INFORMATION SYSTEMS INTEGRATION DURING MERGERS:

INTEGRATION MODES TYPOLOGY AND INTEGRATION

PATHS

Gérald Brunetto

CREGO Laboratory, University of Montpellier II, place Eugene Bataillon, 34095 Montpellier, France,

Keywords: Information system, integration, mergers, acquisitions.

Abstract: Today Information Systems (IS) integration constitutes one of the major success factors of mergers and

acquisitions. This article draws on two case studies of firms having realized more than 10 mergers and

acquisitions between 1990 and 2000. This paper shows the importance of carrying out an approach to

understand IS integration process. This approach represents the necessity of using organizational

configuration to define possible IS integration modes. Thus we show the importance of organizational,

strategic and technological contingencies within the elaboration of integration mode.

1 INTRODUCTION

Currently, mergers and acquisitions are increasing in

numbers and values. The carrying out of mergers

and acquisitions result in an economic and

organizationnal failure for more than 50% of

mergers (Cartwright & Cooper 1993 ; McKinsey

2000 ; Mercer Consulting 2001). The reasons for

explaining mergers failures have been largely put

forward and acknowledged. Strategic fit, although

necessary, is not enough to realize expected synergy.

Informational, cultural and human aspects are now

more and more evoked to account for the result

(Marks 1982 ; Shrivastava 1986 ; Buono, Bowditch

& Lewis 1988 ; Schweiger & Weber 1989 ;

Schweiger & Walsh 1990). It is now largely

established that a major part of mergers failures can

be explain by difficulties with methods, management

processes and information systems (IS) integration.

Then, once the merger or acquisition made

official, integration process is the true key to the

success of this project (Haspelagh et Jemison 1991,

Shrivastava 1986). The 2001 Mercer Consulting

study, about 159 transatlantic mergers between 1994

and 1999, mentions five central factors for the post-

merger integration. In addition to the importance of

human ressources and business preservation

problems, the need to integrate information systems

seems to be on of the main issues to settle in order to

achieve general post-merger integration.

“At the level of mergers, information systems

integration is an organisationnal and technical issue

largely underestimated. It’s not a matter of

administration detail but rather that of a key success

factor considering the way firms are operating

today” as informed a listed big French company

CEO (dec 2004). Hence, the particular integration of

information systems plays a crucial role in the

integration process. Nevertheless the failures

regarding information systems are numerous and

have serious effects on the operating and financial

results of merged firms. Information system

management and its staff are usually pushed aside

from negociation and assessment of the target firm

(Walton 1989).

Consequently, these actors and managers are in

charge of settling all the merging incompatibilities

only at the beginning of the integration process,

which generates several malfunctioning and

blocking situation: one of the argument used to

counteract the merger between Société Générale and

Paribas (two French banks) was the time necessary

to integrate the information systems. At Axa, in

2000, then three years after the merger with UAP,

we rated that information systems merger had just

been finished and had overcost the expected

amounts. At Total-Fina-Elf, six months after the

71

Brunetto G. (2007).

INFORMATION SYSTEMS INTEGRATION DURING MERGERS: INTEGRATION MODES TYPOLOGY AND INTEGRATION PATHS.

In Proceedings of the Ninth International Conference on Enterprise Information Systems - DISI, pages 71-77

DOI: 10.5220/0002348900710077

Copyright

c

SciTePress

merger, one of the source of staff demotivation lies

in the difficulties in information exchanges (data,

mail, ...). This prevented a well functioning of the

firm. The human factor is also often alluded to as a

problematic point. At Aventis, an executive tells that

the delay in the achievement of the information

system integration schedule was due to the fact that

it took 47 work council meetings to have the

integration project accepted. All these examples lead

one to wonder about the IS integration modes and

their implementation.

Nevertheless, literature on mergers and

acquisitions focuses primarily on financial aspects of

the acquisition process, the culture and

communication issues (Mirvis & Marks 1992), the

different general integration strategies (Haspelagh &

Jemison 1991) or also on the analysis of the general

organisational and strategic fit between merger firms

(Jemison & Sitkin 1986). If the latter research

benefits are fundamental to perceive and understand

the post-merger integration process in general, they

call for other specific researches regarding post-

mergers integration of IS. But, when IS integration

is dealt with, it remains mentioned only in

professional and industrial journals, where it focuses

on technical aspects of integration and deals them

apart from strategic and organizational contingencies

(Rubin 1992). In this literature, integration issues are

usually considered as technical incompatibilities

(Rosenberg 1987 ; Johnson 1989 ; Kubilus 1991).

