SUBJECTIVE PREFERENCES IN FINANCIAL PRODUCTS

Emili Vizuete Luciano and Anna Mª Gil Lafuente

Department of Business Administration, University of Barcelona

Av. Diagonal 690, 08034, Barcelona, Spain

Keywords: Fuzzy Sets, Finance, Subjective Preferences.

Abstract: When the decision maker invests in the banking organizations, he is faced with the need to choose between

apparently different products. The financial advisers have to offer an agile and well-qualified service to be

able to continue counting on the confidence of their customers and to increase their results consequently. In

this paper, presents a further step in justifying such evalutation. Results from the proposed approach present

a better undestanding of each system to decision makers for evaluating justification issues which sometimes

cannot be defined.

1 INTRODUCTION

With increasing frequency it can be seen that new

products appear on the market under many different

forms that, either real or apparent, have different

characteristics. It should not be forgotten that the

strong competition characterising the financial world

obliges those offering payment means to a great

effort of diversification and differentiation of

products that permits them, on the one hand, to

cover the widest range of possible users and, on the

other, provoke a flaw by means of the presentation

of different products with the object of get around

the laws of the perfect market.

Evidently that for each business, and even for

each specific situation, there will be a different

valuation of each one of the characteristics of the

financial products (Zadeh, 1971).

In this context two fundamental elements appear

that make up the problem:

1) Differentiation in the characteristics of

each one of the financial products on offer.

2) Different estimate, by the acquirer, of each of

the characteristics relative to the rest, which

provides an order of preference.

Evidently, the degree of preference for each one

of the characteristics relative to the others may

sometimes be determined by means of

measurements, that is, with an objective nature, but

on other occasions it will be necessary to resort to

subjective numerical situations, that is by means of

valuations.

With all this an attempt is made to arrive at

certain results that express the order of preference

between different financial products to which a

business may opt. The subjective nature of the

estimated values should lead to certain conclusions

that can be expressed by means of fuzzy sets

(Bustince & Herrera, 2008).

2 PROBLEM FORMULATION

We start out from the existence of a finite and re-

countable number of financial products

P

1

,P

2

,..., P

n

,

which each posses certain determined characteristics

C

1

,C

2

,...,C

m

in such a way that for each

characteristic it is possible to establish a quantified

(objective or subjective) relation of preferences.

Therefore for

C

j

we have that: P

1

is preferred

μ

1

/

μ

2

times over P

2

,

μ

1

/

μ

3

times over P

3

, …,

μ

1

/

μ

n

times over

P

n

, …,

P

n

is preferred

μ

n

/

μ

1

times over

P

1

,

μ

n

/

μ

2

times over P

2

, …,

μ

n

/

μ

n

−

1

times over

P

n-1

.

