AN OPTIMIZATION METHOD FOR REDEMPTION AND DUE

DATE MATCHING IN ASSIGNMENT OF ELECTRONIC

RECEIVABLES BY USING INTEGER LINEAR PROGRAMMING

Toshiyuki Moritsu

Systems Development Laboratory, Hitachi Ltd. 890, Kashimada, Saiwai-ku, Kawasaki, Kanagawa 212–8567, Japan

Norihisa Komoda

Graduate School of Information Science and Technologies, Osaka University 2–1

Yamadaoka, Suita, Osaka 565-0871, Japan

Keywords:

Electronic Receivables, Integer Linear Programming, Finance, Due Date Matching, Optimization.

Abstract:

This paper shows an optimization method for redemption and due date matching which assigns the receiv-

ables to the payments date under the pre-defined constraints which related companies specified. Our proposed

method determines the pairs of the receivables and the payment with proper new settlement date which closes

the fluid assets of companies to their target amounts by extending/shortening the redemption/due date. This pa-

per shows that this matching program is categorized in integer linear programming. By applying this matching

mechanism, transferors could utilize credit of issuers and also reduce fluid assets for payments. Effectiveness

of our optimization method is shown by executing simulation which emulates the issuing and receiving status

of receivables in Japanese companies.

1 INTRODUCTION

In recent years, various countries have made progress

in the development of systems for handling credit

transactions electronically, including EBPP/EIPP

(Electronic Bill/Invoice Presentation and Payment) in

the United States (Fairchild, 2003) and e-billing sys-

tems in South Korea (KFTC, 2002). Japan is now also

expecting an increase in this type of business, and in

June 2007 the Japanese parliament approvedthe Elec-

tronically Receivables Legislation (FSA, 2005) which

is due to go into force at the end of 2008. Electron-

ically receivables are a new form of credit whereby

electronic registrations at organizations that register

electronic receivables become only requirement for

the generation and transfer of credit, and are expected

to utilized as a means for the exchange of nominative

claims and credits to payment on which contract doc-

uments and printed bonds are based (Ikeda, 2006).

The assignment of claims allocated to the payment

of electronic receivables owned by a business has the

merit of allowing the transferor to utilize the remit-

ter’s credit rating (Oogaki, 2006). Specifically, when

the transferor (company B) owns electronic receiv-

ables issued by a issuer (company A), even if com-

pany B has a poor credit rating and the electronic

receivables issued by company B have not been re-

ceived by the transferee (company C), then if we sup-

pose that company A has a high credit rating then

company B can pay by transferring credit issued by

company A. This supplementation of reliability by a

third party is particularly useful as a way of utilizing

the credit rating of a parent company in the financing

of subcontractor corporations in business affiliations

that account for approximately 60% of such arrange-

ments in Japan (JSBRI, 2007).

However, it has been pointed out that previous

nominative claims and credits to payment are limited

in terms of the opportunities for utilizing one’s credit

in the assignment of claims. One possible reason for

this is that the payment conditions (amount payable

and due date) and credit redemption conditions are

not exactly same. Since electronic receivables make

it easy to rewrite the conditions electronically, it is rel-

atively simple to accommodate differences in sums by

splitting the electronic receivables. This has actually

been implemented in the book entry transfer system

for short term corporate bonds in Japan. On the other

hand, in cases where the due dates do not match, it is

necessary to adjust the gains and losses of the inter-

349

Moritsu T. and Komoda N. (2008).

AN OPTIMIZATION METHOD FOR REDEMPTION AND DUE DATE MATCHING IN ASSIGNMENT OF ELECTRONIC RECEIVABLES BY USING

INTEGER LINEAR PROGRAMMING.

In Proceedings of the International Conference on e-Business, pages 349-356

DOI: 10.5220/0001905603490356

Copyright

c

SciTePress

ested parties (issuer, transferor, transferee) before al-

tering the conditions. This due date modification has

the side benefits of allowing businesses to make effec-

tive use of surplus floating assets (referred to simply

as “assets” in the following) and providing a means

for supplementing shortfalls in assets. It is thus nec-

essary to reach an agreement on items such as what

the interest rate should be and by how much the term

should be extended or contracted.