Recent research provides us with elements on

post-merger information systems integration issues.

Part of this research gives priority to a technological

and computer approach of the IS integration process

(Giacommazzi, Panella et Pernici 1997, Pareek

2004), by proposing a classification which considers

the final configuration of the applications (software)

and the final configuration of the architecture of the

new IS. Another part of the research seeks to

identify key factors of success relative to the process

(Stylianou, Robbins, Jeffries 1996, Stylianou

Robbins 1999). These authors have developped a

research model explaining the variables that

determine the success of the IS integration process

during mergers and acquisitions as well as variables

which enable to measure this success. Another

approach consists in examining the role of

information systems in merger and acquisition

process (Stylianou et Robbins 1999, McKiernan

Merali 1995, Alaranta 2004). This work shows that

IS function has a reactive or a proactive role in

mergers and acquisitions, and asks the question of IS

strategic planning regarding merger process seen as

a whole and integration process in particular. If the

latter research applies to determining variables of the

IS integration process and their key factors of

success, nowhere can we see studies about the

process in progress as such.

Hence, the aim of this article is to provide a

description and a model of the IS post-merger

integration process from a holistic point of view, that

is to seek which are the possible IS integration

modes and how are they implemented in merged

companies.

2 CHARACTERIZATION OF IS

INTEGRATION PROCESS:

ANALYSES FRAMEWORK

IS post-merger integration consists of two

complementary and sequential aspects that we

should consider together in order to propose a

characterization of the process: the first one

concerns possible integration modes, the second one

deal with the implementation of the chosen

integration mode. Then, in this research, we define

IS integration process as an integration mode choice

and as an implementation of the chosen integration

mode in a same time.

We examine the IS integration process through

the theory of fit, enabling us to take into account

technological, orgnizational and strategic

dimensions in a congruent perspective (Buck Lew,

Wardle and Pliskin 1992). If we want to try and

understand how the (emerging or deliberate) choice

of the IS integration mode is made, three dimensions

must be integrated by firms into their integration

vision: a business strategy dimension, an

organizational dimension and an information

technology dimension.

Walton (1989) makes clear that “it’s essential for

a firm to incorporate these three perspectives into a

single vision and to consider each of these

perspectives during the merger process”. This type

of gestalt fit gives opportunity to supply with ideal

profile so as to better comprehend choices of IS

integration modes and to be able to build up a

multidimensional analysis frame. Then, we select a

fit configurational approach drawn from

organizational theories literature. We try to apply

and adapt it in order to analyse IS in mergers and

acquisitions contexts.

ICEIS 2007 - International Conference on Enterprise Information Systems

72

From this angle, organization tries to maintain

the consistency of its gestalt and, among

acquisitions, this maintaining attempt is diluted

because of the number of firms involved. Although

rarely used and capitalized in IS research (Iivari

1992), this fit configurational approach is considered

as the most appropriate way to analyse complex

organizations (Van de Ven & Drazin 1985 ; Miller

1987 ; Meyer & al 1993), which is perfectly the case

of mergers and acquisitions. Thus, merged firms

must choose and implement an IS integration

process allowing them to make consistent their

organizational, strategic and technological

configuration. This compatibility of these three

dimensions, as we showed previously, should be

understood and examined as a single vision (Walton

1989 ; Weber et Pliskin 1996). So, the

configurational approach leads us to keep as a

theoretical framework the MIT works (Scott Morton

1991).

Figure A: Analysis framework from MIT works (Scott

Morton 1991).

