PERSONALISATION AND CUSTOMISATION

A strategic leverage to sustain e-trading market share

Jimmy Liu

Queens' College, the University of Cambridge, UK

Sven Fischer

ABN-AMRO, Amsterdam, the Netherlands

Steef Peters

Vrije Universiteit, Amsterdam, the Netherlands

Keywords: e-banking, e-trading, personalised services, customisation, customer retention.

Abstract: Electronic banking (e-banking) has emerged the most popular

way for retail banks to provide financial

services to private households. Stock trading transformed into e-trading as retail banks created

comprehensive web portals for customers to perform financial transactions. Low search costs have sparked

fierce price competition. For companies to sustain profitability and retain customers, service differentiation

is vital. Personalisation and Customisation (P&C) techniques allow banks to provide this individualised and

differentiated service and foster a stronger customer relationship. Various P&C approaches have been

examined through case studies of top e-trading companies. A three-layer architecture can be used to which

enables P&C to provide an individual service without undermining core business functions.

1 INTRODUCTION

All electronic-services (e-services) suffer greatly

from lack of personal attention towards its

customers. E-banking is no exception as clinical e-

services have seriously undermined the banking

experience. This has also proved to be the case for e-

trading.

E-trading is under heavy price competition, due to

low

search costs. The ease of information over

commission charges forces many e-trading services

to compete purely on price. For successful retention

of trading customers, these services must enhance

service differentiation and abandon pure price

competition. In the past, service differentiation was

undertaken by investment advisors having met face-

to-face with customers, thus ensuring the provision

of the right service and matching the stocks to the

needs of the customers' purposes. Facing e-trading

and given vast amount of data which are not tailored

to meet individual users' needs, the user chooses for

itself from hundreds of domestic and foreign stocks.

Personalisation and Customisation (P&C) is the next

step

towards closing the gap between traditional

trading service and modern clinical e-services. It

guides each customer by filtering and presenting

only relevant information to the individual, thus

making stock purchasing more efficient and

manageable to the average user. P&C techniques

solve the problem of impersonal services by giving

the customer exactly what they require (Spector,

2002). It fosters the relationship between the bank

and its trading customers and gains the trust of the

customer in order to successfully complete the

transaction (Allen et al., 2001). Consequently P&C

realises the strategy of service differentiation. This

enables the sustainability of superior service quality,

customer retention, and ultimately higher

profitability.

This paper presents a survey of innovative e-trading

services

upon which P&C techniques are evaluated

to construct a guideline for best practices.

40

Liu J., Fischer S. and Peters S. (2005).

PERSONALISATION AND CUSTOMISATION - A strategic leverage to sustain e-trading market share.

In Proceedings of the Seventh International Conference on Enterprise Information Systems, pages 40-47

DOI: 10.5220/0002554000400047

Copyright

c

SciTePress

2 RETAINING CUSTOMERS IN E-

TRADING

2.1 E-trading Services in Retail

Banking

There are three core activities upon each trading

transaction: stock-market data analysis, stock

purchasing, and stock portfolio management and

reporting. For e-trading to succeed as the as the

preferred medium for trading, it has to provide the

aforementioned activities in addition to

authentication, mapping of available services and

alerts to-stock market movements.

Good trading services would not present information

overload, but provide the right balance of

information and functionalities. P&C technique

establishes this balance to obtain optimal usability.

These techniques allow the user to individualise the

stock-trading experience by providing means that

allows the user to specify and meets their own

requirements through user profiles. Successfully

implemented, the trading service uses these profiles

to predict users' actions and provides information

and functions pre-empt of request.

2.2 Personalisation and

Customisation: Concepts and

Measures

Personalisation and Customisation is the act of

manipulating information and functionality based on

the users' profile or previous activities (implicit), or

set by the user (explicit). These P&C techniques are:

Explicit customisation refers to the case whereby the

user explicitly customises any part of the

functionality or interface based on revealed

requirements, e.g. optimisation of navigation using

"My Favourites" (msn.com).

Profile based customisation uses a profile of

interests and behaviour that is built up of the user to

select the appropriate content or functions to display,

e.g. localisation of language and content

(google.com); pre-population of form entries

(yahoo.com).

Behaviour or "click-stream" based customisation

selects content or service to display based on the

users' behaviour of past activity, e.g. automatic

notification of updates to previously visited pages

(vbulletin.com).

Collaborative based customisation considers past

behaviour patterns of a service user or community of

users, e.g. recommended of contents to which others

users in the same context are most interested in

(amazon.com).

