Multi-Party E-Commerce Protocol for B2C/B2B Applications

C

˘

at

˘

alin V. B

ˆ

ırjoveanu

1

and Mirela B

ˆ

ırjoveanu

2

1

Department of Computer Science, “Al.I.Cuza” University of Ias¸i, Ias¸i, Romania

2

Continental Automotive, Ias¸i, Romania

Keywords:

B2C/B2B, Multi-Party Electronic Commerce Protocols, Complex Transactions, Electronic Commerce

Security, Fair Exchange.

Abstract:

There are many multi-party fair exchange protocols with applications in e-commerce transactions for buying

digital products, buying physical products, digital signature of contracts, certified e-mail and non-repudiation.

However, none of the existing multi-party fair exchange protocols can be applied to provide fair exchange

in complex transactions where a customer buys digital products from different merchants while maintaining

atomicity. In this paper, we propose a multi-party fair exchange e-commerce protocol for complex transactions

in that the customer wants to buy several digital products from different merchants. Our protocol has appli-

cations to B2C/B2B scenarios. In addition to strong fairness, our protocol provides effectiveness, timeliness,

non-repudiation and confidentiality.

1 INTRODUCTION

In electronic commerce transactions, a common prac-

tice is that a customer wishes to buy a pack of prod-

ucts/services composed of several products (digital

or physical)/services from different merchants. The

atomicity is an important security requirement for

such e-commerce transactions in that the customer

is interested in buying all products from the pack or

no product at all. We will refer to this type of e-

commerce transactions as aggregate/atomic transac-

tions. Also, there are cases in which the customer

wants to buy exactly one product from many mer-

chants, and for this, he specifies in his request more

possible products according to his preferences but

from this options only one will be committed. Such

e-commerce transactions are suitable when the cus-

tomer needs more flexibility in expressing his own

buying options. We will refer to this type of e-

commerce transactions as optional transactions. The

complex transactions are the combination in any form

of aggregate and optional transactions.

Fair exchange is an essential security requirement

in e-commerce protocols. There are a variety of e-

commerce protocols that consider only one customer

and one merchant, for buying digital or physical prod-

ucts. For example, (Alaraj and Munro, 2010) achieves

fair exchange of payment for digital product, and

(Djuric and Gasevic, 2015) achieves fair exchange of

payment for physical product.

Up to date, many multi-party fair exchange pro-

tocols are known with applications in e-commerce

transactions for buying digital goods (Liu, 2009),

buying physical goods (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu,

2018), digital signature of contracts (Draper-Gil et al.,

2013), certified e-mail (Zhou et al., 2005) and non-

repudiation (Yanping and Liaojun, 2009). But, none

of the multi-party fair exchange protocols proposed

can be applied to our problem: providing fair ex-

change in complex transactions where a customer

wants to buy digital products from different mer-

chants.

Some multi-party fair exchange protocols (Liu,

2009), (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018), (Draper-

Gil et al., 2013) solve related problems with our prob-

lem, but in other scenarios. The solution from (Liu,

2009) can not be applied to our problem because it

considers only an aggregate transaction where a cus-

tomer wants to buy several digital products from dif-

ferent merchants. Moreover, (Liu, 2009) does not

provide strong fairness, but only weak fairness. Weak

fairness requires that all parties receive the expected

items, or all honest parties will have enough evidence

to prove that they behaved correctly in front of an ar-

biter. Another two important security requirements

are not assured in (Liu, 2009): timeliness and confi-

dentiality. The solution from (Draper-Gil et al., 2013)

is a multi-two party contract signing protocol, where

164

Bîrjoveanu, C. and Bîrjoveanu, M.

Multi-party E-Commerce Protocol for B2C/B2B Applications.

DOI: 10.5220/0007956801640171

In Proceedings of the 16th International Joint Conference on e-Business and Telecommunications (ICETE 2019), pages 164-171

ISBN: 978-989-758-378-0

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

a consumer and many providers want to sign a con-

tract pairwise, assuring weak fairness. Because this

solution applies to a contract signing scenario differ-

ent from our scenario, it can not be applied to our

problem. (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018) pro-

poses an e-commerce protocol for complex transac-

tions in that the customer wants to buy different phys-

ical products from different merchants. This solution

can not be applied to our problem because it provides

fair exchange between digital receipts and digital pay-

ments for physical products in complex transactions,

while in our scenario the complex transactions in-

volves digital products. The major difference is that

in our scenario the digital products must be effectively

delivered to customers within the protocol, making

the transaction flow more difficult, and this scenario

can not be solved by solution from (B

ˆ

ırjoveanu and

B

ˆ

ırjoveanu, 2018).