The term “configuration” is usually employed in

computer science in a technological perspective,

considering that it constitutes a type profile of

equipement and software designed for a predefined

and definite use. In our analysis framework, “IS

configuration” designates a configurational

representation of the IS dimension. This IS

configuration includes structural contingencies,

management processes and roles of people and

actors belonging to or users of IS function in the

organization. This cares for both organization

(structure and roles definition), technology, strategy

and above all the importance of actors (employees,

managers, consultants) in a reactive and proactive

dimension, makes it possible to present a theoretical

analysis framework of IS configuration of

integration process during the merger, and to

understand the already or emerge integration choices

according to compatibilities or incompatibilities

between the firm’s IS involved. We postulate indeed

that the existing or no compatibility between the two

firms IS involved in merger results from the

similarities of their respective IS configurations.

3 METHODOLOGY AND CASE

PRESENTATION

3.1 Methodology

The chosen method to construct cases is that of

retrospective stories. We chose a technique close to

Yin’s (1990) to reconstruct IS integration and

mergers stories. The latter calls for primary data as

main data source (interviews in total with many

varied actors from 2002 to 2005) and secondary data

to complete it (internal documents, records, press).

We chose to carry out a process analysis by

exploring IS integration process development

phases.

3.2 Data and Results

3.2.1 Data

Our work relies on the analysis of two big French

companies specialized in real estate construction

industry which both engaged in mergers and

acquisitions between 1990 and 2004 (10 in total).

These cases recount IS integration process stories

among both studied mergers. This choice is based,

on the one hand, the will to make comparable

regularities emerge in different post-mergers IS

integration situations and, on the other hand, the

wish to determine the similarities and divergences

between the different studied cases as to elaborate a

generic model putting emphasis on behaviour

patterns adopted within the IS integration process.

3.2.2 Results

The two firms examined, MFC and Geoxia, work in

a fragmented industry. This triggered off external

growth wave which allowed these two firms to buy

up their business rivals. Geoxia started to apply this

policy from the early 90’s, that is, in the middle of

the industry crisis in order to reach the critical size

and continued it up to now. MFC has launched in

acquisitions after its finance listing at the Paris stock

exchange in july 2000. So, the two groups have

competing acquisitions policies during the same

periods (2000-2005).

INFORMATION SYSTEMS INTEGRATION DURING MERGERS - Integration Modes Typology and Integration Paths

73

MFC acquisitions serve a market strategy, i.e. an

increase in profitability, market shares and

economies of scales. Concerning IS function, the

strategic aim is clear: cost rationalization and

reduction. MFC adopts a steady integration mode

and applied in a uniform manner for each acquisition

: MFC information system is applied to the acquired

firm in order to establish a centralized control and to

improve the financial situation. IS configurations of

MFC and other acquired firms are very far away

from each other in terms of technology, management

process, structure and culture. We sum up these

operations characteristics in the following table 1.

