WHAT, HOW AND WHEN

The Story of e-Banking in Croatia

Zoran Bohacek

Croatian Banking Association, Nova ves 17, Zagreb, Croatia

Keywords: e-Banking, Internet banking.

Abstract: This paper will present the reasons for success of e-banking (including actual results) in Croatia both among

the individuals and companies. The main reason is that up to early 2002 all companies' payments were done

through a centralized system. Only then banks started to do payment services for companies which were

faced with a rather easy choice – continue using paper payment orders and receive service that is more

expensive and slower than before or switch to e-banking and get faster and cheaper service.

1 INTRODUCTION

E-banking, sometimes also called “online banking”

or “internet banking” most commonly refers to bank

accounts that can be accessed over the internet. The

e-banking service generally allows account holders

to make payments, initiate or amend direct debits

and standing orders, transfer funds between accounts

and use some of more sophisticated services offered.

That may include foreign currency conversions and

payments to another country, term deposits,

purchasing investment fund shares, checking status

of bank cards, cheques, loan applications and so on.

In principle all this is possible by logging on to a

bank's secure website. More recently e-banking can

be complemented by m-banking where some or all

of the services are accessible over a mobile phone,

too.

Banks view online banking as a powerful value-

added tool, which they use to attract and retain new

customers and expand their offer by converting

offline customers into online and vice versa. E-

banking also substantially reduces operating costs,

removing the need to handle paper transactions. For

customers, the convenience of such a service and the

ease of paying bills, as the most common service,

which combined with reduced cost and increased

security makes e-banking an attractive proposal.

2 HISTORY AND

DEVELOPMENTS

It is next to impossible to define the exact birth date

of internet banking because long before some banks

were offering “PC banking” to its account holders.

This was certainly a kind of e-banking, but it was a

service which could be reached only by dialing a

bank's phone number and then, after some

verification procedures, it would give access to one

or more bank accounts. Even in Croatia, first such

service was offered to the market back in 1991. Only

much later, in 2001, this particular service was

converted to access over the internet. In France,

Minitel technology allowed some banking services

back in the 80's, even on rather rudimentary

technology and very slow speed by today standards

(300, later 1200 bauds).

Some claim that first real e-banking service in

Europe over the internet was launched in May 1997

by Nationwide bank in Great Britain with 13,000

customers registering in the first year. E-banking

growth rates were impressive everywhere, so today

the same bank counts about 3 million internet

banking customers. British statistics claim that the

number of people using e-banking reached 18.1

million by the end of 2006. Five-year growth rate

shows increase of 174%, and the breakdown by age

groups show higher than average growth in the older

age groups. Statistics in other countries prove that e-

banking users are on average better situated, have

higher education than banks' average customers. In

369

Bohacek Z. (2008).

WHAT, HOW AND WHEN - The Story of e-Banking in Croatia.

In Proceedings of the Third International Conference on Software and Data Technologies, pages 369-374

DOI: 10.5220/0001895003690374

Copyright

c

SciTePress

the US, sources say that Stanford Credit Union was

the first financial institution to offer online internet

banking service to its members late in 1994.

Some worldwide surveys mention a number of

122 million users worldwide in 2004, with Western

Europe dominating that with almost 58 million

users, with US and Japan having 23 and 22 million

respectively. Estimates today claim that 50% or

more of internet users are customers of one or more

e-banking services, in developed countries where

such services exist on a large scale.

In most of the developed countries, e-banking is

more widely accepted to manage and access

individuals' bank accounts, while the companies use

them more sparingly. Croatia is an example of just

the opposite, where more than half of the companies

use actively e-banking services.

3 TECHNOLOGY

A common usage of user identification and a

password which is used to access many online sites,

offering either diverse services or internet commerce

is not considered to be secure enough for e-banking.

Therefore, two different security methods were

developed. One is combination of PIN and TAN

(Personal Identification Number and Transaction

Access Number). PIN is, in fact, a password to login

a financial institution's internet site and TAN is a

one-time password used to authenticate transactions.

