Investigation on Pricing Decisions of Remanufactured Products and

Profit of Supply Chain

Yasutaka Kainuma

*

Faculty of Systems Design, Tokyo Metropolitan University, 6-6 Asahigaoka, Hino, Tokyo, Japan

Keywords: Remanufacturing, Pricing, Closed-loop Supply Chain.

Abstract: This study investigates the closed-loop supply chain (CLSC) with respect to hybrid

manufacturing/remanufacturing systems. In this study, a hybrid manufacturing/remanufacturing model is

designed that encompasses the simultaneous production of new manufactured products and remanufactured

products; this model is used to investigate the profitability of a hybrid manufacturing/remanufacturing system.

The impact on the demand for new products (cannibalization effect) caused by selling remanufactured

products is a concern among companies with respect to promoting the CLSC. The purpose of this study is to

examine the effects on the profits obtained by a company. Numerical experiments are conducted to confirm

the profitability of a hybrid manufacturing/remanufacturing system; the relationship between the demand for

manufactured products and that for re-manufactured products is also investigated. This study proposes a

pricing model for remanufactured products by considering consumers’ willingness to pay. The analytical

results indicate that the cannibalization effect was suppressed by considering these, and it is clear that

remanufactured products increase company profits.

1 INTRODUCTION

Japan has undergone a protracted period of economic

growth that is based on mass production, mass

consumption, and mass disposal. As a result, Japan is

facing environmental and resource-depletion

problems. Recently, companies have taken action to

assume corporate social responsibility and address

environmental problems, by manufacturing while

bearing in mind the environment and resource

consumption. A closed-loop supply chain (CLSC)

system is one approach taken to support such efforts.

Various methodologies and examples of supply

chains have recently been reported. An efficient

supply of products and services is required, owing to

the shift from a producer-led economy to a consumer-

led one; however, there is a dearth of quantitative

analyses on the profit potentials of companies that

have manufacturing/remanufacturing systems. Net

losses deriving from collecting, reusing, and

recycling used products can create enterprise-wide

problems; therefore, when employing CLSC systems,

it is critical to ensure that there are net gains.

*

https:// www.sd.tmu.ac.jp/RDstaff/data/ka/641.html

The hybrid model proposed in this study encompasses

both manufacturing and re-manufacturing. Moreover,

scenarios with variable ratios for collecting,

remanufacturing, and refurbishing are used

throughout the proposed model. We also undertake

numerical experiments to confirm the profitability of

hybrid manufacturing/remanufacturing systems.

Additionally, we consider the relationship

between the demand for manufactured products and

that for remanufactured products. If a company

considers used products to be new products, and sells

only new products, it is not necessary to consider the

relationship between these two types of demand.

However, if the company sells remanufactured

products separately from new products, then this

hybrid manufacturing/remanufacturing model can be

used to investigate both the cannibalization effect and

market expansion. These two effects are important to

the development of an effective CLSC, and so we

consider them in the context of the proposed hybrid

manufacturing/remanufacturing model.

Kainuma, Y.

Investigation on Pricing Decisions of Remanufactured Products and Profit of Supply Chain.

DOI: 10.5220/0007313102530257

In Proceedings of the 8th International Conference on Operations Research and Enterprise Systems (ICORES 2019), pages 253-257

ISBN: 978-989-758-352-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

253

2 LITERATURE REVIEW

We reviewed many studies to obtain a comprehensive

understanding of hybrid

manufacturing/remanufacturing systems. Mitra

(2016) considers a duopoly environment with two

manufacturers in direct competition, both of which

are selling their respective new products on the

primary market. Specifically, he considers whether

one manufacturer gains a competitive advantage over

the other when the other manufacturer decides to

remanufacture and sell remanufactured products on

the price-sensitive secondary market. However, Mitra

does not undertake a quantitative assessment in

relation to the cannibalization effect.

Nanasawa and Kainuma (2017) quantitatively

evaluate the impact of the cannibalization effect on

profits in a hybrid manufacturing/remanufacturing

system. By considering the selling price and the

timing of the introduction of remanufactured

products, they elucidate the profitability of

remanufactured product sales.

