Honeynets in 3G – A Game Theoretic Analysis

Christos K. Dimitriadis

University of Piraeus, 80 A. Dimitriou, 18534 Piraeus, Greece

Abstract. Although security improvements were implemented in the air

interface of Third Generation (3G) mobile systems, important security

vulnerabilities remain in the mobile core network, threatening the whole service

provision path. This paper presents an overview of the results of a security

assessment on the Packet Switched domain of a mobile operator’s core network

and studies the benefits from implementing a Honeynet in 3G, by the

deployment of game theory.

1 Introduction

The improvement of 3G security mainly focuses on the air-interface, by implementing

mobile terminal to UMTS Terrestrial Radio Access Network (UTRAN) mutual

authentication, as well as solving a number of existing problems caused by

vulnerabilities of the underlying cryptographic technology of 2G [1]. Having these

features in mind, 3G mobile subscribers may feel more secure when connecting in 3G

networks. This sense of security however, could be proven of being more a perception

than a strict reflection of reality, if except from the UTRAN, we consider all elements

in the service provision path, including the mobile core network.

The 3G core network consists of the Circuit Switched (CS) domain, the Packet

Switched (PS) domain and the IP Multimedia Subsystem (IMS) [2]. The CS domain

serves traffic switching and signaling for voice mobile connections, linking the

UTRAN with other voice networks such as the Public Switched Telephone Network

(PSTN). The PS domain, serves traffic switching and signaling for data connections,

linking the UTRAN with other Packet Domain Networks (PDNs), including the

Internet. The IMS is a complementary subsystem, providing multimedia services over

the PS domain.

This paper identifies open security issues of the PS domain of 3G core networks.

The problem is defined by presenting vulnerabilities and threats identified through a

practical security assessment, which was enriched and validated by a desk research

study on core network security. The introduction of Honeynet technologies is studied,

as a cost effective solution that increases security and provides valuable knowledge to

the security engineers of the mobile operator, towards the addressing of the identified

security issues.

The paper is organized in two main sections, not including the introduction and

conclusions. Section 2, presents an overview of the results of a security assessment

that was conducted on the PS domain of a major mobile operator. This section is

K. Dimitriadis C. (2006).

Honeynets in 3G – A Game Theoretic Analysis.

In Proceedings of the 4th International Workshop on Security in Information Systems, pages 146-152

Copyright

c

SciTePress

enriched with key vulnerabilities of the PS architecture of mobile operators at a global

level, as reported in research papers. In Section 3, Game Theory is deployed in order

to formally present the security advantages from implementing a Honeynet in 3G, as a

response to the identified security issues.

2 3G core Network Security Assessment

During the recent years, mobile telecommunication networks were transformed from

infrastructures that provided voice and very limited data services to infrastructures

that provide a wide range of multimedia data services [3]. The outcome of this

transformation was far different from a mobile core network built from the beginning

according to an organized design based on the new requirements and specifications. It

was an upgrade of the existing closed Signalling System 7 (SS7) based networks to

Internet Protocol (IP) based systems that combined a number of old and new

technologies and applications under the pressure of timely service delivery start-up.

This situation created a number of security vulnerabilities, reported by several

studies in the field, including flat mobile core networks and management networks,

shared operations and management networks also connecting to corporate networks,

insecure billing an lawful interception connectivity, huge number of device logs, not

correlated and not manageable, lack of adequate security capabilities of legacy

systems and inadequate filtering on border gateways [4, 5 , 6, 7, 8].

A security assessment of the PS domain of a major mobile operator validated the

existence of these vulnerabilities and revealed some new ones. An overview of the

main groups of vulnerabilities discovered are presented below:

• Uncontrolled communication with roaming partners

• Insufficient or non-existent logging facilities

• Absence of programmed log inspection processes

• Lack of network intrusion detection or prevention systems

• Inadequate firewall architectures

• Inexistence of security layers depending on the security needs of each part of the

PS core network

Additionally, we discovered a number of non-network security related

vulnerabilities, such as inadequate access control mechanisms for all elements of the

PS core network and direct access of business users to critical systems, without an

adequate business need for justifying the risk.

