Mathematical Model to Estimate Loss by Cyber Incident in Japan

Michihiro Yamada

1

, Hiroaki Kikuchi

2

, Naoki Matsuyama

2

and Koji Inui

2

1

Graduate School of Advanced Mathematical Sciences, Meiji University, Tokyo, Japan

2

School of Interdisciplinary Mathematical Sciences, Meiji University, Tokyo, Japan

Keywords:

Security Insurance, Data Breach, Cyber Incident.

Abstract:

There is a great demand from the viewpoint of security insurance to calculate the value of damage due to leak-

age of personal information. The Japan Network Security Association(JNSA) proposed a model to calculate

the damage compensation amount. However, the coefficient was determined by experts’ subjective evalua-

tions for which there is no basis. We propose a new mathematical model by applying multiple regression

using cyber incident records and information such as enterprise size as explanatory variables and the value of

extraordinary losses to a company as a target variable. We apply the damage model to 15,000 cyber incidents,

compare the two models’ loss amounts, and consider the relationship between them.

1 INTRODUCTION

There is a great demand from security insurance to es-

timate the cost due to cyber incidents including com-

promised sites, data breaches, and leakage of personal

information. This growing interest in cyber insurance

is reflected in many ways. IT strategy consultancies

like Gartner provide guidelines for how to use cyber

insurance effectively (Wheeler and Akshay, 2015).

Insurance industry forecasts predict expected growth

in premiums from around 2 billion USD in 2015 to

some 20 billion USD or more by 2025 (Wells and

Jones, 2016). National governments like the British

are supporting the growth of the cyber insurance mar-

ket to improve cyber security risk management (Cab-

inetOffice, 2014). Franke reported a characterization

of the cyber insurance market in Sweden from the re-

sult of interview (Franke, 2017).

In 2002, the Japan Network Security Associa-

tion(JNSA) proposed a model for a cost of com-

pensation amount, called the “JO model.” The JO

model estimates the potential risk of personal infor-

mation owned by each organization, as well as consid-

ering their corporate social responsibility obligations

(Japan Network Security Association, 2016). The JO

model estimates a cost per victim using a multiplica-

tion of a number of values; e.g., a fundamental con-

stant being the basic information value of one person

of 500 JPY (equivalent to 5 USD), multiplied by a co-

efficient of three if both name and address are leaked.

However, we point out the following problems in

the JO model.

1. The constants such as 500 JPY and coefficients

are determined heuristically by a number of ex-

perts’ experience. Therefore, there is no scientific

analysis based on the statistics.

2. It is an old model, designed 16 years ago. Al-

though circumstances such as recent regulation

have changed, no revisions have been made so far.

3. The accuracy of the estimated predicted cost is un-

known.

A previous study by Romanosky formulated a lin-

ear model based on 10,000 cyber incidents in the

United States (Romanosky, 2016). This model uses

Advicen’s incident dataset but is limited to the United

States context. For example, the cost in the Ro-

manosky model depends on lawsuits, which are not

common in other countries, such as Japan.

In order to address the above drawbacks of the JO

model, we analyze the data from 15,000 cyber inci-

dents covering 12 years from 2005 through 2016 and

attempt to formulate a mathematical model of the to-

tal loss more accurately.

Instead of Advicen’s dataset, we focused on pub-

lic financial information that companies disclose peri-

odically(QUICK.Corp., ). When a large-scale leakage

incident occurs, a company must disclose the cost of

dealing with the incident as an extraordinary loss in

its annual financial report. From this, we can estimate

the cost of incident handling accurately.

In this paper, we propose a new mathematical

model obtained by applying multiple regression to the

reported leaks of personal information and enterprise

statistics; e.g., revenue, number of employees, and ex-

traordinary loss. We apply the proposed model to our

Yamada, M., Kikuchi, H., Matsuyama, N. and Inui, K.

Mathematical Model to Estimate Loss by Cyber Incident in Japan.

DOI: 10.5220/0007368503530360

In Proceedings of the 5th International Conference on Information Systems Security and Privacy (ICISSP 2019), pages 353-360

ISBN: 978-989-758-359-9

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

353

database of 15,000 cyber incidents in Japan and report

on the accuracy of the model. We also compare our

model with the JO model and clarify the relationship

between them.