Our Contribution. In this paper, we propose a multi-

party fair exchange e-commerce protocol for com-

plex transactions in that the customer wants to buy

different digital products from different merchants.

Our protocol has applications to B2C/B2B scenarios.

In addition to strong fairness, our protocol provides

effectiveness, timeliness, non-repudiation and confi-

dentiality.

The paper is structured as follows: section 2 gives

application examples of our protocol, section 3 de-

fines the security requirements, section 4 presents our

protocol, section 5 contains the security analysis of

the protocol, and the conclusions are in section 6.

2 B2C/B2B APPLICATIONS

Our protocol has use cases in Business to Consumer

(B2C) and Business to Business (B2B) applications.

For a B2C application, we consider a person Bob that

wants to change his job in the future into an IT re-

lated field, and to achieve this, he plans to study in his

free time. After studying the market requirements,

Bob decides to go in one of the following two di-

rections: first is programming and web development,

the second is databases. Bob builds his learning plan

by browsing through an online course catalog where

are chargeable downloadable digital courses from dif-

ferent providers, different domains, from which Bob

can choose. Bob starts to build his learning plan by

choosing courses in the order of his preferences. For

programming area, he wants to learn programming

techniques and a programming language. For pro-

gramming technique his first option is the course CP1

Algorithms from Stanford University or if this is not

available due to an course update or review process,

then his second option is CP2 Data structure and Al-

gorithms from San Diego University. For program-

ming language he prefers CP3 Introduction to Java

from San Diego University but if this is not possible,

then CP4 Java Programming from University of Lon-

don. For web development he wants to study CW1

Web development: basic concepts from University

of New Mexico or if this is not possible CW2 Web

application for everybody from University of Michi-

gan. For databases he wants only CD1 Introduction to

structured query language from university of Michi-

gan.

Bob will prepare his learning plan in form of a

complex transaction: ((CP1 or CP2) and (CP3 or

CP4) and (CW1 or CW2)) or CD1. The complex

transaction is an optional transaction in which first

preference is an aggregate transaction and the second

preference is an single product CD1. The aggregate

transaction is composed from three optional transac-

tions.

If instead of a single person, we have a company

who wants to offer technical or soft skills trainings to

their employees based on their possible development

plans, then we have a scenario for B2B application.

3 SECURITY REQUIREMENTS

Next, we will present the following security

requirements: effectiveness, fairness, timeliness,

non-repudiation and confidentiality which will be

achieved in our Multi-Party E-Commerce Protocol

for Digital Products (MPPDP). Also, these require-

ments are stated and analyzed in (B

ˆ

ırjoveanu and

B

ˆ

ırjoveanu, 2018) for multi-party e-commerce proto-

cols for physical products.

Effectiveness requires that if every party involved

in MPPDP behaves honestly, does not want to prema-

turely terminate the protocol, and no communication

error occurs, then the customer receives his expected

digital products from merchants, and the merchants

receive their payments from customer, without any

intervention of Trusted Third Party (TTP). This is a

requirement for optimistic protocols, where TTP in-

tervenes only in case of unexpected situations, such

as a network communication errors or dishonest be-

havior of one party.

Fairness in MPPDP requires:

• for any optional transaction from the complex

transaction, the customer obtains exactly one dig-

ital product for the product’s payment, and

• for any aggregate transaction from the complex

transaction, the customer obtains the digital prod-

ucts for the payments of all products,

Multi-party E-Commerce Protocol for B2C/B2B Applications

165

and each merchant obtains the corresponding pay-

ment for the product, or none of them obtains nothing.

This requirement corresponds to strong fairness.

Timeliness requires that any party involved in MP-

PDP can be sure that the protocol execution will be

finished at a certain finite point of time, and that after

the protocol finish point the level of fairness achieved

cannot be degraded.

Non-repudiation requires that neither the cus-

tomer nor any of merchants can deny their involve-

ment in MPPDP.

Confidentiality in MPPDP requires that the con-

tent of messages sent between participating parties is

accessible only to authorized parties.

4 MULTI-PARTY E-COMMERCE

PROTOCOL

Our protocol uses as building block the multi-party e-

commerce protocol for physical products proposed in

(B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018).

In MPPDP, we consider that one customer can

buy digital products in complex transactions from

many merchants. MPPDP has the following partic-

ipants: the customer (the payment Web segment), the

merchants, the payment gateway, the bank and the

certificate authority.