These vulnerabilities lead to threats, including:

• Critical production systems, such as the Gateway GPRS

1

Support Nodes (GGSNs)

and Serving GPRS Support Nodes (SGSNs), exposed to attacks.

• Exposed GPRS gateways (SGSN and GGSN) may become vaulting houses for

attacking critical systems that are uncontrollably connected to them, such as the

Home Location Register (HLR), the Mobile Switching Center (MSC), the charging

gateways or the billing gateways. This threat reveals an incompetence of protecting

critical systems from attacks launched from the inside of the mobile operator.

1

General Packet Radio Service

147

• The core network of the mobile operator becomes a logical extension of the core

network of the roaming partner with limited control, exposing both to serious

threats, impacting security from and to external (roaming partners) nodes.

• The insufficient logging facility in combination with the non-existent intrusion

detection systems impacts the timely identification of an intrusion, as well as

forensics.

The above threats can be summarized as loss of confidentiality, integrity and

availability of critical data, including legal-sensitive subscriber personal data and call

details, as well as critical systems. All these vulnerabilities in correlation with the

increased business impact from the realization of a threat, reveal a lack of awareness

and knowledge of security issues regarding the PS domain of the mobile core

network.

3 Analysis through Game Theory

A Honeynet, is an architecture of information systems, whose value lies in

unauthorized or illicit use of that resource, in order to be able to learn from attacking

entities and improve the existing security architectures and systems [9]. Honeynets

include a gateway called honeywall, which controls and captures network packets, in

order not only to study them by also to protect other information systems from attacks

launched from the compromised systems of the Honeynet.

We assume a Honeynet architecture, called PSH_NET, operating in a 3G

infrastructure. PSH_NET, is preventive, since it can be used as a decoy, being an easy

target for attackers who are being distracted from the production systems of the

mobile operator. PSH_NET is also detective, since potential attacks to real systems

are detected and analyzed. PSH_NET is finally reactive, since the detection of an

attack warns the security engineers of the mobile operator and the knowledge gained

from the analysis of the attacks helps them improve the existing security architecture

of the mobile core network.

In order to study the benefits of deploying PSH_NET, we deploy Game Theory, as

a mean of formalizing the expressions of our rational. Game Theory is a set of applied

mathematical models which aim to study cooperative and confict interactions with

formalised incentive structures [10]. The foundations of Game Theory lie on the

publication of Augustin Cournot “Researches into the Mathematical Principles of the

Theory of Wealth”. Game theory was founded as a scientific field by John von

Neumann in 1944 by the publication of “The Theory of Games and Economic

Behavior”, which he wrote in collaboration with Oskar Morgenstern. John Nash

introduced in 1950 a principle called Nash equilibrium, proving that the best

responses of all players are in accordance with each other [11].

Our target is the comparison of a mobile operator that implements a Honeynet,

with a mobile operator that doesn’t and study different situations as far as security is

concerned. For this purpose, we define a game called PSH_NET-G. This game is non-

cooperative, since the mobile operators do not have a common security infrastructure

and static since players may make simultaneous moves. Furthermore, PSH_NET-G is

a non-zero sum game, meaning that the total benefit of all players in the game is not

148

zero, because there is no relationship between the gain of one player and the loss of

the other.

PSH_NET-G is a structure of a set of players (N), a set of strategies Σ and a set of

payoffs P, defined by the following expression:

∏

∈

→Σ

Ni

P

ι

π

:

(1)

where N={1,2}, Σ

ι

is the strategy space of player i and

N

RP →

is the players’

payoff at the end of the game.