The remainder of our paper is organized as fol-

lows. In Section 2, we briefly review some related

studies including the JO model. After we define the

proposed model mathematically in Section 3, we eval-

uate its accuracy in Section 4. In Section 5, we discuss

our results, and we conclude the work in Section 6.

2 PREVIOUS STUDIES

2.1 The JO Model

The JNSA Security Damage Investigation Working

Group collected public information of cyber incidents

reported in newspapers, Internet news, and documents

related to incidents published by organizations since

2002. They classified incidents by the type of busi-

ness of the organizations, the number of customers,

the leakage source, and the number of records com-

promised in the incident. The JNSA dataset consists

of attributes including “date,” “information manage-

ment and holding officer,” “industry type,” “social

contribution degree,” “number of victims,” “classi-

fied leakage information,” “incident cause,” “leakage

route,” “incident handling quality,” and “kinds of in-

formation leaked (Name, address, phone number, or,

date of birth).” Table 1 shows the statistics of cyber

incidents occurring in Japan from 2005 through 2016.

The JNSA Damage Operation Model for Personal

Information Leakage (JO model) calculates the cost

to each company from these information leakages

(Japan Network Security Association, 2016) as fol-

lows.

cost = constant × sensitivity × identifiability (1)

× responsibility × handling

where constant is 500 JPY (equivalent to 5 USD),

and sensitivity is defined with the features of compro-

mised personal information as

sensitivity = max(10

max(x)−1

+ 5

max(y)−1

)

where x is a set of constants that are specified by the

mental impact on the individual who suffers the data

breach, and y is a set of constants defined by the fi-

nancial impact of a cyber incident. The range of x

and y is {1,2,3}, and the assignment is predetermined

by a common table. responsibility is defined as 2 if

the company is large or governmental; 1 otherwise.

identifiability is defined as follows.

identifiability =

6 if a record contains both name

and mailing address ,

3 if a record contains name

or (address and telephone number),

1 otherwise.

2.2 Romanosky’s Model

Romanosky proposes a model to estimate the total

cost incurred by a company in each year based on

11,705 incident reports of American companies from

2005 to 2014 obtained from Advicen

1

as follows (Ro-

manosky, 2016).

log(cost

i,t

) = β

0

+ β

1

· log(revenue

i,t

) +β

2

· log(records

i,t

)

+ β

3

· repeat

i,t

+ β

4

· malicious

i,t

+ β

5

· lawsuit

i,t

+ α· FirmType

i,t

+ λ

t

+ ρ

ind

+ µ

i,t

.

(2)

The values of each coefficient are shown in Table 2.

Variable i, t refers to the data of company i in year

t, and “records” shows the number of compromised

personal information records. “repeat” and “lawsuit”

are Boolean values, and “Firm Type” is a dummy vari-

able, defined as 1 if it is applicable, whether the event

is filed in the past, whether it was sued for the inci-

dent, whether it is a government agency or a general

company, otherwise 0, respectively.

However, note that Romanosky’s model is a re-

gression expression based on information from com-

panies in the US, and it is not clear whether the same

model can be applied to Japanese companies.

2.3 Other Studies

In the United States, identity theft resulted in cor-

porate and consumer losses of $56 billion dollars in

2005, with up to 35 percent of known identity thefts

caused by corporate data breaches. Romanosky et

al. estimated the impact of data breach disclosure

laws on identity theft from 2002 to 2009 (Romanosky

et al., 2011). They found that adoption of data breach

disclosure laws reduce identity theft caused by data

breaches by 6.1 percent, on average.

The odds of a firm being sued are 3.5 times greater

when individuals suffer financial harm, but 6 times

lower when the firm provides free credit monitoring.

Moreover, defendants settle 30 percent more often

when plaintiffs allege financial loss, or when faced

with a certified class action suit (Romanosky et al., ).

Gordon proposed a model that determines the op-

timal amount to invest to protect a given set of in-

formation (Gordon and Loeb, 2002) (Gordon et al.,

1

https://www.advisenltd.com/

ICISSP 2019 - 5th International Conference on Information Systems Security and Privacy

354

Table 1: Statics of JNSA dataset.

duration # records # companies (firms) # attributes mean # customers mean # incidents per year mean estimated cost [JPY/person] mean estimated cost [M JPY/firm]

12years 15569 8853 25 11764.32 1297.42 42361.73 460.27

Table 2: Coefficients of Romanosky’s model(Romanosky,

2016).