Gan et al. (2017) proposed a pricing model

developed for short life cycle products in closed loop

supply chain consisting of manufacturer, retailer, and

collector. They showed that implementing separate

channels can improve the overall supply chain benefit

compared to single channel approach.

Souza (2012) shows that remanufactured products

have two effects on consumer demand—namely,

market expansion and cannibalization. Generally, the

cannibalization effect is thought to reduce profits as

new-product demand decreases. However, Atasu et

al. (2010) discuss the theory that remanufactured

product sales can reduce or eliminate new-product

sales, and that the sale of remanufactured products

can make it possible to reach additional market

segments. Furthermore, Guide and Li (2010) assert

that examinations of the cannibalization effect are

important to CLSC development.

During the literature review, we found there to be

many studies on the cannibalization effect; however,

only a few are quantitative evaluations.

3 MODEL

A hybrid manufacturing/remanufacturing system is

modelled and analysed using the proposed model.

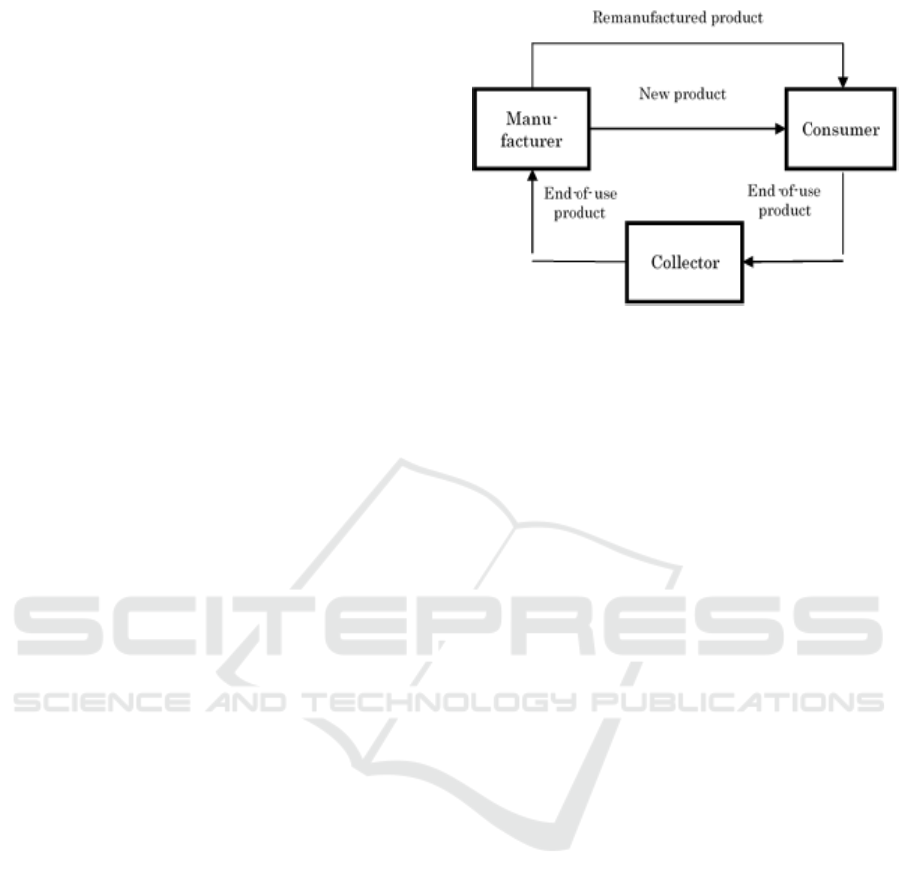

Fig.ure1 shows that the CLSC system consists of

three members - namely, a manufacturer, a products

reach their end of use and become the objects of used-

product collection. The used products are acquired by

Figure 1: A closed-loop supply chain system.

the collector. (It is assumed that the consumer, and a

collector. The closed loop is initiated by a

manufacturer who makes new products for

consumers. After a certain period, the same collector

gathers only those used products that meet the quality

level demanded by the remanufacturing process.)