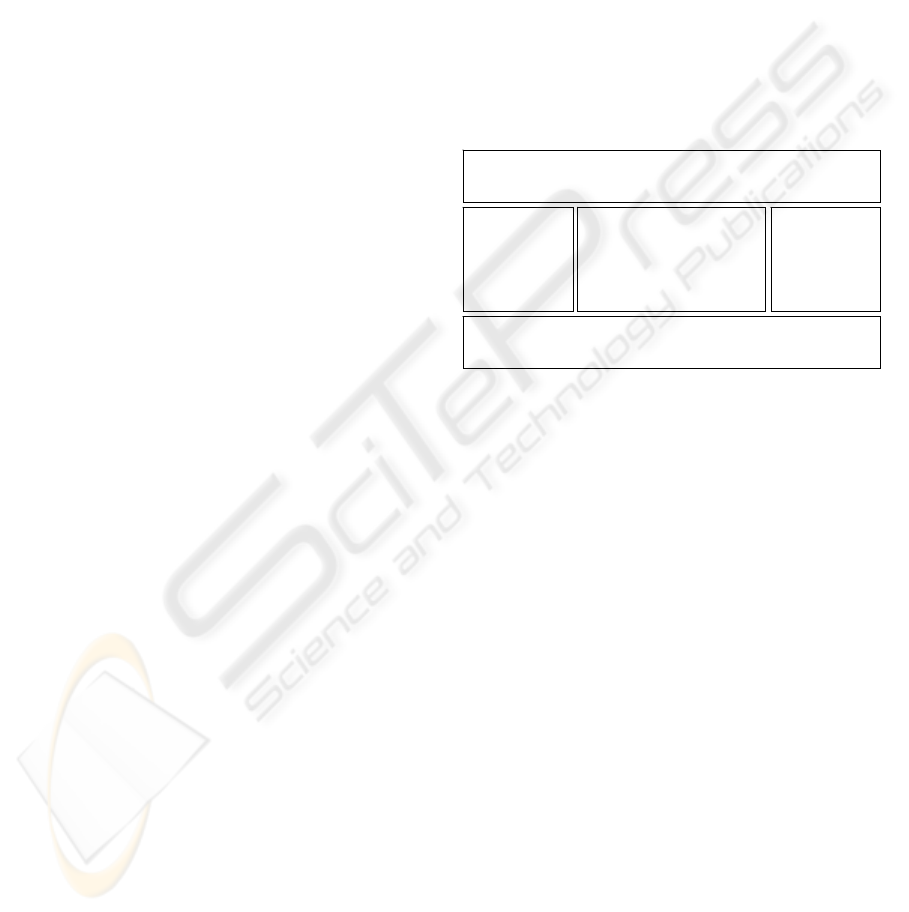

A system that provides services normally

comprises of an interface layer and a functionality

layer. The functionality layer defines all business

functions that are made available through the

interface. This architecture tends to offer all users

with the same set of system functions and services.

Extension by another layer (P&C layer) allows rules

to filter only the relevant content and specific

functionalities, as shown in Figure 1. These

personalisation rules are governed by user and

content profiles. User profiles contain attributes the

location, job title and interests of the user. Content

profiles would contain the price, brand and creator

of the product (Instone, 2000).

User interface layer

User “sees and feels” P&C

User

Profiles

Values which

represent user

interests

Functionality layer

Contents and functionalities

P&C layer

Personalisation rules

Content

Profiles

Values which

represent aspects

of content

User interface layer

User “sees and feels” P&C

User

Profiles

Values which

represent user

interests

Functionality layer

Contents and functionalities

P&C layer

Personalisation rules

Content

Profiles

Values which

represent aspects

of content

Figure 1: P&C information architecture

The level of user involvement determines the

balance of implicit to explicit P&C techniques used

in a system. The degree of P&C use must be

monitored, as too heavy use of explicit user

involvement upfront discourages users. With the

right balance of explicit and implicit involvement,

users build up trust and are more willing to commit

more sensitive profile information. Implementing

P&C techniques in e-trading service will foster

costumer trust and clearly defined responsibility of

the e-trading service would encourage loyalty and

customer retention.

2.3 Research Methodology

A survey followed by a qualitative analysis features

the research approach we have adopted. The survey

takes a cross section of top performing e-trading

companies across Europe and the US. They are E-

trade (US), Charles Schwab (US), Reuters (US), TD

Waterhouse (US), Ameritrade (US), Egg (UK),

Royal Bank of Scotland (UK), Alex (the

Netherlands), and Binck (the Netherlands). The use

of P&C techniques was highlighted and evaluated

for all trading activities in each of the nine

PERSONALISATION AND CUSTOMISATION - A strategic leverage to sustain e-trading market share