It is difficult to make an agreement between the

interested parties regarding the change in due date by

executing work flow between them because it can take

much time to reach an agreement if consideration is

given to factors such as changes of circumstances re-

sulting from conflicting conditions.

Therefore in this study it is envisaged that making

alterations to the due date of electronic receivables in

an effective manner requires a mechanism whereby

the participants first register assets fluctuation targets

and variation conditions whereby changes in due date

can be tolerated, and then combinations of payments

and electronic receivables are determined to satisfy

these constraints. For this study we therefore propose

a matching scheme that optimizes combinations of

payments and electronic receivables so as to achieve

the best possible assets fluctuation targets for all par-

ticipants. In particular, in this matching of electronic

receivables and payments, the level of assets target

achievement of the participants depends not only on

which electronic receivablesshould be combined with

which payments, but also on how the new due date for

the redemption/payment of electronic receivables and

payments is set and matched. We therefore formula-

rize the issue of combining electronic receivables and

payments by including the selection of a new due date

whose selection range is determined by these combi-

nations, and the results can be treated as a problem

of integer linear programming. Also, by simulating

the transaction of electronic receivables under condi-

tions simulating the issue of corporate bills and ac-

counts receivable in Japan, we first verify the extent

to which the assignment of claim is promoted by the

due date matching function. We also verify the opti-

mization effects by comparing the optimized match-

ing of electronic receivables and payments with some

other combination methods.

2 METHOD FOR MATCHING

THE DUE DATES OF

ELECTRONIC RECEIVABLES

In this section we discuss a method for matching elec-

tronic receivables and payments based on the prior

registration of due date alteration conditions which is

a premise of this study. The processing flow is illus-

trated in Fig. 1. First, the participants register their re-

spective asset fluctuation targets and due date adjust-

ment criteria (1). The payment registrations are then

accepted (2), the combination of electronic receiv-

ables and payments is determined based on these in-

formation (3), and approval is obtained for the match-

ing results. The due date adjustment criteria are as-

sumed to consist of a range of possible due dates for

redemption payments, and interest conditions. In the

following, we will discuss the asset fluctuation targets

specified by the participants, the possible range of re-

demption/payment due dates, and the interest condi-

tions.

• Asset Fluctuation Targets.

Each participant specifies when and how much

they would like the current assets to fluctuate. For

example, the estimation of future changes in cur-

rent assets is prepared from predictionsof the pay-

ment and receipt of electronic receivables (and

other settlements), and by setting the target hold-

ings of current assets at each future timing, the

fluctuation targets are set according to the differ-

ence between the target holdings and estimated

transitions.

• Possible Range of Redemption/Payment due

Dates.

If necessary, the participants specify a range for

the extension or contraction of payment due dates

and/or redemption due dates.

• Interest Conditions.

The participants specify a lower limit of interest

to be accepted in cases where the redemption due

date is extended or the payment period is reduced,

and converselyan upper limit of interest to be paid

in cases where the redemption due date is brought

forward or the payment due date is extended. Note

that the interest is set according to the debtor’s

credit rating.

ICE-B 2008 - International Conference on e-Business

350

3 FORMULARIZATION OF THE

PROBLEM OF MATCHING

ELECTRONIC RECEIVABLES

AND PAYMENTS

In this section we will devise a formula for the prob-

lem of matching electronic receivables and payments,

and we will show that this problem can be expressed

as a problem in integer linear programming (Schri-

jver, 1986)(Aardal et al., 2005).

The problem of matching electronic receivables

and payments is expressed using the following nota-

tion.

Constants.

R

ijm

. The m-th electronic receivable issued by issuer i and

held by transferor (current holder) j.

D(R

ijm

). Redemption date of electronic receivable R

ijm

DE(R

ijm

). Upper limit of the extension of the redemption

date of electronic receivables R

ijm

set by issuer i

DS(R

ijm

). Upper limit of the reduction of the redemption

date of electronic receivables R

ijm

set by issuer i

V(R

ijm

). Redemption sum of electronic receivable R

ijm

P

jkn

. n-th payment made to transferee k by transferor j

D(P

jkn

). Payment date of payment P

jkn

DE(P

jkn

). Upper limit of the extension of the payment date

of payment P

jkn

set by transferee k

DS(P

jkn

). Upper limit of the reduction of the payment date

of payment P

jkn

set by transferee k

V(P

jkn

). Payment sum of electronic receivable R

ijm

IP(i, R

ijm

, f)/ IR(i, R

ijm

, f). Upper/lower limit of interest

to be paid/received by issuer i in cases where the

redemption date of electronic receivable R

ijm

is ex-

tended/contracted to date f. Issuer i decide the up-

per/lower limit of interest according floating assets

needs.

