COMBINATION OF A SMARTCARD E-PURSE AND E-COIN TO

MAKE ELECTRONIC PAYMENTS ON THE INTERNET

Antonio Ruiz-Martínez, Antonio F. Gómez-Skarmeta

Department of Information and Communications Engineering, University of Murcia, Murcia, Spain

Óscar Cánovas

Department of Computer Engineering, University of Murcia, Murcia, Spain

Keywords: Smart card e-purse, e-cash, Internet payments, e-commerce.

Abstract: Nowadays e-purses are not being offered as payment method on the Internet. This is mainly due to the fact

that vendors have to integrate in their devices a security application module (SAM) to exchange security

messages between the e-purse and that module during the payment phase. In this paper we introduce a new

payment method that combines the main advantages of e-purses and the use of e-coins to make payments.

This proposal does not need a SAM to make and verify payments on the Internet. Furthermore, it does not

require the e-coin to be checked on-line. Thus, we introduce the possibility that this e-purse can be easily

integrated in payment applications that vendors offer on the Internet.

1 INTRODUCTION

Although smart cards acting as e-purses are more

secure than credit cards, and are very commonly

used in Automatic Teller Machines (ATMs), they

are not widely deployed as payment method on the

Internet. Nowadays, if a vendor wants to sell his

products on the Internet, by offering an e-purse as

payment method, he has to integrate, in his e-

commerce application, some points of sale (POS)

devices with some Secure Application Modules

(SAMs) to make the payment authentication

between e-purse and SAM (CEPSCO, 1999), (EMV,

2000). This integration is not so straightforward and

the transactions are slow due to the exchange of

some messages, through a HTTP/TCP connection,

between the e-purse and the SAM.

On the other hand, e-coins are more suitable to

make payments on the Internet because they are

based on sequences of bytes that can be easily

conveyed as part of the purchase information.

Besides, they can generally be checked via software

and therefore there is no need for special hardware.

In general, e-coins can be classified as generic or

vendor-specific depending on whether they can be

used with any vendor or only with a specific one.

The main advantage of generic e-coins is that they

can be used with any vendor. The main disadvantage

of the previously proposed schemes is that it is

necessary to check on-line, with the issuer, that the

e-coin was not previously delivered to another

vendor in order to avoid the double-spending

(Chaum, 1998, 2000), (Peha, 2003).

On the other hand, vendor-specific e-coins allow

a better control of double-spending because they are

controlled by the vendor. The main problem is for

the user, who has to deal with several issuers.

Besides, he could end up with an important quantity

of money which might not be used with any other

issuer (Glassman, 1995), (Rivest, 1996), or that

cannot be divided into smaller pieces, such as

Payword (Rivest, 1996). However, from the

vendor’s point of view, it is very easy to check or to

integrate e-coins in their system because all the

verifications can be done via software or using on-

line connections.

In this paper, we propose a new method that

combines the advantages of both e-purses and e-

coins. On the one hand, it is secure and portable as

an e-purse because is a payment application stored

in a smartcard. As any other e-purse system, e-

money can be spent with any vendor. On the other

hand, during the payment stage, the e-purse does not

203

Ruiz-Martínez A., F. Gómez-Skarmeta A. and Cánovas Ó. (2006).

COMBINATION OF A SMARTCARD E-PURSE AND E-COIN TO MAKE ELECTRONIC PAYMENTS ON THE INTERNET.

In Proceedings of the International Conference on Security and Cryptography, pages 203-206

DOI: 10.5220/0002104002030206

Copyright

c

SciTePress

exchange messages with a SAM, but it generates a

vendor-specific coin. This way the e-coin can be

checked without an on-line connection with the

bank. Furthermore, the vendor does not need any

hardware to receive e-coins from the e-purse.

2 SYSTEM DESIGN

Our business model is based on prepayment and the

participating entities are: client, vendor and e-purse

issuer (usually, a financial service provider).

In this model, an essential requirement is that

clients have a smart card with an e-purse which

contains a private key and an e-purse certificate as

the basis to make payments. It is worth noting that

this key never leaves the smart card. The idea is that

our e-purse, instead of exchanging APDUs with a

SAM, generates vendor-specific e-coins. Thus,

vendors only need to verify digital signatures and

certificates in order to accept payments. The e-purse

certificates are verified against a set of root

certificates from trusted issuers. Optionally,

depending on the issuer, vendor might need to

manage certificate revocation lists which would be

periodically distributed. Therefore, they do need

neither a SAM device nor making an on-line

connection for each payment. In this model, there

are two entities that can generate e-coins: the e-purse

issuer, to increase the card balance; and, the e-purse,

to make payments to vendors.

