ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES

A Study in the Banking Industry

Nicole Kahmer

Fidelity Investment Services GmbH, Kastanienhöhe 1, 61476 Kronberg i.Ts, Germany

Juergen Moormann

HfB – Business School of Finance and Management, 60003 Frankfurt/M., Germany

Keywords: Banking industry, Customer processes, Internet banking, Web site ranking

Abstract: Banks continually claim to supply customer-orientated services. However, banking services are still focused

on purely delivering financial products. Customers will usually receive financial products but often no

specific solution to their true problem. In that way, customers’ perception of banking services is often far

from satisfaction. In addition, important targets of marketing strategy (e.g., customer loyalty, cross- and up-

selling) do not get achieved. Therefore, the consistent alignment of financial services to customer processes

becomes increasingly important and will significantly enhance the competitiveness of banks. This paper

investigates the extent of customer support provided by banks with respect to the customers’ problem

solving process. The study focuses on the Internet as one of several customer interfaces within a multi-

channel approach. The paper delivers the theoretical framework of customer processes and provides an

empirical identification of customer processes. The main part of the study is represented by the evaluation

of 100 Web sites of banks. As a result, the paper reveals that most of the analyzed Web sites fail to assist

customers within their processes. However, the idea of supporting customer processes is spreading. It will

become a major challenge to transform the banks’ traditional product-driven view into a consequent

customer-driven approach.

1 INTRODUCTION

With only a few exceptions, almost all banks operate

in the field of “sales and distribution”. Within this

part of the value chain the majority of banks focus

on private customers as one of their most relevant

clientèle. Today, the competition on these clients is

getting more and more intense and, at the same time,

the behavior of private customers is constantly

changing: They are increasingly better informed,

they claim an appropriate price-performance ratio,

and their loyalty towards traditional banks is

diminishing. Search engines (e.g., Google, Yahoo!,

Altavista) as well as intermediaries (e.g.,

financescout24, mortgageforless) support the

comparison of various offerings and consequently

the willingness to pick cherries.

In order to differentiate themselves from their

co

mpetitors, many banks try to create the

customer/bank relationship actively. A popular

attempt is to put the customer ‘into the center of all

banking activities’. Up to now, these efforts run out

by offering efficient and obliging customer services

while disregarding an important aspect of customer

orientation: During a banking transaction, a client

finds himself amidst a certain customer process and

in need of a variety of products and services.

Unfortunately, the customer usually has to compose

the respective elements by himself. There is no

doubt that the degree of customer orientation will

become a major success factor in the future.

Hammer (2002, p. 15) describes this trend as the

emerging “customer economy”. A promising

approach to improve customer orientation is the

consequent alignment of all banking services to the

processes running at the customers, regardless which

distribution channel the customers use (Schmid, R.,

Bach, V., and Oesterle, H., 2000, p. 3).

This paper shows whether and to what extent

b

anks actually support their customers’ processes.

Basically, all access points (branch, Web, call center

etc.) to the customers are relevant. However, it can

32

Kahmer N. and Moormann J. (2005).

ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES - A Study in the Banking Industry.

In Proceedings of the Seventh International Conference on Enterprise Information Systems, pages 32-39

DOI: 10.5220/0002545300320039

Copyright

c

SciTePress

be assumed that the Internet – as the latest and most

innovative distribution channel – is the most likely

channel to really support customer processes today.

For this reason, our study focuses on the reflection

of customer processes in the banks´ Web sites

.

2 LITERATURE REVIEW

2.1 Definition of customer processes

A customer process can be characterized as the

entire procedure customers pass through to meet a

desire or to solve a problem. Such a process

comprises every single step until a specific wish has

been fulfilled or the solution for a problem has been

found. During this process, the customer needs a

multitude of information, services, and financial

products which usually will be acquired from

different suppliers. Typically, customers have to get

in touch with all different suppliers instead of

dealing with just one partner leading the customer

through the process (Buehler, W., 2004; Moormann,

J. and Wilkerling, C., 2003; Schmid, R., Bach, V.,

and Oesterle, H., 2000).

