks are given in sec-

tion 6.

2 MATHEMATICAL

DESCRIPTION OF GAP

PROCESSES

Bursty buyer processes can be defined by gaps be-

tween consecutive buyers as highlighted in Fig. 1 and

2.

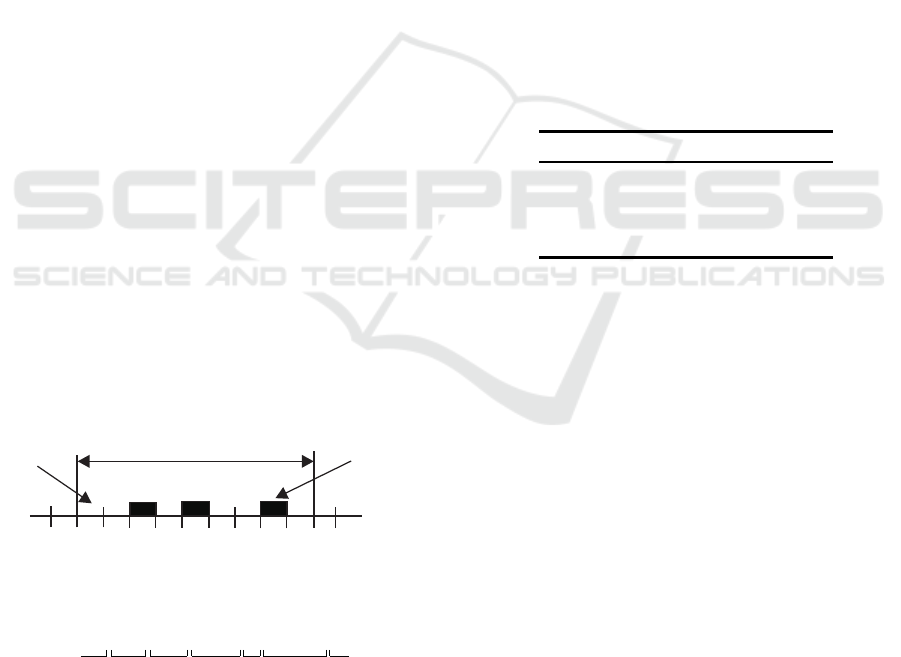

block interval n

buyer

sequence of people

visitor

Figure 1: Buyer processes defined by gaps between consec-

utive buyers.

- x - - x - - x - - - x x - - - - x -

2 2 3 40

Figure 2: Definition of gaps between consecutive buyers (a

buyer (represented by ”x”) within a sequence of non-buying

visitors (represented by ”-”)).

Frequently used and well-suited practical approx-

imations are provided, if the model is based on the in-

dependence of gap intervals. The gap distribution in-

dicates the probability that a gap X between two buy-

ers is greater than or at least equal to a given number

k, i. e.

u(k) = P(X ≥ k) (1)

as well as the gap density function v(k) defining the

probability that a gap X between two buyers is equal

to a given number k, i. e.

v(k) = P(X = k) . (2)

Models that are based on the independence of gap in-

tervals are completely described by the gap density

or the gap distribution, respectively. The assumption

that successive gaps are statistically independent is

regarded as a good practical approximation. Mod-

els with these requirements are described as regenera-

tive models in the literature (Wilhelm, 1976; Ahrens,

2000). Several gap distribution functions u(k) are

shown in Table 1. Whereas the Exponential distribu-

tion function is described by one parameter, Wilhelm

distribution as well as Weibull distribution are defined

by two parameters.

Table 1: Several gap distribution functions.

Type Distribution u(k)

Exponential e

−β

e

k

Weibull e

−(β

w

k)

α

w

Wilhelm ((k+ 1)

α

− k

α

) ·e

−β·k

When taking the gap distribution defined by Wil-

helm into account the following expression was iden-

tified

u(k) = ((k + 1)

α

− k

α

) · e

−β·k

0 ≤ k < ∞ (3)

with

lim

k→∞

e

−β·k

= 0 β > 0 (4)

and

β ≈ p

e

1/α

. (5)

