RESEARCH ON INTERACTIVE MECHANISM

OF TECHNOLOGY PROGRESS AND M&A

Yongmei Cui, Shengnan Tan and Lian Hong

Beijing Jiaotong University, Merger and Reorganization of Enterprises in China Research Center, Beijing, China

Keywords: M&A, Technical progress, Interactive mechanism industrial impact hypothesis.

Abstract: This paper is based on new growth theory, evolutionary economics and industrial impact hypothesis

theoretical basis, Using the mathematical statistics analysis, case analysis, system analysis and inductive

method, first respectively expatiates the internal mechanism of technical progress drives M&A and M&A

promote technological progress, reveals the interactive of technological progress and the M&A through the

establishment of interaction model, then through the comparative analysis of the developed countries ’M&A

and technical wave, verifies the positive correlation between the technological progress and M&A, it comes

to the conclusion that technical progress is a two-phase dynamic process which contains both technological

innovation and technology transfer, in this process, M&A and technical progress exist mutual drive internal

mechanism, mainly for technological innovation and transfer make the reallocation of industry resources,

which finally drive the M&A waves, then M&A promote the technology innovation and transfer through

break the monopoly and concentrate element. The paper is valuable not only in theory but also in practice,

which favourable to the establishment of technological progress system and the maturity of the M&A

market. Dynamic definition of the technical progress and the establishment of the technical progress and

M&A interaction model is the innovation of the article.

1 LITERATURE REVIEW

The most contribution to new growth theory which

studies the inner mechanism and motivation of

economic in a brand new aspect is regarded

technical progress as endogenous variable for

promoting economic progress. Grossman &

Helpman (1991)’ horizontal innovation model

assumes a certain amount of R&D input can produce

certain new products. Evolutionary economics

explores neoclassical growth theory. One viewpoint

is that the evolution of technology happens along

with industry. Industrial impact hypothesis believes

every industry is impacted by technology,

controlling or economy successively. Tradition

M&A motives has been universally acknowledged

in the literature (such as potentiation,

diversification).Recently many scholar believe that

technology progress is one of the driving factor,

which has been growing interested in. (Chakrabarti

et al., 1994); (Grandstrand et al., 1992); (Hitt et al.,

1991); (Gerpot, 1995); (Hagedoorn and Duysters,

2002).

2 INTERACTIVE MECHANISM

OF TECHNOLOGY PROGRESS

AND M&A

2.1 The Internal Mechanism of

Technology Progress Driving M&A

Luc Soete & Roy Turner (1984), Metcalfe (1988,

1992), (Metcalfe & Michael Gihbotxs, 1989) put

forward the evolution model about technology

transfer. In the model, the enterprise use a series of

technology, which are brought in random and

improve by the time. According to the technology

life cycle theory, technology goes through a circle

process for being developed to replaced, which

promote technology progress. In this circle, it can be

divided into two phase.

First, rational resource allocation drives M&A.

Innovation profit drives the enterprise to innovate, as

a result, it sharpens the competition between the

enterprises and broke the original economic

equilibrium. Second, the motive of acquiring new

technology drives M&A. The company won’t

373

Cui Y., Tan S. and Hong L..

RESEARCH ON INTERACTIVE MECHANISM OF TECHNOLOGY PROGRESS AND M&A.

DOI: 10.5220/0003547403730375

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 373-375

ISBN: 978-989-8425-53-9

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

survive without adjusting the industrial and produce

structure according to its own characteristic and

demand, often that adjustment is through M&A.

Third, innovation profit provides adequate liquidity.

2.2 The Internal Mechanism of M&A

Driving Technology Progress

Technology progress driving the M&A, on the

country, M&A is also in favor of technology

innovation and transfer. Many companies get core

technology and knowledge, share advanced

experience, and strengthen innovation ability.

First, the enterprise as an organic system, M&A

help to technology accumulation which is the core

inner factor to success. Second, M&A contributes to

intersect and communicate in the internal

department of the company. Thirdly, M&A makes

the scale of enterprise expand which is the essential

condition of scale effect brought by technology

progress. Lastly, the industry structure affected by

M&A often a perfect macro-environment including

talents, capital, labor and policy to technology

progress.

