SECURITY INVESTMENT ANALYSIS ON GAMING THEORY

WITH MEASUREMENTS OF COST AND DECISION BEHAVIOR

Wang Wei and Ren Ying

School of Economics and Management, Beijing Jiaotong University, Beijing, China

Keywords: Security, Investment, Gaming theory, Cost, Supervision.

Abstract: The enterprises face with problems such as coordination with the security administration, market

competition, decision-making of production, security investment and so on. With the cost of raw material

has been going up in recent years, in order to reduce the cost and maximize the profit, the enterprises are

gaming in the security investment, which results in safety accidents. Based on the gaming model with the

measurements of cost and decision behavior, this paper presents a security investment analysis for decision

maker to enhance the security supervision and improve the production and security status.

1 INTRODUCTION

From the incomplete statistics, the average

preventive investment in developed countries

accounted for 3.3% of GDP. It is estimated that the

security engineering, security facilities, and

outstanding security loans amounted to hundreds of

billions, not including the other expenditures. On the

other hand, the overall loses annually in recent years

occurred in all types of security incidents is more

than trillion dollars of direct loses, plus inestimable

indirect losses. Through the analysis of security

consciousness, security input, security legal system

and on-the-spot government, more and more

countries pay attention to the importance of security

administration and inputs. The emphasis is placed on

as strengthening enterprise's security management,

employing principle of risk concentration to arrange

invested funds for security rationally, using

risk-transfer to lower accident rates, using financial

methods reasonably to reduce losses of accident

(Dixit and Pindyck, 1994; Goeree and Holt, 2005).

Why do not companies want to invest in

security? Firstly, Let us explain this phenomenon

from the principle of minimum security cost and

maximum profit (Kort et al., 1999):

(i) Minimum Security Cost Principle

Considering security investment consists of accident

loses and security cost:

B(S)=L(S)+C(S) (1)

Where, S represents a variable for the security

production, L(S) expresses the loss function of

security; C(S) expresses the cost function of

security.

The optimal case is when B (S) is minimum. To

achieve this objective, the optimal S can be derived

through seeking dB (S) / dS = 0.

(ii) The Maximum Profit Principle

Security investment return E (S) can be expressed

as:

E(S)=F(S) - C(S) (2)

Where, F (S) is a security function which is equal to

the profit appreciated and loss saved of security

inputs. The optimal case is when E (S) the maximum.

It can be derived through setting dE (S) / dS = 0.

No matter whether it is the minimum cost

principle or maximum profit principle, the analysis

comes out from the economics perspective of a

business, and does not take into account the utility

functions of market competition, inter-firm

interaction and other constraints. This paper

introduces game theory into the analysis of

enterprise security investment from the perspective

of technology cost and the decision-making

behavior.

519

Wei W. and Ying R..

SECURITY INVESTMENT ANALYSIS ON GAMING THEORY WITH MEASUREMENTS OF COST AND DECISION BEHAVIOR.

DOI: 10.5220/0003586605190523

In Proceedings of the 13th International Conference on Enterprise Information Systems (SSE-2011), pages 519-523

ISBN: 978-989-8425-53-9

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

2 THE MODEL OF GAMING

2.1 Utility Function

In order to study the security investment gaming

between enterprises, the constructed model involves

two entities (i, j = 1, 2) which has its own utility

function u

i

under the security investment of a

i

(a

i

≥

0), and assumed that

z the enterprise i invested in security at the level

of a

i

=0 and a

i

> 0;

z the probability P of a security accident is very

small. Otherwise, it is not attractive for a rational

investor to invest and the government would

supervise such kind of risky project. The

objective of security investment is to control the

probability of security accident so that the

accident probability decreases to a small level of

P’;

z only the price competition come out of profit

consideration is taken into account for the

market competition;

z an infinite loss of security accident would result

in a bankruptcy.

z The Security investment utility function can be

constructed as follows (

Guang-mao et al.,

2005

):

)()(),(

iiiijiii

avayaaxu −+=

(3)

Where, x

i

(a

i

,a

j

) expresses the overall profit

utility value changed for enterprise i from external

competition of security investment with other

enterprises; y

i

(a

i

) is the utility value for enterprise i

in the security investment; v

i

(a

i

) is the cost of

security investment, and v

i

(a

i

) > 0.

