A Discretized Enriched Technique to Enhance Machine Learning

Performance in Credit Scoring

Roberto Saia, Salvatore Carta, Diego Reforgiato Recupero, Gianni Fenu and Marco Saia

Department of Mathematics and Computer Science,

University of Cagliari, Via Ospedale 72 - 09124 Cagliari, Italy

Keywords:

Business Intelligence, Decision Support System, Credit Scoring, Machine Learning, Algorithms.

Abstract:

The automated credit scoring tools play a crucial role in many financial environments, since they are able to

perform a real-time evaluation of a user (e.g., a loan applicant) on the basis of several solvency criteria, without

the aid of human operators. Such an automation allows who work and offer services in the financial area to

take quick decisions with regard to different services, first and foremost those concerning the consumer credit,

whose requests have exponentially increased over the last years. In order to face some well-known problems

related to the state-of-the-art credit scoring approaches, this paper formalizes a novel data model that we

called Discretized Enriched Data (DED), which operates by transforming the original feature space in order

to improve the performance of the credit scoring machine learning algorithms. The idea behind the proposed

DED model revolves around two processes, the first one aimed to reduce the number of feature patterns

through a data discretization process, and the second one aimed to enrich the discretized data by adding

several meta-features. The data discretization faces the problem of heterogeneity, which characterizes such a

domain, whereas the data enrichment works on the related loss of information by adding meta-features that

improve the data characterization. Our model has been evaluated in the context of real-world datasets with

different sizes and levels of data unbalance, which are considered a benchmark in credit scoring literature.

The obtained results indicate that it is able to improve the performance of one of the most performing machine

learning algorithm largely used in this field, opening up new perspectives for the definition of more effective

credit scoring solutions.

1 INTRODUCTION

In the past decades, the credit scoring techniques have

assumed a great importance in many financial sec-

tors (Siddiqi, 2017), since they are able to take de-

cisions in real-time, avoiding the employment of hu-

mans in order to evaluate the available information

about people who request certain financial services,

such as, for instance, a loan.

In such a context, it should be noted how the major

financial losses of an operator that offers financial ser-

vices are those related to an incorrect evaluation of the

customers reliability (Bijak et al., 2015), For instance,

in the consumer credit context (Livshits, 2015), such

a reliability is expressed in terms of user solvency and

the losses are related to the loans that have not been

fully or partially repaid.

Many sector studies have reported that the con-

sumer credit has exponentially increased over the last

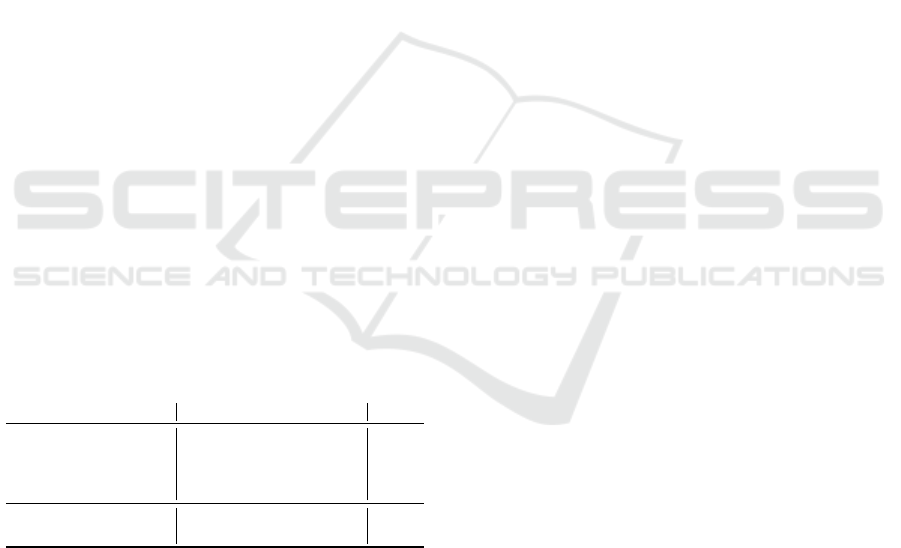

years, as shown in Figure 1, which reports a study

on the Euro area performed by Trading Economics

1

on the basis of the European Central Bank (ECB)

2

data. The Euro area has been used by way of exam-

ple, since a similar trend is also registered in other

world areas such as, for instance, Russia and USA.

Other aspects related to the role of the Credit Rating

Agencies (CRAs)

3

with regard to the globalization of

the financial markets have been investigated and dis-

cussed in (Doumpos et al., 2019).

For the aforementioned reasons, we are assisting

and supporting an important increase of the invest-

ments, in terms of money and number of researchers,

with the aim to develop increasingly effective credit

scoring techniques. Ideally, these technologies should

be able to correctly classify each user as reliable or

unreliable, on the basis of the available information

1

https://tradingeconomics.com/

2

https://www.ecb.europa.eu/

3

Also defined ratings services, they are companies that

assign credit ratings.

202

Saia, R., Carta, S., Recupero, D., Fenu, G. and Saia, M.

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring.

DOI: 10.5220/0008377702020213

In Proceedings of the 11th International Joint Conference on Knowledge Discovery, Knowledge Engineering and Knowledge Management (IC3K 2019), pages 202-213

ISBN: 978-989-758-382-7

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Apr. 2018 Jul. 2018 Oct. 2018 Jan. 2019 Apr. 2019

660

670

680

690

700

Millions of euros (×1000)

Figure 1: Euro Area Consumer Credit.

(e.g., age, current job, status of previous loans, etc.).

Basically, these techniques can be considered sta-

tistical approaches (Mester et al., 1997) focused on

the evaluation of the probability that a user will not re-

pay (or partially repay) a credit (Mester et al., 1997).

On the basis of this probability, typically calculated

in real-time, a financial operator can decide whether

to grant or not the requested financial service (Hassan

et al., 2018).

Similarly to other data domains such as, for in-

stance, those related to the Fraud Detection or the In-

trusion Detection tasks (Dal Pozzolo et al., 2014; Saia

et al., 2017; Saia, 2017), the information that is usu-

ally available to train a credit scoring model is charac-

terized by an unbalanced distribution of data (Rodda

and Erothi, 2016; Saia et al., 2018b).

Therefore, the data that is available to define the

evaluation model (from now on denoted as instances)

is composed by a huge number of reliable sam-

ples, with respect to the unreliable ones (Khemakhem

et al., 2018). Several studies in literature prove that

such a data unbalance reduces the effectiveness of

classification algorithms (Haixiang et al., 2017; Khe-

makhem et al., 2018).

1.1 Research Motivation

On the basis of our previous experience (Saia and

Carta, 2016c; Saia and Carta, 2016a; Saia and Carta,

2016b; Saia and Carta, 2017; Saia et al., 2018a), the

proposed Discretized Enriched Data (DED) model

has been designed by us in order to face some well-

known problems related to this data domain. The first

of them is given by the heterogeneity of the patterns

used to define a classification model, since they de-

pend on the available information about the users,

which is previously collected. Such information is

characterized by a number of features that could be

very different, even when they define the same class

of information.

