WHICH IS BETTER INNOVATIVE INVESTMENT

An Empirical Analysis of Statistics from Chinese Industrial Undertakings

Zongyuan Huang

1,2

1

School of Economics and Management, Beijing Jiaotong University, Beijing 100004, China

2

School of Economics and Management, Guangxi Normal University, Guilin 541004, China

Keywords: Technical innovation, The relations of innovation capital and characteristics of technology and economy,

The best form of innovation capital.

Abstract: The analysis of this paper proves that, due to the differences in terms of characteristics of technology and

economy between the developing countries or less-developed regions and the developed countries, and the

industrial structure in these regions is located in the non-frontier, so the effects of various innovative

investment modes in technological innovation differ from that in the developed countries. The significant

relation, i.e. the effects of current venture investment in US is three times of the R&D investment effects,

turns out to be the fact that the R&D investment produces four times effects than the venture investment

effects in China. Therefore, as to current industry system of China, venture investment is definitely not the

best innovative financing method, while the R&D investment may be much better.

1 INTRODUCTION

Technology innovation is the major source of

technology advancement, which plays significant

guiding and supporting role in the formation of

national competitiveness in the long run. Among the

various factors affecting the efficiency of technology

innovation, innovation investment occupies a crucial

position. A popular notion holds theoretically that

among various innovation investment forms, the

stimulus from venture investment to technology

innovation is much profounder than that of other

investment forms. For example, the research results

of the scholars, Tykvova (2000), Ueda and

Hirukawa (2003), which explores in the angle of

resources supplementation, show that venture

investment can adapted better to the characteristics

and demands of technology innovation, while

traditional financing modes can not be the major

sources of corporation’s technology innovation

investment. Gebhardt’s study aiming at the angle of

curbing budget found that, as to the financing of

innovative projects, venture investment is much

more effective than traditional financing methods

and is able to promote technology innovation better.

(Gebhardt, 2000; 2006), Keuschning applied general

equilibrium in his study and found that the services

including capital and management provided by

venture investment can effectively raise the success

probability of running business, and guarantee the

smooth advancement of technology innovation

under the conditions of general equilibrium.

(Keuschning, 2004), Lv Wei proposed that venture

investment mechanism is a breakthrough of original

technology innovation, causing the lifting of

corporate ability of technology innovation, and as a

result can accelerate greatly technology innovation

(Lv Wei, 2002).

Empirical statistics from some developed

countries like USA and EU give strong support to

the above statements. For example, Kortum and

Lerner carried out empirical analysis on the

relationship between venture investment and

technology innovation according to the statistics

from the USA. The result indicates that the stimulus

of venture investment is approximately three times

of that of R&D. (Kortum, Lerner, 2000) Engel and

Keilbach conducted their study taking German

statistics as samples and they studied the effects of

venture investment on small and medium sized high-

tech businesses, and the result illustrates that the

total number of patents from the businesses with

venture investment is much more than from those

without (Engel, Keilbach, 2007).

Due to the modeling effects of the developed

countries, the above notions and experiences are opt

to become the policy models of industrial

617

Huang Z..

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial Undertakings.

DOI: 10.5220/0003614806170628

In Proceedings of the 13th International Conference on Enterprise Information Systems (PMSS-2011), pages 617-628

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

technology innovation in the developing countries

and less-developed regions, and produce significant

effects. However, indiscriminate acceptance of these

notions may contain potential dangers: the decision

makers might ignore the real situation of that nation

and region, and over-react to these new innovative

investment modes like venture investment and

reduce their attention to tradition innovation

investment and relative administration, which results

in damages to technology innovation practices in

that nation and region. Until now, some crucial

problems haven’t gained adequate attention and

research: for the developing countries and less-

developed regions whose technology and economy

are relatively lagging behind, is venture investment

the best innovation investment mode in their

technology innovation? In the technology

innovation movement in the developing countries

and less-developed regions, if there exists a relation

that the stimulus of venture investment to patent

innovation is larger or times of the effects of R&D

①

?

2 THE THEORETICAL

EXPLANATION MODEL OF

THE FUNCTIONAL

PRINCIPLES OF INNOVATIVE

INVESTMENT IN

TECHNOLOGY INNOVATION

2.1 Theoretical Model

In order to answer these questions, first we need to

establish a model about how innovative investment

functions in technology innovation practice, and

clearly elaborate the functional mechanism and

movement principles of innovative investment in

technology innovation practices theoretically.

According to the Theory of Six Forces of Essential

Factors of Production of academician Xu ShouBo,

any economy and production are executed on the

basis of six fundamental production factors, namely

labor force, financial force, physical force, natural

force, transport force and time force (Xu Shoubo,

2006). As an important technology production

activity of human society, technology innovation

cannot be isolated from the six Essential production

factors. Innovative investment is one of these

important factors-financial force and R&D

investment and venture investment are two

significant modes of innovative investment.