Table 1 presents the notations used in the de-

scription of MPPDP. We use hybrid encryption with

the same meaning as in (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu,

2018). Hybrid encryption {m}

PubKA

of the message m

with the public key PubkA means {m}

K

, {K}

PubKA

:

the message m is encrypted with an AES session

symmetric key K, which is in turn encrypted using

PubKA. If two parties use the session symmetric key

K in a hybrid encryption, then they will use K to hy-

brid encryption of all the messages that will be trans-

mitted between them for the remainder of session.

In MPPDP, we consider the same types of commu-

nication channels as in (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu,

2018): resilient communication channels between PG

and C, respectively between PG and each merchant;

the other communication channels are unreliable.

4.1 Preparation Phase

Before MPPDP execution, a preparation phase is

needed. For every digital product P that a merchant

M wants to sell, he posts on the online catalog a dig-

ital certificate of P, PCert, issued by the certificate

authority CA.

PCert = CI, sigCA(CI)

PCert is build by CA from certification informa-

tion CI and CA’s signature on CI.

CI = ProductDesc, Pid, Price, {P}

K

, {K}

PubKPG

CI contains: the description ProductDesc of P,

an unique P’s identifier Pid, the price Price of P,

and {P}

K

, {K}

PubKPG

the hybrid encryption of P with

PubKPG using the symmetric key K. PCert is unique

for the digital product P and certifies that P has the

description ProductDesc, the identifier Pid, the price

Price and a hybrid encrypted version. Also, M re-

ceives the key K from CA on a private channel.

The customer is browsing through the online cat-

alog where the products from merchants are posted.

After the customer decides the digital products pack

he wants to buy and the options for each product from

the pack, he clicks a ”submit” button on the online

catalog and the download of the payment Web seg-

ment and the digital product certificates is started.

The payment Web segment has the same role as in

the protocol from (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018).

Thus, we use the term customer and payment web seg-

ment interchangeable, the context indicating which

of them we refer to. The payment Web segment is

a software digitally signed by PG that runs on the

customer’s computer, and has the digital certificates

for the public keys of each merchant, PG and CA.

The payment Web segment checks each digital prod-

uct certificate using CA’s public key. The payment

Web segment requires from customer the credit card

information and a challenge code that will be used to

authenticate and authorize the customer for using the

credit card. For each subtransaction involved in the

complex transaction, the payment Web segment gen-

erates a RSA session public/private key pair for cus-

tomer. We consider that each merchant has the digital

certificates for the public keys of PG and CA. Also,

PG has the digital certificates for the public keys of

each merchant and CA.

For an aggregate transaction, we define the aggre-

gation operator, denoted by ∧, as follows: Pid

1

∧. . . ∧

Pid

k

meaning that C wishes to buy exactly k prod-

ucts with product’s identifiers Pid

1

, . . . , Pid

k

. For an

optional transaction, we define the option operator,

denoted by ∨, as follows: Pid

1

∨ . . . ∨ Pid

k

meaning

that C wishes to buy a product that is exactly one of

the products with product’s identifiers Pid

1

, . . . , Pid

k

,

where the apparition order of the product’s identifiers

is the priority given by C.

From the choices of C describing the sequence of

products he wishes to buy, we build a tree over the

product identifiers selected by C using ∧ and ∨ opera-

tors. To represent the tree, we use the left-child, right-

sibling representation in that each internal node cor-

responds to one of the above operators or to an identi-

ICE-B 2019 - 16th International Conference on e-Business

166

Table 1: Notations used in the protocol description.

Notation Interpretation

C, PG, CA, M

i

Identity of Customer, Payment Gateway, Certificate Authority, Merchant i, where 1 ≤ i ≤ n

PubKA, {m}

PubKA

RSA public key of the party A, hybrid encryption of the message m with PubKA

h(m) The digest of the message m obtained by applying of a hash function h (SHA-2)

SigA(m) RSA digital signature of A on h(m)

A → B:m

A sends the message m to B

fier, while each leaf node corresponds to an identifier.

