Do We Really Need Another Blockchain Framework? A Case for a

Legacy-friendly Distributed Ledger Implementation based on Java EE

Web Technologies

Philipp Brune

1,2

1

Neu-Ulm University of Applied Sciences, Wileystraße 1, Neu-Ulm, Germany

2

QWICS Enterprise Systems, Taunustor 1, 60310 Frankfurt/Main, Germany

Keywords:

Blockchain, Distributed Ledger Technology, Web Services, Web Technologies, Java EE, Enterprise Computing.

Abstract:

Cryptocurrencies, blockchain technology and smart contracts could fundamentally change the way how finan-

cial products and financial services are implemented and operated. While many frameworks for implementing

such blockchain applications already exist, these are usually implemented using languages either considered

“fancy” today, like e.g. Go, or are traditionally used for system software, such as C++. On the other hand,

the core business applications e.g. in financial services are typically implemented using enterprise platforms

such as Java Enterprise Edition (EE) and/or COBOL. Therefore, to improve the integration of blockchain

technology in such applications, in this paper we argue in favor of a legacy-friendly distributed ledger solution

by introducing QWICSchain, an implementation build on web services using established open-source enter-

prise technologies such as Java EE and PostgreSQL. It supports the parallel execution of transactions on the

blockchain and in existing legacy applications, thus enabling the blockchain-based modernization of existing

IT infrastructures.

1 INTRODUCTION

Since the appearance of Bitcoin (Nakamoto et al.,

2008), blockchain technology has become highly

popular among the public as well as in research and

practice (W

¨

ust and Gervais, 2018). In particular

for the banking and financial servics industries, it is

widely considered as one of the pillars of digital trans-

formation (The Financial Brand, 2018).

However, the current IT systems in banking fre-

quently do not match the requirements of the digi-

tal age, as the typical traditional monolithic “legacy”

COBOL enterprise applications are too inflexible

and not open enough (Abbany, 2018; The Financial

Brand, 2018). However, their underlying mainframe

platform is by no means an outdated technology and

probably will remain an important part of the enter-

prise IT landscape for a long time (Khadka et al.,

2014; Nelson, 2018; Wilkes, 2018). And despite its

age, together with Java, COBOL still plays an im-

portant role in enterprise application development on

the mainframe (Suganuma et al., 2008; Vinaja, 2014;

Farmer, 2013; Abbany, 2018) (with “mainframe” in

this paper denoting IBM’s S/390 platform and its de-

scendants).

Therefore, the new blockchain-based banking

technologies need to be integrated with the tradi-

tional “legacy” enterprise applications to both pre-

serve their business value and to modernize the bank-

ing IT landscape and enable new types of digital busi-

ness. To achieve this, a blockchain implemenation

which seamlessly fits in traditional enterprise IT land-

scapes is required.

To support this claim, in this paper QWICSchain

1

is presented, an enterprise- and legacy-friendly, Java

Enterprise Edition(EE)

2

-based distributed ledger im-

plementation for financial services, enabling its users

to exchange and trade all kinds of digital assets be-

tween counterparties.

Since Open Source Software (OSS) has recently

been suggested as an important concept for modern

banking applications (FinTech Futures, 2018), it is

built using established OSS components. In partic-

1

https://qwicschain.com

2

Recently, Java EE has been handed over to the Eclipse

Foundation to manage its future development, and there-

fore re-labeled as Jakarta EE (https://jakarta.ee/about/).

However, for sake of simplicity in this paper still only the

term Java EE is used to denote both Java EE and Jakarta

EE.

Brune, P.

Do We Really Need Another Blockchain Framework? A Case for a Legacy-friendly Distributed Ledger Implementation based on Java EE Web Technologies.

DOI: 10.5220/0008344403010306

In Proceedings of the 15th International Conference on Web Information Systems and Technologies (WEBIST 2019), pages 301-306

ISBN: 978-989-758-386-5

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

301

ular, it also integrates the recently proposed Quick

Web-Based Interactive COBOL Service (QWICS)

3

(Brune, 2018) to achieve the simultaneous modern-

ization of “legacy” COBOL applications.

