Project Portfolio Risk Prediction and Analysis using the Random

Walk Method

Xingqi Zou

1 a

, Qing Yang

1 b

, Qian Hu

1 c

and Tao Yao

2 d

1

School of Economics and Management, University of Science and Technology Beijing, 30 Xueyuan Road, Beijing, China

2

Department of Industrial and Manufacturing Engineering, The Pennsylvania State University, University Park, U.S.A.

Keywords: Project Portfolio Selection, Risk Prediction, Sustainable Development, Random Walk Method, Multidomain

Matrix (MDM).

Abstract: Based on the interdependency relationship among projects, the paper analyses risk factors in the project

portfolio network via the random walk algorithm. Sustainability is one of the most important challenges of

the project and portfolio management. This paper analyses the interdependencies among projects in a portfolio

from the perspective of sustainable development and builds models to measure the relationship among risk

factors via the Multidomain matrix (MDM) method. Using the interdependency relationship among projects

and potential relationship between different risk factors as inputs, the paper builds the model of portfolio risk

network to predict the risk in the project portfolio via a random walk algorithm. Because the random walk is

a personalized recommendation algorithm, so our proposed method can achieve an accurate prediction of

portfolio risk through predicting the risk factors and their probabilities in the portfolio. Our method can also

help project managers to rank these risk factors in the portfolio through distinguishing the most concerned

risks.

1 INTRODUCTION

1 Sustainable development is a process of change in

which the exploitation of resources, the direction of

investments and the orientation of technological

development can enhance both the current and future

potential to meet human needs and aspirations.

Portfolio risks may affect the sustainable

development of the portfolio (Ghasemi et al., 2018).

Interdependencies among projects create complexity

for portfolio risk analysis. Several researchers have

explored the sustainability in project management

(Silvius et al., 2017). However, existing studies on

prediction portfolio risks do not account for the

interdependency relationship from the perspective of

sustainable development. So, the paper analyses the

interdependency relationship project portfolio

network from the perspective of sustainable develop

ment. Further, we explore to build the assessment

a

https://orcid.org/0000-0001-5679-8152

b

https://orcid.org/0000-0002-7529-9065

c

https://orcid.org/0000-0002-3441-5613

d

https://orcid.org/0000-0002-2124-5678

criterion of sustainable development and present an

innovative approach to predict the risks in R&D

projects via the random walk algorithm. The paper

has three key contributions to practice: 1) it builds the

assessment criterion to analyse interdependency

relationship between projects; 2) It analyses the

relationship between risk factors using MDM. 3)

Using the interdependency relationship among

projects and initial relationship between different risk

factors as inputs of the random walk algorithm, the

proposed method can predict and analyse the risk

factors in the portfolio.

Zou, X., Yang, Q., Hu, Q. and Yao, T.

Project Portfolio Risk Prediction and Analysis using the Random Walk Method.

DOI: 10.5220/0007357202850291

In Proceedings of the 8th International Conference on Operations Research and Enterprise Systems (ICORES 2019), pages 285-291

ISBN: 978-989-758-352-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

285

2 BUILDING THE ASSESSMENT

CRITERION AND MEASURING

THE INTERDEPENDENCY

STRENGTH IN PORTFOLIO

2.1 The Assessment Criterion

(1) Assessments of social and environmental impact

The social and environmental impact assessment is a

significant feature of sustainable development in

R&D projects. Sustainable development is the

integration of environmental, social and economic

dimensions, regularly observing the ability of projects

to deliver sustainable results on different levels

(Aarseth et al., 2016). Social sustainability of R&D

projects mainly focuses on the external value to

improve the quality of industry chain and fulfil social

responsibility. Environmental sustainability refers to

the use of energy and other resources and waste left

behind as a result of its operations during the process

of project development.

(2) Strategic alignment

Strategic has been adopted by many companies

through their mission statement and strategy (Parisi,

2013). Therefore, reviewing the project’s strategic

alignment is important approach to enhancing

competitiveness and realizing sustainable

development. However, resource limitations require

an organization to strategically allocate resources to a

subset of possible projects (Badri et al., 2001). The

strategic alignment of projects directly affects

resources available. It is fit only when project’s

objective matches the strategy of an enterprise.

