THE EFFECTS OF MARKET DEMAND ON TRUTHFULNESS

IN A COMPUTING RESOURCE OPTIONS MARKET

Owen Rogers and Dave Cliff

Department of Computer Science, University of Bristol, Merchant Venturers Building, Bristol, U.K.

Keywords: Market-oriented computing, Resource reservation, Risk assessment, Utility computing.

Abstract: Grid, cluster and cloud computing provide the opportunity for computing resources to be traded as

commodities in an open marketplace. An options market for computing resources would allow users to

reserve a resource for a fee, and then pay an additional fee later should they actually need to use it.

However, a major issue is ensuring that users do not falsify their likely requirements with the objective of

reducing costs while keeping their right to use the resource. This paper describes an exploratory simulation

implementation of a two-period model that was proposed by Wu, Zhang and Huberman (2008) which they

claimed promoted truth-telling among the population of resource-buyers who interact with a Coordinator (a

central vendor) of resources. Wu et al. provided a theoretical description and analysis of their model, but

presented no empirical analysis of its commercial suitability. Our work, reported in this paper, explores the

model's performance where demand for resources is variable and unpredictable. Using techniques similar to

replicator dynamics (from studies of evolutionary processes in biology), we explore the behaviour of

heterogeneous buyer populations under different market conditions. Through empirical and theoretical

analysis, we determine the optimum honesty for which the Coordinator will most effectively prosper across

a range of market conditions, and show how this data can be used to protect against risk.

1 INTRODUCTION

Grid, cluster and, most recently, cloud computing

have all promised to transform computing resources

into a commodity, that can be delivered in a manner

similar to that of existing utilities, such as electricity,

gas, water and telephone services (Buyya, Yeo et al.

2009). Cloud computing in particular is primed to

deliver a new level of freedom to the consumer,

allowing different levels of service and quality to be

delivered on an as-needed basis without the need for

capital investment.

This utility model provides users with the ability

to purchase computing resources as if they were any

other commodity such as coal or steel. By providing

a suitable mechanism for buying and selling, market

oriented computing opens up a wide range of trading

possibilities - CPU cycles, storage capacity, or

memory allocations can be bought and sold, for

current or future use. This is already happening to

some extent in the market place, and a wide range of

economic and resource sharing models for grids,

clusters and clouds are publicly accessible. (Yeo and

Buyya 2006; Hilley 2009)

However, the variable nature of IT usage means

that pricing the service so that competitiveness and

profitability are balanced has an element of risk. For

the enterprise, determining and hedging their future

demand for a resource is not an easy task. (Khajeh-

Hosseini, Sommerville et al. 2010)

Currently, users purchase capability from the

utility-computing provider directly: the use of

centralised computing marketplaces and

intermediary aggregators and brokers seem likely to

grow in significance over time but have not yet done

so.

Such centralised mechanisms would enable a

true Service Orientated Architecture where customer

needs are matched to the most suitable computing

resources using brokers or Coordinator’s. This

would be controlled through Service Level

Agreements (SLA) which would define the metrics

that must be achieved (e.g. uptime, latency) and the

compensation that would be due to the customer

should the metric not be achieved.

To take account of future requirements for

resource, users could reserve resources through a

derivatives market involving futures and/or options.

330

Rogers O. and Cliff D..

THE EFFECTS OF MARKET DEMAND ON TRUTHFULNESS IN A COMPUTING RESOURCE OPTIONS MARKET .

DOI: 10.5220/0003276003300335

In Proceedings of the 3rd International Conference on Agents and Artificial Intelligence (ICAART-2011), pages 330-335

ISBN: 978-989-8425-41-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

A futures contract is a contractual agreement to buy

or sell an asset for a certain price at a certain time in

the future. An options contract gives the contract

holder the right to buy, or sell, an asset by a certain

date for a certain price, without obligation. (Hull

2005)

It has been proposed that swing options,

originally developed for trading electrical power,

can be used to price a future reservation of

computing resources (Clearwater and Huberman

2005). Analogous to electricity, computing resources

are non-storable and have volatile usage patterns, so

such a model would provide customers with

flexibility in terms of amount and duration of

resource requirement, and enables resource

providers to estimate demand.

