BIOMETRIC BASED SMART CARD FOR SECURITY

Chunlei Yang

Advanced Technology Department, Ingenico Group, 9 Quai De Dion Bouton -92816 Puteaux, France

Guiyun Tian, Steve Ward

School of Computing & Engineering, University of Huddersfield, UK

Keywords: Biometrics, Security, Smart card, Integration.

Abstract: Fingerprint has been increasingly used in authentication applications. Smart card is becoming more and

more common and is moving toward a multi-function era. The integration of biometric and smart card is a

trend for the future of smart card. As a part of our research project which concerns a novel security card, we

propose to integrate the fingerprint sensor with the smart card instead of the normal solution where the

sensor is installed with a terminal machine. This solution has some advantages regarding security, user

privacy as well as flexibility. In this paper, we study the biometric security and outline our solution. In

addition, in the system authentication decision part, a novel adaptive decision algorithm which combined

with biometrics, PIN (personal identify number) is introduced. This algorithm can be a better trade-off

between user convenience and security.

1 INTRODUCTION

Biometrics refers to the automatic identification or

verification of living persons using their enduring

physical or behavioural characteristics. Biometric

personal authentication uses data taken from

measurements of a person’s body, such as

fingerprints, faces, irises, retinal patterns, palm

prints, voice, signature, DNA, and so on. Since

biometrics has features of “not be lost or forgotten,

unique”, it is increasingly used in security or privacy

needed devices.

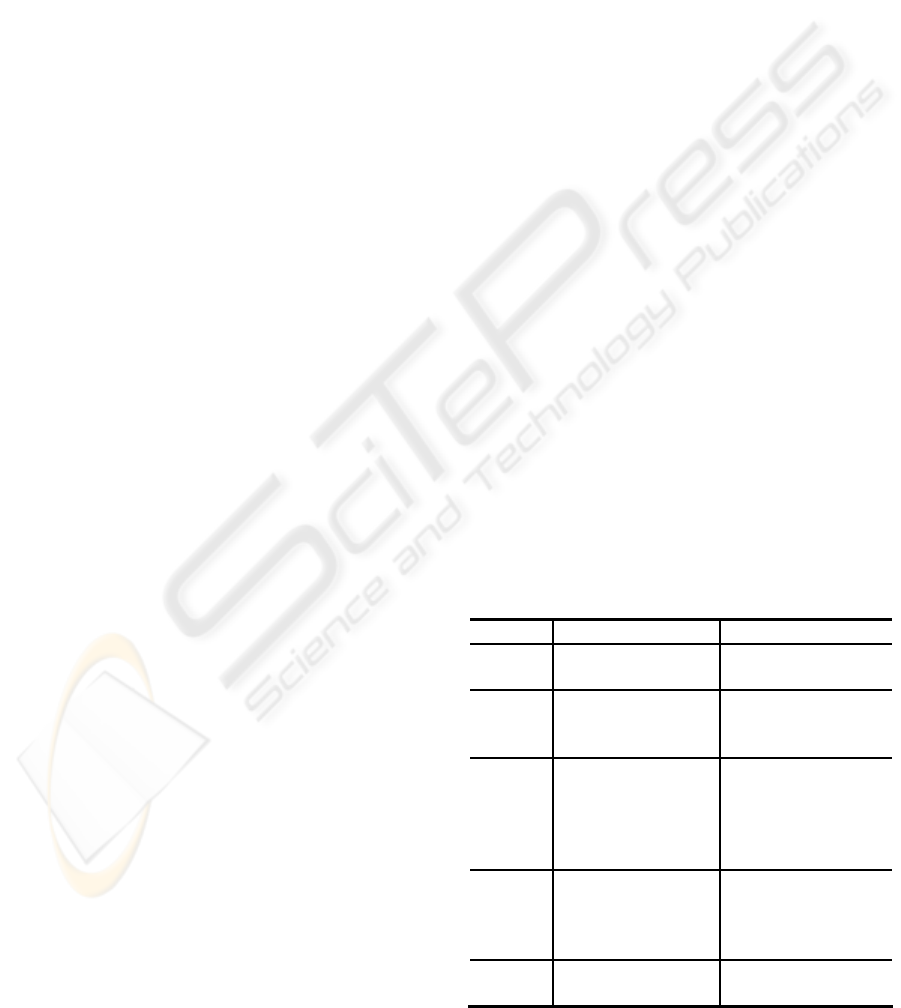

As shown in Table 1, different biometric

technology has its merits and weaknesses (Rodrigo

et al., 2003). For instance, retina scanning requires

that a laser is shone onto the back of the eyes and the

unique characteristics of the retina are measured.

