TOWARDS A VALUE-ORIENTED APPROACH TO

BUSINESS PROCESS MODELLING

Jan vom Brocke

Martin Hilti Chair of Information Systems and Business Process Management (IS&BPM)

University of Liechtenstein Vaduz, Liechtenstein

Jan Mendling, Jan Recker

BPM Group, Enterprise Systems Cluster, Queensland University of Technology, Brisbane, Australia

Keywords: Process re-engineering, value-orientation, process modelling, total cost of ownership, return on investment.

Abstract: To date, typical process modelling approaches put a strong emphasis on behavioural aspects of business op-

erations. However, they often neglect value-related information. Yet, such information is of key importance

to strategic decision-making, for instance in the context of process re-engineering. In this paper we propose

a value-oriented approach to business process modelling that facilitates managerial decision-making in the

context of process re-design based on concepts and metrics from financial and operations management.

1 INTRODUCTION

Over recent decades, business process management

(BPM) has emerged as a popular management

approach in information systems and business

management practice. BPM has over the last three

years continuously been identified as a top business

priority and building business process capability

continues to be a major challenge for senior

executives in the coming years (Gartner Group,

2007). Most notably, BPM practices are employed to

improve, re-design or re-engineer existing business

operations so as to improve overall effectiveness or

efficiency of an enterprise. In fact, a recent survey

on BPM initiatives confirmed that 75% of active

BPM projects are concerned with process

improvement (Palmer, 2007).

A key challenge in process improvement projects

is the initial discovery and description of the

business operations in a manner that is conducive to

process improvement (Burlton, 2001). In this

context, process modelling as an approach to

graphically articulate the activities, events or states,

and control flow logic that constitute a business

process is typically employed to discover existing

processes, and document them in a way that helps

managers making improvement or change decisions

(Recker, 2007; Rosemann, 2006).

However, the graphical description of events,

tasks, control flow logic and the like does actually

little in helping managers making change decisions.

What is missing in process modelling practice is a

focus on business value considerations. More

precisely, popular process modelling approaches,

such as ARIS (Scheer, 2000), provide a reasonably

good understanding of what is happening in the

process – but reveal only little about the financial

consequences of the operations, and how changes to

these operations would contribute – or not – to

corporate success. Surprisingly, also existing

apporaches in process simulation, e. g., Greasley

(2000), or process mining, e. g., van der Aalst

(2005) hardly consider financial information.

The question then is how to leverage process

modelling for the assessment of the business value

of processes (or process changes). In particular,

long-term monetary consequences which are

influenced by market and resource-related stimuli,

should be taken into account for process

improvement. In order to assess the value of a

process with regard to long-term economic

consequences, decisions on the process design have

to be considered as an investment (Devaraij and

Kohli, 2002).

Accordingly, the imperative of our research is to

identify and to describe the different aspects that

contribute to the long-term financial value of a

380

vom Brocke J., Mendling J. and Recker J. (2008).

TOWARDS A VALUE-ORIENTED APPROACH TO BUSINESS PROCESS MODELLING.

In Proceedings of the Tenth International Conference on Enterprise Information Systems - ISAS, pages 380-385

DOI: 10.5220/0001713803800385

Copyright

c

SciTePress

process design. In particular, we propose a

framework that distinguishes three levels of

evaluation, viz., the operational, the budgeting, and

the corporate level. Furthermore, we show how these

different financial dimensions can be identified by

the help of a process model, and how this financial

data relates to process change decisions. Overall, we

call this approach value-oriented process modelling.

We proceed as follows. First, we give an

example of a typical process design scenario and

highlight how and why existing approaches fail to

provide adequate information for process change

decision-making. Then, in Section 3 we introduce

our framework of financial dimensions of a business

process design. In Section 4, we describe in detail

our approach for identifying different financial

aspects in business process models by means of

exemplary methods. We conclude in Section 5 with

an outlook to future work.

2 A MOTIVATING EXAMPLE

Figure 1 depicts a garage fabrication process de-

scribed in Anupindi et al. (1999) as an Event-driven

Process Chain (EPC) (Scheer, 2000). The EPC is a

modelling technique for the representation of tempo-

ral and logical dependencies of activities in a busi-

ness process. The EPC denotes one of the most

popular approaches to process modelling and are

heavily used in practice (Davies et al., 2006), which

is why we use them for illustration purpose. EPCs

include function type elements that can be used to

capture activities of a process and event type ele-

ments that describe pre- and post-conditions of these

functions. Furthermore, there are three kinds of con-

nector types in EPCs to specify the control flow

logic of a process. For details refer to Mendling and

van der Aalst (2007).