Coefficent Estimate

β

0

-3.858*

log(revenue

i,t

) β

1

0.133**

log(record

i,t

) β

2

0.294***

repeat β

3

-0.352

malicious β

4

-0.0294

lawsuit β

5

0.444

FirmType

i,t

β

6

Government -1.339

Private -1.032

Public -0.0654

2015). It suggests that a firm’s investment in IT secu-

rity should not exceed 37% of the losses it expects to

incur from a data breach or cyber event.

Edward et al. studied a popular public dataset

and develop Bayesian Generalized Linear Models to

investigate trends in data breaches(Edwards et al.,

2016).

3 PROPOSED METHOD

3.1 Overview

In this study, we use two datasets. One is the

financial information for the year in which

the personal information leakage incident oc-

curred. This dataset was purchased from

QICK Astra Manager (QUICK.Corp., ). The

other is the JNSA datasets from 2005 to 2016

(Japan Network Security Association, ), which

contain the information leakage incident data.

In the JO model, estimated damage costs were cal-

culated for each incident. In our study, on the other

hand, we use multiple regression with the extraor-

dinary loss as the dependent variable in the year in

which the incident occurred.

3.2 Extraordinary Loss

It is not trivial to estimate the exact expense of han-

dling an incident because there are many possible

factors involved in the incident handling; e.g., the

cost of fixing the vulnerability, the cost of com-

pensation of customers, and the loss of reputa-

tion. Hence, we focus on the financial annual re-

port in which temporary losses and extraordinary

losses are specified. For example, a Japanese ed-

ucational company, Benesse Holdings, recorded ap-

proximately 26 billion JPY (equivalent to 26 mil-

lion USD) as the extraordinary loss in 2014, when

a well-known personal information leakage incident

occurred (Benesse Holdings,Inc., 2014). The amount

of money can be considered to be the total cost of

handling the incident. We found that similar extraor-

dinary losses were reported by other companies just

after their database was compromised. Therefore, in

our study, we take the value of the extraordinary loss

for each company to be the cost of the incident.

3.3 Our Data

The extraordinary loss is the amount of damage

recorded for the incident. However, the whole ex-

traordinary loss is not necessarily generated by the

incident. For example, the extraordinary loss may in-

clude “loss due to discontinuation of system develop-

ment” or “business structure improvement expenses.”

Therefore, we need to process the details of the ex-

traordinary loss and the JNSA dataset before applying

multiple regression to our model.

3.3.1 Aggregating Statistics by Year

A company sometimes is compromised multiple

times in the same year. For example, CyberAgent Inc.

had illegal login incidents twice, on May 11, 2016 and

November 29, 2016. In this case, we aggregate statis-

tics for two incidents per year as follows.

• Number of victims: Total number of victims in a

year

• Cause of incident: True if either of the records is

a Malicious attacker (Insider)

• Leakage item: All items leaked in one year

• Post correspondence degree: Maximum value for

1 year

• Economic damage rank: Maximum value for 1

year

• Mental damage rank: Maximum value for 1 year

• The degree of identity identification: Maximum

value for 1 year

3.3.2 Investigation of Annual Report

We surveyed the annual reports of the top 105 inci-

dents chosen according to the number of victims. Ta-

Mathematical Model to Estimate Loss by Cyber Incident in Japan

355

Table 3: Objects of the annual report survey.

Year # Incident # Company

2005-2016 105 90

ble 3 shows the statistics to be investigated. As a re-

sult of the survey, we show five reports in Table 4 de-

scribing “information security countermeasures” as a

breakdown of extraordinary loss.

2

We show the costs

of information security countermeasures in conjunc-

tion with the extraordinary loss in Table 4. Under the

assumption that these information security counter-

measures were taken as true losses, we perform single

regression and have a simple model of loss by inci-

dent.

Loss by incident = 0.849 · extraordinary loss

As shown in Table 4, the error between information

security countermeasure (true value) and the loss by

incident (estimate) is 10.87 million JPY on average.