The rest of this paper is organized as follows: In

section 2 the related work is discussed in more detail,

which leads to the concept and design of the solution

described in section 3. In section 4, the actual imple-

mentation is described. We conclude with a summary

of our findings.

2 RELATED WORK

Since the cryptocurrency hype originally initiated

by Bitcoin (Nakamoto et al., 2008), numerous

OSS frameworks have been released to implement

blockchain solutions, both for open permissionless

systems (typical for crytocurrencies) as well as per-

missioned ones (used mostly for business blockchain

networks) (W

¨

ust and Gervais, 2018).

Most notably, these range from Ethereum

4

(Wood,

2014) for permissionless to Hyperledger

5

or Rip-

ple

6

(Schwartz et al., 2014) for building permis-

sioned blockchain solutions. For building business

blockchain applications, further frameworks exist,

like e.g. Corda

7

or NEO

8

.

Typically, these frameworks are written either in

languages which are considered modern or “fancy”

by many, such as Go (e.g. for Hyperledger) or

Kotlin (Corda), or in C and its derivates (C++, C#).

Also, with the exception of Corda, they mostly use

their own, non-relational data stores. On the other

hand, typical large-scale online transaction process-

ing (OLTP) enterprise applications e.g. in banks to-

day still are mainly written in Java Enterprise Edition

(EE) or even COBOL (Abbany, 2018).

So while the existing blockchain frameworks

mentioned above are currently evaluated in many

prototypical projects, these frequently are standalone

“green field” approaches, often run separately by cor-

porate innovation labs, and only weakly integrated

with the traditional core enterprise applications. It

could be expected that their usage of new and partially

“exotic” languages and technologies (from an enter-

prise IT perspective) in this context will limit their

adoption and maintainability in the long run.

3

https://qwics.org

4

https://www.ethereum.org/

5

https://www.hyperledger.org/

6

https://ripple.com/

7

http://www.corda.net/

8

https://neo.org/

For building enterprise blockchain solutions

which could be seamlessly integrated with existing

enterprise IT landscapes, it would therefore be ben-

eficial if these would be built using an enterprise plat-

form such as Java EE. Of the existing frameworks,

only Corda follows a similar approach, but it uses the

Kotlin language instead of Java. In addition, the inte-

gration with existing OLTP applications and in partic-

ular “legacy” COBOL applications has not been ad-

dressed by other frameworks so far.

Therefore, to address the question whether a new,

legacy-friendly distributed ledger implementation us-

ing established, open-source enterprise technologies

such as Java EE could enable the blockchain-based

modernization of existing legacy IT infrastructures,

in this paper the implementation of a Java EE-based

enterprise blockchain framework is demonstrated,

which uses established, enterprise-ready OSS compo-

nents and integrates the previously proposed QWICS

framework (Brune, 2018) for “legacy” modernization.

3 DESIGN OF THE DISTRIBUTED

LEDGER FRAMEWORK

3.1 Peer-to-peer Network

As usual for blockchain solutions, the proposed so-

lution is implemented as a peer-to-peer network of

nodes (servers), which represent e.g. banks or their

counterparties (W

¨

ust and Gervais, 2018). Each node

runs an instance of the software and keeps its own,

private copy or replica of the distributed ledger data

structure. Nodes know of and are connected to some

number other nodes (but typically not all others).

Every change to the ledger is performed only by

adding transactions to it. Every node therefore dis-

tributes every valid transaction it receives to all other

nodes it is connected to (leading in effect to repli-

cating every change to all nodes, but with a delay.

The ledger is only eventually consistent among the

nodes). Every modification is made immutable by

cryptographic hashing. Every node may inspect the

content of the ledger on other nodes at any time for

verification (W

¨

ust and Gervais, 2018).