In essence, the garage fabrication process shown

in Figure 1 starts when a garage has to be assembled.

In concurrency (AND-split), the purchased parts

have to be taken out of the warehouse and the roof

has to be fabricated in two steps. Both these inputs

are required for the assembly of the garage. Only

then, the assembled garage can be put into the ware-

house. For each of the EPC functions there are two

operations metrics annotated: first, the flow time

(i.e., the number of garages or parts required for a

garage per week), and second, the flow rate (i.e., the

number of units in dollar that flow through a specific

function per week).

Garage to be

assembled

V

Take

purchased

parts out of

warehouse

Take roof raw

materials out

of warehouse

Fabricate roof

Parts available

Raw materials

available

V

Roof available

Assemble

garage

Garage

assembled

Put garage in

warehouse

Garage in

warehouse

11.12 #/week

0.77 $/week

6.75 #/week

0.96 $/week

7.12 #/week

2.12 $/week

3.14 #/week

3.38 $/week

2.90 #/week

3.38 $/week

Figure 1: EPC of a garage fabrication process.

It should be noted, however, that in many con-

temporary business process modelling projects nei-

ther of these two flow metrics are actually measured

let alone described in a process model. At best, flow

times are collected. Consider now a procedure to

business process improvement that takes flow times

into account. In a naive and ad-hoc approach, one

might argue to focus improvement efforts on the

function that takes the longest time. Assume that this

way the flow time of, let’s say, the ‘purchase parts’

function can be reduced from 11.12 units per week

to 10 units per week. As Figure 1 shows, however,

the flow time reduction does not improve the cycle

time of the overall process since the purchase parts

function is not on the so-called critical path – the

reason is that the roof fabrication takes longer

(6.75+7.12 units per week). And indeed, operations

management (Anupindi et al., 1999) informs us that

such an approach takes too narrow a stance. Instead,

the appropriate criterion to check would be the in-

ventory of each activity. The average inventory can

be calculated according to Little’s law as the product

of average flow rate multiplied with the average

flow time. Accordingly, in the garage fabrication

process the function ‘fabricate roof’ has the highest

inventory with 7.12 #/week * 2.12 $/# = 15.1 $/

week. But even if we follow this operations man-

agement approach, we still miss investments in the

business process infrastructure and tax aspects.

Changing the process design might impact these di-

mensions as well.

TOWARDS A VALUE-ORIENTED APPROACH TO BUSINESS PROCESS MODELLING

381

This small example illustrates the need for taking

financial data into account when making decisions

on business process change. While several authors in

operations management and investment theory (e. g.,

Anupindi, et al., 1999) discuss the financial impact

of changing business processes, these insights are

hardly reflected in recent research let alone practice

on business process modelling. Accordingly, in the

next section, we sketch the integral parts of a system

intended to lend better support.