Through our DED model we perform a twofold

process, the first one aimed to reduce the pattern by

adopting a discretization criterion, whereas the sec-

ond one aimed to enrich the discretized features by

adding a series of meta-features able to better char-

acterize the related class of information (i.e., reliable

or unreliable). In order to assess the real advantages

related to our approach, without the risk of results

being biased by over-fitting (Hawkins, 2004), differ-

ently from the majority of related works in literature,

we do not use a canonical cross-validation criterion.

This because a canonical cross-validation crite-

rion does not guarantee a complete separation be-

tween the data used to define the evaluation model and

the data used to evaluate its performance. For this rea-

son, we have adopted a criterion, largely used in other

domains, which focuses on the importance of assess-

ing the real performance of an evaluation/prediction

model (e.g. financial market forecasting (Henrique

et al., 2019)). Specifically, we assess the performance

of the DED model on never seen before data (conven-

tionally denoted as out-of-sample) and we define it on

different data (conventionally denoted as in-sample).

The canonical cross-validation criterion has been used

only in the context of these two sets of data.

The scientific contribution related to our work is

the following:

- formalization of the Discretized Enriched Data

(DED) model, which is aimed to improve the effec-

tiveness of the machine learning algorithms in the

credit scoring data domain;

- implementation of the DED model in the context

of a machine learning classifier we selected on the

basis of its effectiveness through a series of exper-

iments performed by using the in-sample part of

each credit scoring dataset;

- evaluation of the DED model performance, per-

formed by using the out-of-sample part of each

credit scoring dataset, comparing it with the perfor-

mance of the same machine learning algorithm that

uses the canonical data model.

The rest of the paper has been structured as fol-

lows: Section 2 provides information about the back-

ground and the related work of the credit scoring do-

main; Section 3 introduces the formal notation used in

this paper and defines the problem we address; Sec-

tion 4 provides the formalization and the implemen-

tation details of the proposed data model; Section 5

describes the experimental environment, the datasets,

the experimental strategy, and the used metrics, re-

porting and discussing the experimental results; Sec-

tion 6 makes some concluding remarks and directions

for future works.

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

203

2 BACKGROUND AND RELATED

WORK

This section provides an overview of the concepts re-

lated to the credit scoring research field and the state-

of-the-art solutions, by also describing problems that

are still unsolved and by introducing the idea that

stands behind the DED model proposed in this paper.

2.1 Credit Risk Models

In accord with several studies in literature (Crook

et al., 2007), we start off by identifying the follow-

ing different types of credit risk models, with regard

to a default

4

event: the Probability of Default (PD)

model, which is aimed to evaluate the likelihood of a

default over a specified period; the Exposure At De-

fault (EAD) model, which is aimed to evaluate the

total value a financial operator is exposed to when a

loan defaults; the Loss Given Default (LGD) model,

which is aimed to evaluate the amount of money a fi-

nancial operator loses when a loan defaults.

In this paper we take into account the first of these

credit risk models (i.e., the Probability of Default),

expressing it in terms of binary classification of the

evaluated users, as reliable or unreliable.

2.2 Approaches and Strategies

The current literature offers a number of approaches

and strategies, designed to perform the credit scoring

task, such as:

- those based on statistical methods, where the au-

thors, for instance, exploit the Logistic Regression

(LR) (Sohn et al., 2016) method in order to de-

fine a fuzzy credit scoring model able to predict

the default possibility of a loan, or perform this op-

eration by using the Linear Discriminant Analysis

(LDA) (Khemais et al., 2016);

- those that rely on Machine Learning (ML) algo-

rithms (Barboza et al., 2017), such as the Support

Vector Machines (SVM) method employed in (Har-

ris, 2015), where the authors adopt a Clustered Sup-

port Vector Machine (CSVM) approach to perform

the credit scoring, or in (Zhang et al., 2018), where

instead the authors exploit an optimized Random

Forest (RF) approach to perform such a task;

- those that exploit Artificial Intelligence (AI) strate-

gies (Liu et al., 2019), such as the Artificial Neural

Network (ANN) (Bequ

´

e and Lessmann, 2017);

4

This term denotes the failure to meet the legal obliga-

tions/conditions related to a loan.

- those that rely on transformed data domains, such

as in (Saia and Carta, 2017; Saia et al., 2018a),

where the authors exploit, respectively, the Fourier

and Wavelet transforms;

- those where specific aspects, such as data

entropy (Saia and Carta, 2016a), linear-

dependence (Saia and Carta, 2016c; Saia and

Carta, 2016b), or word embeddings (Boratto et al.,

2016) have been taken into account to perform

credit scoring tasks (Zhao et al., 2019);

- those based on hybrid approaches (Ala’raj and Ab-

bod, 2016; Tripathi et al., 2018) where several dif-

ferent approaches and strategies have been com-

bined in order to define a model able to improve

the credit scoring performance.

The literature also provides many surveys where

the performance of the state-of-the-art solutions for

credit scoring have been compared, such as that

in (Lessmann et al., 2015b).

2.3 Open Problems

Regardless of the approach and strategy used to per-

form credit scoring tasks, there are several common

problems that have to be addressed. The most impor-

tant of them are:

- Datasets Availability: the literature puts an accent

on the limited availability of public datasets to use

in the validation process (Lessmann et al., 2015a).

This issue is mainly related to the fact that finan-

cial operators often refuse to share their data, or

to privacy reasons, e.g., there are many countries

where legal reasons, related to the protection of

privacy, prevent the creation of publicly available

datasets (Jappelli et al., 2000);

- Data Unbalance: the difference between the sam-

ples related to the reliable cases and the samples

related to the unreliable ones, is a common charac-

teristic between the available datasets (Brown and

Mues, 2012). A data configuration of this kind re-

duces the performance of evaluation models that are

trained with these unbalanced sets of data (Chawla

et al., 2004);

- Samples Unavailability: it is related to the well-

known cold start problem that affects many re-

search areas (Li et al., 2019). It happens when there

is no availability of samples related to a class of in-

formation (e.g., the unreliable one), making it im-

possible to train an evaluation model.

2.4 Evaluation Metrics

Several studies have also been performed in literature,

in order to identify the best performance evaluation

KDIR 2019 - 11th International Conference on Knowledge Discovery and Information Retrieval

204

1 2 3 4

5 6

7 8 9 10

0.0

20.0

40.0

60.0

80.0

100.0

5

19

41

71

Discretization range

Continuous values

Figure 2: Discretization Process.

criteria to adopt for a correct evaluation of credit scor-

ing models, such as that in (Chen et al., 2016). Some

of the most used metrics for assessing the effective-

ness of a credit scoring model are reported in the fol-

lowing:

- those based on the confusion matrix

5

, such as the

Accuracy, the Sensitivity, the Specificity, or the

Matthews Correlation Coefficient (MCC) (Powers,

2011);

- those based on the error analysis, such as the Mean

Square Error (MSE), the Root Mean Square Error

(RMSE), or the Mean Absolute Error (MAE) (Chai

and Draxler, 2014);

- those based on the the Receiver Operating Charac-

teristic (ROC) curve, such as the Area Under the

ROC Curve (AUC) (Huang and Ling, 2005).