The following example illustrates the actual

procedure: A customer approaches a bank to apply

for a loan for her housebuilding project. This

demand has been derived from the original desire

“Housing” which can be seen as a customer process

(Niemeyer, V., 2003, p. 144; Winter, R., 2002, p.

42). There are several ways to fulfill this desire. One

might be the acquisition of a new home (Fey, B. et

al., 2000, p. 261). In most cases, banks offer only a

few interfaces to the client along this exemplary

customer process. The main – and often the only –

interface within this process is financing of the new

home. But the customer depends on a number of

further services from other providers, e.g. architect,

building contractor, insurance company et cetera.

Thus, banks do not support the whole customer

process. They are rather the supplier of a singular

separate service within a comprehensive and

complex problem solving process (Niemeyer, V. and

Thymian, M., 2002, p. 14).

Customer processes which aim to buy a product

or to sign a contract correspond to multi-step

approaches like the Customer Buying Cycle (CBC).

This basic concept comprises four phases, i.e.

stimulation, evaluation, purchase, and after-sales

phase (see the overview in Reichmayr, C., 2003).

First of all, the customer collects and assesses all

necessary information (stimulation phase and

evaluation phase). Later the customer gets to her

purchase decision and conducts the transaction

(purchase phase). At the end of the product´s life

cycle the contract expires, the product has to be

disposed of or the customer needs further services

associated with the initial purchase (after-sales

phase). The steps largely depend on the respective

customer process and the specific needs of the

customer (Muther, A., 2002, p. 14; Winter, R., 2002,

p. 42). Piller and Moeslein (2002, p. 10) describe

this approach as “integrating the customer into value

creation”

.

2.2 Current situation in the banking

industry

As an impact of modern information and

communication technologies, customers raised their

demands to the banks’ services and products

considerably. It is not decisive to cover the whole

value chain, but for the majority of banks it is rather

a question of having the most intense customer

contact and thus having the chance to make full use

of the information on customer needs and desires

(Oesterle, H., 2000, p. 23). Due to the rising

percentage of electronic transactions, it becomes

possible for banks to gather and evaluate large

quantities of customer data and, as a consequence, to

develop individual product offerings and to actively

design customer relationships.

Since the emergence of digital distribution

channels, the dependence of banks on physical

presence is decreasing. According to this fact, access

barriers to the banking sector are falling and new

financial services providers with more favorable cost

structures and superior price-performance ratios

penetrate the market. Near banks like insurance

companies (e.g., Allianz, Prudential) as well as non

banks (e.g., DaimlerChrysler, Tesco, Volkswagen,

Woolworths) more and more intrude into traditional

banking reservations.

The banks´ situation gets even more difficult

because customers tend towards holding accounts at

several banks at the same time. They compose

favorable products and services from different

institutions integrating them into a comprehensive

problem solving portfolio. Thus, a customer is quasi

isolated in her customer process and tries to manage

the integration of different partners

.

2.3 The Internet as a touch point to

the customer

To evaluate which financial products will succeed in

the age of Internet, it is essential to consider the

different specifications of a transaction from a

customer’s point of view. Important parameters in

this context are complexity, frequency, and the

ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES - Study in the Banking Industry

33

perceived importance of a transaction. For instance,

the majority of customers would prefer signing a

mortgage contract with some sort of support by their

bank adviser rather than doing the same by

themselves via the Web.

Within the context of multi-channel banking, the

distribution of products and services via the Web

does not constitute a stand-alone solution because

many trans-actions touch several distribution

channels successively. E.g., a customer can obtain

information from her bank adviser, via the call

center or the company’s Web site. The closing of a

contract and further service demands can also be

conducted via different channels. Therefore, the

Internet presents (just) one of several “customer

touch points” (Schwanitz, J., Rathsmann, T., and

Levermann, V., 2002, p. 331).

The distribution of banking products via the

Internet will only be successful if the provided

information offers the customer an added value

compared to traditional distribution channels. The

added value can be derived from the interactivity,

the geographical and temporal independence as well

as the Web’s potential for graphical representation

(Lange, A. and Waeschle, A., 1998, p. 98). Value

added services support conducting customer

processes and increase customer loyalty

(Moormann, J. and Wilkerling, C., 2003). Hence,

appropriate criteria had to be integrated in our

evaluation of Web sites

.