Use of such derivatives presents two problems.

Firstly, how can users accurately predict their future

resource requirement. Secondly, how can the user be

trusted to submit a true representation of their likely

resource requirements.

The first issue can be solved using a forecasting

tool, such as that proposed in (Clearwater and

Huberman 2005) or by analysing historical market

data such as that proposed in (Sandholm, Lai et al.

2006; Sandholm and Lai 2007). For the second

issue, (Wu, Zhang et al. 2008) proposed a

reservation model which was shown to lead to a

truthful reservation on the user's part.

In (Rogers and Cliff 2010) we simulated the

reservation model proposed by Wu et al., in a

multiple user, heterogeneous, variable market. Wu et

al.'s model involved a number of users who require

the resource, plus a central authority ("the

Coordinator") responsible for receiving and

resolving resource requests. We showed that honesty

benefits both the user and the Coordinator when the

market varies uniformly, and that the user-base

evolves to be more honest over time. In the same

paper, we discussed how the model could be

implemented commercially, and how a transaction

fee could be used to offset risk.

In this paper we extend our previous work by

exploring results from simulating the model when

the market has heterogeneous (non-uniform)

variations, and where the users make decisions

based on scarcity or abundance of resources. We

simulate various market conditions, and analyse how

the Coordinator and users behave as a result of this

changing dynamic. Finally, we discuss how our

findings can be used to protect against risk in a

commercial implementation.

We will look at the specific case analysed by Wu

et al. where the value of two key parameters are C=2

and k=1.5. The parameter C is the cost per unit paid

to the resource-providers by the Coordinator in the

second (future) period; the cost per unit is 1 when

purchased in the initial (current) period. The

parameter k is a constant that is used to set the price

per unit charged by the Coordinator to the resource-

users. Exploring this case is most attractive in the

first instance because it allows us to explore the

extent to which the results from Wu et al.’s

theoretical analysis continue to hold as some of their

simplifying assumptions are relaxed. Our primary

research question is to see whether the service

remains profitable in a real-world, multi-user

scenario, where users submit different resource

probabilities using different levels of honesty, in a

dynamically changing marketplace. It is this

heterogeneity of user’s behaviour under different

circumstances that makes our simulation an

extension of the theoretical model and supporting

analysis provided by Wu et al.

2 METHODOLOGY

A computer simulation was implemented in Python

to replicate the model as an options contract. The

algorithm performs the following steps:

1. Each user i in the range 1 to N is assigned an

"honesty", H

i

, chosen randomly from a uniform

distribution over [0,1] which describes the accuracy

with which a probability of future resource

requirement is provided to the Coordinator. An

honesty of 1 means a user will always exercise their

right to purchase as per their forecast probability. An

honesty of 0 means a user will never exercise their

right to purchase.

2. A replicator dynamics approach is adopted,

whereby for every two units of total time T, a user is

randomly chosen to undergo a mutation, and this

user is given a new honesty. The user tries bidding

and executing as per the following steps for a sample

size S, using the new honesty.

a. For each user, a random resource probability, p

i

,

is assigned. A probability of 0 means that a resource

will definitely not be required in the next time

period. A resource probability of 1 means a resource

will definitely be required in the next time period.

b. Each user is given the opportunity to request a

resource to be utilised in the next time period. The

user will submit the following resource probability

to the Coordinator: q

i

= H

i

p

i

c. The user is charged a premium of kq

i

2

/

2

to

THE EFFECTS OF MARKET DEMAND ON TRUTHFULNESS IN A COMPUTING RESOURCE OPTIONS MARKET

331

reserve the resource. The premium and a fixed

transaction fee, F, are removed from the user's bank

balance, and added to the Coordinator's balance.

