A CASE STUDY OF THE E-MONEY APPLICATION IN JAPANESE

PUBLIC TRANSPORTATION

Shoichi Morimoto

Department of Business Administration, Senshu University, 2-1-1 Higashi-mita, Tama-ku, 214-8580, Kanagawa, Japan

Keywords:

Contactless smart card, RFID, Near field communication, ISO/IEC 14443.

Abstract:

Japan leads the world in the field of a rechargeable contactless smart card used as a fare card of public trans-

portation. The card triggered off the spread of Japanese e-money, however, the e-money situation has various

intricate problems to tackle. Therefore, we have surveyed the spread process of the e-money and special

circumstances of Japanese public transportation. In this paper we describe the business success factors and

background. We also analyze and propose the solution against the problems and objectives for globalization

of the market.

1 INTRODUCTION

Recently, the application of e-money has expanded

into a means of payment of public transportation. The

e-money for the fare is generally implemented by

a smart card, particularly a contactless RFID smart

card. Such a contactless smart card is used all over

the world, e.g., Octopus card in Hong Kong, Suica

card in Japan, Oyster card in London, Navigo card in

Paris, T-money in Seoul, Compass Card in San Diego,

Riocard in Rio de Janeiro, GoCard in Nigeria, and so

on. Above all, Japan is an advanced country of the

contactless smart card.

The spread process of Japanese e-money is very

unique. Japanese people had not had interest in e-

money at all, until the fare contactless smart card

became practicable. After the card appeared in ma-

jor rail services, e-money has spread rapidly, be-

cause a commuter can pass without stopping the very

crowded ticket gate during the Japanese rush hours.

The card can also be used at kiosks and vending ma-

chines inside stations. Moreover, recently the card

has been able to be used at convenience stores, su-

permarkets, eating houses and the other shops outside

stations. In addition, the bus trade has introduced the

card. Thus various Japanese transportation companies

have issued such a card with e-money. One innova-

tive service with the card is coming out after another

in quick succession and entry of the other trades into

the market is increasing. Now the business of the con-

tactless smart card with e-money in Japan has been a

great success.

However, the e-money market has some problems

to solve. Since each transportation company has is-

sued its independent card, the Japanese transporta-

tion trade is flooded with many kinds (about 40) of

contactless smart cards. The introduction of the card

system is also very expensive, thus small companies

which do not sufficiently have the capital strength

(e.g., a local bus company) cannot even introduce the

card and they are outdistanced. Moreover, FeliCa, the

Japanese de facto standard of the contactless smart

card, is not certified by the RFID international stan-

dard ISO/IEC 14443, that is, it is not global standard.

The business of e-money in Japan is overly concen-

trated on the domestic market only. There is very lit-

tle room for entry of overseas enterprises.

So far only the technological side of a contact-

less smart card and its system has been highlighted

(Shiibashi, 2007). No studies have tried to survey the

trade all over and to summarize the business success

factors. Therefore, in this paper we survey the evo-

lution process of e-money in Japanese public trans-

portation and clarify the background and the prob-

lems which are caused by special circumstances of

Japanese railways. We also discuss the secrets of suc-

cess and solutions against the problems of compatibil-

ity and localization. The results in this paper open the

Japanese e-money market and help its globalization.

Moreover, they systematize the introduction of a con-

tactless smart card into public transportation. Conse-

quently, it will enliven the e-money market all over

the world.

76

Morimoto S. (2010).

A CASE STUDY OF THE E-MONEY APPLICATION IN JAPANESE PUBLIC TRANSPORTATION.

In Proceedings of the International Conference on e-Business, pages 76-81

DOI: 10.5220/0002995800760081

Copyright

c

SciTePress

2 THE CARD SITUATION

2.1 Early History of Japanese e-Money

In 1998, the first Japanese e-money, VISA Cash, was

introduced experimentally. However, this experiment

has ended in failure. VISA Cash was implemented by

a contact smart card. The user had to take the card

from a holder and input the PIN code. Japanese peo-

ple did not accept such troublesome operations.

In 2001, the first contactless smart card with

e-money, named Edy, appeared. Edy is a pre-

paid rechargeable contactless smart card, which

uses Sony’s FeliCa technology. FeliCa allows to

send/receive data at high speed and with high security

(Kurosawa et al., 2003). It does not need a battery

to operate. Further details of the FeliCa technology

will be presented later. Edy was able to be used only

at convenience stores then. Japanese people did not

particularly interest in Edy yet, because e-money did

not have a good image at the time owing to the former

e-moneys.

