DATA QUALITY IN FINANCES AND ITS IMPACT ON CREDIT

RISK MANAGEMENT AND CRM INTEGRATION

Berislav Nadinić

Risk Department, OTP Banka Hrvatska d.d, Ulica Domovinskog rata 3, 23 000 Zadar, Croatia

Damir Kalpić

Department of Applied Computing, University of Zagreb, Faculty of Electrical Engineering and Computing

Unska 3 10 000 Zagreb, Croatia

Keywords: Basel II, CRM, Data Quality, data mining, standardization, validation, framework.

Abstract: Basel II Capital Accord and increased competition on the financial market are responsible for creation of

repositories of aggregated, customer centric historical data used for internal credit risk model development

and CRM initiatives in banks. This paper discusses the effect of data quality on development of internal

rating models and customer churn models, as well as potential improvements in this regard. A

comprehensive framework for data quality improvement and monitoring in financial institutions is

proposed, taking into account the Basel II requirements for data quality as well as requirements of customer

centric retention campaigns.

1 INTRODUCTION

In recent years, the Basel II Capital Accord has

become the focal point of interest in the banking

world. A successor to Basel I Capital Accord, it

specifies a framework for dealing with major issues

facing banks in relation to credit, operational and

market risks.

This new framework aligns capital adequacy

assessment more closely with the key elements of

banking risks in order to provide incentives for

banks to enhance their risk measurement and

management capabilities. The legislature in

countries throughout the world specifies timetables

when banks have to comply with the guidelines of

the Accord.

The new Accord consists of three mutually

reinforcing pillars, which should contribute to safety

and soundness in the financial system (Tapiero

2004):

First pillar - sets out minimum capital

requirements, with the added option of allowing

banks to use internal estimates of borrower

creditworthiness to assess credit risk in their

respective portfolios. Banks can estimate the

probability of default associated with each

borrower based on social, demographic and

financial information

Second pillar - supervisory review process is the

key aspect of the Basel II Accords which

ensures that the management and control

checks, such as internal control review,

assessment of risks and capital assessment are

thoroughly documented and communicated to

the senior management.

Third pillar – is market discipline which affects

the increased disclosure by banks about the

market trading practices.

Based on these abstract concepts, Basel II

Accord specifies that in order to ensure that

successful credit risk calculations from data

contained in different source systems can be

performed, certain requirements need to be met.

These three main requirements for data include

authenticity, accuracy and transparency (Tapiero

2004) ensuring appropriate levels of data quality for

historical data about customers from which their risk

measures are being calculated.

Also, due to increased market saturation, banks

are increasingly turning to targeted marketing

campaigns in order to retain profitable customers

327

Nadini

´

c B. and Kalpi

´

c D. (2008).

DATA QUALITY IN FINANCES AND ITS IMPACT ON CREDIT RISK MANAGEMENT AND CRM INTEGRATION.

In Proceedings of the Third International Conference on Software and Data Technologies, pages 327-331

DOI: 10.5220/0001879103270331

Copyright

c

SciTePress

and increase the revenue on existing clients by

offering new products and services. The targeted

campaigns usually fall in the domain of analytical

Customer Relationship Management (CRM)

systems.

However, similar to the data quality

requirements specified by the Basel II Capital

Accord, CRM initiatives require that large quantities

of analytical data, containing financial and

demographic information aggregated on the

customer level are of sufficient data quality.

Therefore, these two major business drivers in

the banking community can be severely affected by

poor data quality. In this paper we will discuss the

impact of most common problems encountered, and

suggest a complete framework for improving data

quality.

2 IMPACT OF DATA QUALITY

When dealing with data quality issues while

preparing historical data for creation of internal

rating models in accordance with Basel II

guidelines, as well as targeted marketing campaigns

and retention models for CRM initiatives, one most

frequently encounters the following problems

(Nadinic 2006):

multiple names for the same entity

missing values

incorrect values

duplicate records for the same customer

These problems affect the model creation and

reporting processes in several ways. Multiple names

for the same entity (usually a name of a customer,

organization or a product type) prevent the

aggregation of data on a customer level, while

giving a false idea about the actual number of

customer or organization/product types.

Predictive model development is affected by

missing values and multiple names in the following

way (Nadinic 2006):

If missing values in relevant fields are

treated as a separate category, they may

affect the accuracy by grouping the

characteristics of high-risk and low-risk

clients in the same category. This is also

valid for multiple names where specific

incorrect values can be treated as a separate

category in the modelling process

Multiple names for education levels,

organization and employment information

about the customer can lead to overtraining

of the model on the training set if the

number of defaults (and therefore the

training set) is low. In this way, when the

created model is used for actual scoring of

the customers, the model will not identify

the correct probability of default (and

therefore rating class) to the customer

Creation of marketing campaigns is mostly

affected by incorrect address fields of the customer

which prevents contracting the customer through

different sale channels, and incorrect and missing

information about demographic and financial data

which prevent segmentation and creation of

customer churn models.