Taking enterprise 1 as example, and let x

1

(a

1

, a

2

)

= w

1

a

1

a

2

. Where

211

2

1

/ aaxw ∂∂∂= reflects the

contribution of x

1

to the overall utility value and the

relative impact of competition in security investment

between enterprises, its sign is the same as (a

2

– a

1

).

Under the competition condition that a security

investment would increase the cost for enterprise i,

a

1

has a negative impact and a

2

has a positive impact

on the utility value.

0,)()](1[

')'1()(

≥−−−−=

−−=

i

s

ii

c

ii

sc

ii

uapuap

upupay

γγγ

,(4)

Where, γ

i

expresses the learning ability of

security investment for enterprise i; (p-γ

i

a

i

) indicates

the probability change of accidents for a security

investment, (p-γ

i

a

i

) ≥0; u

c

is the profit for enterprise

without security accidient, u

s

is the profit loss caused

by a security accident, and u

s

→+∞. For a very small

number p, (p-γ

i

a

i

)→0.. It is hard to determine the

value of pu

s

and (p-γ

i

a

i

)u

S

which are meaningless in

the utility function. Consequently, the term (p-γ

i

a

i

)u

s

can be truncated, and the impact of security

investment is focused on the term of [1-(p-γ

i

a

i

)]u

c

.

0,

2

1

)(

2

≥+−=

iiiiiii

cacabav

, (5)

Where b

i

is security investment intention for

enterprise i, c

i

is the significance of security

investment a

i.

Under a security investment, the

utility value for enterprise 1 and enterprise 2 is:

)2,1(,

2

1

)](1[),(

2

2121

=−+

+−−+=

iacab

uapaawaau

iiii

c

iiii

γ

(6)

If enterprise i does not have a security

investment, then a

i

can be substituted by 0, and

2211

),( azazaax

jii

+=

(7)

Where, z

1

and z

2

are constant. If the impact on

enterprise 1 is negative, then the impact on

enterprise 2 would be positive, accordingly,

1

z <0

and

2

z >0.

2.2 Utility Matrix

Suppose the gaming utility matrix for two business

entities is shown in Figure 1, from equation (6),

u

1

(a

1

,a

2

) and u

2

(a

1

,a

2

) can be calculated (Wei-ying,

1996

):

c

upuu )1(),0()0,0(

21

−==

2

1111111111

2

1

)](1[)0,( acabuapazau

c

−+−−+=

γ

c

upazau )1(),0(

2221

−+=

2

2222222222

2

1

)](1[),0( acabuapazau

c

−+−−+=

γ

c

upazau )1()0,(

1112

−+=

Entity 2

0

2

a

Entity 1

0

1

a

F

Figure 1: Two entity’s security invest utility matrix.

u

1

(a

1

,a

2

),u

2

(0,0) u

1

(0,a

2

), u

2

(0,a

2

)

u

1

(a

1

,0), u

2

(a

1

,0) u

1

(a

1

,a

2

), u

2

(a

1

,a

2

)

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

520

If 0 < a

1

< 2(z

1

+b

1

+γ

1

u

c

)/c

1

,then u

1

(a

1

,0)>

u

1

(0,0). It means enterprise 1 continues to invest in

security even though enterprise stops the security

investment.

3 GAMING ANALYSIS

3.1 Graphical Analysis of Gaming

Zones

By means of a game graphics with gaming zones,

the gaming can be divided into two situations

(Jun-jie et al., 2006; Li and Sun, 2005):