Therefore, the strategic alignment can be used to

analyze if the project is in alignment with enterprise’s

strategy and the degree of alignment (Sardana et al.,

2016). In this paper, strategic alignment is measured

by the ratio between “the contribution of the project

to the business strategy” and “the strategic target

value of the business”.

(3) Project benefit contribution

In essence, profits are the ultimate purpose of the

enterprise. Projects are essential to create economic

value, benefit realization from projects is thus

strongly associated with successful organizational

performance. As one of the ways of creating

economic value, projects are strongly associated with

successful organizational performance. And,

financial methods are the most widely used in the

domain of selecting projects. In many situations,

financial methods present better results and, when

used in conjunction with other methods, results are

even better (Shwiff et al., 2013). Therefore,

considering the sustainable development concurrently,

the projects’ benefit contribution is used as a factor to

analyze the interdependency relationship. Using the

cost-benefit analysis (CBA) method to measure the

benefit contribution of projects, the CBA is defined as

a systematic process of calculating and comparing

benefits and costs and provides a basis for comparing

projects which involves comparing the total expected

costs of each project against its total expected

benefits(David et al., 2013; Hemakumara, 2017).

The CBA has two main purposes: to verify

whether the project’s benefits outweigh its costs, and

by how much; to provide a basis for comparing

projects. The steps that comprise cost-benefit analysis

of project: 1) select measurement and measure all

cost/benefit elements of each project; 2) predict

outcome of cost and benefits over relevant time period;

3) convert all costs and benefits into a common

currency; 4) apply discount rate; 5) calculate net

present value of project options; 6) calculate the cost-

benefit ratio of each project.

(4) The evolution of technology performance

The evolution of technology performance is the

key to decide the success and sustainability of R&D

projects. It can be used for monitoring the

performance of R&D process and analyzing when a

technology has reached its performance limit. The

information helps the firms adjust its technological

strategy in time, and thoroughly employ its

technology resources to achieve goals. Therefore, the

evolution of technology performance must be adopted

as a criterion to analyze the interdependency

relationship in the portfolio. Empirical evidence

points out that the S-curve is the accurate

measurement of technology performance whose

evolution is comparatively poor at its inception but

improves rapidly during heavy research and

development activity and finally matures as the

performance saturates near the physical limits or

boundaries (Arendt et al., 2012).

Using the S curve to evaluate the evolution of

technology performance involved in the R&D project,

and choosing the dimension of time to construct the S

curve that the horizontal axis represents the duration

time of R&D project and longitudinal axis refer to the

technology performance. We can intuitively identify

the performance of all the technologies, and predict

the transfer relationship of technologies in the process

of R&D project. Building the S-curve of all projects

in portfolio, the paper can intuitively identify the

performance of all the technologies and determine its

interdependency relationship.

(5) The diffusion of technology, knowledge and

experience

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

286

In many industries, large firms have at least

several product lines and constantly undertake

multiple development projects to add new product

lines or to improve and replace existing products. To

achieve economies of scale and scope, firms must

appropriately allocate resources and systematically

manage these multiple projects (Huemann and Silvius,

2017). Specifically, technologies, knowledge and

experience developed in one project are often reused

or transferred to other projects within the firm (Dutra

et al., 2014). Therefore, each new product

development project often has both technological and

organizational linkages and interdependencies with

other past or on-going projects. Technologies,

knowledge and experience gained from one project

can be disseminated to the other projects. Also, we

can achieve the effect of organizational learning

through the application of shared knowledge and

experience. In fact, some companies carry out basic

research projects for the sake of learning new

knowledge and experience. In this case, financial

benefits are not high in priority, but the knowledge

and experience gained for future endeavor is, and the

formal education brought into company is more

concerned. There are some projects that we are doing

mainly to gain experience in some areas. So, the paper

analyzes the interdependency relationship through the

diffusion of technology, knowledge and experience.