The 95% confidence interval is [−18.37 million JPY,

+40.11 million JPY].

3.3.3 Exclusion of Unprecedented Data

Extraordinary loss also is affected by events in finan-

cial markets or disasters that affect the economy. For

example, the Lehman shock that occurred in 2008 re-

sulted in many companies suffering greatly increased

extraordinary losses around that time. In order to

eliminate the influence of such events, we exclude

data before 2010.

Similarly, we exclude banks from our dataset be-

cause they report these extraordinary losses in a quite

different way. There are some institutions that we ex-

clude from our analysis.

3

3.4 The Linear Multiple Regression

Model

After preprocessing the above data, we are left with

144 records. A summary of the targeted dataset is

shown in Table 5. For the 144 records, we propose the

following linear model obtained by applying multi-

ple regression with loss by incident as the objective

2

Seki Co. Ltd. reported that it is liable to pay com-

pensation for an information leakage incident, such as, “On

September 15 last year, we announced ‘Apology and No-

tice about the leakage of our customer information.’ For the

subsequent secondary damage, we have not reported at the

moment. There is concern that personal information leaked

to the outside due to unauthorized access from the outside,

and the correspondence cost related to them, is recorded as

an information security countermeasure fee.” (Seki, )

3

The Japan Pension Organization and Japan Post have

no corporation ID in the dataset.

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Figure 1: Scatter plot between revenue and loss by incident.

variable y.

log(y) = f (x

1

, x

2

, ··· , x

16

) (3)

= β

0

+ β

1

· log(x

1

) + β

2

· log(x

2

) +

··· +β

16

· x

16

,

where coefficients of the explanatory variable are

shown Table 6. We indicate ∗ for p < 0.1 (signifi-

cance level10%), ** for p < 0.05 (significance level

5%), and *** for p < 0.01 (significance level 1%). In

the proposed model, we find that the most significant

variable (***) is revenue. That is, our estimated loss

from an incident strongly depends on revenue (β

2

).

We observed that some large industries such as the

construction industry are dominant in loss caused by

incident. We also note that a small number of compa-

nies are targeted for incidents.

We used the lm function of R for multiple regres-

sion.

4 EVALUATION

4.1 Our Model and Incidents

Figure 1 shows the scatter plot between revenue and

loss by incident, and the proposed regression model.

In the plot, we assigned the mean values for variables

x

1

, x

3

, ··· except for revenue x

2

.