3 A GENERAL FRAMEWORK

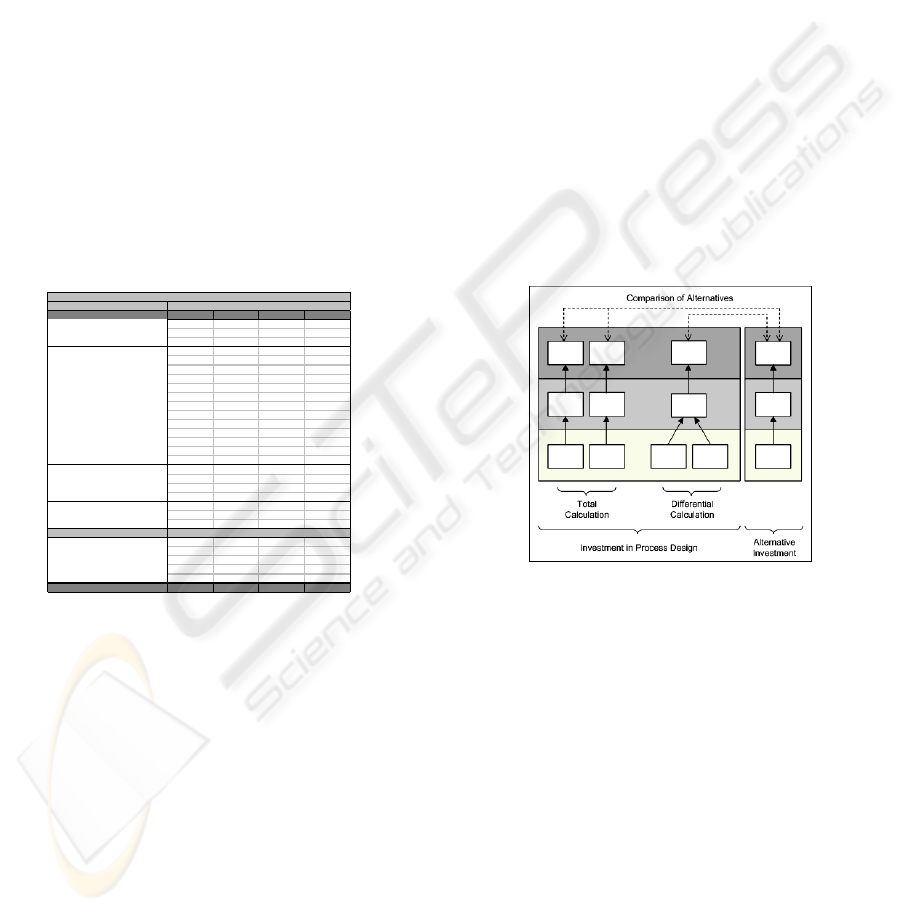

The measurement system presented in this paper dis-

tinguishes three levels of evaluation: the operational

level, the budgeting level, and the corporate level

(see Figure 2). The operational level serves to collect

payments relevant to a specific process design. The

economic value of these payments referring to a

company’s situation is subsequently evaluated, first

on the budgeting, and then on the corporate level.

The budgeting level aggregates payments of process

designs over time and the corporate level condenses

the data to key performance indicators that can form

the basis for decision-making.

On the operational level payments (out-

payments) and receivables (in-payments) are calcu-

lated. They can be directly assigned to decisions on

the process design (consider, for instance, payments

driven by the process performance). Obviously,

these payments considered to be relevant in a spe-

cific situation may vary according to a specific deci-

sion situation. Research in the field of value-based

business process management focuses on the analy-

sis of typical situations in order to derive sets of pay-

ments representative for certain application areas.

On the budgeting level, additional parameters are

taken into account for establishing the economic

value created by respective series of payments.

Relevant parameters are derived from specific con-

ditions of funding and tax obligations that a com-

pany has to meet. These series of payments are con-

solidated over time by applying methods of capital

budgeting (Grob, 1993; Seitz and Ellison, 2004;

Shapiro, 2004). That way, a survey of financial con-

sequences is created.

Finally, on the corporate level, the profitability

of a process design and operation has to be judged

by condensing the aggregated economic process data

into key performance indicators. Measures like the

Total Cost of Ownership (TCO) and the Return on

Investment (ROI) help to consider relevant parame-

ters for this purpose (Seitz and Ellison, 2004;

Shapiro, 2004; Gartner Group, 2003).

As for the budgeting and corporate level, well-

established measurement systems already exist

(Grob, 1993; Shapiro, 2004). Our framework is de-

signed to integrate these methods from financial

management into the context of process re-design.

This allows measuring the financial implications of a

process design. In doing so, however, the challenge

is to find relevant in- and out-payments on the op-

erational level. One promising approach in this con-

text could be the use of Activity-based Costing,

(Sapp, Crawford and Rebishcke, 1998), which is a

method to decompose cost measures alongside the

activities of a business process to identify critical

cost drivers.

Figure 2: Framework for Measuring the Economic Process

Value (EPV).

Still, we have to note that the notion of ‘corpo-

rate success’ typically transcends beyond financial

measures. The Balanced Scorecard approach, for in-

stance, takes multiple perspectives into considera-

tion (Kaplan and Norton, 1992). It distinguishes four

perspectives of performance measurement, including

’Financial’, ’Customer’, ’Internal Business Proc-

esses’, and ’Learning & Growth’. Of these, we focus

on the financial perspective, which measures the

economic value generated within the other perspec-

tives, in particular by improvements to business

processes.