41

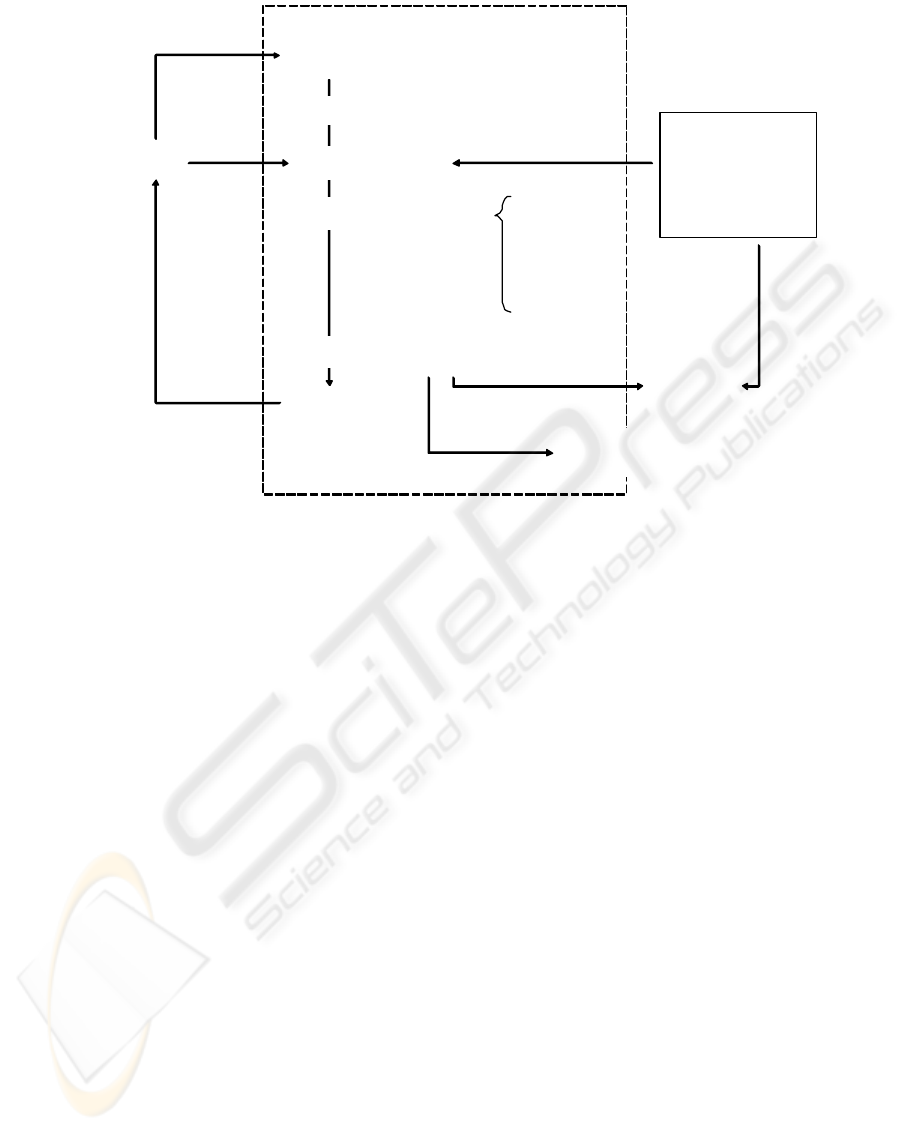

(1) Login

(2) Service mapping & Navigation

(3) Data Gathering

Trading

share type X

(5) Portfolio Management & Reporting

(6) Portfolio

Monitoring

& Alerts

(4) Implement transaction

Non-Secure Part

(1) Logout

Trading Y

Trading Z

Secure Part

(7) E-trading account

management

Outsourced

Information

Vendor

Stock research

Breaking news

Figure 2: Trading activities to be evaluated

companies. This produces a guide for optimally

implement P&C techniques in e-trading.

For a rigid and comprehensive investigation of each

e-trading company and to establish where to best

organise P&C into the most relevant stages, a

generic trading transactions process was generated

from an overview of each service. Opportunities of

P&C were then categorised in accordance to each

stage of activity. Some activities do not require a

secure environment whilst for others a secure

environment is essential. The seven major activities

in e-trading are depicted in Figure 2, which reflects

the areas of research.

User identity verification is conducted as the first

activity (Activity 1), which allows the user to login

and sign out. Service mapping and navigation

(Activity 2), provides an overview of all available

services. Data gathering (Activity 3), presents

market activity and breaking news often from

outsourced information vendors such as Bloomberg

and Telerate (Veale, 2001). Trading and stock

ordering (Activity 4) allows the purchasing and

selling of stock based on purchasing criteria and

limits. Portfolio management and reporting (Activity

5), presents the collection of stocks held and

archives past trading activity. Portfolio monitoring

(Activity 6), alerts the user of market condition

regarding stock held of interested in. E-trading

account management (Activity 7), performs

administrative duties and allows the use to set

trading preferences.

We evaluated each company based on the seven

activities based on the following five usability

criteria. (Beynon-Davis, 2004):

Level of "individualisation" evaluates the success of

P&C techniques and the level of intelligence each e-

trading service provides.

"Ease of use" rates the companies on clarity of

navigation, logic of e-service and consistency of

contents and layout.

"Accessibility" evaluates the help functions and

stock-trading guides for new user or inexperienced

share trader.

"Efficiency" scores the time per transaction, number

of keystrokes to purchase one stock and the levels of

navigation present in each company.

"Facility to return" rates the ease of error correction

after mistaken input.