Each node of the tree is represented by a structure

with the following fields: info for storing the useful

information (identifier or one of the operators), left

for pointing to the leftmost child of node, and right

for pointing to the sibling of the node immediately

to the right. The access to tree is realized trough the

root. An example of tree derived from the complex

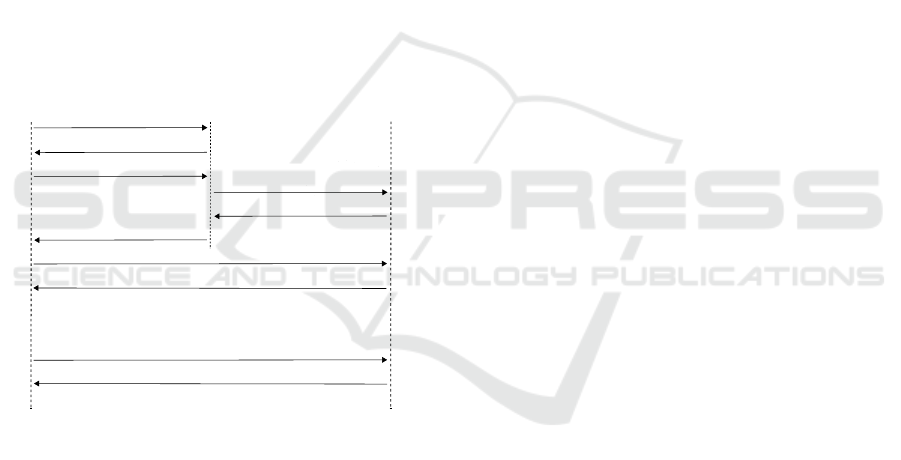

transaction from section 2, is shown in Figure 1.

Pid

1

corresponds to CP1, Pid

2

to CP2, Pid

3

to

CP3, Pid

4

to CP4, Pid

5

to CW1, Pid

6

to CW2 and

Pid

7

to CD1. The root node has ∨ operator as info

and its children are one node having ∧ operator as

info and one node with Pid

7

as info.

Our protocol has two phases: the payment phase

in that C sends to merchants the payments for

digital products, and the delivery phase in that each

merchant sends to C the corresponding decryption

key for digital product. Next, we will describe the

Payment and Delivery sub-protocols.

Pid1

Pid2

Pid4

Pid7

Pid3

Pid5

Pid6

Figure 1: Tree describing the customer’s choices in left-

child, right-sibling representation.

4.2 Payment Sub-protocol

Payment sub-protocol uses the Subtransaction Pay-

ment SPayment sub-protocol. First, we will describe

SPayment sub-protocol in that the customer C agrees

with a certain merchant M to buy a certain digital

product, C sends to M the payment for product and

M sends to C the digital receipt for payment.

4.2.1 SPayment Sub-protocol

SPayment consists of four sub-protocols: the

setup sub-protocol, the pay sub-protocol and two

resolution sub-protocols. Next, we will describe

SPayment’s sub-protocols messages that are graphi-

cally represented in Figure 2.

Setup Sub-protocol. In the first message, the pay-

ment Web segment sends to M the customer’s session

public key PubKC generated in the preparation phase.

Message 1.1: C → M:{PubKC}

PubKM

Upon receiving the first message, M generates a fresh

random number Sid that will be used as an unique

identifier of the subtransaction. M sends to C, Sid and

his signature on Sid, both encrypted with PubKC. If

for any reason, M does not want to continue the setup

sub-protocol, then he will send instead to C a signed

response Resp with the value ABORT . On reception,

C decrypts it and authenticates M by checking M’s

signature.

Message 1.2: M → C:{Sid, SigM(Sid)}

PubKC

, or

M → C:{Resp, Sid, SigM(Resp, Sid)}

PubKC

, where

Resp = ABORT

Pay Sub-protocol. If C dos not receive an ABORT

response and he authenticates M, then the payment

Web segment sends to M in the message 1.3 a pay-

ment message PM and a purchase order message PO,

both encrypted with PubKM.

Message 1.3: C → M:{PM, PO}

PubKM

PM = {PI, SigC(PI)}

PubKPG

The payment Web segment builds PM by encrypt-

ing with PG’s public key the payment information PI

and the customer’s signature on PI.

PI = CardN, CCode, Sid, Price, PubKC, NC, M

PI contains the data provided by user: card num-

ber CardN and a challenge code CCode issued by

bank to user via SMS which has a minimum length

of four characters. PI contains in addition Sid, Price,

PubKC, a fresh nonce NC generated by C, and the

merchant’s identity M.

PO = OI, SigC(OI)

The payment Web segment builds PO from the or-

der information OI provided by C and the signature of

C on OI. OI contains OrderDesc - the order descrip-

tion for product, Pid, Sid and Price. M decrypts it

and checks the signature of C on OI. If M agrees with

PO received from C, then he stores PO as an evidence

of C’s order and sends the message 1.4 to PG. Other-

wise, M sends to C an ABORT response.

Message 1.4: M → PG:

{PM, SigM(Sid, PubKC, Price)}

PubKPG

In the message 1.4, M sends to PG the payment

message PM and his signature on Sid, PubKC and

Multi-party E-Commerce Protocol for B2C/B2B Applications

167

Price. PG decrypts it, checks C’s signature on PI and

checks if C is authorized to use the card by check-

ing if the combination of CardN and CCode is valid.

