ACCOUNTING INFORMATION CONTENT AND TIMELINESS

OF ANNUAL REPORT DISCLOSURE

An Evidence from China’s Listed Companies

Hou Pu, Geng Guanyu

School of Economics and Management, Beijing Jiaotong University, Beijing, China

Ma Zhong

School of Economics and Management, Beijing Jiaotong University, Beijing, China

Keywords: Timeliness, Information content, Accounting, China market.

Abstract: In China, new corporate accounting standards and new CPAs auditing standards were mandatory

implemented in 2007, which brought in more convergence with international standards. In the same year,

the Administrative Measures on Information Disclosure for Listed Companies was also implemented,

setting up more specific requirements on information disclosure for annual reports. Based on these

institutional changes and current analysis of report disclosure, this study examines the timeliness of

accounting information disclosure and related information content. Our findings provide evidences that in

current China market, while the pattern of “slack starting and tight ending” continues, most listed

corporations still won’t disclose their information until latter half of report disclosure period, some evidence

of improvements has begun to appear in comparison with previous years. The empirical results further

suggest that compared with companies making late disclosures, firms making early disclosures tent to

surprise the market with stronger price reactions, larger abnormal earning and more accumulative surplus

profits. It also indicates that institutional changes have improved the timeliness of information disclosure;

the timeliness does possess information capacity. The earlier a disclosure is made, the larger information

content it may carry out, which is particularly reflected non-state enterprises and competition industry.

1 INTRODUCTION

Early or late disclosure of information may give rise

to different degrees of market reaction. The timelier

information disclosure it is, the stronger market

reaction will be (Chen et al., 2005). As the market

reaction is mainly reflected in the volatility of the

stock price, timeliness of accounting information

disclosure plays a critical role for investors’

decision- making.

Disclosure of accounting information in China

has always appeared in a pattern of “slack starting

and tight ending”. Distributions of disclosure time

are extremely uneven. Most listed companies choose

to disclose their information just before the deadline

(Haw et al., 2000). Companies with poor

performances are even more seriously lagging

behind (Chai & Tung, 2002). Compared with

developed countries, Chinese listed companies have

more serious problems lagging of information

disclosure. However, as the government regulations

and business operations get improved over time, the

situation may gradually change (McGee & Yuan,

2008).

China has begun to implement “Administrative

Measures on Information Disclosure by Listed

Companies” since 2007 and has thoroughly changed

the disclosure rules of 1993 version, with a special

emphasis on the importance of regulated timely

information disclosure system. Since then, China

Ministry of Finance has also implemented a set of

new corporate accounting standards and new CPAs

auditing standards with mandatory, which sets the

Chinese system in more convergence with

international standards. The standards require a

higher quality of information disclosure and expand

the scope of information disclosed.

400

Yue Z. and Jiaguo L..

MODEL OF THE EMERGENCIES RISK TRANSMISSION IN PRICE-DRIVEN SUPPLY CHAIN.

DOI: 10.5220/0003569504050411

In Proceedings of the 13th International Conference on Enterprise Information Systems (NMI-2011), pages 405-411

ISBN: 978-989-8425-53-9

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

With these institutional changes and

development, what new trends in information

disclosure will show whether the lagging situation

will indeed get improved, what relationship between

timeliness and market reaction will evolve, and

whether the timeliness includes information content?

This article will focus on these important issues. We

have selected relevant data from 2007-2009 annual

reports of listed companies in Shanghai and

Shenzhen and developed test models of information

content to study timeliness of information disclosure

after the systematic changes.

2 LITERATURE REVIEW &

HYPOTHESIS

Most of the previous studies on timeliness focus on

two issues. One is analysis of the timeliness and its

influencing factors; the other is the information

content of timeliness. On the timeliness and its

influencing factors, many scholars have conducted

empirical researches based on different samples.

Based on a study of 588 firms’ Annual reports in

1998 in Bangladesh, India and Pakistan, Kamran

(2003) found that delay in information disclosure

popularly exists among the listed companies in all of

the three countries. And the results are apparently

affected by lagging in auditoria practice of these

countries. Whittred (1980) proved in his study that

in Australian listed companies with reservation

opinion to their audit reports will usually lag longer.

More serious the enterprise’s unclean opinion is, the

longer the delay appears, and the lag of annual

report disclosure therefore becomes even longer.

There are many factors that may cause delay of audit,

such as industry environment, unexpected surplus

and the situation of auditors and other financial

difficulties etc. Kinney & McDaniel (1993)

conducted a research on these factors, and the result

is consistent with the conclusion drawn above, that

is, the process of unclean opinion leads to a longer

delay of audit and therefore leads to delay of the

annual disclosure.

Academic studies about the impact of "good

news" and "bad news" on the information disclosure

delay have obtained different results. The results of

Chambers & Penman (1984), Kross & Schroeder

(1984) showed that managers tend to release good

news early, and bad news late. Compared to the

previous studies, this time pattern of accounting

information disclosure has been a consistent

conclusions among most researches of this nature.

However, it was not the case in France, Germany

and the UK. listed companies in these countries

tended to report bad news earlier and good news

later (Rees & Giner, 2001).

In china market, influenced by the political

environment, social system and level of economic

development, China is still in a process of economic

transformation. Companies in such financial

transformation are always far more behind in

timeliness of information disclosure than the

companies with established management system are,

which may have caused the Chinese listed

companies weaker in the timeliness (McGee,2007).