The retina is an extremely stable biometrics because

it is ‘hidden’ and not subject to wear, the

system is

hard to fool because the retina is not visible and

cannot be faked easily. However, it is a potential risk

to health and the invasive nature is unattractive to

customers. Face recognition is a quite natural

method, but in practice, it is affected by lighting,

pose and expression strongly. It also needs high

computation power and the embedded system cannot

meet this requirement. Therefore, thinking

comprehensively based on the factors of accuracy,

cost, convenience and marketing, fingerprint has the

feature of convenient, proven, miniaturization and

inexpensiveness, and it has the best potential for

mass market authentication schema.

As in a typical biometrics-based personal

authentication, fingerprint authentication uses a

four-step process including capture, extraction,

Table 1: Comparison of common biometric.

Type Merits Weakness

Iris High accuracy,

hard to fool

Large and expensive

equipment

Face Non-invasive, no

physical interaction

with sensor needed

Low accurateness,

affected by lighting

& face position

Finger-

print

Convenient, well-

developed,

inexpensive, high

potential for

miniaturization

Accuracy depends

on fingerprint

quality,

Finger subject to

wear

Voice Non-invasive and

natural

Subject to wide

variation, hard to

detect recorded

voice

Retina Stable, hard to fool Invasive, not well

tested, expensive

240

Yang C., Tian G. and Ward S. (2005).

BIOMETRIC BASED SMART CARD FOR SECURITY.

In Proceedings of the Second International Conference on e-Business and Telecommunication Networks, pages 240-246

DOI: 10.5220/0001407302400246

Copyright

c

SciTePress

comparison and matching. The pre-stored minutiae

for matching during an enrolment is also called

template. Two techniques are used to decide if the

verification data really corresponds with the

reference data. One is based on minutia matching

(local details) and the other is based on pattern

matching (global structure). Generally speaking,

minutia matching is more commonly used. Figure 1

illustrates how to extract fingerprint minutiae.

Figure 1: Fingerprint minutiae extraction.

There are two common ways to implement a

biometric system according to the different places of

storing templates and matching: online and offline.

Online means the fingerprint templates are stored

and matched in a centralized server computer. This

solution has advantages in terms of management and

rapid system update, however a stable

communication is always needed and it will increase

the cost and slowdown the transaction. Offline

means the authentication can be done locally

because the template is stored and matching is

finished locally. This solution can verify identity

without complex communication infrastructures and

cut cost. It is especially important in mobile

application and at sites away from the

communication line. The vital question for offline

solution is how to store the template securely. A

smart card can be an ideal solution to address these

questions. It can operate both online and offline.

A smart card has an embedded processor and

memory. From a functional standpoint a smart card

is a miniature computer. The smart card has the

capability to record and modify information in its

own non-volatile memory and the security data can

be well protected or ‘hidden’ by the operating

system and hardware. These features make the smart

card a powerful and practical tool against

unauthorized data access and copy (Peyret P. et al.,

1990;

David M. and Moti Y., 2001.). More and more

technologies are integrated with the smart card. The

PKI (public key infrastructure) has reinforced the

smart card security and makes the smart card be an

ideal place to carry varying degrees of sensitive

information. In the past years, the biometric and

smart card technology have been combining together

in some applications (BioT1, 2003; Chunhsing L.

and Yiyi L, 2004). As illustrated in Fig.2, a terminal

with a fingerprint sensor captures the fingerprint and

extracts the minutiae, then the extracted minutiae are

sent to the smart card to match with the stored

fingerprint templates in the smart card. The process

is called match-on-card (MOC) and the card is

called biometric card (BioT3, 2003).

The rest of the paper is organized as follows:

Section 2 analyses the general security of the

fingerprint authentication system, namely attacks

and countermeasures. Section 3 describes the

proposed system, including architecture, procedure

and an adaptive decision algorithm. Section 4 is a

conclusion and future work description.

Fingerprint

capture

Extracted

fingerprint

data

match

decision

Reader (terminal) Smart card

Stored templetes

Figure 2: Diagram of Match-on-Card process.

2 BIOMETRIC SYSTEM

SECURITY

2.1 Fingerprint System Security

In this section, the general security of biometric

system will be analysed.