E-banking client usually receives a list of TANs by

mail and uses them in order. A more secure way of

using TANs is to generate them whenever needed

using a security token which a bank gives to each

customer. Web browser used to access e-banking

site normally uses SSL secured connections so there

is no need to additional encryption.

The second, more advanced security method is

digital signature. To use this technology, a user must

have a smart card and a card reader connected to his

computer. Then, on a smartcard a bank's certificate

is downloaded through appropriate procedure, so it

can be used when digitally signing transactions or

other documents. This technology is more

expensive, so in many cases it is used only for

company customers, while individuals are more

likely to use the PIN/TAN technology. If an

individual would prefer a smart card and a reader, he

would be assessed a fee.

4 SITUATION IN CROATIA

Croatia had a rather particular situation. Coming

from a socialist system where there was an

overwhelming state control of the entire economy,

more than a decade after getting rid of such a system

the entire payment systems for companies were still

handled by a state-owned agency. Other countries

coming from the same provenience managed to

convert the system in one way or the other, while

Croatia, in spite of the plans made in 1994, waited

until 2002 to finally “move” the company payment

services to where they belong – to banks.

So, until 2002, while individuals and small,

mainly personal businesses would go to banks for

services like in the rest of Europe, all companies'

accounts were held in one agency (at the time it had

the name Institute for Payment Systems) and only

nominally they were on a bank's books (the amounts

were counted into a bank's assets or liabilities at the

end of a day, but the money was never moved). That

means all payments between companies were

processed within this agency, giving state full

control of all money flowing between companies

because payments were executed according to

unique rules providing for situations when there

were insufficient funds. It was easy to devise

procedures for different situations because money

was practically never leaving the agency. The same

agency also handled all cash in the country.

One “problem” with this agency was that the

service was extremely efficient and cheap. It was a

monopoly, with no fears of competition and priced

not according to business requirements, but decided

by the head of agency and approved by the central

bank. Therefore there was no big motivation to close

such a service and go into something more costly

and with questionable efficiency. However, it was

obvious that banks as a service companies had to

offer full set of services to their corporate clients,

rounding the offer and making it similar to other

countries. Even with the plan from 1994 delayed, the

agency had developed a National Clearing System

(NCS) which it was using exclusively, performing

transactions on behalf of banks – in fact on behalf of

those bank's clients. The intention was to have a

system whose doors would open some day to direct

access by the banks and allow them to finally

perform payment services and other transactions

directly with other banks through NCS, without the

need to go to the agency counters or computers.