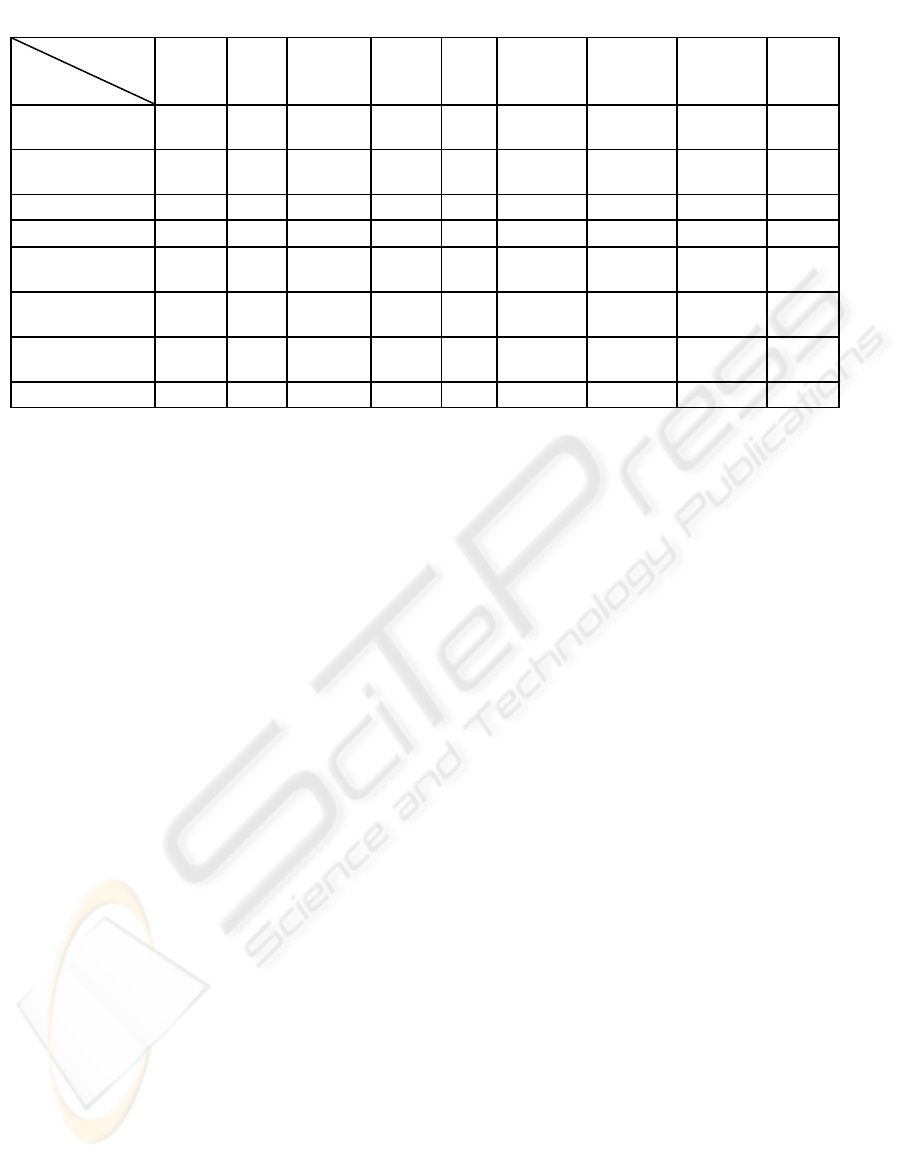

From this ranking, the top companies use of P&C

techniques can be highlighted and evaluated.

3 BEST PRACTICES IN E-

TRADING

The top five companies were E*Trade, Alex, Binck,

Reuters and Egg with Table 1 depicting the results.

The evaluation based on usability criteria showed

that two categories of e-trading sites could be

distinguished, those companies targeting

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

42

experienced customers (those with more than three

years of trading experience) and non-experienced

customers (less than three years). The top company

targeting experienced customers was E*Trade and

targeting non-experienced customers was Alex. The

distinction between targeting experienced and non-

experienced customers does not only differ on

functions, but also on amount of market information

and depth of analysis (as observed in Ameritrade),

and commission charged; the trader chooses the

most appropriate package. To successfully maintain

market share in each market, all e-trading services

should provide both types of platforms and let the

user choose the package that it requires.