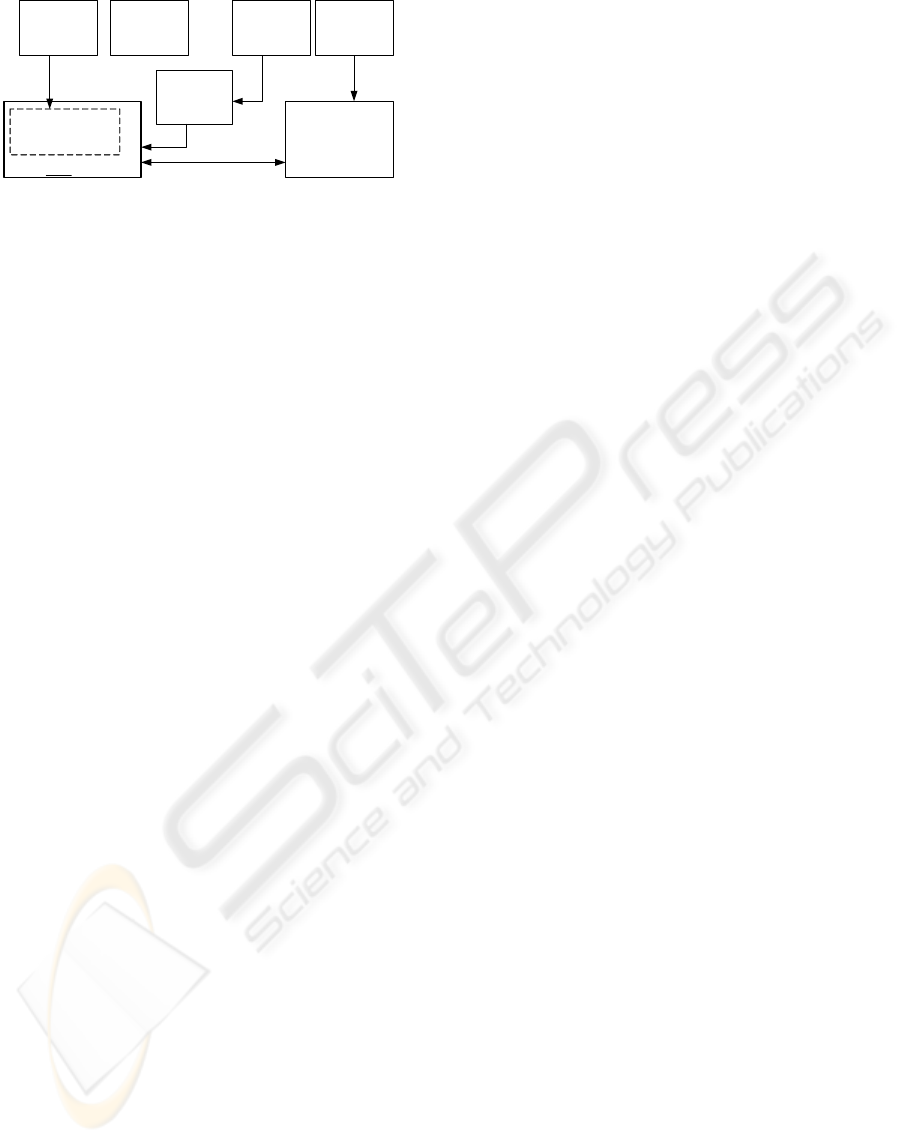

A generic biometric data processing model is

shown in Figure 3. Within this model, following the

data process from sensor until application, we

identify nine basic biometric attacks (Attack 1; . . . ;

9) that plague biometric based authentication

systems. For simplicity, the enrolment of the

fingerprint template is not included, although that is

a quite important link of the whole biometrics

security system.

Typically, Attack 1 could be an impersonation

attack where the attacker uses a fake fingerprint to

fool the sensor. Attack 2, 4, 7, 8 belong to channel

attacks where the attacker can use line taping,

intercept the biometric data or use previous recorded

signal to replay attacks. Besides such direct channel

attacks, some advanced crypt-analytical techniques,

so called side channel attacks, also pose serious

threats to biometric system even to the channels that

are encrypted. For instance, by analyzing the power

dissipation or timing of encryptions in device,

encrypted information inside can be deduced (An Y.

and David S., 2004.; Ross A. and Markus K., 1997.).

BIOMETRIC BASED SMART CARD FOR SECURITY

241

Attack 3, 5, 6, 9 fall into the categories which attack

the inside software or secure keys (if the

cryptographic technology is employed for secure

data transmission). Below more details about attacks

and countermeasures will be examined.

A fake finger attack is a serious threat to

biometric authentication systems, since this type of

attack directly exploits the intrinsic weakness of

biometrics: easy to be captured and hard to revoke.

When fingers touch an object, the chemicals in

finger sweat may be absorbed into that object (paper

Matsumoto T. 2002 is a good example), and there

are new chemicals which can develop these quite

nicely. Afterwards, a fake finger can be made to fool

the biometric system. With the ongoing development

of technology, a latent fingerprint can be detected

and captured easily and a very sophisticated fake

finger can be made. E.g. the fake print made from

gelatine, which is low-cost, electrically quite like

real flesh, can already fool many optical, capacitive,

pressure based sensors (Matsumoto et al., 2002).

