IS INTERNAL CAPITAL MARKET OF CHINA LISTED

COMPANIES EFFICIENT?

Empirical Evidences from Listed Companies which Have

Multiple Divisions in H-stock

Fengjuan Wang and Zhihua Xie

Business School, Beijing Technological and Business University, Fucheng Road, Beijing, P.R. China

Keywords: Internal capital market efficiency, Cash flow-sensitivity based on ROA, Evaluation method.

Abstract: In theory, when external capital market is not efficiency, groups can allocate resource efficiently through

internal capital market. In this paper, we studied of listed companies which have multiple divisions in H-

stock, used Cash Flow-Sensitivity Based on ROA to validate internal capital market efficiency of large

samples. Results display that, on the whole, internal capital market of listed companies is efficiency, and the

greater part of listed companies can continually allocate resource efficiently through internal capital market,

part of listed companies have excellent capacity to “pick winner”. This paper is the first literature which

employs listed companies as large samples to evaluate internal capital market efficiency directly, which

would make research results more reliable and more representative. It would provide evidences for

developing groups in our country and lay the foundation of further research in theory and method.

1 INTRODUCTION

Due to the serious friction in the external capital

market, the rapid development of enterprise groups

and the wide presence of internal capital market

practice, in recent years the concern on the theory of

internal capital market in emerging market countries

gradually exceeds the origin of this theory——the

United States and other developed countries.

Theoretically speaking, when the external capital

market is inefficient or ineffective, the resources can

be effectively allocated through internal capital

market. Enterprises can build the internal capital

market through diversified or group-based operation.

Enterprise groups in China are rather common with a

relatively high degree of diversification, internal

capital market practice is prevalent and developing

enterprise groups has always been seen as an

important economic policy by the Government.

However, the existing cases or empirical research

literature about internal capital market efficiency (Lu

Jianxin, 2008; Xu Qiting, 2008; Shao Jun and Liu

Zhiyuan, 2007) all choose “the Family Enterprise” as

the research object, which draws a conclusion that

the internal capital market is inefficient. Wang

Fengjuan and Zou Cunliang(2009) raised questions

about their samples and concludes.

In summary, the internal capital market theory,

practice and empirical evidence suffer contradiction.

Does this mean that the economic policy of

developing enterprise groups is wrong? Does it mean

that the market behavior of the enterprise groups is

irrational? To answer the questions is the aim of this

article.

2 LITERATURE REVIEW AND

THEORETICAL ANALYSIS

2.1 The Theoretical Basis for the

Effective Internal Capital Market

The effectiveness of internal capital markets is due to

the headquarters remaining control and information

superiority, which can reduce the information

asymmetry, increase motivation and effective

supervision, producing “more-money effect” and

“smarter -money effect”.

The internal capital market results from the

imperfection of the external capital market:

asymmetric information. Due to the internal

600

Wang F. and Xie Z..

IS INTERNAL CAPITAL MARKET OF CHINA LISTED COMPANIES EFFICIENT? - Empirical Evidences from Listed Companies which Have Multiple

Divisions in H-stock .

DOI: 10.5220/0003597206000605

In Proceedings of the 13th International Conference on Enterprise Information Systems (PMSS-2011), pages 600-605

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

information barriers or high costs existing in

obtaining the internal information of an enterprise,

the external capital market can not conduct

continuous fine-tuning to the company based on the

market conditions, while the internal capital market

is superior in the authenticity, timeliness and

accuracy of the information, and has an advantage on

the adaptability to the market environment

(Williamson, 1975). Myers and Majluf (1984), Stein

(1997) also provides the same evidences.

Gertner, Scharfstein and Stein (1994) built a

model on the basis of Grossman and Hart ownership

theory. They said that in the internal capital market,

corporate headquarters (the investor) is the direct

owner of the assets of divisions that utilize funds, and

has residual control rights, while the investors of the

external capital markets are not the direct owner of

those assets. Due to this essential difference, the

enterprise messaging, monitoring and incentives

produce different results between internal capital

markets and external capital markets. In the internal

capital markets, the corporate headquarters with the

residual control rights can better supervise and

motivate departmental managers.