Considering that some of these metrics do not

work well with data unbalance (Jeni et al., 2013),

such as, for instance, the majority of metrics based

on on the confusion matrix, many works in literature

addressing the problem of unbalanced datasets (e.g.,

as it happens in the credit scoring context taken into

account in this paper) adopt more that one metric to

correctly evaluate their results.

2.5 Data Transformation

Some basic concepts, related to data discretization

and enrichment processes, are briefly introduced in

this section, along with the reasons why we decided

to use them for defining the proposed DED model.

2.5.1 Discretization

Many algorithms must have knowledge of the type

and domain of the data where they operate and, in

addition, some of them (e.g., Decision Trees) require

categorical feature values (Garc

´

ıa et al., 2016), con-

straining us to perform a preprocessing of the contin-

uous feature values through a discretization method.

The process of data discretization is largely

adopted in literature as an effective data preprocess-

5

The matrix of size 2x2 that contains the number of True

Negatives (TN), False Negatives (FN), True Positives (TP),

and False Positives (FP).

ing technique (Liu et al., 2002). Its goal is to trans-

form the feature values from a quantitative to a quali-

tative form, by dividing each feature value into a dis-

crete number of non overlapped intervals. This means

that each numerical feature value (continuous or dis-

crete) is mapped into one of these intervals, improv-

ing the effectiveness of many machine learning al-

gorithms (Wu and Kumar, 2009) that deal with real-

world data usually characterized by continuous val-

ues.

However, regardless of the algorithms that need

a discretized data input, the discretization process

presents additional advantages, such as the data di-

mensionality reduction that leads towards a faster and

accurate learning (Garc

´

ıa et al., 2016) or the improve-

ment in terms of data understandability, given by the

discretization of the original continuous values (Liu

et al., 2002).

If, on one hand, the main disadvantage of a dis-

cretization process is given by the loss of information

that occurs during the transformation of continuous

values into discrete values, on the other hand, an op-

timal discretization of the original data represents a

NP-complete

6

process.

In the DED model proposed in this paper, the data

discretization process produces a twofold advantage:

the first one related to the aforementioned benefits for

the involved machine learning algorithms; the second

one related to the reduction of the possible feature

patterns, since all the continuous values have been

mapped to a limited range of discrete values.

By way of example, Figure 2 shows the discretiza-

tion of four feature values defined in a continue range

of values [0,100] into a discrete range {0,1,...,10}.

2.5.2 Enrichment

The literature indicates the data enrichment as a pro-

cess adopted in order to improve a data domain

through a series of additional information, such as

meta-features. For instance, the work presented

in (Giraud-Carrier et al., 2004) defines a set of meta-

features able to improve the prediction performance

of the learning algorithms taken into account.

The meta-features are usually defined by aggre-

gating some original features, according to a specific

metric (e.g., minimum value, maximum value, mean

value, standard deviation, etc.), which can be calcu-

lated in the space of a single dataset instance (row)

or in the context of the entire dataset (Castiello et al.,

2005).

6

The computational complexity theory defines NP-

complete a problem when its solution requires a restricted

class of brute force search algorithms

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

205

It should be observed that the meta-features are

largely used in the field of Meta Learning (Vilalta and

Drissi, 2002), a branch of machine learning that ex-

ploits automatic learning algorithms on meta-data in

the context of machine learning processes.

For this paper purposes, we exploit them to bal-

ance the loss of information, which is a consequence

of the applied discretization process, in order to add

further information aimed to well characterize the in-

volved classes of information (i.e., reliable and un-

reliable). More formally, given a set of discretized

features {d

1

,d

2

,...,d

X

}, we add a series of meta-

features to them {m

1

,m

2

,...,m

Y

}, obtaining a new

set of features, as shown in Equation 1.

d

1,1

,d

1,2

,..., d

1,X

,m

1,X+1

,m

1,X+2

,. .., m

1,X+Y

(1)

3 NOTATION AND PROBLEM

DEFINITION

This section describes the formal notation adopted in

this paper and defines the addressed problem.

3.1 Formal Notation

Given a set I of already classified instances, com-

posed by a subset I

+

⊆ I of reliable cases and a sub-

set I

−

⊆ I of unreliable cases, and a set

ˆ

I of unclas-

sified instances, considering that an instance is com-

posed by a set of features F and that it belongs to only

one class in the set C, we define the formal notation

adopted in this paper as reported in Table 1.

Table 1: Formal Notation.

Notation Description Note

I = {i

1

,i

2

,...,i

X

} Set of classified instances

I

+

= {i

+

1

,i

+

2

,...,i

+

Y

} Subset of reliable instances I

+

⊆ I

I

−

= {i

−

1

,i

−

2

,...,i

−

W

} Subset of unreliable instances I

−

⊆ I

ˆ

I = {

ˆ

i

1

,

ˆ

i

2

,...,

ˆ

i

Z

} Set of unclassified instances

F = {f

1

, f

2

,..., f

N

} Set of instance features

C = {reliable,unreliable} Set of instance classifications

3.2 Problem Definition

We can formalize our objective as shown in Equa-

tion 2, where the function f (

ˆ

i,I) evaluates the classi-

fication of the

ˆ

i instance, performed by exploiting the

available information in the set I. It returns a binary

value β, where 0 denotes a misclassification and 1 de-

notes a correct classification. Therefore, our objec-

tive is the maximization of the σ value, which repre-

sents the sum of the β values returned by the function

f (

ˆ

i,I).

max

0≤σ≤|

ˆ

I|

σ =

|

ˆ

I|

∑

z=1

f (

ˆ

i

z

,I) (2)

4 APPROACH FORMALIZATION

The proposed DED model has been defined and im-

plemented in a credit scoring system by performing

the following four steps:

- Data Discretization: the values of all features in

the sets I and

ˆ

I are discretized in accord with a range

defined in the context of a series of experiments per-

formed by using the in-sample data;

- Data Enrichment: a series of meta-features are de-

fined and added to the discretized features of each

instance i ∈ I and

ˆ

i ∈

ˆ

I;

- Data Model: the DED model to use in the context

of a credit scoring machine learning algorithm is

defined on the basis of the previous data processes;

- Data Classification: the DED model is imple-

mented in a classification algorithm aimed to clas-

sify each instance

ˆ

i ∈

ˆ

I as reliable or unreliable.

4.1 Data Discretization

Each feature f ∈ F in the sets I and

ˆ

I has been pro-

cessed in order to move the original range of value of

each feature to a defined range of discrete integer val-

ues {0,1, . . . , ∆} ∈ Z, where the value of ∆ has been

determined in experimental way, as reported in Sec-

tion 5.4.5.