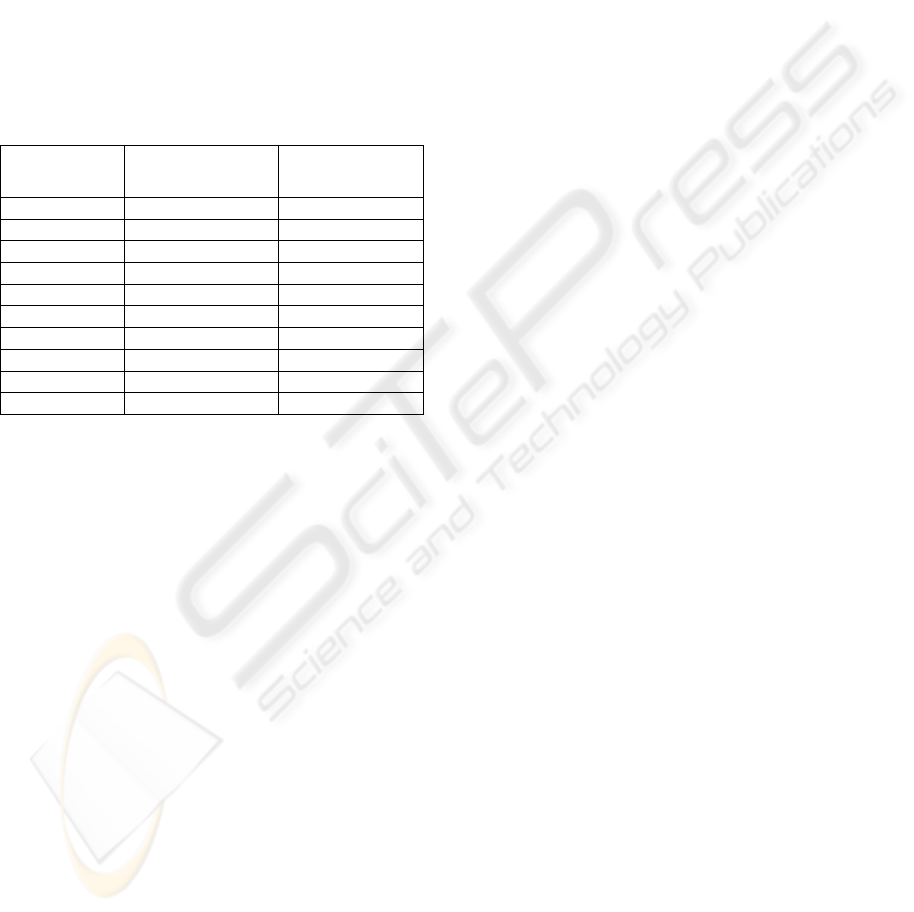

Table 1: Mergers and acquisitions realized by the two

groups between 1990 and 2004.

Acquisition

Date

Purchaser Acquired

07/2000 MFC OCR

06/2001 MFC Berval

07/2002 MFC GHPA

07/2003 MFC Bruno Petit

10/2004 MFC Horizons

12/1989 GEOXIA H-France

03/1991 GEOXIA MFamiliales

10/1992 GEOXIA MBouygues

02/2002 GEOXIA DCA

04/2002 GEOXIA Stylgit

Geoxia group begins its purchasing policy in

following a market strategy as well. Geoxia

configurations and those of its first acquisitions are

quite similar: same structure, same management

process, close technologies. Contrary to MFC,

Geoxia experiences an integration mode based on

setting up a simple link between technologies and

conversion procedures. The merged firms IS are

kept as they are and must cohabit. Then, Geoxia is

aiming at the cheapest IS integration in an industry

crisis context.

The merger with Maisons Bouygues in 1992

marks a change of integration mode. Their IS

configurations are incompatible due to the structures

in place, the formalization level, the technologies

employed and the different cultures in the computer

departments. In addition, this merger aims at other

strategic goals based on synergies seeking and a

market leader group identity creation leading to

value creation for customers and shareholders. This

results in an integration which finds expression in a

radical overhaul of IS. It takes three years for the

new set to take shape. Business processes are

rethought, structures are modified, previous systems

are given up to the benefit of a new architecture.

New IS will act as an integration catalyst during the

last group acquisitions in the 2000’s.

New integration mode: since its new IS

implementation at the end of 1999, Geoxia holds an

atypical configuration compared with other market

actors, which remain less formalized, less structured

and technologically less equiped. The studied IS

configurations are witnessing strong

incompatibilities, coupled with an integration

strategy turned to integration cost cutting and

rationalization. IS integration mode corresponds to

absorption: Geoxia IS is applied to acquired firms.

Geoxia relies on its IS to accelerate the general

integration phase: better financial consolidation,

building sites management centralization,

accelerated reporting, ... Thus, in the space of 14

merging years, three integration modes have

succeeded as regards IS.