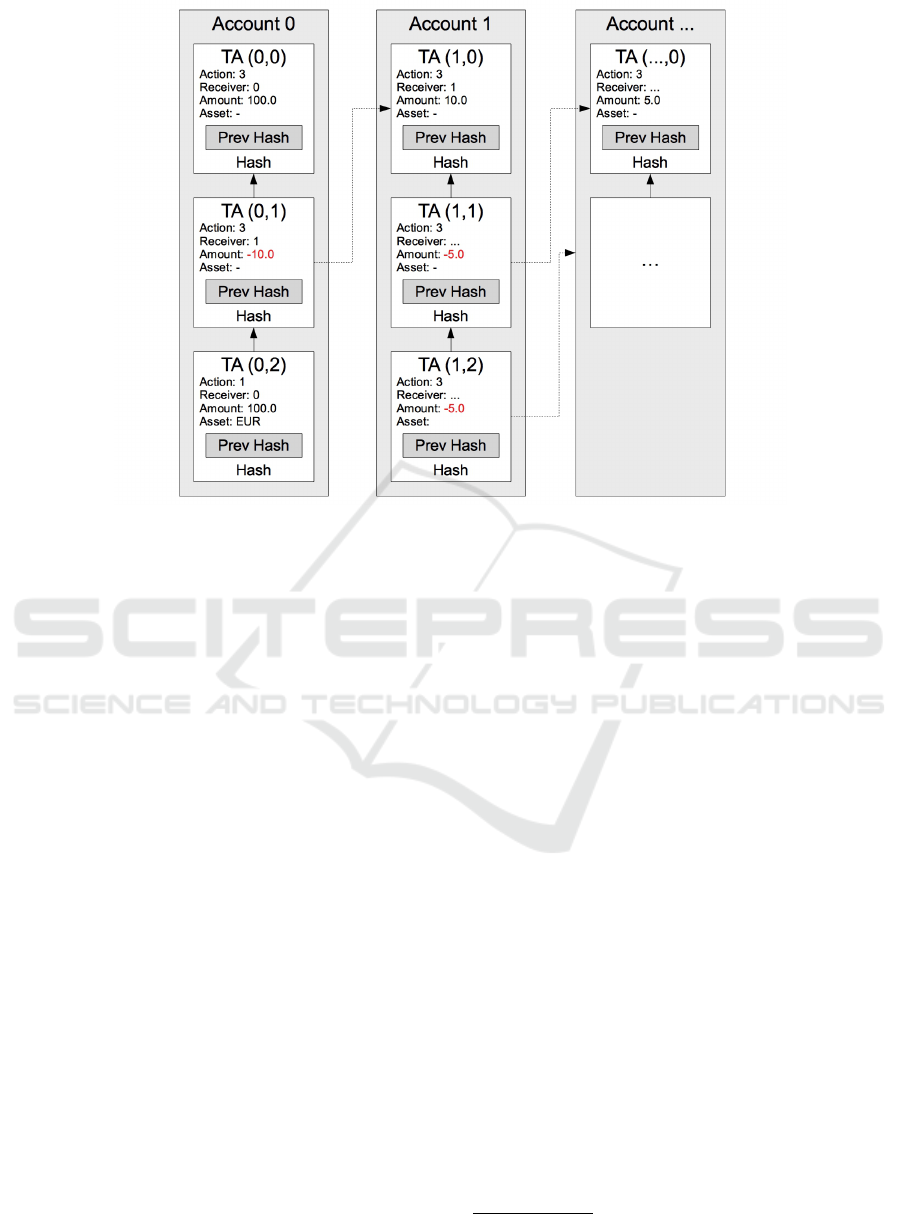

3.2 Distributed Ledger Structure

The proposed distributed ledger data structure focuses

on integrity and consistency of the transactions stored

in it. As illustrated in figure 1, it uses the basic entities

account and transaction.

WEBIST 2019 - 15th International Conference on Web Information Systems and Technologies

302

Figure 1: Concept of the proposed distributed ledger data structure consisting of accounts and their respective transactions,

representing changes to the accounts.