If these checks are successfully passed, then also C

proves as being the owner of the public key PubKC.

PG checks M’s signature, and if is successful, then it

has the confirmation that both C and M agreed on Sid,

PubKC and Price. Also, PG checks the freshness of

PubKC, Sid and NC to avoid any replay attack from

dishonest merchants. If some check fails, then PG

sends to M an ABORT response for aborting the sub-

transaction. If all checks are successful, PG sends PM

to the bank. The bank checks C’s account balance,

and if it is enough, then the bank makes the transfer in

M’s account providing a Y ES response (Resp = Y ES)

to PG that forwards it to M in the message 1.5. Other-

wise, if checking C’s account balance fails, then also

the transfer fails and the bank provides an ABORT re-

sponse (Resp = ABORT ) to PG that forwards it to M

in the message 1.5. As an evidence of the subtransac-

tion details, PG stores the messages 1.4 and 1.5 in its

databases.

C

M

PG

1.1

if t1 = false then 1.2

1.3

1.4

1.5

if t2 = false then 1.6

else 1.7

1.8

endif

else 1.9

1.10

endif

Figure 2: SPayment message flow.

Message 1.5: PG → M:

{Resp, Sid, SigPG(Resp, Sid, Price, NC)}

PubKM

M decrypts the message 1.5, checks PG’s signa-

ture, and sends to C the message 1.6.

Message 1.6: M → C:

{Resp, Sid, SigPG(Resp, Sid, Price, NC)}

PubKC

C decrypts message 1.6 and checks PG’s sig-

nature. If checking is successful, then C has the

guarantee of the response’s authenticity and it cor-

responds to the current subtransaction. The pres-

ence in response of Sid, Price and NC proves the

response’s freshness. A response with Resp=Y ES

means that the payment subtransaction success-

fully finished and the content of message 1.6

(Resp, Sid, SigPG(Resp, Sid, Price, NC)) is a digital

receipt for the payment of product. A response with

Resp = ABORT means that the content of message

1.6 is a proof of the subtransaction’s abort.

Resolution 1 Sub-protocol. If C initiates SPayment,

but he does not receive any message from M or re-

ceives an invalid message 1.2 from M, then the current

subtransaction’s state is undefined. If we consider

only the current subtransaction, then SPayment does

not give any benefit to any party. However, this case

must be solved if we reason that the current subtrans-

action belongs to an aggregate transaction that con-

tains subtransactions in which the payment already

successfully finished, as we will see in Payment sub-

protocol. In this case, a timeout t1 is defined, in which

C waits the message 1.2 from M. If t1 expires and C

does not receive the message 1.2 from M or receives

an invalid message, then C initiates the Resolution 1

sub-protocol with PG.

Message 1.7: C → PG:{PubKC)}

PubKPG

C sends to PG in the message 1.7 a response re-

quest for the current subtransaction. PG decrypts

it, checks that no response has been generated for

PubKC, generates a subtransaction identifier Sid and

sends to C in message 1.8 a signed ABORT response.

Also, PG stores the response in its databases.

Message 1.8: PG → C:

{Resp, Sid, SigPG(Resp, Sid)}

PubKC

, where

Resp = ABORT . C decrypts and authenticates it.

Resolution 2 Sub-protocol. If C sends the payment

in message 1.3, but he does not receive message 1.6,

or receives an invalid message from M, then an unfair

case appears: C sends the payment and it was pro-

cessed, but C did not receive any response. In this

case, a timeout t2 is defined, in which C waits mes-

sage 1.6 from M. If t2 expires and C does not re-

ceive message 1.6 from M or receives an invalid mes-

sage, then C initiates the Resolution 2 sub-protocol

with PG.

Message 1.9: C→PG:{Sid, Price, NC, PubKC,

SigC(Sid, Price, NC, PubKC)}

PubKPG

PG decrypts it and checks if a response has been

generated for Sid, Price, NC and PubKC. If PG finds

in its database a response, and checking the signature

of C using PubKC is successful, then sends to C the

response in message 1.10. Otherwise, if PG does not

find a response, then sends to C an ABORT response

in message 1.10 and stores it.

Message 1.10: PG → C:

{Resp, Sid, SigPG(Resp, Sid, Price, NC)}

PubKC

4.2.2 Payment Sub-protocol Description

In Payment sub-protocol, a subtransaction s, de-

noted by SPayment(C, M, Pid), is an instance of

SPayment in which C buys the digital product with

Pid identifier from M. We define St(s) the state of the

ICE-B 2019 - 16th International Conference on e-Business

168

Table 2: Payment sub-protocol.