In the same year, the Suica service started in the

metropolitan area (Shirakawa and Shiibashi, 2003).

Suica using the FeliCa technology is a rechargeable

contactless smart card used as a fare card on train

lines. Suica was able to be used only as the fare pay-

ment in the limited lines then; nevertheless it had a

circulation of one million only in 19 days and two

million only in two months. The service has been ex-

panded besides the fare payment after 2004 succes-

sively.

The e-money trade has been an arena of rival cards

since Suica achieved a great success. Many public

transportation companies followed the service and is-

sued similar cards. We describe details of such cards

and their development in the following subsections.

2.2 The Cards in Public Railways

Japanese railways are classified into two types; JR

(Japan Railways) or non-JR. JR used to be the na-

tional railway JNR (Japan National Railways), which

dissolved and separated into seven (six passenger rail-

ways and one freightage) JR companies in 1987. The

passenger railways are separated by region. Figure 1

shows each JR company’s area.

Although Japan is a small island country, the char-

acteristic of the people of each region varies accord-

ing to the locality. For instance, consumer behavior

and interest differ from the Kanto region (Tokyo) to

the Kansai region (Osaka/Kyoto) very much. Each JR

company has to work out management policies which

bear closely on the needs of local people. Each JR

Figure 1: The region of JR companies.

company also considers the other JR companies com-

petitors which scramble for business chances. There-

fore, the companies developed their own cards shown

in Table 1. All the cards are implemented by FeliCa.

Table 1: The contactless smart cards of JR group.

Company Card name Number of stations

JR Hokkaido Kitaca 465

JR East Suica 1705

JR Central TOICA 404

JR West ICOCA 1222

JR Shikoku – 259

JR Kyushu SUGOCA 560

A user can charge money on to the card at ticket

vending machines inside each station. The charged

money is a profit of the JR company in the card re-

gion. Thus, at first each card was not able to use in the

other regions. The introduction of contactless smart

cards to the Shinkansen line, which is a high-speed

railway line, had also been put off for some years. The

Tokaido Shinkansen line is the main artery crossing

the Japanese mainland. JR Central has jurisdiction

over the line. Because the line lies across the regions,

JR Central and the other JR companies have been at

odds with each other over the profit at the stations in

the Tokaido Shinkansen line.