Therefore, all of the collected returns are transferred

to the manufacturer as inputs for the remanufacturing

process.

We divide consumers into two segments. One

comprises primary consumers who are conscious of

novelty. They basically purchase new products, but

there is the possibility of buying remanufactured

products at lower prices. The other comprises ‘green’

consumers aware of functionality. They purchase

remanufactured products only because (we assume)

the price of a new product is higher than that which

they estimate.Before estimating the expected profit,

we introduce the following notations and parameters,

which are used in Equations (1)–(8).

Notations

Total expected profit of entire

supply chain

M

Manufacturer’s total expected profit

C

Collector’s total expected profit

D

n

Demand for new product

D

r

Demand for remanufactured product

Parameters

p

n

Selling price of new products

p

r

Selling price of remanufactured

products

p

c

Purchase price of end-of-use

products

p

f

Selling price of end-of-use products

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

254

p

m

Maximum price as the upper limit

c

rw

Unit raw material cost for producing

new product

c

m

Unit manufacturing cost for

producing new product

c

r

Unit remanufacturing cost for

producing remanufactured product

c

Unit collecting cost

d

n

Cumulative potential demand for

new product

d

r

Cumulative potential demand for

remanufactured product

1

Scaling factor of remanufactured

products for primary consumers

2

Scaling factor of remanufactured

products for green consumers

Discount ratio

Constant

Exponential constant

3.1 Expected Profit

This study assumes that the demand for

remanufactured products differs from that for new

products, and that the new product price is different

from that of the remanufactured product price. The

total expected profit is derived via Equation (1).

Furthermore, Equation (2) derives the total expected

profit of the manufacturer, while Equation (3) derives

the total expected profit of the collector.

CM

(1)

rfrrmrwnnM

cppDccpD

(2)

cppDp

cfncC

(3)

3.2 Demand

We analyse the relationship between the demand for

new manufactured products (Equation (4)) and that

for remanufactured products (Equation (5)). Souza

(2012) criticizes the CLSC approach and instead

focuses on the strategic problem of network design,

as well as the tactical problem of use and disposal.

Souza claims that the remanufacturing of products

has two effects on consumer demand. The first of

these is market expansion. Souza suggests that the

sale of remanufactured products drives consumer

expansion, given price differences between new and

remanufactured products. The second effect is

cannibalization, where consumers who had originally

intended to purchase new products decide instead to

purchase remanufactured products, given their lower

price.

(4)

(5)

4 NUMERICAL EXPERIMENT

AND RESULTS

We conducted numerical experiments by using the

proposed model. Optimization is carried out under a

sequential Stackelberg game, with the manufacturer

as the leader. The objective of the pricing model is to

determine the optimal prices that maximize profits.

Here, the demand function varies depending on the

price of the remanufactured products, and so

numerical experiments are carried out separately in

the following cases.

Condition (a):

nr

pp

1

Condition (b):

nrn

ppp

21

Since the purchase price of end-of-use products

does not fluctuate under either condition, it is

indicated by Equation (6). The selling price of end-

of-use products in conditions (a) and (b) is given by

Equations (7) and (8), respectively.

0

1

12

1

12

nm

m

rn

m

m

n

pp

p

d

pp

p

p

d

D

nr

nrn

nr

pp

ppp

pp

2

21

1

0

1

2

34

11

12

2

34

r

m

m

r

rn

m

r

m

m

r

p

p

p

d

p

pp

p

d

p

p

p

d

D

nr

nrn

nr

pp

ppp

pp

2

21

1

Investigation on Pricing Decisions of Remanufactured Products and Profit of Supply Chain

255

1

cp

p

f

c

(6)

c

pp

p

d

ppp

d

p

pd

p

rn

m

rrnr

m

f

1

1

1

1

1

12

11

12

2

34

(7)

c

ppd

p

pd

p

nm

r

m

f

1

1

12

2

34

(8)

Table 1 shows the prices of new and remanufactured

products when the total expected profit is maximized.