IP( j, R

ijm

, f)/ IR( j, R

ijm

, f). Upper/lower limit of interest

to be paid/received by transferor j in cases where the

redemption date of electronic receivable R

ijm

is con-

tracted/extended to date f . Transferor j decides the

Figure 1: Process of Due Date Adjustment between Elec-

tronic Receivables and Payments.

upper limit of interest according her/his floating assets

needs and the lower limit according to credit rating of

issuer of R

ijm

and transferors (who transfer R

ijm

before

transferor j).

IP( j, P

jkn

, f)/ IR( j, P

jkn

, f). Upper/lower limit of interest

to be paid/received by transferor j in cases where the

payment date of payment P

jkn

is contracted/extended

to date f. Transferor j decides the upper/lower limit

same as in case of IP( j, R

ijm

, f)/ IR( j, R

ijm

, f).

IP(k, P

jkn

, f)/ IR(k, P

jkn

, f). Upper limit of interest to be

paid/received by transferee k in cases where the pay-

ment date of payment P

jkn

is extended/contracted to

date f. Transferee k decides the upper/lower limit same

as in case of IP( j, R

ijm

, f)/ IR( j, R

ijm

, f).

C

xe

. Fluctuation target sum of current assets of participant

x on date e

Variables.

v(R

ijm

, P

jkn

, f) . Transferred sum whereby electronic re-

ceivable R

ijm

is allocated to payment P

jkn

at a new due

date f

The Objective function of this matching problem

can be expressed as shown in Formula 1.

Objective Function.

Max(Σ

ijkmn f

|D(R

ijm

) − D(P

jkn

)| · v(R

ijm

, P

jkn

, f) (1)

The target of this problem is to make the best pos-

sible effort to ensure that the fluctuation targets of all

participants are satisfied by the fluctuation of current

assets resulting from changes to the due dates of elec-

tronic receivables and payments. To achieve this goal,

it is preferable to mach the combinations of payments

and electronic receivables having longer discrepan-

cies of due dates with the greatest transferred sums,

within the range of the following constraints. As a re-

sult, the target function can be expressed as the sum

total of the values obtained by multiplying the trans-

ferred sums by the discrepancies between the redemp-

tion due dates and payment due dates, and can be ex-

pressed by formula 1.

Meanwhile, the constraint formulae can be

expressed by Formulae 2 through 15 as follows:

Constraint formulae.

v(R

ijm

, P

jkn

, f) ≥ 0 (2)

V(R

ijm

) ≥ Σ

kn f

v(R

ijm

, P

jkn

, f) (3)

V(P

jkn

) ≥ Σ

imf

v(R

ijm

, P

jkn

, f) (4)

C

xe

≥

Σ

jkmn f

v(R

xjm

, P

jkn

, f) +

Σ

ijmn f

v(R

ijm

, P

jxn

, f) (5)

where C

xe

≥ 0 && D(R

xjm

) ≤ e < f &&

f < e ≤ D(P

jxn

)

AN OPTIMIZATION METHOD FOR REDEMPTION AND DUE DATE MATCHING IN ASSIGNMENT OF

ELECTRONIC RECEIVABLES BY USING INTEGER LINEAR PROGRAMMING

351

C

xe

≤

−Σ

jkmn f

v(R

xjm

, P

jkn

, f) −

Σ

ijmn f

v(R

ijm

, P

jxn

, f) (6)

where C

xe

< 0 && f < e ≤ D(R

xjm

) &&

D(P

jxn

) ≤ e < f

v(R

ijm

, P

jkn

, f) = 0 (7)

where ( f ≤ D(R

ijm

) || D(P

jkm

) ≤ f) &&

D(R

ijm

) < D(P

jkm

) (8)

where ( f ≤ D(P

jkm

) || D(R

ijm

) ≤ f) &&

D(P

jkm

) < D(R

xjm

) (9)

where f < DS(R

ijm

) || f > DE(R

ijm

) ||

f < DS(P

jkn

) || f > DE(P

jkn

) (10)