In mid-2001 the new Law on Payment Traffic

was enacted providing for the necessary basis to take

over payments from the agency. April 2002 was

ICSOFT 2008 - International Conference on Software and Data Technologies

370

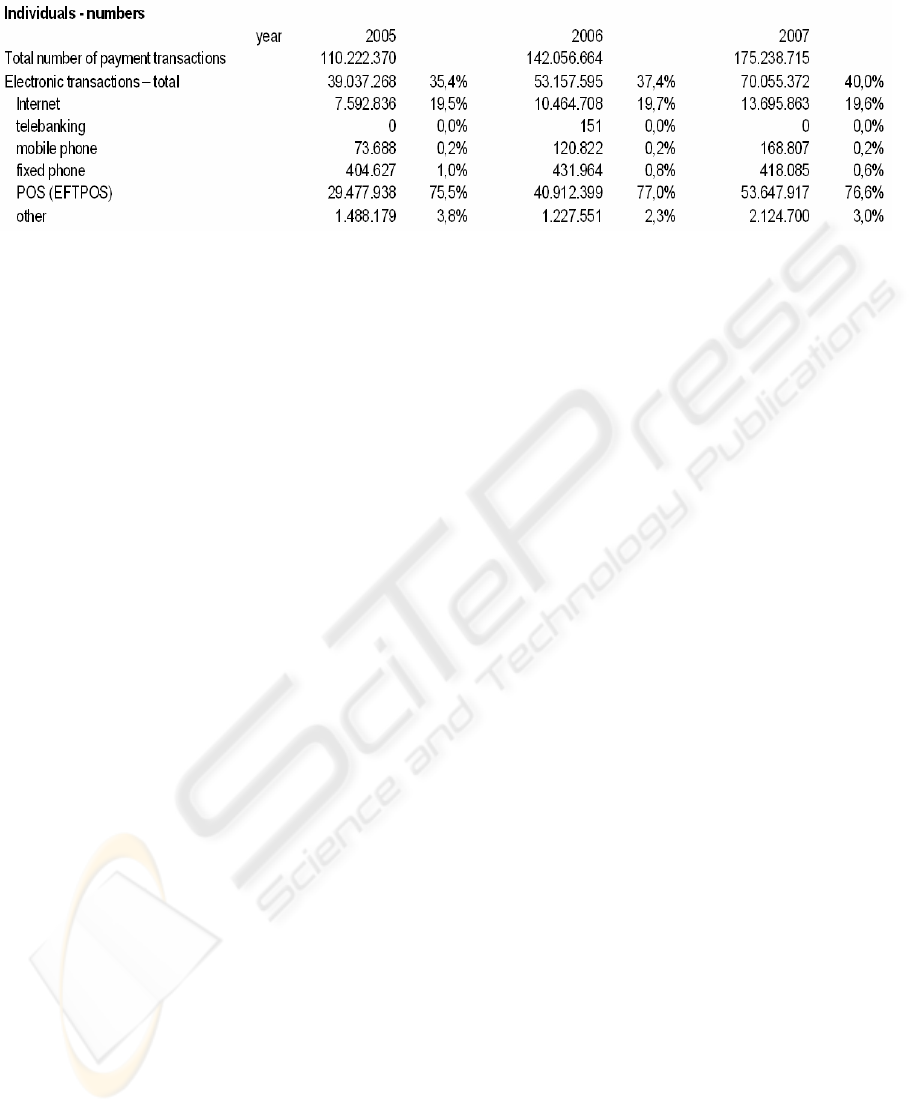

Table 1: Payment transactions in Croatia 2005-2007 – individuals.

determined to be the month of conversion and that

was a major task, because more than 100.000

accounts which were “physically” held at the

agency, had to be transferred into banks' books

without disruption, allowing customers to perform

their banking without noticeable difference. In the

old system companies would have to go to the

agency's branches (spread all over the country), and

place all their payment orders, withdraw cash and

get their daily account statements. Instead of having

secretaries with paper orders go into branches, in the

final years, it was possible to bring floppy disks with

data, or even connect directly to computers and

upload and download the files. No online access to

services was possible.

Of course, a complete switch was impossible.

That would mean complete desertion of agency's

branches and major crowds getting into banks to

perform same tasks as they did in the agency earlier.

Therefore, agreement was made between agency and

each bank where the agency would (still) perform

the same services, only this time on behalf of the

bank, and bank would be issuing statements and,

depending on one of the three possible business

models, slower or faster take over most of the tasks

of full handling of companies' accounts.

However, due to the set up of the clearing system

(NCS) which had several processing cycles,

transactions wouldn't be almost immediate (as they

appeared earlier, but it was not really known given

that all accounts were at the same place), and the

pricing was defined, where a bank could choose

different options. As a result, to an ordinary

customer, it seemed as a substantial deterioration of

the service he had before – it was bound to be slower

and more expensive.

5 MOTIVATION TO GO INTO

e-BANKING

So, the stage was set and in 2002 the internet

banking technology was already well developed and

present on the market to individuals and small

businesses. A few months before the switch, banks

started to offer to corporate clients an e-banking

service which turned out to be very competitive

business proposal. Instead of crowding bank's

branches or going into “old” agency's branches,

which was a service that a bank would have to pay

to the agency (it performed those tasks on behalf of

a bank), a company could satisfy most of its banking

needs without leaving the office, and at a price

which was substantially lower than off-line

transactions and even lower than fee for payment

transactions in the old (agency-only) system.