Denoting the data discretization process as f

∆

−→d,

we operate in order to move each feature f ∈ F from

its original value to one of the values in the discrete

range of integers {d

1

,d

2

,...,d

∆

}. Such a process re-

duces the number of possible patterns of values (con-

tinuous and discrete) given by the original feature

vector F, with respect to the ∆ value, as shown in

Equation 3.

{f

1

, f

2

, . .. , f

N

}

∆

−→ {d

1

,d

2

,. .., d

N

}, ∀ i ∈I

{f

1

, f

2

, . .. , f

N

}

∆

−→ {d

1

,d

2

,. .., d

N

}, ∀

ˆ

i ∈

ˆ

I

(3)

4.2 Data Enrichment

After performing the discretization process

previously described, the new feature vector

{d

1

,d

2

,...,d

∆

} of each instance in the sets I and

ˆ

I

has been enriched by adding some meta-features we

denoted µ. These meta-features have been calculated

in the context of each feature vector and they are:

Minimum (m), Maximum (M), Average (A), and Stan-

dard Deviation (S), then we have µ = {m,M, A, S}.

This new process mitigates the pattern reduction

KDIR 2019 - 11th International Conference on Knowledge Discovery and Information Retrieval

206

operated during the discretization by adding a series

of information able to improve the characterization

of the instances, and it is formalized in Equation 4.

µ =

m = min(d

1

,d

2

,. .., d

N

)

M = max(d

1

,d

2

,. .., d

N

)

A =

1

N

∑

N

n=1

(d

n

)

S =

q

1

N−1

∑

N

n=1

(d

n

−

¯

d)

2

(4)

4.3 Data Model

As a result of the data discretization and data enrich-

ment processes, we obtain our new DED data model

where the original values f ∈ F assumed by each

instance feature have been transformed into a new

value, in accord with an experimental defined value ∆,

and the number of features have been extended with a

series µ = {m,M,A,S} of new meta-features, as for-

malized in Equation 5. It should be noted that, for the

sake of simplicity, the equation refers to the set I only,

but the formalization is the same for the set

ˆ

I).

DED(I) =

d

1,1

d

1,2

... d

1,N

m

1,N+1

M

1,N+2

A

1,N+3

S

1,N+4

d

2,1

d

2,2

... d

2,N

m

2,N+1

M

2,N+2

A

2,N+3

S

2,N+4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d

X,1

d

X,2

... d

X,N

m

X,N+1

M

X,N+2

A

X,N+3

S

X,N+4

(5)

4.4 Data Classification

Finally, in the last step of our approach, we implement

the new DED model in the classification Algorithm 1,

in order to perform the classification of each unclas-

sified instance

ˆ

i ∈

ˆ

I.

At step 1, the procedure takes the following pa-

rameters as input: a classification algorithm alg, the

set of classified instances in the set I, and the unclas-

sified instances in the set

ˆ

I. The data transformation

related to our DED approach is performed for these

sets of data at steps 2 and 3, and the transformed data

of the set I is used in order to train the algorithm alg

model at step 4. The classification process is per-

formed at steps from 5 to 8 for each instance in the

set

ˆ

I and the classifications are stored in the out. At

the end of the process of classification, the results are

returned by the algorithm at step 9.

5 EXPERIMENTS

This section presents the experimental environment,

the adopted real-world datasets, the assessment met-

rics, the experimental strategy, and the obtained re-

sults.

Algorithm 1: Instance classification.

Require: alg=Classifier, I=Classified instances,

ˆ

I=Unclassified instances

Ensure: out=Classification of instances in

ˆ

I

1: procedure INSTANCECLASSIFICATION(alg, I,

ˆ

I)

2: I

00

← getDED(I)

3:

ˆ

I

00

← getDED(

ˆ

I)

4: model ←Classi f ierTraining(alg, I

00

)

5: for each

ˆ

i

00

∈

ˆ

I

00

do

6: c ←getClass(model,

ˆ

i

00

)

7: out.add(c)

8: end for

9: return out

10: end procedure

5.1 Environment

The code related to the performed experiments has

been written in Python language, using the scikit-

learn

7

library.

In addition, in order to grant the experiments re-

producibility, we have fixed the seed of the pseudo-

random number generator to 1 in the scikit-learn code

(i.e., the random state parameter).

5.2 Datasets

The German Credit (GC) and the Default of Credit

Card Clients (GC) are real-world datasets we selected

in order to validate the proposed DED model. They

represent two benchmarks in the credit score research

context and they both are characterized by different

size and data unbalance (as shown in Table 2), repro-

ducing different data configurations in the credit scor-

ing scenario. All of them are freely downloadable at

the UCI Repository of Machine Learning Databases

8

.

Premising that each instance (i.e., each dataset

row) in these datasets is numerically classified as reli-

able or unreliable, in the following we briefly provide

their description:

• the GC dataset is composed by 1,000 instances,

of which 700 classified as reliable (70.00%) and

300 classified as unreliable (30.00%), and each

instance is characterized by 20 features, as de-

tailed in Table 3.

• the DC dataset is composed by 30,000 instances,

of which 23,364 classified as reliable (77.88%)

and 6,636 classified as unreliable (22.12%), and

each instance is characterized by 23 features, as

detailed in Table 4;

7

http://scikit-learn.org

8

ftp://ftp.ics.uci.edu/pub/machine-learning-

databases/statlog/

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

207

Table 2: Datasets composition.

Dataset Total Reliable Unreliable Number of

name instances instances instances features

GC 1,000 700 300 21

DC 30,000 23,364 6,636 23

Table 3: Features of GC Dataset.

Field Feature Field Feature

01 Status of checking account 11 Present residence since

02 Duration 12 Property

03 Credit history 13 Age

04 Purpose 14 Other installment plans

05 Credit amount 15 Housing

06 Savings account/bonds 16 Existing credits

07 Present employment since 17 Job

08 Installment rate 18 Maintained people

09 Personal status and sex 19 Telephone

10 Other debtors/guarantors 20 Foreign worker

Table 4: Features of DC Dataset.

Field Feature Field Feature

01 Credit amount 13 Bill statement in August 2005

02 Gender 14 Bill statement in July 2005

03 Education 15 Bill statement in June 2005

04 Marital status 16 Bill statement in May 2005

05 Age 17 Bill statement in April 2005

06 Repayments in September 2005 18 Amount paid in September 2005

07 Repayments in August 2005 19 Amount paid in August 2005

08 Repayments in July 2005 20 Amount paid in July 2005

09 Repayments in June 2005 21 Amount paid in June 2005

10 Repayments in May 2005 22 Amount paid in May 2005

11 Repayments in April 2005 23 Amount paid in April 2005

12 Bill statement in September 2005

5.3 Metrics

In order to assess the performance of the proposed

DED model, with regard to a canonical data model,

we have adopted two different metrics.

The first one is the Sensitivity, a metric based on

the confusion matrix that reports us the true positive

rate related to the performed classification, then the

capability of the evaluation model to correctly classify

the reliable instances.