d. The Coordinator purchases units from the

resource provider at a cost of 1 per unit. This is

removed from the Coordinator's balance and added

to the resource provider’s balance. As an example, a

user i with H

i

= 1 who anticipates the future

requirement with a probability of 0.8, will submit a

probability of 0.8 to the Coordinator as q

i

= H

i

p

i

e. A user i with H

i

= 1 will not always exercise

their right as per their submitted probability. For

instance, a user with honesty 0.7 who anticipates the

future resource requirement with a probability of

0.8, will submit a probability of future resource

requirement with q

i

= H

i

p

i

= 0.56.

f. Each user is now given the option of exercising

their right to use their resource.

g. A user will exercise their right where p

i

> A

where A is the availability of the resource. An

availability of 0 means that there is no surplus of the

resource and all users will exercise their right. An

availability of 1 means that that the resource is

abundant, and no users will exercise their right.

h. A is chosen randomly from a triangular

distribution, where the peak frequency of the

triangle is varied to show different market

conditions. An increase in the peak of the triangular

distribution represents an increase in the availability

of the resource - the increased frequency of random

values chosen at the peak of the triangle simulate a

variable market, which is biased towards either a

resource scarcity or abundance. A

p

is the peak and

A

m

is the mean of the distribution.

i. If a user wishes to use the resource, they are

charged a price, 1+(k/2)-kq

i

, which is removed from

their balance and added to the Coordinator's balance.

j. If the Coordinator has not previously purchased

enough resource from the resource provider, they

will purchase the deficit at a cost of C per unit.

k. This cost is removed from the Coordinator's

balance and added to the resource providers.

3. Steps a-k are repeated S times, to ensure each

user provides a range of probabilities to the

Coordinator using the same honesty.

4. If the user finds that the mean cost per required

resource over the sample S is lower using the

mutated honesty, the honesty remains and the new

behaviour is adopted by the user. If not, the honesty

returns to its previous value and the old behaviour

continues.

5. A new mutation is determined as per Step 2, and

this process continues until T iterations have passed.

3 RESULTS

The simulation was executed with F=0.01,

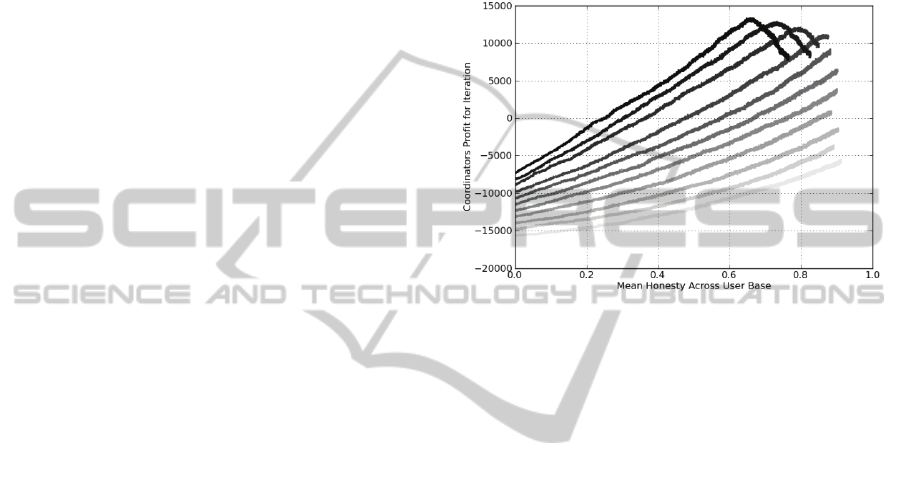

N=1000, S=100 and T=20000. See Figure 1.

Figure 1: Scatter plot of Coordinator’s profit against mean

honesty (legend in Table 1).

As can be seen from Figure 1, the Coordinator

generally benefits with increased profit when there is

a higher availability for resources and therefore

demand is low, although the amount of profit or loss

is still dependent on the mean honesty of the users.

This makes sense, as users have paid a premium

and a fee to use the service, but have not chosen to

execute their right due to the availability of cheaper

resources on the open market.