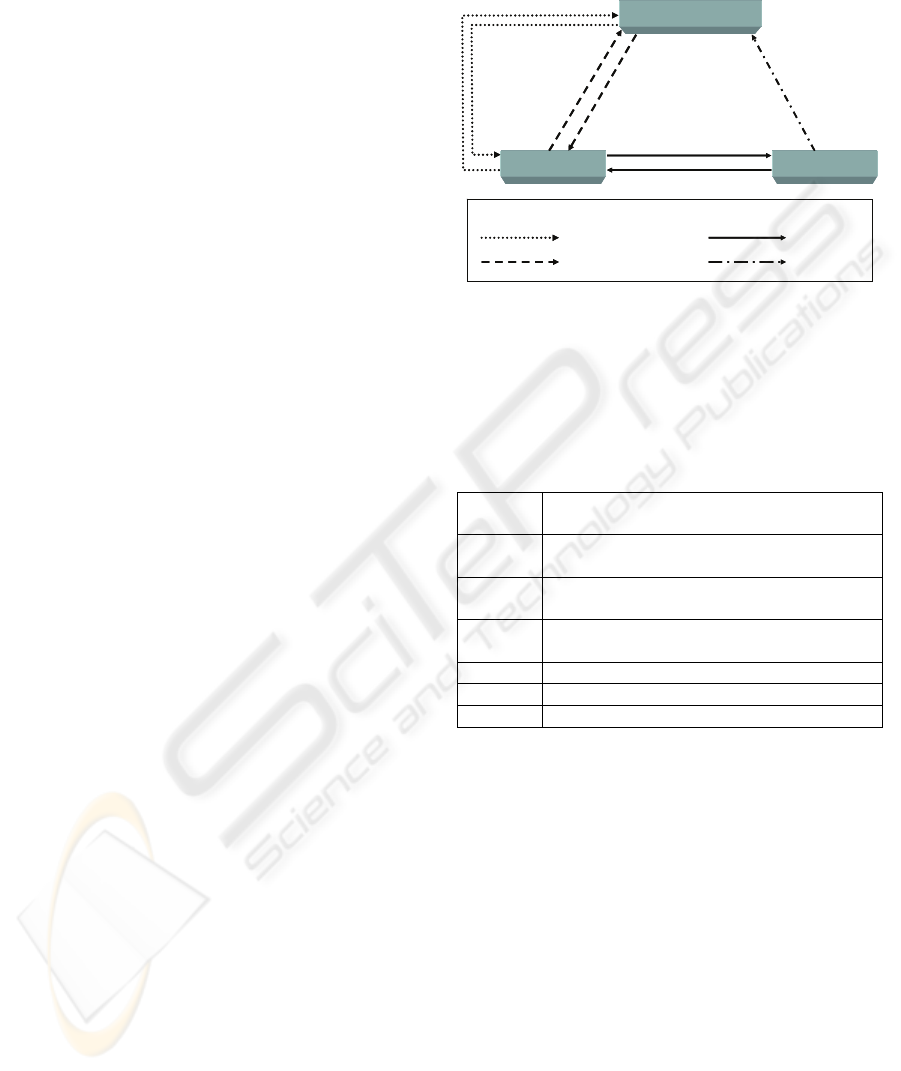

When the user obtains the e-purse, if the private

key and the certificate have not been previously pre-

installed, he has to make a process of certification as

it appears in phase I, in Figure 1 (e-purse

certification). This process is similar to request a

certificate to a PKI.

Before making payments with the e-purse, it is

necessary to load the e-purse with e-money. This

process is named e-purse load (Figure 1, phase II).

When a client wants to pay, the e-purse has to

generate a vendor-specific e-coin of the appropriate

amount. Next, the client sends the e-coin to the

vendor by means of a previously agreed protocol.

Then, he receives the product or the access to the

service. These steps correspond with phase III

(payment). Later, when the vendor estimates, he

sends to the e-purse issuer the e-coins received as

payment in order to be paid (phase IV-deposit). The

e-purse issuer is simply called issuer from now on.

His management tasks are vendor’s deposit of e-

coins, redemption of the e-coins received from

vendors, transfer the total amount to their accounts,

load of e-purses, operations related to certificates

and detection of possible frauds.

E-PURSE ISSUER

CUSTOMER VENDOR

III.1. Specific-vendor e-coin

III.2. Product or Service

II.2. Load response:

generic e-coin

II.1. E-purse load

request

IV.1. E-coins

deposit

I.2. E-purse certificate

I.1. E-purse request

Phase Caption:

I. E-purse certification

II. E -purse load

III. Payment

IV. Deposit

E-PURSE ISSUER

CUSTOMER VENDOR

III.1. Specific-vendor e-coin

III.2. Product or Service

II.2. Load response:

generic e-coin

II.1. E-purse load

request

IV.1. E-coins

deposit

I.2. E-purse certificate

I.1. E-purse request

Phase Caption:

I. E-purse certification

II. E -purse load

III. Payment

IV. Deposit

Figure 1: Business model.