The second one is the Matthews Correlation Co-

efficient, it is also based on the confusion matrix and

it is able to evaluate the effectiveness of the evalua-

tion model in terms of distinguishing the reliable in-

stances from the unreliable ones and, for this reason,

it is commonly used in order to evaluate the perfor-

mance of a binary evaluation model.

The third metric is based on the the Receiver Op-

erating Characteristic (ROC) curve. It is the Area

Under the Receiver Operating Characteristic curve

(AUC) and it represents a metric largely used for

its capability to evaluate the predictive capability of

an evaluation model, even when the involved data is

characterized by a high degree of data unbalance.

All the aforementioned metrics are formalized in

the following sections.

5.3.1 Sensitivity

According to the formal notation provided in Sec-

tion 3.1, the formalization of the Sensitivity metric

is shown in Equation 6, where

ˆ

I denotes the set of

unclassified instances, TP is the number of instances

correctly classified as reliable, and FN is the num-

ber of unreliable instances wrongly classified as reli-

able. This gives us the proportion of instances which

are correctly classified by an evaluation model (Bequ

´

e

and Lessmann, 2017).

Sensitivity(

ˆ

I) =

T P

(T P + FN)

(6)

5.3.2 Matthews Correlation Coefficient

The Matthews Correlation Coefficient (MCC) per-

forms a balanced evaluation and it also works well

with data imbalance (Luque et al., 2019; Boughorbel

et al., 2017). Its formalization is shown in Equation 7

and its result is a value in the range [−1,+1], with

+1 when all the classifications are correct and −1

when all the classifications are wrong, whereas 0 in-

dicates the performance related to a random predictor.

It should be observed how such a metric can be seen

as a discretization of the Pearson correlation (Benesty

et al., 2009) for binary variables.

MCC =

(T P·T N)−(F P·FN)

√

(T P+FP)·(TP+FN)·(T N+FP)·(T N+FN)

(7)

5.3.3 AUC

As reported in a large number of studies in litera-

ture (Abell

´

an and Castellano, 2017; Powers, 2011) ,

the Area Under the Receiver Operating Characteris-

tic curve (AUC) represents a reliable metric for the

evaluation of the performance related to a credit scor-

ing model. More formally, given the subsets of reli-

able and unreliable instances in the set I, respectively,

I

+

and I

−

, the possible comparisons κ of the scores

of each instance i are formalized in the Equation 8,

whereas the AUC is obtained by averaging over them,

as formalized in Equation 9. It returns a value in the

range [0,1], where 1 denotes the best performance.

κ(i

+

,i

−

) =

1, i f i

+

> i

−

0.5, i f i

+

= i

−

0, i f i

+

< i

−

(8)

AUC =

1

I

+

·I

−

|I

+

|

∑

1

|I

−

|

∑

1

κ(i

+

,i

−

) (9)

KDIR 2019 - 11th International Conference on Knowledge Discovery and Information Retrieval

208

5.4 Strategy

Here we report all the details of the experimental

strategy, from the choice of the best state-of-the-art

algorithm to the definition of the discretization range

∆.

5.4.1 Algorithm Selection

In order to evaluate the benefits of our DED model,

we will perform a series of experiments aimed to se-

lect the most performing state-of-the-art algorithm to

use as competitor. This means that we compare the

performance of this algorithm, before and after ap-

plying our data model.

For this task we have taken into account the

following five machine learning algorithms, since

they represent the most performing and widely used

ones in credit scoring literature: Gradient Boost-

ing (GBC) (Chopra and Bhilare, 2018); Adaptive

Boosting (ADA) (Xia et al., 2017); Random Forests

(RFA) (Malekipirbazari and Aksakalli, 2015); Multi-

layer Perceptron (MLP) (Luo et al., 2017); Decision

Tree (DTC) (Damrongsakmethee and Neagoe, 2019).

5.4.2 Evaluation Criteria

The proposed DED model has been evaluated by di-

viding each dataset in two parts: the first one (in-

sample), used to identify the most performing ap-

proach to use as a competitor and to define the ∆ pa-

rameter of our model, which will be applied to the

selected algorithm in order to assess its benefits, and

the second one (out-of-sample), which we use for this

operation (i.e., performance comparison).

This kind of strategy, analogously to other stud-

ies in the literature (Rapach and Wohar, 2006), allows

us to evaluate the results, by preventing the algorithm

selection and parameter definition process from intro-

ducing bias by over-fitting (Hawkins, 2004), a risk re-

lated to the use of a canonical k-fold cross-validation

process of data validation.

For this reason, each of the adopted datasets (i.e.,

GC and DC) has been divided into an in-sample part

(50%) and an out-of-sample part (50%) . In addition,

with the aim to further reduce the impact of the data

dependency, in the context of each of these subsets we

have adopted a k-fold cross-validation criterion (k=5).

5.4.3 Data Preprocessing

Before the experiments, we preprocessed the datasets

through a binarization method aimed to transform

each instance classification (when required) from its

original form to the binary form 0=reliable and 1=un-

reliable.

According to the literature (Ghodselahi, 2011;

Wang and Huang, 2009) that, in order to better ex-

pose the data structure to the machine learning algo-

rithms, allowing them to get better performance or

converge faster, suggests to convert the feature val-

ues to the same range of values, we decided to verify

the performance improvement related to the adoption

of two largely used preprocessing methods: normal-

ization and standardization.

The first method rescales each f feature value into

the range [0,1], whereas the second one (also known

as Z-score normalization) rescales the feature values

so that they assume the properties of a Gaussian dis-

tribution with µ = 0 and σ = 1, where µ denotes the

mean and σ the standard deviation from that mean,

according to Equation 10.

f

00

=

f −µ

σ

(10)

As shown in Table 5, which reports the mean per-

formance (i.e., related to the Accuracy, MCC, and

AUC metrics) measured in all datasets and all al-

gorithms after the application of the aforementioned

methods of data preprocessing, along to that mea-

sured without any data preprocessing. The best per-

formances are highlighted in bold and, furthermore,

in this case all the performed experiments involve

only the in-sample part of each dataset.

The results indicate that the data preprocessing

through the normalization and standardization meth-

ods does not lead toward significant improvement in

terms of overall mean performance, since 5 times out

of 10 we obtain a better performance without using

any data preprocessing (against 3 out of 10 and 2 out

of 10). For this reason we decided to not apply any

method of data preprocessing during the paper exper-

iments.

5.4.4 Competitor Selection

On the basis of the algorithms introduced in Sec-

tion 5.4.1, the evaluation criteria defined in Sec-

tion 5.4.2, and the data preprocessing performed

as described in Section 5.4.3, we selected Gradient

Boosting (GBC) as the competitor algorithm to use

in order to evaluate the effectiveness of the proposed

DED model.

It has been selected since the mean value of the

Gradient Boosting performance (i.e., in terms of Sen-

sitivity, MCC, and AUC) measured on all datasets is

better than that of the other algorithms taken into ac-

count, as shown in Table 6.