But with institutional improving, the state gradually

regulate the disclosure regime, the cost of late

disclosure of listed companies will increase. Under

the effect of instutional changes, as the improvement

of operating results, internal control and financial

system, the possibility of getting an unclean opinion

has reduced. It is likely that the timeliness of

Chinese companies issuing their financial statements

and annual reports will be improved (McGee &

Yuan, 2008). However, due to the big gap in general

between China and developed countries in level of

development, the overall lag in information

disclosure will not have a substantial change.

Based on the analysis above, we come up with

the first research hypothesis of this article:

H1: After the institutional changes, the overall

trend of information disclosure of listed companies

in China will continue show a delay, but the

timeliness will be improved than before.

Early or late information disclosure has different

information content, and there had not shown a

information content decline during the last three

decades (Landsman & Maydew, 2002). Gilvoly &

Palmon (1982) found in their study on timeliness of

annual report disclosure of listed companies in New

York Stock Exchange during 1960-1974, that market

price reacts stronger to earlier disclosure than later.

It is suggested that more timely disclosure of

information, the greater its information content

becomes. This is consistent with China's market

research findings (Chen et al., 2005). For companies

in the same industry, late information disclosure

may cause information leak more easily (Kross &

Schroeder, 1984). However, during the Gulf crisis of

the 1990s, petroleum refining companies, which

delayed reporting extraordinarily high profits

because of the political repercussions (Han &

Wang, 1998). Research also shows that annual

report disclosure in countries with a strong system of

investor protection has more information content

(DoFond et al., 2007).

ACCOUNTING INFORMATION CONTENT AND TIMELINESS OF ANNUAL REPORT DISCLOSURE - An

Evidence from China's Listed Companies

401

Whether for investors or regulators, the listed

companies’ accounting information is an important

tool to understand their business situation. It has

important significance for making economic

decisions. Timely disclosure of accounting

information, on one hand, can reduce the possibility

of management using information disclosure delay

to engage in insider trading, and help to provide

more reliable accounting information for external

information users. On the other hand, it can help

investors for rationally valuating the companies,

preventing excessive pricing error. Conversely, it

may lead to "information asymmetry". It will causes

information delay and much adverse impact to

policymakers, investors, regulators and many other

stake holders. Specifically, as for external

stakeholders, untimely accounting information may

cause hazards. Firstly it increases investor’s

decision-making risk-lack of a deterministic

decision-making basis; Secondly it damages the

foundational status of accounting information, so

that information users turn to other sources of

information; Finally, it may create time condition for

some companies to manipulate accounting

information and prepare false statements.

According to the provision of China Securities

Regulatory Commission (CSRC), the deadline of

listed company annual report disclosure is next April

30 generally. If the company has special situation

and can’t disclose the annual report before April 30,

it should apply to the CSRC. But the latest

disclosure date can’t exceed June 30. In the context

of this system, with the impacts of listed companies'

ownership structure and industry, early and late

disclosure of information will have different market

reactions, which will lead to the issues of timely

disclosed information content.

In 2007, China implemented the new Enterprise

Accounting Standards and the new auditing

standards. Based on the changes, are the conclusions

on information content still consistent with previous?

There has been no evidence.

Based on the analysis above, We propose the

second research hypothesis:

H2: Companies with early disclosure of their

annual reports will get a stronger market reaction

than those with later disclosure.

Since we use Abnormal Return (AR) and

Cumulative Abnormal Return (CAR) to measure

degrees of market reaction, the above hypothesis

may be further explained as:

Companies with early disclosure of their annual

reports will have definitely stronger AR and CAR

than those with late disclosure.

3 METHODOLOGY & MODELS

3.1 Timeliness of Accounting

Information disclosure

The paper uses Rlag (Reporting Lag) as the proxy

variable of timeliness (Chambers & Penman,1984).

It refers to the interval between the date of annual

report disclosure and accounting year end. We study

the annual disclosure measurement with the specific

situation of China's securities market and use trade

date method to determine the Rlag. The Rlag is

described as the number of trading days between the

date of annual report disclosure and Dec.31st. The

smaller the Rlag is, the timelier the reports

disclosure is. If the company's annual report is

disclosed during non-trading days, the disclosure

date is determined as the first trading day following

the disclosure date. Based on the above

considerations, we define two time variables in this

paper. One is URlag (Unexpected Reporting Lag),

and the other is RLI (Reporting Lag INDUex). In

this paper, we use Random-walking model “E(Rlag)

=Rlag

t-1

” to calculate the Rlag. Therefore, URlag =

Rlag

t

-Rlag

t-1

. Rlag

t

means the company i t-year’s

Rlag. RLI =n/N, “n” is equal to Rlag. “N” means the

sum of trading days within the time limit of annual

reports disclosure. In this paper N equals to 81.

We use the mean and t-test (Model 1) to measure

the improvement of timeliness after the

implementation of new institution. We compared the

mean of Rlag during 2006-2009 to analyze the

improvement of timeliness, especially in the late half

of the disclosure period. In order to test hypothesis 1,

we also analyzed the variation of March-disclosure

percentage.

3.2 Market Reaction

Investors’ reaction in stock market is reflected

mainly through stock prices. Therefore, we use

Abnormal Return (AR) and Cumulative Abnormal

Return (CAR) to measure the market reactions. AR

is the estimated value of changes in the company

stock price of the day caused by the events; it's the

income that is unexpected, the difference between

the actual return and expected return: AR

it

=R

it

-R

mt

.

AR

it

means the company i t-day’s abnormal returns.