3 IDENTIFICATION OF

CUSTOMER PROCESSES

Although current literature shows a number of

definitions and examples of customer processes

(e.g., Oesterle, H., Fleisch, E., and Alt, R., 2001;

Hagel, J. and Singer, M., 2000, p. 86), it is hard to

find an explicit and consistent list of customer

processes or to find even an appropriate

classification. This section (chap 3) provides an

empirical identification and categorization of

customer processes. This investigation will be the

basis for the second part of our study, the evaluation

of the banks´ Web sites (chap 4)

.

3.1 Methodological approach

Banks should only support those customer processes

which are assumed as relevant and important to

them. Furthermore, there should be a certain desire

of customers to be supported by their bank.

Accordingly, there is no need for banks to support

entire processes for which customers do not feel the

need for assistance.

We have conducted a comprehensive

questionnaire to identify and classify relevant

customer processes. 373 students of HfB – Business

School of Finance & Management, Germany, have

been asked to participate in this study. The

respondents major in business adminis-tration and

work in the banking industry. Owing to their

compulsory employment contract, it is guaranteed

that all respondents maintain at least a checking

account. By virtue of this background, it can be

assumed that the respondents show a basic

understanding for the topic of the questionnaire.

However, it must be taken into account that the

students could be biased regarding their expectations

of the support of customer processes – compared to

private clients who do not have an employ-ment

relationship with a bank.

The main focus of the survey is an assortment of

30 activities or events with tangible and intangible

character which we suggested as possible customer

processes. These activities have been analyzed by

means of different questions concerning the

classification as a customer process, as relevant for

banks and as important to be supported by banks.

We received 264 completed questionnaires which

corresponds to a return rate of 70.8 per cent

.

3.2 Survey results

A central issue was how important certain customer

needs are within the scope of a financial decision. It

came out that all needs have been regarded as at

least “neutral”, “important”, or “very important” for

the respondents. The results indicate that to some

extent customer needs during the stimulation and

after-sales phase seem to be more important than

customer needs during the purchase phase. This

highlights the necessity for banks to support their

customers during all phases of the CBC and not to

focus on contract closures only

.

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

34

Table 1: Classification of identified customer processes

Class A Class B Class C

retirement

(90,5%)

desire for support

97,4%

buying or selling

a car (54,9%)

desire for support

= 53,0%

buying and

administrating of

IT (58,7%)

no desire for

support = 75,8%

buying or selling

a house (79,9%)

desire for support

= 53,0%

Buying and

protection of

household goods

(59,5%)

desire for support

= 68,9%

travel planning

(55,3%)

no desire for

support = 78,0%

pension coverage

(80,3%)

desire for support

= 96,2%

private adminis-

tration (58,3%)

desire for support

= 84,5%

further

(professional)

education

(46,2%)

no desire for

support = 52,3%

covering risks

(81,4%)

desire for support

= 97,4%

renting and

furbishing an

apartment

(55,3%)

desire for support

= 51,1%

renovation/

home improve-

ment (44,7%)

no desire for

support = 58,3%

processing event

of death and

inheritance

(51,5%)

desire for support

= 85,3%

asset

building/financial

planning (96,4%)

desire for support

= 96,2%

Those activities or events which have been

identified as a “total or predominant” customer

process are shown in Table 1. Furthermore, we

linked them with the respective wish of the

respondents to be supported by banks. The processes

have been classified into three classes, depen-ding

on their banking affinity. The numbers in brackets

show the degree of the proximity of each customer

process to the respective class. The desire for

assistance by banks is also given in percentages.

Processes attached to Class A represent issues of

the traditional core business of banks. All processes

but “Processing event of death and inheritance” are

assumed as banking affine with at least 80 per cent.

Class A is also characterized by the respondents’

strong desire for support by banks and their co-

operating partners.

Customer processes of Class B just get limited or

even no support by banks. Here, opportunities arise

to help customers much more within their processes.