4 PERSONALISING E-TRADING

SERVICES FOR COMPETITIVE

EDGE

Due to low search costs e-trading is under heavy

price competition. The ease of comparing

commission charges forces many e-trading services

to compete purely on price. For successful retention

of customers, e-trading companies must provide a

superior service through individualisation so as to

closely match customer's needs. Furthermore a

superior service it will enhance differentiation and

abandon unprofitable price competition. P&C

techniques form part of this individualisation

strategy and currently implemented techniques are

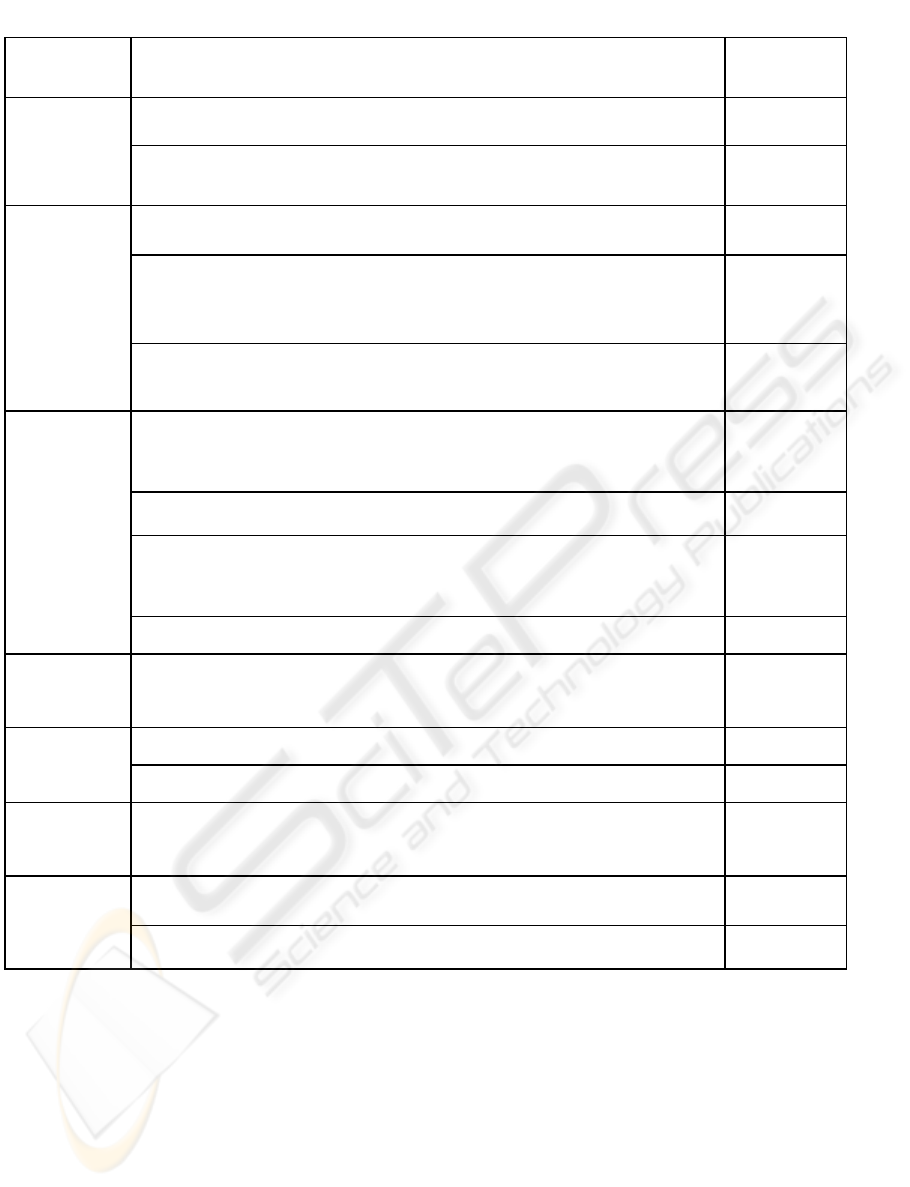

outlined in Table 2.

As shown, P&C techniques can be performed in all

phases of e-trading. A selection of the five most

effective techniques is presented below. The number

between brackets refers to the corresponding type of

customisation as described in Table 2.

