FINANCIAL REPORTING: AN INTERNET

CLEARINGHOUSE

Max M. Gottlieb, Boris Stavrovski

City University of New York,

The College of Staten Island, 2800 Victory Blvd, Staten Island, New York, USA

Keywords: Internet Clearinghouse, Accounting, Financial Reporting

Abstract: The creation of accounting transactions has been changed from a manual to computerized recording. In many

ope

rational applications the accounting entries are generated as a byproduct of the underlying transactions (such

as sales), thus making it possible to shorten the existing delays in creation of accounting data. Under this method

it is possible to issue financial statements monthly or weekly, as opposed to the presently used quarterly and

annual periods. Many corporations already generate such financial reports for their internal use, but not for

external purposes. Corporations provide the Security and Exchange Commission (SEC) with more detailed and

supplemental information, in addition to the financial reporting, including sales of their stocks by their officers.

Corporations also disclose substantial facts in their press releases and conferences with financial analysts. They

are obligated to disclose this information to their shareholders. But how to do it quickly and in a way that small

investor could obtain this information at the same time as the institutional investors? It would be advisable to

distribute financial reports via an electronic clearinghouse. This method would permit an instant access to the

reports and assure that these documents cannot be modified. In the following paragraphs we will review the

existing reporting frequency contrasting them with the needs of investors, and describe the generation of

accounting transactions. Next, the proposed method of collection and distribution of financial reports as well as

their possible analyses by a central electronic clearinghouse will be discussed. Finally, we will explore the need

for changes of the attestation standards, describe how to assure the integrity of distributed electronically financial

statements, and propose sequence of implementation of the new distribution.

1 EXISTING REPORTING

FREQUENCY VS. INVESTORS

NEEDS

During the last decades we experienced great

improvements in the areas of data communication and

telecommunication. News about events around the

world are delivered almost instantly. Similarly,

financial news are distributed with minimal delays.

With the fast growth of the securities trade there is a

growing need for fast and reliable financial

information.

The basic reliable source of financial information

i

s presently provided by the financial reports.

Corporations listed on American exchanges are

obligated to provide all its shareholders and potential

investors with annual audited and quarterly un-audited

(but reviewed by auditors) reports. In many European

and Asian countries listed companies are required to

provide only semiannual and annual reports.

Markets usually respond very quickly to the results

presen

ted on financial reports. And so, a report with a

lower than expected earnings of few technology

companies in the year 1995 and 2000 resulted in a

dramatic drop of stock prices of the entire technology

industry. Although more frequent reporting would

not prevent the recent accounting frauds committed by

several corporations, but it could potentially speed up

the discovery of the problems since it is more difficult

to manipulate reports a dozen times a year then four

times.

The existing frequency of reporting was

est

ablished in the pre-computer era. One may assume

that such reporting periods were the most feasible

frequencies at a time of manual time-consuming

preparation of reports.

Today's investors must wait until the end of a

quart

er to learn about financial results, or for an

occasional release of earlier estimates of corporate

earnings. Such information is immediately absorbed

397

M. Gottlieb M. and Stavrovski B. (2004).

FINANCIAL REPORTING: AN INTERNET CLEARINGHOUSE.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 397-402

DOI: 10.5220/0002602703970402

Copyright

c

SciTePress

by the markets, resulting very often in significant

changes of security prices. It becomes clear that

institutional and individual investors would like to

make use of more frequently released financial

information. Such information would be most

beneficial for individual shareholders since mutual

funds and investment houses often obtain information

directly from corporations between the reporting

periods. Actually, the annual financial reports are

delayed more than a quarter from the end of the annual

accounting period. It takes several weeks to proof and

print these reports, then distribute them by mail. Most

of annual financial reports reach the investors in the

month of March of the next year.

In the summer of 1996 the American Security and

Exchange Commission (SEC) adopter a rule

permitting the use of the electronic media delivery in

compliance with the information delivery

requirements of the federal securities law. The term

“electronic delivery” refers to transmission of

information via facsimile, CD-ROM, electronic mail,

electronic bulletin boards, Internet, or computer

networks. SEC also issued interpretive guidance on

the use of electronic media by broker-dealers, transfer

agents, and investment advisors for the delivery of

information to their customers.

In the year 2000 SEC issued regulation requiring

listed companies to make their financial releases

available to shareholders at the same time as they

become available to investors.