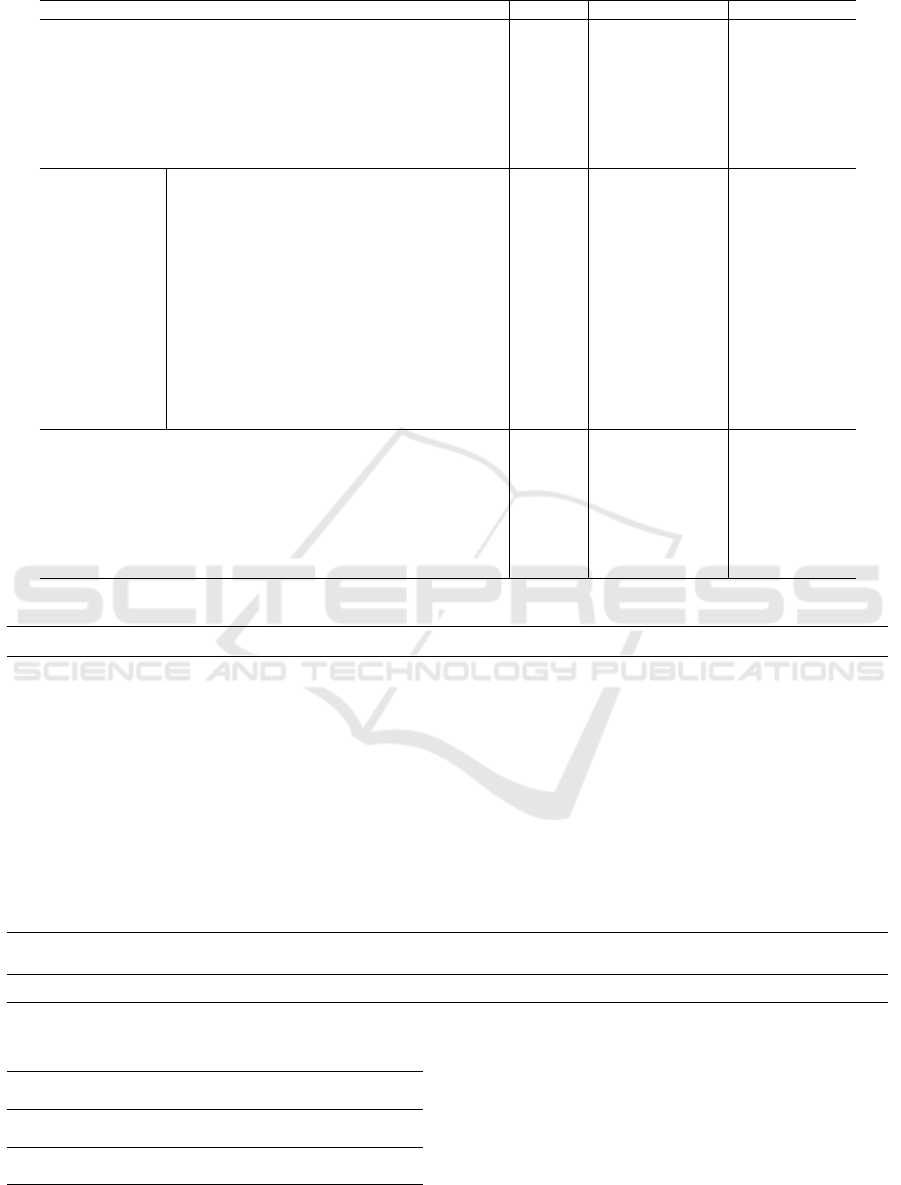

The scatter plot of loss by incident y with respect

to the number of victims (customer) x

1

is shown in

Fig. 2. Similarly, we assigned the mean for variables

x

2

, x

3

, ··· except for the number of victims x

1

. Unfor-

tunately, we find in Figure 1 that our model does not

fit well.

We show the relationship between our model, the

JO model, and Romanosky’s model of loss by inci-

dent in terms of the number of victims x

1

in Fig. 3. For

the JO model, the cost is proportional to the number

ICISSP 2019 - 5th International Conference on Information Systems Security and Privacy

356

Table 4: Information security measures[million yen].

Name of Company Year Information Security Countermeasure Extraordinary Loss Loss by Incident Error

Benesse Holdings, Inc. 2015 26039 30642 26045.7 + 6.7

Seki 2016 210.67 234 198.9 -11.77

Stream Co., Ltd. 2014 5.56 66 56.1 + 50.54

Misawa 2012 27.24 42 35.7 + 8.46

Ahkun Co., Ltd. 2016 8.92 11 9.35 + 0.43

Average 5256.69 6199.4 5269.15 +10.87

Confidence Interval(95%) 10.87 ± 29.24

Table 5: Dataset for multiple regression.

Term # Record # Company Mean # Victim Mean Revenue[Million JPY] Average Extraordinary Loss[Million JPY]

2010-2016 144 115 356630.2 90005.99 515.6

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Figure 2: Scatter plot between # customer and loss by inci-

dent.

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Figure 3: Scatter plot between # customer and loss (com-

parison of three models).

of victims, and the influence is significant. However,

in the proposed model and Romanosky’s model, the

estimated cost is less sensitive to the number of vic-

tims. Alternative variables might be more significant

for incident cost in either model.

4.2 Comparison with the JO Model

The JO model of Equation (1) is multiplicative, with

some constants according to the per capita compen-

sation for leaked information. On the other hand, our

proposed model (Equation (4)) is a linear expression,

and the two models seem to be inconsistent. However,

we show that these models are equivalent by trans-

forming our proposed model as follows.

loss = e

f (x)

= e

β

0

+β

1

·log(x

1

)+β

2

·log(x

2

)+β

3

·x

1

+β

4

·x

2

+···

= e

β

0

· e

β

1

·log(x

1

)

· e

β

2

·log(x

2

)

· e

β

3

·x

1

· ···

= e

β

0

· x

β

1

1

· x

β

2

2

· e

β

3

·x

3

· ···

(4)

Table 8 compares coefficients between the our pro-

posed model and the JO model. We find that both

models are of multiplicative form with some differ-

ence in coefficients.