Table 1: Top performers in

e

-trading

Trader

Activity

E-

Trade

Alex

Reuters

Binck

Egg

Schwab

TD

Water-

house

Ameri-

trade

RBS

1 User Identity

Verification 5 5 5 5 4 4 4 3 3

2 Service Map &

Navig 5 5 4 5 5 4 4 4 4

3 Data Gathering 4 4 4 4 4 4 3 4 4

4 Stock Ordering 5 5 5 4 4 4 4 4 4

5 Portf Mgmt &

Reporting

5 5 4 4 4 3 3 3 3

6 Portf Monitor &

Alerts

4 3 5 4 5 5 5 4 3

7 E-Trading Acc

Mg mt

4 5 5 4 4 4 4 4 3

Total Score 32 32 32 30 30 28 27 26 24

Table 1: To

p

p

erformers in e-learnin

g

4.1 Customisation of Menu and

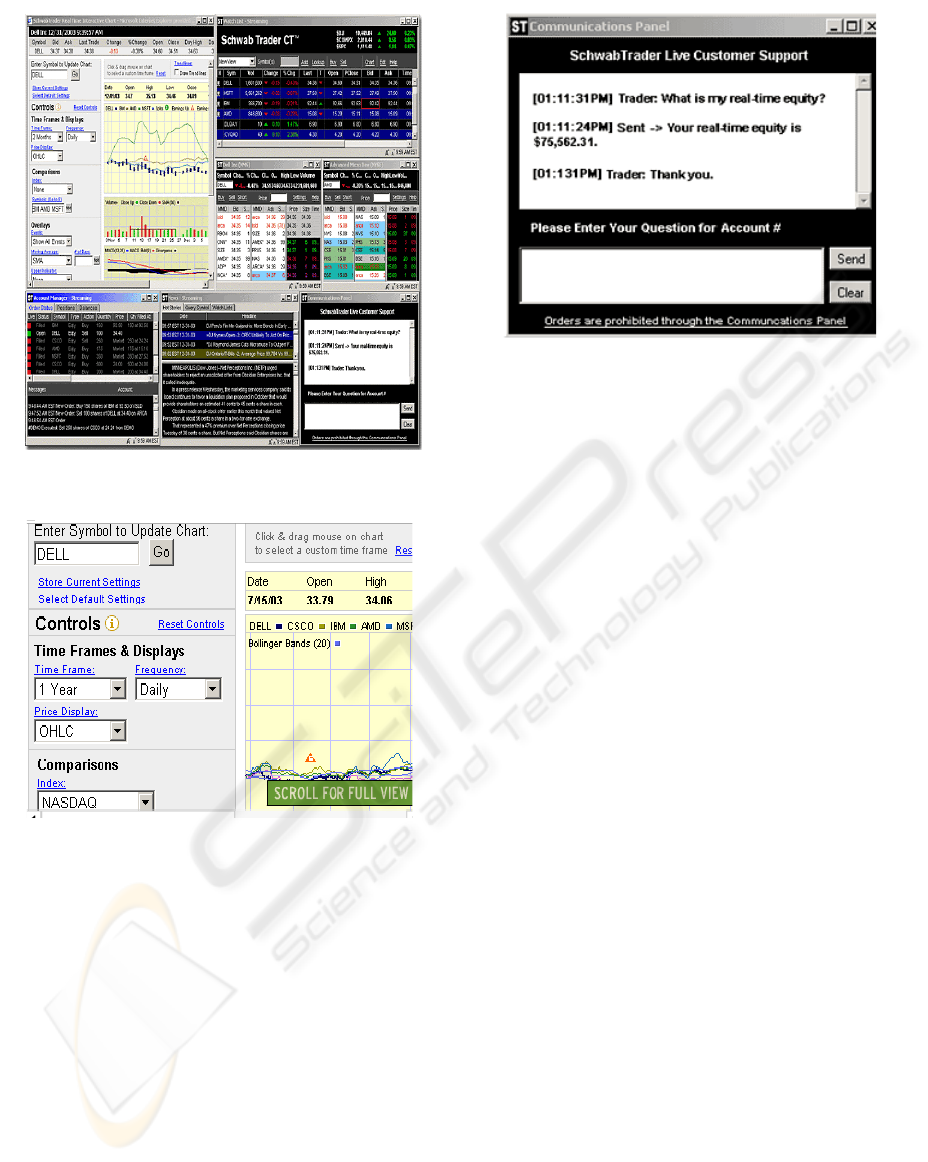

Interface (2a & 2b)

One of the most obvious means of customisation is

allowing the user to adjust the menu and navigation

map of the website. This results in highly accessible

functions. Schwab Trader has successfully

implemented this type of customisation, as shown in

Figure 3. It allows the user to arrange and save the

layout of charts and stock market analysis.

The user determines the most important activities

and information for display and saves this layout. By

saving different interface layouts a user can create

different profiles: e.g. one basic layout for trading at

work, and a more extensive layout that allows for

detailed stock analysis for the evenings at home.

4.2 Interactive Data Charting (3a)

The data-gathering phase of e-trading is very

suitable for customisation. Charts and figures can be

configured in different ways, e.g. trend lines can be

added and modified, and different charts can be

integrated to establish moving averages. Figure 4

shows an example of interactive data charting as

implemented in the Schwab Trader website. With

this type of customisation, efficiency of use is

significantly improved with the option of saving the

chart format setting for future uses.

PERSONALISATION AND CUSTOMISATION - A strategic leverage to sustain e-trading market share

43

T

able 2:

Current

P&C Techni

q

ues

Activity

P&C Techniques

Trader

or

C

om pany

1a Change

preferred start page, e.g.from “non-secured homepage” to “log in”

page

.

Schwab

1 User Identity

Verification

1b Individualise first secured page to users’ preference, e.g. change from

secured homepage to

inbox or portfolio management pages.

Schwab

E*Trade

2a Fully customisable menu bar and windows, e.g. change the number of,

position of

and size

of windows

Schwab

2b

Creation of several custom display profiles depending on the complexity that

trader needs for

current trade, e.g less analysis and stock news presented to

user w hen e

-

trading is performed at w ork, comprehensive stock research when

user implements trading

in

evenings w eekends.

Schwab

2 Service Map

& Navig

2c

Drop dow n menu of frequently visited functions pages or information services

set by user, e.g.

favourites

.

Reuters

3

a

Format display of interactive charts according to user settings, e.g according

to pre set time range of prices.

Schwab

A

meritrade

Reuters

3b

Displaying news and quotes related to trader’s interest or portfolio holdings.

Reuters

3

c

A

dvisor’s message and emails of trading tips on shares which fit traders’

profile.

Schwab

-

Messenger

Reuters

-

MS N

3 Data

Gathering

3d

List all stocks previously browsed in current session

e

-

bay

4 Stock

Ordering

4a

Sel

f

-selection

between simple view (non-experienced users) or complex view

(

experienced users).

The

user decides whether its walk-through mode or expert

mode

and determines

the number of checks and limits of trading.

Binck

5a

Sort stocks in portfolio to display according to user requirements

E*Trade

5 Portf Mgmt

& Reporting

5b

Create

custom views of

portfolios and watch-lists.