R

it

means the company i t-day’s daily return. R

mt

means the company i t-day’s expected daily return

rate. In this paper, we count R

mt

by using Market-

adjustment model. That is, using the daily market

yields weighted by total market value as an estimate

of the expected rate of return. To a certain time

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

402

period, the sum of the daily abnormal returns is

CAR.

Since this paper uses event-study to research the

impact of timeliness on the stock, when calculating

CAR, we need to set a time interval, which is also

called event window. We should consider not only

the duration of event influence, but also the

interference from other events. In normal situation, a

market reaction caused by information leaks has

occured usually before the annual report is disclosed,

and the reaction does not last long. Based on this

assumption, we pick [-20, -3] and [-20, 2] as event

windows to measure the possible information leak.

At the same time, we also pick [-5, 5], [-2, 2] and [-1,

1] as three symmetric windows to measure the

market reaction to the report disclosure.

3.3 Research Model Design

The paper uses RLag, URLag and RLI as variables

to measure the timeliness of report disclosure. When

measuring improvements of timeliness, we use

NMar. We also use AR and CAR as the proxy

variables of market reaction.

3.3.1 Research Design for Hypothesis 1

This paper divides the sample into two groups by

months and trading days, and uses descriptive

statistics to analyze the status of annual reports

disclosure during 2007-2009. Then three variables

RLag, URLag and RLI are analyzed to further

examine the hypothesis1.

We use the mean and t-test (Model 1) to measure

the improvement of timeliness after the

implementation of new institution. We compared the

mean of Rlag during 2006-2009 to analyze the

improvement of timeliness, especially in the late half

of the disclosure period. In order to test hypothesis 1,

we also analyzed the variation of March-disclosure

percentage.

3.3.2 Research Design for Hypothesis 2

By analysing the correlation between AR, CAR and

Rlag, RLI, and grouping the samples according to

certain standards, we can compare AR and CAR of

both early and late disclosure companies.

Model 2: AR measures the change of company

value caused by important events. We use model 2

to calculate the market reaction, based on the study

of the connection between CAR and Rlag around the

report disclosure date:

AR

i

t

=α

0

+α

1

Rlag

i

+ε (1)

ARit is the company i t-day’s abnormal returns.

Rlagi is the company i t-day’s report lag. ε is the

random error.

Model 3 is used to make sure if CAR of early

reporting disclosure companies is significantly

higher than the late ones. It needs to compare the

sample mean of two groups and make a t-test on the

reporting lag. The standards of grouping are below:

(1) Firms disclose report in January and February

(Early disclosure group) and firms disclose reports

in March and April (Late disclosure group).

(2) URlag < 0 (Early disclosure group) and

URlag >= 0 (Late disclosure group).

(3) RLI<0.3 (Early disclosure group) and

RLI>0.7 (Late disclosure group).

Since some firm characteristics and market variables

such as size, message type, audit opinion and the

nature of ownership may affect the cumulative

abnormal returns, they have to be controlled, in

order to have a better review on the factors that

affect the reaction proceeds during the period of

annual report disclosure. Therefore, we have

designed a multiple regression model (Model 4):

CAR=β

0

+β

1

URlag+β

2

SIZE+β

3

PUBL+β

4

UE+β

5

EPS

+β

6

LAR+β

7

AUDI+β

8

CONT+β

9

EXCH+β

10

INDU

+β

11

YEAR+ε (2)

In this model, SIZE means the company size.

PUBL is the proportion of tradable shares. INDU

means the industry. UE is the unexpected earnings.

EPS is earnings per share. LAR is the asset-liability

ratio. AUDI is the audit opinion. CONT is the nature

of ownership. EXCH is type of the exchange. YEAR

means for the year of reporting disclosure. ε is the

random error.

3.4 Sample & Variables

Table1 shows the interpretation of variables

appeared in this paper:

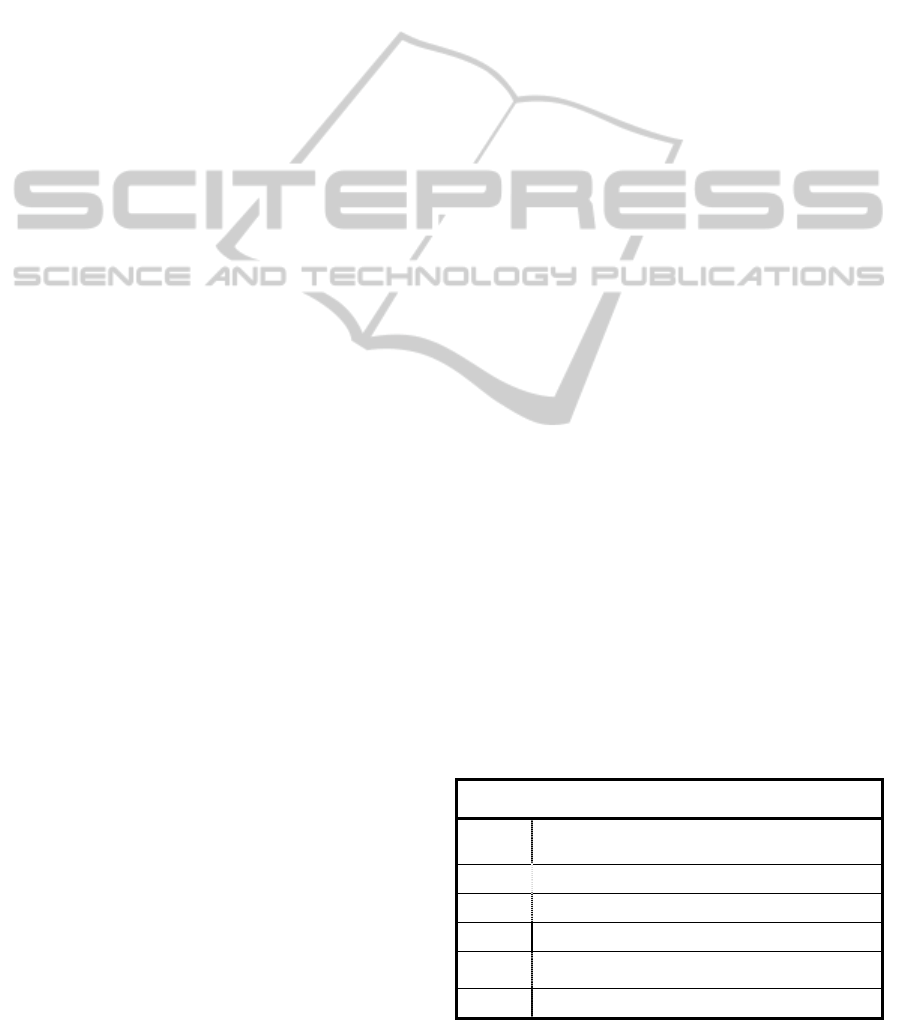

Table1: Variables.

Variable Variable Description

Rlag

Trading days between the date of annual

report released and Dec.31st

URlag URlag=Rlag

t

-Rlag

t-1

RLI RLI =n/N

AR AR

it

=R

it

-R

mt

CAR CA

R

,

=

SIZE Natural logarithm of final total assets

ACCOUNTING INFORMATION CONTENT AND TIMELINESS OF ANNUAL REPORT DISCLOSURE - An

Evidence from China's Listed Companies

403

Table1: Variables (cont.).

Variable Variable Description

PUBL

PUBL=number of year-end floating stock/

total shares

INDU Competitive industry INDU=1;else INDU=0

EPS EPS= retained profits /year-end total shares

UE UE=EPS

t

-EPS

t-1

LAR

LAR=year-end total liability / year-end total

assets

AUDI clean opinion AUDI=; else AUDI=1

CONT State-owned, CONT=0; else CONT=1

EXCH

Shenzhen exchange EXCH=1,Shanghai

exchange EXCH=0

YEAR

Setting two dummy variables based on 2007

Considering the impacts of new accounting

standards, we choose all companies that publish A

share and listed on the Shenzhen or Shanghai

exchanges as our sample. On this basis, the paper

has removed the following types of listed companies:

(1) Financial companies

(2) ST / PT companies

(3) Companies that disclose their annual reports

later than Apr.30th.

(4) Companies that miss part of the data or data

can’t be obtained.

Thus, there are a total of 2,927 sample

companies in the paper.

3.5 Data Sources & Tools

In addition to the audit opinion data obtained from

the wind database, other data are all from CSMAR

database. The statistical tools used are STATA 11.0,

Access2010 and SPSS 19.0.

4 FINDINGS

4.1 Describe Statistical Analysis

When examining research hypotheses 1, we make a

basic descriptive statistical analysis on the variables

of timeliness:

Table 2 reflects the descriptive statistics of

distribution of listed companies annual reports

disclosure time by month. It can be seen from the

distribution that the number (1358) and the

percentage (46.40%) of sample companies which

choose to disclose annual reports in March is

significantly more than that in January (63,2.15%)