Here, the business process, i.e. the buyers’ character-

istics, is modelled by two parameters, namely visitor

probability to buy (also referred as the buyers’ proba-

bility) p

e

and the buyers’ concentration (1− α). Typ-

ical values for the buyer concentration are (1−α) = 0

for the memoryless buyer scenario (also known as the

Bernoulli scenario), i. e. the buyers appear indepen-

dently distributed and 0 < (1− α) ≤ 0.5 for a bursty

buyer scenario. Assuming that the buyers appear in-

dependently form each other, i.e. (1 − α) = 0, the

buyers’ gap distribution function u(k) defined by Wil-

helm simplifies to

u(k) = e

−p

e

·k

= (e

−p

e

)

k

. (6)

SENSORNETS 2019 - 8th International Conference on Sensor Networks

24

Taking the Taylor series of the exponential function

e

−x

for small x into account, the function e

−x

can be

re-written as

e

−x

= 1− x+

x

2

2

−

x

3

6

+

x

4

24

+ · ·· (7)

and approximated by

e

−x

≈ 1− x (8)

for small x. Finally, the buyers’ gap distribution func-

tion u(k), defined in (3), results for small p

e

in

u(k) = P(X ≥ k) = (1 − p

e

)

k

=

p

k

e

. (9)

The parameter

p

e

described the probability of non-

buying and can be defined as

p

e

=

Number of Visitors - Number of Buyers

Number of Visitors

.

(10)

It should be noted that equation (9) is well-known

in probability theory for the product of independent

events and is valid for any p

e

. Obtaining equation

(9) testifies the correctness of the equality (3) for the

memoryless buyer scenario.

The probability of a non-buying visitor is given by

p

e

= (1− p

e

). Finally, the probability u(k) = P(X ≥

k) that X ≥ k consecutive visitors are non-buying vis-

itors results in

u(k) =

p

k

e

= (1− p

e

)

k

. (11)

Re-writing of u(k) leads to the buyers’ gap density

function v(k), i. e.

v(k) = P(X = k) , (12)

which describes the probability of a gap X equal to k.

The buyers’ gap density function v(k) can be calcu-

lated as follows

u(k) = v(k) + v(k+ 1) + v(k+ 2) + ·· ·

u(k+ 1) = v(k+ 1) + v(k+ 2) + ··· .

By calculating the difference between u(k) and

u(k + 1) the buyers’ gap density function v(k) =

P(X = k) can be obtained

v(k) = u(k) − u(k + 1) (13)

and results for the memoryless buying process with

(9) in

v(k) =

p

k

e

− p

k+1

e

= p

k

e

· (1− p

e

) (14)

and can be simplified as

v(k) = (1− p

e

)

k

· (1− (1− p

e

)) = (1− p

e

)

k

· p

e

.

(15)

The probability that after a buyer in the distance of

k = 0 another buyer appears results in

v(0) = p

e

(16)