In the following paragraphs we will try to argue

that it is possible to greatly increase the frequency of

financial reporting without a significant increase in the

preparation effort. Also, a method for the electronic

delivery of financial information will be discussed.

2 POSSIBILITY OF PAPERLESS

ACCOUNTING

In the early stages of the computerized era it was easy

to be convinced that we are approaching the so called

"paperless society," where the use of the paper for the

commerce would be greatly reduced. Ironically,

computers, with their vast ability of printing reports

and documents, increased the paper usage. It is

assumed that paper usage will grow at least until the

end of this decade (Rifkin, 1995, p. 450).

What are the reasons for such an increase in paper

usage despite the fast growing computerization?

Essentially, paper is preferred by readers. Reading

from a computer screen is not convenient. Paper is

accessible and easy to read. Only during the last few

years has significant progress had been made in

transferring documents electronically within a

company on the organization's network, usually local

area networks (LAN) and between companies and

individuals on wide area networks, mainly via

INTERNET. Still, these links for retrieval and

transmission of documents are awkward to use and

require technical skills. Since security issues are still

plaguing computerized networks, the users are

reluctant to make themselves dependent on

computerized documents. At the same time the

printing of computerized data in a high resolution and

even color hard copy is getting easier and cheaper.

The largest maker of printers "Hewlett Packard is

shipping monthly almost 1 million laser and ink-jet

printers" (Rifkin, 1995 p. 47).

Despite this paper glut the base for electronic

transactions is being expanded. Banks and software

companies are introducing the second time around,

easier systems for electronic banking. The

proliferation of PC's and increased ease of use of

INTERNET has drawn over 100 million estimated

users, as of year 2000.

The internal electronic mail system is used by

virtually all large companies and institutions. The

document imaging technology, which converts paper

documents into digital form, makes significant inroads

into insurance, banking, and other paper intensive

industries. And for years some operations, such as

electronic money transfers, have been for the most part

"paperless." Another application that could operate in

a similar manner, without paper is financial reporting.

Several large corporations, such as General Motors

or Microsoft, post their financial statements on their

Web sites. Although this information may be helpful

to investors, the usage of such sites may be

cumbersome to investors since each site is organized

in a different fashion making the search time

consuming. Furthermore, such sites may post only

financial statements and skip the supplemental

information, such as the SEC fillings. A shareholder

having twenty stocks will have to access twenty sites,

sometimes several times if the reports were not

released yet.

The clearinghouse would have a send emails

informing registered shareholders that their companies

reports were posted or just email the financial reports

and the supplemental information. This way every

shareholder, small or large, will have an equal

opportunity to review financial reports as soon as they

are released.

3 PROPOSED METHOD FOR

DISTRIBUTION OF FINANCIAL

REPORTS

Accounting is a prevalent computerized application in

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

398

all industries. Frequently paper is being used as the

source for its input and almost always as its output.

Such manufacturing companies as the SATURN car

factory, a division of General Motors, started to

eliminate paper documents in dealing with their

suppliers. SATURN transfers supply requests via

computers, paying suppliers for material based on the

number of finished cars. Although most companies

are still lacking a "paperless" electronic link to outside

commercial partners their internal flow of accounting

data is usually performed on an electronic media,

either via tapes/disk or increasingly via INTERNET or

network transfer.