Duplicate records about the same customer may

result in repeated offerings/contacts to the customer

and can prevent identification of the profitable ones.

These data quality issues can reduce the

effectiveness of created internal rating models, while

in the case of CRM initiatives, they cause substantial

financial losses.

3 PROPOSED SOLUTION

The proposed framework for data quality monitoring

and improvement is divided into several distinct

phases:

Data quality analysis through operational

and strategic data quality indicators

Standardization

Data cleaning according to business rules

and constraints

De-duplication and creation of “best

records” for each customer

Data quality assurance on data entry

It has to be noticed that all data quality activities

should be performed on the organizational level by a

group of dedicated employees, thus providing a

framework for total data management.

3.1 Data Quality Analysis

Data quality analysis (data profiling) is the analysis

of fields and tables in search of interesting

information (Ericson 2003). Therefore, we propose

to formalize this approach by creating two types of

information indicators:

Operational data quality indicators

Strategic data quality indicators

ICSOFT 2008 - International Conference on Software and Data Technologies

328

Operational indicators are used to determine data

quality on an operation level – fields and tables from

the transactional systems containing financial and

demographic information, while strategic indicators

are used to assess data quality on the customer level

after the data have been aggregated.

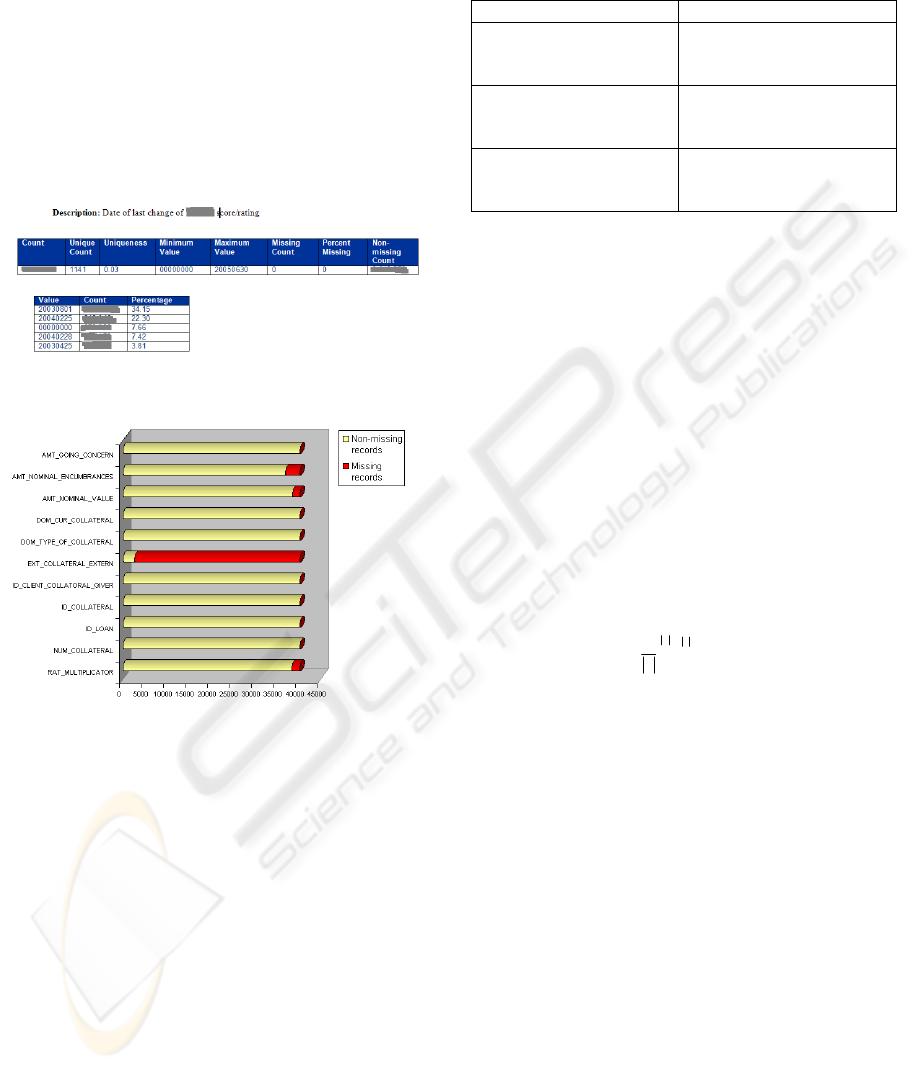

Operational indicators, as shown in figures 1 and

2 can be comprised of information such as number

of records/unique/missing records, outliers,

statistical values for numerical variables and data

patterns and redundant data analysis for character

variables.