When there is information asymmetry between

external investors and company management about

the company assets value and expected return on

investment projects, the securities issued by high-

quality companies to finance investment projects

may be undervalued, because companies may not

obtain sufficient funds at a reasonable cost, they have

to give up some projects with a positive net present

value (Myers and Majluf, 1984) . Stulz (1990)

pointed out that since the creation of a strong internal

capital markets in diversified companies, it will

effectively solve the problem of insufficient

investment, so diversified business operations than

single enterprises can make greater use of the

investment opportunities that present value is

positive, which will enhance corporate value.

2.2 The Theoretical Basis for the

Ineffective Internal Capital Market

Due to the agency problem, influence costs and

abuse of free cash flow, the internal capital market is

inefficient or even ineffective in capital allocation.

Scharfstein and Stein (2000)believed a good

investment project suffers relative under-investment

and a poor investment project enjoys over-

investment. With regard to the causes of "Company

socialism", Scharfstein and Stein (2000) continued to

analyze and found that this was due to the department

manager's rent-seeking behavior. Rajan, etc. (2000)

study have also reached the similar conclusion.

Managers have the tendency of over-investment

with the remaining cash flows (Jensen, 1986, 1993),

and the organizational structure of large enterprise

provides more cash flow for managers, which thus

easily leads to over-investment. Free cash flow

theory

suggests that due to the temptation of a

number of factors, entrepreneurs prefer to invest in

the project that would not increase shareholder

wealth as opposed to paying the dividend, such as

the money for its own on-the-job

consumption

(purchase of commercial aircraft), or the

consumption for honor(for social contributions, etc.).

2.3 China's External Capital Market

Efficiency and the Empirical

Evidences

In China, the external capital market is inefficient,

which has been proved by a large number of research

literature. The first is the low efficiency of the

banking system. Lu Jianxin(2008) argued that the

bank-led financing model prevails in China, but for

quite a long time, China's banking resource allocation

is based upon the administrative relations. As the

backbone of the banking system, state-owned

commercial banks inject their credit facilities into the

state economy whose economic contribution rate is

not high. As a result, input and output are

significantly mismatched, funding does not flow into

sectors of high efficiency, and the allocation of

resources is markedly ineffective. Second, the

efficiency of China's stock market is rather low. Yu

Qiao (1994) , Wu Shinong(1996), Chen Xiaoyue, et

al (1997), Han Liyan and Cai Hongyan (2002),

Zhang Bing and Li Xiaoming (2003), and Zeng

Yamin (2004) have used different methods to study

the stock market efficiency and reached the

conclusions that China's stock market is ineffective

or inefficient.

3 EVALUATION MODEL

SELECTION OF INTERNAL

CAPITAL MARKET

EFFICIENCY AND

EVALUATION METHODS

3.1 Internal Capital Market Efficiency

Evaluation Model Selection

Measurement methods of internal capital market

IS INTERNAL CAPITAL MARKET OF CHINA LISTED COMPANIES EFFICIENT? - Empirical Evidences from Listed

Companies which Have Multiple Divisions in H-stock

601

efficiency can be divided into indirect and direct

research methods. In the early empirical studies,

researchers largely used the indirect research method.

The indirect research method is a rough

measurement; its use stems from researchers'

inability to obtain needed business segment data (Lu

Jianxin, 2008). With the improvement of segment

reporting standards, segment information gradually

meets the need of directly measuring the efficiency

of the internal capital market. Particularly, after the

advent of databases directly providing detailed

financial data of the enterprise segment such as

COMPUSTAT database and the LRD database, the

direct research method has been increasingly

used(Wang Fengjuan,2009). In abroad, the direct

research model mainly has the following four kinds:

investment cash flow sensitivity method (Shin and

Stulz, 1998), the value added method (Rajan and

Zingales, 2000), Q-sensitivity (Peyer and Shivdasani,

2001), and cash flow sensitivity method

(Maksimovic and Phillips, 2002; Shcoar, 2002).