4 METHODICAL SUPPORT

4.1 Preliminaries

This section discusses the systematic consideration

of relevant process payments. Our approach is based

on the observation that in every process, each and

every function brings about payments (out-

ICEIS 2008 - International Conference on Enterprise Information Systems

382

payments) and receivables (in-payments). The ap-

proach we propose is to estimate these and aggregate

them based on the overall process structure.

The method provided in this chapter sets certain as-

sumptions for covering this task:

Costs lead to in- and out-payments. The reason

for this is that multiple time periods are consid-

ered. Accordingly, factor input and/or creation

has long term consequences on capital costs.

Capital costs are dependent on capital stock that

is influenced by means of payments (and not by

means of costs and performances).

Costs have to be allocated to a process. Calcu-

lating the value of a single process implies that

relations to various other processes have to be

taken into account. Here, payments are calcu-

lated in relation to the process they are caused

by.

Against the background of these preliminaries, ex-

emplary methods for the value assessment of busi-

ness processes on each layer shall now be presented.

4.2 Measurement on the Operational

Level

Payments can be calculated according to different

schemas. In this section, basic operations for calcu-

lating out-payments are presented. Factors serving as

input in the process are identified and assessed. As

to the apportionment, factors for both consumption

and usage have to be distinguished. Factors of con-

sumption are objects that are consumed by func-

tions. Factors of usage, however, are objects of input

that serve as resources for processing a function.

They can either be calculated fully or partitioned ac-

cording to certain keys. The concept of the prevail-

ing calculation is shown in Figure 3.

Out-payments of a function are assembled by

payments for the required objects of usage as well as

the objects of input that were consumed in the exe-

cution of the function. We assume that the payments

are aggregated per period such that they capture the

operational inventory. In order to calculate objects

of input, the amount (and type) of the objects ap-

plied in the function have to be accounted for. In or-

der to assess out-payments, the amounts have to be

multiplied by the cost per unit. The payment for ob-

jects of usage is calculated according to the fre-

quency-of-utilisation principle. This procedure is

similar in application to the procedure of activity-

based costing. That is, the percentage of resource-

utilisation of a function is calculated. For this calcu-

lation, resource units that are used by a certain func-

tion are proportional to the total sum of all units

provided by this resource (see Figure 3).

ii

i

1

,

i

1

,

i

ject]essourceob[Payment.R]nputobject[Payment.I

Payment][

]bject.CostRessourceo[ge]object.Usa[Ressource

ject]essourceob[Payment.R

t.Price]Inputobjec[ct.Amount][Inputobje

]nputobject[Payment.I

+=

⋅=

⋅=

∑

∑

=

=

m

j

jji

q

p

ppi

[Function]

i

[Ressour-

ceobject]

1

[Ressour-

ceobject]

2

[Inputobject]

1

[Ressourceobject.Cost]

1

[Ressourceobject.Cost]

2

[Ressourceobject.Usage]

1,2

[Ressourceobject.Usage]

1,1

Symbols

i Index for Functions

p Index for Objects of Input

j Index for Objects of Resource

Figure 3: Calculating out-payments.

Payments related to functions now need to be

aggregated for each specific process and each period

within the planning-horizon. Generally, payments of

all functions have to be added. In case of process

branches in which an alternative processing takes

place, the probability of branches has to be consid-

ered (see figure 4).

∑

=

⋅=

n

i

i

1

i

g

ty][ProbabiliPayment][Function.

yment]Process.Pa[

[Function.

OR]

1

[Function.

OR]

3

OR

OR

[Fun ction.

OR]

2

[Probability]

1

[Event]

1

[Ev en t]

2

[Ev en t]

3

[Probability]

2

[Probability ]

3

Symbols

i Index for Functions

g Index for the Excerpt of a Process

Figure 4: Aggregating Payments.

In order to investigate the probability, relative

frequencies can be estimated in which events re-

occur when instantiating the process multiple times.

While probabilities of all events related to a branch

clearly have to sum up to one in case of an XOR

connector, the sum of rates can differ from 100% in

the case of OR connectors.

In order to partition both in- and out-payments

on various periods during the phase of operation,

TOWARDS A VALUE-ORIENTED APPROACH TO BUSINESS PROCESS MODELLING

383

constant trend rates can be applied. In addition, spe-

cial payments can also be planned explicitly and in-

cluded in the calculation.