2.2 Measuring the Interdependency

Strength

Further, we build the portfolio dependency network

under the constraints of assessment criterions. The

network is a directed-weighted network with the

project as the "node" and the interdependence

between projects as the "edge". The direction of

"directed edges" reflects the direction of project’s

dependences.

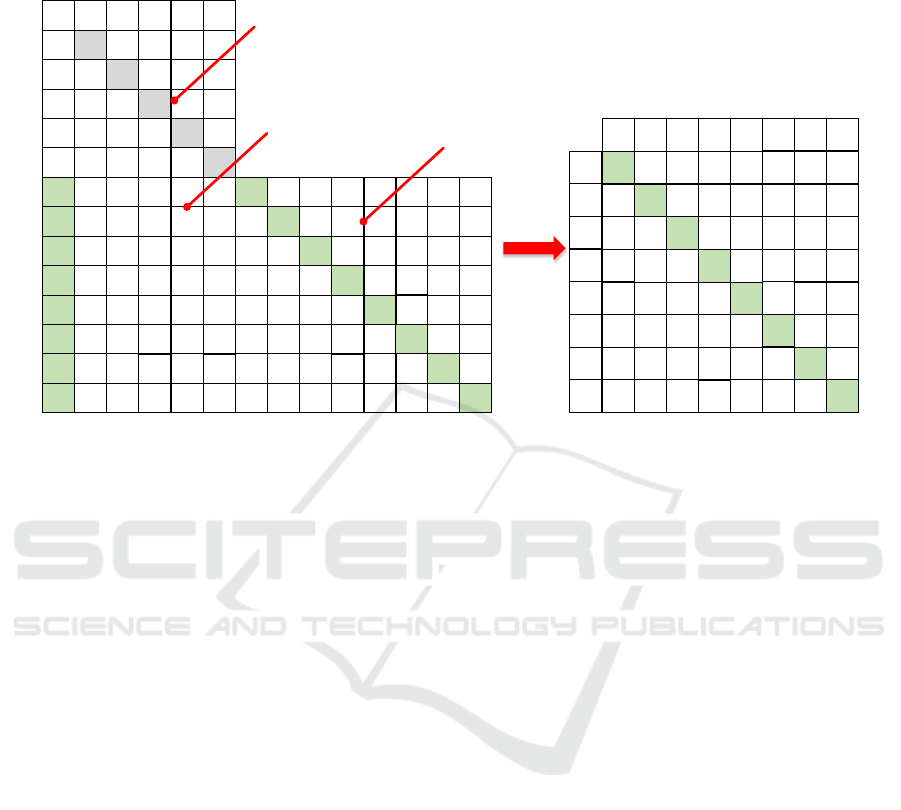

As shown in Fig.1, the portfolio interdependency

network is built under the constraints of project

benefit contribution, and the attribute value of the

node in the network is the benefit contribution of

projects. If the benefit contribution of P1 is higher

than P

2

, it is shown that P

1

is superior to P

2

, then there

is a directed edge from P

1

to P

2

. Similarly, the

interdependency network constrained by other criteria

can be built (Fig. 1 (b) and (c)), so the final

interdependency network is shown as Fig. 1 (d).

Finally, the interdependency strength is derived from

the sum of values representing the aforementioned

interaction types. For example, if there are strategic

alignment, project benefit contribution between the

two projects and there is no other interdependency

relationship, then the interdependency strength could

be valued 2.

3 IDENTIFYING THE

RELATIONSHIP BETWEEN

RISK FACTORS USING MDM

According to the criterion from the perspective of

sustainable development, the paper concludes the risk

factors,namely: 1) choosing too many projects for

the limited resources (PR1); 2)portfolio’s imbalance

between long-term and short-term projects (PR2); 3)

the risk of social and environmental impact (PR3);4)

the risk of strategic alignment (PR4); 5) political and

social changes which leads to the changing strategy,

and project’s objectives lack of alignment with new

strategy (PR5); 6) the risk of technology, technology

maturity can’t meet project requirements(PR6);7)

lacking diffusion in technology and

knowledge/experience(PR7);8) not having cross-

trained staff who can easily switch from project to

project(PR8) .