We show the estimated loss in the three models for

20 major incidents in Table 7. In the proposed model

and the JO model, there was a large difference in the

estimated loss, with the average calculated by the JO

model being 11,686.5 million JPY. The average error

rate for the loss by incident in the proposed model is

1.73. This error is the smallest of the three models.

Let us consider the validity of this constant in the

proposed model. In the JO model, the cost was multi-

plied by a constant, such as 10 times and 5 times de-

pending on the stage, for financial impact, mental im-

pact, and the degree of individual identification. For

example, the degree of individual identification x

7

= 1

to the loss amount of x

7

= 3 is estimated as follows.

f (x

1

, x

2

, ·· · , x

7

= 3, ··· )

f (x

1

, x

2

, ·· · , x

7

= 1, ··· )

=

e

β

0

· x

β

1

1

· x

β

2

2

· · ··e

3β

7

···

e

β

0

· x

β

1

1

· x

β

2

2

· · ··e

1β

7

···

=

e

3β

7

e

1β

7

= e

2β

7

= 1.5158 < 3

(5)

That is, the JO model tripled the cost, which is too

expensive in the context of the current financial situ-

ation. The JO model estimates 1.5 times higher than

actual loss. We estimate the increase in loss when the

financial impact x

7

rises by one step in our model and

show the results in Table 8 for each stage.

For any variable in the proposed model, the in-

crease is smaller than that of the JO model.

Mathematical Model to Estimate Loss by Cyber Incident in Japan

357

Table 6: Coefficient of proposed model.

Coefficient Estimate p.value Domain Mean

β

0

−3.9632 0.0093 ∗ ∗ ∗

log(revenue) log(x

1

) β

1

0.9904 2.18E −23 ∗ ∗ ∗ 11.40

log(#customer) log(x

2

) β

2

0.0379 0.4612 6.15

malicious x

3

β

3

0.6261 0.6808 0,1 0.15

responsibility x

4

β

4

N/A N/A 0,1 0

financial impact x

5

β

5

0.1590 0.5025 1,2,3 1.31

mental impact x

6

β

6

0.0128 0.9772 1,2,3 1.11

identifiability x

7

β

7

0.2079 0.6930 1,3,6 4.26

Type of Industry

Real Estate

x

8

β

8

−0.9664 0.2141

0,1

0.08

Construction −2.3409 0.0020 ∗ ∗ ∗ 0.10

Information and Communication −1.0501 0.1409 0.19

Forestry −1.3298 0.2738 0.01

Electric Power and Gas −1.7914 0.0657 ∗ 0.03

Life and Entertainment −2.0012 0.1181 0.01

Service (not classified elsewhere) −0.8641 0.2857 0.07

Wholesale Trade −1.3594 0.0518 ∗ 0.17

Medical, Welfare −1.5521 0.1356 0.03

Food −1.3504 0.1380 0.04

Manufacturing −1.6206 0.0213 ∗∗ 0.17

Education −0.5533 0.6155 0.02

Academic Research −1.0657 0.4271 0.01

Financing Business −2.6764 0.0104 ∗∗ 0.03

name x

9

β

9

−0.6231 0.6007 0,1 0.82

address x

10

β

10

−0.5169 0.7406 0,1 0.55

telephone number x

11

β

11

−0.5337 −0.7562 ∗ 0,1 0.51

birth day x

12

β

12

−0.2348 0.5105 0,1 0.26

sex x

13

β

13

0.2624 0.5296 0,1 0.17

job x

14

β

14

0.1453 0.7767 0,1 0.07

e-mail address x

15

β

15

−0.3845 0.2318 0,1 0.46

ID/PASS x

16

β

16

−0.2810 0.5025 0,1 0.12

Table 7: Cost in each model.