Therefore, the explanation model of how innovative

investment functions in technology innovation

practice actually is an innovative model proposed by

the writer on the basis of six production factors

principle

②

.

It can be learned from the innovative model

based on the Theory of Six Forces of Essential

Factors of Production, technology innovation system

is a complex adaptive system, whose subject is an

adjuster that take the initiative in trying to adapt well

to circumstances, possessing limited rationale and

opportunism. The innovation result is the outcome

of the mutual function of the system subject under

the certain system structure and circumstances, and

then the rules of the system are very significant.

Thus, as an important fundamental production factor,

in what way does the innovation investment

participate in technology innovation? How does it

adjust to and influence the other factors? And what

about the function mechanism of various innovation

investments like venture investment and R&D

investment?

The writer holds that there are several basic

points to be grasped. Firstly, in the innovation

activities, the action and decision system of various

subjects is a “Target-oriented Self-adjusting

process”, whose target is to realize the maximum of

its own benefits and the minimum of comprehensive

cost (including cost of transaction and management).

Secondly, the subjects of various factors have both

limited rationale and the features of opportunism, so

their action principles are continuously repeated and

evolved towards the adjustment to the external

environment and reaction to the feedback cha ains,

integrating the features of nonlinearity, complexity

and dynamic evolvement. Therefore, in terms of

decision making methods, the subjects of various

factors all abide by “convention”, and their response

principles are adjusted dynamically on that basis,

and this is a conventional study process and

accumulation process of technology experience

(Nelson and Wentt, 1982).

If satisfactory returns could be achieved when

the subjects of these factors function conventionally,

the conventions will be continued and strengthened;

Otherwise, if abnormity occurs when the factors

function conventionally and the return is lower than

a certain level, the subjects of the factors will need

to adjust the convention, namely seeking a new

convention suitable for itself among the existing

technology and conventions, or by innovation

discovering a new emerging convention which had

never been found before. Then what are the

dimensions consisting of the conventions? The

writer holds that essentially the convention is a kind

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

618

of technology program when the subject faces and

settles problems, so its dimensions are

characteristics of technology and economy.