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

209

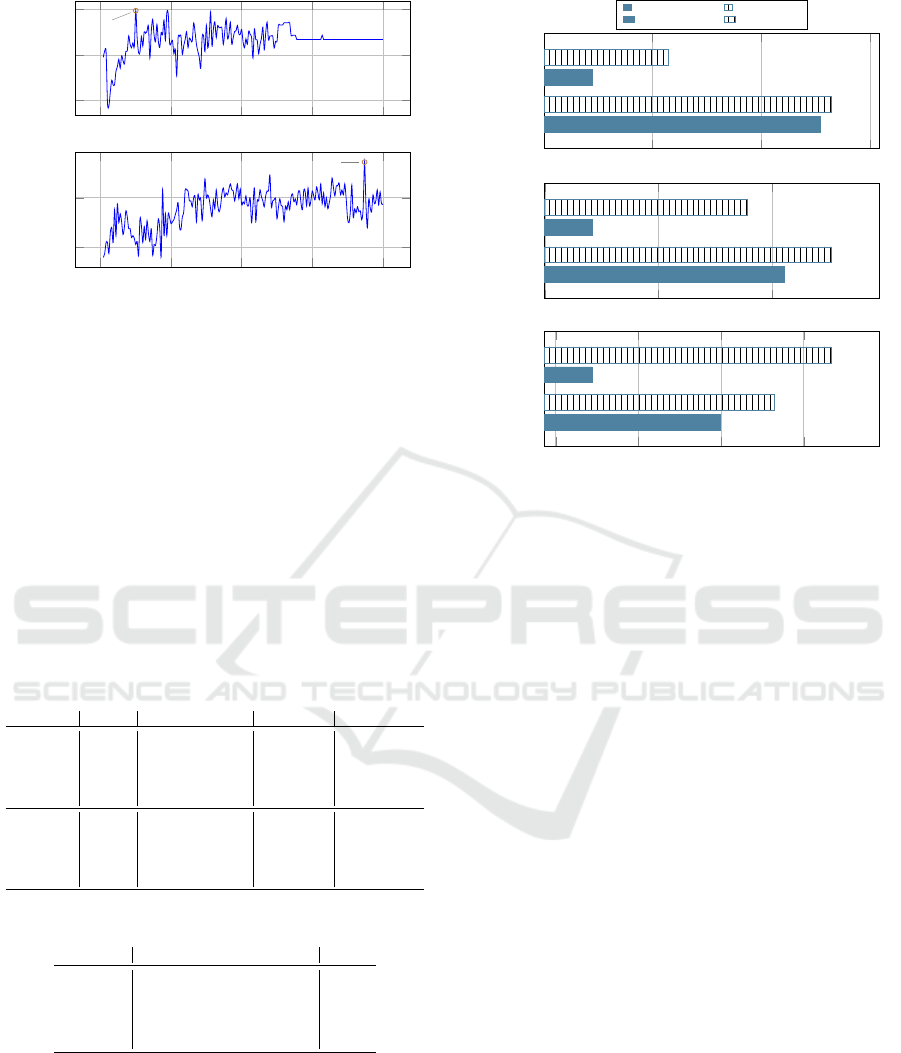

0

50

100

150

200

0.50

0.55

0.60

(25)

∆ (GC Dataset)

Performance

0

50

100

150

200

0.61

0.62

(187)

∆ (DC Dataset)

Performance

Figure 3: Out-of-sample Discretization Range Definition.

5.4.5 Discretization Range Definition

According to the previous steps, this new set of ex-

periments is aimed to define the optimal range of dis-

cretization ∆ by using the selected algorithm (i.e.,

Gradient Boosting) in the context of the in-sample

part of each dataset.

The obtained results are shown in Figure 3, where

Performance denotes the average value between Ac-

curacy, MCC, and AUC metrics, i.e., (Accuracy +

MCC + AUC)/3. They indicate 25 and 187 as the

optimal ∆ value for the GC and DC datasets, respec-

tively.

Table 5: Mean Performance After Features Preprocessing.

Algorithm Dataset Non-preprocessed Normalized Standardized

GBC GC 0.5614 0.5942 0.6007

ADA GC 0.5766 0.6246 0.5861

RFA GC 0.5540 0.5614 0.5579

MLP GC 0.6114 0.5649 0.5589

DTC GC 0.5796 0.5456 0.5521

GBC DC 0.6087 0.5442 0.6076

ADA DC 0.6031 0.5361 0.5980

RFA DC 0.5613 0.4909 0.5586

MLP DC 0.4613 0.6177 0.5985

DTC DC 0.4982 0.4572 0.5185

Table 6: Algorithms Performance.

Algorithm Sensitivity MCC AUC Mean

GBC 0,8325 0,7065 0,4463 0,6617

ADA 0,8204 0,6943 0,4283 0,6477

RFA 0,8216 0,6939 0,4344 0,6500

MLP 0,7501 0,6038 0,2317 0,5285

DTC 0,8222 0,6791 0,3605 0,6206

5.5 Results

This section presents and discusses the results of the

experiments, with the aim to assess the effectiveness

of the proposed model with regard to a canonical one.

0.80 0.82 0.84

GC

DC

0.7889

0.8308

0.8029

0.8330

Sensitivity

Datasets

Canonical model DED model

0.25

0.30

0.35

GC

DC

0.2708

0.3555

0.3393

0.3764

MCC

Datasets

0.62 0.63 0.64 0.65

GC

DC

0.6244

0.6399

0.6534

0.6464

AUC

Datasets

Figure 4: Out-of-sample Classification Performance.

5.5.1 Results Presentation

In this set of experiments, we apply the algorithm

and the ∆ value detected through the previous exper-

iments, described in Section 5.4, in order to evaluate

the capability of the proposed DED model with re-

gard to a canonical data model based on the original

feature space.

5.5.2 Results Analysis

The analysis of the experimental results leads toward

the following considerations:

- in terms of single metrics of evaluation, Figure 4

shows that our DED model outperforms the canoni-

cal one in terms of Sensitivity, MCC, and AUC met-

rics, in both datasets;

- the improvement measured in terms of Sensitivity is

not related to a degradation of the MCC and AUC

performance, meaning that there is not a direct cor-

relation between the increasing of the true positive

rate and the increasing of the false positive rate;

- considering that the used GC and DC datasets are

characterized by different size (respectively, 1,000

and 30,000 samples) and level of data unbalance

(respectively, 30.00% and 22.12% of unreliable

samples), our model has proved its effectiveness in

different credit scoring scenarios;

- it should be noted that the adopted in-sample/out-

of-sample validation strategy has further increased

the data unbalance in the GG dataset, since its out-

KDIR 2019 - 11th International Conference on Knowledge Discovery and Information Retrieval

210

GC DC

0.56

0.58

0.60

0.62

Datasets

Performance

Canonical model DED model

Figure 5: Overall Performance.

of-sample part contains a 27.20% of reliable sam-

ples (22.51% in the DC dataset);

- combining the in-sample/out-of-sample validation

strategy with the canonical k-fold cross-validation

criterion allowed us to verify the effectiveness of

the proposed model on never seen before data,

therefore without over-fitting;

- the DED model proposed in this paper has proved

its effectiveness in terms of instance characteriza-

tion, by exploiting a combined approach based on

data discretization/enrichment, outperforming the

best machine learning algorithm based on a canon-

ical data model, which we selected in the same data

domain (i.e., in-sample data) used to tune (i.e., the

∆ range of discretization) it;

- in conclusion, since the proposed data model is

able to improve the overall performance (i.e., mean

value of all metrics) of a machine learning algo-

rithm, as shown in Figure 5, it can be exploited in

many state-of-the-art solutions based on machine

learning algorithms, such as, for instance, those

based on hybrid or ensemble configurations.