Chinese scholars mostly use Q-sensitivity and cash

flow sensitivity methods, including Wang Fengjuan

and Zou Cunliang (2009), Lu Jianxin (2008), Xu

Qiting (2008), Shao Jun and Liu Zhiyuan (2007).

Conducted an in-depth analysis of the four models

above, Wang Fengjuan and Xie Zhihua(2010)

designed a new model named “cash flow sensitivity

methods based on asset return”.

The formula of cash flow sensitivity coefficients

based on the return on assets is as follows:

])()[(

1

,

BA

BA

BA

capex

BA

capex

BA

cf

BA

cf

CFS

j

j

j

n

j

j

j

A

−−=

∑

=

In the formula BAj is the book assets of segment

j, BA is the book assets of all segments; cf is the cash

flow of all segments. Capex is capital expenditure.

The model is an improvement on cash flow sensitive

method, replacing

⎟

⎟

⎠

⎞

⎜

⎜

⎝

⎛

−

sale

cf

sale

cf

j

j

with

⎟

⎟

⎠

⎞

⎜

⎜

⎝

⎛

−

BA

cf

BA

cf

j

j

.

Just as the external investors invest to obtain

investment return, the ultimate goal of internal

capital allocation is to maximize return on capital.

Thus, in theory, regardless of the external or internal

capital markets, the return on investment is the

resource allocation criterion which is the principle to

design cash-flow sensitivity method based on assets

return. Therefore, this article selects cash-flow

sensitivity method based on return assets to evaluate

the internal capital market efficiency.

3.2 Evaluation Methods of Internal

Capital Market Efficiency

This paper uses two approaches to evaluate the

internal capital market effectiveness of the samples

as a whole. The first is based on the mean and

median of the sample company's cash flow

sensitivity coefficient: if both are positive, then the

internal capital market is effective; if they are

opposite, then make a judgment after further analysis.

The second is based on the positive and negative

signs of cash flow sensitivity coefficients, and

calculates the percentage of samples with positive

efficiency to the total sample (referred to "percentage

of effective class"), when the percentage is greater

than or equal to 50%, the internal capital market is

effective on the whole.

In addition to the overall evaluation of all

samples, in order to determine continuity of internal

capital market efficiency in the sample companies,

this paper has also drawn the samples that have

disclosed segment data for 8 consecutive years, or

throughout the period covered by our research,

calculated the percentage of the years in which

resources are effectively allocated to the 8 years. If

the percentage is greater than or equal to 50%, then

the sample's internal capital market as a whole is

effective.

