CLASSIFICATION OF MARKET NEWS

AND PREDICTION OF MARKET TRENDS

P. Kroha and R. Nienhold

Department of Computer Science, University of Technology, Strasse der Nationen 62, 09111 Chemnitz, Germany

Keywords:

Text classification, Stock exchange news, Market trends.

Abstract:

In this contribution we present our results concerning the influence of news on market trends. We processed

stock news with a grammar-driven classification. We found some potentialities of market trend prediction

and present promising experimental results. As a main result we present the fact that there are two points

(altogether only two) representing the minimum of good news/bad news relation for two long-term trends

breaking points (altogether only two) during the last 10 years and that both of these points representing news

appear in both cases about six months before the long-term trend of markets changed.

1 INTRODUCTION

Text mining is a promising new field combining meth-

ods of linguistics, computer science, artificial intelli-

gence, and mathematics. The goal is to extract, rep-

resent, and use the meaning of texts. A subset of text

mining is text classification. Text classification is eas-

ier because the topic is not the meaning of a text but

the similarity of textual objects. Classification meth-

ods are known from other fields of applications. The

main idea is that we have to find specific features

of objects to be classified that can be used to define

classes and to controll the process of assigning an ob-

ject to a class.

One practical application of text classification is

the classification of short messages, e.g. advertise-

ments. We considered it interesting to classify news

concerning markets because we can investigate the in-

fluence of the obtained classes and their cardinalities

on market prediction after the classification.

There are some thousands of daily news available

that can influence markets. Nobody can read them

all. Usually, analysts are specialized and read only

news of some branch, published by some respectable

agency.

Most investors believe that markets are driven by

news so that they need to read them and use them

for their investment decision. Because of that, news

about economic and political events that concern mar-

kets and stock exchange situation are a very well-

selling article. There are profitable agencies selling

news subscriptions of any possible kind.

Theoretically, this concept is controversial or at

least disputed. The currently accepted theory of effi-

cient markets (Fama, 1970) states that the information

contained in any public news story is already con-

tained in stock prices so that it cannot bring a profit

anymore. As we started our investigation we stated

a hypothesis based on the theory of efficient markets.

Our hypothesis was that when news only describe the

existing situation, i.e. when the information obtained

in news is already contained in stock prices then news

cannot have any prediction features.

However, there is also the theory of inefficient

markets (Shleifer, 2000) that has interesting argu-

ments, too. Practically, investors hope that markets

are inefficient and believe that they can use various

strategies how to exploit the news obtained. Some of

them are buying on good news, some of them are sell-

ing on good news. If the majority of investors wants

to buy, the up-trend will be generated. If the major-

ity of investors wants to sell, the down-trend will be

generated.

The process is complex because the market con-

text changes very chaotically. Many investors do not

have a stable behavior and they do not use fixed rules

but often only an intuition. The situation which is

necessary for the stock exchange to work is that at

any time point there is a group of investors thinking

that this is the right point to sell and at the same time

point there is another group of investors thinking that

this is the best time point to buy. In other cases, the

stock exchange would not work.

Our motivation was to investigate the influence of

187

Kroha P. and Nienhold R. (2010).

CLASSIFICATION OF MARKET NEWS AND PREDICTION OF MARKET TRENDS.

In Proceedings of the 12th International Conference on Enterprise Information Systems - Artificial Intelligence and Decision Support Systems, pages

187-192

DOI: 10.5220/0002867301870192

Copyright

c

SciTePress

news on long-term market trends using different tech-

niques of text classification. We continued the re-

search presented in (Kroha and Baeza-Yates, 2005),

(Kroha et al., 2006), (Kroha and Reichel, 2007),

(Kroha et al., 2007) that resulted in the conclusion

that the quotient between good and bad news starts to

recover some months sooner before the markets start

to grow up again.

In (Kroha and Reichel, 2007), we introduced our

grammar-driven text classification method for market

news in English and found that the curve representing

the quotient between positive and negative news starts

to grow about some months before the markets start

to grow. Because we investigate long-term trends and

because we have our data staring in 1999 we found

only one such situation described above.

Ever since, the prime crisis has come and there is

another down trend (2007 - 2009) and another break-

ing point (March 2009) in markets.