This is based on the confidence customers put into

banks and on the knowledge banks have gathered on

their customers. For all processes of Class B the

interviewees show the demand for assistance. This

indicates that the offering of products and services

which exceed the traditional core competences of

banks could gain hugh importance in the future.

The processes allocated in Class C feature a truly

intangible character. Banks and their co-operating

partners just have little knowledge on these

activities. Therefore, it seems rather difficult for

banks to offer sufficient support here. This is

confirmed by the fact that the majority of

respondents does not want any assistance within

these processes anyway.

In summary, it may be said that the respondents

wish further assistance from their banks, but only

regarding customer processes for which they expect

the banks´ competence. Obviously, the interviewees

were not aware of or did not consider the possibility

that banks could also possess knowledge on non-

traditional respective non-financial issues. Thus,

banks should not focus on the support of these

customer processes but rather concentrate on more

classical banking topics and care for a support of the

entire processes. It will be a real challenge to align

all business processes to the customers’ needs and to

deliver all relevant interfaces concerning customer

processes of Class A. After achieving this goal

banks may have further potential to support

additional customer processes

.

4 EVALUATION OF WEB SITES

The aim of the following research was to analyze to

what degree the Web sites of banks support

processes of their customers. For this purpose, we

selected three relevant customer processes based on

the survey shown in chapter 3. We evaluated the

alignment to customer processes by means of a

catalogue of specific criteria.

Our investigation comprises a total of 100 Web

sites from banks in Austria, Germany, Switzerland,

UK, and USA. Due to the accent on banks in

Germany, the criteria focus primarily on German

customers’ needs. However, the criteria catalogue

also includes country specific needs of customers in

Austria, Switzerland, UK, and USA. The empirical

data collection follows strictly the customer’s

perspective and uses information and content from

publicly accessible banking Web sites only. The data

have been collected from Q4 2002 to Q2 2003

.

ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES - Study in the Banking Industry

35

4.1 Definition of the sample

The objects of our investigation are the following six

national banking groups: Germany (58 banks),

Austria (6 banks), Switzerland (6 banks), UK (5

banks), and USA (25 banks). In the case of Germany

we selected the 50 largest banks (measured by total

assets) with an explicit focus on private customers.

In addition, the investigation includes 8 online banks

because it can be assumed that they are privileged to

support customer processes online due to their

specialization on the Internet. The banks of the other

groups, i.e. Austria, Switzerland, UK, and USA,

have also been selected by the criterion of total

assets and a minimum degree of private clients

focus

.

4.2 Evaluation categories

The Web site evaluation has been divided into two

categories: content and structure. Our emphasis lay

on the category “Content” and referred to the

offering of information by the included banks during

all phases of the CBC. In our investigation we

analyzed three customer processes (all out of Class

A). The customer desire buying or selling a house is

specified as the customer process “Housing”. The

issues retirement care, pension coverage, and

covering risks have been included in the process

“Caring for one’s old age” which covers all three

customer needs. “Asset building/financial planning”

is the third customer process we selected for our

evaluation. These three customer processes have

been assessed from our respondents as highly affine

to banking. Additionally, the participants expressed

a strong desire to get support on these processes

from banks and there partners.

The category “Structure” is the second group of

evaluation criteria. The Internet provides access to

almost all necessary information. Thus, in the future,

it will be highly relevant for banks to assist

customers within the information overload.

According to this, the category “Structure” comes up

to the customer’s desire for transparency to simplify

their processes

.

4.3 List of criteria

The resulting list of criteria comprised a total of 64

aspects (the list of criteria can be obtained from the

authors). The criteria of the category “Structure”

(11) serve to investigate the logical concept of the

banks´ Web sites. However, most of our criteria (53)

deal with “Content” concerning the three selected

customer processes:

• The customer process “Housing” represents the

desire for acquiring a home ownership which can

mean building, buying, or renting a house

respectively purchasing or renting an apartment.

Many aspects have to be taken into consideration

to support this process appropriately.

• Since the pension level will further decline in the

future and life expectation is rising, the customer

process “Caring for one’s old age” is of

enormous importance for private customers.