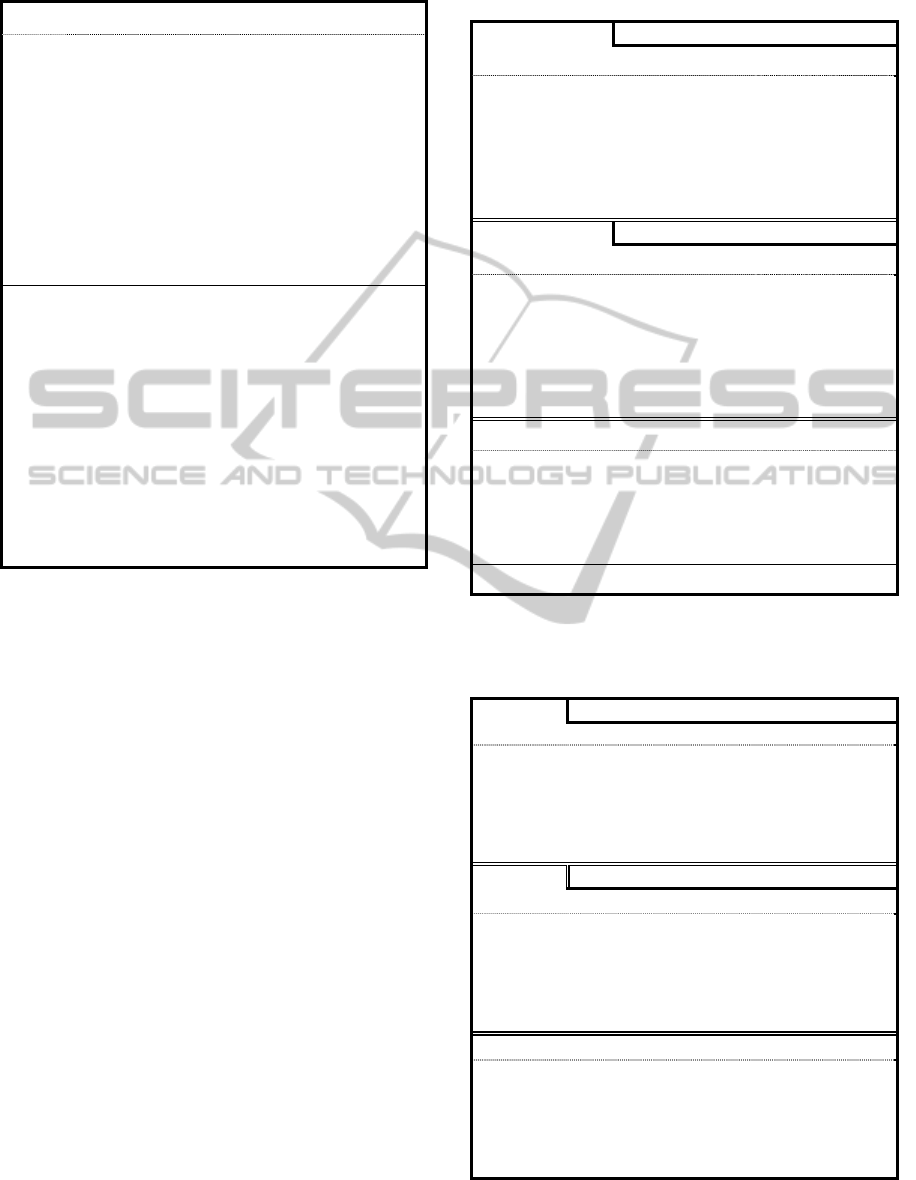

Table 2: Frequency statistics of annual report disclosure 1.

Months

Jan. Feb.

Year/Sample Number (%) Number (%)

2007(901) 34 3.77% 131 14.54%

2008(940) 7 0.74% 82 8.72%

2009(1086) 22 2.03% 121 11.14%

Sum(2927) 63 2.15% 334 11.41%

Months

Mar. Apr.

Year/Sample Number (%) Number (%)

2007(901) 378 41.95% 358 39.73%

2008(940) 462 49.15% 389 41.38%

2009(1086) 518 47.70% 425 39.13%

Sum(2927) 1358 46.40% 1172 40.04%

and in February (334, 11.41%). It is slightly more

than that in April (1172, 40.04%). The result shows

that the number of firms choosing to disclose annual

report in January and February is far less than that in

March and April. The disclosure of annual report

reflects hysteresis phenomena of delay as a whole.

Table 3: Frequency statistics of annual report disclosure 2.

Days

Year

Sum

2007 2008 2009

0-15 0 7 10 17

16-25 42 17 39 98

26-35 53 65 94 212

36-45 119 105 111 335

46-55 135 256 249 640

56-65 276 255 289 820

66-77 276 235 294 805

Sum 901 940 1086 2927

Figure1: Frequency distribution of annual report

disclosure.

0

50

100

150

200

250

300

350

0-15 16-25 26-35 36-45 46-55 56-65 66-77

The Conpany Number

Reporting Lag (Days)

2007

2008

2009

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

404

Table 3 shows the results of detailed statistical

analysis of annual report disclosure frequency with

10 trading day as an unit. It further reflects the

distribution of annual report disclosure time. The

number of companies is respectively 640, 820 and

805, which choose to disclose annual report in the

intervals of [46, 55], [56, 65] and [66, 77]. The

number of the three intervals increases suddenly

relative to the interval of [36, 45]. This phenomenon

can be more intuitively observed in Figure 1. The

result above further explans that a majority of

companies disclose their reports in March and April.

It also reflects the pattern of " slack starting and tight

ending " mentioned previously.

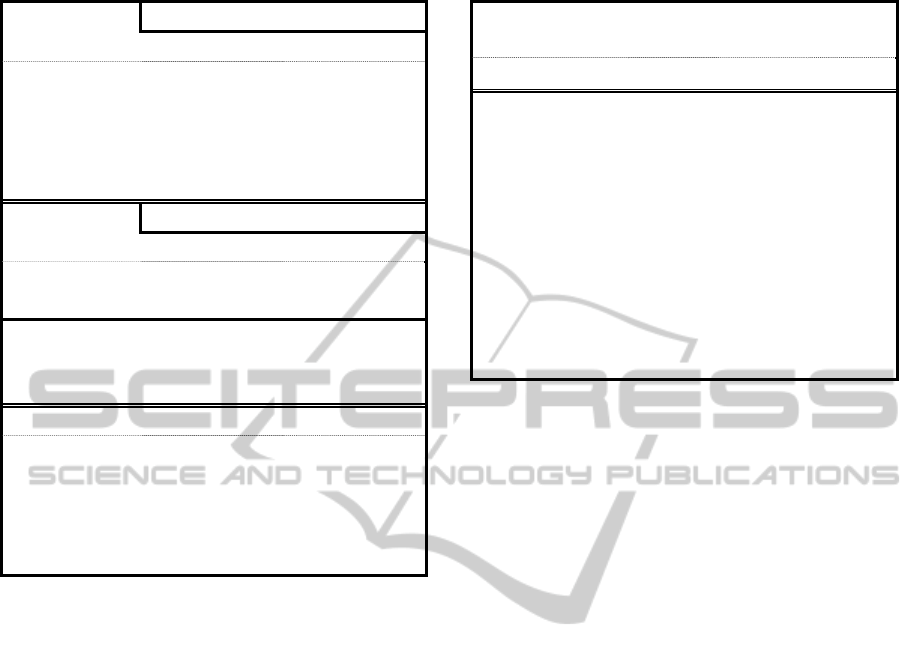

Table 4: Frequency statistics of annual report lag.