4 EVALUATION OF INTERNAL

CAPITAL MARKET

EFFICIENCY IN H SHARES

LISTED COMPANIES WITH

MULTI-SEGMENT

4.1 Sample Selection and Data Sources

In China listed company's shares include A shares, B

shares, H shares, N shares and S shares. This

distinction is primarily based on the location and

investors the stock may target. In the quantitative

terms, A-share listed company is largest and most

representative, but due to incomplete division

information, there is a lack of the critical data

necessary to measure the internal capital market

efficiency: "segment capital expenditure" and

"division cash flow". Therefore, this paper selects H-

share listed companies as object and makes an

overall assessment of the internal capital market

efficiency of listed companies in China. H-share and

A-share listed companies are registered in the

Mainland, there are therefore identical in terms of

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

602

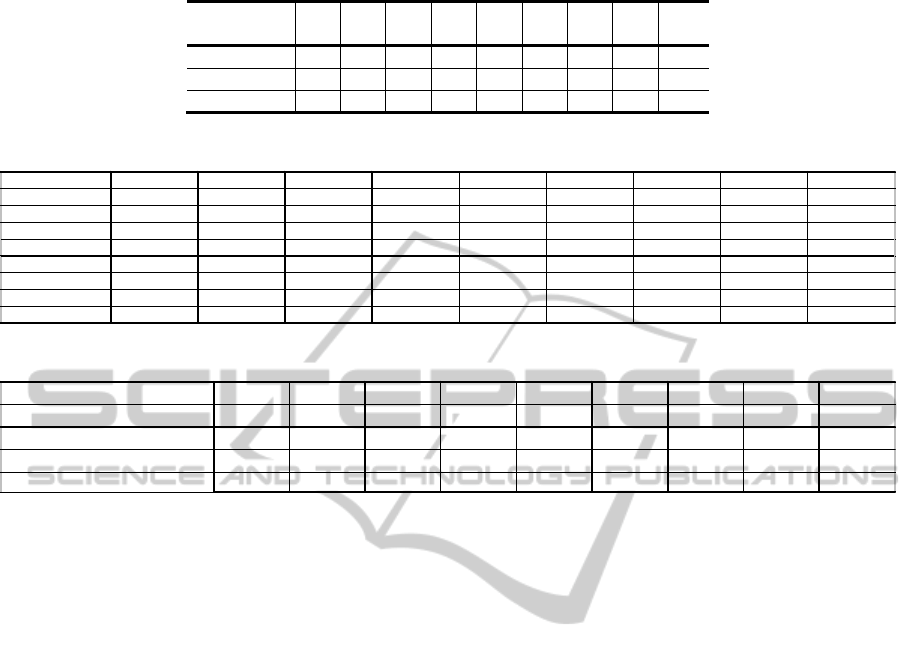

Table 1: Total samples and distribution in each year.

Year

20

07

20

06

20

05

20

04

20

03

20

02

20

01

20

00

Tot

-al

Sample 72 64 46 37 29 20 17 12 297

Main board 56 49 33 26 20 15 15 11 225

GEM 16 15 13 11 9 5 2 1 72

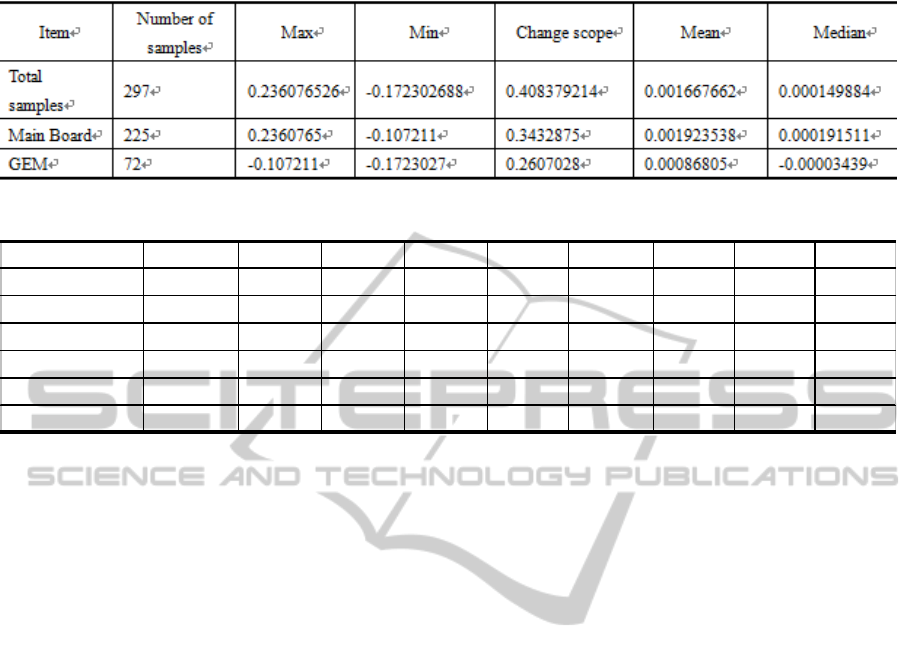

Table 2: The descriptive statistics.