An account contains an amount of coins and a set

of digital assets. It is represented by a numerical ac-

count id. Ownership of an account is represented by

a private-public cryptographic key pair, of which the

public key is stored in the account, while the private

key remains kept secret by the account owner. The

account id is a hash value of this public key.

Every transaction belongs to an account and repre-

sents one of the three possible elementary operations

on it: The creation of assets or the transfer of coins or

assets to another account. A valid transaction needs

always to be signed using the private key of the ac-

count owner, before it is added to the ledger. This en-

sures that “transferring away” coins or assets from an

account may only be initiated by the account owner.

New accounts are created by transferring an ini-

tial amount of coins to a so far non-existent account

id from an existing account (the “spender”). This

requires the ab-initio existence of a genesis account

(id=0), which serves as a “central bank”, and in the

beginning owns all available coins. This account is

controlled by the manager of the blockchain. This

approach is similar to e.g. Ripple (Schwartz et al.,

2014).

Therefore, different from other distributed ledger

implementations, the transactions here in fact do

not form an actual “chain”, but a tree-like structure.

While it has some similarities with the “tangle” used

by IOTA

9

(Popov, 2016), there are also fundamen-

tal differences to IOTA, e.g. regarding the order and

approval of the transactions. In QWICSchain, every

transaction needs to have exactly one predecessor, and

contains the hash value of it. The first transaction of

each account contains the hash value of the account-

creating transaction in the “spender” account. Thus,

still a manipulation of an earlier transaction could be

easily detected as it affects most (but not all) subse-

quent transactions.

In addition, the tree-like structure at any time

allows to delete all transactions of an account (ex-

cept the account-creating transaction) without violat-

ing the integrity of the rest of the ledger. This enables

the deletion of person-related information from the

ledger e.g. upon request, therefore improving com-

pliance of the solution with data privacy regulations

such as EU GDPR

10

.

Each transaction is validated separately before be-

ing added to the ledger, they are not grouped into

blocks. Thus, a block is identical to a transaction in

this approach.

A set of rules guarantees that it is as difficult as

possible to inject fraudulent transactions to the net-

work: A valid transaction needs to be signed by the

account owner, needs to transfer coins or assets which

the transaction’s account contains before, needs to

9

https://www.iota.org/

10

https://eur-lex.europa.eu/eli/reg/2016/679/oj

Do We Really Need Another Blockchain Framework? A Case for a Legacy-friendly Distributed Ledger Implementation based on Java EE