No. company date number of customers

JOmodel

(M JPY)

Romanosky’s model

(M JPY)

our model

(M JPY)

Loss by incident

(M JPY)

Information Security

Countermeasure(M JPY)

1 Benesse Holdings, Inc. 2014/7/9 48580000 1603140 2367.64 13287.36 26045.7 26039

2 Seki 2015/9/15 267000 41652 325.19 87.43 198.9 210.68

3 Stream Co., Ltd. 2014/1/30 94359 566.15 256.64 152.89 56.1 5.56

4 Misawa 2011/5/26 16798 1310.24 126.87 17.1 35.7 27.24

5 Ahkun Co., Ltd. 2016/1/13 3859 23.15 66.98 4.4 9.35 8.92

6 CyberAgent, Inc. 2016/11/29 640368 742.18 466.35 3532.63 4021.35

7 KOSHIDAKA HOLDINGS Co., LTD. 2014/9/17 310000 930 403.73 199.01 266.9

8 CyberAgent, Inc. 2013/8/12 243266 1459.6 446.95 1273.35 5566.65

9 PASCO CORPORATION 2010/3/21 201414 9063.63 355.01 637.05 438.6

10 GMO Internet, Inc. 2015/2/27 188047 1011.3 276.47 1444.65 1752.7

11 AMUSE INC. 2009/8/10 148680 11597.04 307.14 187.89 1362.55

12 RareJob Inc. 2012/5/14 110000 330 182.83 7.97 5.1

13 EZAKI GLICO CO.,LTD. 2016/3/7 83194 6489.13 361.5 1375.64 349.35

14 TSUBAKIMOTO CHAIN CO. 2016/11/14 64742 194.23 311.08 612.94 373.15

15 Hotman.co.Ltd 2014/7/1 61977 1115.59 227.81 51.94 85

16 CyberAgent, Inc. 2014/6/23 38280 76.56 267.69 1852.89 3427.2

17 SUNNY SIDE UP Inc. 2015/8/28 37006 37.01 184.36 145.42 228.65

18 Livesense Inc. 2013/2/28 32132 282.79 98.19 4.56 3.4

19 Ryohin Keikaku Co.,Ltd. 2015/1/5 22385 405.07 165.95 716.14 495.55

20 GAKKEN HOLDINGS CO.,LTD. 2015/7/13 22108 132.65 205.88 509.37 1002.15

Mean 11,686.5 107.4 2,741.46 4940.4

Max 1,603,140 2,367.6 36,953.72 349,630.7

Minimum 0.002 6.7 4.0 1.7

Average error 17,650.7 6,363.7 4,935.2

Weighted mean error rate 4.54 2.50 1.73

Table 8: Comparison of coefficients of our proposed model

and the JO model.

Financial impact

JO model 10

0

10

1

10

2

Proposed model 1 1.1723 1.3743

Mental impact

JO model 5

0

5

1

5

2

Proposed model 1 1.0129 1.0261

Identifiability

JO model 1 3 6

Proposed model 1 1.5158 2.8291

Based on data for incidents with financial impact,

mental impact, and identifiability all being 1, we esti-

mate the constant value per person in Table 9. When

the financial impact, mental impact, and identifiabil-

ity are all 1, the loss per person in the JO model is 500

JPY from the Equation (1) but is 212,106.1 JPY in the

proposed model.

ICISSP 2019 - 5th International Conference on Information Systems Security and Privacy

358

Table 9: Constant(data of x

5

= x

6

= x

7

= 1).

# incident Mean # customer Mean Loss[Million JPY] Mean Loss[JPY/# customer]

20 5031.3 1067.17 212106.1

4.3 Comparison with Romanosky’s

Model

For the incident data used for regression, the re-

sults of each of Romanosky model and the proposed

model are shown in Table 7. We omitted variables

lawsuit

i,t

, FirmType

i,t

, λ

t

, ρ

ind

, andµ

i,t

because these

costs are not relevant in Japan. In the Romanosky

model, the average estimated loss is 107.4 million

JPY, which is very small.

5 DISCUSSION

The comparison of the value calculated for the JO

model shows that the estimates are quite different.

Let us focus on the estimated loss per particular in-

cident for Benesse Holdings in Table 7. In the JO

model, the error rate of loss by incident is 6154.1, but

in the proposed model, it is 0.49, and the error for

this latter model is very small. The per capita cost

divided by the number of victims is 33,000 JPY in

the JO model, while it is about 273 JPY in the pro-

posed model. Looking at the average per capita loss

by incident from Table 9, attention must be paid to

the fact that the capital loss estimated by our proposed

model is very large. We found that our model depends

greatly on the revenue of the company, so it might

not be suitable for the estimation of cases where the

company revenue is large but the number of victims

is small.