4 DISCUSSION

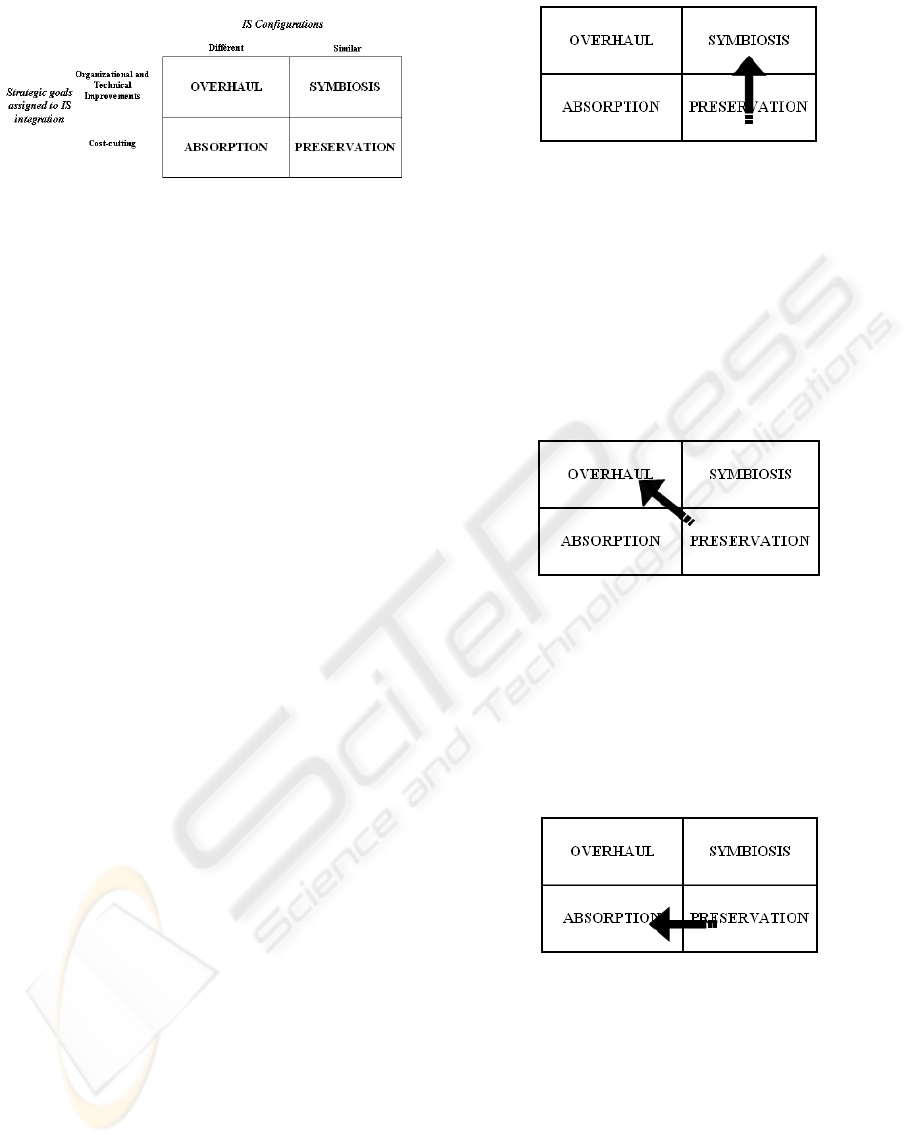

4.1 An Emerging IS Integration Modes

Typology

Exploration of these firms, having each experienced

more than 5 mergers during a long period, enable us

to propose a typology presenting several

combinations within a matrix built up on two axes :

the degree of IS configurations compatibility, and

the strategic goals assigned to IS function.

Overhaul. In incompatible IS configurations

cases, overhaul process constitutes the hardest

process to implement. It requires management

process reconstruction of each firm to integrate,

architecture and IS structures conception, an

overhaul of technological elements. This process led

by Geoxia illustrates the organization will to create

synergies and value in spite of initial disparities

presented by each firm IS configuration. However, a

major risk is inherent in this approach : attempting to

adopt individual components stemming from each of

the present configuration, and trying to merge them

into a new configuration may lead to failure because

of the discrepancy inside entities interdependents

components to integrate and because of the

discrepancy between the two underlying

organization schemes.

ICEIS 2007 - International Conference on Enterprise Information Systems

74

Figure 1: IS integration modes typology.

Absorption. Resolving different IS

incompatibility occurs through an absorption process

as well. So, integration issue is largely simplified to

the extent that one configuration absorbs the other

one. Present risks in the overhaul process are

strongly reduced making migration the preferred

process in an incompatibility context (process

immediately chosen by MFC from 2000 at the time

of its acquisitions, then by Geoxia in 2002 to make

its new IS pay). Neverthless other risks of different

kinds are emerging : risks of destroying acquired

firm initial value, change reluctance, no-

acknowledgement of acquired firm IS specificities.

Symbiosis. In the case of IS configurations

compatibility synergies can be achieved more easily.