Theoretically each data transfer channel is

susceptible to channel and side channel attacks if it

is not well protected. The typical attacks can be a

replay attack, resubmission of an old digitally stored

biometric signal, or an electronic impersonation.

More specifically, like in Attack 2, after the features

have been captured by the sensor, if the sensor and

the extractor hardware has a long and exposed

channel (e.g. connected with cables), this captured

data can be replaced with a different synthesized

feature set. In Attack 4 the minutiae can be replaced.

In Attack 7 the templates from the stored database

which are sent to the matcher can be altered before

they reach the matcher. In Attack 8, the final

decision of the matching module can be overridden.

From a software perspective, the compiled

source code stored in the system is susceptible to de-

compilation and reverse engineering (Gleb N. and

Nasir M., 2003.), which means the program could be

read and analyzed. Therefore, if the security

mechanism is merely based on some tricks in the

program, it will be easily subverted by analyzing the

program and designing some actions to avoid

triggering the security mechanism. If the adversary

can install a Trojan horse into the biometric system,

some information will be disclosed to the attacker,

etc.

2.2 Countermeasures for Biometrics

Attacks

Based on above threat analysis, some

countermeasures can be taken to improve the

security.

To prevent a fake finger attack, a multi-modal

sensor could be an effective way. In a multi-modal

sensor, for example, in addition to capturing a

fingerprint, the warmth and pulse can also be

detected. Or like some advanced sensor, instead of

taking a static picture of the surface of the finger, it

reads the fingerprint from the live layer below the

surface of the skin. This method ensures that the

device will acquire the fingerprint despite varying

skin moisture levels; abrasion of the fingerprint from

harsh chemicals or friction like rubbing; and

common contaminants such as lotion, grease, or

smoke. This subsurface-imaging approach thereby

eliminates the surface-based recognition failures

common with surface-imaging fingerprint sensors

based on capacitive, thermal, optical, or pressure-

sensing techniques (AuthenTec, 2004).

There are several solutions that can improve the

system security. As proposed in the paper by Nalini

K. et al. (Nalini et al., 2003), 1) “Image based

challenge/response method”. The matcher unit

generates a pseudorandom challenge for the

transaction and the sensor unit acquires a signal at

this point of time and computes a response to the

challenge based on the new biometric signal. 2).

WSQ (Wavelet Scalar Quantization) -based data

sensor

Template

extractor

matcher

Application

Template

database

1 2 3

4

5

6

7

8

9

Legend

x

Data flow

Attacks

Figure 3: Biometric system security model.

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

242

hiding. It uses data hiding techniques to embed

additional information directly in compressed

fingerprint images to guard against replay attacks.

However, such measures can hardly meet high

security requirements. If the hardware is not secured

and the program can be reverse engineering and

analyzed, such a system can be subverted without

difficulty.

Therefore, finally, the essential protection is to

seal as many of the system components as possible

into a tamper-proof device, including the data

transmission channels. If some channels cannot

really be sealed, then cryptographic technology

should be employed to ensure data integrity and

confidentiality. The security key must be very well

protected. Following these thoughts, we consider the

combination of biometrics and smart card could be

an attractive solution. As the match-on-card solution

which is introduced before, the smart card is used to

store the biometric template to match the signals

from outside of the card.

3 PROPOSED ‘CAPTURE &

MATCH-ON-CARD’ SOLUTION

However, we propose another solution which is

other than the above outlined match-on-card

solution. The fingerprint sensor is integrated with

the smart card body in our new proposed system.

The considerations are listed as follows:

- Increase the difficulty for attackers. In practice,

most of the attackers need to install an electric

bug or apparatus to the attacked object. A

terminal machine (card reader) normally has a

spacious plastic housing which contains many

PCBs, electric components, etc. The wires linking

the system components to each other could

become potentially passive or active penetration

routes. It is not difficult to find a small space in

the terminal for installing an electric bug inside.

However, if the fingerprint sensor is integrated

with the smart card, all these electric elements

can be packed into one very thin plastic package,

or even be integrated into one single chip and

interlinks can be hidden.

- Distribute the security risk. The adversary can

get far more potential benefits from

compromising a terminal security system than

compromising a single card. If the biometric

sensor in a terminal is compromised, it will

jeopardize all its users. Thus by distributing the

sensor to the cards can distribute the risk.

- Protect the privacy and increase the flexibility.

Nowadays, the sensor is installed with the

terminal machine. Although the terminal

providers as well as the merchants declare that

“we don’t take your fingerprint images but only

features”, it is hard to believe when the customers

see their fingerprints scanned by the terminal.