6 CONCLUSIONS AND FUTURE

WORK

The growth in terms of importance and use of credit

scoring tools has led towards an increasing number

of research activities aimed to detect more and more

effective methods and strategies.

Similarly to other scenarios, characterized by a

data unbalance such as, for instance, the Fraud Detec-

tion or the Intrusion Detection ones, even in this sce-

nario a slight performance improvement of a classifi-

cation model produces enormous advantages, which

in our case are related to the reduction of the financial

losses.

The DED model proposed in this paper has proved

that the transformation of the original feature space,

made by applying a discretization and an enrichment

process, improves the performance of one of the most

performing machine learning algorithm (i.e., Gradi-

ent Boosting).

This result opens up new perspectives for the

definition of more effective credit scoring solutions,

considering that many state-of-the-art approaches are

based on machine learning algorithms (e.g., those that

perform credit scoring in the context of rating agen-

cies, financial institutions, etc.).

As future work we want to test the effectiveness

of the proposed data model in the context of credit

scoring solutions that implement more than a sin-

gle machine learning algorithm, such as, for exam-

ple, the homogeneous and heterogeneous ensemble

approaches.

ACKNOWLEDGEMENTS

This research is partially funded by Italian Ministry

of Education, University and Research - Program

Smart Cities and Communities and Social Innovation

project ILEARNTV (D.D. n.1937 del 05.06.2014,

CUP F74G14000200008 F19G14000910008). We

gratefully acknowledge the support of NVIDIA Cor-

poration with the donation of the Titan Xp GPU used

for this research.

REFERENCES

Abell

´

an, J. and Castellano, J. G. (2017). A compara-

tive study on base classifiers in ensemble methods

for credit scoring. Expert Systems with Applications,

73:1–10.

Ala’raj, M. and Abbod, M. F. (2016). A new hybrid ensem-

ble credit scoring model based on classifiers consen-

sus system approach. Expert Systems with Applica-

tions, 64:36–55.

Barboza, F., Kimura, H., and Altman, E. (2017). Machine

learning models and bankruptcy prediction. Expert

Systems with Applications, 83:405–417.

Benesty, J., Chen, J., Huang, Y., and Cohen, I. (2009).

Pearson correlation coefficient. In Noise reduction in

speech processing, pages 1–4. Springer.

Bequ

´

e, A. and Lessmann, S. (2017). Extreme learning ma-

chines for credit scoring: An empirical evaluation. Ex-

pert Systems with Applications, 86:42–53.

Bijak, K., Mues, C., So, M.-C., and Thomas, L. (2015).

Credit card market literature review: Affordability and

repayment.

Boratto, L., Carta, S., Fenu, G., and Saia, R. (2016). Us-

ing neural word embeddings to model user behavior

and detect user segments. Knowledge-based systems,

108:5–14.

Boughorbel, S., Jarray, F., and El-Anbari, M. (2017). Opti-

mal classifier for imbalanced data using matthews cor-

relation coefficient metric. PloS one, 12(6):e0177678.

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

211

Brown, I. and Mues, C. (2012). An experimental compari-

son of classification algorithms for imbalanced credit

scoring data sets. Expert Systems with Applications,

39(3):3446–3453.

Castiello, C., Castellano, G., and Fanelli, A. M. (2005).

Meta-data: Characterization of input features for

meta-learning. In International Conference on Mod-

eling Decisions for Artificial Intelligence, pages 457–

468. Springer.

Chai, T. and Draxler, R. R. (2014). Root mean square er-

ror (rmse) or mean absolute error (mae)?–arguments

against avoiding rmse in the literature. Geoscientific

model development, 7(3):1247–1250.

Chawla, N. V., Japkowicz, N., and Kotcz, A. (2004). Special

issue on learning from imbalanced data sets. ACM

Sigkdd Explorations Newsletter, 6(1):1–6.

Chen, N., Ribeiro, B., and Chen, A. (2016). Financial credit

risk assessment: a recent review. Artificial Intelli-

gence Review, 45(1):1–23.

Chopra, A. and Bhilare, P. (2018). Application of ensemble

models in credit scoring models. Business Perspec-

tives and Research, 6(2):129–141.

Crook, J. N., Edelman, D. B., and Thomas, L. C. (2007).

Recent developments in consumer credit risk assess-

ment. European Journal of Operational Research,

183(3):1447–1465.

Dal Pozzolo, A., Caelen, O., Le Borgne, Y.-A., Wa-

terschoot, S., and Bontempi, G. (2014). Learned

lessons in credit card fraud detection from a practi-

tioner perspective. Expert systems with applications,

41(10):4915–4928.

Damrongsakmethee, T. and Neagoe, V.-E. (2019). Principal

component analysis and relieff cascaded with decision

tree for credit scoring. In Computer Science On-line

Conference, pages 85–95. Springer.

Doumpos, M., Lemonakis, C., Niklis, D., and Zopounidis,

C. (2019). Credit scoring and rating. In Analytical

Techniques in the Assessment of Credit Risk, pages

23–41. Springer.

Garc

´

ıa, S., Ram

´

ırez-Gallego, S., Luengo, J., Ben

´

ıtez, J. M.,

and Herrera, F. (2016). Big data preprocessing: meth-

ods and prospects. Big Data Analytics, 1(1):9.

Ghodselahi, A. (2011). A hybrid support vector machine

ensemble model for credit scoring. International

Journal of Computer Applications, 17(5):1–5.

Giraud-Carrier, C., Vilalta, R., and Brazdil, P. (2004). Intro-

duction to the special issue on meta-learning. Machine

learning, 54(3):187–193.

Haixiang, G., Yijing, L., Shang, J., Mingyun, G., Yuanyue,

H., and Bing, G. (2017). Learning from class-

imbalanced data: Review of methods and applica-

tions. Expert Systems with Applications, 73:220–239.

Harris, T. (2015). Credit scoring using the clustered sup-

port vector machine. Expert Systems with Applica-

tions, 42(2):741–750.

Hassan, M. K., Brodmann, J., Rayfield, B., and Huda, M.

(2018). Modeling credit risk in credit unions using

survival analysis. International Journal of Bank Mar-

keting, 36(3):482–495.

Hawkins, D. M. (2004). The problem of overfitting. Jour-

nal of chemical information and computer sciences,

44(1):1–12.

Henrique, B. M., Sobreiro, V. A., and Kimura, H. (2019).

Literature review: Machine learning techniques ap-

plied to financial market prediction. Expert Systems

with Applications.