and is solely defined by the buyer probability p

e

as

expected for the memoryless buyer scenario. In sit-

uations with bursty buyers, the probability v(0) in-

creased as highlighted in Fig. 3

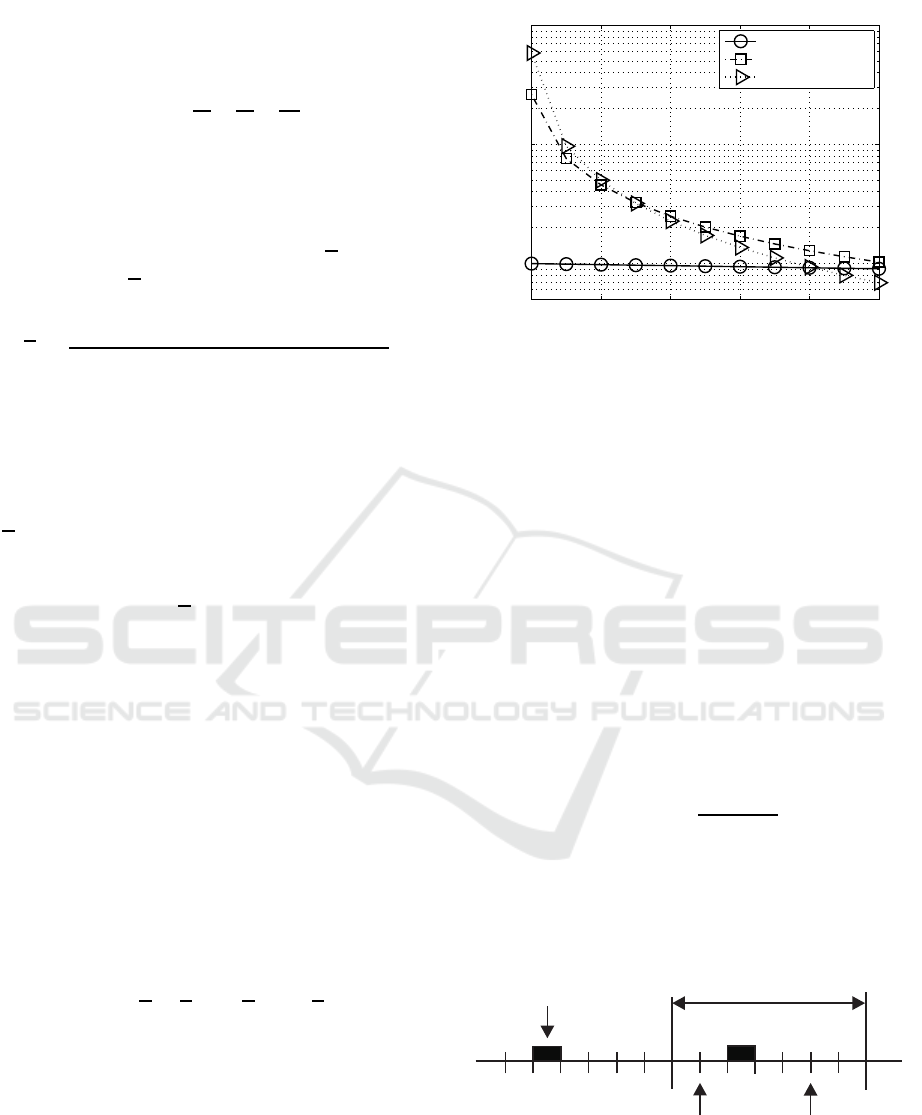

0 2 4 6 8 10

10

−2

10

−1

10

0

v(k) →

n →

(1 − α) = 0.0

(1 − α) = 0.2

(1 − α) = 0.5

Figure 3: Buyers’ gap density function v(k) for different

parameters of the (1 − α) at a buyer’s probability of p

e

=

10

−2

.

3 STATISTICAL ANALYSIS OF

ARBITRARILY BUYERS’

PATTERNS

In this section, the proof is given that the beforehand

defined functions u(k) and v(k), introduced by Wil-

helm, can be used to calculate the probability of ar-

bitrarily buyer pattern with e buyers within an inter-

val of n visitors. Let us denote the number of pattern

with K

n,e

and start with the memoryless buyer sce-

nario with (1 − α) = 0. Analysing a pattern E of n

visitors with e buyers, total number of pattern within

an interval n is given by

K

n,e

=

n

e

=

n!

e!(n− e)!

. (17)

Here it is worth noting that when analysing the mem-

oryless buyer scenario all pattern E within an interval

of n visitors with e buyers appear with the same prob-

ability.

block interval

n = 7

buyer

with p

e

position

1 2

3

4

5 6

7

u(2)

u(4)

Figure 4: Calculation of the probability P

E

(7,1) of a pattern

E within an interval of n = 7 visitors with e = 1 buyer at the

position n

1

= 3.

According to Fig. 4, the probability P

E

(7,1) of such

a pattern E within an interval of n = 7 visitors with

Gap Distributions for Analysing Buyer Behaviour in Agent-based Simulation

25

e = 1 buyer results in

P

E

(7,1) = p

e

· u(2) · u(4) . (18)

The term p

e

· u(2) defines the probability that there

will be a buyer before the considered interval fol-

lowed by a gap of at least two visitors. With

u(k) = (1− p

e

)

k

=

p

k

e

. (19)

the probability P

E

(7,1) can be expressed for the con-

sidered pattern and the memoryless buyer scenario as

P

E

(7,1) = p

e

·

p

2

e

· p

4

e

= p

e

· p

6

e

, (20)

indicating that six non-buying visitors within an inter-

val of n = 7 visitors appear. Here the position of the

buyer is not of any interest, as the pattern depicted in

Fig. 5 results in the same probability for P

E

(7,1).