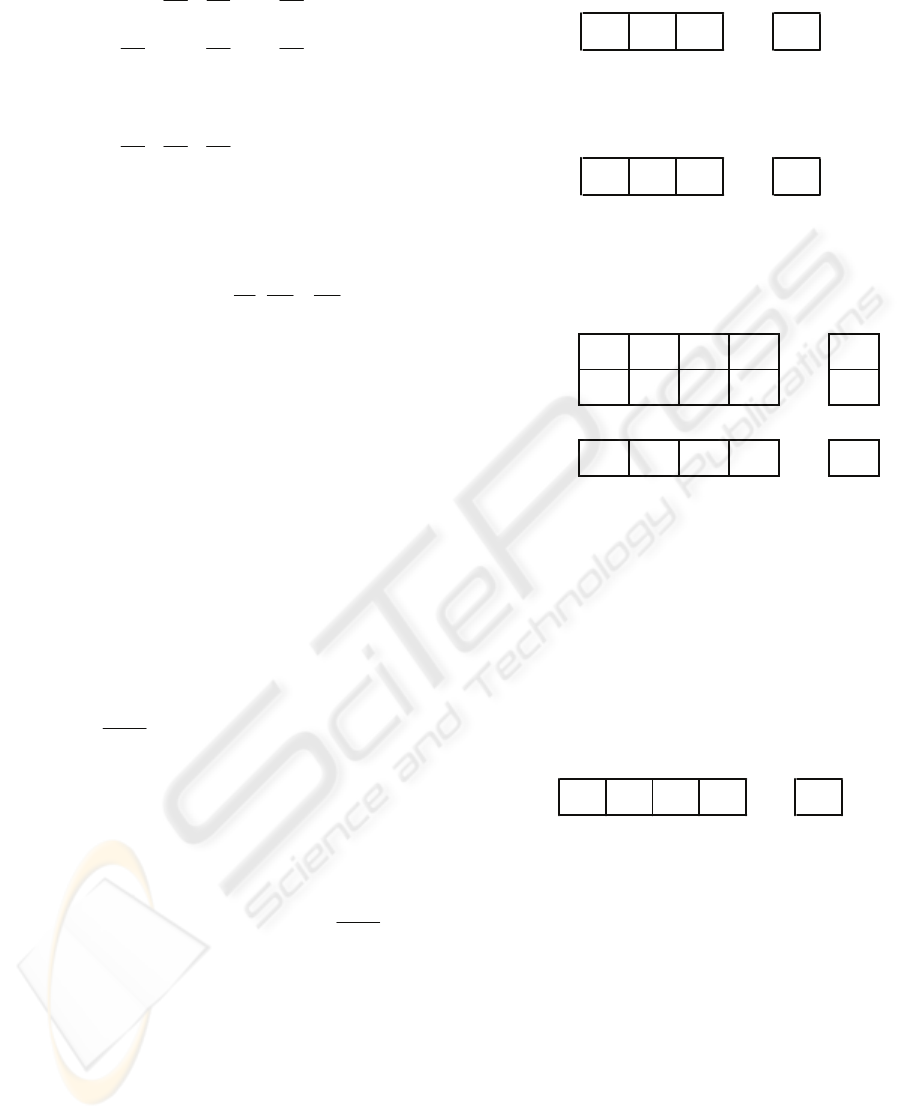

With this previous relation of preferences we

will be able to construct the following matrix, which

will be reflexive and reciprocal by construction:

407

Vizuete Luciano E. and M

a

Gil Lafuente A. (2008).

SUBJECTIVE PREFERENCES IN FINANCIAL PRODUCTS.

In Proceedings of the Tenth International Conference on Enterprise Information Systems - AIDSS, pages 407-410

DOI: 10.5220/0001676904070410

Copyright

c

SciTePress

[C

ij

] =

1

μ

1

μ

2

μ

1

μ

3

...

μ

1

μ

n

μ

2

μ

1

1

μ

2

μ

3

...

μ

2

μ

n

... ... ... ... ...

μ

n

μ

1

μ

n

μ

2

μ

n

μ

3

... 1

⎡

⎣

⎢

⎢

⎢

⎢

⎢

⎢

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⎥

⎥

⎥

⎥

⎥

⎥

(1)

This matrix is also coherent or consistent,

(Dubois & Prade, 1995) since the following is

complied with:

∀i, j,k ∈ {1, 2, ..., n},

μ

i

μ

j

⋅

μ

j

μ

k

=

μ

i

μ

k

(2)

For this reason we are going to consider certain

properties (Vasantha, 2007), those in which all the

elements that are members of

R

0

+

:

a) A positive square matrix posses a

dominant value of its own l real positive which is

unique for which what is complied is that

λ

≥ n,

where n is the order of the square matrix.

b) The vector that corresponds to the dominant

own value is found also formed by positive terms

and when normalised, is unique.

When

λ is a number close to n it is said that the

matrix is nearly coherent; on the contrary it will be

necessary to make an adjustment between the

elements of the matrix (Gil Aluja, 1998 & 1999), if

wanting to use this scheme correctly. It is considered

that

λ−n or

λ−n

n

is an index of coherence. As is

very well known, when a reciprocal matrix is also

coherent it complies with

[C

ij

] ⋅[v

i

]

T

= n ⋅[v

i

]

T

where

[v

i

]

T

is the transpose of row i.

When the reciprocal matrix is not coherent, we

write:

[C

ij

] ⋅[ ′ v

i

]

T

=λ⋅[ ′ v

i

]

T

. We accept [

′

v

i

] as the

result when the index of coherence

λ

−

n

n

is

sufficiently small.

For each characteristic

C

j

, j = 1, 2, ...,

m

the

corresponding reflexive and reciprocal matrix

[C

ij

]

is obtained. Once the m matrices are constructed the

dominant own values

λ

j

and their corresponding

vectors

[

]

nj

X

ij

X ...

must be found for each one,

verifying if they posses sufficient consistency by

means of the «index of coherence».