As a result, e-banking became a huge success for

both the banks and the companies, and banks that

were first on the market reported that relatively large

percentage of its clients signed up for e-banking.

Nowadays, more than half of all companies in

Croatia use e-banking service generating a large

proportions of transactions.

6 DATA ON e-BANKING IN

CROATIA

Source: Croatian National Bank

Note: data for 2005 are factorized, because

statistics start only from 3

rd

quarter of 2005.

Table 1 shows that out of total number of payment

transactions, executed by individuals, electronic

transactions had a share of 35,4% in 2005 and that

share grew to 40% in 2007. Internet transactions

were at the constant share of close to 20% of all

electronic transactions. Majority of transactions

WHAT, HOW AND WHEN - The Story of e-Banking in Croatia

371

Table 2: Payment transactions in Croatia 2005-2007 – companies.

Table 3: Value of payment transactions in Croatia 2005-2007 – individuals.

Table 4: Value of payment transactions in Croatia 2005-2007 – companies.

were purchases by cards on the point of sale (POS).

At the same time, as Table 2 shows, electronic

transactions' share performed by companies

(corporate clients, legal entities) grew from 47,3% in

2005 to 56,8% in 2007. Already in 2005 share of

internet transactions was extremely high (62,9%)

and the share slightly increased to 64,9% in 2007.

That means, in 2007, close to 37% of ALL

payment transactions initiated by a company were

executed through internet.

When we look at the value of transactions in

Table 3, for individuals, there is a major difference

compared to number of transactions. Even as the

share of electronic transactions in total value is

smaller, and grew from 29,4% in 2005 to 35,8% in

2007 (compared to Table 1), the share of value of

internet transactions went from 52,4% to 68,5% in

the same period. The reason is that POS transactions

which have a clear majority when looking at the

numbers, are of smaller value, while credit transfers

(paying bills and other transactions) have higher

money value.