Meanwhile, if the card has a biometric sensor

itself, it can improve the flexibility and customers

can use and benefit from the potential advanced

biometric technology everywhere.

Obviously the feasibility of this solution relies on

two issues: the cost of a sensor and whether the

physical shape of the sensor allows it to be

integrated into a card. Thanks to the ever evolving

research and improvements in biometric sensors,

especially the new silicon swipe fingerprint sensor,

this proposed work becomes more realistic than

ever. For example, recently the cost of a swipe

sensor can already be less than four US dollars, and

the dimension and the thickness makes it nearly

possible for it to be integrated into the smart card

body, the thickness of which is 0,8mm. The fragile

sensor can be protected by a thin metal sheet around

it.

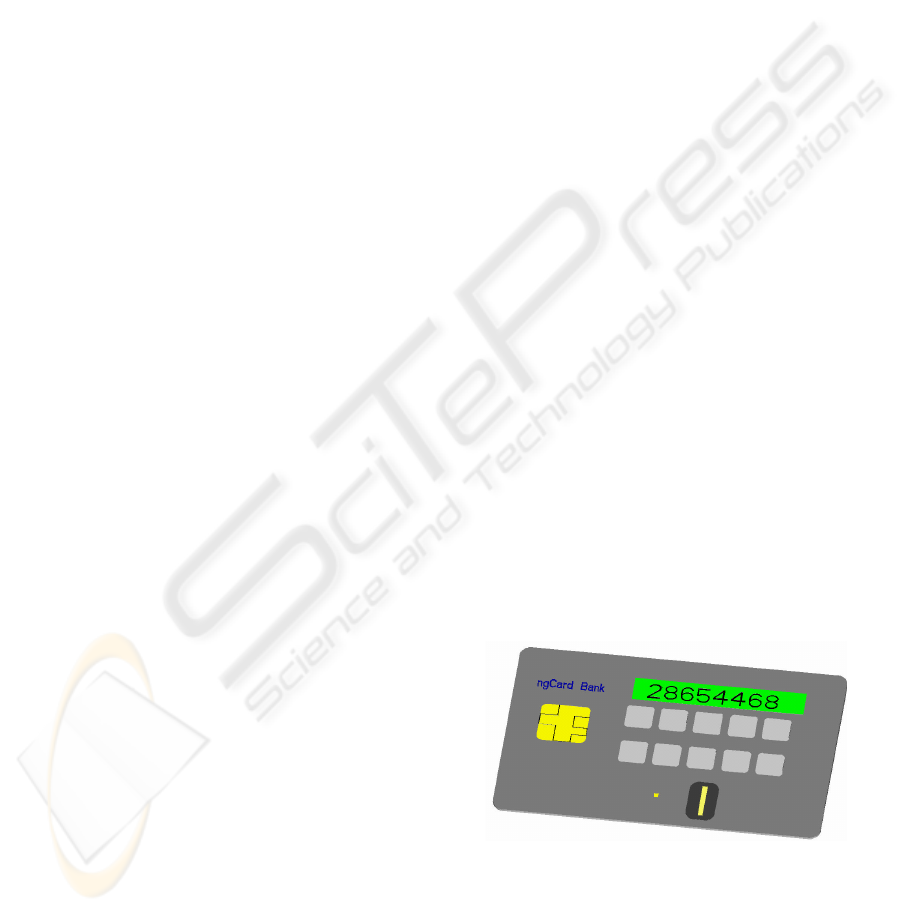

The novel security card is illustrated in Fig. 4. In

this paper, we only describe the part of our project

which concerns biometric security. The envisioned

architecture and procedures are presented. In

addition, an adaptive decision algorithm of

authentication, which is combined with biometrics

and PIN (Personal identify number), is introduced.

This algorithm can be a better trade-off between user

convenience and security.

Figure 4: A 3D simulation picture of our project.

BIOMETRIC BASED SMART CARD FOR SECURITY

243

The principle and architecture of proposed

system is illustrated in Fig.5. The smart card has a

fingerprint sensor and a small LED. They are

packaged together and offer the possibility of

integrating the security sensitive components into

one small chip and apply some ripe tamperproof

technologies from the smart card industry

(Wolfgang, 2003). Meanwhile part of the system

security risk can be distributed to many cards.

For our system experiments, a swipe type

fingerprint sensor AES2510 from AuthenTec Inc has

been selected, not only for its small size and low

cost, but also for security. It uses a radio frequency

(RF) imaging technique that allows the sensor to

generate an image of the shape of the live layer of

the skin that is buried beneath the surface of the

finger. Thus it can better prevent attacks like

gelatine fake finger. AuthenTec promised to offer a

smaller and cheaper version of swipe fingerprint

later.