Furthermore, the paper investigates the probability of

risks in the portfolio, then we use MDM to identify

the relationship between risk factors.

The MDM is an extension of DSM modeling in which

two or more DSM models in different domains are

represented simultaneously, each single-domain

P

2

P

1

P

3

P

5

P

4

P

2

P

1

P

3

P

5

P

4

P

2

P

1

P

3

P

5

P

4

P

2

P

1

P

3

P

5

P

4

(a)

(b)

(c) (d)

Figure 1: The independency network of the project portfolio.

Project Portfolio Risk Prediction and Analysis using the Random Walk Method

287

11

_ ( , ) ( _ ( , ) ( _ ( , ) _ ( , )))

mm

i j i i j j i j

i j j i

R DSM P P PR DMM R P PR DMM R P P DSM P P

,

(1)

R

1

R

2

R

3

R

4

R

5

R

1

R

2

R

3

R

4

R

5

R

1

.14 .17

.2

.17

.12

R

2

.11

.15

.13

.38

.33 R

3

.45

.41

.45

.47 .5

R

4

.5

.37

.36 .41

.45

R

5

.44

.42 .44

.45

.44

.09

.09 .12

.14

.12

.54

.58 .58

.57

.57

.22

.12 .23

.13

.11 .17

.42

.38 .47

.5

.45 .52

.44

.37 .47

R

6

.43 .43

.15

R

7

.16

.54

.55 R

8

R

6

R

7

R

8

R

6

R

7

R

8

(a) Portfolio-risk MDM

(b) Risk factors DSM

P

1

P

2

P

3

P

4

P

5

P

1

P

1

.25

.19

.11

.13

P

2

.12 P

2

.14

.27

.12

P

3

.11 .05

P

3

.23

.03

P

4

.13 .61

.46

P

4

.32

P

5

.07 .17

.13

.16

P

5

R

1

.6

.8

R

2

.4

.1 .4

R

3

.5 .7 .3 .3 .6

R

4

.7 .3

.6

.6

.4

R

5

.6 .4

.7

.4

.3

R

6

.1 .5 .7

.6

R

7

.3

.5 .2

R

8

.6 .3

.2

.9

.5

R

1

.14 .17

.2

.17

.12

R

2

.11

.15

.13

.38

.33 R

3

.45 .41

.45

.47 .5

R

4

.5

.37

.36 .41

.45

R

5

.44

.42 .44

.45

.44

.09

.09 .12

.14

.12

.54

.58 .58

.57

.57

.22

.12 .23

.13

.11 .17

.42 .38 .47

.5

.45 .52

.44 .37 .47

R

6

.43 .43

.15

R

7

.16

.54

.55 R

8

Portfolio DSM

Portfolio-risk DMM

Risk DSM

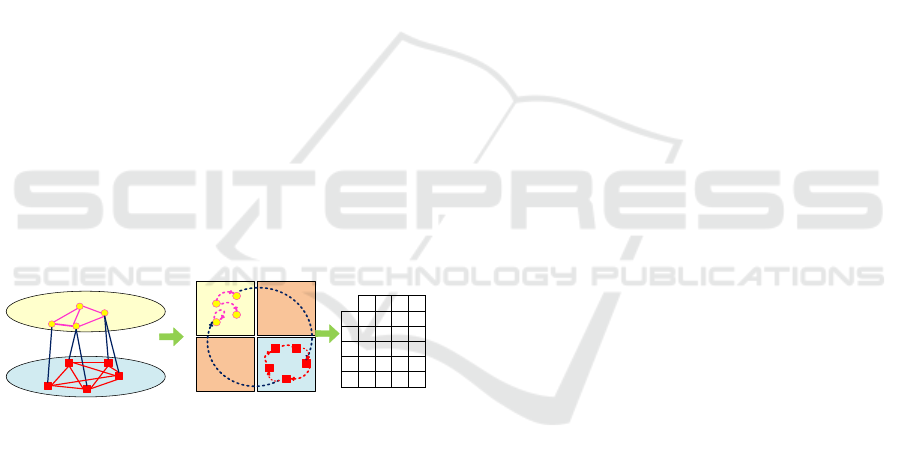

Figure 2: The calculation of initial PR_DSM.