4.3 Measurement on the Budgeting

Level

On the budget-level, the financial consequences are

measured that are derived by the payments on the

operational level. For that purpose, the method of

´Visualisation Of Financial Implications´ (VOFI)

can be applied (Grob, 1993). Using VOFI, the finan-

cial consequences of long-term decisions are struc-

tured and calculated by means of spreadsheets that

serve as a database for further analysis. Compared to

formulas applied by conventional methods of capital

budgeting (e.g., Present Value or Annuity of an In-

vestment Project), calculating the investment on the

basis of a spreadsheet offers greater transparency

and adaptability (vom Brocke and Lindner, 2004). A

template of an appropriate VOFI is illustrated in

Figure 5.

Point in Time 0 1 …n… h

Series of Pa

y

ments

Internal Funds

– Withdrawals

+ Deposits

Instalment Loan

+ Credit Intake

– Redemption

– Debitor Interest

Annuit

y

Loan

+ Credit Intake

– Redemption

– Debitor Interest

– Creditor Interest

Loan in Current Account

+ Credit Inatake

– Redemption

– Creditor Interest

Financial Investment

– Reinvestment

+ Disinvestment

– Debitor Interest

Tax Pa

y

ments

– Out-Payment

+ In-Pa

y

ment

Accountin

g

Balance 0 0 0 0

Balance on

instalment loan

annuity loan

current account

financial investment

Net Balance

[Final Value]

VOFI for Profitability of Business Processes

Figure 5: Template for Calculating the Financial Conse-

quences of Processes.

The calculation shown in Figure 5 is to be re-

peated for each considered period. With this algo-

rithm, the value of an investment in the implementa-

tion of a to-be model of a process can be monitored

across its life-cycle by observing the net balance in

each relevant period. The net balance of period t=n

is then the final value of the investment.

4.4 Measurement on the Corporate

Level

Apart from general measures provided by capital

budgeting, other measures can be calculated associ-

ated with specific aspects or relevance to process

management. We cannot detail these measures at

this stage and instead refer the reader to the discus-

sion in (vom Brocke, 2007).

The approach described here is not restricted to

the assessment of single business processes. Rather,

it can be used to facilitate decision-making between

different process designs. And indeed, economic

process value in a narrow sense can only be assessed

properly when at least two alternatives are com-

pared: taking a certain decision or not taking this de-

cision – or in more practical terms: sticking to the

as-is state or implementing a to-be model.

In comparing alternative process designs, two

different approaches can be applied: a total and a

differential calculation (see Figure 6 in contrast to

Figure 2). According to a total calculation scheme,

each process is measured independently. The com-

parison takes place on the corporate level by evalu-

ating the performance measures for each design.

This approach gives a high flexibility, as numerous

alternatives can be compared. However, the effort of

establishing precise value measurements for each

design alternative is substantial.

Figure 6: Comparing alternative Process Designs.

Under the differential calculation scheme, the

idea is to focus only on those additional payments

relevant to the comparison of two alternatives (e. g.,

not the total but only the additional expenditure for

the implementation of a to-be model, compared to

the current state). Accordingly, the comparison is

based on measures collected on the operational

level, whereby only one financial plan and set of

measures is calculated on the corporate level that

represents the added value of one alternative com-

pared to the other. The differential approach, how-

ever, is limited to pair-wise design comparisons.

When comparing more than two alternatives, the ef-

fort related to pair-wise comparisons to be assessed

grows exponentially.

Following either of the two approaches, the re-

sulting measures should be compared with those re-

ICEIS 2008 - International Conference on Enterprise Information Systems

384

sulting for alternative investments (the ‘opportu-

nity’, Grob, 1993). This way, the return of invest-

ments in a process design is compared to the return

on investments in further fields (similar to a finan-

cial investment). Only in comparison, the value of a

process design can be assessed considering the spe-

cific situation of a company.

5 CONCLUSIONS

In this paper we presented and discussed an ap-

proach to extend typical process modelling ap-

proaches with value-related information. This way,

managerial decision-making in the context of proc-

ess management, most notably process improve-

ment, can better be supported. In turn, our approach

presents a stronger business case for process model-

ling. We showed how process modelling can be lev-

eraged to more cohesively and comprehensively

provide stakeholders with financial information re-

quired to assist process change management.

The presented research findings have to be con-

textualised in light of some limitations. Most nota-

bly, our elaborations have been of analytical and

conceptual nature and lack empirical testing. How-

ever, our endeavour was to amalgamate existing,

proven practices from both process management and

financial management practice. Nevertheless, we do

consider empirical evaluation an essential aspect of

our work, and look to validate our approach in the

future by means of case studies with companies en-

gaging in process improvement initiatives and we

look forward to present initial results at ICEIS 2008.