Table 4 shows exactly the opposite phenomenon

for companies. While share of the value of electronic

transactions among all transactions has similar share

as in numbers (in fact, it is slightly lower – holding

steady around 51%), the value share of internet

transaction is lower. It grew from 56,4% in 2005 to

60,9% in 2007, but is well below 62,9-64,9% of

share in number of transactions. It can easily be

ICSOFT 2008 - International Conference on Software and Data Technologies

372

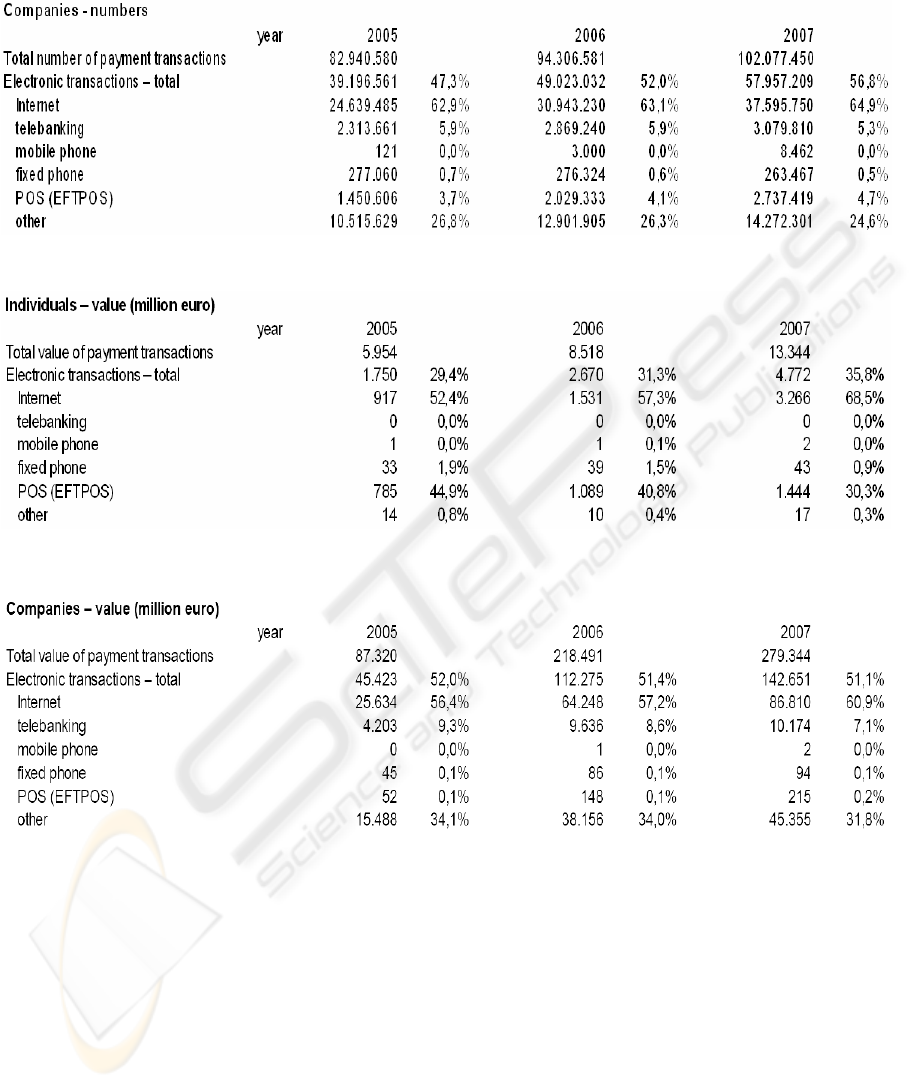

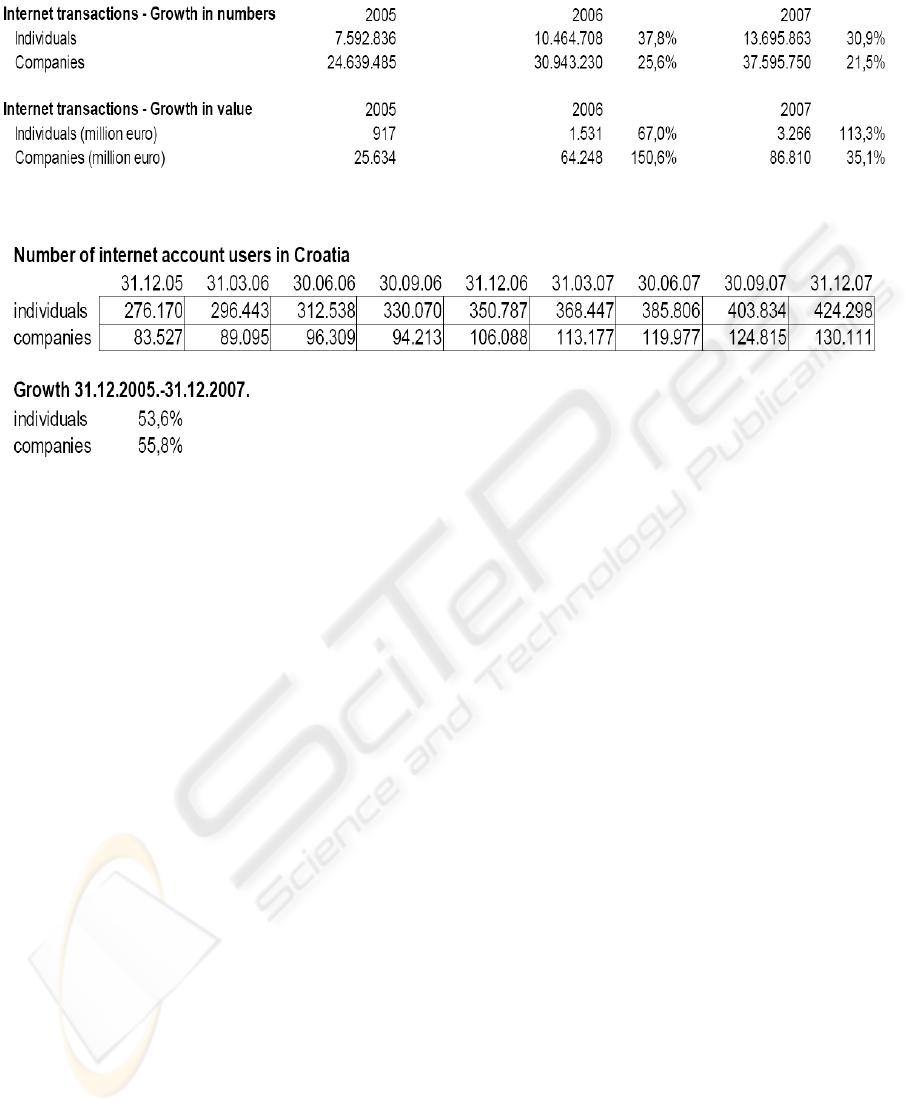

Table 5: Growth of internet transactions in Croatia 2005-2007.

Table 6: Number of internet banking users and growth in Croatia 2005-2007.

explained by the fact that highest value transactions

among companies are executed in “other” category,

usually due to contractual constraints, usage of

escrow accounts, or just preferring to give a written

order to the bank to transfer funds, instead of doing

it themselves over the internet.

Table 5 shows yearly growth in internet

transactions. Here, looking at the number of internet

transactions, we can see that individuals grew at a

faster rate than companies, which can be explained

by the fact that there is much higher penetration of

internet banking among companies, so there is less

room for growth. It seems that growth is slowing

down, because year-on-year growth slowed down

from 37,9% (individuals) and 25,6% (companies) in

2006, to 30,9% and 21,5% respectively in 2007.

When we compare value of internet transactions,

the growth was even more impressive, and in both

segments (individuals and companies) growth was

more than three times in this period. Individuals paid

more than 3,2 billion euro in 2007 over the internet

(compared to 917 million in 2005), and companies

total payments over the internet reached impressive

86,8 billion euro, starting with 25,6 billion in 2005.

Data which exist only from the initial period

published by the central bank (end 2005) show that

