Risk Analysis of Distributed Generation Scenarios

Paula Medina Maçaira, Margarete Afonso de Sousa, Reinaldo Castro Souza

and

Fernando Luiz Cyrino Oliveira

Industrial Engineering Department, Pontifícia Universidade Católica do Rio de Janeiro,

Rua Marquês de São Vicente, 225, Rio de Janeiro, Brazil

Keywords: Forecasting, Time Series, Hydroelectric Power Generation, Distributed Generation, Small Hydropower

Plant, Exogeneous Variables.

Abstract: Assertiveness in generation forecast is an important issue for utilities when they are planning their

operation. Hydropower Generation forecast has a strong stochastic component and thinking about small

hydropower plants (SHP) is even more complex. In recent years, many SHP was installed in Brazil due to a

Government incentive and the distributed generation penetration has an impact in technical losses’

estimation. The objective of this study is to propose a methodology to generate synthetic scenarios of

distributed generation for hydro sources. A case study was carried on with historical generation data from

SHP located in Minas Gerais. The periodic regression model was considered the best model for forecast

hydropower generation. Three distributed generation scenarios are obtained using Conditional Value at Risk

analysis after combining multiple scenarios from inflow forecasting generated with the periodic regression

model.

1 INTRODUCTION

The Brazilian electricity generation system, called as

National Interconnected System (NIS), is mainly

composed by hydroelectric plants. In December

2017, the installed power capacity was

approximately 155 GW and hydroelectric generation

represented 67.8% of this total. To complement the

electricity matrix there are also thermal, wind power

and other kinds of source (ONSa, 2018).

According to the Brazilian legislation,

hydroelectric plants that generate between 5 and 30

MW, with a reservoir area that not exceeds 13 km

2

,

are called Small Hydroelectric Power Plants (SHP).

There is also Reduced Capacity Generating Plants

(RCGP) that produces 5 MW or less and do not have

reservoirs. This type of plants has low

environmental impact and represents 3.7% of NIS

installed capacity nowadays (ABRAPCH, 2018).

In order to encourage the alternative energy

sources, like SHP, wind and biomass, the Brazilian

Government created a program called PROINFA.

Such program increases the numbers of SHP and

RCGP, reaching nowadays 436 and 683,

respectively, in operation in Brazil (ANEEL, 2018;

ABRAPCH, 2018).

Hydroelectric generation depends on the amount

of water in the rivers that depends mostly on

precipitation. The rainfall can vary within an hour, a

month, a year and, also, between the years. And this

alternation between dry and wet periods affects the

amount of power generation (Maçaira et al., 2017;

Lima et al., 2014).

Given this, the future generation from hydro

sources must be estimated considering its past

generation and also considering exogenous

information, such as inflows and precipitation.

The estimation of technical losses is also an

important issue for utilities. To do so, they have to

forecast future generation. For hydro sources with

strong stochastic components, improve generation

forecats is fundamental to achieve better results.

In many situations, for SHP and RCGP, there are

no inflows data available. Therefore, the main

objective of this study is to use inflow time series

from neighboring basins as exogenous variables

(Lohmann et al., 2016), via Linear Regression

models, in order to predict SHP and RCGP future

generation. To build future scenarios it is proposed a

methodology based on historical power generation

and CVaR risk analysis. With this approach the

utilities could provide better forecast power

378

Maçaira, P., Afonso de Sousa, M., Souza, R. and Oliveira, F.

Risk Analysis of Distributed Generation Scenarios.

DOI: 10.5220/0007389203780383

In Proceedings of the 8th International Conference on Operations Research and Enterprise Systems (ICORES 2019), pages 378-383

ISBN: 978-989-758-352-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

generation and, consequentely, aid in the prediction

of technical losses, due to the distributed generation

penetration. A case study was carried out to test the

methodology accuracy.

This paper is organized in 4 sections. Section 1 is

the introduction and presents the motivation of this

paper. Section 2 presents an explanation of the

metodology used. The discussions and results are

presented in section 3 and in section 4 the

conclusion of this study and its final considerations

are shown.

2 METHODOLOGY

Time series models are popular and useful for long-

term forecasting and simulation. There is a wide

variety of methods that meet this purpose and the

choice of a suitable one for modeling a particular

problem depends on many factors, such as: amount

of time series available, precision required, period of

time available, the ability to interpret results, among

others.