where (IR( j, R

ijm

, f) < IP(i, R

ijm

, f) ||

IR( j, P

jkn

, f) < IP(k, P

jkn

, f)) &&

D(R

ijm

) < D(P

jkm

) (11)

where (IR(i, R

ijm

, f) < IP( j, R

ijm

, f) ||

IR(k, P

jkn

, f) < IP( j, P

jkn

, f)) &&

D(P

jkm

) < D(R

xjm

) (12)

where C

ie

> 0 && f < e ≤ D(R

ijm

) (13)

where C

ie

< 0 && D(R

ijm

) ≤ e < f (14)

where C

ke

> 0 && D(P

jkn

) ≤ e < f (15)

where C

ke

< 0 && f < e ≤ D(R

jkn

) (16)

The constraint formulae consist of the following three

types:

1. Constraints in which the possible range of trans-

ferred sums is predetermined (formulae 2–4)

2. Constraints in which fluctuations of current assets

arising from transfers associated with changes of

due dates are kept within the fluctuation target

(formulae 5–6)

3. Constraints in which the electronic receivables

and payments that can be combined are predeter-

mined (formulae 7–16)

Constraint formula 2 imposes the condition that

the transferred sum must be positive.

Constraint formula 3 imposes the condition that

the sum total of sums transferred when electronic re-

ceivables are transferred in separate parts does not

exceed the sum of the original electronic receivables

(but not necessarily equal since the splitting of elec-

tronic receivables may leave parts that are not suitable

for transfer).

Constraint formula 4 imposes the condition that

the sum total of payments made by the transfer

of electronic receivables does not exceed the total

amount of be paid (but not necessarily equal since

new issues and combinations are made in cases where

the payable sum cannot be fully allocated by the trans-

fer of electronic receivables alone).

Constraint formula 5 shows that when the fluctu-

ation target of the current assets of participant x on

day e is increased, the increase target of participant x

on day e is greater than the sum of the total amount

of electronic receivables drawn by participant x for an

extension astride day e and the total amount of pay-

ments in which participant x is the transferee for a re-

duction astride day e (a participant’s current assets are

increased by the extension of redemption due dates on

electronic receivables drawn by the same participant,

or by the reduction in payment due date of payments

received by the participant).

Constraint formula 6 is the converse of constraint

formula 5, and shows that when the fluctuation target

of the current assets of participant x on day e is de-

creased, the reduction target of participant x on day

e is less than the sum of the total amount of elec-

tronic receivables drawn by participant x for a reduc-

tion astride day e multiplied by the negative value of

the total amount of payments in which participant x is

the transferee for an extension astride day e (a partic-

ipant’s current assets are reduced by the reduction of

redemption due dates on electronic receivables drawn

by the same participant, or by the extension in pay-

ment due date of payments received by the partici-

pant).

Constraint formulae 7–15 define the possible

range of combinations of electronic receivables and

payments. Specifically, the range for which reverse

combinations are not possible is defined as a trans-

ferred amount of 0 in formula 7, and the applicable

ranges are specified by formulae 8–16.

Range 8 and range 9 specify that electronic receiv-

ables and payments cannot be matched unless the new

due date after modification is between the redemp-

tion date of the electronic receivables and the date on

which the payment is due.

Range 10 specifies that electronic receivables and

payments cannot be matched unless the new due date

after modification is within the redemption dates of

the electronic receivables and the possible range of

payment due dates of the payment.

Range 11 specifies that in cases where the redemp-

tion due date of electronic receivables is before the

date on which payment is due, matching of the elec-

tronic receivables and payments is not possible unless

the interest to be paid by the receiver due to extension

of the redemption due date on the electronic receiv-

ables is less than the interest required by the transferor

due to this extension, and the interest paid by the as-

signee due to a reduction in the redemption due date

is smaller than the interest required by the transferor

ICE-B 2008 - International Conference on e-Business

352

due to this reduction.

Range 12 relates to the case where the redemp-

tion due date comes after the date on which the pay-

ment is due, and is the converse of range 11 where the

payer/payee relationships of interest payments by the

debtor, transferor and transferee are reversed.