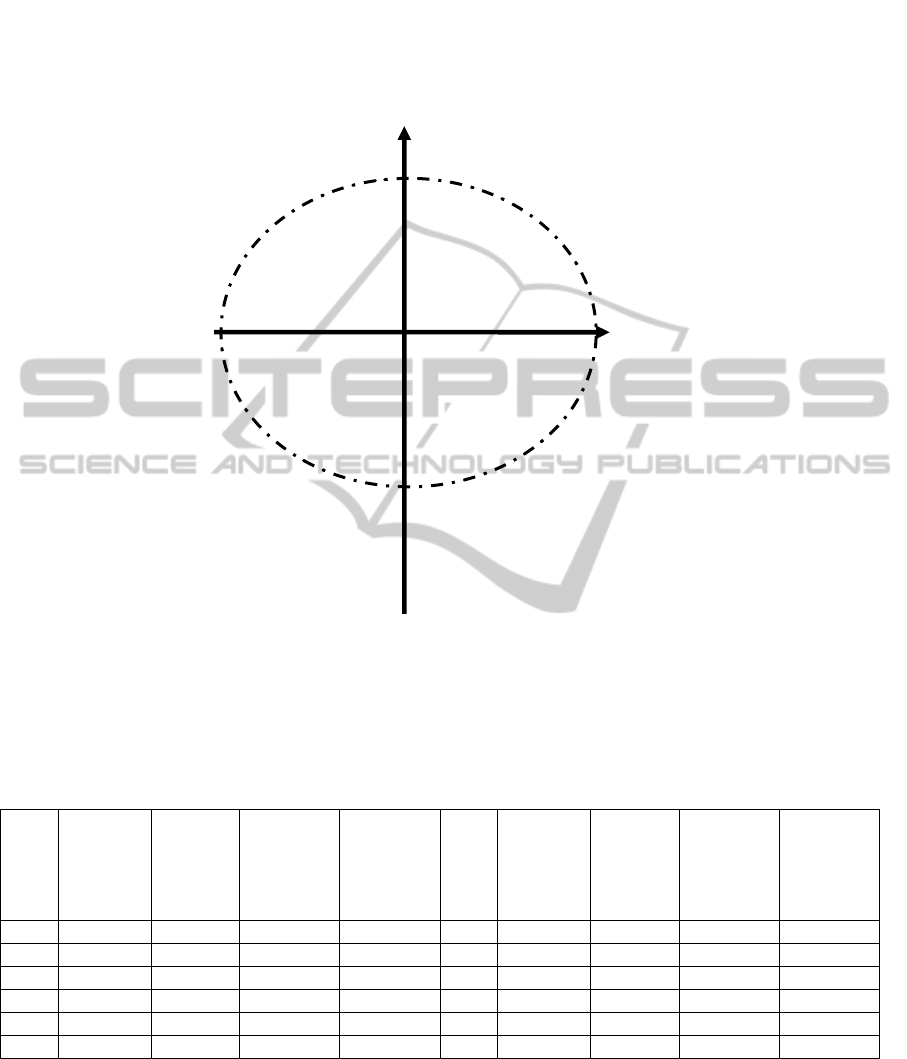

Based on the above analysis, the writer proposed

a coupling relationship model integrating the

innovation investment and technology

characteristics (with tokens to display technology

complexity), and the economy characteristics. As

illustrated by Graph 1, this model actually is evolved

from the K Model by Mr. Herbert (Kitschelt·Herbert,

1991)

③

. According to this model, the coupling

relationship cross-functioned by various innovation

investment and technology characteristics and the

economy characteristics could be summed up as

follows:

(1) In those industries with more mature technology

and fierce market competition such as textile

industry, light industry, machinery industry etc.,

because the market structures are closer to perfect

competition market, so the technology innovation

have its uniqueness in the following three aspects:

first, the demand of technology innovation is strong

and diversified; second, the assets specificity is low

during the process of innovation, and the results of

innovation can hardly lead to considerable

monopoly profits; third, the technology of the

industries are relatively mature, less complex, and

the uncertainty of innovation is relatively low. The

compare analysis of the returns of innovation

subjects and the comprehensive cost indicates that

R&D investment by the corporations in this industry

and private innovation investment might produce

relatively high profits and low comprehensive cost,

while venture investment and national R&D

investment may lead to the problems of low profits

and high comprehensive cost. Therefore, corporate

R&D investment and private innovation investment

are more suitable for this kind of industry, as

illustrated by Graph 1 Section 1.

(2) In those industries whose technologies are

relatively mature and whose market structures tend

to be monopolized, such as fundamental chemistry,

steel and railway transportation, there are limited

corporations to be chosen from to expand innovation

results. The innovation results turn up in the manner

of Know-How and the asset specificity and cost of

innovation are both very high, so the corporate

center laboratory is more suitable, as illustrated by

SectionⅡ of Graph 1.

(3) In those industries whose technologies are highly

complex, market structures tend to be monopoly, the

innovation demands are concentrated and the asset

specificity of innovation are very high, such as

nuclear technology, aviation industry, huge aircrafts

manufacture and telecommunication, there are

considerable risk during the innovation process and

it requires the national and corporate R&D

investment, as illustrated by Section Ⅲ of Graph 1.

(4) In those industries whose technologies are highly

complex but whose market positions are still in the

infant phase, whose market structures tend to be

competitive, and at many times the dominant

industry design and stand haven’t come into shape,

such as IT, software, artificial intelligence, genetic

engineering and pharmaceuticals etc., the technology

innovation corporations are mostly newly start-ups

which demand a large sum of investment in

technology R&D and market development,

possessing high uncertainty and risk of innovation.

However, once the innovation succeeds, a vast

market prospect and great returns will be enjoyed.

Judging from the experience of developed countries,

prior to the technology innovation in this kind of

industry, national R&D investment are needed, and

in the commercialized innovation phase, the venture

capital will be very influential, as illustrated by

Section Ⅳ Graph 1.

(5) In those industries, which are moderate complex

and face moderate market competition, such as

electronic equipment, household appliance,

sophisticated chemistry, machinery and automobile

manufacture, there is less demand of technology

innovation, and relatively high asset specificity may

be formed during the process of innovation.

Meanwhile, the technology in this kind of industry

may change drastically, requiring considerable input,

imposing serious demand on market scale and

producing high risk of innovation, therefore, they are

more suitable for the innovative investment forms

like R&D activities in the center laboratory of large

corporations and innovation alliance, as illustrated

by Section Ⅴ of Graph 1.

2.2 Theoretical Explanation of

Technology Innovation Activities in

the Developing Countries and the

Less-developed Regions

Analysing the technology innovation activities in the

developing countries and less-developed regions

applying the above mentioned model, the writer

came to an important conclusion: since the industry

structure and characteristics of technology and

economy in the developing countries and less-

developed regions are different from that of the

developed countries, therefore, as to the technology

innovation in the developing countries and the less-

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial

Undertakings

619

developed regions, venture investment is not the best

innovation investment method. The relation, namely

the venture investment has much larger or times of

stimulating influence on patent innovation than the

effects of R&D, stands no ground.