Web Technologies

303

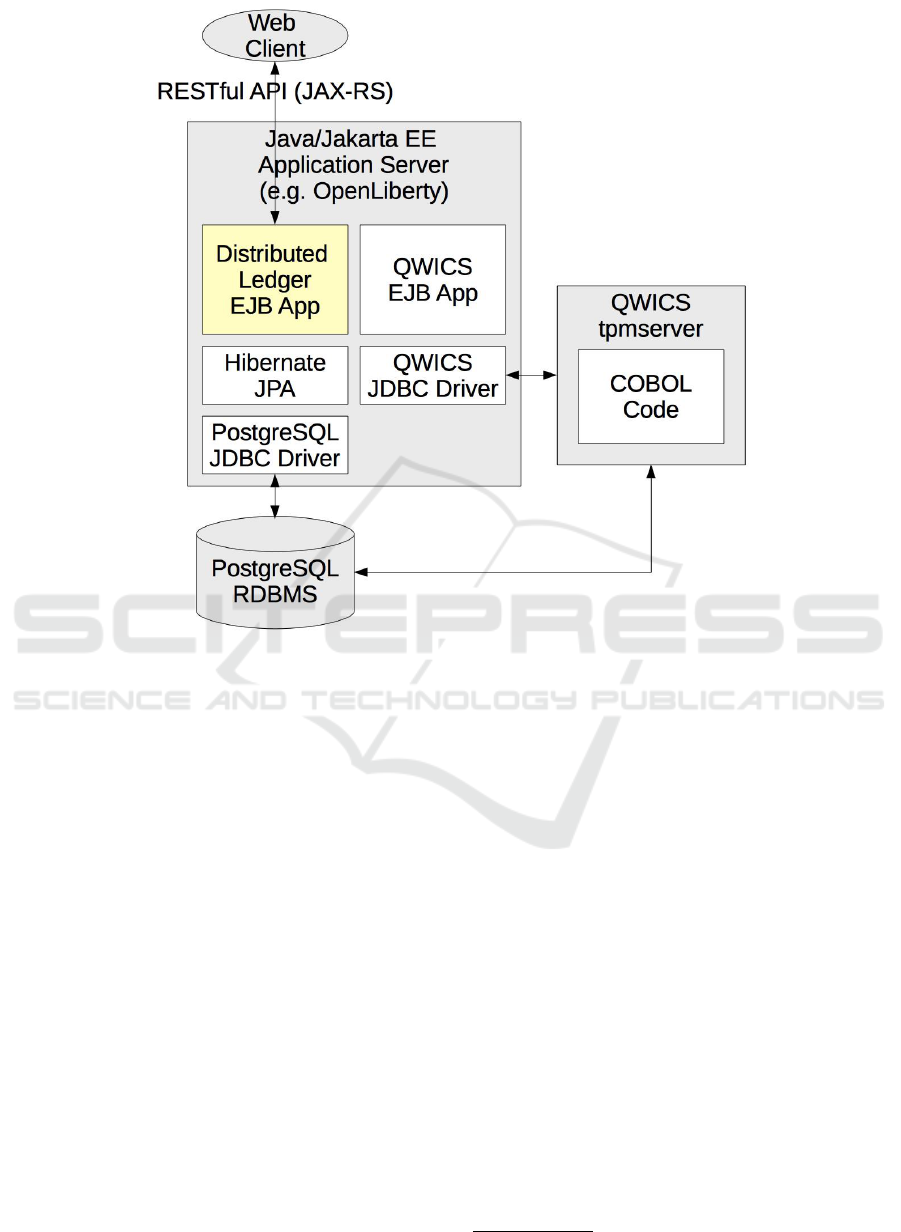

Figure 2: Architecture overview of the proposed Java EE-based distributed ledger implementation including the integration

with legacy COBOL applications using the QWICS framework (Brune, 2018).

have a valid transaction as its predecessor, and so on.

3.3 Consensus Scheme

Consensus about the validity of every new transac-

tion added to the ledger needs to be obtained among

all nodes, at least the non-fraudulent ones. In Bitcoin

(Nakamoto et al., 2008) and other popular blockchain

frameworks like e.g. Ethereum (Wood, 2014), this

consensus about new transactions is obtained by the

so-called Proof-of-Work (PoW) algorithm, which is

highly criticised for wasting a lot of energy and there-

fore not being sustainable.

In case of the proposed solution, PoW is not

necessary, since it is designed as a permissioned

blockchain (W

¨

ust and Gervais, 2018). In the latter,

it is not easily possible for an adversary to add a large

number of fraudulent nodes, which could be used then

to manipulate the ledger. Therefore, the majority of

the nodes can be assumed to be trustful. In this case,

the problem of determining if a new transaction is

valid is equivalent to the Byzantine Generals problem

(Lamport et al., 1982).

Here, the proposed approach uses the algorithm

with signed messages as described in section 4 in the

work of Lamport et al. (Lamport et al., 1982). The

choice function in that algorithm here is implemented

in such a way that a transaction is considered valid by

a node if more then 80% of a node’s neighbours con-

sider it valid as well. This is similar to the approach

taken by Ripple (Schwartz et al., 2014).

3.4 Software Architecture

The software architecture of the platform is designed

to fit well in a traditional enterprise IT landscape, e.g.

of financial institutions, by using established, mature,

enterprise-ready components and frameworks. On the

other hand, it still should be as lightweight, open and

flexible as possible.