In the investigation described in this paper, we

want to answer the following questions:

• How easy or difficult it is to construct a gram-

mar for our grammar-driven classification of tex-

tual market news when it should be done for Ger-

man language (complex declination, conjugation,

irregular plurals)? We were trying to answer it for

German language because we have about 554.000

news available.

• When we change not only the language of news

but also the time interval do we get similar re-

sults compared with our previous? This means,

we were curious whether the dependences found

for english market news from the time interval

1999 - 2006 can be observed in german market

news from the time interval 1999 - 2009, too.

We used the grammar-driven method like we did in

(Kroha and Reichel, 2007) but we constructed a gram-

mar for classification of news written in German. Fi-

nally, we found that the conclusion from analysing

market news in English from 1999 - 2006 can be

confirmed through experiments with market news in

German from 1999 - 2009. As we will show, the

news indicator (good news/bad news) processed by

our grammar-driven text classification method seems

to have interesting features that could be used for fore-

casting because the news indicator changes its trend

some months before the market changes its trend.

The rest of the paper is organized as follows. In

Section 2 we discuss related work. In Section 3 we

briefly explain why we want to use a grammar-driven

method. In Section 4 we take a look to the imple-

mented system which proceed all messages. Section 5

describes our results in comparison to the DAX stock

index. In the last section we present some measure-

ment results and conclude.

2 RELATED WORK

In related papers, the approach to classification of

market news is similar to the approach to document

relevance. Experts construct a set of keywords which

they think are important for moving markets. The

occurrences of such a fixed set of several hundreds

of keywords will be counted in every message. The

counts are then transformed into weights. Finally, the

weights are the input into a prediction engine, which

forecasts which class the analyzed message should be

assigned to.

In (Nahm and Mooney, 2001) and (Nahm, 2002),

a small number of documents was manually annotated

(we can say indexed) and the obtained index, i.e. a

set of keywords, will be induced to a large body of

text to construct a large structured database for data

mining. The authors work with documents contain-

ing job posting templates. A similar procedure can

be found in (Macskassy and Provost, 2001). The key

to his approach is the user’s specification to label his-

torical documents. These data then form a training

corpus to which inductive algorithms will be applied

to build a text classifier.

In (Lavrenko et al., 2000), a set of news is corre-

lated with each trend. The goal is to learn a language

model correlated with the trend and use it for predic-

tion. A language model determines the statistics of

word usage patterns among the news in the training

set. Once a language model has been learned for ev-

ery trend, a stream of incoming news can be mon-

itored and it can be estimated which of the known

trend models is most likely to generate the story.

Compared to our investigation, there are two differ-

ences. One difference is that Lavrenko uses his mod-

els of trends and corresponding news only for day

trading. The weak point of this approach is that it is

not clear how quickly the market responds to news re-

leases. The next difference is that our grammar-driven

method respects the structure of a sentence that can

have a fundamental influence on the meaning of the

sentence.

In our previous work (Kroha and Baeza-Yates,

2005), we have been experimenting with statistical

methods of text classification that are based on the

frequency of terms to distinguish between positive

news and negative news in terms of long-term mar-

ket trends. In (Kroha and Reichel, 2007), we pre-

sented a grammar-driven text mining method, i.e. we

have built a grammar that describes templates typical

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

188

for specific groups of news stories written in English.

Each sentence in a news story is analyzed by a parser

that determines the template to which the sentence

belongs. Sentences and news are classified accord-

ing to these assignments. We compared the statisti-

cal method and the grammar-driven method in (Kroha

et al., 2007).

The first method (Kroha and Baeza-Yates, 2005),

(Kroha et al., 2006) uses Bayes classification in two

modifications. Its disadvantage is that it is based on

frequency of words and does not respect the struc-

ture of sentences. The next method (Kroha and Re-

ichel, 2007) is grammar-driven, i.e. it uses a gram-

mar for description of classification so that it can

mine more from sentences—so far from composed

sentences. This method can be seen as a refinement

of the first method.

3 GRAMMAR-DRIVEN METHOD

FOR NEWS IN GERMAN

In methods of information retrieval, stop-list and

term frequency are used to specify the content of doc-

uments. The goal is to find documents that concern

the given topic which is given by some terms, too.