Among time series univariate methods, the most

popular belongs to the Box & Jenkins family (Box

and Jenkins, 1976; Box et al., 1994). These models

consider only time series historical and according to

Salas et al., (1982) natural phenomena are, in

general, stationary.

In this field, the most applied models are

periodic ones. They have the ability to capture the

dependence not only of the time interval between

observations, but also of the data period (Moss and

Bryson, 1974). The most used are the Periodic

Autoregressive (PAR) and the Periodic

Autoregressive Moving Average (PARMA).

With the Computer Science advances, methods

that incorporate external information to improve

time series forecasting and/or simulation have

gained space. Recent studies confirm the

applicability forecasting models using external

information. It means that appropriate use of

exogenous variables makes the prediction models

more robust with ample possibility to represent

future events with different characteristics from

those that happened in the past.

In a recent study, Maçaira et al., (2018) show

that, in Environmental Sciences area, such kind of

models have produced better results. The most used

are: Linear Regression, Artificial Neural N,

ARIMAX and Support Vector Machine.

In this study, the candidate models used for

forecast the generation time series are Regression

Linear ones.

Considering a time series , with periods (

12 for monthly time series), the number of years

and is number of steps-aheads. So,

,

,

,

,…,

,

,…,

,

. As the time series,

in this study, have a seasonal/periodic component,

the first model tested is a Seasonal Average. It

means that the forecast for any given month will

always be the historical average for that month, as

Equation 1.

,

,

(1)

The second model proposed, named as Seasonal

Naïve, forecasts, for any given month, the last

historical observation of those month, as shown in

Equation 2.

,

,

(2)

In the same way as the first model, these two

methodologies are considered as benchmarks.

However, among the models proposed, the

Seasonal Autoregressive Integrated Moving Average

– SARIMA

,,

,,

is a traditional

one. This is a univariate model for stationary and

non-stationary series (Box and Jenkins, 1976; Box et

al., 1994).

The next two proposed models are Linear

Regression ones. It means that the exogenous

variable, inflow series, that explains power

generation behavior (Hyndman and Athanasopoulos,

2013).

In the first linear regression model, as shown in

Equation 3, there is no consideration of seasonality

represented by the months within the year. Unique

(intercept) and

(slope) are obtained from the

data.

,

,

(3)

The second linear regression model takes into

account the periodic monthly effect. In this case, 12

coefficients

(intercept) and 12 coefficients

(slope) are estimated, one for each month.

,

,

,

,

(4)

To compare all these models, two metrics have been

used. The Root Mean Square Error (RMSE) and the

Mean Absolute Percentage Error (MAPE).

∑

(5)

Risk Analysis of Distributed Generation Scenarios

379

100

1

(6)

Where

is the time series value in period ,

is the

adjusted value on period and is the total of

observations.

After the best model has been chosen, the next

step consists of simulate synthetic scenarios for

power generation. According to the Brazilian

legislation, for small hydropower plants, the object

of this study, power generation is considered as

“distributed generation”.

Hence, to generate these artificial time series, it

will be combined synthetic scenarios from the

independent variable and the model selected. In this

case study, the data is from hydro sources, so the

independent variable are the inflows time series. To

to so, the methodology is the same used by the

official model in Brazil, which combines Periodic

Autoregressive model (PARp) with LogNormal

distributed probability. For more details, see

Oliveira et al., (2015) and Charbeneau (1978).

If the Periodic Regression model is chosen

(equation 4), the distributed generation scenarios are

obtained as shown in Equation 7, where

1,…, and is the number of scenarios generated.

,

,

,

,

,,

(7)

By this methodology it is possible to obtain a great

number of scenarios that implies in choosing which

are the ones of interest. According to the literature,

to do so, risk measures, as Value at Risk (VaR) and

Conditional Value at Risk (CVaR) are used.

VaR is the maximum potential loss (or worst

loss) valuation at a specified confidence interval (

confidence level) that an investor would be exposed

within a considered time horizon. The VaR can be

translated as the amount in which the losses do not

exceed 1% of the scenarios. The VaR

calculation is quite simple, since it is, by definition,

some quantile associated with a distribution extreme

percentile (usually 1% or 5%). For example, it can

calculate the worst result among the best 95% or the

best among the worst 5%. This cut off value is 5%

VaR. A criticism related to VaR is that it does not

provide the expected loss size estimation since the

loss has exceeded the critical value, that is, it does

not bring any information about the losses greater

than the value found for the quantile1

(Rockafellar and Uryasev, 2002).