Variable Mean Median St. Dev Min. Max.

Rlag 55.2156 57 14.3224 9 77

RLI 0.6817 0.7037 22.5611 0.1111 0.9506

URlag 3.2928 0 0.1768 -64 77

Table 4 presents descriptive statistical analysis

results of Rlag, RLI and URlag. The mean of Rlag is

55.2156 and the median of Rlag is 57. The mean of

RLI is 0.6817 and the median of RLI is 0.7037.The

evidence shows that a majority of China’s listed

companies choose relatively late disclosure of their

annual reports and that the distribution of report

disclosure time is not random.

The result of descriptive statistical analysis

powerfully supports the relevant content of

hypotheses 1: Disclosure of corporate annual reports

in China is serious lagging.

Table 5: Compare of mean of Rlag.

mean-Rlag t-test

2006 2007 t-Value p-Value

57.2433 55.4022 -2.6591 0.004**

Table 6: Mean of Rlag during 2006 - 2009.

Year 2006 2007 2008 2009

Rlag 57.2433 55.4022 55.1610 54.7360

Table 5 reflects the results of compare of mean-

Rlag between 2006 and 2007. The result shows that

in 2007 mean of Rlag is significantly less than that

in 2006 (t=-2.6591). It confirms that the timeliness

of report disclosure has improved due to the

institutional changes in 2007.

Table 6 reflects the change of mean-Rlag during

2006 to 2009, and it finds that mean of Rlag

decreased significantly in 2007compared with 2006

while it maintained at the same level in 2008 and

2009.The result above suggest that the reform of

new system has improved the situation of annual

report disclosure lag overall, and the improvement

was Long-term effective.

Table 7: Percentage of company disclosing report in Mar.

Year 2006 2007 2008 2009

Mar. (%) 35.6 41.9 49.1 47.7

Table 7 reflects the percentage of the number of

companies disclosing annual report in March in

2006-2009. We can find that the percentage

increased significantly during 2006 to 2008, and it

tended to recede in 2009. The result shows that the

percentage of the number of companies disclosing

annual report in March had increased significantly

due to the institutional reform.

The result suggest that the situation of timeliness

of annual report disclosure has significantly

improved in China after the reform of institution and

the improvement mainly concentrated in the second

half of the disclosure period combined with the

analysis of Table 2 and Table 3.

4.2 Market Response Analysis

This paper uses two variables (AR and CAR) to

measure the strength of the market reaction, and then

studies the information content of timeliness. Table

8 to Table 12 present the results of AR and CAR

caused by the timeliness of annual reports disclosure

(Model 2-Model 4).

Table 8 presents the result of relevance analysis

between AR and Rlag (Model 2). It shows that 12

trading days out of 17 observation days have

significant regression coefficients at the 0.05 or 0.01

level. The statistical significance is more clearly

reflected during the day 11 and the day 3 before the

disclosure day. In addition, 14 regression

coefficients are less than zero. The evidences above

show that the smaller Rlag is, the bigger AR is,

meaning that the more timely the disclosure of

report is, the stronger the market reaction is.

ACCOUNTING INFORMATION CONTENT AND TIMELINESS OF ANNUAL REPORT DISCLOSURE - An

Evidence from China's Listed Companies

405

Table 8: Abnormal returns around disclosure.

Days Coefficient t-Value F-Value Sig.

-11 -0.00008 -2.2556 5.0878 0.02418*

-10 -0.00020 -4.1674 17.3673 0.00003**

-9 -0.00011 -3.0942 9.5742 0.00199**

-8 -0.00012 -4.0002 16.0017 0.00006**

-7 -0.00011 -3.3588 11.2817 0.00079**

-6 -0.00014 -3.9048 15.2477 0.00009**

-5 -0.00007 -1.9650 3.8612 0.04952*

-4 -0.00007 -2.0294 4.1183 0.04252*

-3 -0.00012 -3.0250 9.1505 0.00251**

-2 -0.00003 -0.8820 0.7780 0.37783

-1 0.00003 0.8940 0.7993 0.37137

0 -0.00004 -1.0693 1.1433 0.28502

1 -0.00005 -1.3110 1.7187 0.18998

2 0.00002 0.4445 0.1976 0.65672

3 -0.00012 -2.9276 8.5706 0.00344**

4 -0.00012 -2.8417 8.0753 0.00452**

5 0.00008 2.1906 4.7988 0.02856*

* Significant at the 0.05 level.

** Significant at the 0.01 level.

Table 9 presents the result of mean differences

comparative analysis of CAR grouped by report

disclosure earlier and later (Model 3). Result shows

that among all 5 intervals, there are 4 intervals

who’s CAR in early disclosure group (Jan. & Feb.)

is significantly bigger than that in late disclosure

group (Mar. & Apr.). This shows that listed

companies with annual reports disclosed earlier will

get better market reaction. It supports the hypothesis

2 of this paper.

Table 10 and Table 11 respectively show the

results of comparative analysis of CAR while the

samples are grouped by URlag and RLI (Model 3).