• The customer process “Asset building/financial

planning” comprises all activities to invest

money in a structured manner concerning one’s

individual financial experience, willingness to

take risk, and the respective financial and family

situation. The term asset comprises monetary

values like checking account balances, savings,

fixed-interest securities, and claims on

endowment insurance contracts as well as stocks,

real estate, property funds, and other values.

We refrained from constructing different

catalogues for each national banking group because

most of the criteria correspond to the customer needs

of private clients in general. Hence, in some cases

we modified the criteria into country specific ones to

ensure a fair comparison of the Web sites. In some

cases criteria have been excluded from our

investigation

.

4.4 Data collection

The Web sites of all banks in our sample have been

evaluated regarding every single criterion. We

especially investigated the appropriate order of

supportive activities to the respective phase of the

CBC. For example, aspects of the stimulation phase

should be reflected on the Web site at the beginning

of the customer process.

The 64 criteria have not been weighted because

they should reflect the support of customer processes

entirely. For this reason, all criteria are assumed to

be of equal relevance. Additionally, potential

customers have different needs and desires and

therefore the criteria can be of different importance

for individual clients.

We evaluated the existence of each criterion and

recorded the results with “0” for “criterion

available” or “1” for “criterion not available”. This

nominal scaling is suitable for investigations with a

high number of objects or criteria (Chung, W. and

Paynter, J., 2002). The study comprised a total of

6,400 observations

.

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

36

4.5 Results

The Web site ranking shown in the following section

has been calculated by the achieved performance in

per cent. The assessment of the data has been

conducted on the basis of four performance classes

(Table 2)

.

Table 2: Performance classes for Web site ranking

≥ 80 per cent A fulfillment of at least 80 per cent of

the evaluated criteria reflects an excellent

orientation on customer processes

50 to 79,9

per cent

An accomplishment from 50 to 79,9 per

cent indicates a good orientation on

customer processes. However, further

potential exists for improvement.

30 to 49.9

per cent

Criteria are fulfilled at a degree of 30 to

49,9 per cent which reflects at most a

satisfying orientation on customer

processes. Partly, clear deficits exist.

< 30 per cent A performance of less than 30 per cent is

characteristic for an insufficient orienta-

tion on customer processes.