For the purpose of text classification, term fre-

quency is not enough and some words from the stop-

list can completely change the classification. Some

features that are important for the classification are

given by the sentence structure and not by the term

frequency. In (Kroha and Baeza-Yates, 2005), we pre-

sented an example in which two news stories have the

same term frequency but a completely different mean-

ing.

To overcome the problem presented above, we

have written a grammar describing grammatical con-

structions in English (Kroha and Baeza-Yates, 2005)

that usually bring positive or negative meaning to a

sentence.

3.1 Data for Grammar Construction

To get an overview what form a positive or a nega-

tive news story in German can have, we analysed by

hand 547 market news having 8448 sentences. News

and sentences are not only positive or negative. Many

of them do not have clearly defined meaning, i.e. it

cannot be clearly decided what an influence they can

have. Because of that we filtered out all sentences that

did not have a company name (no company news) as a

subject, all sentences that only commented the move-

ment of indices, all sentences having political content,

all sentences containing speculations and guesswork.

This way we filtered out about 64 % of news sto-

ries. Some news use the company name only in the

first sentence and the following sentences can be dif-

ficult to assign (roundup news). Some sentences de-

scribe events but it is difficult to decide in which way

they influence the markets, e.g. company take-over,

suspension of staff, paying a penalty. Some sentences

can be clearly identified as positive or negative. They

were only 514 of 8,448. Many sentences could not

be assigned to any pattern and were marked as “not

classified”. They were 2,240 of 8,448. The overview

is given in Table 1.

Starting from the news and sentences analysed

manually, we defined terms and structure of sentences

that should be represented in a grammar.

Example:

Start = {System.out.println

("Classification: ");}

(Sentence)* ;

Sentence = Positive | Negative;

Positive = {System.out.print

("test positive");}

Company Subject PosVerb ’.’

{System.out.println

(" > is positive");};

Negative = {System.out.print

("test negative");}

Company Subject NegVerb ’.’

{System.out.println

(" > is negative");};

Company = ’Allianz’ | ’Bosch’;

PosVerb = ’steigern’ | ’steigert’;

Verb = ’verzeichnen’ | ’verzeichnet’;

Subject = ’Gewinn’ | ’Umsatzrueckgang’;

3.2 Precision of our Grammar

The used grammar was build with messages from

November 1999 and tested with messages from

November 2004. To avoid a lot of sentences get-

ting filtered by the withoutcompany-filter, a set of

companies and company paraphrases were also in-

serted into our grammar. To check how accurately

it works, we compared every grammar-found classifi-

cation with the proceeding sentences by hand. In fact,

89 % of all sentences were correctly matched by the

grammar in our training period. As much as 91 %

compliance could be achieved for the test period.

Considering the huge number of messages, it has

been impossible to get a recall about sentences that

should have been matched by the grammar but have

not been.

CLASSIFICATION OF MARKET NEWS AND PREDICTION OF MARKET TRENDS

189

Table 1: Types of news stories.

Type Number of News Number of Sentences Filtered out

Company news 297 3878 53 %

Roundup news 30 687 53 %

Overview 59 1612 55 %

Currency news & Commodity news 128 1831 91 %

Political news 33 440 98 %

∑

547 8448 64 %

4 IMPLEMENTATION

The described system was implemented as a compo-

nent of the information system WEBIS in Java under

Eclipse in (Nienhold, 2009). The BNF-form of the

grammar was transformed into an executable version

of a parser. We used the tool Bex (Franke, 2000) that

produced the source code of the corresponding ll(k)-

parsers. This source code was adapted by a classifi-

cation object ClassifyObj(c) that completed the gram-

mar by semantic rules describing the classification of

messages.

The grammar can be easily created and edited us-

ing the grammar editor we wrote. It is possible to

enhance new keywords and patterns to match more

sentences. Via an import interface the opportunity is

given to add several companies that are listed in a text

file. In fact, the result will become more exact.

The lexical analysis has to transpose the textual

messages into a form suitable for processing by the

parser, i.e. into a form that will be accepted by all

means (the case notClassified is a part of the gram-

mar). It is necessary for every sentence to be classi-

fied because the parser should not interrupt the classi-

fication.