DSM is on the diagonal of the MDM, and the off-

diagonal blocks are DMMs(Eppinger and

Browning,2012). The DSM method proposed by

Steward (1981) is a powerful structural method to

represent the elements comprising a system and their

dependencies (Yang et al., 2015).

The P_DSM is a square matrix with diagonal

entries representing projects and off-diagonal entries

(i, j) representing the interdependency strength

between projects. In the R_DSM the elements of

column represent instigating risk and the elements of

row represent the affected risk, Let R_DSM (m, n)

represents the influencing strength of risk n on risk m,

that is, the conditional probability of risk m if risk n

occurs.

To identify the R_DSM and analyze the

relationship between risk factors, the paper uses

Multidomain matrix (MDM) to build the portfolio-

risk matrix. As shown in Fig. 2, the MDM consists of

three essential parts: the portfolio DSM (P_DSM), the

portfolio risk domain mapping matrix (PR_DMM)

and the risk DSM (R_DSM). The P_DSM describes

the interdependency strength among projects in the

portfolio; the PR_DMM reflects the relationship

between project and risk. The R_DSM can be

calculated by using equation 1.

4 PROJECT PORTFOLIO RISK

NETWORK ANALYSIS BASED

ON RANDOM WALK

There are three steps to build the model of project

portfolio risk network analysis based on random walk

with restart method: 1) Building the portfolio-risk

network and simulating the walker’s random walk

process in the portfolio network; 2) Realizing the

simulation of the walk process when the iteration

approaches infinity (i.e. realizing infinite random

walk simulation) and extracting the stable probability

distribution of the random walker in the portfolio risk

network; 3)Analyzing the portfolio risk based on this

stable probability distribution value.

4.1 Random Walk with Restart Method

The fundamental idea of the random walk algorithm

is that the walker starts from one node in the network

and travels through the whole network graph. Then,

in each step of the journey, the walker may select to

move to the adjacent node of the current node with

probability α or choose to jump to other non-neighbor

node with probability 1-α (Gan and Jiang, 2015). In

the random walk with restart algorithm, the walker

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

288

can not only choose to move to the adjacent node and

jump to the non-neighbor node, but also return to the

starting node with a certain probability v to start a new

walk. Therefore, random walk with restart considers

not only the relationship between the two different

domains, but also the internal relationship between

the two domains, making the analysis more accurate

from the overall network.

4.2 Random Walk in the Portfolio

Network

In the network of project portfolio, the walker start

form one node in the network, such as projects or risk

factors, and travel through the whole portfolio

network. Then, in each step of the journey, the walker

may select to move to other projects or risk factors

with probability α or start a new journey with

probability 1-α. A new journey means that the walker

will start form one node in the network again. Each

movement of the walker produces a probability

distribution. Based on it, the walker makes the next

movement and the probability distribution of the next

movement could be iteratively calculated. The walker

continues to move, and the probability distribution

could be continuously iteratively calculated. After a

certain number of iterations, the probability

distribution will tend to a certain value and finally

obtain a stable probability distribution.

The risk factors

layer

R_DSM

P_DSM

R_DSM

DMM

P_DSM

A

E

R

2

R

3

R

4

R

1

P

1

P

2

P

3

P

4

P

5

R A

A

T

The portfolio

layer

Figure 3: The project portfolio risk network based on the

random walk with restart method.

Fig. 3 depicts the calculation process for solving

the relationship between risk factors via the random

walk with restart algorithm. Fig. 3 (a) shows the

portfolio risk network model; Fig.3 (b) shows the

random walk process of the walker in the portfolio

risk network. The influence relationship matrix

between risk factors can be obtained via the random

walk with restart algorithm as shown in Fig.3(c).