Payment(t)

1. if (t → left 6= NULL) child[0] = Payment(t → left);

2. if ((t → info = ∨ and St(s).Resp = Y ES, for all St(s) from child[0]) or

3. (t → info = ∧ and St(s).Resp = ABORT , for all St(s) from child[0])) Ns(t) = child[0]; return Ns(t);

4. j = 1; k = t → left → right;

5. while (k 6= NULL)

6. child[j] = Payment(k);

7. if (t → info = ∨ and St(s).Resp = Y ES, for all St(s) from child[j]) Ns(t) = child[j]; return Ns(t);

8. if (t → info = ∧ and St(s).Resp = ABORT , for all St(s) from child[j])

9. for (c = 0; c ≤ j; c = c + 1) Ns(t) = Ns(t)child[c]; end for

10. AggregateAbort(Ns(t)); return Ns(t);

11. k = k → right; j = j + 1; end while

12. if (t → info = Pid

i

) Ns(t) = St(SPayment(C, M

i

, Pid

i

)); return Ns(t);

13. else if (t → info = ∨) k = t → left;

14. while (k → right 6= NULL) k = k → right; end while

15. Ns(t) = Ns(k); return Ns(t);

16. else for (c = 0; c ≤ j - 1; c = c + 1) Ns(t) = Ns(t)child[c]; end for

17. return Ns(t); end if end if

subtransaction s as being the content of one of the

messages 1.2, 1.6, 1.8 or 1.10 that C will receive in

s.

For St(s) a state of the subtransaction s, we denote

by St(s).Resp the response (Resp) in St(s).

We define Ns(p) - the state of the node p as a se-

quence of subtransaction states St(s

1

). . . St(s

m

) cor-

responding to the product defined by p similarly as in

(B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018).

The Payment sub-protocol, described in Table 2,

recursively calculates Ns(t) (t is the root of the tree

derived from the customer’s choices), traversing the

tree in a similar manner with depth-first search. For

any node p of the tree, we use a child array to store

the node states of all children of p.

Although some subtransactions from the aggre-

gate transaction successfully completed SPayment,

there may be cases in which an aborted subtrans-

action/sequence of subtransactions leads to abort-

ing the entire aggregate transaction. Therefore, an

unfair case occurs for C: the aggregate transac-

tion is not successful, but C has paid for certain

products. For example, for a node p that cor-

responds to ∧ operator, the Payment sub-protocol

computes Ns(p) = St(s

1

). . . St(s

k

)St(s

k+1

). . . St(s

m

),

where St(s

i

).Resp = Y ES for any 1 ≤ i ≤ k and

St(s

j

).Resp = ABORT for any k + 1 ≤ j ≤ m. The

complex transaction corresponding to p is unsuccess-

ful because s

k+1

, . . . , s

m

are aborted, but C paid for

the products involved in s

1

, . . . , s

k

. So, fairness will

be obtained by applying AggregateAbort(Ns(p)) sub-

protocol from (B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018) in

that entire aggregate transaction will be aborted.

After Payment sub-protocol is completed, Ns(t −

root) is the sequence of the subtransaction states for

which either all subtransactions successfully com-

pleted SPayment or all aborted.

4.3 Delivery Sub-protocol

If after Payment all subtransactions from Ns(t − root)

successfully completed SPayment, then for each of

these subtransactions the Delivery sub-protocol is ex-

ecuted. In Delivery sub-protocol, the decryption key

of the digital product involved in the subtransaction is

sent from the corresponding merchant M to C. Below,

we describe the Delivery sub-protocol for an arbitrary

subtransaction s as shown in Figure 3.

C

M

PG

2.1

if t3 = false then 2.2

else 2.3

2.4

endif

Figure 3: Delivery message flow.

The payment web segment initiates in the mes-

sage 2.1 the Delivery sub-protocol by sending to M

the state of the subtransaction s that contains the dig-

ital receipt for the payment of product ordered in s.

Multi-party E-Commerce Protocol for B2C/B2B Applications

169

Message 2.1: C → M: {St(s)}

PubKM

, where

St(s) = (Resp, Sid, SigPG(Resp, Sid, Price, NC))

with Resp = Y ES. M decrypts it, checks PG’s sig-

nature and checks if it has already stored this digital

receipt. If all checks are successful, then M sends to

C the decryption key K of the product ordered in s.

Message 2.2: M → C: {Sid, K, SigM(Sid, K)}

PubKC

Upon receiving, C decrypts it, recovers the key K,

checks M’s signature, and uses K to obtain the digital

product P by decrypting {P}

K

from PCert.