Huang, J. and Ling, C. X. (2005). Using auc and accuracy

in evaluating learning algorithms. IEEE Transactions

on knowledge and Data Engineering, 17(3):299–310.

Jappelli, T., Pagano, M., et al. (2000). Information sharing

in credit markets: a survey. Technical report, CSEF

working paper.

Jeni, L. A., Cohn, J. F., and De La Torre, F. (2013). Fac-

ing imbalanced data–recommendations for the use of

performance metrics. In 2013 Humaine Association

Conference on Affective Computing and Intelligent In-

teraction, pages 245–251. IEEE.

Khemais, Z., Nesrine, D., Mohamed, M., et al. (2016).

Credit scoring and default risk prediction: A compar-

ative study between discriminant analysis & logistic

regression. International Journal of Economics and

Finance, 8(4):39.

Khemakhem, S., Ben Said, F., and Boujelbene, Y. (2018).

Credit risk assessment for unbalanced datasets based

on data mining, artificial neural network and support

vector machines. Journal of Modelling in Manage-

ment, 13(4):932–951.

Lessmann, S., Baesens, B., Seow, H., and Thomas, L. C.

(2015a). Benchmarking state-of-the-art classifica-

tion algorithms for credit scoring: An update of re-

search. European Journal of Operational Research,

247(1):124–136.

Lessmann, S., Baesens, B., Seow, H.-V., and Thomas,

L. C. (2015b). Benchmarking state-of-the-art classi-

fication algorithms for credit scoring: An update of

research. European Journal of Operational Research,

247(1):124–136.

Li, Q., Wu, Q., Zhu, C., Zhang, J., and Zhao, W. (2019).

Unsupervised user behavior representation for fraud

review detection with cold-start problem. In Pacific-

Asia Conference on Knowledge Discovery and Data

Mining, pages 222–236. Springer.

Liu, C., Huang, H., and Lu, S. (2019). Research on personal

credit scoring model based on artificial intelligence. In

International Conference on Application of Intelligent

Systems in Multi-modal Information Analytics, pages

466–473. Springer.

Liu, H., Hussain, F., Tan, C. L., and Dash, M. (2002). Dis-

cretization: An enabling technique. Data mining and

knowledge discovery, 6(4):393–423.

Livshits, I. (2015). Recent developments in consumer credit

and default literature. Journal of Economic Surveys,

29(4):594–613.

Luo, C., Wu, D., and Wu, D. (2017). A deep learn-

ing approach for credit scoring using credit default

swaps. Engineering Applications of Artificial Intel-

ligence, 65:465–470.

Luque, A., Carrasco, A., Mart

´

ın, A., and de las Heras, A.

(2019). The impact of class imbalance in classifica-

KDIR 2019 - 11th International Conference on Knowledge Discovery and Information Retrieval

212

tion performance metrics based on the binary confu-

sion matrix. Pattern Recognition, 91:216–231.

Malekipirbazari, M. and Aksakalli, V. (2015). Risk assess-

ment in social lending via random forests. Expert Sys-

tems with Applications, 42(10):4621–4631.

Mester, L. J. et al. (1997). What’s the point of credit scor-

ing? Business review, 3:3–16.

Powers, D. M. (2011). Evaluation: from precision, recall

and f-measure to roc, informedness, markedness and

correlation.

Rapach, D. E. and Wohar, M. E. (2006). In-sample vs.

out-of-sample tests of stock return predictability in the

context of data mining. Journal of Empirical Finance,

13(2):231–247.

Rodda, S. and Erothi, U. S. R. (2016). Class imbal-

ance problem in the network intrusion detection sys-

tems. In 2016 International Conference on Electrical,

Electronics, and Optimization Techniques (ICEEOT),

pages 2685–2688. IEEE.

Saia, R. (2017). A discrete wavelet transform approach to

fraud detection. In International Conference on Net-

work and System Security, pages 464–474. Springer.

Saia, R. and Carta, S. (2016a). An entropy based algorithm

for credit scoring. In International Conference on Re-

search and Practical Issues of Enterprise Information

Systems, pages 263–276. Springer.

Saia, R. and Carta, S. (2016b). Introducing a vector space

model to perform a proactive credit scoring. In In-

ternational Joint Conference on Knowledge Discov-

ery, Knowledge Engineering, and Knowledge Man-

agement, pages 125–148. Springer.

Saia, R. and Carta, S. (2016c). A linear-dependence-based

approach to design proactive credit scoring models. In

KDIR, pages 111–120.

Saia, R. and Carta, S. (2017). A fourier spectral pattern

analysis to design credit scoring models. In Proceed-

ings of the 1st International Conference on Internet of

Things and Machine Learning, page 18. ACM.

Saia, R., Carta, S., et al. (2017). A frequency-domain-

based pattern mining for credit card fraud detection.

In IoTBDS, pages 386–391.

Saia, R., Carta, S., and Fenu, G. (2018a). A wavelet-based

data analysis to credit scoring. In Proceedings of the

2nd International Conference on Digital Signal Pro-

cessing, pages 176–180. ACM.

Saia, R., Carta, S., and Recupero, D. R. (2018b). A

probabilistic-driven ensemble approach to perform

event classification in intrusion detection system. In

KDIR, pages 139–146. SciTePress.

Siddiqi, N. (2017). Intelligent credit scoring: Building and

implementing better credit risk scorecards. John Wi-

ley & Sons.

Sohn, S. Y., Kim, D. H., and Yoon, J. H. (2016). Technol-

ogy credit scoring model with fuzzy logistic regres-

sion. Applied Soft Computing, 43:150–158.

Tripathi, D., Edla, D. R., and Cheruku, R. (2018). Hy-

brid credit scoring model using neighborhood rough

set and multi-layer ensemble classification. Journal

of Intelligent & Fuzzy Systems, 34(3):1543–1549.

Vilalta, R. and Drissi, Y. (2002). A perspective view and

survey of meta-learning. Artificial intelligence review,

18(2):77–95.

Wang, C.-M. and Huang, Y.-F. (2009). Evolutionary-based

feature selection approaches with new criteria for data

mining: A case study of credit approval data. Expert

Systems with Applications, 36(3):5900–5908.

Wu, X. and Kumar, V. (2009). The top ten algorithms in

data mining. CRC press.

Xia, Y., Liu, C., Li, Y., and Liu, N. (2017). A boosted de-

cision tree approach using bayesian hyper-parameter

optimization for credit scoring. Expert Systems with

Applications, 78:225–241.

Zhang, X., Yang, Y., and Zhou, Z. (2018). A novel credit

scoring model based on optimized random forest. In

2018 IEEE 8th Annual Computing and Communica-

tion Workshop and Conference (CCWC), pages 60–

65. IEEE.

Zhao, Y., Shen, Y., and Huang, Y. (2019). Dmdp: A

dynamic multi-source default probability prediction

framework. Data Science and Engineering, 4(1):3–

13.

A Discretized Enriched Technique to Enhance Machine Learning Performance in Credit Scoring

213