Therefore, as illustrated in figure 2, each node of

the network is implemented using Java EE, based on

the lightweight, open-source OpenLiberty

11

applica-

tion server (currently version 18.0.0.4). The latter

was selected due to its small memory footprint, high

11

https://openliberty.io

WEBIST 2019 - 15th International Conference on Web Information Systems and Technologies

304

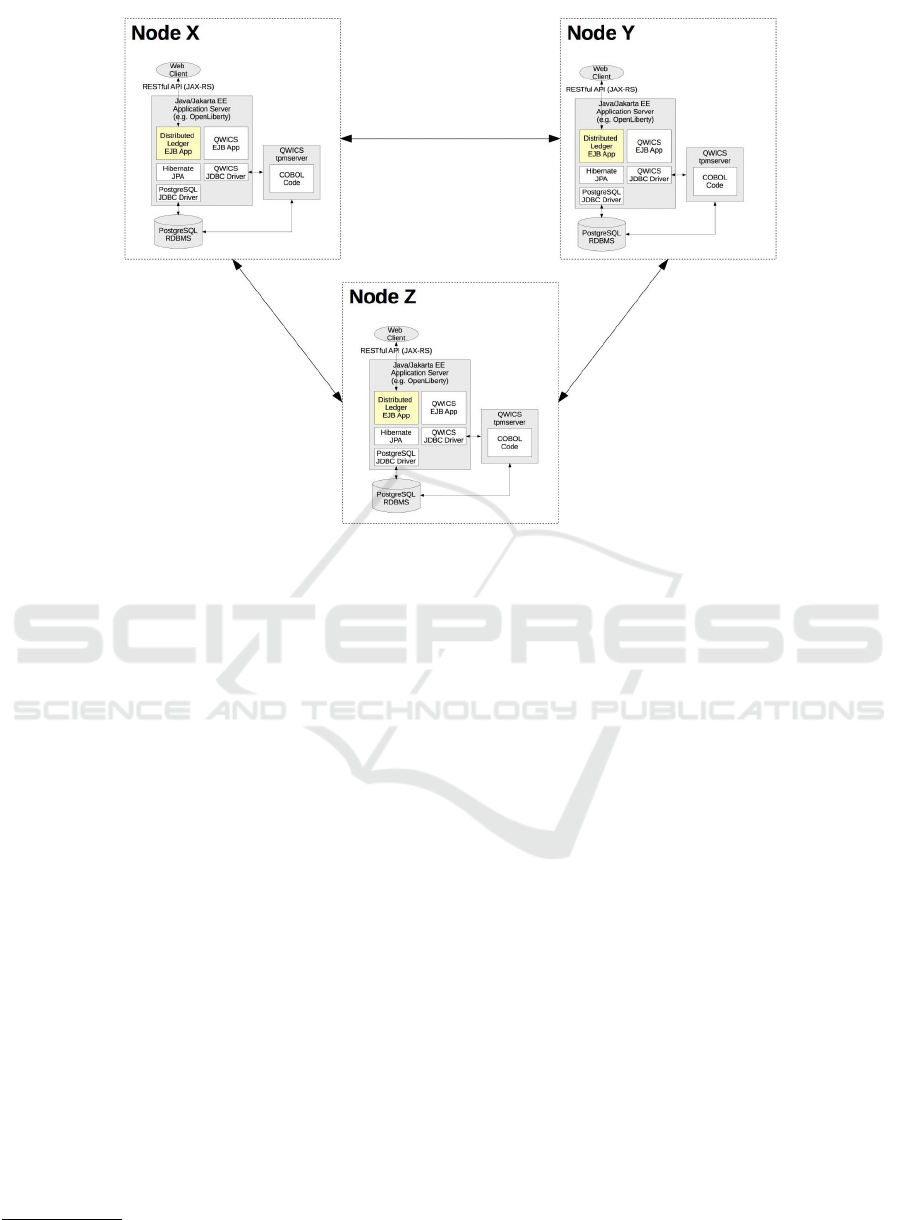

Figure 3: Examplified network consisting of three nodes X, Y and Z, each running a separate node.

speed, easy configuration and cloud-readiness, while

being well integrateable in enterprise environments.