Range 13 specifies that when there is an increase

in the fluctuation target for current assets on day e,

it is not possible to perform matching with electronic

receivables issued by the issuer involving a change in

the redemption due date so as to reduce the redemp-

tion due date astride day e (a change that depletes cur-

rent assets). Since this means it is possible to exceed

the target if only one of the combinations is agreed

upon, in this formularization the fact that fluctuation

targets cannot be exceeded is added as a premise to

this constraint.

Range 14 relates to the converse of range 13 in

cases where the current formula fluctuation target of

the issuer is reduced.

Ranges 15 and 16 are the same as ranges 13 and

14 where the issuer imposes limits on the redemption

due data by means of restrictions on changes to the

payment due date in transferee k.

With regard to the definition contents of the above

target functions and constant formulae, first, target

function 1 is the maximization of a primary function

with v(R

ijm

, P

jkn

, f) as a variable, and it takes an inte-

ger value. Also, the constraint formulae are all first-

order inequalities that take v(R

ijm

, P

jkn

, f) as a vari-

able. This problem can therefore be classified as an

integer linear programming problem.

4 EVALUATION

The effects of changes in due date and the effects

of optimizing the combinations of electronic receiv-

ables and payments were verified by simulation. This

section discusses the preconditions under which the

simulation was conducted, and then presents the mea-

surement results.

4.1 Preconditions

There is currently no statistical information relating

to the issue of electronic receivables. We therefore

performed the simulation by assuming conditions for

the issue of electronic receivables based on finan-

cial information from Japanese businesses. Table 1

shows the financial information and the conditions

for the issue of electronic receivables assumed in this

simulation. The financial information was sourced

from corporate statistics published by the National

Tax Agency and from settlement trends for 2003 pub-

lished by the Bank of Japan, including the average

sales figures for Japanese corporations, payable liabil-

ities (accounts payable, bills payable), received credit

(accounts receivable, bills receivable), average sum

of bills cleared, and average sum of accounts receiv-

able. The conditions for the issue of electronic receiv-

ables were assumed based on this financial informa-

tion. Specifically, we made assumptions regardingthe

average redemption period of electronic receivables,

the average frequency of issue and the average sum.

The respective calculation formulae are shown below.

• Average redemption period of electronic receiv-

ables = receivable credit / sales × 365

• Average number of electronic receivables issued

= (bills receivable / average sum of bills cleared

+ accounts receivable / average sum of accounts

receivable) / 365

• Average sum of credit = receivable credit / (bills

receivable / average sum of bills cleared + ac-

counts receivable / average sum of accounts re-

ceivable)

In the simulation, the number of companies was

taken to be 260 (one thousandth of the actual num-

ber of businesses), and measurements were performed

by repeating the transactions over two years. In real

situations, not necessarily all the credit is replaced

with electronic receivables, and not necessarily all

the electronic receivables are subject to being trans-

ferred, so the simulation was performed by making a

few changes to the ratio of transferable sums with re-

gard to the credit sums of the electronic receivables

belonging to a business. The simulation environment

parameters were as follows: MPU: Xeon

1

2.8 GHz,

Memory: 3 GByte, Windows XP

2

, JDK 1.6.0 01

01

3

,

LpSolve 5.5.0.10(Berkelaar et al., 2004). In the evalu-

ation results shown in the next section, measurements

were also performed by varying some conditions of

the other parameters (variation in redemption peri-

ods of electronic receivables, variation in frequency

of issue of electronic receivables, variation in mone-

tary value of electronic receivables, number of com-

panies simulated), but the effects of these changes

were smaller than those of the parameters shown in

Table 1 and thus these results are omitted.

1

Xeon is a registered trademark of Intel Corporation.

2

Windows XP is a registered trademark of Microsoft

Corporation.

3

Java is a trademark of Sun Microsystems, Inc.

AN OPTIMIZATION METHOD FOR REDEMPTION AND DUE DATE MATCHING IN ASSIGNMENT OF

ELECTRONIC RECEIVABLES BY USING INTEGER LINEAR PROGRAMMING

353

Table 1: Financial Statement of Average Japanese Company

and Assumed Issue Condition of Electronic Receivables.