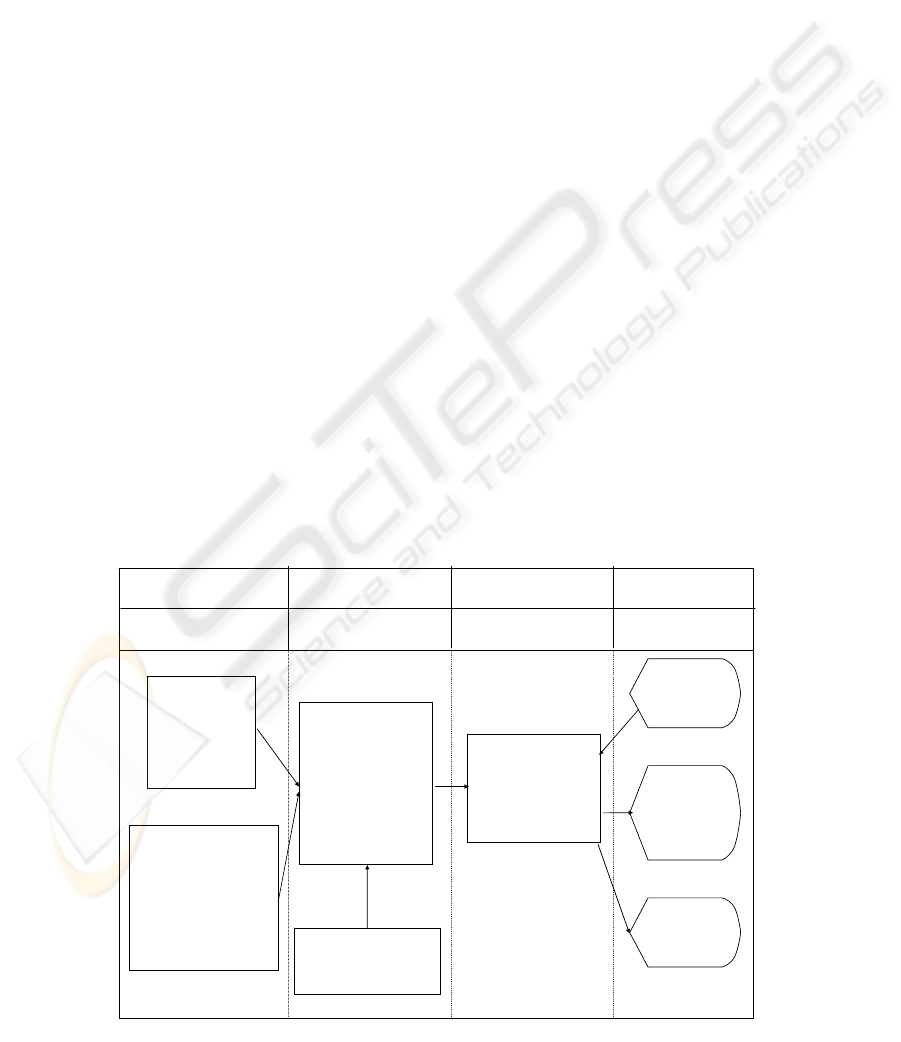

Table 1- Web Based Financial Reporting Using

Clearinghouse illustrates this method. Under this

approach operational applications such as Sales or

Manufacturing generate, as a byproduct of their basic

operational functions, the resulting accounting journal

entries, which, in turn, are fed into the general ledger

system. It is feasible to create weekly or monthly

financial statements from such an almost updated

ledger (short of some additional entries) and submit

them electronically to a clearinghouse. Shareholders

of a corporation and other investors would have a

prompt access to these reports and financial ratios on

an as-needed basis to facilitate the investment

decisions. Obviously, proper method to assure

accuracy and integrity of data must be in place.

For several companies, such as Bankers Trust of

New York, the creation of accounting data is a

required part of their technological architecture of each

application. Therefore, general ledgers are

customarily updated on a daily or weekly basis via

magnetic media. An example of Motorola, a $22

billion company with six operating sectors, which does

its monthly books within 2 days, proves that the

preparation of frequent financial statements is an

achievable task (Zarowin, 1995, pp. 59-62).

The existing frequency of report issuance (annually

for audited reports and quarterly for the un-audited

ones) was established in the pre-computer era.

Corporations are now operationally able to prepare

monthly or weekly reports and to issue them with

much shorter delays than it is done presently. Part of

the delays is due to the usage of a printer services

preparing glossy reports, attractive to read, but taking

long time to validate and print. And with today’s color

printers and graphical capabilities investors may

receive quite esthetically pleasing reports via internet.

Investors, both institutional and individual, would

benefit from having these reports on a monthly or

weekly basis. For this frequency change to occur one

or few clearinghouses should be established in order to

collect and reports from corporations via INTERNET.

Markets respond quickly to the reported news

about earnings and earning projections of companies.

Presently, such information is known mostly to some

financial analysts and institutional investors, thus

depriving individual shareholders from usage of this

information for their trading decisions.

Information submitted to clearinghouses on a

predetermined period basis should be accessible to all

interested parties. The files should be protected from

alteration. No addition or modification should be

permitted, to assure the data integrity.