The specification of each card system is also dif-

ferent from the others. For example, the Suica system

closes a ticket gate if e-money on the card is under the

starting fare when a passenger enters. Meanwhile the

ICOCA system does not close it unless the e-money is

empty, since the Kansai region people generally tend

to dislike a time-consuming operation. TOICA ac-

cepts the empty card. Moreover, the fare adjustment

A CASE STUDY OF THE E-MONEY APPLICATION IN JAPANESE PUBLIC TRANSPORTATION

77

rule of each JR company is different. The difference

is also caused by the introduction order. The JR com-

panies following the formers can watch the response

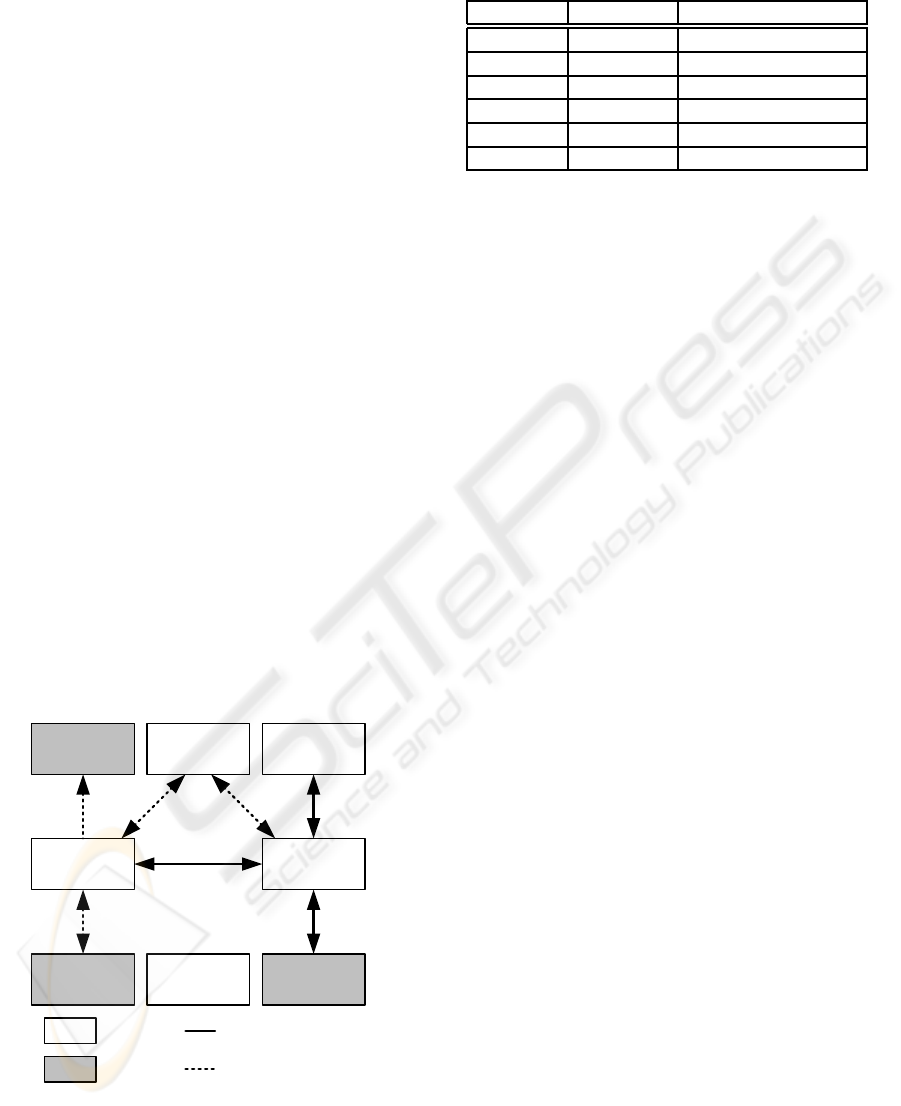

to the card. The year of each introduction is shown

in Figure 2 (the number in parenthesis). The compat-

ibility is implemented by a software program in the

card reader, however, each card system must have the

programs against all the other cards.

2.3 The Cards in Private Railways

The private railways (non-JR railways) also started

the fare contactless smart card service. The services

are classified into a joint capital type or an inde-

pendent type. In the metropolitan area, the private

railways established a new association PASMO Co.

Ltd. of the contactless smart card business by joint

capital. The PASMO card is perfectly compatible

with Suica. Therefore, transfer of JR lines and pri-

vate/underground railways has been very convenient;

we can change one line to another only with one con-

tactless smart card in the Kanto region. It was the

epochal event of Japanese railways history, because

JR and non-JR had been always competitors one an-

other. Similarly, the Kansai region private railways

have issued the common card PiTaPa. PiTaPa is a

novel card in Japanese public transportation, which

is a postpay type card like a credit card for the impa-

tient Kansai region people. PiTaPa also implements

various discount services. The private railways in the

other regions have also issued their own cards shown

in Table 2.

㪪㫌㫀㪺㪸

㩿㪉㪇㪇㪈㪀

㪧㪘㪪㪤㪦

㩿㪉㪇㪇㪎㪀

㪢㫀㫋㪸㪺㪸

㩿㪉㪇㪇㪏㪀

㪫㪦㪠㪚㪘

㩿㪉㪇㪇㪍㪀

㪠㪚㪦㪚㪘

㩿㪉㪇㪇㪊㪀

㪧㫀㪫㪸㪧㪸

㩿㪉㪇㪇㪋㪀

㪧㪘㪪㪧㪰

㩿㪉㪇㪇㪏㪀

㪉㪇㪇㪐

㪉㪇㪇㪎

㪉㪇㪇㪏

㪉㪇㪇㪍

㪉㪇㪇㪏

㪉㪇㪇㪏

㪉㪇㪇㪏

㪝㪸㫉㪼㩷㪸㫅㪻㩷㫊㪿㫆㫇㫇㫀㫅㪾

㪦㫅㫃㫐㩷㪽㪸㫉㪼

㪪㪬㪞㪦㪚㪘

㩿㪉㪇㪇㪐㪀

㪡㪩

㪥㫆㫅㪄㪡㪩

Figure 2: The compatibility of the cards.

The private railways cards have the problem of

compatibility. Each card is compatible only with the

JR card in its same region (see Figure 2). For ex-

ample, the PASMO card can use only in the JR East

Table 2: The contactless smart cards of the private railways.