From this table, we can see that the overall profit is

significantly higher under condition (a) than under

condition (b). This is thought to be due to an increase

in profits as a result of further increasing the demand

for remanufactured products, while demand for new

products has decreased due to the evaluation of

remanufactured products.

In addition, we found that benefits accruing from

the overall supply chain are increased if the selling

price is reduced when comparing the selling price of

the remanufactured product (i.e. the largest profit of

the manufacturer) and the selling price of the

remanufactured product (i.e. the maximum profit of

the entire supply chain). This is due to an increase in

the profit of the collector as the demand for

remanufactured products increases and the number

of used products increases, both as a result of

reducing the selling price of remanufactured

products; this in turn results in an increase in the

overall supply chain.

Table 1: Prices of new and remanufactured products when

total expected profit is maximized (in Japanese yen).

Condition a

Condition b)

Max

M

Max

Max

M

Max

p

n

8,300

8,300

8,200

8,200

p

r

5,644

5,561

4,756

4,674

M

2,849,619,740

2,849,231,360

2,690,604,111

2,690,59

9,220

C

11,106,216

17,075,940

2,830,719

2,966,87

7

2,860,725,956

2,866,307,299

2,693,434,829

2,693,56

6,097

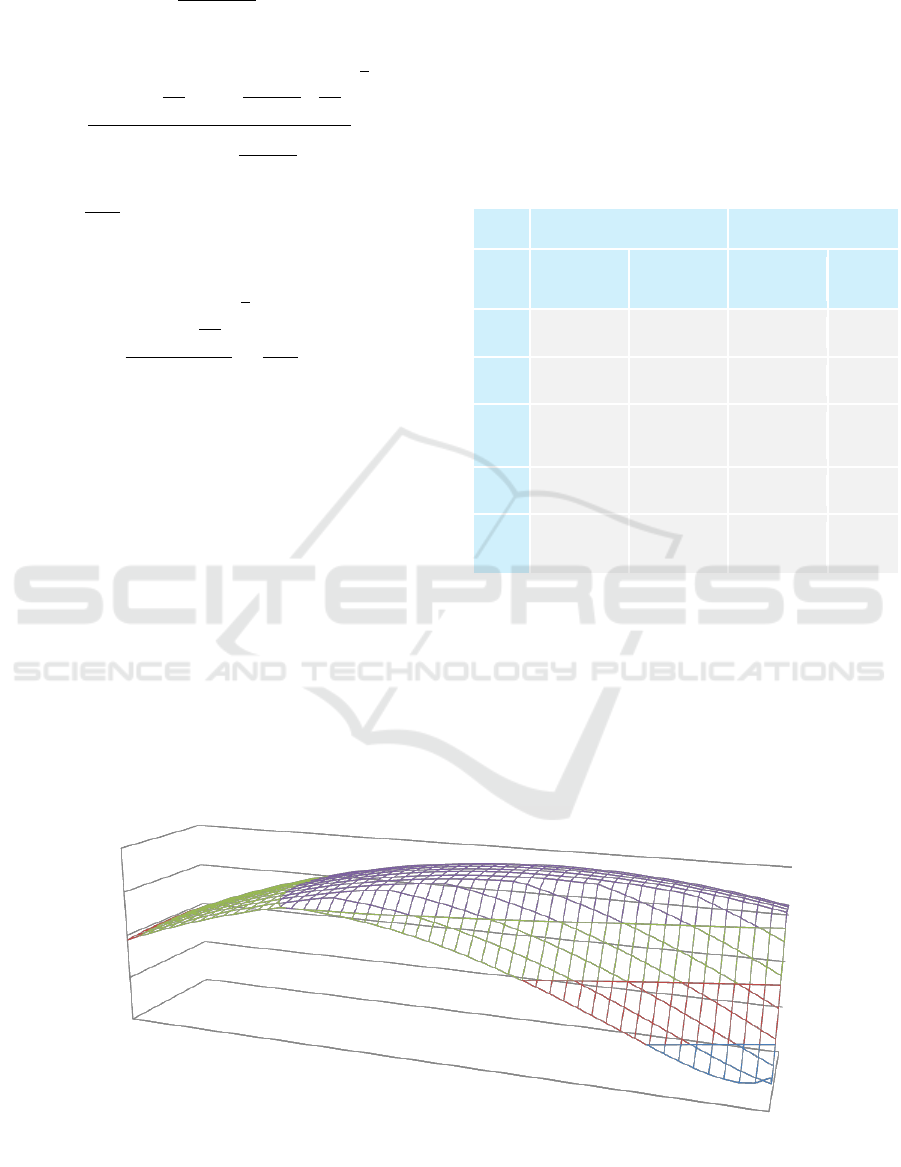

Figure 2 shows the relationships among the total

expected profit for the overall supply chain, the

selling price of new product, and the discount ratio.

We found that there were cases in which the total

expected profit of the overall supply chain had

decreased. This is because the demand for the new

products will decrease and the collection volume of

end-of-use products will decrease if the selling price

of new products is too high. It is considered that the

Figure 2: Relationships among total expected profit for the entire supply chain, the selling price of new product, and discount

ratio.

0.4

0.36

0.32

10

15

20

25

30

5,000

5,500

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

10,000

Discount ratio

Total expected profit for the entire supply chain

(million yen

)

Selling price of new product (yen)

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

256

profit of the overall supply chain will decrease,

because while there is still potential demand for

remanufactured products, they cannot be sold if the

collection volume of end-of-use products decreases.