4.3 The Calculation Process of Random

Walk with Restart Algorithm

The random walk process of the walker in portfolio

risk network can be described as matrix X,

~~

~

~

(1 )

(1 )

T

RA

X

AP

(2)

where R is the influence relationship matrix among

risk factors, P is the interaction intensity matrix

between projects, A is the correspondence matrix

between the project and risk factors, and A

T

is the

transpose matrix of A (reflecting the correspondence

between risk factors and project);

~

R

、

~

P

、

~

A

、

~

T

A

are

matrix after the above matrix normalization

respectively. Normalizing the matrix X can obtain the

random walk matrix W of the random walker in the

portfolio risk network, where represents the

probabilities that the random walker moves from the

node j to i, m the number of items in the portfolio and

n is the number of risk factors.

Starting from project P

j

, we analyze its

relationship in project portfolio risk network. R

j

(0)

represents the relationship between project P

j

and the

risk factor layer which can be obtained by the

correspondence matrix between the project and risk

factors. P

j

(0)

represents the relationship between

project P

j

and other projects in portfolio which could

be obtained by the interaction intensity matrix

between projects. Therefore, the relationship vector

x

j

(0)

of project P

j

in portfolio risk network is defined

as equation 3.

(0)

(0)

(0)

(1 )

j

j

j

R

x

P

(3)

where

is the weight of relationship between project

and risk factors and

1

is the weight of project

portfolio layer. By normalizing x

j

(0)

, we obtain the

initial probability vector of project PV

j

(0)

. The initial

probability vectors of all the projects in the "Portfolio

Network Layer" are constructed into the initial

probability matrix PV

(0)

.

The matrix represents the initial probability of the

random walker staying at each node on the portfolio

risk network. If

()

()

()

ij

tt

m n n

PV pv

denotes the

probability of staying at each node at time t. The

probability matrix PV tends to be stable when the

number of iterations is infinite, so a stable probability

value

PV

can be obtained.

PV

is

()m n m

matrix, where m represents the number of projects in

portfolio and n represents the number of risks in the

risk factors layer. It can be seen from the structure of

the PV

(0)

matrix that the first to n rows reflect the

correspondence between the project portfolio and the

risk factors layer, so the first to n rows of the

PV

matrix are intercepted to analyze the portfolio risk.

Project Portfolio Risk Prediction and Analysis using the Random Walk Method

289

1

(0)

(1 )

T

PV v I v W PV

(4)

Through the calculation of random walk, we

achieve an accurate prediction of portfolio risk

through predicting the risk factors and their

probabilities in the portfolio.

5 AN ILLUSTRATIVE EXAMPLE

The following case study will illustrate how the model

and methodology developed in the preceding sections

can be applied in a real-work setting. Based on the

research and development of aeronautical equipment

(P

1

-P

5

), the paper analyzes the interdependency

relationship between different projects in the portfolio,

identifies risk factors (R

1

-R

8

) and determines the

potential relationship between different risk factors.

Moreover, using the random walk, we predict the risk

factors and its probability in the portfolio. The risk

factors are technical risk, scope management risk,

organization management risk, schedule management

risk, cost management risk, supplier management,

quality management risk and market competition risk.

Firstly, as shown in Fig.2, the paper calculates the

interdependency strength between different projects

_ ( , )

ij

P DSM P P

, the relationship between risk factors

and projects

_ ( , )

jj

PR DMM R P

, the risk factors and

its potential relationship

_ ( , )