First, according to the model, if two industries

differ in characteristics of technology and economy,

the innovation investment forms that they fit for will

differ accordingly. For example, as to the rising

industries with vast prospects, who have

sophisticated technology and great uncertainty, and

who face fierce competitive market without mature

standard, such as IT, artificial intelligence, genetic

pharmaceuticals, venture capital is an optimum

innovation investment. However, as to the industries

with relatively mature technology and serious

competition such as textile and light industry, due to

mature technology standards , specified market, and

high level of marketization, the suitable innovation

investment mode are corporate R&D input or private

investment. The reason is that in this kind of

industry, the growth margin is limited. If the venture

investment enters this kind of industry, the rate of

return will be very low. At the same time, since the

cost of transaction and management is very high, the

community income of society doesn’t accord with

personal income, and the rate of return of national

R&D investment will be low too. As a result, for this

kind of industry, these two kinds of innovation

investment modes may not be suitable.

Then, for the developing countries and less-

developed regions, what are the essential differences

in terms of characteristics of industrial technology

and economy between them and the developed

countries? The writer maintains that the most

distinctive difference between them lies in that the

developed countries are in the leading edge of

industrial technology and economy, while the

developing countries and less-developed regions are

mostly in the following edge. Just as Mr. Lin Yifu

point out, because the developed counties occupy

the leading positions in global industrial chain, in

most of the cases enterprises have different views on

the problem that which industry will come as next

new and promising industry in the national

economy, so they form no social consensus. Among

various investment options, projects of few

enterprises succeed, while projects from most

enterprises would fail. The continual economic

development relies on the choice of market. Later

reality proves that the investment projects of a

number of successful enterprises will promote next

round of emerging of new industry, and drive the

development of entire national economy. However,

the industries of developing countries position low

in the global chain of industry, the economic

development of developing countries positions

inside the global industrial chain, go through a

process of upgrading along the track of the current

industry with varied capital and technology

intensity. The industrial upgrading during economic

developing, the enterprises invest in the technology-

mature, product-existing-market industries inside the

global industrial chain. Which industry is new and

which is promising? The enterprises inside the

economy are opting to see eye to eye with one

another, and swarm into it one by one and form

“emergence”. (Lin Yifu, 2007) This difference

between the developing countries and the less-

developed regions decides their essential differences

in technology innovation: the technology innovation

activities in the developed countries position mainly

in the industries in Section Ⅲ , Ⅳ , and Ⅴ of the

model; while the technology innovation activities in

the developing countries and less-developed regions

position mainly in the industries in the Section Ⅰ,

Ⅱ, and Ⅲ of the model. That is to say, in the

developing countries and less-developed regions, in

terms of industrial structure, the industries with

relative mature technology and high level of market

competition dominate. This judgment could be

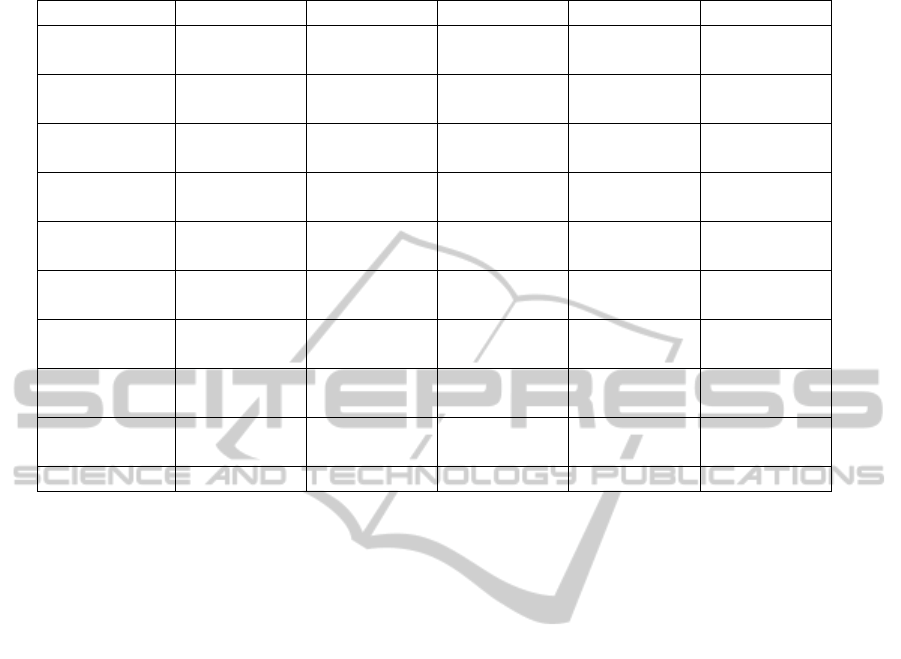

proved by the proportion and changes of added

value of Chinese high-tech industry in GDP since

1996. The statistics in Table 1 indicate that the

proportion of added value of high-tech industry of

China in GDP will rise from 1.81% in1996 to 4.48%

of 2007, presenting an entire rising trend. Although

it indicates a great advancement of high-tech

industry of China over more than ten years, it, at the

same time, also presents an important fact that the

scale of the high-tech industry of China is still very

small, and other traditional industries apart from

high-tech industry still dominate the industrial

structure of China.