At the very beginning, each message will be de-

composed into sentences. All abbreviations are inves-

tigated for change (to delete the dot) to guarantee that

sentences are identified correctly. Then all words will

be removed from each sentence that are not terminals

of the given grammar. This process of text message

preparation can be called normalization. In the next

step normalized texts are processed.

The process of classification runs on normal-

ized text messages. The parser reads every mes-

sage and builds a corresponding object ClassifyObj

that contains the number of classified (event. non-

classified) sentences. This means that every clas-

sification of a sentence is stored (negative, posi-

tive or non-classified) and—as a result of a major-

ity decision—the whole message gets a classifier, too.

All details are described in (Nienhold, 2009).

5 EXPERIMENTS AND RESULTS

We used about 554,000 market news in German cov-

ering the interval from November 1999 to June 2009.

It was not possible to recognize and classify all sen-

tences completely. In the set we checked, we achieved

a recall of about 73 %, i.e. 27 % of the relevant sen-

tences were not matched by the grammar, and a pre-

cision of about 88 %, i.e. 12 % of all sentences were

classified wrongly. The data processing was time con-

suming. In the first approach we used a PC having In-

tel Core 2 DUO E6750 processor with 2 GB memory.

It took 21 hours. In the next approach we used an Ap-

ple MacPro computer having 8 kernels, we wrote our

programms using threads. The process took 4 hours

then.

The classification found was used to calculate a

prediction. We weighted the positive news with +1,

the negative news with -1, not classified news with 0.

Then, we can use the following formula:

Prediction

t

(pos, neg) =

h

t

(pos) − h

t

(neg)

h

t

(pos) + h

t

(neg)

(1)

In the equation above (1) h

t

(pos) is the number of

positive classified news at time point t and h

t

(neg) is

the number of negative classified news at time point t.