The symbiosis process appears to be as the process

to be preferred to take advantage IS configurations

proximities offered by the connection established

between the firms. Here IS acts as a synergies

catalyst and makes it possible to turn strategy to

value. Firms examined here didn’t allow us to

observe such a case.

Preservation. In the case where goals declared

by the acquired firm depend upon cost-

rationalization or cutting, preservation process

permits to answer positively to this situation. Indeed,

configurations compatibility allows the possibility to

minimize integration costs and to establish a

minimal technological, structural and organizational

coherence in the merger of the two firms concerned

(Geoxia case). Basic technical or procedural links

are then set up (two front offices, two back offices)

in order to fulfil these objectives.

The longitudinal study of these two groups

reveals several integration paths leading from one

mode to another one. We strive to identify and

explain them.

Path n°1: A strategy change turn toward

integration to symbiosis. Merged firms make the

most of their configurational compatibilities in order

to generate value and synergies

Figure 2: Path n°1.

Path n°2: Merged companies configurational

compatibility moves with time to an incompatibility

due to technological initiatives, process changes or

structures done separetly by firms. The Geoxia case

from 1993 illustrates this transition. The sliding

move to these configurations and the change in

strategy decided by the new management enforced

in 1994 explain the IS overhaul giving a new

character to integration process.

Figure 3: Path n°2.

Path n°3: Same sliding move as for path n°2,

but the strategy assigned to IS remains focused on

observed when purchaser and acquired firm have

similar configurations. The fact that the acquired

firm commits to a change in its IS (for instance an

ERP implementation) leads to an automatic

alignement of the acquired firm’s configuration.

Figure 4: Path n°3.