Item

2007 2006 2005 2004 2003 2002 2001 2000

total

Observation

72 64 46 37 29 20 17 12 297

Mean

0.0005885 0.0034292 0.000528 -0.001498 0.0030955 0.0081759 0.0002153 0.0006378 0.0016677

Median

1.956E-05 0.0004584 5.631E-05 0.000006 0.0000981 0.0006605 0.0001805 -4.6E-05 0.0001499

Change scope

0.0522768 0.4083792 0.0406579 0.1560778 0.075269 0.0912034 0.0157066 0.0165996 0.4083792

Min

-0.020521 -0.172303 -0.025152 -0.107211 -0.016456 -0.002803 -0.009739 -0.007817 -0.172303

Max

0.0317557 0.2360765 0.015506 0.0488668 0.058813 0.0884001 0.005968 0.008783 0.2360765

Skewness

1.8238095 1.9762107 -1.004468 -3.720129 3.1522601 3.2461998 -1.02608 0.2011373 -3.720129

Kurtosis

10.528633 25.898063 7.2486914 22.297462 11.018523 10.814744 3.661448 0.2791072 22.297462

Table 3: The statistics by class for each year.

Year

2007 2006 2005 2004 2003 2002 2001 2000 Total

Number of samples

72 64 46 37 29 20 17 12 297

Inefficient Class

35 25 21 18 13 6 7

6

131

Efficient Class

37 39 25 19 16 14 10

6

166

P

ercen

t

age o

f

e

ffi

c

i

en

t

class

51.39 60.94 53.35 51.35 55.17 70 58.82 50 55.89

ownership structure, corporate governance and

business environment. Some of the samples belong to

both A-share and H-share, so the samples have a

strong representative value. The paper ultimately

obtains 297 samples, with the total number of

samples and the distribution in each year are set out

in Table 1.

4.2 The Evaluation based on All

Samples

All samples and the descriptive statistics of cash flow

sensitivity coefficients of sample groups for each

year are set out in Table 2.

It can be seen from Table 2 that the maximum of

cash flow sensitivity coefficient of all samples is

0.236076526, the minimum is -0.172302688 and

change amplitude is 0.408379214, which indicate the

level of differences in the efficiency of the internal

capital market is relatively large; the mean is

0.001667662, the median is 0.000149884, both are

positive. Therefore, the internal capital market of the

samples as a whole is effective. From the descriptive

statistics for each year, except in 2000 and 2004, the

mean and median are positive, indicating in the six

years the samples are able to effectively allocate

resources. A further analysis found that in 2004 the

sample statistical bias degree was -3.72012936,

indicating the efficiency indicators of sample

companies presented serious left side. When

excluding the minimum, the mean is 0.001438145,

and the median is 0.00004489, both being positive;

when excluding the minimum and maximum, the

mean is 8.30393E-05, and the median is 0.000006,

both being positive.

4.3 The Evaluation based on All

Samples Comparison of Main

Board and Growth Enterprise

Market

The comparison of internal capital market efficiency

of Main Board and Growth Enterprise is set out in

table 4.

In Table 4 by comparing the mean and median of

cash flow sensitivity coefficient in Main Board and

GEM, the internal capital market efficiency of Main

Board is higher than the GEM. This is mainly

because the size of listed companies in the Main

Board is large, cash flows are highly complementary

and the internal capital operating mechanism are

relatively advanced and standardized.

4.3 Evaluation of the Continuity of

Internal Capital Market Efficiency

The above statistical analysis in general evaluates the

internal capital market efficiency of Chinese listed

companies, but because the return on capital may

occur at a later time. The cash flow sensitivity

coefficient for a period is negative, this does not

IS INTERNAL CAPITAL MARKET OF CHINA LISTED COMPANIES EFFICIENT? - Empirical Evidences from Listed

Companies which Have Multiple Divisions in H-stock

603

Table 4: Cash flow sensitivity coefficient of Main Board and Grow Enterprise Market.