Resolution 3 Sub-protocol. If C sends in message

2.1 the digital receipt for the payment of product or-

dered in s, but he does not receive message 2.2, or

receives an invalid decryption key, then an unfair case

appears: C sends the payment for product and it was

processed, but C did not receive the corresponding de-

cryption key for product’s decryption. In this case, a

timeout t3 is defined, in which C waits message 2.2

from M. If t3 expires and C does not receive mes-

sage 2.2 from M or receives an invalid decryption key,

then C initiates the Resolution 3 sub-protocol with

PG. The message 2.3 is build from PO, the state of

s, and the product’s certificate PCert, all of them en-

crypted with PubKPG.

Message 2.3: C→PG:{PO, St(s), PCert)}

PubKPG

,

with St(s) = (Resp, Sid, SigPG(Resp, Sid, Price, NC))

and Resp = Y ES. PG decrypts it and recovers PO,

St(s) and PCert. PG checks the signature of C from

PO, his signature from St(s), and if Sid and Price

from PO, respectively St(s) are the same. If these

checks are satisfied, then PG is ensured that the

digital receipt from St(s) corresponds to the product

ordered by C in PO. PG checks CA’s signature

from PCert, and if the product identifier Pid from

PCert is identical with the one from PO. Then, PG

has the guarantee that the digital receipt from St(s)

corresponds to the product (ordered in PO) that has

the digital certificate PCert. PG decrypts {K}

PubKPG

(from PCert) with his private key and recovers the

key K that will send to C in the message 2.4.

Message 2.4: PG → C:

{Sid, K, SigPG(Sid, K)}

PubKC

C decrypts it, recovers K and uses it to obtain P.

5 SECURITY ANALYSIS

In what follows, we will analyze the security require-

ments stated in section 3 for our MPPDP.

Effectiveness. If every party involved in MPPDP be-

haves according to the protocol’s steps, does not want

to prematurely terminate the protocol and there are no

network communication delays/errors, then MPPDP

assures that C receives the digital products from mer-

chants, and each merchant receives his payment from

C without TTP involvement.

Fairness. MPPDP consists of the Payment sub-

protocol followed by the Delivery sub-protocol. Fair

exchange of payments for digital products in com-

plex transactions in MPPDP is obtained from fair ex-

change of payments for digital receipts in complex

transactions in Payment and fair exchange of digital

receipts for decryption keys of digital products in De-

livery.

Payment uses SPayment. Fairness in SPayment is

obtained by a similarly analysis with the one from

(B

ˆ

ırjoveanu and B

ˆ

ırjoveanu, 2018) for fairness of

STP protocol.

To obtain fairness in Payment, two requirements

must be ensured in addition to fairness in SPayment.

First, for any optional transaction from the complex

transaction, C obtains exactly one digital receipt for

the payment of only one product, and corresponding

merchant obtains the payment for product, or none of

them obtains nothing. This requirement is satisfied in

Payment from the way in which the node state cor-

responding to ∨ operator is computed (Table 2). Sec-

ondly, for any aggregate transaction from the complex

transaction, C obtains the digital receipts for the pay-

ments of all products, and each merchant obtains the

payment for product, or none of them obtains nothing.

In Payment, the node state for a node corresponding

to the ∧ operator is computed as follows: if all sub-

transactions from all node states of all children of the

node ∧ have successfully finished SPayment, then the

node state of ∧ is the sequence of node states of its

children. Otherwise, an unfair scenario can occur for

C if the entire aggregate transaction is not successful,

but C has paid for certain products and he received

the digital receipts for these. To obtain fairness in

this case, the AggregateAbort sub-protocol is applied

to abort any subtransaction that successfully finished

SPayment and that belongs to the unsuccessful aggre-

gate transaction. So, fair exchange of payments for

digital receipts in Payment is provided.

If after Payment all subtransactions from Ns(t −

root) are aborted, then Delivery is not applied and

fairness in MPPDP is obtained from fairness of Pay-

ment: C does not obtain any digital receipt for pay-

ment and no merchant receives the payment. If after

Payment all subtransactions from Ns(t) successfully

completed SPayment, then for each of these subtrans-

actions the Delivery sub-protocol is executed. In De-

livery, the fairness for C is not insured only in one

case: in some subtransaction from Ns(t), C sends the

digital receipt for payment to M in message 2.1, but

he does not receive the corresponding decryption key

in message 2.2. In this case, C waits for the message

ICE-B 2019 - 16th International Conference on e-Business

170

2.2 until the timeout t3 expires and then C initiates the

Resolution 3 sub-protocol with PG to receive the cor-

responding decryption key. As we can see, the unfair

case is solved and fairness in Delivery is provided: C

receives the corresponding decryption keys for digital

products and each merchant receives the payment for

corresponding product. So, fairness in MPPDP and

atomicity of complex transactions are preserved.