We define two players, the Mobile Operator 1 (MO1), who is a mobile operator

that implements a Honeynet architecture, and Mobile Operator 2 (MO2), who is a

mobile operator who doesn’t. For each player there are two possible strategies, or

more precisely for our study, modes of behavior, depending on whether the player’s

nodes are compromised by the realization of a security incident, or not compromised:

• Σ1: compromised node behavior

• Σ2: normal node behavior

Forward to the above, Σ

ι

=(Σ1, Σ2). By following this logic, instead of traditionally

studying the gain of the possible moves of the players, we are studying the gain of

implementing or not a Honeynet in different security related situations.

The payoff receives specific values from a definite set P={P1, P2,…, Pm}. Let

each possible payoff Pi, where i={1,2,…,m}, be a sum of gains from Table 1,

depending on a specific condition.

Table 1. Gain types and values.

Gain ID Description Gain value

G

1

Self-security from internal nodes 10

G

2

Security from external nodes 10

G

3

Security to external nodes 10

G

4

Knowledge 10

G

5

Cost -5

The first three gains correspond to the threats described in the previous section,

including attacks from the inside, as well as attacks to and from external nodes

(especially roaming partners). The fourth gain corresponds to the knowledge

produced by a security architecture that is able to study attacks and evolve according

to the tactics of the attackers. The last gain is a negative one, corresponding to the

cost of an additional open source security architecture.

Forward to the above, Pi is defined by the following equation: Pi=a

1

G

1

+a

2

G

2

+

a

3

G

3

+ a

4

G

4

+ a

5

G

5

. The parameters a

n

={0,1} (n={1,2,3,4,5}), are 1 when the player

receives the corresponding gain in a specific condition and 0 in the opposite scenario.

The payoff matrix of a game shows what payoff each player will receive, as an

outcome of the game, depending on the combined actions of the players. The payoff

matrix of PSH_NET-G is presented in Table 2.

149

Table 2. Payoff matrix of PSH_NET-G.

MO2

Attack Normal

Attack 35,10 25,10

MO1

Normal 15,10 -5,0

In more detail, when both operators have compromised nodes, we have an Attack-

Attack condition, where MO1 receives all gains of Table 1, protecting its internal

nodes, preventing attacks to other mobile operators, gaining knowledge and also

paying the Honeynet cost. MO2, who does not implement the honeynet, receives only

gain G2, while being protected from the compromised node of MO1 (blocked by the

Honeynet), revealing a network gain for all players. In an Attack-Normal condition,

MO1, does not receive the G2 gain since MO2 is not attacking, but receives the rest

of the gains as in the previous condition. MO2, receives gain G2, like in the previous

condition. In a Normal-Attack condition, MO1 receives gains G2,G4 and G5, while

MO2 receives gain G3, since MO1 is protected by the Honeynet. In a Normal-Normal

condition there is no positive gain for the players, while MO1 pays the cost of the

Honeynet.

The payoff matrix reveals two Nash Equilibria. A Nash equilibrium is identified,

by marking the best responses of a player, taking as constant the response the other

player. For example if MO2 lies in an attack mode, the attack mode of MO1 is the one

with the greatest payoff for MO1. By marking in bold these payoffs, we identify two

Nash equilibria, Attack-Attack and Attack-Normal, which are the conditions that lead

both players to a mutual best advantage.

Analyzing the results of the game we conclude to the following:

• There is a net benefit for all players due to the implementation of the Honeynet,

shown in the Attack-Attack situation, since security depends on the security of

others. This net benefit could be increased by the proliferation of knowledge

gained by MO1.

• There are two Nash equilibria, Attack-Attack and Attack-Normal, revealing that

the implementation of a Honeynet is most useful for both players in these

situations.

• In the case that MO2 is compromised and forced to attack, there is a clear benefit

for the MO1, who implements the Honeynet.

• The highest payoffs are received by MO1, who implements the Honeynet, except

from the case that there is no security incident.