On the other hand, from Table 7, clearly, the

cost estimates in Romanosky’s model were smaller

than that in our proposed model. The estimate of

revenue in our model is 0.9904(β

1

), which is about

seven times higher than Romanosky’s model(β

1

=

0.133). In the data used for Romanosky’s regres-

sion, the average revenue is 8031 million USD. Note

that, β

2

(about #customer) is about one-eight Ro-

manosky’s model(our model: 0.0379, Romanosky’s

model: 0.294). We claim that it is caused by the dif-

ference in the frequency of litigation between the US

and Japan. In Japan, it is rare to pay a large amount of

compensation by trial. Instead, it is common just by

paying a small amount of apology fee to customers.

These implies that Romanosky’s model is not suitable

for the evaluation of Japanese incidents because of the

difference in market size and culture between the US

and Japan.

6 CONCLUSION

In this study, we proposed a new mathematical model

to estimate the cost of cyber incidents, and we cre-

ated a model that estimates the value of losses more

accurately than either of the previous studies. The

weighted average error rate of our proposed model

was 1.73. Benesse’s per capita damage amounted

to 273 JPY, which implies that it is a more realistic

model. However, there is a concern that the extraor-

dinary loss as the objective variable may include the

influence of the natural disasters and other events that

do not relate to breaches of data security. Therefore,

we devised a method of collecting data on the value

of losses related only to incidents themselves, includ-

ing, most importantly, information security counter-

measures.

ACKNOWLEDGEMENTS

We thank the Japan Network Security Association for

their useful data collection.

REFERENCES

CabinetOffice (2014). Cyber insurance market:

joint government and industry statement.

https://www.gov.uk/government/uploads/system/

uploads/attachment data/file/371036/Cyber

Insurance Joint Statement 5 November 2014.pdf.

Edwards, B., Hofmeyr, S., and Forrest, S. (2016). Hype and

heavy tails: A closer look at data breaches. Journal of

Cybersecurity, 2(1):3–14.

Franke, U. (2017). The cyber insurance market in sweden.

Computers & Security, 68:130 – 144.

Gordon, L. A. and Loeb, M. P. (2002). The economics of

information security investment. ACM Trans. Inf. Syst.

Secur., 5(4):438–457.

Gordon, L. A., Loeb, M. P., Lucyshyn, W., and Zhou, L.

(2015). Increasing cybersecurity investments in pri-

vate sector firms. Journal of Cybersecurity, 1(1):3–

17.

Benesse Holdings,Inc. (2014). Accident summary. https:

//www.benesse.co.jp/customer/bcinfo/01.html. ac-

cessed 31/January/2018.

Japan Network Security Association. Information security

incident survey report(jnsa data set).

Mathematical Model to Estimate Loss by Cyber Incident in Japan

359

Japan Network Security Association (2016). Survey report

on information security incident data breach edit-

ing . http://www.jnsa.org/result/incident/. accessed

1/February/2018.

QUICK.Corp. This settlement (consolidated priority) data.

http://biz.quick.co.jp/lp astram/.

Romanosky, S. (2016). Examining the costs and causes of

cyber incidents. Journal of Cybersecurity, 2(2):121–

135.

Romanosky, S., Hoffman, D., and Acquisti, A. Empirical

analysis of data breach litigation. Journal of Empirical

Legal Studies, 11(1):74–104.

Romanosky, S., Telang, R., and Acquisti, A. (2011).

Do data breach disclosure laws reduce identity

theft? Journal of Policy Analysis and Management,

30(2):256–286.

Seki. Fiscal year ended march 31 2015.

https://www.seki.co.jp/material/dl/ir/kessan/

20160506 LdfbMJKUnbPG.pdf.

Wells, A. and Jones, S. (2016). Growth in cyber coverage

expected as underwriting evolves.

Wheeler, J. and Akshay, L. (2015). Understanding when

and how to use cyberinsurance effectively. PE Proctor

- 2015 - Technical report.

ICISSP 2019 - 5th International Conference on Information Systems Security and Privacy

360