2.3 The Model of Interactive

Mechanism between Technology

and M&A

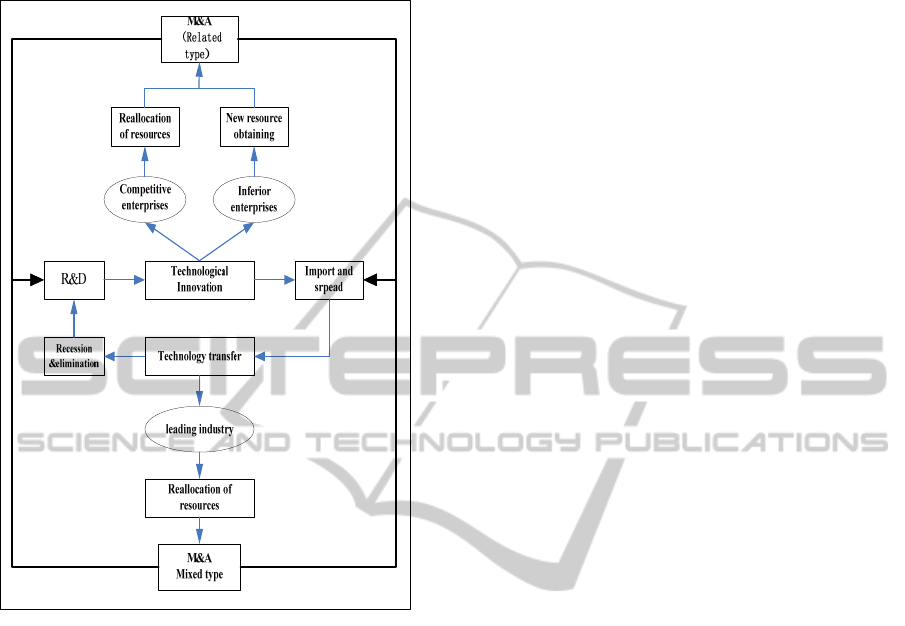

This paper above discusses the Interactive

Mechanism of Technology Progress and M&A. As

for the whole society, both is a interactive system,

just as the chart4 say, technology innovation drive

the M&A among the competitive and the inferior to

grab resource and technology, it comes to the result

that resources flow into progress field, the condition

for more R&D is available. And Importing and

spreading makes the beneficiary stay on the higher

ground to achieve profit. The gather of resource

formed by the emergence of the leading industry is

good to R&D and reallocate resource, at the same

time, the big scale M&A promotes the break of

monopoly, interaction of different apartment. That’s

all facilitation for technology innovation.

In one word, the depth and scope of M&A

depends on the degree of technology progress, while

all form of also promote technology innovation and

spread.

3 SOME EMPIRICAL

RESEARCH ABOUT

TECHNOLOGY PROGRESS

AND M&A FROM DEVELOPED

COUNTRIES

American’s data about labor productivity and M&A

growth rate in 1980-2005 indicate that technology

positive relation. This paper use correlation

coefficient and statistical analysis to prove the

relationship (see table 1 below).

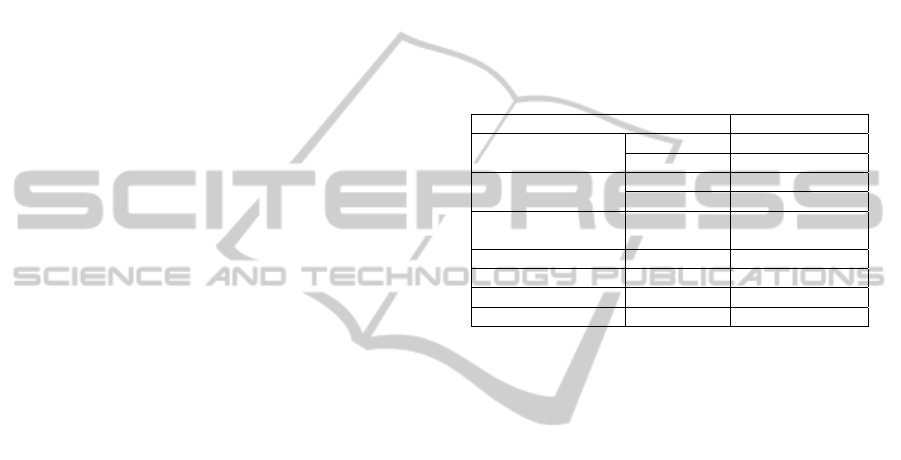

Table 1: Correlation coefficient text.