To persistently store the distributed ledger, the Hi-

bernate

12

Java Persistence API (JPA) provider im-

plementation is used in conjunction with the Post-

greSQL

13

relational database. PostgreSQL has been

selected since it is the most mature, enterprise-quality

open source database available, e.g. due to features

such as full transaction support (Karremans, 2018).

In figure 2, also the optional integration with a

“legacy” COBOL application modernized by integrat-

ing it into Java EE is illustrated in an examplified way.

Every transaction booked on the distributed ledger is

forwarded optionally to another Enterprise Java Bean

(EJB) application for handling it there as well. In

this case, an EJB application is used, which embeds

COBOL code in Java EE applications.

Each node in the network runs its own instance

of the described software. The nodes communicate

with each other using a RESTful web service API im-

plemented using JAX-RS. This is illustrated in fig-

ure 3 for an examplified network of three nodes X,

Y and Z. Of course, all counterparties (nodes) join-

ing the network may run their copy of the distributed

ledger on premises, in their own cloud environment

or as a Software-as-a-Service solution (Mell et al.,

2011) as provided by QWICS Enterprise Systems at

12

http://hibernate.org/

13

https://www.postgresql.org/

https://qwicschain.com.

A new transaction is initially sent to one node by

an account owner, and after validation by this node

distributed to its neighbouring nodes, which distribute

it further. Every node adds its cryptographic signa-

ture to the transaction before distributing it. Thus,

the path on which a transaction propagates through

the network is always known and traceable. Fraud-

ulent nodes may be detected more easily due to this

scheme. This corresponds to the algorithm using

signed messages as described in section 4 in the work

of Lamport et al. (Lamport et al., 1982).

4 IMPLEMENTATION

In the architecture described in section 3, the actual

distributed ledger functionality on one hand is imple-

mented using Java JPA entity classes to map the basic

data structures transaction, account and asset as illus-

trated in figure 1.

On the other hand, EJB session beans are used

to implement the actual functionality of adding and

validating transactions, obtaining consensus between

nodes and managing the local node. Also the web

service API for inter-node communication and adding

transactions is implemented in that way.

Currently, the demo and trial implementa-

tion available online at https://qwicschain.com/

Do We Really Need Another Blockchain Framework? A Case for a Legacy-friendly Distributed Ledger Implementation based on Java EE

Web Technologies

305

QwicsChain/login.html runs inside Docker

14

contain-

ers and using OpenJDK8 in conjunction with the

Eclipse OpenJ9

15

Java Virtual Machine (JVM). The

latter has been selected to run smoothly not only on

x86 architecture, but also on enterprise platforms such

as the mainframe (S/390 architecture).

QWICSchain is publicly available for a free trial

on https://qwicschain.com to evaluate and further pro-

mote its concepts. While this already demonstrates

the feasibility and strengths of the approach, ongoing

real-world evaluation will led to further insights and

improvements.

5 CONCLUSION

In conclusion, in this paper a legacy-friendly dis-

tributed ledger implementation has been presented,

to address the question about the possibility of a

blockchain-based modernization of existing legacy IT

infrastructures.

The respective software architecture and imple-

mentation have been described, which are based on

mature web and enterprise technologies used in tra-

ditional transaction processing applications, such as

Java EE and the PostgreSQL RDBMS. The usage of

these established, open-source technologies promises

to simplify the integration of distributed ledger tech-

nology with traditional enterprise applications.

In particular, by integrating the previously pro-

posed QWICS framework. it also supports the mod-

ernization of “legacy” online transaction processing

(OLTP) applications like they are typical for financial

service providers.