Second, we have not considered other, potentially

relevant, non-monetary measures of process change.

Clearly, values of culture, training, people, govern-

ance, knowledge, resistance to change, leadership

and the like also display pertinence to the success of

process improvement projects.

We do not consider our research complete. We

do hope, however, that we made a case towards

long-needed extensions of process modelling prac-

tice so as to be able to better leverage the graphical

articulation of processes for various types of deci-

sion-making scenarios.

REFERENCES

Anupindi, R., Chopra, S., Deshmukh, S. D., Van

Mieghem, J.A., Zemel, E., 1999. Managing Business

Process Flows. Prentice Hall, Upper Saddle River,

New Jersey.

Burlton, R. 2001, Business Process Management: Profit-

ing From Process. Sams, Indianapolis, Indiana.

Davies, I., Green, P., Rosemann, M., Indulska, M., Gallo,

S., 2006. How do Practitioners Use Conceptual Mod-

eling in Practice? In Data & Knowledge Engineering.

58 (3), 358-380.

Devaraij, S., Kohli, R., 2002, The IT Payoff. Meausring

the Business Value of Information Technology Invest-

ments, FT Press, New York, New York 2002.

Gartner Group, 2003. A Report and Estimating Tool for K-

12 School Districts: Why Total Cost of Ownership

(TCO) Matters. Gartner, Inc, Stamford, Connecticut.

Gartner Group, 2007. Delivering IT’s Contribution: The

2007 CIO Agenda. EXP Premier Report, Gartner, Inc,

Stamford, Connecticut.

Greasley, A., 2000. Effective Uses of Business Process

Simulation. In Proceedings of the 32nd Conference on

Winter Simulation (Eds.: Joines, J. A., Barton, R. R.,

Kang, K., Fishwick, P. A.), Society for Computer

Simulation International, Orlando, Florida, 2004-2009.

Grob, H. L., 1993. Capital budgeting with financial plans,

an introduction, Gabler, Wiesbaden, Germany.

Kaplan, R.S., D.P. Norton, 1992. The Balanced Score-

card: Measures that Drive Performance. In Harvard

Business Review. 70 (1), 71-79.

Mendling, J., van der Aalst, W.M.P., 2007. Formalization

and Verification of EPCs with OR-Joins Based on

State and Context. In Proceedings of the the 19th In-

ternational Conference on Advanced Information Sys-

tems Engineering (Eds.: Krogstie, J., Opdahl, A. L.,

Sindre, G.), Trondheim, Norway, 439-453.

Palmer, N., 2007. A Survey of Business Process Initia-

tives. In Business Process Trends Report,

www.BPTrends.com.

Recker, J., 2007. A Socio-Pragmatic Constructionist

Framework for Understanding Quality in Process

Modelling. In Australasian Journal of Information

Systems, 14 (2), 43-63.

Rosemann, M., 2006. Potential Pitfalls of Process Model-

ing: Part A. In Business Process Management Journal,

12 (2), 249-254.

Sapp, R. W., Crawford, D. M., Rebishcke, S. A., 1998.

Activity – Based Information for Financial Institu-

tions. In The Journal of Bank Cost & Management

Accounting. 3 (2), 53-62.

Scheer, A.-W., 2000. ARIS - Business Process Modeling,

Springer, Berlin, Germany, 3

rd

edition.

Seitz, N., Ellison, M., 2004. Capital budgeting and long-

term financing decisions. 3

rd

edition, Gale Group,

Farmington Hills, Michigan.

Shapiro, A. C., 2004. Capital budgeting and investment

analysis, Prentice Hall, Englewood Cliffs, New Jersey.

vom Brocke, J., 2007, Service Portfolio Measurement.

Evaluating Financial Performance of Service-Oriented

Business Processes. In: International Journal of Web

Services Research (IJWSR), 4 (2), S. 1-32.

vom Brocke, J., Lindner, M. A., 2004. Service portfolio

measurement: a framework for evaluating the financial

consequences of out-tasking decisions. In Proceedings

of the 2nd international conference on Service ori-

ented computing. New York, New York, 203-211.

TOWARDS A VALUE-ORIENTED APPROACH TO BUSINESS PROCESS MODELLING

385