Table 1: Web Based Financial Reporting Using Clearinghouse

Operational

Applications

General

Ledgers

Daily

Daily, Weekly,

or Monthly

Clearing

House

Shareholders

& Investors

Weekly or

Monthly

As Needed

SALES

- Invoices

-G/L

Entries

via LAN

MANUFACTURING

- Material usage

-G/L Entries

via LAN

COLLECT G/L

ENTRIES

-Proof G/L

-Financial

Statements to

Clearing House

-Earnings

Estimates

YEAR-ROUND

EXTERNAL

AUDIT

MAINTAIN

1. Financial

Statements

2. Vote Count

SEC

Reports

& Press

Releases

Financial

Statements

Inquiry

via

Internet

FINANCIAL REPORTING: AN INTERNET CLEARINGHOUSE

399

Each shareholder would be in a position to

retrieve the financial reports on his/her computer as

soon as they become available at the clearinghouse or

have it automatically emailed to his computer.

Shareholders should still have an option of receiving

paper printed statements, incurring the delays

associated with their printing and postal delivery.

4 FINANCIAL RATIOS AND

VOTING

The financial statements should contain comparison of

several comparable periods for at least five years.

Additionally, ratios comparing a given corporation to

other entities within the industry group could be

calculated. Such data should be helpful in performing

financial analysis, including computation of the

popular ratios.

In addition to the financial report the corporations

would transmit to the clearinghouse their SEC reports

(10K, 10Q and others),

sclosures made to finan

as a site EDGAR which contains SEC filings it is

rm

financial analysis of its own results. However, it would

be advisable to request the clearing house to compute

thout any

ng these

res y an individual shareholder would

have access to analysis available to institutional

d be welcomed by shareholders and it

c

reporting, quantitative analysis, and rewrites of

accounting data. To relieve these problems the

American Institute of Certified Public Accountants

(AICPA), Reuters, and thirty other organizations

created in year 2000 a task force to create a special

version of a widely used language for Web sites

called the Extensible Markup Language-XML.

This accounting oriented new language, named

Extensible Business Reporting Language-XBRL,

uses data tags or markers to define and describe data

elements comprising financial statements. These

markers, always attached to the data elements,

permit users to utilize all data elements for variety of

reports and calculations, regardless of the temporary

position of such elements due to sorting or

processing of data. Imagine an eagle with an

implanted chip, which may always be identified,

even if he moved to another location. Every

language and software program, such as Java,

spreadsheet, or data base language could identify a

particular data element, such as a depreciation

ded marker. XBRL is

nd improvements, but

several companies and institutions are experimenting

to utilize the data by different programs on different

operating system platforms. XBRL is not limited to

se

y

ma tries more

und reign users.

their press releases and

cial analysts. Although SEC

amount, based on the embed

still undergoing changes a

di

h

difficult for a shareholder to navigate this site and the

data is not arranged in a comparative fashion, which

would help in analysis, especially for a small

shareholder owing a dozen or two different stocks.

Since financial analysis is presently not required

under the existing accounting standards the users do

not expect the issuer of the statements to perfo

the popular financial ratios and indicators, wi

commentary or recommendations regardi

ults. This wa

investors employing its own analysts.

The voting for the board of directors by all

shareholders is done via mail. It could be done via

Internet, assuming adequate security. Several

corporations are already offering such an option, but

again, having a standardized and secure procedure in

one place woul

could even increase the voters’ participation.

5 XBRL- THE NEW LANGUAGE

OF ACCOUNTING AND

FINANCE

Users of accounting and financial information

en ounter many difficulties in transmission,

with the new language.

Furthermore, XBRL utilizes templates that

recognize the internal structure of financial

statements, helping in the creation and quantitative

analysis of such reports. Having the markers and

templates we will recognize a given amount, let’s

say depreciation, as a sale or administrative expense

and also link it to the accumulated depreciation on

the balance sheet. For users and preparers of

financial reports it will be relatively easy to utilize

such marked data for analysis, computation,

reporting, and comparison with prior periods or

other companies.

It could be beneficial if the data in the clearing

house is stored in the XBRL format, making it easier

American users, but it is intended for u

internationally. This way, it may also help b

king the data of different coun

erstandable to fo

6 COST AND SECURITY ISSUES

ASSOCIATED WITH REPORT

DISTRIBUTION

The electronic distribution cost would probably not

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

400

exceed the recent expenses of printing and distribution

of paper reports. Most probably, it would resul

t in

sig

.

s would have to be

modified, to provide for the attestation of issued

statements. However, many auditing firms already

by

me

aud zed

rec y.

Most probably a new type of attestation opinion

r information about

any corporation even if it is stored on another site.