The possibilities, however, for the realization of no security incident are proven to

be very small, which when combined with the low cost of implementing open source

solutions, like Honeynets, reveal the cost effectiveness of Honeynets in 3G. In order

to prove more formally this expression, we use a concept of economics and finance

theory, called risk aversion [12]. An entity is risk averse, when it is willing to accept a

lower expected payoff if it means that it could have a more predictable outcome.

Mobile operators are a very good example of risk averse entities, in contradiction to

risk seeking entities, due to the increased business impact from the realization of a

threat in the PS, especially when the cost of a security solution is very low.

The following equation, represents the gain in security, as a function of the

monetary value that the entity is willing to invest in security: y=f(x). The f function is

150

convex, if the entity is risk averse, meaning that this entity is willing to invest more

money in order to have a more predictable result, and concave if the entity is risk

seeking, meaning that this entity is not willing to invest money in security and take

chances. The corresponding curves, which we should mention that they are inverted

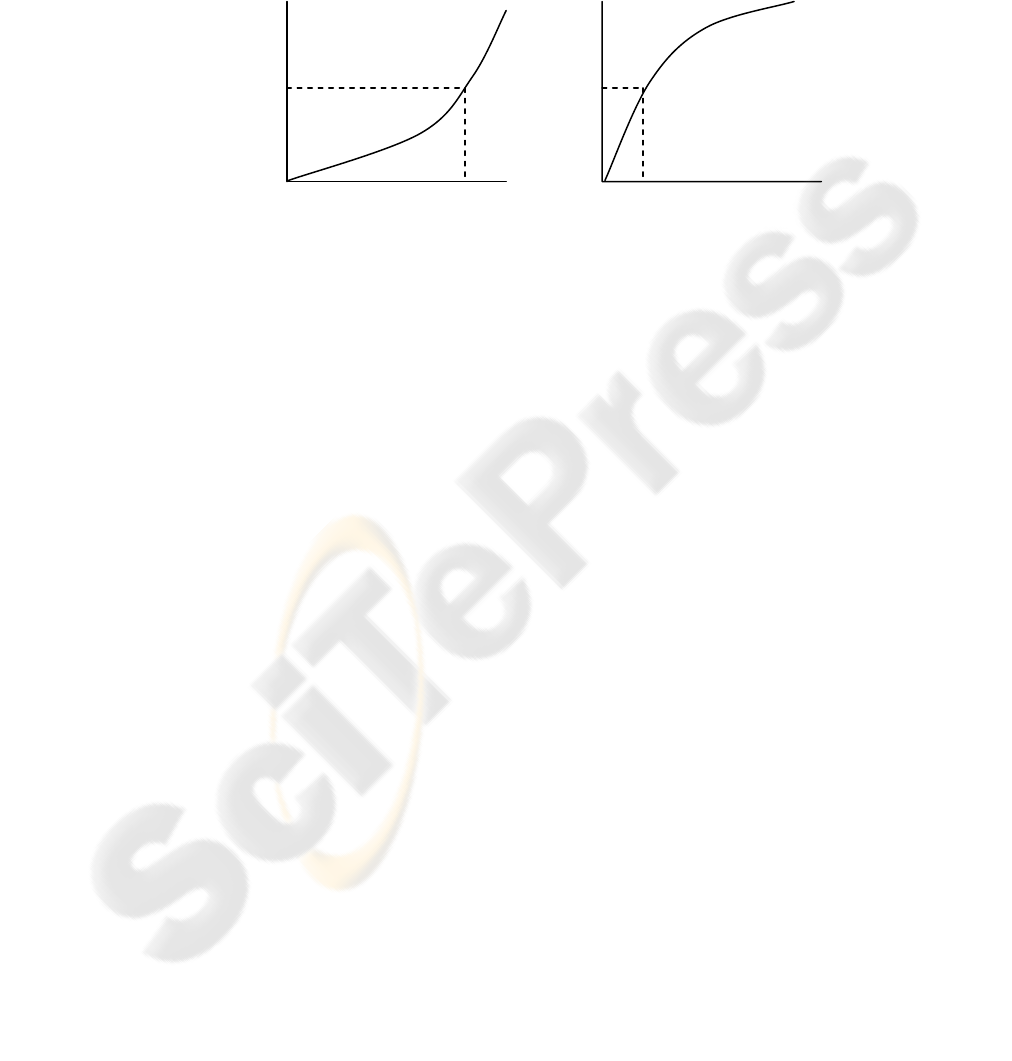

in gambling situations, are shown in Fig. 1.

Fig. 1. Risk averse and risk seeking behavior.

The dotted lines in Fig. 1, represent another concept called certainty equivalents,

meaning that if there is a 50% possibility for a security incident to occur, the first

entity would invest more money in order to ensure that it will be addressed by

countermeasures, while the second one would take more chances, building a less

expensive architecture. However, in the case of honeynets, y>>x, meaning that the

cost of an open source solution like a Honeynet is much smaller than the cost from a

security incident in a production system on a 3G architecture, where most applications

are time sensitive. Taking into account the results of PSH_NET-G and the results of

the risk-aversion study, we conclude that Honeynets are a cost-effective security

solution with important security benefits.

4 Conclusions and Future Work

Although the latest 3G standards and implementations improved UTRAN security,

important security issues remain in the mobile core network, threatening the whole