M&A Amount

Growth rate of

Business sector

Correlation 0.412**

t (0.041)

Growth rate of none-

Business sector

Correlation 0.389*

t (0.055)

M&A value Growth rate of

M&A Amount

Growth rate of

M&A vaule

0.370* 0.401** 0.098

(0.069) (0.047) (0.642)

0.353* 0.346* 0.073

(0.083) (0.090) (0.727)

From the table, M&A amount, M&A value,

growth rate of M&A amount and value are all

positive, besides the growth rate of M&A amount;

other three factors all pass the text.

4 RESEARCH CONCLUSIONS

The relationship between technology and M&A is a

worthy question. It came to the conclusion below

through researching the relationship:

First, technology progress contains both

innovation and transfer which represent two phrases

of technology cycle mechanism.

Second, technology progress and M&A is

positive correlation which express as interactivity.

Technology progress promotes M&A, one the

country, M&A also promote technology. That exits

in the technology cycle mechanism. The depth and

scope of M&A depends on the degree of the

technology, while all forms of M&A promote the

innovation and spread of technology.

ACKOWLEDGEMENTS

This paper is funded by the ministry of humanities

and social science research (10YJAZH014) and

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

374

special fund in basic research projects of Beijing

Jiaotong University.

Figure 1.

REFERENCES

J. A. Schumpeter, Theory of economic development [M],

Beijing: The Commercial Press, 1990.73-74.

Fu Jiayi, Technological innovation [M], Beijing, Tsinghai

University Press, 1998.13-13.

Liu Yulin, 21th Technological Innovation in China [M],

Beijing: Peking University Press, 2001.5-6.

Chen Ping, Economic chaos and Evolutionary Economic

Dynamics [M] Beijing: Peking University Press, 2004.

Li Jingwen, M&A Forum 2007[M], Beijing: China

Economics Publishing House, 2007.

Grossman, G. M. & E. Helpman. Innovation and Growth

in the Global Economy [J]. MIT Press. 1991.

Agion, P. & P. Howitt,A model of growth through

creative destruction [J]. Econometrica 1992,

60(2):323-351.

Caballero, R. J. & A. B. Jaffe. How high are the giant’s

shoulders [J]. NEBR Macroeconomics Annua1.

1993.15-74.

Englmann, F. C. A. Schumpeterian model of endogenous

innovation and growth[J]. Journal of Evolutionary

Economics. 1994.(9):227—241.

Barro,R. J. & X. Sala-I-Martin. Economic Growth [J].

New York: McGraw

—

Hil1. 1995.

Gerald Siverberg, Giovanni Dosi & Luigi Orsenigo.

Innovation, Diversity and diffusion: A Self Organizing

Model[J]. Economic Journal. 1988. 98(393):1032-

1054.

Mitchell M. L. and Mulherin J. H. The Impact of Industry

Shocks on Takeover and Restructuring Activity[J].

Journal of Financial Economics. 1996.41(2):193-229.

Jovanovic B. and Rousseau P. The Q Theory of

Mergers[J]. American Economic Review.

2002.92(2):198- 204.

Andrade G., Mitchell M. and Stafford E. New Evidence

and Perspectives on Mergers [J]. Journal of Economic

Perspectives. 2001.15 (2):103-120.

Soete Luc and Turner Roy. Technoligical Diffusion and

the Rate of Technical Change[J]. Economic Journal.

1984.94(375):612-623.

Metcalfe Stanley. Variety,Structure and Change:An

Evolutionary Perspective On the Competitive

Process[J]. Revue D Economie Industrielle.1992

(59):46-61.

Ard-Pieter de Man and Geert Duysters. Collaboration and

innovation: a review of the effects of mergers,

acquisitions and alliances on innovation[J].

Technovation. 2005 (25):1377–1387.

Zheng Deyuan, Li Zhan, Wu Qingsheng. Study on Policy

Towards R&D with Two-way Spillovers of Upstream

Firms[J], Journal of Industrial Engineering and

Engineering Management. 2002.16(1).84-85.

Cui Peijun, Chen Jian, Chen Jixiang, Optimal Spillovers

for Cooperative and Noncooperative R&D in

Duopoly[J], Chinese Journal of Management Science,

2002.10(6).92-96.

RESEARCH ON INTERACTIVE MECHANISM OF TECHNOLOGY PROGRESS AND M&A

375