This process will transparent to the shareholders.

ons will have

an eir data to a clearinghouse.

er. Although some

m

o use if an independent and a well

secured clearinghouse would be responsible for the

distribution of all financial reports.

ler for an

inv tain information

about all of his companies from one source in a

BRL format,

nificant savings. The cost associated with electronic

reporting should be absorbed by the issuers of

financial statements.

In addition to distribution of financial reports, the

clearing house should distribute also the ad-hoc

company press releases to make them available to all

users at once, as required by the new SEC regulations.

The clearing house may also collect shareholder votes

in board of directors elections, saving again on the

mailing of proxy and the count of votes.

To make it easier for shareholders, every

clearinghouse, assuming there will be a few of them,

will have automatically transfer reports of any

corporation, even if it is posted on a different

clearinghouse. This way no shareholder will be

required to access more then one clearinghouse in

order to get all his reports

The clearing house would have to undergo periodic

audits by a regulatory agency such as SEC, to insure

that its operations satisfy the requirements for data

integrity and secure accessibility.

7 NEW ATTESTATION

STANDARDS

Since corporations are not required presently to issue

monthly or weekly statements, the auditing standards

wou

ld probably have to be modified to take into

account the new frequency and delivery methods.

Issuers of financial statements would have to make

more frequent adjusting entries, such as depreciation.

However, these adjustments will not constitute a great

hardship to the preparers since extracting this

information from the existing computerized databases

is easy.

The existing auditing method

perform "constant" audits of a company's results

examining its computerized records. In fact, so

itors have an on-line access to the computeri

ords of the audited compan

would have to be established for these frequent

reports.

8 PROPOSED STEPS FOR

IMPLEMENTATION

The discussed above changes require time and careful

planning for their implementation. The initial steps,

foreseen for the change, are as follows:

-Issuance of standards for the new reporting

frequency and attestation could take affect within two

years, so the issuers would have sufficient time for

implementation of the change.

-Execution of a pilot program for companies that

will elect to comply with the new requirements before

he

t due date.

-Selection of several clearing houses to provide the

distribution services. Each of the selected clearing

houses will be obligated to transfe

-After initial test phase all corporati

obligation to submit th

-Each shareholder will have an option to receive

the data about the corporation that he/she owes shares

in a selected way. Shareholder will specify the desired

delivery method: email, Internet access on demand, or

hard copy reports.

9 CONCLUSIONS

In conclusion, it is reasonable to assume that it

would be both possible and beneficial, especially for

individual investors, to receive more frequent,

electronically distributed financial statements. The

new technology makes such an operation possible,

most probably without any increase in the costs of

delivery to the provider or us

co panies already offer such an option to their

shareholders, these services would be more reliable

and much easier t

Also, it would be much simp

estor holding several stocks ob

uniform manner, common to all companies. The

clearinghouse would be in a good position to ascertain

that all reports are provided in the X

enabling users to prepare their own reports and

analytical ratios, if so desired.

FINANCIAL REPORTING: AN INTERNET CLEARINGHOUSE

401

Shareholders would have to deal with only one

or electronic voting for their boards and have

E

twork

if

r.

Weiss, M.J., 1994. The Paperless Office, Journal of

-85

Financial Closings; 12

Nonevents a Year. Journal of Accounting, November,

source f

an instant access to companies’ press releases.

R FERENCES

Markoff, J., 1991. Adobe Tackles the Paper Glut With a

Software for All Systems, The New York Times,

December 22, p. 9

orse, S., 1995. Networks: How to Stay Ahead of Ne

M

Explosion, Network Computing, February 15, pp. 54-63

Passell, P., 1992 “Fast Money," The New York Times

Magazine, October 18, p. 42-75

R kin, G., 1995. The Future of the Document, Forbes ASAP,

October 9, pp. 42-51.

Stein, D., and Rittenberg, L., 1994. Electronic Data

Interchange Systems: Implications for Audit Evidence as

a Prelude to Re-engineering the Audit Process,

Unpublished pape

Accounting, November, pp. 73

Zarowin, S., 1995. Motorola's

pp. 59-62.

Barton, K. E, 2003, XBRL: Extensible Business Reporting

Language, The Trusted Professional, Vol.8, Sept. 9, p.

15

ICEIS 2004 - SOFTWARE AGENTS AND INTERNET COMPUTING

402