The analysis results show that CAR in early

disclosure group (RLI<0.3, URlag<0) is bigger than

that in late disclosure group (RLI>0.7, URlag>0)

among all the 5 intervals. And the result is

significant in the intervals of [-20, -3], [-20, +2] and

[-5, +5]. This reflects that the market reaction of

early disclosure group is stronger than that of late

disclosure group. The above results further support

the research hypotheses 2 of this paper: Companies

with early disclosure of their annual reports deliver a

stronger market reaction than those with later

disclosure.

Table 9: Cumulative Abnormal Return by bi-monthly

sample.

Interval

Mean

Jan. & Feb. Mar. & Apr.

[-20, -3] 0.090845 0.023563

[-20,+2] 0.098488 0.021351

[-5, +5] 0.039215 0.004218

[-2, +2] 0.007642 -0.002212

[-1, +1] -0.001936 -0.00431

Interval

St. Dev

Jan. & Feb. Mar. & Apr.

[-20, -3] 0.113971 0.110172

[-20,+2] 0.129946 0.126724

[-5, +5] 0.100501 0.096095

[-2, +2] 0.079571 0.073968

[-1, +1] 0.071061 0.057869

Interval Z-Value Sig.

[-20, -3] -10.9849 0**

[-20,+2] -11.0329 0**

[-5, +5] -6.48868 0**

[-2, +2] -2.31545 0.010294*

[-1, +1] -0.63346 0.263215

* Significant at the 0.05 level.

** Significant at the 0.01 level.

Table 10: Cumulative Abnormal Return by RLI.

Interval

Mean

RLI<0.3 RLI>0.7

[-20, -3] 0.115494 0.014266

[-20,+2] 0.118977 0.009399

[-5, +5] 0.023766 0.002502

[-2, +2] 0.003483 -0.004867

[-1, +1] -0.005702 -0.005694

Interval

St. Dev

RLI<0.3 RLI>0.7

[-20, -3] 0.119024 0.118076

[-20,+2] 0.128209 0.136097

[-5, +5] 0.110129 0.105047

[-2, +2] 0.090953 0.081236

[-1, +1] 0.080079 0.061966

Interval Z-Value Sig.

[-20, -3] -8.323938

0**

[-20,+2] -8.320053

0**

[-5, +5] -1.894145

0.029103*

[-2, +2] -0.903715

0.183073

[-1, +1] 0.001005

0.499599

* Significant at the 0.05 level.

** Significant at the 0.01 level.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

406

Table 11: Cumulative Abnormal Return by URlag.

Interval

Mean

URlag<0 URlag>=0

[-20, -3] 0.041738 0.024931

[-20,+2] 0.043843 0.021501

[-5, +5] 0.015183 0.003634

[-2, +2] 0.002105 -0.00343

[-1, +1] -0.001133 -0.006436

Interval

St. Dev

URlag<0 URlag>=0

[-20, -3] 0.107114 0.117377

[-20,+2] 0.124877 0.133158

[-5, +5] 0.094637 0.099478

[-2, +2] 0.072653 0.07655

[-1, +1] 0.059161 0.060292

Interval Z-Value Sig.

[-20, -3] -8.323938

0.000026**

[-20,+2] -8.320053

0**

[-5, +5] -1.894145

0.000653**

[-2, +2] -0.903715

0.022506*

[-1, +1] 0.001005

0.008280**

* Significant at the 0.05 level.

** Significant at the 0.01 level.

Finally, table 12 presents the result of relativity

analysis between timeliness and CAR, after

controlling the variables such as company features

and market factors (Model 3). The regression

analysis of CAR in the intervals of [-20,-3] and [-20,

+2] shows similar features, i.e., the regression

coefficient of URlag is negative number and it is

statistically significant at the 0.01 level. The result

shows that the CAR of early disclosure group is

bigger than that of the late disclosure group.

Besides the performance variable EPS and CAR

is positively correlated and the relationship of the

audit opinion and the CAR is significant negative,

which is consistent with previous researches. In

addition, the nature of ownership variable CONT

and CAR are positively correlated; reflecting that

investor’s expectations on the performance of non-

state enterprises is lower than that of the state-owned

enterprises in the Chinese market.

Therefore, the annual reports of non-state

enterprises are more likely to surprise the market

and achieve higher abnormal returns those of state

enterprises do. The result also shows that INDU and

CAR are positively correlated; meaning that

compared with non-competitive industry protected

Table 12: Multivariate regression.

CAR(-20,-3) CAR(-20,2)

R

2

0.0434 0.0442

Var.

coefficient t-Value coefficient t-Value

URlag -0.000912 -7.3** -0.000959 -6.56**

SIZE -0.01313 -6.65** -0.014054 -6.08**

LAR 0.020623 1.77* 0.015413 1.13

PUBL -0.013033 -1.46 -0.01297 -1.24

EPS 0.006208 1.21 0.010268 1.71*

UE 0.002824 0.53 0.001611 0.26

AUDI -0.034434 -1.74* -0.040022 -1.73*

EXCH -0.01132 -2.65** -0.005558 -1.11

INDU 0.006902 1.63 -0.002025 -0.41

* Significant at the 0.05 level.

** Significant at the 0.01 level.

by the government, the timeliness of report

disclosure of competitive industry may cause

stronger market reaction, and has more information

content.

The above analysis shows that annual reports of

the non-state listed company in a competitive

industry have a strong market reaction with earlier

disclosure, better performance and cleaner opinion,

which further confirms the research hypothesis 2.