The obtained prediction function (smoothed) in

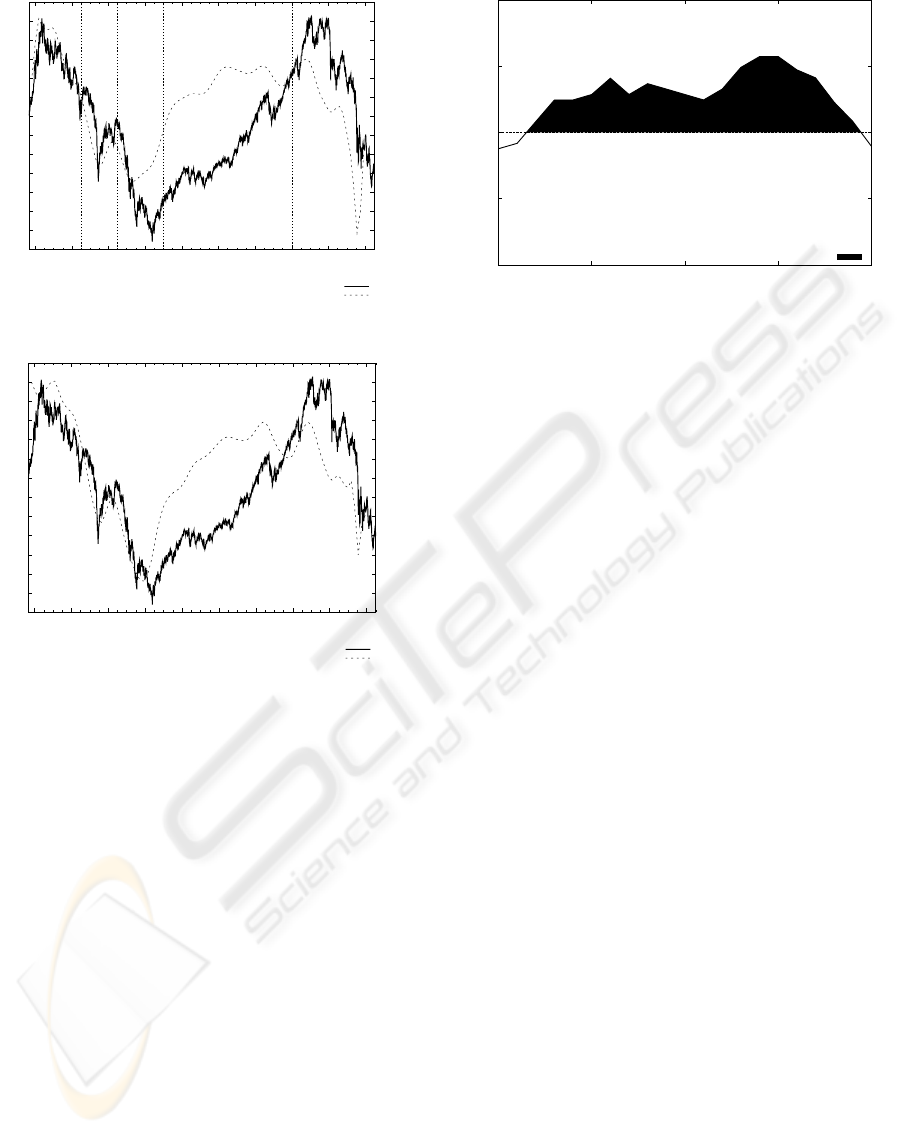

context of the german DAX market index is shown in

Fig. 1. In region A (November 1999 - March 2001),

we can see that the DAX and our prediction are prac-

tically identical. In region B (April 2002 - June 2003),

we can see the breaking point of our prediction curve

get ahead of the breaking point of DAX by about nine

months. In region C (January 2007 - March 2009), we

can see again that the breaking point of our predic-

tion curve gets ahead of the breaking point of DAX

by about a half a year, i.e. the minimum of the predic-

tion curve comes at end of September 2008 and the

minimum of DAX comes at the end of March 2009.

We have got a more precise prediction—shown in

Fig. 2—when we calculated the prediction only from

news that concern companies obtained in index DAX.

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

190

2000

2500

3000

3500

4000

4500

5000

5500

6000

6500

7000

7500

8000

8500

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

0.20

0.25

0.30

0.35

0.40

0.45

0.50

0.55

0.60

0.65

0.70

0.75

0.80

0.85

DAX

forecast

year

A B C

DAX

grammar forecast

Figure 1: DAX and prediction smoothed - All market news.

2000

2500

3000

3500

4000

4500

5000

5500

6000

6500

7000

7500

8000

8500

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

0.25

0.30

0.35

0.40

0.45

0.50

0.55

0.60

0.65

0.70

0.75

0.80

0.85

0.90

DAX

forecast

year

DAX

grammar forecast

Figure 2: DAX and prediction smoothed - DAX market

news.

In this case, our prediction get six month ahead of

DAX in both cases B and C.

5.1 Statistical Analysis

In the previous section, we predicted two breaking

points of type from-Down-to-Up with a forward of

half a year to nine months. As we can see in Fig. 2,

we are not able to predict the breaking points of type

from-Up-to-Down.

An interesting topic is now to investigate to what

extend it is possible to predict the DAX within n

weeks in the future, i.e. what is the precision of the

forecast and how it depends on time. We compared all

existing trends of the DAX weekly with the trends of

our prediction in a time intervall by [-20 weeks, +20

weeks]. The result is shown in Fig. 3.

The resulted pseudo code represents the way we

have obtained values given in Fig. 3 :

for i=-20 to 20 step 1

for n=firstWeek to lastWeek step 1

40

45

50

55

60

0 5 10 15 20

rate of congruence in %

week

positive congruence

Figure 3: Congruence between the prediction and the DAX

trend.

if(lastWeek < n+i < firstWeek)

continue

if(DAXweek_n = uptrend)

if(PREDweek_(n+i) = uptrend)

equal++

rate_of_congruence_i = equal/n

Hence, we got an overcome by 55.7 % in +14 and

+15 weeks. So we can say that if our prediction shows

an uptrend in 14 weeks the DAX will have an uptrend

by 55.7 %, too.

6 CONCLUSIONS

As we have shown, our prediction calculated from the

quotient of good and bad news has interesting proper-

ties. In the last ten years, we have two breaking points

of long-term trends changing from down to up. In

both cases, our prediction curve obtained from news

about companies in DAX gets six months ahead of the

DAX index which is the main index of the market in

Germany. Of course, two cases are not enough and

we cannot state it as a rule. Additionally, there are

other influences not contained in market news.