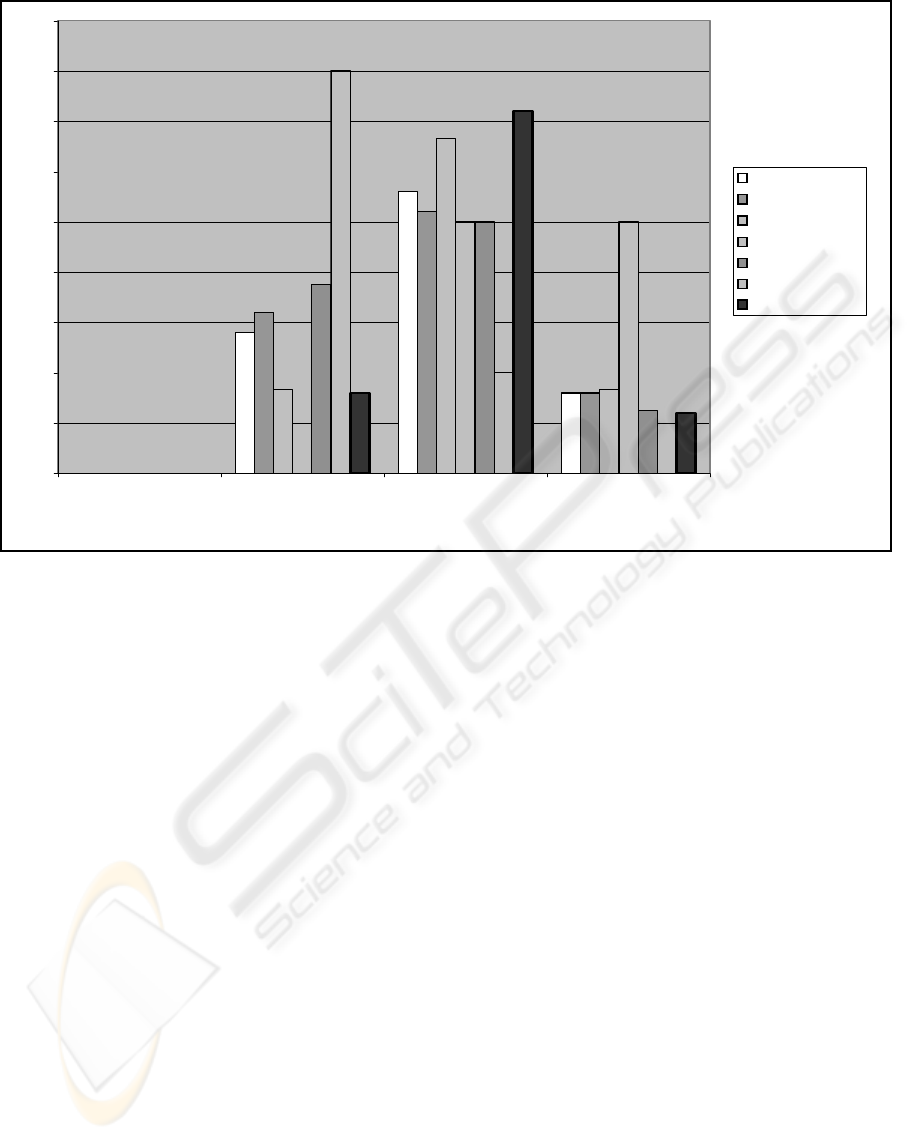

Figure 1 delivers a first overview on the support

of customer processes based on the analyzed

banking Web sites. It can be noted that none of the

100 banks features an explicit orientation on

customer processes (i.e., performance of at least 80

per cent). The graphic shows that the majority of

banks offer just a rudimentary orientation on

customer processes with a result of only 30 to 49.9

per cent which reflects the existence of clear deficits.

The banks which are ranked best show results in

a range between 50 to 79.9 per cent. It is astonishing

that the banks of Austria and Switzerland are not

represented within this performance class (with the

exception of Erste Bank, Austria). Apart from the

UK banks, banks of all nationalities are represented

within the lowest performance class (less than 30 per

cent)

.

4.6 Web site ranking

Table 3 presents the ranking of the Top 15 banks.

Banks with the same overall result are placed at the

same position within the ranking.

Nassauische Sparkasse (Naspa) which is one of the

major savings banks in Germany

attained the best

overall result of 73.4 per cent. It heads the ranking

by a distance of almost 10 per cent. Naspa’s Web

site shows a close orientation on customer

processes including a customer-driven offering

structure. Potential customers of Naspa find a clearly

arranged access to the three customer processes via

the sections “Home and living”, “Caring for the

future”, and “Financial investments” as well as

“Securities and stock exchange”. In the category

“Content” Naspa achieved 69.8 per cent of all

criteria. Particularly during the stimulation phase,

customers obtain all necessary information for their

fields of interest. Within the category “Structure”,

Naspa’s Web site serves all criteria except the call-

back button.

It is noticeable that German banks occupy the

first positions – acknowledging that this group has

been the biggest group in our sample. Interestingly,

10 German savings banks can be found among the

25 best positioned financial institutions. Only two of

Germany’s large banks – HypoVereinsbank (HVB)

and Deutsche Bank – are among the Top Ten

.

Table 3: Web site ranking (Top 15)

Position Bank Natio-

nality

Total degree

of perfor-

mance in %

1 Nassauische Sparkasse G 73,4

2 HypoVereinsbank G 64,1

Sparkasse Nürnberg G 64,1

4 Stadtsparkasse München G 62,5

5 Deutsche Postbank G 60,9

Hamburger Sparkasse G 60,9

Stadtsparkasse Hannover G 60,9

8 Barclays UK 60,0

9 Deutsche Bank G 59,4

10 Erste Bank AU 59,0

11 Stadt+Kreissparkasse

Pforzheim

G 57,8

12 JP Morgan Chase US 55,2

13 Stadtsparkasse Köln G 54,7

NetBank G 54,7

15 Citicorp US 53,4

Wachovia US 53,4

AU = Austria, G = Germany, UK = United Kingdom, US =

United States

5 DISCUSSION

The results show that online banks do not always

perform better than banks whose Web sites just

represent an additional distribution channel in a

multi-channel approach. Only three of the eight

evaluated online banks are positioned among the top

25 banks, and NetBank, the superior bank of this

group, holds just position 13. This result underlines

that traditional banks are absolutely able to compete

with their online offerings with pure Internet banks

.

ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES - Study in the Banking Industry

37

0

10

20

30

40

50

60

70

80

90

> 80 % 50 % to 79.9 % 30 % to 49.9 % < 30 %

performance classes

proportion of banks in per cent

total (100 banks)

Germany

Austria

Switzerland

online banks

UK

USA

Figure 1: Overall results on the basis of four performance classes

The Web sites of Anglo-Saxon banks are,

concerning their orientation towards customer

processes, very similar to the Web sites of the

included German banks. The highest ranked UK

bank is Barclays on position 8 whereas the best

ranked US bank, JP Morgan Chase, finds itself on

position 12. Compared to other national banking

groups Austrian and Swiss banks came off

disappointing. Besides Erste Bank, which ranks

tenth, there is no Austrian or Swiss bank with a

higher performance than 46 per cent (Credit Suisse).

Based on our research it must be stated that most

of the analyzed Web sites fail to assist customers

within their processes. It is striking that the majority

of Web sites still show a clear (traditional) product-

driven structure. Even banks with a more customer-

need oriented approach provide products on the next

level of their Web site. Also, only a few banks

support customers according to the time line of the

respective process. In rare cases customers obtain an

overview on the chronology of all necessary steps

within their process.

These observations are confirmed by the fact that

many of the evaluated banks distinct the customer

process “Asset building/financial planning” into two

separate topics: Saving and investing and Securities

and stock exchange. Often both topics are treated

isolated and banks do not point out that both parts

should be seen as complementary investment

opportunities. This observation reflects the

traditional “stovepipe thinking” in the banking

industry. We observed this fact primarily at the

investigated Anglo-Saxon banks. Similarly, some

banks differentiate between offerings on Mortgage

financing and Real estate services in the customer

process “Housing”, although both topics perfectly

complement each other and thus, support the whole

process. As a result, this stovepipe thinking

approach in presenting financial services leads to the

disruption of customer processes.

Apparently, banks often design their Web sites

based on the assumption that customers are already

equipped with a profound knowledge on various

topics. In this case, banks do not provide any

necessary information during the stimulation phase,

but they directly confront their customers with a

portfolio of products. Only seldom the customers get

accompanied by their bank during the entire process.

Also, the fulfillment of customer needs within the

respective life cycle is hardly reflected in the Web.

The results of our study show that only a third of

the evaluated banks enrich their offers by services of

co-operation partners. Mostly, the much praised

open product architecture can be observed in the

field of investment funds only (offering of third-

party funds). Some of the analyzed banks co-operate

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

38

with insurance companies or real estate agencies

(often subsidiaries of the same bank). One could

criticize again the basically product-oriented focus

of these co-operations, the unsatisfying process

focus, and missing real partnerships with co-

operating companies apart from the own group

.

6 CONCLUSION

The reflection of customer processes in the Web

sites of banks has been investigated at the example

of three processes which have been selected on the

basis of a comprehensive questionnaire survey. The

results confirm a general trend to deliver customer

process support by banks. Since the three exemplary

processes correspond very much to the core

competences of banks (these customer processes

belong to Class A) they should be supported in an

optimal way. Customer processes exceeding the

traditional banking business have not been taken into

consideration in this study. It can be assumed that

customer processes of Classes B and C almost do

not achieve any support by banks. Accordingly, it is

necessary in the first step that banks consequently

concentrate on those customer processes which

correspond with their core competences.

In the future the alignment of financial products

and services to customer processes will become one

of the key drivers of success in the banking business.

Thus, the customers´ needs should become the

benchmark of a bank´s offering to differentiate itself

from its competitors. This will also be a major

challenge for those responsible for the bank´s

customer data bases and the front end application

systems including the Web. The medium Internet as

one of several customer touch points offers great

potential to implement the idea of supporting

customers within their processes and to shape much

closer customer relationships.