ij

R DSM R R

. Further,

building the network model of portfolio risk, taking

the interdependency strength between different

projects, the relationship between risks and projects,

and the relationship between risk factors as the input

data, we can get the results of “predicting the risk

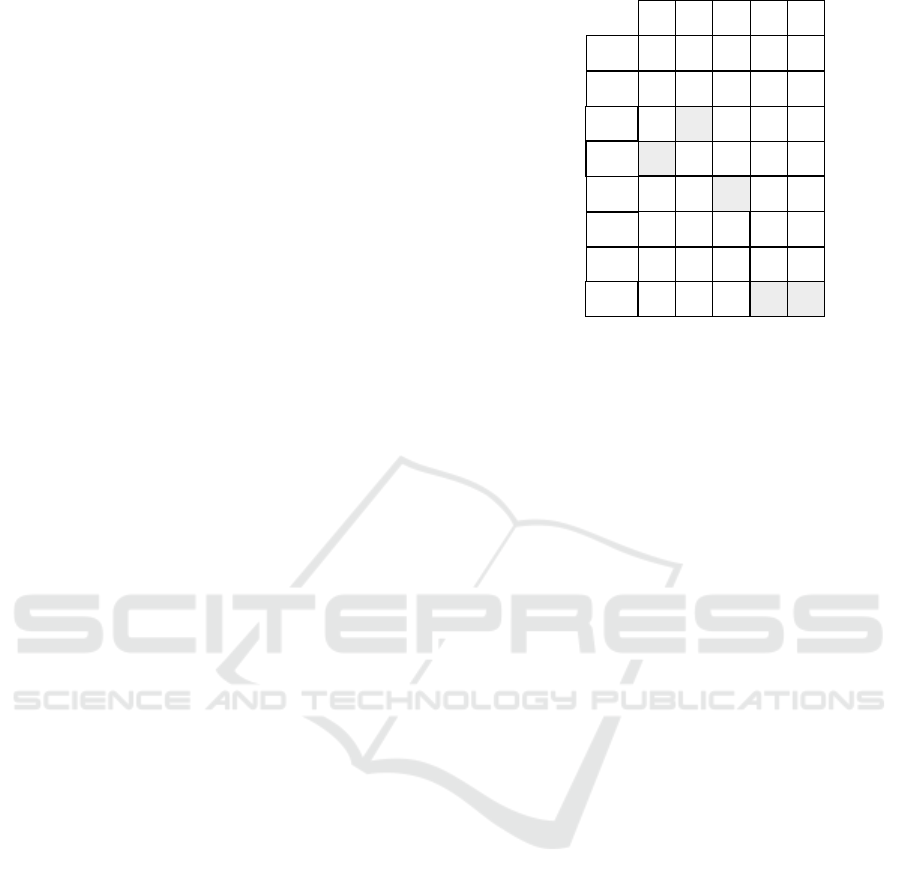

factors in portfolio” using random walk. From the

output results, we can accurately predict the risk

factors and its probability in the portfolio and achieve

the targeted analysis of risk factors. Also, it can help

the project managers to intuitively distinguish the

most concerned risks, for example, the R

4

is highest

in the project P

1

and R

3

is highest in the project P

2

.

Correspondingly, we can calculate the risk

severity in the portfolio (P_RS_DSM) using equation

5, calculation results show that the ranking of risk

factors in the portfolio is R

8

-R

4

-R

3

-R

5

-R

6

-R

1

-R

7

-R

2

.

1

_ _ ( ) _ ( , )

m

i i j

j

P RS DSM R R DSM R R

(5)

.121 .06 .048 .116.042

.2 .113 .121 .17.141

.134 .169 .177 .139.179

.145 .179 .138 .116.159

.05 .178 .051 .047.147

P

2

P

3

P

4

P

5

P

1

.165 .067 .188 .171.074

.046 .125 .047 .08.093

.14 .109 .231 .161.165

R

1

R

2

R

3

R

4

R

5

R

6

R

7

R

8

Figure 4: Output matrix of portfolio risk network using

random walk.

6 CONCLUSIONS

To assist managers in facing risks in the portfolio

environment, the paper analyses risk factors in the

project portfolio network via the random walk

algorithm. On the basis of analyzing the

interdependency relationship among projects, the

paper measures the strength using complex network.

Then, we builds the risk network of project portfolio.

Using the interdependency relationship among

projects and potential relationship between different

risk factors as inputs, the paper builds the model of

portfolio risk network to predict the risk in the project

portfolio via a random walk algorithm.

In the highly competitive global market

environment, it is necessary for enterprises to carry

out multiple projects and seek complementary

advantages between projects to maximize their profits

under the constraints of limited resources. Identifying

the portfolio risk is an important issue that decision-

makers cannot avoid. The project portfolio risk is a

complex system which has multi-level, nonlinear and

emergent characteristics. In the portfolio risk network,

different levels and different nodes at the same level

are interdependent each other, and exists a correlation

effect. So, the paper focused the following work: 1) It

analyzes the interdependencies between projects from

the perspective of sustainable development; 2) It

builds models to identify the relationship between risk

factors using Multidomain matrix (MDM) model; 3)

It builds the model of portfolio risk network to predict

the risks in the portfolio and rank these risk factors in

the portfolio via random walk method.