The elements of each corresponding own vector

will give rise to a fuzzy sub-set:

…

=…

P

1

P

2

P

3

P

n

X

j

x

1j

x

2j

x

3j

x

4j

which once normalised in sum equal to one will

be:

…

=…

P

1

P

2

P

3

P

n

D

j

p

1j

p

2j

p

3j

p

4j

The

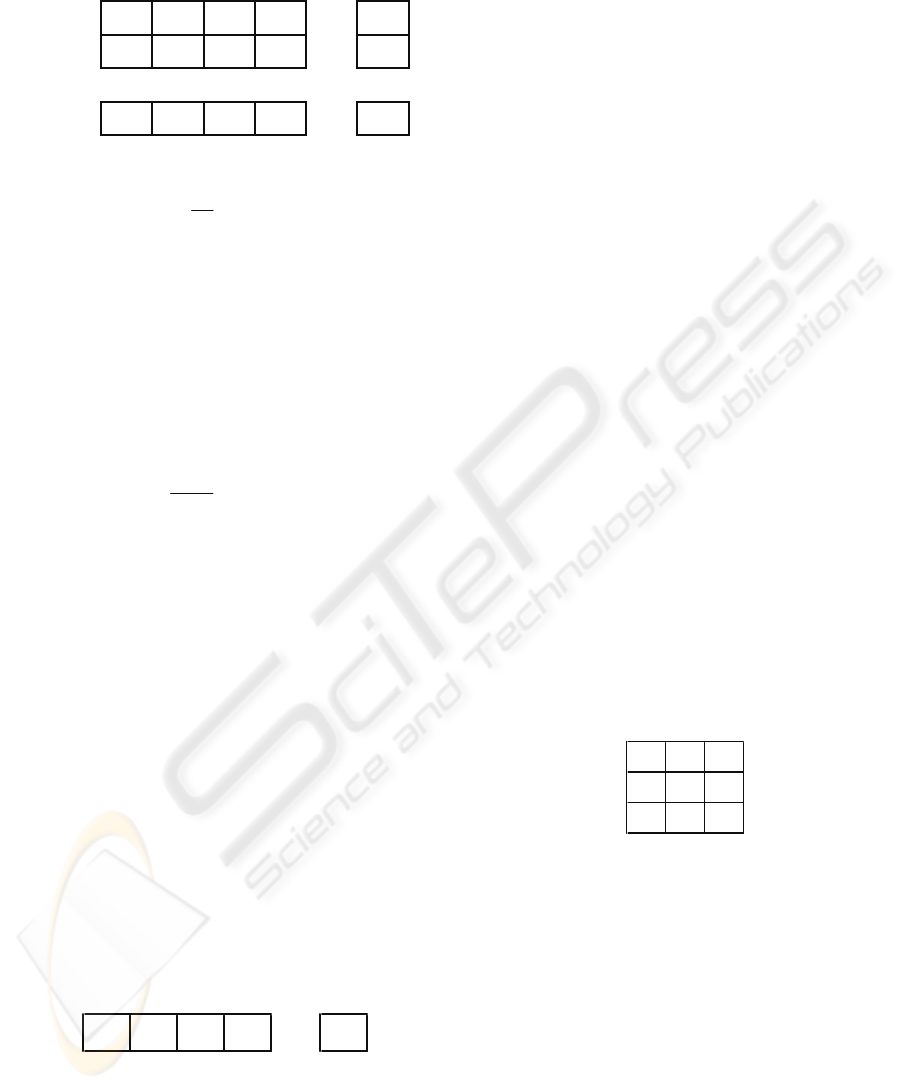

m own vectors are regrouped forming a

Matrix 1, the form of which will be:

Matrix 1

C1

C2

C3

C4

Cm

P1

P11

P12

P13

P14

…

P1m

[Pij]=

P2

P21

P22

P23

P24

…

P2m

… …

…

…

…

Pn

Pn1

Pn2

Pn3

Pn4

…

Pnm

Each column of this matrix brings to light the

relative degree in which a characteristic is possessed

by all the financial products. As we have already

pointed out, this can be represented by a normalised

fuzzy sub-set

D

j

. From this perspective there exist

m fuzzy sub-sets (Kao & Liu, 2001). On the other

hand each row expressed, for one product, the

degree in which it possess each one of the

characteristics, which is also represented by a fuzzy

sub-set

Q

i

such as:

…

=…

Q

i

p

i1

p

i2

p

i3

p

i4

p

im

C

1

C

2

C

3

C

4

C

m

On the other hand, each business has a different

appreciation of the importance that each

characteristic has (Gil Lafuente, 2005). Evidently,

this estimate can vary from one moment to another

and its quantification has a basically subjective

sense, therefore will be expressed by means of

valuations.