When the market is in high demand for

computing resources, the Coordinator will benefit

from increased profit as a result of increased mean

user-base honesty. However, the Coordinator will

often never make a profit regardless of the honesty

of the user-base. In these situations, the Coordinator

would be better off suspending sales completely or

implementing a higher transaction fee (see our

discussion of Dynamic Risk Offsetting, below).

However, when the availability of resources is

high there appears to be a point where profit no

longer increases with an increase in honesty, but

peaks at an optimum honesty where the Coordinator

achieves a peak profit.

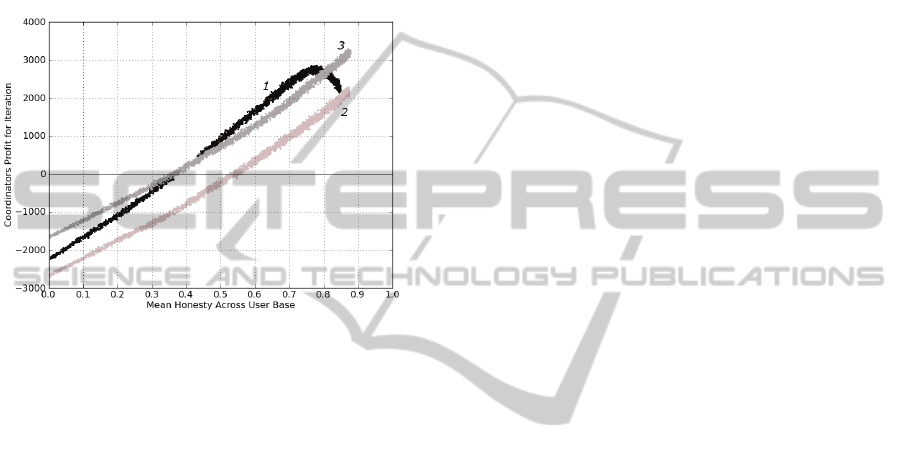

Figure 2 shows the surplus/deficit of resource

purchased by the Coordinator in T=2 at the higher

rate of C=2. It can be seen that there is a correlation

between the values of H at which the peak profit

occurs in Fig. 1 and the values of H at which there is

no surplus or deficit of resource purchased in Fig. 2.

ICAART 2011 - 3rd International Conference on Agents and Artificial Intelligence

332

Figure 2: Best fit plot of resource surplus (legend Table 1).

If the Coordinator reserves too much resource in

T=1, they have effectively purchased assets that are

fully depreciated in T=2 and the investment has

gone to waste. If the Coordinator purchases too little

resource, they must purchase further resource in

T=2, now at the higher rate of C=2.

Thus, the optimum mean honesty of a user-base is

the honesty at which there is no surplus or deficit of

resource purchased by the Coordinator. As the

surplus is equal to the difference between the

resource required at T=2 and the resource reserved

at T=1, we can write:

Table 1 shows how the results obtained from

simulation closely match that determined using the

above formula when P

bar

=0.5.

Table 1: Table of results.

A

p

A

m

Honesty at

Peak Profit

(Sim)

Honesty at

Peak Profit

(Calc)

Graph

Legend

1.00 0.66 0.64 0.68

0.90 0.63 0.72 0.74

0.80 0.60 0.80 0.80

0.70 0.57 0.86 0.86

0.60 0.53 - 0.94

0.50 0.50 - 1.00

0.40 0.47 - 1.06

0.30 0.43 - 1.14

0.20 0.40 - 1.20

0.10 0.36 - 1.28

0.00 0.33 - 1.34

When there is poor availability of a resource, the

results show the Coordinator may make a loss in a

dishonest user-base as users are more likely to

execute their options, causing a deficit which must

be purchased at the higher value C=2.

When considering implementing the model in a

new market, the Coordinator must make a decision

regarding whether it is strategically better to

compete in a market where the user-base always

shows an increasing profit for an increase in honesty

(for example, as in A

m

= 0.53) albeit for less profit,

or where there is more demand for a resource, but a

decline in profit may occur once a certain level of

honesty has been reached by the user-base, as in

A

m

=0.6.