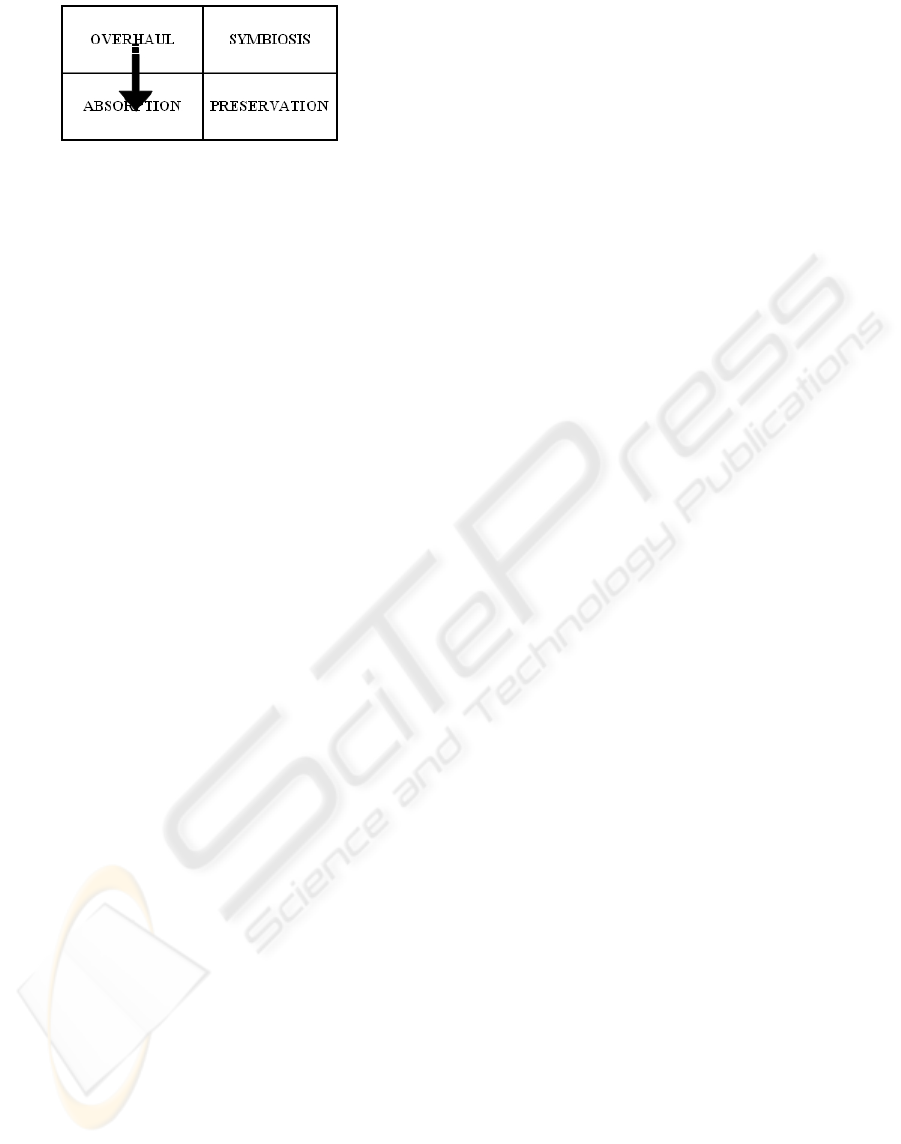

Path n°4: Purchaser strategy is modified in order

to make the investments undertaken in IS overhaul

pay. The latter is then assessed as an integration

catalyst. The new acquisitions whose configuration

is close to that of the purchaser find themselves

forced to apply purchaser IS in the perspective of

“copy-pasting” style. Integration process led by

Geoxia between 1999 and 2002 follows this path.

INFORMATION SYSTEMS INTEGRATION DURING MERGERS - Integration Modes Typology and Integration Paths

75

Figure 5: Path n°4.

5 CONCLUSION

Our research doesn’t focus on the integration

failures reasons. It aims to offer an understanding of

the construction, implementation and issues related

to IS integration process by integrating strategic,

organizational and technological contingencies. So

this research aims to make clear which integration

type should be set up related to the IS getting

merged, and to define the pooling of the different IS

during this integration process. Similarly, this

research is about the degrees of this integration and

the actors characterization, their role in the

participation in the process as well as the

interactions between the same actors.

We carried out two case-studies reflecting

different IS integration process approaches. We

considered temporality each of these actions and

their intervention levels in the process. The research

results enable us to identify the determinants of the

possible IS integration modes. We suggest an

approach insisting on contingencies leading to

absorption, preservation, symbiosis and overhaul

modes. For this purpose, we put forward the

necessity to take into account a vision based on

organizational, strategic and technological levels. So

configurational approach allows to show the

importance of fit between two merged firms within

the IS integration process. This fit between these 3

levels makes it possible to understand IS integration

process and to characterize it according to two

perspectives : chosen or emergent integration mode

and dynamics implementation of this mode.

If mergers and acquisitions are two of the main

focuses of media attention at the announcement

time, they constitute operations hard to study due to

their strategic and confidential nature, namely at the

integration phase. In order to consolidate our results,

we advocate to extend our study field to other firms

belonging to different industry sectors. This

perspective would permit to refine our analysis and

more particulary one integration mode (symbiosis)

that we couldn’t observe in our field and which

remains a theoritical conclusion in our research.

Similarly, it ought to enhance the possible

complementarities between the two dynamics

noticed in our study in other case studies.

REFERENCES

Alaranta, M., Parvinen, P. (2004). Contribution of

Governance Theories of the Firm to the Analysis of

M&A and Post-Merger Integration of the Information

Systems. Conference paper: IRIS27, Falkenberg,

Sweden.

Buck-Lew, M., Wardle, C. E and Pliskin, N. (1992).

Accounting for Information Technology in Corporate

Acquisitions. Information & Management, vol. 22, No.

6, p. 363-370.

Buono A.F., Bowditch J.L., Lewis J.W. (1988). The

cultural dynamics of transformation :the case of a

bank merger. Corporate transformation:revitalising

organizations for a competitive world. San

Francisco:Jossey-Bay, p.497-522

Cartwright S., Cooper C.L.(1993). The role of culture

compatibility in successful organizational marriage.

Academy of management executive vol7 (2), p. 57-70

Giacomazzi F., Panella C., Pernici B. (1997). Informations

systems integration in mergers and acquisitions : a

normative model. Information and Management, 32, p.

289-302

Haspeslagh P.C., Jemison D.B (1991). Managing

Acquisitions : creating value through corporate

renewal. The Free Press

Iivari J. (1992). The organizational fit of information

systems. Journal of Information Systems, vol. 2, No 1,

p. 3-30

Jeminson, D., Sitkin, S. (1986). Corporate Acquisitions: A

Process Perspective. Academy of Management

Review, vol. 11, No. 1, p. 145-163.