Total Sales(kY=) 20,483

Total Receivables(kY=) 82,887

⁀

Account Receivables(kY=) 66,287

⁀

Note Receivalbes(kY= 16,600

Average Amount of Account Receivables 2,000

Average Amount of Note Receivables 4,000

Assumed Average Redemption Period 59

of Electronic Receivables(Day)

Assumed Average Issue Cycle of 0.102

Electronic Receivables(Times/Day)

Assumed Average Amount of Electronic 2222

Receivables(kY=)

Figure 2: Ratio of Payments by Transfer.

4.2 Measurement Results

We will first use the due date modification function

to investigate the extent to which payments are pro-

moted by transfers. Next, by optimizing the combi-

nations of payments and electronic receivables, we

will verify the extent to which it is possible to achieve

the participants’ fluctuation targets. Finally, we will

investigate the computational load required for opti-

mization.

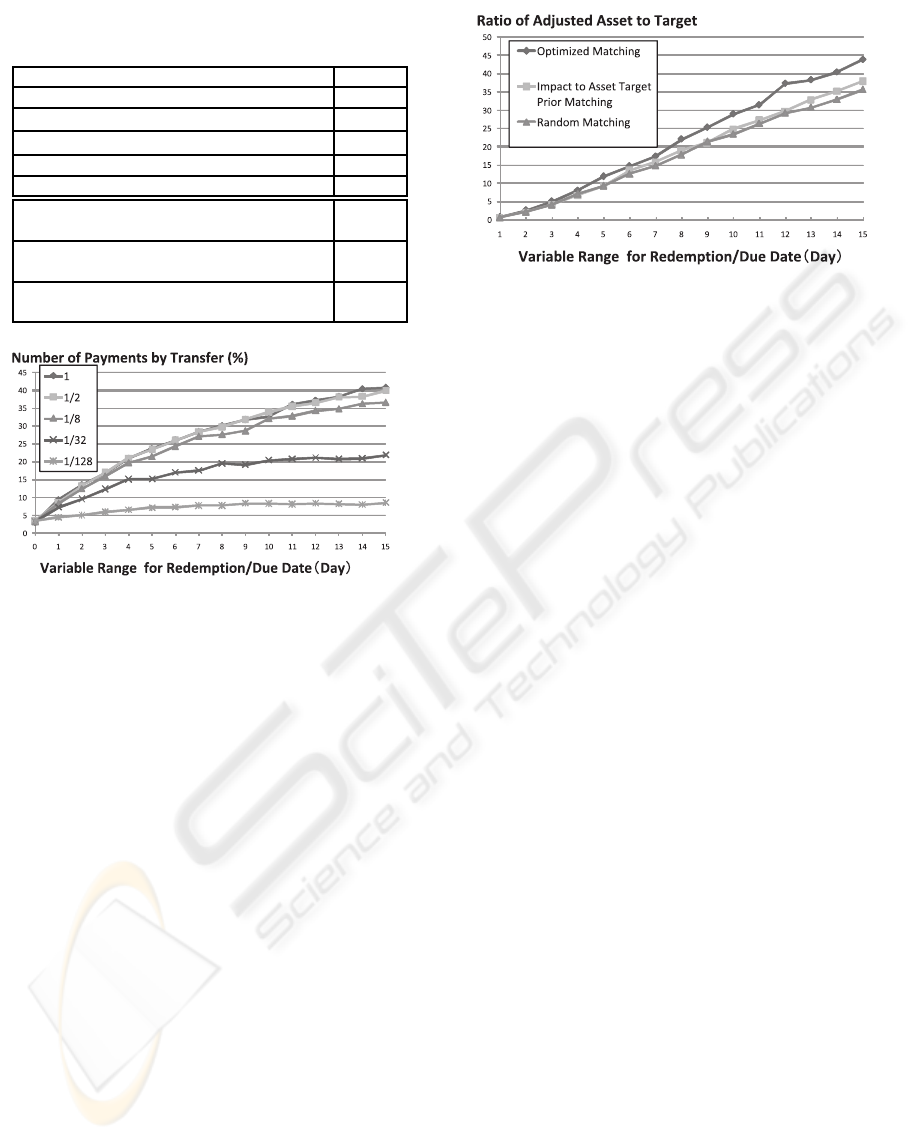

The graph in Fig. 2 shows the ratio of all pay-

ments in which payment was made by assignment of

claim. The horizontal axis shows the number of days

by which the payment due date and redemption due

date can be varied in either direction. The multiple

measurement results in this graph correspond to mea-

surements made while varying the criteria regarding

the extent to which the electronic receivables owned

by a business are transferred on a monetary basis.