Taking two buyers within an interval of n visitors

into consideration as exemplary depicted in Fig. 6, the

probability P

E

(7,2) of such a pattern E within an in-

terval of n = 7 visitors results in

P

E

(7,2) = p

e

· u(2) · v(1) · u(2) . (21)

With

u(k) = (1 − p

e

)

k

=

p

k

e

(22)

and

v(k) = (1− p

e

)

k

· p

e

=

p

k

e

· p

e

(23)

the probability P

E

(7,2) can be expressed for the

memoryless buyer scenario as

P

E

(7,2) = p

e

· p

2

e

· p

e

· p

e

· p

2

e

= p

2

e

· p

5

e

(24)

indicating that five non-buying visitors within an in-

terval of n = 7 visitors with 2 buyers appear.

On the other hand, 2 buyers between 7 visitors

may appear in another sequence.

It yields from (17) that the total number of such

combinations (pattern) equals to

K

7,2

=

7

2

=

7!

2!(7− 2)!

= 21 . (25)

Therefore, the probability of 2 buyers between 7 visi-

tors of all patterns is given by the Bernoulli formula

P(7,2) = K

7,2

· P

E

(7,2) =

7!

2!(7− 2)!

· p

2

e

·

p

5

e

. (26)

block interval

n = 7

buyer

with p

e

position

1 2

3

4

5 6

7

u(3)

u(3)

Figure 5: Calculation of the probability P

E

(7,1)) of a pat-

tern E within an interval of n = 7 visitors with e = 1 buyer

at the position n

1

= 4.

block interval

n = 7

buyer

with p

e

position

1 2

3

4

5 6

7

u(2) v(1)

u(2)

Figure 6: Calculation of the probability P

E

(7,1) of a pattern

E within an interval of n = 7 visitors with e = 2 buyers at

the position n

1

= 3 and n

2

= 5.

Therefore, for the memoryless channel it can be

shown that the obtained results coincide with the

Bernoulli model.

Having more than 2 buyers within an interval of

n visitors, the probability P

E

(n,e) of a pattern E in

an interval of n visitors with e buyers at the positions

n

1

,n

2

,· ·· , n

e

can be obtained as

P

E

(n,e) = p

e

· u(n

1

− 1)· u(n−n

e

) ·

e

∏

ν=2

v(n

ν

− n

ν−1

− 1) .

(27)

The ith pattern (with 1 ≤ i ≤ K

n,e

) is determined by

the buyers’ position n

1

,n

2

,· ·· , n

e

.

Fig. 7 illustrates the calculation of the probability

P

E

(7,3) of a pattern E within an interval of n = 7

visitors. Here, the e = 3 buyers are at the positions

n

1

= 3, n

2

= 4 and n

3

= 6. The probability P

E

(7,3)

of such a pattern E within an interval of n = 7 visitors

is given by

P

E

(7,3) = p

e

· u(2) · v(0) · v(1) · u(1) . (28)

With

u(k) =

p

k

e

(29)

and

v(k) =

p

k

e

· p

e

(30)

the probability P

E

(7,3) can be expressed for the

memoryless buyer scenario as

P

E

(7,3) ≈ p

e

·

p

2

e

· p

e

· p

e

· p

e

· p

e

= p

3

e

· p

4

e

. (31)

block interval

n = 7

buyer

with p

e

position

1 2

3

4

5 6

7

u(2) v(0) v(1) u(1)

Figure 7: Calculation of the probability P

E

(7,3) of a pattern

E within an interval of n = 7 visitors with e = 3 buyers at

the positions n

1

= 3, n

2

= 4 and n

3

= 6.

SENSORNETS 2019 - 8th International Conference on Sensor Networks

26

Taking the total number of such combinations

(pattern) such as

K

7,3

=

7

3

=

7!

3!(7− 4)!

= 35 (32)

into account, the probabilityof 3 buyers in a sequence

of 7 visitors is given by the Bernoulli formula

P(7,3) = K

7,3

·P

E

(7,3) =

7!

3!(7− 3)!

· p

3

e

·

p

4

e

. (33)

Analysing the memoryless buyer scenario, the

probability P

E

(n,e) can be written as

P

E

(n,e) ≈= p

e

e

·

p

n−e

e

(34)

and is independent of the individual pattern when

analysing the memoryless buyer scenario where each

pattern E appears with the same probability.

4 COMPARISON OF GAP

DISTRIBUTIONS

In this section the interconnections of Exponential,

Weibull and Wilhelm distribution are to be shown. It

is assumed that the given buyers’ characteristic under-

goes the Wilhelm distribution with given parameters

p

e

and (1− α).