3.1 Architectural Description

As illustrated in Figure 5, theoretically after the

sensor has been integrated with the smart card, all

the capture, feature extraction and matching can be

done inside the card. However, due to the fact that

the normal embedded processor of the smart card as

well as the memory can hardly fulfil the

requirements of complex image processing, the

image data store and fingerprint minutiae extraction

parts are moved to the card reader side. The swipe

fingerprint sensor reads the finger line by line,

generates a challenge and sends the data to FIFO

(first in, first out) via parallel or DMA (direct

memory access) communication. The data in FIFO

will be encrypted and directly sent out to the

memory of the card reader machine. After the image

capture is complete, the image data will be

decrypted and the minutiae extracted before it is sent

back to the smart card for verification. In addition,

one LED light is added and integrated with the smart

card. This LED can change the role of the smart card

from a passive and ‘dumb’ card to an active one,

e.g., it can indicate some serious edicts to improve

the security as well as user convenience.

3.2 Procedure and Security

The authentication procedures are outlined as below

in five steps:

1. Mutual authentication using PKI technology

between the card and the card reader (EMV4.1,

2004)

As shown in Figure 6. The card issuer uses its

Issuer private key S

I

to certify the card public key

P

C,

and saves the certified P

C

in a readable area of

the smart card. However, the card private key S

C

and

the fingerprint template are saved in the ‘hidden’

area in the smart card. These data are hidden, and

cannot be copied or read out by an external card

reader.

The issuer public key P

I

is distributed to the card

reader. So the card reader can use P

I

to verify that

the card’s P

C

was certified by the issuer, and use P

C

to verify the digital signature of the card data.

Therefore, in this way the terminal can confirm that

the card is original and has not been modified. On

the other side, to determine whether the card reader

is genuine, the card can check the certification of the

card reader. In case the above mutual authentication

fails, the application will be cancelled and both the

card reader display and the card will indicate the

error message, i.e. the LED on the card will flash.

This is an important feature because it can detect a

dummy terminal which is made by an adversary to

cheat the user.

FIFO

Minutiae Extraction

Bio template,

private Key S

C

match

Image data

minutiae

Result

Sensor

Challenge

LED

Card reader

Card

Re-process

Encryption/

Decryption

Note:

memory

Certified card

Public key, P

C

Adaptive decision

algorithm

Fi

g

ure 5: Architecture of the

p

ro

p

osed s

y

stem.

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

244

Private Key

(Card)

S

C

Public Key

(Card)

P

C

Private Key

(Issuer)

S

I

Public Key

(Issuer)

P

I

Card reader

P

C

certified

with S

I

S

C

&

fingerpint template

communication

card

Figure 6: Diagram of Dynamic Data Authentication.

2. Session key generation

A session key can be used as a secure key for the

encrypted communication between the card and the

reader (e.g. DES encryption). The session key

derivation function in both the card and the reader,

generate a unique session key Ks for each ICC

application transaction as per the following method.

The system first generates unique Master Keys K

M

from the user primary account number and Issuer

Master key, then Ks can be derived from K

M

, ATC

(Application Transaction Counter) using

diversification data R. The detailed generation

method can refer to EMV definition (EMV 2004).

K

M

:= F (Primary Account Number, Issuer Master

key

)

Ks : = F (K

M,

ATC) [R]

3. Fingerprint capture and extraction

The fingerprint sensor reads the finger image and

adds random data to the fingerprint data. The

random data can prevent replay attack. The mixed

data are sent to FIFO, after DES-encryption using

the session Ks, they are sent out to the memory of

the card reader. After fingerprint reading is

complete, the stored image can be decrypted and the

minutiae extracted. The minutiae are encrypted

again and sent back to the card for authentication.

4. The card decrypts the received minutiae.

5. Match the acquired minutiae with the hidden

fingerprint template in the smart card and generate a

similarity score. The final decision comes from an

adaptive algorithm (refer to section 3.3). The

decision is encrypted and sent both to the card reader

and the smart card LED. This is a special measure

because the conventional way is just to send it either

to the card or the card reader. In this way, even the

attacker faked a result in card reader and the card

reader display shows the operation is right, but the

LED on the smart card will start to flash and give a

warning.