number of internet account users grew slightly more

that 50% in the last two years, as shown in Table 6.

Unfortunately, it was not possible to find the

exact share of internet users compared to all

accounts, because there is not a unique methodology

in counting. Many individuals and most companies

have more than one bank account, and then it cannot

be resolved if they use internet on all accounts or

just their “main” accounts, so some of them can be

counted more than once. However, trying to get data

on number of internet account users from major

banks (and then extrapolating to reach the entire

market), it can be estimated with good certainty that

more than 20% of all individuals accounts are used

over the internet (not exclusively, of course), and

more than 60% of all company accounts. These

numbers are supported by data we have on internet

transactions and are shown in Tables 1-4.

7 CONCLUSIONS

Main reason for relatively high usage of e-banking

among companies in Croatia is due to the fact that

banks were not allowed to service companies and

their needs before 2002. Since, at that time, e-

banking was well developed and ready to be used on

a large scale, and it would offer more efficient and

less costly service, many companies immediately

switched to e-banking and caused the high share of

accounts and transactions (both by volume and by

value) to be performed electronically.

WHAT, HOW AND WHEN - The Story of e-Banking in Croatia

373

ACKNOWLEDGEMENTS

I want to cordially thank members of the Payment

Systems Committee of the Croatian Banking

Association, and members of its E-Invoice Working

Group for kindly providing me with individual

banks' data and thus, allowing me to get better

insight in history and technology used in providing

e-banking services.

REFERENCES

Payment System Statistics – collected by the Croatian

National Bank, published at www.hnb.hr

ICSOFT 2008 - International Conference on Software and Data Technologies

374