CVaR is a measure that indicates the average

loss that exceeds VaR, it means, it quantifies "how

big" is the average loss (risk) exposure. CVaR is

considered a coherent measure of risk (Artzner et

al., 1999) and is more pessimistic than VaR. It is

used to measure losses. Therefore, while the VaR

answers the question "What is the minimum loss

incurred by the portfolio in% worst scenarios?",

The CVaR answers the question "What is the

average loss incurred by the portfolio in % worst

scenarios?". A great benefit of using CVaR over

VaR is in detecting the maximum acceptable losses.

The software R is used, in this study to fit all

models and to present results (R Core Team,2015).

3 RESULTS AND DISCUSSIONS

The power plant Ivan Botelho II SHP is in operation

since November 28, 2003, with installed capacity of

12.4 MW. It is located in Minas Gerais and will be

used as a case study to test the methodology

accuracy.

For the proposed approaches, the inflow monthly

data base of Ivan Botelho II SHP is required. The

historical power generation was provided by the

company who owns the SHP concession, but the

inflow data with an enough historical size to allow

the realization of this study was not available. This

way, was used neighbouring inflows data provided

by the National Electric System Operator (ONSb,

2018). To find the highest correlation (temporal and

spatial) with power generation, 32 Hydroelectric

Power Plants (HPP) inflow data, located in Rio de

Janeiro, Minas Gerais and Espírito Santo, were

analysed.

The Sobragi power plant, located at Paraibuna

River, in Minas Gerais, was the one that presented

the highest correlation with Ivan Botelho II SHP.

Figure 1 shows the both power generation and

inflow between January 2010 and December 2016.

Although the start date of Ivan Botelho II is January

2004, the inflow data of Sobragi available is from

January 2010 and to use regression models the two

series may have the same length.

Figure 1: Sobragi HPP inflow and Ivan Botelho II SHP

power generation.