Region Card name Number of members

Kanto PASMO 103 (77)

Kansai PiTaPa 37 (17)

Hokuriku ICa 4 (3)

Chugoku PASPY 13 (9)

Shikoku DESUCA 5 (4)

Kyushu RaPiCa 4 (3)

(Suica) region and is not compatible with any other

cards. Thus the member companies which have fully

the capital strength want to cooperate with the other

regions; on the other hand the small member com-

panies oppose it. Each member company has to pay

a membership fee and maintenance costs of several

hundreds millions Yen (about several millions USD)

every year. Moreover, it must pay several millions

Yen whenever changes of the system happen. The

small or local companies do not interest in use in the

other regions, because they cannot make a profit on

the mutual use any more.

Besides the cards in Table 2, some local private

railways had to issue their independent card for lack

of an alternative. Such cards do not have any compat-

ibility.

2.4 Bus Companies

The bus companies have joined the association of the

private railways. The number in parenthesis in Table

2 shows the number of bus member companies out of

the total. The bus companies’ case also has the same

financial problem as well as the private railways case.

The bus member companies of PASMO have

about 15,000 buses in all, however, the contactless

smart card system has been introduced into only 30%

of the buses. Because besides the membership fee

and maintenance costs, the introduction of the system

requires from seven to eight hundred thousand Yen

(from eight to nine thousand USD) per bus. Nowa-

days Japanese people think it a matter of course that

the contactless smart card can be used in public trans-

portation. The bus companies which have not intro-

duced it may lose customers.

3 THE CARD TECHNOLOGY

In this section, we describe why the card has spread

rapidly from the technology viewpoint.

ICE-B 2010 - International Conference on e-Business

78

3.1 Why Contactless?

Japanese railways have special circumstances which

other countries do not have (and cannot understand).

Almost all Japanese people in the metropolitan ar-

eas take the train daily to work. Therefore, a station

and a train are terribly crowded in rush hours. About

60 commuters per minute pass a ticket gate in peak

hours. In Europe, it is 30 per minute. Additionally,

Japanese train service is strictly on time. The machine

of Japanese ticket gate requires high throughput.

There are many kinds of train tickets in Japanese

railways. The ticket gate must examine varied train

tickets. The gate also does not care insertion direc-

tion and the front/back of a ticket. One ticket gate

accepts both of entry and exit of passengers (Figure

3). The Japanese ticket gate is a very complex ma-

chine. Therefore, the ticket gate machine tends to

break down and its maintenance cost comes high. If

the physical contact can be avoided as much as possi-

ble, the maintenance cost is reducible.

Consequently, a contactless smart card has been

suitable against the foregoingcircumstances. The first

and most successful card Suica of JR East has suc-

ceeded in cutting down the maintenance cost by 1/3.

Figure 3: The ticket gate machine.

3.2 FeliCa Technology

Almost all Japanese contactless smart cards are im-

plemented by FeliCa. To solve the congestion men-

tioned above, JR East invited tenders for the card sys-

tem which can examine one card in 0.1 second. That

is, it has to communicate at 211.875 kbit/s. It was

very high level of specification. Moreover, JR East

requested that the card reader should examine two or

more cards in piles. Only FeliCa had satisfied these

requirements. Since FeliCa had been already intro-

duced into public transportation in Hong Kong, it was

also reliable (Chau and Poon, 2003). After JR East

adopted FeliCa, it has become the de facto standard.

㪘㫅㫋㪼㫅㫅㪸

㪠㪚㩷㪺㪿㫀㫇

Figure 4: The Suica card and its cutaway drawing.

FeliCa uses Manchester coding at 212 kbit/s in the

13.56 MHz range. It can also operate without a bat-

tery using the electromagnetic induction. Thus it is

thin and light in weight. The coil like a leaf shown in

Figure 4 is an antenna. The leaf form is a device for

reading two or more cards. When the antenna comes

close to the reader, an electric current is generated.

FeliCa reads and writes data with the power. It can

implement various applications, if only software in

the reader is rewritten. Moreover, the security of Fel-

iCa has been certified by ISO/IEC 15408. These Fel-

iCa functions are suitable for the smart card of public

transportation.