Reuters

6 Portf

Monitor &

A

lerts

6a

Pr e

-

set alerts

on stock price movements, e.g upon reaching price limits,

trading service send a

lart

to any mediu m of communication including e-mai l,

MS N

, SMS or i

-

mode.

Egg

7a

User specifie

s

the frequency of

confirmations, e.g user is able to turn on or off

stock order confirmation

.

A

mer itrade

7 E

-

Trading

A

cc Mgmt

7b

Create key

-

stoke short cuts t o vital functions , e.g. cont+p to view portfolios

page.

Yahoo

Table 2: Current P&C Techniques

4.3 Personalised Stock Research and

Trading Advice (3c)

An instant messenger window gives the e-trading

interface a more individualised feel; the customer

does not face a static data chart. Schwab Trader has

provided customers with a so-called

"Communications Panel" that answers customer

specific queries in real time (see figure 5). This is

important in building up a customer firm

relationship and thus adds to customer retention.

"Ease of Use" and "Accessibility" is high as the

interface is based on the widely used MSN

Messenger layout. Reuters, for example, solves these

two problems by directly using MSN Messenger for

real time customer queries.

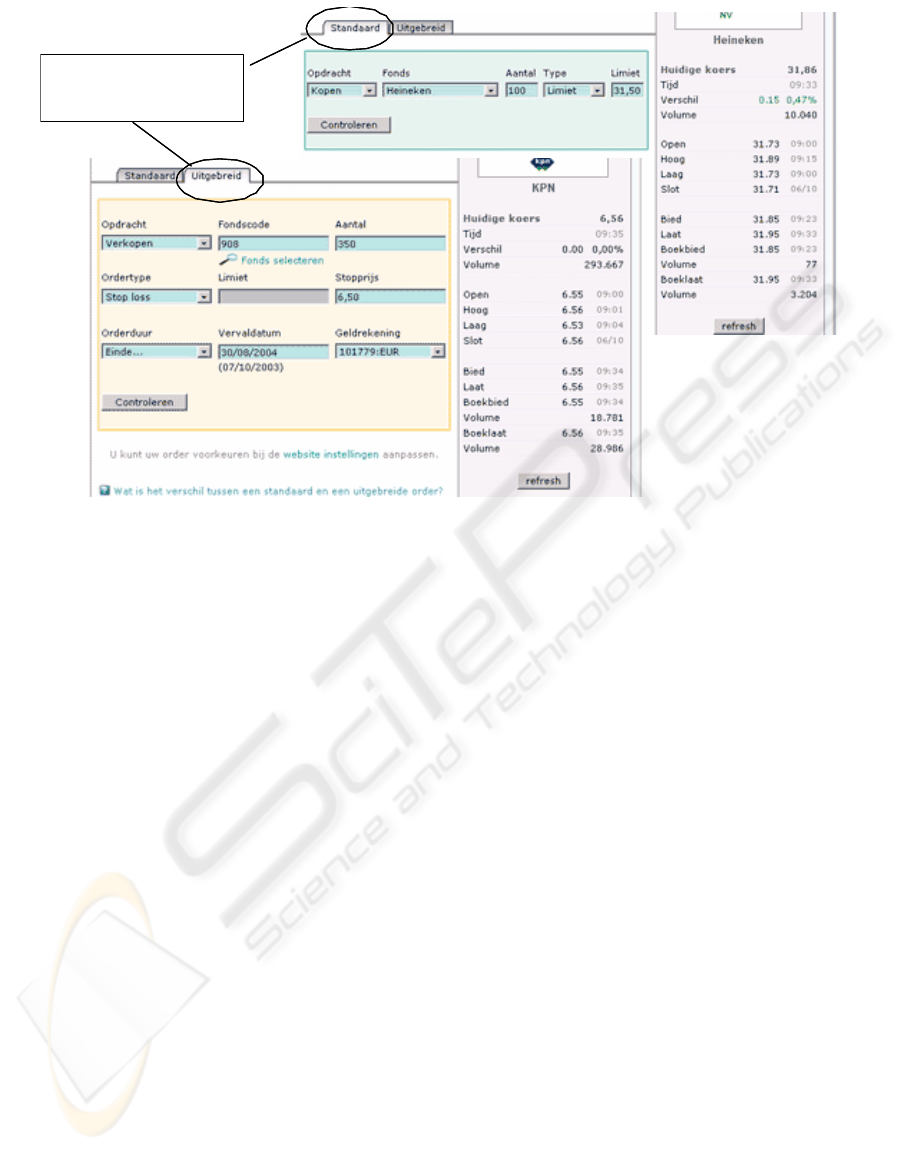

4.4 Individualise Complexity of

Transactions' Criteria (4a)

Customers will have different amount of trading

experience. For those users who are not accustomed

to finance, there should be a simple stock-ordering

interface with minimal distraction and confusion.

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

44

Figure 5: Schwab Trader’s personal trading advisor

For those who have traded extensively, they require

a more complex interface that allows for further

refinement of the purchasing conditions.