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

380

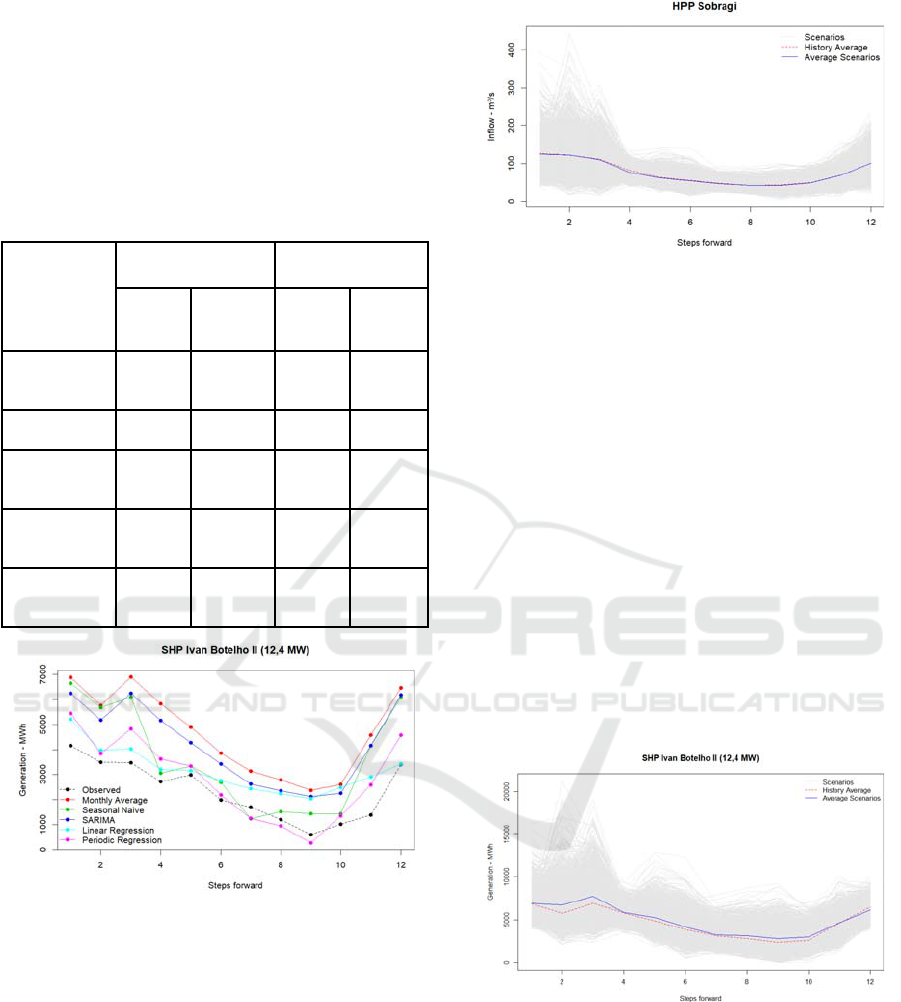

In order to check the predictive power of each

proposed methodology, the generation series was

split into training period (Jan/2010 to Dec/2016) and

validation (Jan/2017 to Dec/2017). Table 1 shows

the results for in-sample and out-of-sample

adjustment with the RMSE and MAPE error metrics.

The behavior for each approach is shown in Figure

2.

Table 1: RMSE and MAPE comparative results.

Model

In-sample Out-of-sample

MAPE

(%)

RMSE

(MWh)

MAPE

(%)

RMSE

(MWh)

Periodic

Regression

15,96 827,74 33,24 685,22

SARIMA 18,53 1040,40 45,97 1841,55

Linear

Regression

21,57 1135,43 29,41 809,72

Seasonal

Average

25,09 1651,45 52,03 2328,09

Naive

Seasonal

33,13 1567,34 35,23 1347,13

Figure 2: 12-step-ahead out-of-sample Ivan Botelho II

SHP forecasts.

Therefore, 2,000 synthetic scenarios for Sobragi

inflow data, with 12-step-ahead out-of-sample

forecast,

were simulated via PARp model and

LogNormal probability distribution, as explained in

the Methodology section. The scenarios, historical

average observed and Sobragi inflow average

scenarios are presented in Figure 3.

Figure 3: Sobragi HPP inflow synthetic scenarios.

By combining the estimated model through

Periodic Regression (Equation 8) and the inflow

scenarios (Figure 3), it was possible to obtain 2,000

distributed generation scenarios for Ivan Botelho II,

as shown in Figure 4.

,

,

0.2850.806

,,

,

,

0.1351.041

,,

,

,

0.1621.317

,,

,

,

0.0921.498

,,

,

,

0.0652.171

,,

,

,

0.1122.182

,,

,

,

0.1792.382

,,

,

,

0.2002.673

,,

,

,

0.2172.588

,,

,

,

0.1011.820

,,

,

,

0.0251.473

,,

,

,

0.3540.669

,

,

(8)

Figure 4: Ivan Botelho II SHP distributed generation

synthetic scenarios.

Considering the assumption that the greatest risk

of technical losses occurs when the distributed

generation penetration is greater, the selection of

interest scenarios occurred through the CVaR

with1%,5%,10%. The extracted scenarios are

shown in Figure 5.

Risk Analysis of Distributed Generation Scenarios

381

Figure 5: Scenarios obtained by CVaR risk measure with

1%,5%,10%.

4 FINAL CONSIDERATIONS

The main objective of this paper is to provide energy

generation scenarios for the further estimation of

technical losses. Hydro sources are strongly

dependent on hydrological regimes, and because of

this, the power generation forecast models from such

sources should consider exogenous variables such as

inflow and/or precipitation in order to obtain more

robust and accurate forecasts. The case of study is

from a SHP plant located in Brazil that has no

hydrological data available. So the first methodology

developed seeks neighboring hydrological series that

explain the small plants generation series. This

approach involves the test of many techniques in

order to find the most suitable forecast model. With

the purpose of build energy generation scenarios it

was used the periodic autoregressive model, from

Box & Jenkins, and the Conditional Value at Risk

analysis.

The proposed methodology to find the most

correlated basin inflow with the SHP generation

present good results and as consequence the periodic

regression that uses the inflow database as

exogenous variable was the method that shows the

smallest error metrics (RMSE and MAPE). The

CVaR 1%, 5% and 10% have been shown to be

efficient to select scenarios that can provide highest

technical losses since when more energy is

generated from SHP greater are the technical losses.

For further studies, it is possible to apply this

methodology with other types of distributed

generation, as wind power. It is also possible, to

continue the research, to execute the complete cycle,

it means with the scenarios obtained, simulate the

technical losses and compare with real data.

Another research path could be the use of

dummies variables to explain low generation, in

several times due to maintenance periods.