The reason why we can predict only from-Down-

to-Up changes is very probably a psychological one.

Frustrated investors observing markets going down

do not want to believe that there are some positive

changes in news and this is why the change of news

goes ahead of market change.

In further work, we will try to evaluate the impact

of messages in context of other economic parameters.

We are sure that the same news story will be inter-

preted by investors differently when it comes in a dif-

ferent context of other economic parameters. We are

just experimenting in including parameters concerned

the classified news as inputs into a neuronal network.

CLASSIFICATION OF MARKET NEWS AND PREDICTION OF MARKET TRENDS

191

In such a way, we can observe not only the influence

of market news but also the influence of other eco-

nomic parameters like oil price, gold price, relation

between currencies, etc. We hope to get some refine-

ment of the prediction.

The next problem is that we also need to take into

account that some of news are not true and some of

them has been constructed with the intention to mys-

tify the investors. The task to filter out such news

would be very interesting but too difficult at the very

moment.

Also, we will try to evaluate a correlation be-

tween specific events of messages over a short and

long timeperiod, i.e. fulfilled prognoses. An event

weighting will get more precisely using weights in an

intervall of [-1, +1] instead of -1, 0 and +1.

REFERENCES

Fama, E. (1970). Efficient capital markets: A review of the-

ory and empirical work. Journal of Finance, 25, pp.

383-417,.

Franke, S. (2000). Bex a bnf to java source compiler. In

http://www.bebbosoft.de/.

Kroha, P. and Baeza-Yates, R. (2005). A case study: News

classification based on term frequency. In Proceedings

of 16th International Conference DEXA’2005, Work-

shop on Theory and Applications of Knowledge Man-

agement TAKMA’2005, pp. 428-432. IEEE Computer

Society.

Kroha, P., Baeza-Yates, R., and Krellner, B. (2006). Text

mining of business news for forecasting. In Proceed-

ings of 17th International Conference DEXA’2006,

Workshop on Theory and Applications of Knowledge

Management TAKMA’2006, pp. 171-175. IEEE Com-

puter Society.

Kroha, P. and Reichel, T. (2007). Using grammars for text

classification. In Cardoso, J., Cordeiro, J., Filipe,

J.(Eds.): Proceedings of the 9th International Confer-

ence on Enterprise Information Systems ICEIS’2007,

Volume Artificial Intelligence and Decision Support

Systems, INSTICC with ACM SIGMIS and AAAI, pp.

259-264. INSTICC with ACM SIGMIS and AAAI.

Kroha, P., Reichel, T., and Krellner, B. (2007). Text mining

for indication of changes in long-term market trends.

In Tochtermann, K., Maurer, H. (Eds.): Proceed-

ings of I-KNOW’07 7th International Conference on

Knowledge Management as part of TRIPLE-I 2007,

Journal of Universal Computer Science, pp. 424-431.

Lavrenko, S., Lawrie, O., and Jensen, A. (2000). Language

models for financial news recommendation. In Pro-

ceedings of the Ninth International Conference on In-

formation and Knowledge Management, pp. 389-396.

Macskassy, S. and Provost, F. (2001). Intelligent Informa-

tion Triage. In Proceedings of SIGIR’01, New Or-

leans, USA.

Nahm, M. (2002). Text mining with information extraction.

In AAAI 2002, Spring Symposium on Mining Answers

from Texts and Knowledge Bases, Stanford.

Nahm, U. and Mooney, R. (2001). Mining Soft-Matching

Rules from Textual Data. In Proceedings of the 17th

International Joint Conference on Artificial Intelli-

gence IJCAI-01.

Nienhold, P. (2009). Classification of News by a ll(k)-

Grammar as a Component of WEBIS. M.Sc. The-

sis, Department of Computer Science, TU Chemnitz,

Chemnitz, (in german) edition.

Shleifer, A. (2000). Inefficient Markets – An Introduction to

Behavioral Finance. Oxford University Press, Oxford.

ICEIS 2010 - 12th International Conference on Enterprise Information Systems

192