Table 5: Cash flow sensitivity coefficient of sub-sample.

Item 2007 2006 2005 2004 2003 2002 2001 2000 total

Number of samples 12 12 12 12 12 12 12 12 96

Max 0.021319 0.236077 0.005891 0.008910 0.058813 0.011401 0.005968 0.008783 0.236077

Min -0.002943 -0.001282 -0.001448 -0.107211 -0.001240 -0.002803 -0.009739 -0.007817 -0.107211

Change scope 0.024262 0.237359 0.007339 0.116121 0.060053 0.014204 0.015707 0.016600 0.343288

Mean 0.002467 0.022108 0.001183 -0.007753 0.005943 0.001776 0.000395 0.000638 0.003345

Median 0.000912 0.000651 0.000098 0.000171 0.000234 0.000985 0.000376 -0.000046 0.000349

necessarily point to the inefficient resources

allocation in the current period. Therefore, it is

needed to conduct a continuity research on the

allocation efficiency for each year. Of the 72 sample

companies with 2007 as the base, 12 companies

disclosed segment information throughout 8 years

from 2000 to 2007, and met the requirements for the

calculation of cash flow sensitivity coefficients based

on the return on assets. Therefore, this paper selects

the 12 listed companies as the research object and got

96 sub-samples.

The descriptive statistics of cash flow sensitivity

coefficients of the 96 sub-samples are set out in

Table 5. As seen from Table 5, except that the

median in 2000 is negative (consistent with the

analysis of total sample), the mean and median of the

other years as well as the total sample are positive.

Therefore, either from the sub-sample for each year

or from the sub-sample for the total sample, the

internal capital market is effective.

5 CONCLUSIONS, LIMITATIONS

AND FUTURE RESEARCH

DIRECTIONS

5.1 Conclusions

By analyzing 297 samples from 2000 to 2007 by year

and by the Main Board and the GEM, and evaluating

the sample in accordance with the mean and median

of the cash flow sensitivity coefficient and the

percentage of efficient class, this paper arrives at the

conclusion that the internal capital market of the

sample companies was effective, and the internal

capital market of the Main Board samples was more

efficient than that of the GEM. As the samples have

strong representativeness, this paper concludes that

internal capital markets of Chinese listed companies

and even non-listed companies are efficient, and the

internal capital market efficiency of large enterprises

was higher than that of small businesses.

5.2 The Limitations of this Article and

Future Research Directions

Although H-share listed companies and A-share

listed companies are registered and operate in the

Mainland, and are identical in terms of ownership

structure, corporate governance and business

environment, the conclusions of the study has certain

limitations due to the difference in the regulatory

level between the A-share and H-share market.

Therefore, the research directly on the A shares will

be more meaningful. But this requires improvements

on segment information disclosure in the A-stock

market or a new empirical model designed based on

existing available information, which is exactly the

direction of future research. Moreover, the paper

finds that 44.11% of the sample companies were still

unable to effectively

allocate resources. So why

can some companies allocate resources

efficiently, while others can not? What factors

have led

to differences in the efficiency of resource

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

604

allocation? How to build an effective internal capital

market? These are valuable research topics.

ACKNOWLEDGEMENTS

This article is subsidized by Beijing Education

Commission (SM201010011008 and PHR20100512)

and Beijing Natural Science Foundation (9112005)

.

REFERENCES

Chen Xiaoyue, Chen Xiao, and Gu Bin, 1997. Empirical

research on weak efficiency in the Chinese stock

market. Economic Research Journal , vol.9, pp.13-17.

Gertner, R. H., D. S. Scharfstein and J. C., Stein, 1994.

Internal Versus External Capital Markets. The

Quarterly Journal of Economics, No.109, pp.1211-

1230.