Timeliness. In MPPDP, we have introduced three

timeouts: t1 and t2 in SPayment, and t3 in Delivery.

If for 1 ≤ i ≤ 3, a timeout ti expires, then C initiates

the Resolution i sub-protocol with PG. Moreover, if

in MPPDP, the AggregateAbort sub-protocol is exe-

cuted, then the communication channels used are re-

silient: between C and PG, respectively between each

merchant and PG. So, the execution of MPPDP will

be finished at a certain finite point of time.

If after MPPDP finish point, C has the digital

products, then each merchant obtains the correspond-

ing payment for his product. Also, if each merchant

involved obtains the payment for his product, then, af-

ter the protocol finish point, C gets the corresponding

digital products because he receives the correspond-

ing decryption keys of the digital products from De-

livery or Resolution 3. On the other side, if each mer-

chant did not get the payment, then C does not obtain

the digital products. Conversely, if C has not obtained

the digital products, then also no merchant gets the

payment. Thus, after MPPDP finish point, the level

of fairness achieved cannot be degraded.

Non-repudiation. C cannot deny its participation in

MPPDP because in any subtransaction from MPPDP,

PG stores in its database C’s signature on PI and thus,

C cannot deny its signature on PI. Also, no merchant

can deny its participation in MPPDP because in any

subtransaction from MPPDP, PG has the evidence of

the merchant’s signature (from message 1.4) on Sid,

PubKC and Price.

Confidentiality. In MPPDP, only the authorized re-

ceiver of any message can read the message’s con-

tent because every message transmitted is hybrid en-

crypted with the receiver’s public key. For example,

the confidentiality of CardN between C and PG is ob-

tained because C sends CardN hybrid encrypted with

PG’s public key.

6 CONCLUSIONS

In this paper, we proposed an optimistic multi-

party fair exchange e-commerce protocol for complex

transactions applicable to B2C and B2B scenarios.

Table 3 emphasizes the security requirements ensured

for our protocol and compares these with the security

requirements obtained by the most related solutions

to our proposal. The highlights of our protocol are

strong fair exchange, atomicity, usage of PG as offline

TTP, timeliness, non-repudiation and confidentiality.

Table 3: Comparative analysis of multi-party fair exchange

e-commerce protocols.

MPPDP Liu B

ˆ

ırjoveanu Draper-Gil

Scenario 1 2 3 4

Atomicity Y Y Y Y

Effectiveness Y Y Y Y

Fairness Strong Weak Strong Weak

Timeliness Y N Y Y

Non-repudiation Y Y Y Y

Confidentiality Y N Y Y

1 = Payment for digital products in complex transactions

2 = Payment for digital products in aggregate transactions

3 = Payment for physical products in complex transactions

4 = Contract signing

Y=YES, N=NO

Future work will include extending the proposed

protocol by taken into consideration of active inter-

mediary agents between customer and merchants.

REFERENCES

Alaraj, A. and Munro, M. (2010). Enforcing Honesty in

Fair Exchange Protocols. Springer.

B

ˆ

ırjoveanu, C. V. and B

ˆ

ırjoveanu, M. (2018). An optimistic

fair exchange e-commerce protocol for complex trans-

actions. In 15th International Joint Conference on e-

Business and Telecommunications. SCITEPRESS.

Djuric, Z. and Gasevic, D. (2015). Feips: A secure fair-

exchange payment system for internet transactions.

The Computer Journal.

Draper-Gil, G., Ferrer-Gomila, J. L., Hinarejos, M. F., and

Zhou, J. (2013). An asynchronous optimistic proto-

col for atomic multi-two-party contract signing. The

Computer Journal.

Liu, Y. (2009). An optimistic fair protocol for aggregate

exchange. In 2nd International Conference on Future

Information Technology and Management Engineer-

ing. IEEE.

Yanping, L. and Liaojun, P. (2009). Multi-party non-

repudiation protocol with different message ex-

changed. In 5th International Conference on Infor-

mation Assurance and Security. IEEE.

Zhou, J., Onieva, J. A., and Lopez, J. (2005). Optimised

multi-party certified email protocols. Information

Management & Computer Security Journal.

Multi-party E-Commerce Protocol for B2C/B2B Applications

171