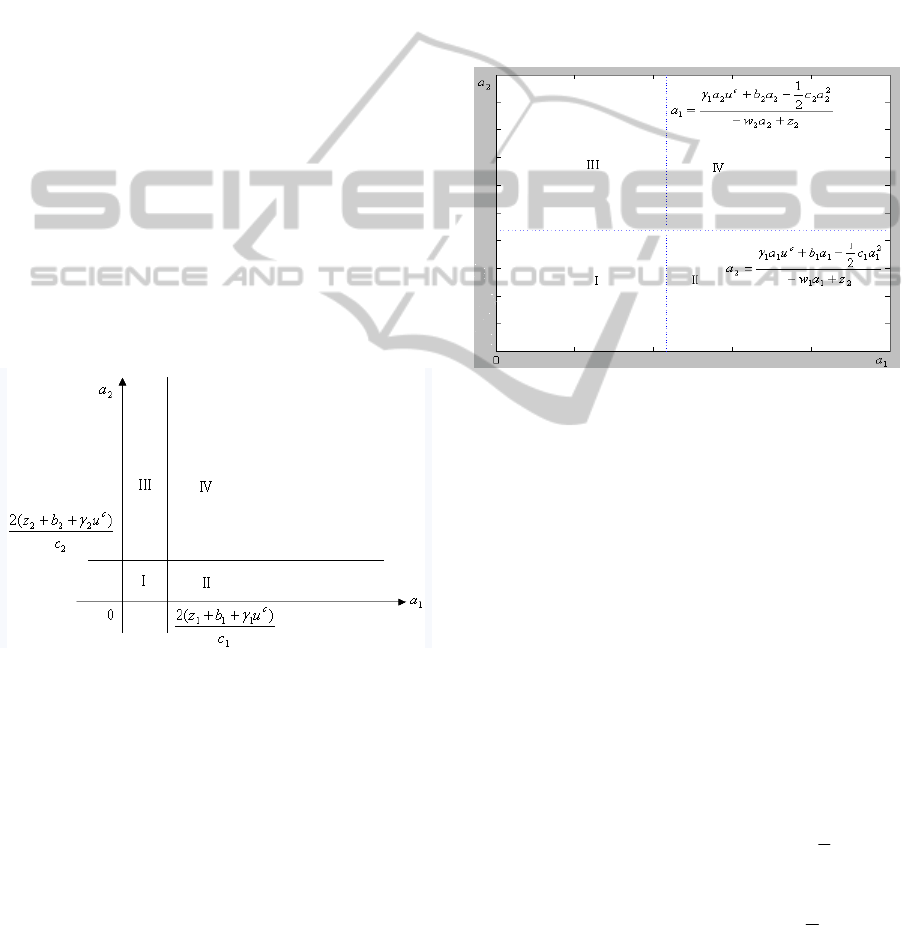

Situation 1:

Corresponding to u

1

(0,0)=u

1

(a

1

,0) and u

2

(0,0) =

u

2

(0,a

2

),there are four gaming zones (I, II, III, IV)

divided by the cross lines of a

1

=2(z

1

+b

1

+γ

1

u

c

)/c

1

and

a

2

= 2(z

2

+b

2

+γ

2

u

c

)/c

2

, which is shown in Figure 2.

In zone I,u

1

(0,0) < u

1

(a

1

,0) and u

2

(0,0) <

u

2

(0,a

2

) , the security investment choices for the two

enterprises are(a

1

,a

2

). Similarly, in zone II, III, IV the

security investment choices are (0,a

2

), (a

1

,0) and

(0,0).

Figure 2: Graphics for gaming situation 1.

Situation 2:

Corresponding to u

1

(a

1

,a

2

)=u

1

(0,a

2

) and u

2

(a

1

,a

2

) =

u

2

(a

1

,0), the four gaming zones (I, II, III, IV) are

divided by the cross lines of

a

1

=(γ

2

a

2

u

c

+b

2

a

2

-0.5c

2

a

2

2

)/(-w

2

a

2

+z

2

)

and

a

2

=(γ

1

a

1

u

c

+b

1

a

1

-0.5c

1

a

1

2

)/(-w

1

a

1

+z

1

)

,

which is shown in Figure 3. Through an iterative

calculation, the gaming zones can be obtained and

shown briefly as Figure 3. Any change of the

parameters can only affect the size of the zones but

not the relationship between zones. The security

investment choices for gaming zone I, II, III, IV are

(0,0), (0,a

2

), (a

1

,0), (a

1

,a

2

), respectively.