This evaluation shows the results obtained when the

matching of electronic receivables and payments is

optimized.

In these results, the case where the modifiable date

is 0 corresponds to the case where no changes can be

made to the redemption due date of the electronic re-

ceivables. In this case, the ratio of the payment that

Figure 3: Ratio of Adjusted Asset to Target.

can be assigned in the transfer of electronic receiv-

ables is about 3.3% of the total. On the other hand,

when the redemption due date and payment due date

are set with the ability to be varied forwards or back-

wards by up to 3 days, the ratio of the payment in

the transfer increases to 16.7% (about 5 times larger)

when all the electronic receivables are transferred.

Also, even when the ratio of the electronic receivables

to be transferred is reduced to about 1/32 of the to-

tal electronic receivables, an increase of 12.3% (about

3.7 times) is seen. These results show that by provid-

ing a framework for making adjustments of a few days

in the redemption due date or payment due date, each

business can make a relatively large improvement to

the ratio of payments made by transfers.

The optimization results are shown next. Figure 3

shows the extent to which it is possible to achieve the

fluctuation targets of current assets set by the partici-

pants for each method of matching a number of elec-

tronic receivables and payments. The specific match-

ing methods used to make these measurements were

as follows:

• Randomly ordered Matching.

Matching is performed in random order from

among candidates consisting of electronic receiv-

ables and payments that are capable of being com-

bined.

• Matching in Order of Effects on the Level of

Achievement.

Matching is performed in order of the magnitude

of how the achievement of the fluctuation targets

is affected by candidates consisting of electronic

receivables and payments that are capable of be-

ing combined.

• Matching based on Optimal Pattern Searching.

Matching is performed by searching for optimal

patterns that are closer overall to the fluctuation

targets.

ICE-B 2008 - International Conference on e-Business

354

Figure 4: Effect of Optimization.

Figure 5: Calculation Time for Daily Optimization.

The horizontal axis in the graph of Fig. 3 shows

the number of days by which the payment due date

and redemption due date can be varied in either di-

rection. The vertical axis shows the extent to which

the fluctuation targets preset by each business could

be achieved. With regard to these measurements,

the fluctuation targets of the businesses were set ran-

domly in the range of the sums of electronic receiv-

ables owned by these businesses. Figure 4 compares

the improvement rate of optimization between ran-

dom matching and matching based on the effects on

the level of achievement. These results show that al-

though there is some degree of variation when there

are few modifiable days, the average ratio of improve-

ment is approximately 18.1% for matching based on

the effects on the level of achievement, and approxi-

mately 19.6% for random matching.

Next, the computation time needed to optimize the

combinations of electronic receivables and payments

is investigated using the graph shown in Fig. 5. In this

graph, the number of businesses is shown on the hori-

zontal axis and the time required for the optimization

computations per day is shown on the vertical axis.

In a simulation of 260 companies, the computation

time required for optimization was 113 seconds per

day on average. This remains future work to make

this method in practice because this simulation done

with 1/1000 of actual number of companies and the

computation time glows exponentially according to

increase the number of companies. We discuss this

problem in section 5.

Finally, Table 2 shows the extent to which the

Table 2: Fragmented Number of the Electronic Receivables.

Average Standard Max

Deviation

Random Matching 2.09 1.05 10

Impact to Asset Target 1.38 0.57 7

Prior Matching

Optimized Matching 2.06 1.93 9

electronic receivables are fragmented by the match-

ing of due dates. The number of fragments is a value

that shows on average how many electronic receiv-

ables the original electronic receivables are divided

into at the time of redemption. The average number

of fragments was 2.08 when matching was performed

in random order, 1.38 when matching was performed

in order of the effects on the effects on the level of

target achievement, and 2.06 when matching was per-

formed based on optimal pattern searching. The rea-

son for the small number of fragments obtained when

matching in order of the effects on the effects on the

level of target achievement is thought to be because in

this algorithm, matching is performed preferentially

on groups of electronic receivables and payments in-

volving larger sums and greater differences in due

dates, and these larger sums suppress the fine frag-

mentation of electronic receivables.