By means of a free online trial implementation,

the proposed approach is currently evaluated in a pub-

lic beta test. While the first results are promising and

indicate that indeed the described approach might be

beneficial for future enterprise applications, further

research is needed to evaluate it in greater depth in

lab and field tests.

REFERENCES

Abbany, Z. (2018). Fail by design: Banking’s legacy of dark

code. https://m.dw.com/en/fail-by-design-bankings-

legacy-of-dark-code/a-43645522. Accessed: 2019-

01-05.

Brune, P. (2018). A hybrid approach to re-host and mix

transactional cobol and java code in java ee web ap-

plications using open source software. In Proceedings

14

https://www.docker.com/

15

https://www.eclipse.org/openj9/

of the 14th International Conference on Web Informa-

tion Systems and Technologies - Volume 1: WEBIST,,

pages 239–246. INSTICC, SciTePress.

Farmer, E. (2013). The reality of rehosting: Understanding

the value of your mainframe.

FinTech Futures (2018). How open will your bank be-

come? https://www.bankingtech.com/2018/11/how-

open-will-your-bank-become/. Accessed: 2019-01-

05.

Karremans, J. (2018). Postgres in the enter-

prise: Real world reasons for adoption.

https://www.enterprisedb.com/blog/postgres-

enterprise-real-world-reasons-adoption. Accessed:

2019-01-05.

Khadka, R., Batlajery, B. V., Saeidi, A. M., Jansen, S., and

Hage, J. (2014). How do professionals perceive legacy

systems and software modernization? In Proceedings

of the 36th International Conference on Software En-

gineering, pages 36–47. ACM.

Lamport, L., Shostak, R., and Pease, M. (1982). The

byzantine generals problem. ACM Transactions on

Programming Languages and Systems (TOPLAS),

4(3):382–401.

Mell, P., Grance, T., et al. (2011). The nist definition of

cloud computing.

Nakamoto, S. et al. (2008). Bitcoin: A peer-to-peer elec-

tronic cash system.

Nelson, J. (2018). Why banks didn’t ‘rip and replace’

their mainframes. https://www.networkworld.com/

article/3305745/hardware/why-banks-didnt-rip-

and-replace-their-mainframes.html. Accessed:

2019-01-05.

Popov, S. (2016). The tangle. http://tanglereport.com/wp-

content/uploads/2018/01/IOTA Whitepaper.pdf. Ac-

cessed: 2019-07-26.

Schwartz, D., Youngs, N., Britto, A., et al. (2014). The

ripple protocol consensus algorithm. Ripple Labs Inc

White Paper, 5.

Suganuma, T., Yasue, T., Onodera, T., and Nakatani, T.

(2008). Performance pitfalls in large-scale java ap-

plications translated from COBOL. In Companion

to the 23rd ACM SIGPLAN conference on Object-

oriented programming systems languages and appli-

cations, pages 685–696. ACM.

The Financial Brand (2018). The four pil-

lars of digital transformation in banking.

https://thefinancialbrand.com/71733/four-pillars-

of-digital-transformation-banking-strategy/. Ac-

cessed: 2019-01-05.

Vinaja, R. (2014). 50 th aniversary of the mainframe com-

puter: a reflective analysis. Journal of Computing Sci-

ences in Colleges, 30(2):116–124.

Wilkes, A. (2018). The mainframe evolution: Banking

still needs workhorse tech. https://www.finextra.

com/blogposting/16067/the-mainframe-evolution-

banking-still-needs-workhorse-tech. Accessed:

2019-01-05.

Wood, G. (2014). Ethereum: A secure decentralised gen-

eralised transaction ledger. Ethereum project yellow

paper, 151:1–32.

W

¨

ust, K. and Gervais, A. (2018). Do you need a

blockchain? In 2018 Crypto Valley Conference on

Blockchain Technology (CVCBT), pages 45–54. IEEE.

WEBIST 2019 - 15th International Conference on Web Information Systems and Technologies

306