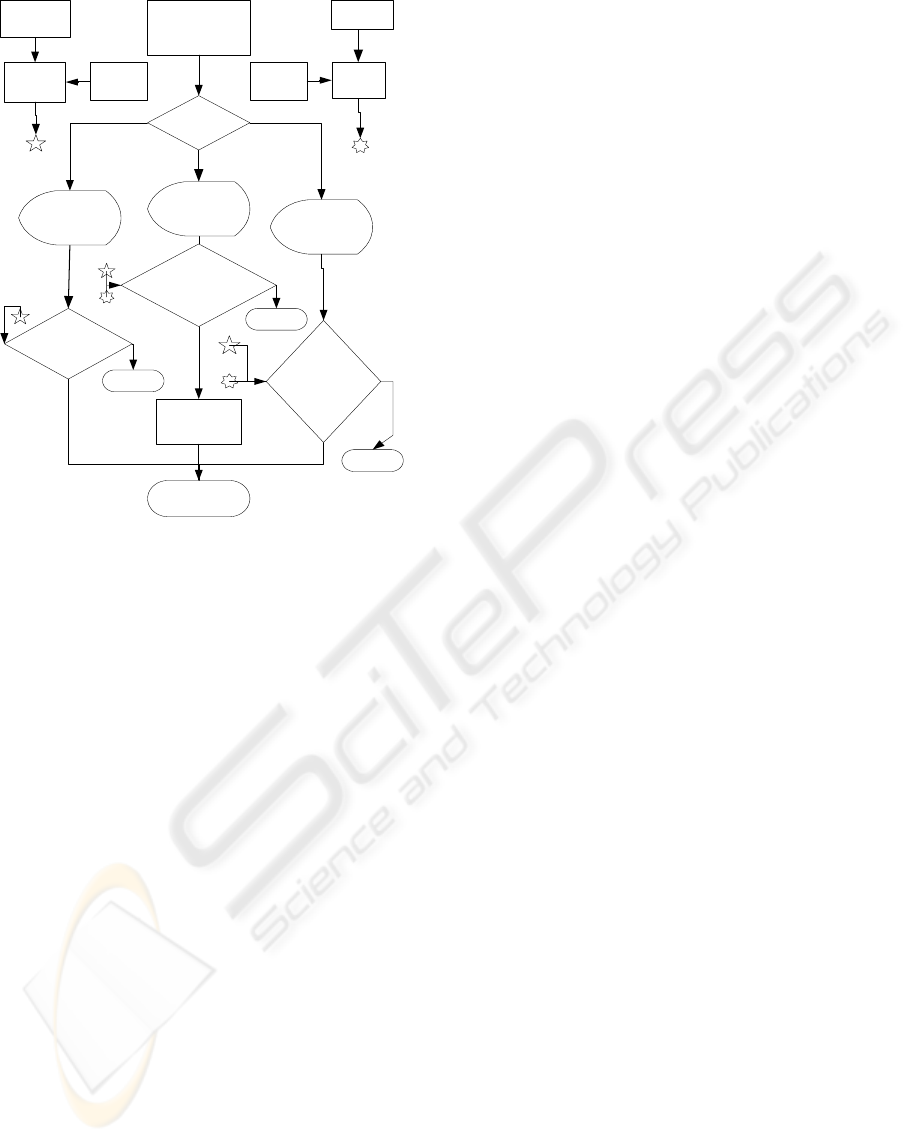

3.3 An Adaptive Decision Algorithm

Two authentication methods, PIN and biometric,

have their own features. The PIN authentication is

stable but prone to be disclosed and forgotten; the

biometric authentication is convenient but cannot

reach a perfect recognition rate and be updated. Thus

they cannot really replace each other completely.

Actually, a high security system can be based on a

combination of three factors: ‘something-you-have’

which is the smart card factor, ‘something-you-

know’ which is the PIN factor and ‘something-you-

are” which is the biometrics factor (Stephen et al.,

2000). Nowadays the smart card becomes a platform

for multi-applications. More and more payment and

non-payment applications (lottery, access control)

have been integrated into a single card. Actually

different applications need different level

authentications. Even the same application, e.g.

payment application, the risk for low amount and

high amount transaction are different.

In order to better balance the security

requirements and user convenience, we propose an

adaptive algorithm and apply it in the authentication

decision. Principally, we first classify different

applications into several predefined levels according

to various security requirements and transaction

value. Then the algorithm selects different methods,

varies the threshold value of biometric similarity

degree, even vary the similarity degree of PIN.

Adaptive decision algorithms are illustrated in

Figure 7.

A new concept of PIN match with a tolerance

(fuzzy PIN) is proposed. For example, for some

applications, when the user can offer a standard

fingerprint, then even he/she makes some small

mistakes in PIN, (e.g. should be 63456 but entered

63455), which the system will also accept (but issue

a warning, so the legitimate user can check it later at

home). To protect the card against exhaustive

search, the card will be locked after 10 successive

unsuccessful fingerprint verifications.

These measures have practical significances and

can cut the management cost. Many calls to the help

desk concern the PIN because it is forgettable.