5 CONCLUDING COMMENTS

The paper empirically examines whether timeliness

of China’s accounting information has improved and

possesses information content after a series of

institutional changes, based on a sample of 2927

non-financial Chinese listed corporations during

2007-2009. We uses abnormal return (AR) and

accumulative abnormal return (CAR) as proxy

variables of market reaction and process the data

through statistics and multiple regression analysis.

In the analysis of current situation and timeliness

improvement, this paper firstly divides the sample

into two groups by months and trading days, and

uses descriptive statistic to analyze the current

situation and the improvement of timeliness over

time. The results prove that the information

disclosure of listed companies in China has a trail in

general. By comparing the mean of the Rlag during

2006-2007, it confirms that the timeliness of report

disclosure has improved due to the institutional

changes. This kind of improvement will last long

ACCOUNTING INFORMATION CONTENT AND TIMELINESS OF ANNUAL REPORT DISCLOSURE - An

Evidence from China's Listed Companies

407

and mainly reflect on the late half of disclosure

period.

In analysis of information content of timeliness,

we firstly analyze the co-efficiency between

reporting lag and abnormal returns. The empirical

evidence suggests that the relationship between

abnormal returns around announcement date and the

reporting lag is obviously negative. Secondly, this

paper conducts a comparative average analysis on

the cumulative abnormal returns of the early

disclosure group and the late disclosure group

around the announcement date. The results show

that the cumulative abnormal returns of early

disclosure groups are greater than that of the late

disclosure groups. Finally, in control of the company

size, ownership nature, revenue, exchange and other

variables, we further discussed the relationship

between reporting delay and cumulative abnormal

returns. Results of a multiple regression analysis

confirm that early disclosure always has a stronger

market response. All of the results above are

consistent with the second hypothesis: In

comparison with companies that make late

announcements, companies that make early

announcements tent to surprise the market with

higher price reactions, which proves that timeliness

has information content.

The new findings of this paper is that timeliness

of information disclosure has improved and has

information content in China market with some new

characteristics since the new institutions were

implemented. The results also confirm that in the

emerging market of China, state-owned enterprises

and enterprises in a competitive industry, the

information content of timeliness of annual reports

disclosures is more obvious.

REFERENCES

Ahmed, K., 2003. The Timeliness of Corporate Reporting:

A Comparative Study of South Asia. Advances in

International Accounting, 16: 17-43.

Annaert, J., Marc J. K. DeCeuster, R. Polfliet, R. & Van

Campenhout, G.2002. To be or not be…‘Too late’: The

case of the Belgian semi-annual earnings

announcements. Journal of Business Finance &

Accounting, 29(3&4): 477-495.

Chai, M. L., S. Tung, 2002. The effect of earnings

announcement timing on earnings management.

Journal of Business Finance & Accounting, 29 (9 &

10), 1337-1354.

Chambers, A., S. Penman, 1984. Timeliness of reporting

and the stock price reaction to earnings announcements.

Journal of Accounting Research, 22(1): 21-47.

Chen, G. M., C. Louis, G. Ning, 2005, Information content

and timing of earnings announcements, Journal of

Business Finance & Accounting, 32(1): 65-95.

DoFond, M., M. Y. Hung, R. Trezevant. 2007, Investor

protection and the information content of annual

earnings announcements: International evidence.

Journal of Accounting and Economics, 43: 37-67.

Gigler, F. B., T. Hemmer. 2001. Conservatism Optimal

Disclosure Policy and the Timeliness of Financial

Reports. The Accounting Review, 76(4): 471-493.

Gilvoly, D., D. Palmon. 1982. Timeliness of Annual

Earnings Announcements: Some Empirical Evidence.

The Accounting Review, 57: 486-508.

Han, J. C. Y., S. Wang, 1998. Political costs and earnings

management of oil companies during the 1990 Persian

Gulf Crises. The Accounting Review, 73, 103-117.

Haw, I. M., D. Qi, W. Wu, 2000. Timeliness of annual

report releases and market reaction to earnings,

announcements in an emerging capital market: The

case of China. Journal of International Financial

Management and Accounting, (11): 108-131.

Haw, I. M. G., K. Park, D. Qi, W. Wu. 2003. Audit

qualification and timing of earnings announcements:

Evidence from China, Auditing: A Journal of Practice

& Theory, 22 (2): 121-146.

Kinney, W. R., Jr., L. S. McDaniel. 1993. Audit delay for

firms correcting quarterly earnings, Auditing: A

Journal of Practice & Theory, 12: 135-142.

Kross, W., D. A. Schroeder. 1984. An empirical

investigation of the effect of quarterly earnings

announcement timing on stock returns, Journal of

Accounting Research, 22: 153-176.

Landsman, W. R., E. L. Maydew, 2011. J. R. Thornock.

The information content of annual earnings

announcements and mandatory adoption of IFRS. The

UNC Working Paper.

McGee, R. W., 2007. Corporate governance and the

timeliness of financial reporting: A case study of the

Russian energy sector. 5th International Conference on

Accounting and Finance in Transition. London, July

12-14.

McGee, R. W., Y. Li, 2008. Corporate governance and the

timeliness of financial reporting: An empirical study of

the People's Republic of China. Florida International

University Working Paper.

Rees, W. P., B. Giner, 2001. On the asymmetric

recognition of good and bad news in France, Germany

and the UK. Journal of Business Finance &

Accounting, 28 (9&10): 1285-1332.

Whittred, G. P. 1980. Audit qualification and the

timeliness of corporate annual reports. The Accounting

Review, 55:563-577.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

408