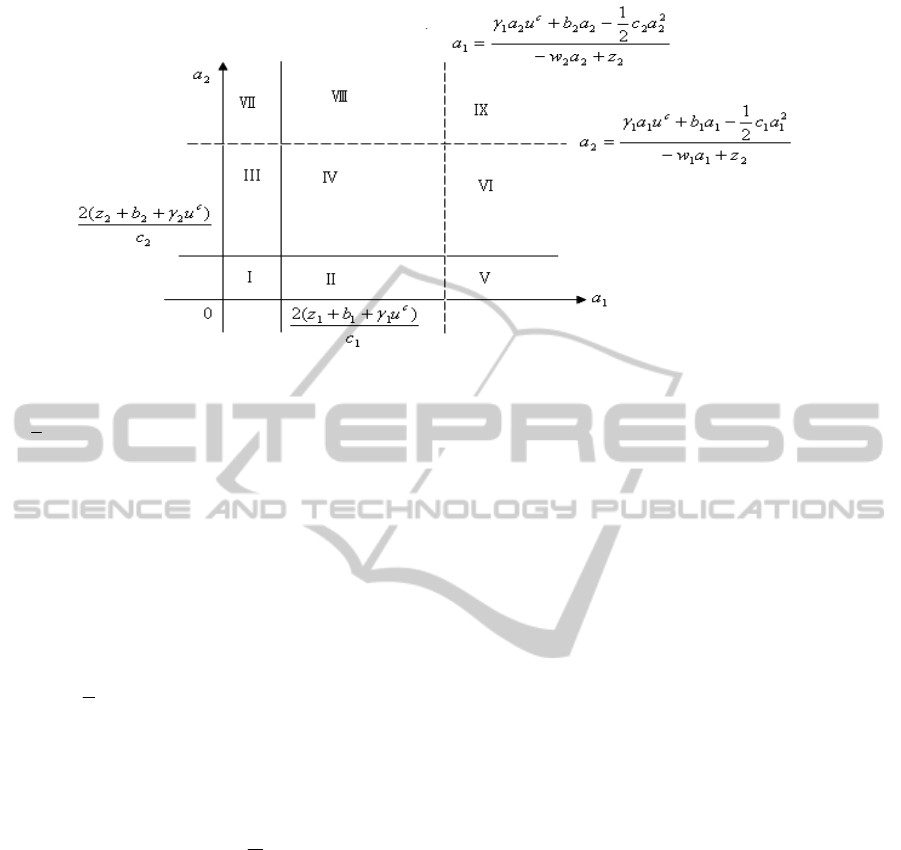

Combining Figure 2 with Figure 3 into one

coordinate frame, there are nine gaming zones

available in Figure 4.

It should be noted that the relative location of

gaming zones in Figure 4 might be changed based

on the value of (z

1

+b

1

+γ

1

u

c

)/c

1

, (z

2

+b

2

+γ

2

u

c

)/c

2,

(γ

2

a

2

u

c

+ b

2

a

2

- 0.5c

2

a

2

2

)/(-w

2

a

2

+ z

2

),

and (γ

1

a

1

u

c

+

b

1

a

1

- 0.5c

1

a

1

2

)/(-w

1

a

1

+ z

1

)

.

It can also be observed

from Figure 4 that the gaming results are always the

same for zone IV, V, and VII, which are (0,0), (0, a

2

),

(a

1

, 0), respectively. The gaming results for the other

zones might vary from different gaming situations.

Figure 3: Graphics for gaming situation 2.

3.2 Gaming Analysis for Security

Investment

Another observation from the gaming model and

gaming zone analysis is that the security investment

is very much dependent upon the parameters.

However, the actual security investment decision for

an enterprise is not complicated, in most of the cases,

it is dependent upon the cost and technology

instrument.

For enterprise 1, obviously, the investment

choices could be (0,0), (a

1

, 0), (0, a

2

), (a

1

,a

2

). The

decision can be made after the comparison

of

u

1

(0, 0) and u

1

(a

1

, 0), as well as u

1

(0, a

2

) and

u

1

(a

1

, a

2

). From (6) we can obtain (Liang-qiao,

2007):

2

11111111111

2

1

)0,0()0,( acabuaazuau

c

−++=−

γ

(8)

2

111111

2221121211

2

1

),0(),(

acabua

azaawauaau

c

−++

+−=−

γ

(9)

In (8), z

1

a

1

<0. From the presupposition of

security investment cost v

i

(a

i

) > 0, we can know:

SECURITY INVESTMENT ANALYSIS ON GAMING THEORY WITH MEASUREMENTS OF COST AND

DECISION BEHAVIOR

521

Figure 4: Integrated gaming zones.

0

2

1

2

1111

<− acab

. Under a certain level of investment

a

1

,γ

1

a

1

u

c

depends on the value ofγ

1

and u

c

. γ

1

is

mainly affected by business environment and

technology level, the higher the technical level

requires, the greater value

γ

1

from the impact of

security probability would be. u

c

is related to the

enterprise cost, a lower cost reflects a higher value

of u

c

. From the viewpoint of technology and cost

components, a lower level of technology would

cause a higher investment cost. Compared with z

a

a

1

and

)

2

1

(

2

1111

acab −

, the value ofγ

1

a

1

u

c

is very small

and can be ignored. Therefore, u

1

(a

1

, 0) - u

1

(0, 0) <

0. In the situations of

(0,0)and (a

1

, 0), enterprise 1

would not make a security investment until an

improvement of technology and profit occurs.