The establishment of these valuations can be

done by means of a comparison between the relative

importance of a characteristic in relation to the rest.

Therefore, for example, it can be said that a

characteristic is two times as important as another,

or has half the importance of a third.

In this way we can construct a Matrix 2, that

obviously will be square, reflexive and anti-

symmetrical. Since there are n products, its order

will be

m

×

m

:

ICEIS 2008 - International Conference on Enterprise Information Systems

408

Matrix 2

C1

C2

C3

C4

Cm

C1

1

a12

a13

a14

…

a1m

[Pij]=

C2

a21

1

a23

a24

…

a2m

… …

…

…

…

Cm

am1

am2

am3

am4

…

1

Due to the condition of asymmetry the following

will be complied with:

ij

ij

a

a

1

=

(3)

Once the matrix 2 has been determined, we

proceed to obtain the corresponding dominant value

and vector. This vector will bring to light the

preferences of the business relative to the

characteristics,

[

]

5

4321

yyyyy

j

y =

In order for this vector to be susceptible to being

used as a weighting element, we are going to convert

it into another that possesses the property that the sum

of its elements be equal to the unit. For this we do:

∑

=

=

m

j

j

j

j

y

y

b

1

,

j = 1, 2, ...,

m

(4)

With which we arrive at

[

]

5

4321

bbbbb

j

b =

We are now in a position finally to arrive at the

sought after result, by taking matrix

[p

ij

] and

multiplying it to the right by vector

[b

j

]. The result

will be another vector, which will express the

relative importance of each financial product for the

business, taking into account its preferences for each

one of the characteristics:

p

11

p

12

p

13

... p

1m

p

21

p

22

p

23

... p

2m

p

31

p

32

p

33

... p

3m

... ... ... ... ...

p

n1

p

n2

p

n3

... p

nm

⎡

⎣

⎢

⎢

⎢

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⎥

⎥

⎥

⋅

b

1

b

2

b

3

...

b

m

⎡

⎣

⎢

⎢

⎢

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⎥

⎥

⎥

=

d

1

d

2

d

3

...

d

m

⎡

⎣

⎢

⎢

⎢

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⎥

⎥

⎥

(5)

The result can also be expressed by means of a

normal fuzzy sub-set, by doing:

…

=…

P

1

P

2

P

3

P

m

H

h

1

h

2

h

3

h

m

P

4

h

4

This model on the contrary to all those that use

as the only basis for selection, the price of the

money, has as its greatest advantage the possibility

of incorporating a wide range of elements that, in the

reality of businesses, at times play a decisive role at

the time of taking the decision to select a financial

product from among those offered on the market.

These elements normally do not have the same

weight at the time of making a valuation.

3 APPLICATION OF THE

PROPOSED MODEL

With the object of illustrating the model a case has

been considered which we have linked to the one

shown, in order to cover certain financial

requirements, resorts to three credit institutions

which propose as the most adequate, one financial

product each (Vizuete & Gil Lafuente, 2007).

Therefore there is a choice between three products

P

1

,

P

2

,

P

3

.

The characteristics of these products makes them

different, but in certain aspects some are more

attractive, but in others these are less favourable.

Obviously, in the eyes of the businessman not all the

characteristics have the same weight at the time of

deciding to accept one or another (Kaufmann & Gil

Aluja, 1987 & 1990). The five characteristics

mentioned previously were considered as important:

price of the money, payback period, possibilities for

renewal, fractioning repayments, speed of granting.

1. With regard to the price of the money the

following data is considered: for

P

1

20%, for

P

2

22% and for

P

3

18%. This then is objective data and

it is logical to think that the preference would be for

the lowest price in a proportional manner. In this

way the following matrix can be constructed:

1 11/10 9/10

10/11 1 9/11

10/9 11/9 1

P

1

P

2

P

3

P

1

P

2

P

3

Once this matrix has been constructed the

corresponding dominant own value and vector must

be obtained. Among the various procedures existing

we are going to use the following:

11,10,9

0,9090 1 0,8181

1,1111 1,2222 1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⋅

1

1

1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

=

3

2,7271

3,3333

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

= 3,3333⋅

0, 9

0,8181

1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

11,10,9

0,9090 1 0,8181

1,1111 1,2222 1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

⋅

0, 9

0,8181

1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

=

2,6999

2,4543

2,9998

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

= 2,9998⋅

0, 9

0,8181

1

⎡

⎣

⎢

⎢

⎢

⎤

⎦

⎥

⎥

⎥

For normalisation of the sum equal to 1, in this

way arriving at:

SUBJECTIVE PREFERENCES IN FINANCIAL PRODUCTS

409

P1

P2

P3

[Pi1]=

0,3311

0,3009

0,3679

The same process should be developed for Pi2,

..., Pi5. Once we have obtained these five vectors

[p

ij

], j = 1, 2, 3, 4 , 5 , we group them and form the

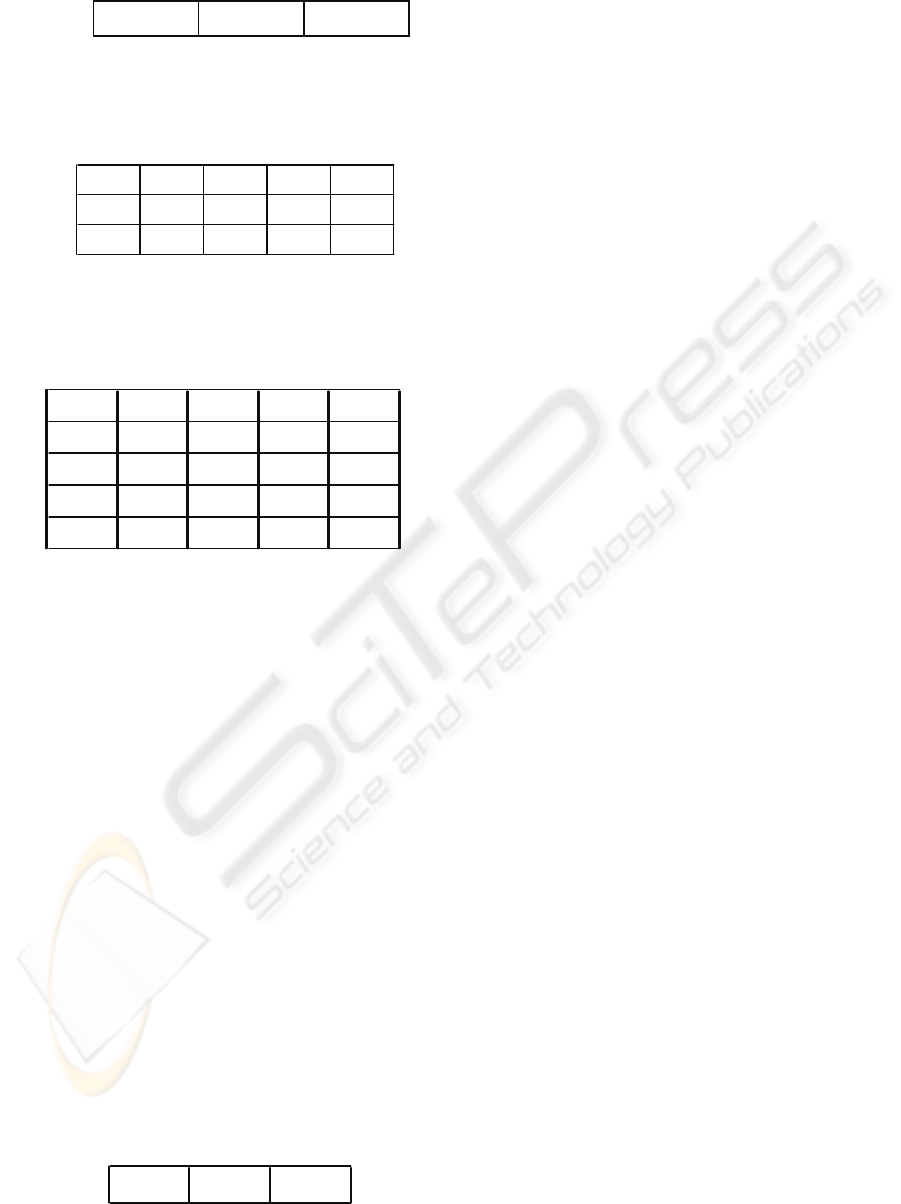

following matrix:

0,3311 0,3333 0,1681 0,4285 0,6483

0,3009 0,4000 0,3572 0,1428 0,2296

0,3679 0,2666 0,4746 0,4285 0,1219

[p

ij

] =

P

1

P

2

P

3

C

1

C

2

C

3

C

4

C

5

With the following square, reflexive and

reciprocal matrix can be arrived at matrix 3:

Matrix 3

12684

1/21462

1/6 1/4 1 3 1/2

1/8 1/6 1/3 1 1/3

1/4 1/2 2 3 1

C

1

C

2

C

3

C

4

C

1

C

2

C

3

C

4

C

5

C

5

In order to obtain the corresponding dominant

own value and vector the same process can be used

as followed before. In this way with the

normalisation in sum equal to one:

[

]

0, 4704 0, 2685 0, 836 0, 0430 0, 1342

j

b =

⎡⎤

⎣⎦

Finally, if we take matrix

[p

ij

] and multiply to

the right by vector

[b

j

], which in short constitutes a

weighting, we arrive at:

0, 4704

0, 3311 0, 3333 0,1681 0, 4285 0, 6483 0, 3647

0, 2685

[d ] = 0, 3009 0, 4000 0, 3572 0,1428 0, 2296 × = 0, 3157

0, 0836

j

0, 3679 0, 2666 0, 4746 0, 4285 0, 1219 0, 3191

0, 0430

0,1342

⎡⎤

⎢⎥

⎡⎤⎡⎤

⎢⎥

⎢⎥⎢⎥

⎢⎥

⎢⎥⎢⎥

⎢⎥

⎢⎥⎢⎥

⎣⎦⎣⎦

⎢⎥

⎢⎥

⎣⎦

Taking into account that we have only

considered four decimal points and the last one has

not been rounded up, the sum of the elements of the

last matrix does not give the unit as the result, which

would have occurred if the rounding up were to have

been done.

The result we have arrived at can also be

expressed by means of a normal fuzzy sub-set, as

follows:

= 1,0000 0,8656 0,8749

P

P

1

P

2

P

3

It will be seen in this fuzzy sub-set that financial

product

P

1

is preferable to products

P

2

and

P

3

,

although not too much. There is very little difference

between

P

2

and P

3

.

4 CONCLUSIONS

In this paper, we have studied an example could be

taken as typical since it shows what happens often in

financial reality, when the decison maker is faced

with the need to choose between apparently different

products but which, when all is said and done, are

very similar. This situation should not come as a

surprise to us if it is thought that financial

institutions attempt to compensate certain

disadvantages of a product relative to other of the

competition, by means of incentives to certain

aspects that make it more attractive and allow in this

way for its placing in the market under conditions of

competitiveness.

REFERENCES

Bustince, H., Herrera, F., 2008. Fuzzy Sets and their

extensions: Representation, aggregation and models.

Springer Verlag Berlin.

Dubois, D., Prade, H., 1995. Fuzzy Relation Equations

and Causal Reasoning, Fuzzy Sets and Systems, 75; p.

119-134.

Gil-Aluja, J., 1999. Elements for a Theory of Decision in

Uncertainty, Kluwer Academic Publishers. Dordrecht,

Boston, London

Gil-Aluja, J., 1998. The interactive management of human

resources in uncertainty. Kluwer Academic

Publishers. Dortrech.

Gil Lafuente, A.M., 2005. Fuzzy logic in financial

analysis. Springer. London.

Kao,C., Liu, S.T., 2001. Fractional programming approach

to fuzzy weighted average. Fuzzy Sets and Systems,

120, p. 435-444.

Kaufmann, A., Gil-Aluja, J., 1990. Las matemáticas del

azar y de la incertidumbre. Editorial Ceura, Madrid,

Spain.

Kaufmann, A., Gil-Aluja, J., 1987, Técnicas operativas de

gestión para el tratamiento de la incertidumbre.

Editorial Hispano Europea, Barcelona, Spain.

Vasantha Kandasamy, W.B., 2007. Elementary Fuzzy

Matrix Theory and Fuzzy Models for Social Scientists.

Indian space research. USA, p. 72-90

Vizuete Luciano, E., Gil Lafuente, A.M., 2007.

Algoritmos para el tratamiento y selección de

productos financieros en al incertidumbre

(Unpublished) Doctoral Thesis in University of

Barcelona. Spain.

Zadeh, L., 1971. Similarity Relations and Fuzzy

Orderings, Inform Sci. 3. p.177-200.

ICEIS 2008 - International Conference on Enterprise Information Systems

410