Table 2 and 3 show the resulting estimation errors

for p

e

= 10

−2

. As quality parameter for the approx-

imation between the given Wilhelm gap interval dis-

tribution u

Wilhelm

(k) and the investigated distribution

function u(k) (Exponential, Weibull) the mean square

error

MSE

min

=

k

max

−1

∑

k=0

|u(k) − u

Wilhelm

(k)|

2

(35)

is used and minimized when using least-square opti-

mization. The parameter k

max

specifies the maximum

gap length to be considered.

Tab. 2 shows the obtained results when using

an Exponential gap distribution instead of the Wil-

helm distribution. As the Exponentialgap distribution

equals the Wilhelm distribution for the memoryless

(non-bursty) buyer scenario, a perfect mapping can be

achieved. With increasing buyers’ concentration, the

gap between the Wilhelm and Exponential gap distri-

bution becomes larger as the Exponential gap distri-

bution function is not able to take the buyers’ concen-

tration into account.

Tab. 3 highlights the obtained results when using

Weibull gap distribution instead of the Wilhelm one.

Here, a better adaptation can be reached, as gap distri-

bution functions with two parameters lead to a better

Table 2: Estimation errors when using the Exponential dis-

tribution instead of the Wilhelm distribution.

(1−α) β

e

MSE

0,0 0,010 0,000

0,1 0,016 0,989

0.2 0,026 2,377

0,3 0,055 2,613

adaptation. Finally, Fig. 8 shows the approximated

gap distributions as a function of the interval length k

at a buyer concentration of (1− α) = 0, 2 and a buyer

probability of p

e

= 10

−2

.

Table 3: Estimation errors when using the Weibull distribu-

tion instead of the Wilhelm distribution.

(1−α) β

w

α

w

Error

0,0 0,010 1,000 0,000

0,1 0,013 0,460 0,007

0.2 0,033 0,310 0.002

0,3 0,119 0,264 0,007

0 20 40 60 80 100

0

0.2

0.4

0.6

0.8

1

interval length k →

u(k) →

Wilhelm

Exponential

Weibull

Figure 8: Approximated gap distributions as a function of

the interval length n at a buyer concentration of (1− α) =

0,2 and a buyer probability of p

e

= 10

−2

.

5 AGENT-BASED SIMULATION

In this section a model validation is carried out by

demonstrating that the model is a reasonable repre-

sentation of the investigated system (Martis, 2006).

Therefore, the objective of this section is compare

the probability P(n,e) with simulation outcomes ob-

tained by agent-based approach (Sajjad et al., 2016).

By agents relatively autonomous computational ob-

jects are understood. Agents of the same environment

Gap Distributions for Analysing Buyer Behaviour in Agent-based Simulation

27

Table 4: Comparison of the frequency γ

e

with the probability P(n,e) for memoryless buying scenarios.

block length number m

e

of probability mumber m of blocks in probability relative frequency

(theory) (simulation)

n of buying events p

e

simulated sample P(n,e) γ

e

5 2 0.01 200 0.001 0.000

5 1 0.01 200 0.048 0.040

5 2 0.1 200 0.073 0.051

5 1 0.1 200 0.328 0.328

7 4 0.1 142 0.003 0.007

7 2 0.1 142 0.128 0.078

5 2 0.5 200 0.031 0.030

5 1 0.5 200 0.156 0.197

7 4 0.5 142 0.273 0.234

7 2 0.5 142 0.164 0.170

may slightly differ in values of their properties, called

also attributes. Agents from different environments

may differ essentially. They exchange messages and

carry out activities influencing other agents and their

environment. Finally, agent activities are defined by

their own rules. Results of agent activities may be

message sending to other agents or the change of its

own state. The state of the agent may be changed

by other agents as well. Therefore according to vari-

ous authors, agents may have the following properties

(Ahrens et al., 2019):

• Intelligence: this property is implemented with

simple If then rules, fuzzy logic methods, built-in

neural networks, genetic algorithms, etc.

• Autonomy: agents are able to make decisions in-

dependently.

• Reactivity: agents have an ability to respond to

the activities of other agents and environment.

• Pro-activity: the agent may have a goal and are

programmed to reach it; the agent also may be

able to foresee possible negative events and to try

to avoid them.

• Adaptivity: agents may change their own rules of

behaviour responding to activities of other agents

and changes of environment as well as evaluating

accumulated statistics.

• Robustness: the ability to carry out activities and

survive in different environments.

• Goal-orientation: agents act according to their

goals and do nothing more.