2.1 Notation

In this section we describe the notation that we have

used in the specification of our e-purse.

Table 1: Notation.

[Data] It indicates that this piece of Data is

optional, and it could not be in the message.

H(Data) A message digest of Data, obtained using a

hash algorithm as SHA2.

|Data|

K

Data, encrypted by a symmetric cipher

using the key K.

{Data}

X

-

1

Data is signed using a private key of X.

X => Y It indicates that X sends one message to Y.

Ct, Vn Customer and Vendor respectively

EP, EPI E-purse and E-purse Issuer respectively.

2.2 E-purse Features

The e-purse stores the following information:

- Serial number (SN

E

). It is an array of bytes

identifying the e-purse univocally.

- Balance. This counter stores the actual amount

of money in the e-purse.

- Transaction counter. It stores the number of

transactions made by the e-purse, that is, the

transaction number (TN

E

). Each time an

operation is made, its value is increased.

- Private key. It is any asymmetric key that

supports digital signature operations.

- Certificate. It is generated by the issuer and it is

according to the X.509v3 certificate format.

- Issuer public key. This key allows checking the

information received from the issuer.

SECRYPT 2006 - INTERNATIONAL CONFERENCE ON SECURITY AND CRYPTOGRAPHY

204

The e-purse should also provide the usual operations

related to management of the private key and the

certificate as well as operations (query, update,…)

related to the fields mentioned in this section.

2.3 E-purse Load

The issuer can offer several payment methods to

increase the e-purse balance such as: credit cards,

bank transfers and so on. Besides the payment

information, the user sends some fresh information

to avoid replay attacks that could lead to increase

several times the e-purse. Once the payment is

made, the issuer mints an e-coin with this

information. This e-coin is sent to the e-purse and,

after being properly verified, the balance is

increased with the indicated amount. This is the

information exchanged during the load operation:

1. Ct => EP: (load initiation command)

2. EP => Ct: {SN

E

,TN

E

,RandNum}

E

-1

3. Ct => EPI:

(Payment,{SN

E

,TN

E

,RandNum}

E

-1

)

4. EPI=> Ct => EP:

{SN

E

,TN

E

,RandNum,Amount}

EPI

-1

2.4 E-coin

In this proposal, an e-coin has the following format:

e-coin

E

={SN

E

,VnID,TID,RandNum,Amount}

E

-1

where VnID is a vendor’s identifier (the hash of his

public key or an e-mail address). TID is a transaction

identifier which is provided by the vendor in the

payment process, and it is formed by the hash of the

transaction information. Finally, RandNum is a

random number.

2.5 Payment and Deposit

The payment process consists of generating a

vendor-specific e-coin that will be sent by the user to

the vendor using a previously agreed payment

protocol. When the vendor receives and verifies the

payment, he delivers or provides the request product

or service. In this section, we explain how an e-coin

is generated but we do not specify the protocol to

send the e-coin and receive the product since it is out

of the scope of this paper.

To mint an e-coin the e-purse needs the

information shown in the Step 1. Next, if there is

enough balance, the e-purse mints an e-coin and

decreases its balance.

When the vendor receives the e-coin and the

certificate, he checks that the certificate is still valid,

that the e-coin was signed with the private key

associated to that certificate, and the e-coin’s

amount. In that case, the vendor will provide the

product or service requested. It is worth noting that

there is no need for on-line verifications or SAM

modules. Next, we show the information exchanged.

1. Vn => Ct: (VnID, TID, Amount)

2. Ct => EP: (Command to generate e-

coin with VnID, TID, Amount)

3. EP => Ct:

{SN

E

,VnID,TID,RandNum,Amount}

E

-1

, Cert

E

4. Ct => Vn:

{SNE,VnID,TID,RandNum,Amount}

E

-1

, Cert

E

5. Vn => Ct: product or service

The vendor can store the different e-coins received,

which will be deposited at the end of each day (or

other suitable period) by sending them to the issuer.

In this way, the vendor will get paid.

3 SECURITY ANALYSIS AND

BENEFITS

In this section we analyze both the security of this

new e-purse and its main benefits. Regarding the

security analysis:

1. E-purse. The e-purse is a tamper-resistant

device that manages its private key and the

operations mentioned in section 2. This key

never cannot be exported in order to prevent the

generation of fake money.

2. Security in e-purse load process. The security of

the whole transaction depends on both the

protocol used to pay and receive e-coins, the

security of the e-coin itself and how is loaded in

the e-purse. The protocol to pay and receive the

e-coin is out of the scope of our proposal. This

process should be made using a fair protocol.