However, FeliCa has been rejected by the RFID

international standard (ISO/IEC 14443, 2008). It has

been certified by the NFC (Near Field Communi-

cation) international standard later (ISO/IEC 18092,

2004). ISO/IEC 14443 provides two types of the

RFID card. The type A uses Modified Miller cod-

ing at 106 kbit/s, which is developed by Philips in

Netherlands. The type B uses NRZ (Non Return to

Zero) coding at 106 kbit/s, which is developed by Mo-

torola in the U.S. The type A is most widely used in

the world. Nevertheless, the type A and B are hardly

used in Japan.

A CASE STUDY OF THE E-MONEY APPLICATION IN JAPANESE PUBLIC TRANSPORTATION

79

4 DISCUSSION

Nowadays, 50% of Japanese people in the major cities

have more than one contactless smart card with e-

money. Suica certainly triggered the spread of e-

money. Japanese people have understood conve-

nience of e-money by Suica. The graph shown in

Figure 5 backs up this fact. The Edy e-money only

for shopping has been gradually increasing, since

Suica appeared. The spread of the mutual use among

㪇

㪈㪇

㪉㪇

㪊㪇

㪋㪇

㪌㪇

㪍㪇

㪉㪇㪇㪈 㪉㪇㪇㪉 㪉㪇㪇㪊 㪉㪇㪇㪋 㪉㪇㪇㪌 㪉㪇㪇㪍 㪉㪇㪇㪎 㪉㪇㪇㪏 㪉㪇㪇㪐

㪜㪻㫐 㪪㫌㫀㪺㪸

㩿㫄㫀㫃㫃㫀㫆㫅㪀

Figure 5: The number of Edy and Suica cards.

the cards will promote competition among the major

companies and improve the quality of the service. On

the other hand, it may merely encourage the disparity

between local areas and metropolitan areas. Japan is a

conspicuous aging society. Therefore, the local trans-

portation companies aim to revitalize depopulated ar-

eas using e-money with the contactless smart cards.

However, the mutual use has few merits for the lo-

cal transportation companies. In addition, it requires

the software development, but the local transportation

companies do not have software engineers. They have

to request a software vendor to develop it: the devel-

opment cost is about one million Yen (10,000 USD).

Now the government partially supports the local com-

panies only in the initial costs. It should support them

further.

㪫㪿㪼㩷㫅㫌㫄㪹㪼㫉㩷㫆㪽㩷㫇㪸㫐㫄㪼㫅㫋㩷㫇㪼㫉㩷㫊㫋㫆㫉㪼

㪊㪇㪇

㪊㪉㪇

㪊㪋㪇

㪊㪍㪇

㪊㪏㪇

㪋㪇㪇

㪋㪉㪇

㪋㪋㪇

㪋㪍㪇

㪋㪏㪇

㪌㪇㪇

㪡㫌㫃㪄㪇㪏

㪘㫌㪾㪄㪇㪏

㪪

㪼

㫇㪄

㪇㪏

㪦

㪺

㫋㪄㪇㪏

㪥㫆㫍㪄㪇㪏

㪛㪼㪺㪄㪇㪏

㪡㪸㫅㪄㪇㪐

㪝㪼㪹

㪄

㪇㪐

㪤㪸㫉㪄㪇

㪐

㪘㫇㫉㪄

㪇㪐

㪤㪸㫐㪄㪇

㪐

㪡㫌㫅㪄㪇㪐

Figure 6: The number of payment per store with Suica.

㪈㪅㪐㪍

㪎㪅㪈㪉

㪈㪈㪅㪈㪌㪋

㪈㪐

㪉㪊㪅㪋

㪉㪎㪅㪉

㪊㪇㪅㪊㪏

㪊㪊㪅㪈㪏

㪊㪌㪅㪍

㪇

㪌

㪈㪇

㪈㪌

㪉㪇

㪉㪌

㪊㪇

㪊㪌

㪋㪇

㪉㪇㪇㪍 㪉㪇㪇㪎 㪉㪇㪇㪏 㪉㪇㪇㪐 㪉㪇㪈㪇 㪉㪇㪈㪈 㪉㪇㪈㪉 㪉㪇㪈㪊 㪉㪇㪈㪋

㩿㪹㫀㫃㫃㫀㫆㫅㩷㪬㪪㪛㪀

Figure 7: The prospect of the e-money market in Japan.