4 PRACTICAL APPLICATIONS

4.1 Maximising Profit

through Honesty Balancing

The simulation has shown how during times of low

demand, the Coordinator’s profit peaks at a certain

level of honesty across the user-base. If we want to

maximise the profit during this time, it should be

possible to develop an algorithm which balances the

user-base such that this peak honesty is achieved.

For example, consider the situation where at

T=1, the mean availability of the resource is A

m

=

0.53 and at T=2 the mean availability is predicted to

be A

m

=0.60. If users are submitting a mean

probability of 0.5 then it is straightforward to

calculate that at T=1, H

bar

=0.94; and at T=2, H

bar

=0.80. Thus, at T=1, the Coordinator will make a

maximum profit when 94% of the user-base is

honest. However, at T=2 the Coordinator will make

a profit when 80% of the user-base are honest. To

maximise the Coordinator’s profit, the mean honesty

of the user-base should be lowered to 80%. To

achieve this we propose that there should be an

ongoing process of monitoring and recording the

average honesties of all users over time. Once

gathered, analysis of this data in terms of sector,

industry, location, and any other classifications

should be done as required. This would then allow

the following process to be performed in each period

(i.e., at each successive value of T):

1. Determine mean market availability of market in

T=2, using methods such as discussed in (Sandholm,

Lai et al. 2006; Sandholm and Lai 2007)

2. Calculate H

bar

for which maximum profit is

achieved in T=2

THE EFFECTS OF MARKET DEMAND ON TRUTHFULNESS IN A COMPUTING RESOURCE OPTIONS MARKET

333

3. Using historical data and market intelligence,

determine which users or segments have an honesty

such that the optimum mean honesty can be

achieved.

4. Offer these users or segments a reduced

transaction fee as an incentive to purchase options as

a means of increasing or decreasing the mean

honesty of the user-base.

By incentivising users with a higher, or lower, mean

honesty it may be possible to move the overall

population mean to the optimum in T=2. This is one

avenue of future research that we aim to explore.

4.2 Dynamic Risk Offsetting

As discussed in Rogers & Cliff (2010), it is possible

for the Coordinator to protect herself against risk by

charging an appropriate transaction fee. The new

results presented in this paper show that the risk can

be further offset by anticipating market demand in

T=2 and charging an appropriate transaction fee.

It seems plausible that data-mining may establish

that a particular customer-base is more likely to be

dishonest. For example, one geographical region

may be less likely to be honest to a Coordinator in a

different geographical region due to previous

existing social, economic, political or cultural issues,

which causes an inherent lack of trust.

The term “honesty” can be here reasonably

interchanged with reliability. It may be that a

particular customer base has the best intentions, but

regularly reserve resources with an incorrect

probability. For example, a user who deals with

implementing complex systems may find it more

difficult to predict future usage accurately due to the

longer sales, implementation and acceptance cycles

brought about by determining complicated design

requirements. On the other hand, a particular

customer base may have a very accurate view of

future requirements, such as a website that has a

fixed number of users.

If the honesty of a particular segment is known,

the Coordinator may choose to charge a transaction

fee which varies with the market demand. Raising

the fee will increase the y-intercept of the profit

curve and therefore ensure a profit is achieved at

lower levels of honesty.

Figure 3 shows such an event, in which the user-

base has a mean honesty of 0.4 based on previous

experience for the sector:

1. During a period of high availability A

m

= 0.6, and

the Coordinator takes a profit.

2. It is predicted that in the next period, availability

will decrease to A

m

=0.53 and therefore demand will

increase. If the mean honesty of the user-base were

to remain constant, the Coordinator will make a loss.

3. To prevent this, the fee is raised to 0.05 which is

still insignificant compared to purchasing the

resource direct from the Coordinator (as C=2) but is

enough to offset this risk.