Different sections maintain different

characteristics of industrial technology and

economy, so the suitable innovation investment

mode should be different too. In terms of the

characteristics of technology and economy, high-

tech industry positions in the section Ⅳ of the

model, and the suitable innovation investment mode

in the rising phase is national public R&D input, and

in the following phase is venture investment.

However, the industrial system of the developing

countries and less-developed regions is still

dominated by the industries in Section Ⅰ, Ⅱ, and

Ⅲ, so the innovation investment mode should be

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

620

only and mainly the R&D investment from all

aspects (including the nation, corporation and

enterprises). In other words, for the developing

countries like China, the optimal innovation

investment modes haven’t advanced to the phase of

venture investment, therefore in the technology

innovation, the relation that venture investment

produces much larger or times of stimulating effects

than the effects of R&D holds no ground either.

3 EMPIRICAL ANALYSIS

TAKING THE STATISTICS OF

INDUSTRIES OF CHINA AS

SAMPLE

In the following part, the paper will proceed to

empirical analysis of the technology innovation

statistics in industries of provinces, cities and

autonomous regions in China, in order to test

whether the above mentioned theoretical analysis

result accord with the reality or not. As a developing

country, technology innovation is an important

strategy for both of the central government and the

provinces, metropolis and autonomous regions. In

fact, over the past three decades, the provinces,

metropolis and autonomous regions all have devoted

to upgrading their innovative ability, and

accumulated a great many statistics and rich

experience. The test taking these statistics as sample

eventually is trustable.

3.1 Model Testing and Sample

Description

3.1.1 Variable Selection

In order to make up the defects of the Time-series

date, this paper chooses the Cross-sectional data of

China between 2006 and 2008 and the Panel data to

analyse this problem empirically. According to the

nature and features of the problem to be tested, the

following variables are chosen:

(1) Patent: This paper chooses the number of patent

achieved as an index to measure corporate

technology innovation. There has been a lasting

dispute over the selection of technology innovation

index. Previously, usually the indexes chosen

included innovative intermediary products (such as

patents), total factor productivity (TFP), and the

terminal output of innovation (such as the number of

innovation) etc. Since the obtaining patent is the

major foundation of technology innovation result,

and the statistics about patents have strong

obtainability, this paper selects patent variables as

the measurement index of technology innovation.

The number of patent can be divided into two types:

the number of patent applied and the number of

patents authorized. This paper selects both of them

as explaining variables to research the effects of

technology innovation input and output.

(2) Venture investment: Researchers usually choose

the total number of annual venture investment

project to be the index to measure venture

investment, and some may adopt the total volume of

venture investment and the number of venture

investor instead. The total number of annual venture

investment project refers to the total number of real

investment project of venture investment institution

in that year. The annual volume of venture

investment refers to the volume of real investment of

venture investment institution in that year, indicating

the real expenditure of one country in venture

investment, so it has primly direct impact on

technology innovation. This paper chooses the total

number of annual venture investment project and the

total volume of venture investment as measuring

indexes, and select provincial statistics that are

studied by the China Growth Enterprise Market

Research Report published by China Venture.

(3) R&D investment: As the index of innovation

input, R&D sheds obvious influence on innovation

output, and is the principal explaining variable of

patented output. This paper chooses respectively the

R&D input of the whole society and the R&D of

large and medium sized enterprises as the explaining

variables, and studies their influences on technology

innovation output.

3.1.2 Sample Description

The statistics of patents in this paper are adapted

from China Statistical Yearbook of 2005-2009;

R&D statistics are from China Statistics Yearbook

of Science and Technology of 2005-2009; Statistics

of venture investment are from the Research Report

of China Growth Enterprise Market published

between 2007 and 2009. Although related statistics

of venture investment in provinces Henan, Gansu,

Ningxia, Qinghai and Tibet are not included, the

statistics of 25 provinces that are chosen have

covered the major part of China, so the statistics are

representative.

This paper selects two samples: one is the Cross-

sectional data sample, including the statistics of

various variables of 25 provinces, metropolis and

autonomous regions in 2005; another is the Panel

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial

Undertakings

621

data sample, including the statistics of the year 2006,

2007, and 2008.

3.1.3 Model Testing

Based on the model mentioned above and its

features of testing problem, this paper sets the model

of analysis as follows:

log( ) log( ) log( )PRDVC

(1)

In this formula, P, RD, VC stands respectively for

the number of patents applied, number of patents

authorized, R&D input and venture investment,

while

stands for the random error.