ACKNOWLEDGEMENTS

This study was financed in part by the Coordenação

de Aperfeiçoamento de Pessoal de Nível Superior -

Brasil (CAPES) - Finance Code 001. The authors

also thank the R&D program of the Brazilian

Electricity Regulatory Agency (ANEEL) for the

financial support (P&D 06585-1802/2018) and the

support of the National Council of Technological

and Scientific Development (CNPq - 304843/2016-

4) and FAPERJ (202.673/2018).

REFERENCES

ABRAPCH. 2018. O que são PCHs e CGHs. Associação

Brasileira de Pequenas Centrais Hidrelétricas e

Centrais Geradoras Hidrelétricas. Avaiable at

http://www.abrapch.org.br/pchs/o-que-sao-pchs-e-

cghs (accessed date June 15, 2018).

Artzner, P., Delbaen, F., Eber, J. M., Heath, D., 1999.

Coherent measures of risk. Mathematical Finance, vol.

9, no. 3.

BRASIL. ANEEL, 2015. Resolução Normativa nº 673, de

4 de Agosto de 2015. Estabelece os requisites e

procedimentos para obtenção de outorga de

autorização para exploração de aproveitamento de

potencial hidráulico com características de Pequena

Central Hidrelétrica – PCH, Available at

http://www2.aneel.gov.br/cedoc/ren2015673.pdf

[accessed date October 5, 2018].

Box, G. E. P., Jenkins, G. M., 1976. Time Series Analysis:

Forecasting and Control. Holden-Day, San Francisco,.

Box, G. E. P., Jenkins, G. M., Reinsel, G. C., 1994. Time

Series Analysis: Forecasting and Control. Prentice

Hall.

Charbeneau, R. J., 1978. Comparison of the two and three-

parameter log normal distributions used in streamflow

synthesis. Water Resource Research, 1978,14(1):149–

50.

Hyndman, R., Athanasopoulos, G. 2013. Forecasting:

principles and practice. Avaiable at http://

otexts.com/fpp/ (accessed date July 7, 2018).

Lima, L. M. M., Popova, E., Damien, P., 2014. Modeling

and forecasting of Brazilian reservoir inflows via

dynamic linear models. International Journal of

Forecasting, 30(3):464–476.

Lohmann, T., Hering, A. S.,Rebennack, S., 2016. Spatio-

temporal hydro forecasting of multireservoir inflows

for hydro-thermal scheduling. European Journal of

Operational Research, 255(1):243–258.

Maçaira, P. M., Cyrino Oliveira, F. L., Ferreira, P. G. C.,

Almeida, F. V. N., Souza, R. C., 2017. Introducing a

causal PAR(p) model to evaluate the influence of

climate variables in reservoir inflows: a Brazilian

case. Pesquisa Operacional (Impresso), v. 37, p. 107-

128.

ICORES 2019 - 8th International Conference on Operations Research and Enterprise Systems

382

Maçaira, P. M., Thomé, A. M. T., Cyrino Oliveira, F. L.,

Ferrer, A. L. C., 2018. Time series analysis with

explanatory variables: A systematic literature review.

Environmental Modelling & Software, vol. 107, pag.

199-209.

Moss, M. E., Bryson, M. C., 1974. Autocorrelation

structure of monthly streamflows. Water Resources

Research, vol. 10, pag. 737-744.

Oliveira, F. L. C., Souza, R.C., Marcato, A. L. M., 2015. A

time series model for building scenarios trees applied

to stochastic optimisation. International Journal of

Electrical Power & Energy Systems, v. 67, p. 315-323.

ONS, 2018a. Operador Nacional do Sistema Elétrico.

Avaiable at http://ons.org.br/paginas/sobre-o-sin/o-

que-e-o-sin (accessed date June 25 ,2018).

ONS. 2018b. Resultados da Operação – Histórico da

Operação - Dados Hidrológicos/Vazões. Avaiable at

http://ons.org.br/Paginas/resultados-da-

operacao/historico-da-

operacao/dados_hidrologicos_vazoes.aspx [accessed

date July 10, 2018].

Rockafellar, R. T., Uryasev, S., 2002. Conditional value-

at-risk for general loss distributions. Journal of

Banking & Finance, vol. 26, no. 7.

Salas, J. D., Boes, D. C., Smith, R. A., 1982. Estimation of

ARMA Models with seasonal parameters. Water

Resources Research, vol. 18, no. 4, pag. 1006-1010.

R Core Team. 2015. The R Project for Statistical

Computing. Avaiable at https://www.r-project.org/

[accessed date March 20, 2018].

Risk Analysis of Distributed Generation Scenarios

383