In fact, it may be possible to use the simulator in

real-time with predictive algorithms to counteract

the risk. Such an algorithm might look as follows:

1. Estimate demand for resources in T=2 using a

method such as those discussed in (Sandholm, Lai et

al. 2006; Sandholm and Lai 2007)

2. Estimate profit using the simulator, using

estimates for number of users, etc.

3. An appropriate transaction fee is determined to

offset any risk, which is presented to customers prior

to purchasing the option.

Further work should be undertaken to determine if

such inherent honesties/reliabilities exist in the

addressable market, and to determine a transaction

fee for each market segment such that risk and

competitive pricing are balanced. This segment

specific, variable-market pricing could be a powerful

differentiator.

5 CONCLUSIONS

This paper has provided an empirical demonstration

of how a truth telling reservation model for

computing resources described by Wu et al. can

provide the basis for a commercially feasible options

market in utility computing resources. The model

was simulated with multiple heterogeneous users,

submitting a wide range of probabilities over a long

term, over a variety of market profiles. It was found

that the Coordinator benefits more when resources

are in abundance, and less when resources are scare.

However, it was also found that when resources are

abundant, the Coordinator does not always benefit

financially as the honesty of the user-base increases.

There is an optimum honesty, which can be

determined from a simple equation, at which the

Coordinator’s profit is at a maximum.

The simulation has identified two methods that

can optimise the Coordinator’s profit, and reduce her

exposure to risk. The first is to bias the honesty of

the user-base towards the optimum honesty for a

predicted market demand by incentivising those

users who have a desired honesty. The second is to

ICAART 2011 - 3rd International Conference on Agents and Artificial Intelligence

334

vary the transaction fee payable by the user, to offset

predicted changes in market demand.

By taking the results from this paper and

extending them with future research into the

performance of the model under different conditions

and inherent honesties, in different segments, a

commercial offering that is profitable to the

Coordinator, beneficial to the user, and with

calculable levels of risk looks likely to be

achievable.

Figure 3: Example of risk offsetting procedure.

ACKNOWLEDGEMENTS

We thank the UK EPSRC for funding this research

as part of the Large-Scale Complex IT Systems

Initiative (www.lscits.org), as well as HP Labs

Adaptive Infrastructure Lab for providing additional

financial support.

REFERENCES

Buyya, R., C. S. Yeo, et al. (2009). "Cloud computing and

emerging IT platforms: Vision, hype, and reality for

delivering computing as the 5th utility." Future

Generation Computer Systems 25: 599-616.

Clearwater, S. H. and B. Huberman (2005). "Swing

Options: A Mechanism for Pricing IT Peak Demand."

Proceedings of 11th International Conference on

Computing in Economics.

Hilley, D. (2009). "Cloud Computing: A Taxonomy of

Platform and Infrastructure-level Offerings Cloud

Computing: A Taxonomy of Platform and

Infrastructure-level Offerings." Technology.

Hull, J. C. (2005). Fundamentals of Futures and Options

Markets.

Khajeh-Hosseini, A., I. Sommerville, et al. (2010).

"Research Challenges for Enterprise Cloud

Computing." Arxiv preprint.

Rogers, O. and D. Cliff (2010). "The Effects of

Truthfulness on a Computing Resource Options

Market." 1-6, ADPC'10 Proceedings.

Sandholm, T. and K. Lai (2007). "A statistical approach to

risk mitigation in computational markets."

Proceedings of the 16th international symposium on

high performance distributed computing 2007.

Sandholm, T., K. Lai, et al. (2006). "Market-based

resource allocation using price prediction in a high

performance computing grid for scientific

applications." HPDC'06: Proceedings.

Wu, F., L. Zhang, et al. (2008). "Truth-telling

reservations." Proceedings of 11th International

Conference on Computing in Economics.

Yeo, C. S. and R. Buyya (2006). "A taxonomy of market-

based resource management systems for utility-driven

cluster." Cluster Computing: 1381-1419.

THE EFFECTS OF MARKET DEMAND ON TRUTHFULNESS IN A COMPUTING RESOURCE OPTIONS MARKET

335