3.2 Regressive Analysis of the

Cross-sectional Data

The OLS estimation result of the statistics of the

selected Cross-sectional data samples of the 25

provinces, metropolis and autonomous regions of

China in 2005 can be referred to Table 3 and Table

4. The result indicates that: when the venture

investment volume(VC1) and the R&D investment

from large and medium-sized enterprises (RD2)

serve as explaining variables, if the venture

investment volume increases by 1%, the number of

patent applied will increase approximately by 0.17%

(Model 1), and the number of patent authorized

increase by 0.16% (Model 6). This result proves that

venture investment imposes obvious positive effects

on patent output, complying with the conclusion of

Kortum and Lerner (2000) and Tykvova (2000)

essentially.

However, the result of Table 3 and Table 4 also

indicate that : when R&D investment from large

and medium-sized enterprises increases by 1%, the

number of patent applied will increase

approximately by 0.72% (Model 1), and the number

of patent authorized can increase by 0.69% (Model

6). Therefore, R&D investment is much larger than

the effects that venture investment produces on the

output of patent, almost 4.31 times of the stimulating

effects that venture investment produces on the

patent innovation. Obviously, this result is different

from the Kortum and Lerner’s (2000) conclusion

which was drawn on the samples of American

statistics. Because according to their conclusion, the

stimulating effects that American venture investment

produces on the patent innovation are three times of

the R&D investment. It can be seen that in the

technology innovation of China, the effect that R&D

input and venture investment produce in the patent

output is obviously different from that of America.

If the number of venture investment project (VC2),

and R&D input of large and medium-sized

enterprises (RD2) are taken as explaining variables,

we can see that : when the number of venture

project increases by 1%, the number of patent

applied will increase by 0.30% approximately

(Model 3), and the number of patent authorized will

increase by 0.26% (Model 8).

Moreover, if the lag terms in 1-2 period of VC

and RD are inserted into the model, (see Model 4, 5,

9, 10). It can be seen that: The insertion of lag terms

can improve the explanation ability of the model, but

the statistical coefficients of the lag terms are not

obvious and the model is not convincing. It proves

that the expenditure of VC and RD largely coincide

with the patent output, which accord with basically

the conclusion of Hall, Griliches and Hausman

(1986).

3.3 Regressive Analysis of Mixed

Cross-sectional Data

3.3.1 Chow Testing of Mixed Cross-sectional

data

Before the regressive analysis of mixed cross

section, it is necessary to research whether there are

distinctive structural changes between regressive

coefficients of each year; therefore we need to carry

out Stability Tests on the Model. This paper, by the

approaches of Chow Tests, divides 59 observed

values into three sub-samples of 2008, 2007, and

2006 in a view of testing them. The result is

illustrated by Table 5.

Seen from the result of Chow Tests, there is no

distinctive differences between the three sectional

samples, namely there is no any obvious structural

changes between 2006 ,2007and 2008, therefore, it

is feasible to conduct regressive analysis on the

cross sections by mixing up the statistics of the three

years.

3.3.2 The Result of Regressive Analysis of

Mixed Cross-sectional Data

The result of OLS estimation on the Mixed Cross-

sectional data sample statistics from the year 2006 to

2008 is displayed in table 6 and table 7. The result

indicates that venture investment has obvious

positive effects on the patent output; when venture

investment volume increases by 1%, the number of

patent applied will increase by about 0.17% (Model

1), and the number of patent authorized will increase

by 0.16% (Model 6); when R&D input from large

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

622

and medium-sized enterprises increases by 1%, the

number of patent applied will increase by about

0.75% (Model 1), and the number of patent

authorized will increase by 0.72% (Model 6).

Herein, the effects that venture investment

volume produces on patent output is far less than the

effects R&D investment produces on patent, which

is basically in line with the result of regression of

Cross-section.

The result with the number of venture investment

project (VC2), and the R&D investment from large

and medium-sized enterprises (RD2)as explaining

variables also indicates that :when the number of

venture investment project increases by 1%, the

number of patent applied will increase by about

0.30% (Model 3), and the number of patent

authorized will increase by 0.27% (Model 8), which

accords highly with the regression result of Cross-

section.

Moreover, the result of inserting the lag terms of

1-2 period into VC and RD (see Model 4, 5, 9, 10)

also indicates that: although the insertion of the lag

terms can improve the explaining ability of the

model, the statistical coefficients of the lag terms are

not obvious, which proves that the influences

produced by venture investment and R&D

expenditure coincident on the output of technology

innovation, and there is not obvious hysteresis

quality, which is completely in line with the

regression result of the Cross-section analysis.

4 CONCLUSIONS

In the developed countries, the effects made by

venture investment on the technology innovation

output are generally superior to R&D investment. In

the USA, it exists that the effects made by venture

investment on the output of technology innovation is

three times of that made by R&D investment.