On the other hand, the security of the issuer e-

coin depends on the length of the issuer’s

private key. If the length is long enough we

could be sure that nobody, except the issuer, can

generate a valid coin. If the issuer’s private key

was compromised, the certificate would be

revoked. Thus, the e-purse increases its balance

after receiving an e-coin signed by the issuer

and containing the information indicated in step

2 of the load process.

COMBINATION OF A SMARTCARD E-PURSE AND E-COIN TO MAKE ELECTRONIC PAYMENTS ON THE

INTERNET

205

3. Security in e-coin generation process. If we

guarantee this process, we can be sure that

nobody, except an e-purse, could mint an e-

coin. To generate e-coins without the e-purse,

we would have to sign some information with a

private key which is certified by the issuer. So

the user should obtain an e-purse private key,

that is, he would have to hack the e-purse.

Anyway, the cost of such type of attacks might

be even higher than the benefit obtained.

Besides, after detecting fake money, the related

certificate will be revoked, and therefore the

private key. Finally, since we mint a vendor-

specific e-coin, only the true vendor can deposit

the e-coin.

4. Double-spending. The vendor uses TID value

provided during the payment phase, to check

whether the e-coin was previously delivered.

5. Security in a payment. In this phase the security

depends on both the security of the e-coins and

the payment protocol involved. The protocol

should guarantee fairness and provide enough

information to resolve conflicts.

6. Non repudiation. It is impossible to mint e-coins

unless e-purse private keys are compromised.

Therefore, any minted e-coin should be

accepted by a vendor except when it has been

previously delivered.

Next, we underline our proposal’s advantages:

1. Prepayment. Prepayment systems are well

accepted by both end users, since it is

comfortable and anonymous, and financial

entities since they receive the money in advance

2. Portability. User can convey comfortably his

money because is stored in his smart card.

3. Generic e-coins. “E-coins” contained in the

user’s e-purse are generic, and then, they can be

used with any vendor.

4. Divisibility. We can specify the exact amount of

e-coins.

5. Reduction of the number of elements in the

system. The vendors do not need either a SAM

or an on-line connection with the issuer to

verify e-coins. Therefore, the exchange of

messages to make a payment is reduced, the

payment process is faster and the costs of

transaction are lower.

6. Pay-per-click. This scheme could be easily

introduced to make payments-per-click as well

as in mobile phones or in Bluetooth devices.

7. ATM. Due to the fact that this e-purse has been

designed to avoid the on-line connection with

the issuer, it could be incorporated easily in any

POS (Point of Sale).

8. Anonymity. Since the e-coin does not contain

any personal information, the payment is

anonymous.

4 CONCLUSIONS

We have proposed a payment scheme based on e-

purses in which the payment can be checked by

software without having special keys in a SAM. Our

contribution solves this problem with a payment

method based on smart cards that combines the

advantages of an e-purse with the use of a vendor-

specific e-coins. Unlike others proposals, we do not

need the e-coin to be validated against a third party.

Besides, the e-purse can generate e-coins for any

vendor. In such way, we can conclude that the

incorporation of e-purse payment to the Internet

applications is facilitated against some previous

proposals.

As future research directions we are considering

the integration of this e-purse with a fair protocol.

ACKNOWLEDGEMENTS

This work has been partially supported by PROFIT

SESTERCIO FIT-360000-2005-23 project.

REFERENCES

CEPSCO, 1999. CEPSCO LLC: Common Electronic

Purse Specifications, March 1999.

Chaum, D., Fiat, A., Naor, M., 1988: Untraceable

electronic cash. In Advances in Cryptology-

CRYPTO’88, volume 403 of Lecture Notes in

Computer Science, pages 319-327. Springer-Verlag.

EMV, 2000 Integrated Circuit Card Specification for

Payment Systems, December 2000.

Glassman, S. et al, 1995: The Millicent protocol for

inexpensive electronic commerce. World Wide Web

Journal, 4th International WWW Conference

Proceedings, pages 603-618, December 1995.

GlobalPlatform, 2000: Open Platform Card Specification

v2.0.1. April 2000.

Peha, J. M., Khamitov, I.: Pay Cash, 2003: A secure

Efficient Internet Payment System. Proceedings of 5th

Intern. Conference on E-Commerce, October 2003.

Rivest, R. L., Shamir, A., 1996: Payword and Micromint:

two simple micropayment schemes. Proc. of Intern.

Workshop on Security Protocols, Lecture Notes in

Computer Science n 1189, p. 69-87. Springer, 1997.

SECRYPT 2006 - INTERNATIONAL CONFERENCE ON SECURITY AND CRYPTOGRAPHY

206