5 CONCLUDING REMARKS

The number of the contactless smart cards in Japan

has virtually reached the ceiling; nevertheless the

number of the payment per store is gradually decreas-

ing (Figure 6). For the further spread, each company

or association has to increase member store inside and

outside stations and to propose novel and attractive

privileges. JR East has made full use of the advantage

in the metropolitan area. Suica money is mutually ex-

changeable for the mileage point of ANA (All Nippon

Airways). Suica is also developing novel services us-

ing data-mining from the use records as lifelogs.

The contactless smart cards with e-money have

spread in the world. For instance, PayPass of Master-

Card has a circulation of 60 millions. Sooner or later

Japan must open the contactless smart card market.

Before opening the market, the Japanese e-money

trade has to solve the problem of the mutual use

among FeliCa, the type A and the type B of ISO/IEC

14443. ISO/IEC 18092 standardizes NFC, which has

unified FeliCa and type A. Similarly, type B has been

added to NFC (ISO/IEC 21481, 2005). The card

reader adapting to NFC can use FeliCa, type A and

type B. Such reader is spreading; however,NFC is up-

ward compatible for the hardware protocol. The sys-

tem must have software applications for every chips.

Thus, NFC cannot become a radical solution. More-

over, FeliCa has a serious problem. Generally, a re-

cent mobile phone has a contactless smart card built-

in. In response to the situation, GSMA (Global Sys-

tem for Mobile communications Association, 2010)

has standardized a contactless smart card system for

a mobile phone and adopted type A and type B as a

global standard. All over the world, e-money services

with such mobile phones have already begun. Since

Japanese mobile phones, which are equipped with Fe-

liCa, have the protocol stack different from the mobile

ICE-B 2010 - International Conference on e-Business

80

phones with type A/B, Japan may be isolated in the

mobile field too. In the future, Japanese mobile phone

should have not only FeliCa but the other global IC

chip and use different applications for every chips.

Nomura Research Institute showed very interest-

ing statistics shown in Figure 7 (Nomura Research In-

stitute, 2008). Theyexpect that the e-moneymarket in

Japan will be expanded further. Thus there are many

business chances for the domestic and foreign com-

panies. The foreign company which entries into the

Japanese market must understand the national char-

acter and special circumstances of Japanese public

transportation. The architecture of the payment sys-

tem with contactless smart cards in Japanese public

transportation has been referred to the IFMS (Interop-

erable Fare Management System) standard (ISO/IEC

24014, 2007). Japan has been nominated for the ed-

itor of ISO/IEC 24014 Part 2: recommend business

practice for set of rules. The organization is currently

summarizing the business model as the technical re-

port. This standardization will be certainly helpful for

the spread of the e-money application of public trans-

portation in the world.

REFERENCES

Chau, P. and Poon, S. (2003). Octopus: An e-cash payment

system success story. Communications of the ACM,

46(9):129–133.

Global System for Mobile communications Associa-

tion. (2010). Gsm world –connecting the world–.

http://www.gsmworld.com/.

ISO/IEC 14443 (2008). Identification cards - Contactless

integrated circuit(s) cards - Proximity cards -.

ISO/IEC 18092 (2004). Information technology – Telecom-

munications and information exchange between sys-

tems – Near Field Communication – Interface and

Protocol (NFCIP-1).

ISO/IEC 21481 (2005). Information technology – Telecom-

munications and information exchange between sys-

tems – Near Field Communication Interface and Pro-

tocol -2 (NFCIP-2).

ISO/IEC 24014 (2007). Public transport – Interoperable

fare management system – Part 1: Architecture.

Kurosawa, A., Morita, T., and Kusakabe, S. (2003). Con-

tactless ic card technology “felica” and new approach.

In Proceedings of International Symposium on Seed-

up and Service Technology for Railway and Maglev

Systems, pages 323–327.

Nomura Research Institute, Ltd. (2008). Survey

on e-money reveals rapid expansion of retail e-

money cards, showing signs of growing compe-

tition for becoming the primary e-money card.

http://www.nri.co.jp/english/news/2008/080717.html.

Shiibashi, A. (2007). High-speed processing and high-

reliability technology in an integrated fixed-line and

wireless, autonomous decentralized ic card system.

Systems and Computers in Japan, 38(9):1–10.

Shirakawa, Y. and Shiibashi, A. (2003). Jr east contact-less

ic card automatic fare collection system ‘suica’. IE-

ICE Transactions on Information and Systems, E86-

D(10):2070–2076.

A CASE STUDY OF THE E-MONEY APPLICATION IN JAPANESE PUBLIC TRANSPORTATION

81