For expression (9),

2

1111

2

1

acab −

<0, w

1

a

1

a

2

–

z

2

a

2

= (w

1

a

1

– z

2

)a

2

. As a matter of experience, under

the unique condition of competition, the choice of

(0,a

2

)is better than(a

1

,a

2

) for enterprise 1 to

improve the competition, this conclusion can also be

derived from the analysis of utility functions.

Compared with the case of (0, a

2

), the case (a

1

, a

2

)

implies a smaller impact of the overall utility value

for enterprise 1, and w

1

a

1

a

2

– z

2

a

2

< 0. The value of

γ

1

a

1

u

c

is very small compared with that of z

1

a

1

and

w

1

a

1

a

2

– z

2

a

2

, so it can be ignored. u

1

(a

1

, a

2

) - u

1

(0, a

2

)

<0, so we have the same conclusion for the

situations of (0,0) and (a

1

, 0) that enterprise 1 would

not make a security investment until an

improvement of safety instruments.

From the analysis of (8) and (9), under the

condition of a low technology level and a high

security investment cost, the enterprise 1 thought it

is not necessary to make a security investment

because of the low utility value in the short run.

Without a change of business environment,

enterprise 1 would be gaming forever. Similarly,

enterprise 2 also gets the same conclusion and does

not want to invest neither. Consequently, the choices

for enterprise 1 and enterprise 2 would be (0, 0)

which located at zone IV in Figure 4, both

enterprises are unwilling to make a security

investment.

4 CONCLUSIONS

The reason why enterprises are reluctant to make a

security investment is partially due to a low level of

technology, high investment cost as well as a result

of ineffective supervision, thereof the problems of

low input and technology instrument are not difficult

to solve. However, the fact of inadequate

government supervision and the pursuit of maximum

profit leads to the enterprises’ gaming behavior. To

improve the security investment efficiency, some

suggestions are summarized as follows:

z The managerial principle of profit

maximization results in a shortage of security

input, irrational gaming, inappropriate

supervision, and even corruption. A task of top

priority is to strengthen security supervision,

add impetus to the marketization of public

utilities, improve funds efficiency, and

establish a rational institutional system. The

enterprises may have to provide detailed

statements timely to the administrative

agencies.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

522

z The government should encourage the

enterprises to improve the technology level

through making more R&D investment and

accelerating the pace of imports and

international cooperation in advanced

technology.

z Facing with the problems of high security input

cost and capital shortage in the context of the

recent crisis in global financial markets and

weakening of global economic activity, the

government should make an effort to adjust the

policy, including the government subvention

,

public subsidy, tax exemption and reduction.

z The enterprises must identify the objective and

the use of security investment funds, including

government subsidies, R&D, and the security

fee deducted, setting up a proactive investment

mechanism and risk preventive system.

z The enterprises should establish a budget and

check framework to monitor progress and

effectiveness of the security funds, as well as

create an internal performance reporting

structure to ensure the funds are in a virtuous

cycle.

REFERENCES

Dixit, A . K. and Pindyck, R. S., Investment under

Uncertainty, Princeton University Press, Princeton

,

N J

,1994

Goeree and Holt (2005)

:An experimental study of costly

coordination

.games and economics behavior.(51),

349—364

.

P.M. Kort; J. L. Haunschmied; G Feichtinger, “Optimal

firm investment in security”, Annals of Operations

Research 1999(1):81_98

Annals of Operations Research

Dong Guang-mao, Yuan Li, LIAO Xiu-wu. “The failure

of strategic alliances Game Analysis: coordination

failures perspective”, Journal of Systems Engineering,

2005, 23 (8): 91_ 95.

Zhang Wei-ying. Game Theory and Information

Economics, Shanghai People's Press, 1996.

Lu Jun- jie, Chiu Wan-hua, WANG Yuan-Zhuo. “Based

on the interdependence of information security

investment in the game”, Journal of China

Management Science, 2006 (3).

Meng Li, Wei Sun. “On the competitive power generation

business under the conditions of the investment

strategy of the game options research”, Journal of

contemporary economic management, 2005 (3).

Zhang Liang-qiao. “Coordination game with a balanced

selection”, Journal of Explorations, 2007 (5).

SECURITY INVESTMENT ANALYSIS ON GAMING THEORY WITH MEASUREMENTS OF COST AND

DECISION BEHAVIOR

523