Therefore, in terms of raising the efficiency of

technology innovation, venture investment is surely

a better innovation investment mode. However, this

paper proves theoretically that: because the industry

structure of the developing countries and less-

developed regions, as a whole, is not in the leading

edge of the world in technology and economy, and

their industries characteristics of technology and

economy are different from the developer countries,

so as a result, in the developing countries, the

influences produced by the innovation investment in

various forms are different from that of the

developed countries, so that significant relation, i.e.

in the technology innovation the effect caused by

venture investment should be times of that caused by

R&D investment, holds no ground. The empirical

analysis with statistical samples of Chinese

industrial enterprises advocates this important

conclusion: in China, though venture investment

produces obvious positive effects on the patent

output, for example, when the venture investment

volume increases by 1%, the number of patent

applied will increase by 0.17%, and the number of

patent authorized will increase by 0.16%. However,

the relation, namely the effects produced by venture

investment on the technology innovation should be

three times of that produced by R&D investment, is

not true in the technology innovation of Chinese

industrial enterprises. Instead, it occurs that the

R&D investment produces effects on technology

innovation, which is several times of that produced

by venture investment. The fact fully elaborates that

currently in the industrial technology innovation of

China; venture investment is not the best innovation

financing method. On the contrary, R&D investment

may be more suitable.

This conclusion could offer plenty helpful

enlightenment to the developing countries and the

less-developed regions in terms of the policies about

technology innovation and decision-making. First,

the policies about technology innovation should be

rooted in the actual situation of current industrial

system of that country or region. The experiences

and conclusions of the developed countries should

not be copied blindly. For example, in the traditional

industries, if the venture investment is unilaterally

stressed and the functions of R&D investment are

ignored, the policies about technology innovation

may take a wrong road and produce harmful

influences on technology innovation. Second, since

the R&D investment has not a single form, instead it

has various forms and levels, at the present stage the

effects of technology innovation made by R&D

investment in different forms at different levels

should be stressed, be studied profoundly about its

principles and be innovated continuously. For

example, the systematization, modularization and

integration innovation mode has come into the

automobile industry; it requires us to conduct

researches on the new modes of these innovation

institutions, as well as the developing trends and the

suitable R&D investment. Demanding more

attention, the research of this paper also proves that

the industry system of China is still relatively

backward, lagging greatly behind the developed

countries, and being kept away from the phase

where the new innovation investments like venture

investment are utilized efficiently. In fact, the

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial

Undertakings

623

practices of the developed countries have proved

that venture investment can produce tremendous

prompting effects on the development of new

industries. Therefore, how to realize the adjustment

and upgrading of industrial structure system of

China and get it used to the new trend of industry

development globally as soon as possible, are still

significant problems requiring further studies.

-------------------------------------------------------------

①The answer to this question is very crucial. If the answer is

negative, there should be a necessity of reflection on certain

policies and actions in terms of technology innovation. In fact,

this question has alerted some researchers. For example, Kortum

and Lerner pointed out that what they used in their researches was

the statistics of the USA, and the empirical analysis they

conducted was about the situation of the USA, so they didn’t

answer the question that whether venture investments in other

countries could promote technology innovation or not.

②Referring to Huang Zongyuan. Systematic Analysis Principle

of Industry Development in Less-developed Regions [M].Beijing:

Economic Science Press,2008,P 201-202.

③This model is evolved on the basis of H Model proposed by the

writer previously, and the H Model is rooted in the K Model of

Mr. Kitschelt, referring to Huang Zongyuan. Systematic Analysis

Principle of Industry Development in Less-developed Regions

[M].Beijing: Economic Science Press,2008, P215.

REFERENCES

Cheng Siwei. Collections of Theses on Venture

Investment of Science [M]. Beijing: Democracy

Construction Press, 1997

Dirk Engel and Max Keilbach. Firm-level implications of

early stage venture capital investment-An empirical

investigation [J]. Journal of Empirical Finance, 2007,

(14):150-167.

Gebhardt, G., 2000, Innovations and Venture Capital [J].

Working Paper, University of Munich.

Gebhardt, G., 2006, A Soft Budget Constraint Explanation

for the Venture Capital Cycle [J]. Working Paper,

University of Munich.

Hall, B. H, Z. Griliches and J. A. Hausman. Patents and

R&D: Is There a Lag [J], International Economic

Review, 1986, No 27, pp.265-283

Huang Zongyuan. Systematic Analysis Principle of

Industry Development in Less-developed Regions [M].

Beijing: Economic Science Press, 2008.

Keuschnigg, Christian, 2004, Venture Capital Backed

Growth [J], Journal of Economic Growth, 9(2), pp239-

261.

Kortum and Lerner.Assessing the Contribution of Venture

Capital to Innovation [J]. Rand Journal of Economics,

2000, 31(4):674-92.

Kitschelt·Herbert,Industrial Governance Structure

Innovation Strategies and the Case of Japan: Sectoral

or Cross-National Comparative Analysis?,

International Organizations, Autumn, 1991, pp.453-

493

Lv Wei. On Technological Innovation Principle of

Venture Investment Mechanism [J]. Economic

Research Journal, 2002, (2).