5 CONCLUSIONS

In this study, we have proposed a scheme for optimiz-

ing the matching of redemption due dates and pay-

ment due dates for electronic receivables to promote

the transfer of electronic receivables. Specifically,

we have demonstrated an optimization scheme that

makes every effort to make the fluctuations in the cur-

rent assets of each business (caused by changes of due

date) approach their fluctuation targets based on cri-

teria specified by each business regarding the fluctua-

tion targets of current assets, the range of alterations

to due dates, and the rates of interest. We have also

shown that this problem can be classified as a type

of integer linear programming problem. By perform-

ing simulations based on the financial circumstances

of average Japanese businesses, we have shown that

this technique is capable of promoting transfers in-

volving changes of due date and improving the degree

to which fluctuation targets are achieved by optimiza-

tion.

One issue for further study is the problem of elec-

tronic receivables being finely fragmented by the op-

timization process. In the method of this study, if the

fluctuation targets of the participants’ assets are im-

AN OPTIMIZATION METHOD FOR REDEMPTION AND DUE DATE MATCHING IN ASSIGNMENT OF

ELECTRONIC RECEIVABLES BY USING INTEGER LINEAR PROGRAMMING

355

proved, then the electronic receivables can be arbi-

trarily fragmented and a number of payments will be

assigned to a number of new due dates. This fragmen-

tation of electronic receivables leads to increased ad-

ministration costs, so to actually put this method into

practice, it is important to investigate how to control

the fragmentation of electronic receivables.

A second issue is that of partitioning the opti-

mization regions. In this study, optimization was per-

formed by using a single target function to represent

the criteria of all the companies concerned, but this is

inefficient with regard to increasing the scale of busi-

nesses to which the method is applied. In practice,

there is considered to be some degree of locality in

the transaction relationships between businesses, so if

groups of businesses can be split into suitable ranges,

then it should be possible to split the optimization

problem into multiple sub-problems with fewer vari-

ables and constraints. In this way it should be possi-

ble to reduce the computational cost and speed up the

computation time by employing parallel processing.

A third issue is that not necessarily all of the opti-

mal matching results demonstrated by this algorithm

are the best matching results from the viewpoint of

each individual business. For actual operations, an

important issue is therefore to somehow present alter-

native proposals in cases where a business rejects the

matching results.

REFERENCES

Aardal, K., Nemhauser, G., and Weismantel, R. (2005). Op-

timization: Handbooks in Operations Research and

Management Science, volume 12. Elsevier.

Berkelaar, M., Eikland, K., and Notebaert, P. (2004). lp-

Solve: Open Source (Mixed-Integer) Linear Program-

ming System. GNU LGPL (Lesser General Public Li-

cense).

Fairchild, A. (2003). Possible Distinermediation: What

Role for Banks in Electronic Invoicing(EIPP).

In 16th Bled eCommerce Conference eTransfor-

mation, pages 107–118. http://domino.fov.uni-

mb.si/ECOMFrames.nsf/pages/bled2003.

FSA (2005). Summary of Discussion on Electronic

Receivable Legislation from a Financial System

Perspective. Newsletter of Financial Services

Agency, The Japanese Government, pages 2–5.

http://www.fsa.go.jp/en/newsletter.

Ikeda, M. (2006). Electronic receivables - examination

and essay for legislation - (in japanese). Banking

Law Journal, Kinzai Institute for Financial Affairs,

1781:8–19.

JSBRI (2007). White Paper on Small and Medium En-

terprises in Japan. Japan Small Business Research

Institute. http://www.chusho.meti.go.jp/sme

english/

whitepaper/whitepaper.html.

KFTC (2002). Check clearings. KFTC 2002, pages 18–19.

http://www.kftc.or.kr/english/statistics/KFTCAR.pdf.

Oogaki, H. (2006). Finance in secondary loan market

and electronic receivables (in japanese). Banking

Law Journal, Kinzai Institute for Financial Affairs,

1781:20–28.

Schrijver, A. (1986). Theory of Linear and Integer Pro-

gramming. Wiley-Interscience.

Shimamura, A., Moritsu, T., and Someya, H. (2006). Deliv-

ery path length and holding tree minimization method

of securities delivery among the registration agencies

connected as non-tree (in japanese). IEEJ Trans., 126-

C(4):506–512.

ICE-B 2008 - International Conference on e-Business

356