Figure 1: Example of data quality indicators.

Figure 2: Example of data quality indicators.

3.2 Standardization

The standardization process encompasses all

activities that result in a group of alphanumerical

strings being transformed into a single string as

shown in (1).

()

BAAA

n

→,...,

21

(1)

Therefore, we propose the use of standardization

reference lists, coupled with the version of an

algorithm for calculation of the distance between

strings as a foundation for all standardization efforts.

In this way, the dedicated data quality experts

may develop the standardization reference lists

containing the value to be standardized, together

with the mapped standardized value, as shown in

Table 1 example.

Table 1: Reference standardization lists denoting three

different names for the same entity and the standardized

value in the right column.

Value for standardization Standardized value

FER Faculty of Electrical

Engineering and

Computing

Faculty of E.

Engineering and C.

Faculty of Electrical

Engineering and

Computing

FACULTY OF ENG.

AND COMPUTING

Faculty of Electrical

Engineering and

Computing

We propose a variation of the Monge-Elkan

algorithm (Monge, Elkan 1995) where the distance

between the strings is calculated not only for the

entry string and the standardized value, but for the

entry string and each of the values in the cluster for

the same standardization values. In this way, special

cases which substantially differ from the

standardized value are included in the

standardization process, as shown in the first row of

Table 1.

With the variation of the Monge-Elkan algorithm

for string comparison between strings A and B (2),

we propose to calculate two measures (distance to

standardized value and distance to value for

standardization) to formalize the difference between

the entry string and the values in the standardization

table.

∑

=

=

=

A

i

ji

B

j

BAmatch

A

BAmatch

1

1

),(max

1

),(

(2)

A new algorithm is used for assigning these

measures to each new entry string in the data

cleaning process.

3.3 Data Cleaning According to

Business Rules and Constraints

We suggest that in this part of the process, business

rules and data constraints developed externally or

through the process of data analysis through

operational and strategic data quality indicators are

applied on the data.

The developed standardization techniques from

the previous phase are used to standardize the

heterogeneous values in the attributes and ensure

adequate data quality.

DATA QUALITY IN FINANCES AND ITS IMPACT ON CREDIT RISK MANAGEMENT AND CRM

INTEGRATION

329

3.4 De-duplication and Creation of

“Best Records” for the Customer

In this phase, we propose to use a system of “keys”

(Hernandez, Solfo 1998), for each record aggregated

on a customer level which captures the essential

information about the customer that can be used in

comparing the two customer records and identifying

potential duplicates, as shown in Table 2. These

keys are created by concatenating information from

different fields that is least susceptible to data entry

errors.

Table 2: Creation of keys for different records denoting

the same customer.

Name Address Key

John Smith Elk Road 23 JSmEl

J. Smith Elk r. 23 JSmEl

J. Smythe Elkk road xx JSmEl

When dealing with the creation of “best record”

containing the most correct information about the

customer from multiple duplicate records, we

propose to include the criteria based on non-missing

information, most recent data and data that exist in

standardization reference lists.

3.5 Data Quality Assurance on Data

Entry

After steps have been taken to increase data quality

on historical data used for modelling and campaign

creation, we propose steps to ensure increased data

quality on data entry points (notably information

entered through forms in branches and Internet

banking Web applications) to ensure sufficient

quality in future historical data. These steps include:

Use of categorical information in credit

application forms for increased data quality

for application scoring

Selection of character string attributes from

standardized reference lists and existing

information in the database to reduce

multiple names

Use of obligatory fields in branch and Web

applications to reduce the number of missing

values

Use of data constraints and business rules for

exclusion of outliers

Implementing these steps may result in reduction of

data quality issues on data entry points, while

simultaneously reducing the necessary data quality

tasks performed while loading the data into a data

warehouse or a data repository used as a source for

modelling.