security chain. This paper presented a summary of the results of a security assessment

on the PS domain of a mobile operator’s core network and deployed game theory, in

order to study the benefits from implementing a Honeynet architecture in 3G.

The results of the game theoretic analysis in combination with the deployment of

risk-aversion theory concluded that PSH_NET is a cost-effective security solution

that provides important security benefits to mobile operators. PSH_NET is primarily

dealing with the lack of knowledge and awareness regarding specialized attacks

against the 3G core network, which leads to inadequate firewall and network intrusion

detection-prevention architectures, as well as to uncontrolled communication with

roaming partners.

x = monetary

y (utility =

security)

y (utility =

security)

x = monetary cost

151

Future work regards the implementation and practical testing of PSH_NET in order

to prove its advantages and contribution in practice.

References

1. Neimi, V., Nyberg, K.: UMTS Security. John Wiley & Sons (2003)

2. 3rd Generation Partnership Project: TS 23.002 - Network architecture (2004)

3. Wisely, D., Eardley, P., Burness, L.: IP for 3G—Networking Technologies for Mobile

Communications. John Wiley & Sons, ISBN 0-471-48697-3 (2002)

4. Whitehouse, O., Murphy, G.:Attacks and Counter Measures in 2.5G and 3G Cellular IP

Networks. @stake press (2004)

5. Kameswari, K., Peng, L., Yan. S., Thomas, F.,L,: A Taxonomy of Cyber Attacks on 3G

Networks. IEEE International Conference on Intelligence and Security (2005).

6. Donald, W., Scott, L.: Wireless Security Threat Taxonomy, IEEE Workshop on

Information Assurance (2003)

7. El-Fishway, N., Nofal, M., Tadros, A.: An Improvement on Secure Communication in PCS.

Performance, Computing, and Communications Conference, Conference Proceedings of the

2003 IEEE International (2003)

8. Mitchell, C. J.: Security for Mobility. IEE Telecommunication Series, 51, 2004.

9. The Honeynet Project Know Your Enemy. 2nd ed Learning About Security Threats.

Addison-Wesley (2004)

10. Osborne, M.J., Rubinstein, A.: A course in game theory, MIT press (1997)

11. Nash, J.: Equilibrium points in n-person games. Proceedings of the National Academy of

the USA 36(1):48-49 (1950)

12. Rabin, M.: Risk Aversion and Expected-Utility Theory: A Calibration Theorem,

Econometrica 68(5), 1281-1292, September (2000)

152