The results of our study attest that the majority of

the evaluated banks pursue a product-oriented

offering strategy instead of a customer-driven

offering strategy. Furthermore, most of them fail to

assist customers adequately. In fact, many banks

offer extensive supporting tools, services, and

information but almost none of them is able to

support all phases of the CBC. The results

demonstrate the need for a stronger focus on the

customer-driven approach in the banking industry

and the existence of huge potential in Web site

design. The bank of the future will have to ensure

that IT managers fully understand the logic of

customer processes. It will be their task to

implement this business-driven approach into the

front end applications of banks

.

REFERENCES

Buehler, W., 2004. Retailgeschäft: Ertragszuwachs durch

unkonventionelles Mehrwert-Banking. In: Die Bank,

No. 2, pp. 100-103.

Chung, W. and Paynter, J., 2002. An Evaluation of

Internet Banking in New Zealand. In: Proceedings of

the 35th Hawaii International Conference on System

Sciences (HICSS-35), IEEE: Los Alamitos/Cal.

Fey, B. et al., 2000. Ein Geschäftsmodell für die

Finanzindustrie im Informationszeitalter. In: Oesterle,

H. and Winter, R. (eds.): Business Engineering,

Springer: Berlin, pp. 257-270.

Hagel, J. III and Singer, M., 2000. Net Value. Der Weg des

digitalen Kunden, Gabler: Wiesbaden

Hammer, M., 2002. Business Back to Basics, Econ:

Munich.

Lange, A. and Waeschle, A., 1998. Strategisches

Marketing des Internet Banking. In: Lange, T. (ed.):

Internet-Banking. Der Bankvertrieb im Umbruch,

Gabler: Wiesbaden, pp. 81-100.

Moormann, J. and Wilkerling, C., 2003. Value-Added-

Services durch Einsatz intelligenter Dokumente. In:

BIT. Banking and Information Technology 4, No. 3,

pp. 67-78.

Muther, A., 2002. Customer Relationship Management.

Electronic Customer Care in the New Economy,

Springer: Berlin.

Niemeyer, V., 2003. Virtuelle Beratung. Kundenbeglei-

tung im elektronischen Vertrieb der Finanzdienst-

leister, Physica: Heidelberg.

Niemeyer, V. and Thymian, M., 2002. e-Improvement:

Ein systemtheoretischer Vertriebsansatz. In: Geld-

institute 33, No. 9, pp. 14-19.

Oesterle, H., 2000. Geschäftsmodell des Informations-

zeitalters. In: Oesterle, H. and Winter, R. (eds.):

Business Engineering, Springer: Berlin, pp. 21-42.

Oesterle, H., Fleisch, E., and Alt, R., 2001, (eds.).

Business Networking. Shaping Collaboration Between

Enterprises, Springer: Berlin.

Piller, F.T. and Moeslein, K., 2002. From economies of

scale towards economies of customer integration. In:

Working paper No. 31, Department of General and

Industrial Management, Technical University Munich.

Reichmayr, C., 2003. Collaboration und WebServices,

Springer: Berlin.

Schmid, R., Bach, V., and Oesterle, H., 2000. Mit

Customer Relationship Management zum Prozess-

portal. In: Bach, V. and Oesterle, H. (eds.): Customer-

Relationship-Management in der Praxis, Springer:

Berlin, pp. 3-55.

Schwanitz, J., Rathsmann, T., and Levermann, V., 2002.

Vom Web-Controlling zur Multi-Kanal-Vertriebs-

steuerung. In: Betriebswirtschaftliche Blätter 51, No.

7, pp. 331-334.

Winter, R., 2002. Retail Banking im Informationszeitalter.

Trends, Geschäftsarchitektur und erste Beispiele. In:

Leist, S. and Winter, R. (eds.): Retail Banking im

Informationszeitalter, Springer: Berlin, pp. 29-50.

ALIGNMENT OF WEB SITES TO CUSTOMER PROCESSES - Study in the Banking Industry

39