A lot

of legitimate users’ cards are mis-locked or

applications have to be cancelled on site. A recent

IDC study put annual password management costs at

between US$230-460 per user (BioT2, 2004), which

would add up to a significant amount when a bank

has a large number of customers. The fuzzy PIN

matching combined with biometric measures can

help to avoid such nuisances without lowering the

security.

BIOMETRIC BASED SMART CARD FOR SECURITY

245

low

midium

Inputted

PIN

finger Score>0.85

PIN score>0.95

&

finger score>0.85

PIN score=1

&

finger score>0.95

PIN

match

Fingerprint

match

high

Input

fingerprint

Input PIN &

fingerprint

Input PIN &

fingerprint

Risk rank

PIN warning

Stored

fingerprint

Acquired

fingerprint

Stored

PIN

access

Y

Y

Y

deny

deny

deny

N

N

N

Applications,

amounts

PIN

score

finger

score

4 CONCLUSION AND FUTURE

WORK

This paper has reviewed the security of biometric

system. It argues the advantages of integrating a

fingerprint sensor with smart card, in terms of

security, privacy protection as well as system

flexibility. Based on the review, proposed types of

architecture, procedures and security issues are

presented and analyzed. The merits of the proposed

approach are heightened.

The project is still in progress. Further work on

the system fabrication, implementation and system

evaluation such as system design, minutiae

extraction and testing the system’s real performance,

etc, will be undertaken.

REFERENCES

Anil K. J., Umut U., 2003. Hiding Biometric Data, IEEE

Transaction on Pattern Analysis and Machine

Intelligence, Vol. 25, No. 11, pp. 1494-1498.

An Y. and David S., 2004. Clock-less Implementation of

the AES Resists to Power and Timing Attacks,

International Conference on Information Technology:

Coding and Computing (ITCC'04) Volume 2, Las

Vegas, Nevada, p. 525 A.

AuthTec, 2004. Website of AuthenTec,

www.authTec.com.

BioT1, 2003. Match on card system for IT security,

Biometric Technology Today, Volume 11, Issue 7,

Pages 3-4.

BioT2, 2004. Biometrics secure loan application,

Biometric Technology Today, Volume 12, Issue 7,

Page 3.

BioT3, 2003. Match on card system for IT security,

Biometric Technology Today, Volume 11, Issue 7, pp.

3-4.

Chunhsing L. and Yiyi L., 2004. A flexible biometrics

remote user authentication scheme, Computer

Standards & Interfaces, Volume 27, Issue 1, Page 19-

23.

David M. and Moti Y., 2001. E-commerce applications of

smart cards, Computer Networks, Volume 36, Issue 4,

pp. 453-472.

EMV 4.1, 2004. Integrated Circuit Card Specification for

Payment Systems. Book 2. They can be downloaded

from http://www.emvco.com

Gleb N. and Nasir M., 2003. Preventing Piracy, Reverse

Engineering, and Tampering, COMPUTER, IEEE

Computer Society, Vol. 36No. 7, pp. 64-71.

Matsumoto T. and Matsumoto H. and Yamada K. and

Hoshino S., 2002. Impact of Artificial Gummy Fingers

on Fingerprint Systems, Proceedings of SPIE Vol.

#4677, Optical Security and Counterfeit Deterrence

Techniques IV.

Nalini K. R. and Jonathan H. C. and Ruud M. B., 2003.

Biometrics break-ins and band-aids, Pattern

Recognition Letters 24 (2003) 2105–2113.

Peyret P. and Lisimaque G. and Chua T.Y., 1990. Smart

cards provide very high security and flexibility in

subscribers management, IEEE Transactions on

Consumer Electronics 36 3, pp. 744–752.

Rodrigo de Luis-García, Carlos Alberola-López, Otman

Aghzout and Juan Ruiz-Alzola. 2003. Biometric

identification systems, Signal Processing, Volume 83,

Issue 12, Pages 2539-2557.

Ross Anderson and Markus Kuhn, 1997. Low Cost Attacks

on Tamper Resistant Devices, Proceedings of the 5th

International Workshop on Security Protocols,

Springer-Verlag LNCS No.1361, April 1997, p.125.

Stephen M. and Matyas Jr. and Jeff S., 2000. A Biometric

Standard for Information Management and Security,

Computers & Security, 19 (2000) 428-441.

Wolfgang R., 2003. Overview about attacks on smart

cards, Information Security Technical Report, Volume

8, Issue 1, Pages 67-84 .

Figure 7: Diagram of adaptive decision algorithm.

ICETE 2005 - SECURITY AND RELIABILITY IN INFORMATION SYSTEMS AND NETWORKS

246