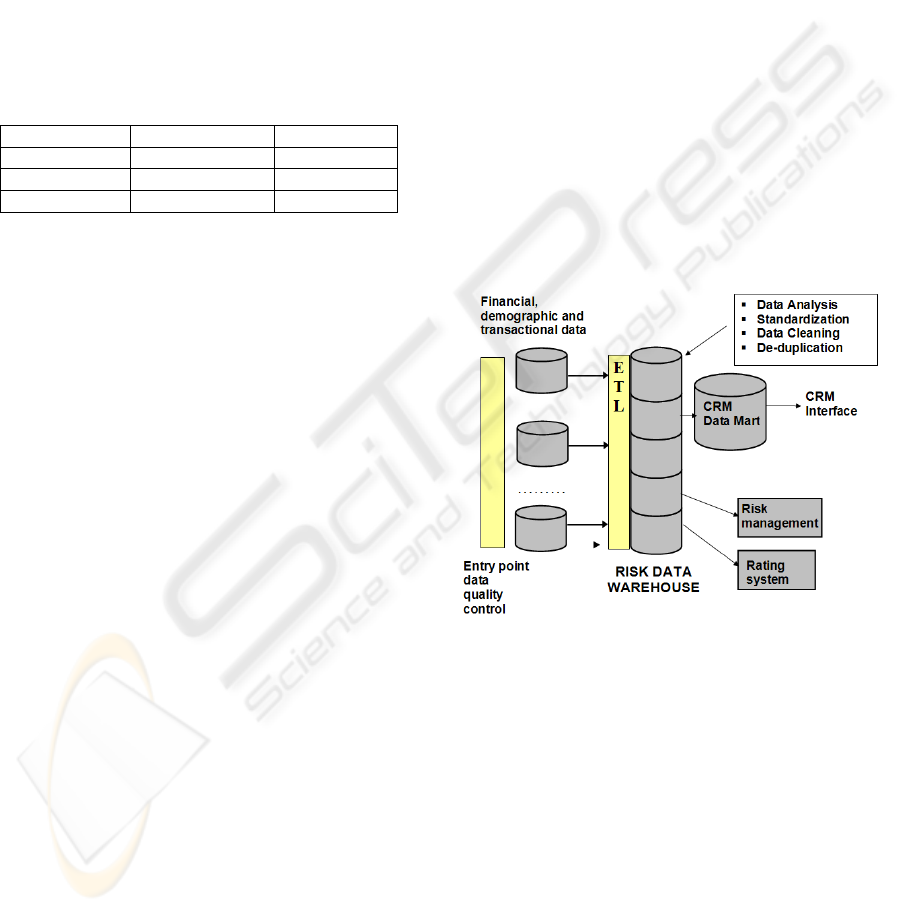

4 FRAMEWORK

In this section we will discuss the implementation of

the proposed solution into a complete Basel II

framework. This implementation is an organization-

level effort, concentrating on a team of data quality

analysts that should ensure enterprise-wide

standardization and data cleaning conventions. Data

quality should be controlled on two major points:

data entry into transactional systems

data entry into data warehouse/data

repository

Steps should be taken to ensure that the data

used for both internal rating model creation and

CRM activities should be subjected to the same data

quality assurance processes as discussed in the

previous chapter

Figure 3: An integrated Basel II framework for ensuring

data quality.

5 CONCLUSIONS

In this paper we have discussed the data quality

issues concerning banks that are faced with two

major business drivers – Basel II Accord compliancy

and the development of CRM initiatives, notably

marketing campaigns and the development of churn

prediction models.

We have outlined major points in our approach

that should increase quality of the historical data

used for modelling, while at the same time giving an

overview of methods used for controlling data entry.

ICSOFT 2008 - International Conference on Software and Data Technologies

330

It should be noted that this framework is currently

being implemented in several Croatian banks, which

are faced with the increased pressure from their

respective owners and the local regulator to comply

with the Basel II guidelines.

By using these methods for data quality

improvement, they are trying to maximize the return

on investment in their resources used to develop

Basel II compliant framework. They are increasing

the accuracy of created models and are dramatically

reducing the costs of marketing and sales campaigns

towards their clients

REFERENCES

Tapiero, C., Risk and Financial Management:

Mathematical and Computational methods, Wiley &

Sons 2004

Monge, C. Elkan; The field Matching Problem:

Algorithms and Applications, 1995

Nadinic: The Challenge of Data Quality: Business and

Regulatory Implications and how to overcome it,

Proceedings of the SAS Forum Adriatic Region,

October 2006

W. Ericson: Data Profiling- Minimizing risk in Data

Management projects, DM Review 2003

M. Hernandez, S. Solfo: Real World Data is Dirty: Data

Cleansing and The Merge/Purge problem, Journal of

Data Mining Knowledge Discovery 1998

DATA QUALITY IN FINANCES AND ITS IMPACT ON CREDIT RISK MANAGEMENT AND CRM

INTEGRATION

331