Our novel approach integrates various kinds of

direct and indirect relationship among projects. By

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

290

considering projects as portfolio risk networks,

including the single network (the project layer and the

risk layer) and corresponding relationship network,

and using random walk algorithm to measuring the

risk factors in the portfolio.

Nevertheless, the approach has also some

limitations that are outlined in the following. Since

this is a mathematical deductive approach, we had to

make a few assumptions. For instance, we calculate

the interdependency strength deriving from the sum

of values representing the aforementioned interaction

types. We try to more accurately measure the strength

of dependencies among projects in the next step.

ACKNOWLEDGEMENTS

This study was supported by the National Natural

Science Foundation of China (No. 71472013,

71528005 and 71872011).

REFERENCES

Aarseth, W., Ahola, T., Aaltonen, K., Økland, A.,

Andersen, B., 2016. Project sustainability strategies: a

systematic literature review. International Journal of

Project Management, 35(6), 1133-1150.

Arendt, J. L., Mcadams, D. A., Malak, R. J., 2012.

Uncertain technology evolution and decision making in

design. Journal of Mechanical Design, 134(10),

100904.

Badri, M. A., Davis, D., Davis, D., 2001. A comprehensive

0–1 goal programming model for project selection.

International Journal of Project Management, 19(4),

243-252.

David, R., Ngulube, P., Dube, A., 2013. A cost-benefit

analysis of document management strategies used at a

financial institution in Zimbabwe: a case study. South

African Journal of Information Management, 15(2), 1-

10.

Dutra, C. C., Ribeiro, J. L. D., Carvalho, M. M. D., 2014.

An economic–probabilistic model for project selection

and prioritization. International Journal of Project

Management, 32(6), 1042-1055.

Eppinger, S. D., Browning, T. R., 2012. Design Structure

Matrix methods and applications. MIT Press Books, 1.

Gan, M., Jiang, R., 2015. ROUND: Walking on an object–

user heterogeneous network for personalized

recommendations. Expert Systems with Applications,

42(22), 8791-8804.

Ghasemi, F., Sari, M., Yousefi, V., Falsafi, R.,

Tamošaitienė, J., 2018. Project portfolio risk

identification and analysis, considering project risk

interactions and using Bayesian networks.

Sustainability, 10(5), 1609-1632.

Hemakumara, G., 2017. Cost-Benefit Analysis of Proposed

God agama development node under the Greater Matera

development planning program. International Research

Journal of Management and Commerce, 4(9), 2348-

9766.

Huemann, M., Silvius, G., 2017. Projects to create the

future: managing projects meets sustainable

development. International Journal of Project

Management, 35(6), 1066-1070.

Parisi, C., 2013. The impact of organisational alignment on

the effectiveness of firms’ sustainability strategic

performance measurement systems: an empirical

analysis. Journal of Management & Governance, 17(1),

71-97.

Sardana, D., Terziovski, M., Gupta, N., 2016. The impact

of strategic alignment and responsiveness to market on

manufacturing firm's performance. International

Journal of Production Economics, 177, 131-138.

Shwiff, S. A., Anderson, A., Cullen, R., White, P. C. L.,

Shwiff, S. S., 2013. Assignment of measurable costs

and benefits to wildlife conservation projects. Wildlife

Research, 40(40), 134-141.

Silvius, A. J. G., Kampinga, M., Paniagua, S., Mooi, H.,

2017. Considering sustainability in project management

decision making; an investigation using q-

methodology. International Journal of Project

Management, 35(6), 1133-1150.

Yang, Q., Kherbachi, S., Hong, Y. S., Shan, C., 2015.

Identifying and managing coordination complexity in

global product development project. International

Journal of Project Management, 33(7), 1464-1475.

Project Portfolio Risk Prediction and Analysis using the Random Walk Method

291