• Mobility: agents may change their virtual place in

2D and 3D environments and they may be placed

on GIS map.

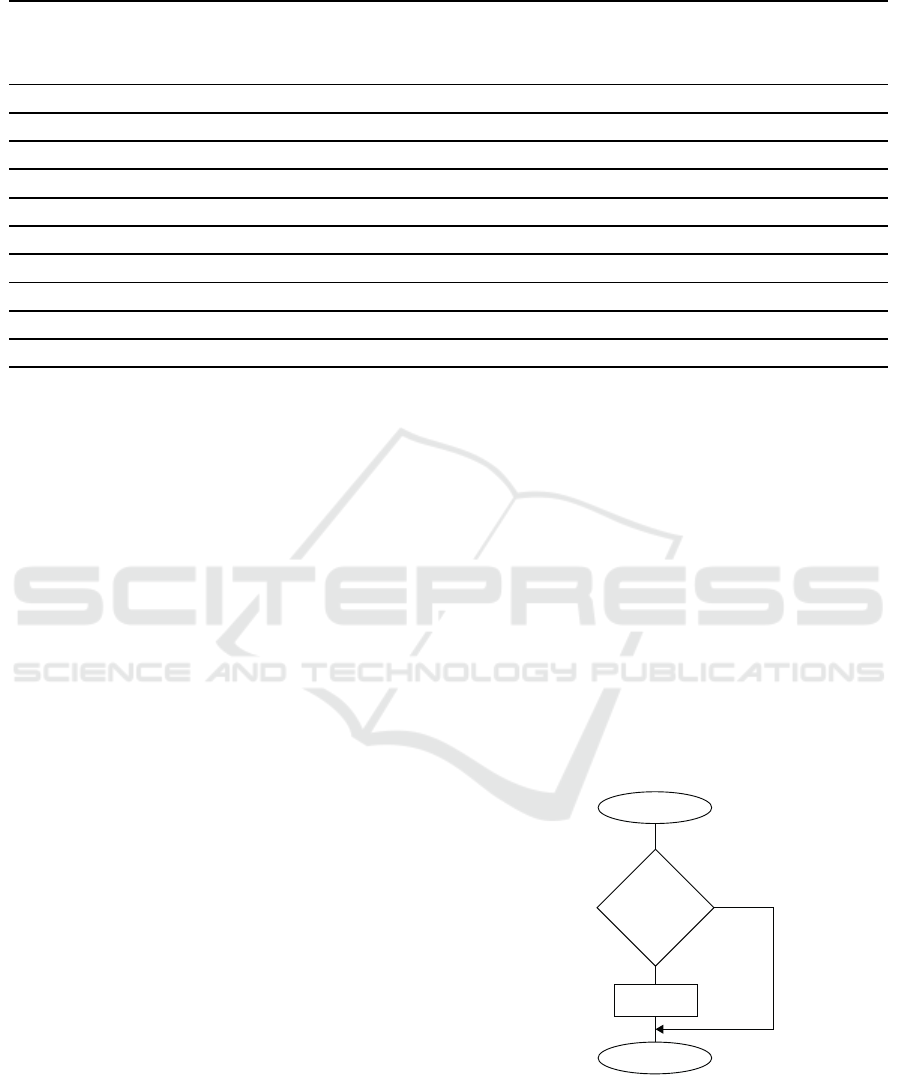

The process of making decisions when buyers enter

the shop was modelled using agent-based approach.

Each visitor was simulated as an autonomous agent

(Fig. 9). The visitors’ decisions were implemented as

rules. Each agent after entering the shop generated

a random decision to buy a product or service with

a given probability p

e

. Various statistics and logs of

the whole process were collected as well as various

properties of the burstiness were calculated (Ahrens

et al., 2019).

For the purposes of this work, the simulation was

supplemented for the memoryless buyer scenario by

the export of the sequence of one thousand agents’

decisions to the Excel file. Fig. 9 shows the structure

of an individual agent simulating the decision of an

individual buyer.

entering

exiting

buying

yes

no

deciding

Figure 9: Individual Agent simulating the decision of an

individual buyer.