Johnson M. (1989). Compatible information systems a key

to merger success. Healthcare Financial Management,

43, 6, p. 56-62

Kubilus N., (1991), ”Acquired and abandoned”, Journal of

Information Strategy : The executive’s journal, Vol.7,

n°2, p.33-40.

Marks M.L. (1982). Merging human ressources. Mergers

and Acquisitions, 17, 2 p. 38-43

Markus, M.L. (2000). Paradigm shifts, E-Business and

Business/Systems integration. Communication of the

AIS, vol.4 N° 10, p.1-45

Markus, M.L. (2001). Reflections on the systems

integration enterprise. Business Process Management

Journal, vol.7, N°3, p.171-176

McKinsey (2000). Why mergers fail. McKinsey Quartely

vol.4

McKiernan, P., Y. Merali (1995). Integrating information

systems after a merger. Long Range Planning, vol. 28,

no. 4, p. 54-62.

Mercer Consulting Group (2001). Trans-Atlantic mergers

and acquisitions:review of research findings

ICEIS 2007 - International Conference on Enterprise Information Systems

76

Meyer, A., Tsui, A., Hinings, C. (1993). Configurational

approches to organizational analysis. Academy of

Management Journal, Vol. 36, No 6, p. 1175-1195

Miller, D. (1987). The genesis of configuration. Academy

of Management Review, Vol. 18, No 1, p.687-701.

Mirvis P & Marks ML (1992). The human side of merger

planning : assessing and analyzing fit. Human

Resource Planning, Vol. 15, No 3, p. 69-92

Napier N.K. (1989). Mergers and acquisitions, human

resource issues and outcomes : a review and

suggested typology. Journal of management studies,

n°26, p.271-289

Nonaka, I. (1988). Creating organizational order out of

chaos: self-renewal in Japanese firms. California

Management Review, spring, p.57-73

Pareek, M. (2004). IT gouvernance and post-merger

systems integration. Conference paper: K-Net ISACA

Robbins, S. S., Stylianou, A. C. (1999). Post-merger

systems integration: the impact on IS capabilities.

Information & Management, vol. 36, no. 4, p. 205-

212.

Rosenberg R. (1987). Network trauma: making ends meet

when two firms merge. Data Communication, 16,8, p.

102-111

Rubin H. (1992). The intricate process of merging two

bank information systems. The Bankers Magazine,

sept-oct, p. 72-77

Schweiger D.M, Walsh J.P. (1990). Mergers and

Acquisitions: an interdisciplinary view. In Ferris G.R.

and Rowland K.M. Research in personnel and human

resources management. JAI Press, Vol.8, p. 41-107

Schweiger D.M., Weber Y. (1989). Strategies for

managing human resources during mergers and

acquisitions : an empirical investigation. Human

Resource Planning, Vol. 12, No 2, p. 69-86

Scott Morton, M. (1991). The corporation of the 1990s:

Information Technology and Oganizational

Transformation. Oxford University Press, New York

Shrisvatava P. (1986). Post-Merger Integration. Journal of

Business Strategy, Vol. 7, No 1, p.65-76

Stylianou, A. C., Jeffries, C. J., Robbins, S. S. (1996).

Corporate mergers and the problem of IS integration.

Information & Management, vol. 31, no. 4, p. 203-

213.

Van de Ven, A., Drazin, R., (1985). The concept of fit in

contingency theory. Research in Organizational

Behaviour, No 7, p. 333-365.

Walton R.E. (1989). Up and runnig : Integrating

information technology and the organization. Harvard

Business School Press, Boston, MA

Weber, Y., Pliskin, N. (1996). Effects of information

systems integration and organizational culture on a

firm's effectiveness. Information & Management, vol.

30, no. 2, p. 81-90.

Weick, K. E. (1977). Organization Design: Organizations

as self-designing systems. Organizational Dynamics.

Autumn, p. 31-46

Yin, R.K. (1984). Case study research. Beverly Hills.

Sage

INFORMATION SYSTEMS INTEGRATION DURING MERGERS - Integration Modes Typology and Integration Paths

77