Binck, has implemented this concept by providing

two different trading interfaces (see figure 6), a

simple view and a complex view. The simple view

provides high-level guidance and literally 'walks"

the user through making trade transaction. The

advanced view allows the user to make extensive

use of stock purchasing conditions. The advanced

view also provides little help of guidance and hence

minimal interference.

4.5 Custom reports (5a & 5b)

Trading activity is profitable, but is highly risky.

The firm (agent) simply implements the trade on

behalf of the customer (principal). This can lead to

the principal-agent problem of the firm (agent) not

acting in the best interest of the customer (principal).

Records of trading activity in the form of reports

ensure the clear definition of responsibilities

(Mishkin, 2001). For reports of portfolio

performance to be of use, they have to be easy to

interpret. The user often does not need to see all the

data, so something is needed for sorting the data into

relevant information.

Figure 3: Schwab Trader’s fully customisable trading

interface

Figure 4: Schwab Trader’s interactive charting

E*Trade and Schwab Trader use customisation

techniques to create an interactive report which lists

the relevant information for the user to interpret and

use. E*Trade's P&C technique in sorting stocks

displays the stocks held according to different

requirements including "performance", "research"

and "trader".

Schwab Trader's applies the same technique and

allows the user to sort stocks in its watch list.

Sorting conditions include "company name",

"volume of stocks", and "level" and "percentage" of

change. These views can be saved to be retrieved at

a later stage (5b).

4.6 Caveats

Comparing the e-trader rankings in section 3 with

the examples of P&C techniques, there is a clear

warning that the sole use of P&C techniques does

not imply high usability. Although E*Trade and

Alex were ranked as the highest firms providing e-

trading services, they were not central of discussion

in P&C techniques. This suggests that extensive use

of P&C techniques is not a substitute to good

interface design based on the five ratings criteria.

Additionally users may make mistakes that are

recorded, or fill in wrong personal information that

generates bad profiles (Esteban, 2000). This could

render profile based and behaviour customisation

techniques useless. Only the monitored use of these

PERSONALISATION AND CUSTOMISATION - A strategic leverage to sustain e-trading market share

45

Choice of level of details

in transactions

Choice of level of details

in transactions

Figure 6: Binck’s Stock Transactions interface

techniques will add value and foster customer trust,

which will build on exciting customer-firm

relationships. This will lead to the retention of e-

trading market share.

5 CONCLUSIONS AND FUTURE

WORK

Customer retention is an extremely important factor

to a firm in remaining competitive. P&C techniques

are an important means of achieving this goal. The

research of top performing e-trading companies has

suggested a series of efficient methods in P&C for e-

trading. Most of which have built P&C techniques

into the interface of the company’s application

The increased use of P&C techniques suggests that

these techniques add value to the interaction

between the customer and the supplier, i.e. the

financial institution. Models describing the pre-

transaction process of e-commerce, such as the

Landscape model developed by Verhagen

(Verhagen, 1999) originally presented P&C

techniques as “adaptation” of the website and “

customisation” of the product on offer. The new

P&C techniques we investigated show that P&C

takes a more central role in de pre-transaction

process: both the supplier and the customer have the

ability to further tailor the transaction process to the

needs of the customer. The supplier can customize

the pre-transaction process based on customer

characteristics and previous actions of the customer.

Even product characteristics (fees and payment

conditions) may be customised to specific customer

characteristics. The customer can customise using

his or her own user profile, and can increasingly

“adapt” the product on offer – in this case the stock

purchasing order – to his or her preferences.

Further research in other fields of e-commerce may

be necessary, but based on this research it seems fair

to conclude that the current pre-transaction models

describing e-commerce are too limited in describing

personalisation and customisation. Information and

interaction currently take a central role in these

models. On the other hand the research suggest that

the progress in P&C techniques will take a more

central role.

REFERENCES

Allen, C., Kania, D. and Yaekel, B., 2001, One-to-One

Web Marketing: Build a Relationship Marketing

Strategy One Customer at a Time, John Wiley & Sons

Beynon-Davis, P, 2004, E-Business, Palgrave Macmillian,

Basingstoke

Esteban, A. D., Gómez-Navarro, P. G., Jiménez, A. G.,

2000, Evaluating a User-Model Based Personalisation

Architecture for Digital News Services, in proceedings

of 4th European Conference, ECDL 2000, Lisbon

Instone, K., 2000, Information Architecture and

Personalization. An Information Architecture-Based

Framework for Personalization Systems, whitepaper,

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

46

at http://argus-

acia.com/white_papers/personalization.html

Mishkin, F, 2001, The Economics of Money, Banking and

Financial Markets, Addison Wesley, Boston

Spector, R., 2002, Anytime, Anywhere: How the Best

Bricks-and-Clicks Businesses Deliver Seamless

Service To Their Customers, Perseus Publishing,

Cambridge

Veale, S. R., 2001, Stocks Bonds Option Future, Prentice

Hall Press, New York.

Verhagen, T., July 1999, Towards an Internet-generation

Pre-transaction model, in Serie Research Memoranda,

Research Memorandum 1999-37, Vrije Universiteit,

Amsterdam, The Netherlands.

PERSONALISATION AND CUSTOMISATION - A strategic leverage to sustain e-trading market share

47