5 CONCLUSIONS

In this study, we proposed a pricing decision model

for remanufactured products while considering game

theory. We executed numerical experiments using a

hybrid manufacturing–remanufacturing model. The

model was evaluated using a number of different

parameters. We were able to evaluate profitability by

examining trends in expected profits that derive from

the selling prices of new products and remanufactured

products. The results indicate that a hybrid

manufacturing–remanufacturing system is more

profitable. Furthermore, the demand model used in

this study clearly shows the relationship between the

demand for new manufactured products and the

demand for remanufactured products. Therefore, by

studying the appropriate priced of new and

remanufactured products, companies should be able

to successfully structure their remanufacturing

businesses so as to mitigate profit reductions incurred

by the cannibalization effect. In addition, we found

that is essential to consider not only a manufacturer’s

own profit, but also pricing while bearing in mind the

optimum of the overall supply chain.

Finally, we plan to extend our research by

considering comparisons among products with

different cost structures, opportunity losses, and

penalties, among other characteristics.

ACKNOWLEDGEMENTS

This research was partially supported by a grant-in-

aid for scientific research (No. 15K01219) from the

Japan Society for the Promotion of Science (JSPS).

REFERENCES

Atasu, A., Guide, V.D.R., Van Wassenhove, L.N. So what

if remanufacturing cannibalizes my new product sales?

California Management Review, 52(2):56-76, 2010.

Gan, S.S., Pujawan, I.N., Supamo, Widodo, B. Pricing

decision for new and remanufactured product in a

closed-loop supply chain with separate sales-channel.

International Journal of Production Economics,

190:120-132, 2017.

Guide, V.D.R., Li, J. The potential for cannibalization of

new products sales by remanufactured products.

Decision Sciences, 41(3):547-572, 2010.

Mitra, S. Models to explore remanufacturing as a

competitive strategy under duopoly. Omega, 59:215-

227, 2016.

Nanasawa, T., Kainuma, Y. Quantifying the

cannibalization effect of hybrid

manufacturing/remanufacturing system in closed-loop

supply chain. Procedia CIRP, 61:201-205, 2017.

Souza, G.C. Closed-loop supply chains: A critical review,

and future research. Decision Sciences, 44(1):7-38,

2012.

Investigation on Pricing Decisions of Remanufactured Products and Profit of Supply Chain

257