Han Liyan, Cai Hongyan, 2002. Research on the capital

allocation efficiency in China and its relationship with

the financial market. Management World, no.1, pp.65-

70.

Jensen, M., 1986. Agency Costs of Free Cash Flow,

Corporate Finance , and Takeovers. the American

Economics, vol.76, no.2, pp.323-329.

Jensen, M., 1993. The Model Industrial Revolution, Exit,

and the Failure of Internal Control Systems. Journal of

Financial, vol.46, no.2, pp.831-880.

Lu Jiangxin, 2008. Research on allocation efficiency of

internal capital market. Peking University Press.

Maksimovic, V., G. Phillips, 2002. Do Conglomerate

Firms Allocate Resources Inefficiently across

Industries? Theory and Evidence. Journal of Finance,

Vol.56, No.2, pp.721-768.

Myers, S. C., and N. C. Majlufm, 1984. Corporate

Financing and Investment Decision when Firms Have

Information that Investors Do Not Have. Journal of

Financial Economics,no.13, pp.187-222.

Peyer, U. C. and A. Shivdasani, 2001. Leverage and

internal capital markets: Evidence from leveraged

recapitalizations. Journal of Financial Economics,

Vol.59, No. 2: pp.477-515.

Schoar, A., 2002. Effects of Corporate Diversification on

Productivity. Journal of Finance, Vol.57, No.6,

pp.2379-2403.

Rajan, R., S. Henri, and L. Zingales, 2000. The Cost of

Diversity: The Diversification Discount and Inefficient

Investment. Journal of Finance, Vol.52, No.1, pp.35-

80.

Shao Jun, Liu Zhiyuan, 2007. Is the internal capital market

within an enterprise family efficient? – case study

based on the Hongyi Family. Management World ,

No.6,pp.114-121.

Shin and Stulz, 1998. Are Internal Capital Market

Efficient?. Quarterly Journal of Economics, Vol. 113,

No.2 (May), pp.531-552.

Stein, J. C., 1997. Internal Capital Markets and the

Competition for Corporate Resources. The Journal of

Finance, vol.52, pp.111-133.

Stulz, R., 1990. Managerial Discretion and Optimal

Financing Policies. Journal of Financial Economics,

Vol.26, No.1, pp.3-27.

Wang Fengjuan, 2009. Research on Internal Capital

Market efficiency: A Study Based on H-stock.

Economic sciences press

Wang Fengjuan, Xie Zhihua, 2010. The Modification and

Verification of Empirical Model to Measure Internal

Capital Market Efficiency. Accounting Research, no.8,

108-124.

Wang Fengjuan, and Zou Cunliang, 2009. Degree of

diversification and efficiency of internal capital market

– study of cases based on division data. Management

World , no.4,pp.153-161.

Williamson, O liver E., 1975. Markets and Hierarchies

:

Analysis and Antitrust Implication. New York:Free

Press.

Wu Shinong, 1996. Analysis of the efficiency in the

Chinese securities market. Economic Research

Journal, no.4, pp.13-19.

Xu Qiting, 2008. Research on efficiency of internal capital

market – empirical study based on privately-owned

listed companies in China. Economic Science Press.

Yu Qiao 1994. Efficient Market, Abnormal Circle and

Volatile Stock Price. Economic Research Journal,

no.9, pp.43-50.

Zeng Yamin, and Zhang Junsheng, 2004. Ownership

structure and output efficiency: empirical study on

Chinese enterprise. Finance and Economics Reseach,

no.7, pp.89-96.

Zhang Bing, and Li Xiaoming, 2003. Study on gradual

efficiency in the Chinese stock market. Economic

Research Journal , no.1, pp.54-61.

IS INTERNAL CAPITAL MARKET OF CHINA LISTED COMPANIES EFFICIENT? - Empirical Evidences from Listed

Companies which Have Multiple Divisions in H-stock

605