These decisions known as binary customer be-

haviour were coded by series of 1 (decision to buy)

and 0 (not to buy). The series were splitted into m

blocks each of the length n (number of visitors, pat-

SENSORNETS 2019 - 8th International Conference on Sensor Networks

28

tern length). Therefore the total number of visitors is

given by n · m. For instance, when a pattern length

of n = 10 is considered, the series contained m = 100

blocks and therefore a series of n · m = 1000 visitors

is considered. Then the number m

e

of blocks con-

taining e buying events were counted. According to

the statistical definition of the probability, the relative

frequency

γ

e

=

m

e

m

(36)

is an estimation of the theoretical probability P(n,e).

Tab. 4 presents the comparison of the simulated rel-

ative frequency γ

e

with the probability P(n,e). As

Tab. 4 shows, the difference between the probability

P(n,e) and the relative frequency γ

e

is not large, and

can be be explained by the randomness of the agents’

behaviour. The match testifies the consistency of an-

alytical and simulation models.

6 CONCLUSIONS

The present research has successfully demonstrated

the adaptation of gap distribution functions from data

transmission theory in telecommunications to busi-

ness processes. The similar nature, namely bursty na-

ture, of bit-errors in telecommunications and buyers

in business management has been outlined. Conse-

quently, the present paper has emphasized the bursty

nature of business processes such as buying and sell-

ing, too. The complex process of buying by analysing

such properties of buyers’ behaviour as buyer proba-

bility and buyer concentration has been highlighted.

The research has resulted in proposing the use of

gaps for the description of the buying process. The

mathematical description of gap processes built on

the independence of gap intervals has been revealed

in the present paper. As shown by our research re-

sults, distribution functions with two parameters such

as Weibull or Wilhelm have been found to be an ade-

quate tool for the analysis of both, namely the buyers’

behaviour and the process of buying.

REFERENCES

Ahrens, A. (2000). A new digital channel model suitable

for the simulation and evaluation of channel error ef-

fects. In Colloquium on Speech Coding Algorithms

for Radio Channels, London (UK).

Ahrens, A., Purvinis, O., Zaˇsˇcerinska, J., and Andreeva, N.

(2015). Gap Processes for Modelling Binary Cus-

tomer Behavior. In 8th International Conference on

Engineering and Business Education, pages 8–13, Os-

tfold University College, Fredrikstad (Norway).

Ahrens, A., Purvinis, O., Zaˇsˇcerinska, J., Miceviˇciene, D.,

and Tautkus, A. (2019). Burstiness Management for

Smart, Sustainable and Inclusive Growth: Emerging

Research and Opportunities. IGI Global, 1 edition.

Ahrens, A. and Zaˇsˇcerinska, J. (2016). Gap Processes for

Analysing Buyers’ Burstiness in E-Business Process.

In International Conference on e-Business (ICE-B),

pages 8–13, Lisbon (Portugal).

Albanese, P. (2006). Inside Economic Man: Behavioral

Economics and Consumer Behavior. . In Altman, M.,

editor, Handbook of Contemporary Behavioral Eco-

nomics, volume 1, chapter 1, pages 3–77. Sharpe, 1

edition.

Axelrod, R. (2006). Agent-based Modeling as a Bridge Be-

tween Disciplines. In Tesfatsion, L. and Judd, K. L.,

editors, Handbook of Computational Economics, vol-

ume 2, chapter 33, pages 1565–1584. Elsevier, 1 edi-

tion.

Elliott, E. O. (1963). Estimates of Error Rates for Codes on

Burst-Noise Channels. Bell System Technical Journal,

42(5):1977–1997.

Gilbert, E. N. (1960). Capacity of a Burst-Noise Channel.

Bell System Technical Journal, 39:1253–1265.

Martis, M. S. (2006). Validation of Simulation Based Mod-

els: A Theoretical Outlook. Electronic Journal of

Business Research Methods, 4(1):39–46.

Sajjad, M., Singh, K., Paik, E., and Ahn, C. (2016). So-

cial Simulation: The need of data-driven agent-based

modelling Approach. In 2016 18th International

Conference on Advanced Communication Technology

(ICACT), pages 818–821.

Tesfatsion, L. (2006). Agent-Based Computational Eco-

nomics: A Constructive Approach to Economic The-

ory. In Tesfatsion, L. and Judd, K. L., editors, Hand-

book of Computational Economics, volume 2, pages

831–880. Elsevier, 1 edition.

Wilhelm, H. (1976). Daten¨ubertragung (in German).

Milit¨arverlag, Berlin.

Gap Distributions for Analysing Buyer Behaviour in Agent-based Simulation

29