Lin Yifu. Wave Phenomenon and the Reconstruction of

Macro-economic Theories for Developing

Countries[J]. Economic Research Journal, 2007(1).

Li Yongzhou. Studies on Venture Investment in High-tech

Industry [M]. Beijing: Economic Science Press, 2006.

Richard R. Nelson, Sidney·G.·Wentt: Brief Introduction to

An Evolution Theory of Economic Change[M]

(Chinese version ), Beijing: Commercial Press, 1997.

Tykvova T., 2000, Venture Capital in Germany and its

impact on innovation[J], Social Science Research

Network Working Paper, presented at the 2000, (3)

Conference, Athens.

Xu Shoubo. Theory of Six Forces on Factors of

Production [J]. Journal of Beijing Jiaotong University

(Social Sciences Edition, 2006(3).

Zhang Jing’an. Technology Innovation and Venture

Investment [M]. Beijing: China Finance Press. 2000.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

624

APPENDIX

Figure 1: Coupling relationship model of the innovation investment and characteristics of technology and economy.

Table 1: The Proportion of Two Industries in GDP of China Since 1996.

Year

High-tech

industry

Added

Value

(billion)

Gross

national

GDP

(billion)

High-tech

Industry

proportion

(%)

Other

industries

proportion

(%)

Year

High-tech

industry

Added

value

(billion)

Gross

national

GDP

(billion)

High-tech

industry

proportion

(%)

Other

industries

proportion

(%)

1996 1271.95 70142.49 1.81 98.19 2002 3768.58 119095.69 3.16 96.84

1997 1539.96 78060.83 1.97 98.03 2003 5034.02 135173.98 3.72 96.28

1998 1785.33 83024.28 2.15 97.85 2004 6341.30 159586.75 3.97 96.03

1999 2107.12 88479.15 2.38 97.62 2005 8127.79 184088.60 4.42 95.58

2000 2758.75 98000.45 2.82 97.18 2006 10055.51 213131.70 4.72 95.28

2001 3094.81 108068.22 2.86 97.14 2007 11620.66 259258.90 4.48 95.52

sources: Adapted from China Statistical Yearbook and China High-tech Industry Statistical Yearbook between the year 1997 and 2008,

published by China State Statistics Bureau.

Technology features

·Low complexity

·More mature

·Low uncertainty

section Ⅴ

Electronic equipment household

appliances

Chemical industry petrochemical

industry

Machine manufacture automobile

industry suitable innovation

investment mode:

Innovation alliance

Section Ⅳ

IT industry, software industry,

artificial intelligence, genetic

engineering and pharmaceutical

industry etc.

features: complex technology ,

fierce competition

suitable innovation investment

mode: Venture investment,

innovation club, national R&D

Section II: Fundamental chemical

industry, steel and railway

transportation etc.

features: Less complex technology,

highly monopoly,

suitable innovation investment mode:

R&D in corporate center laboratory

Section III

Nuclear technology, aviation

industry, huge aircrafts

technology and telecommu-

nication, etc.

features: Complex technology,

irreplaceable

suitable innovation investment:

National R&D and corporate

R&D

Technology features

·High uncertainty

·High immature

·High complexity

Economy feature

High monopoly

Economy feature

High competition

Section I: Traditional industries

as textile, light industry, and

machinery industry etc.

features: Simple technology,

lower irreplaceable

suitable innovation investment

mode: Adjust to innovation

investment, private investment,

and corporate R&D

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial

Undertakings

625

Table 2: Definition and Elaboration of Variables.

Name of variable Elaboration of Variable Index Unit

P1

Variables explained: the number of patents applied

a

P2

Variables explained:the number of patents authorized

a

VC1

Variables explaining:volume of venture investment

Million USD

VC2

Variables explaining:the number of venture investment project

a

RD1

Variables explaining:R&D expenditure of the whole society

Billion RMB

RD2 Variables explaining: R&D expenditure of large and medium-sized enterprises Billion RMB

Table 3: The Regressive Result of Cross-sectional data – Taking P1 as the Induced Variable.

Model 1 Model 2 Model 3

M

odel 4 Model 5

Constant 6.030521***

(0.0000)

5.083878***

(0.0000)

6.262084***

(0.0000)

5.493210***

(0.0000)

5.642896***

(0.0000)

log(RD1) 0.899826***

(0.0000)

log(RD2) 0.716225***

(0.0000)

0.684397***

(0.0000)

0.716391***

(0.0000)

0.712027***

(0.0000)

log(VC1) 0.174657**

(0.0036)

0.069933

(0.2155)

0.171766*

(0.0074)

0.188194**

(0.0049)

log(VC2) 0.302276***

(0.0000)

log(RD2(-1)) 0.094017

(0.2231)

0.090564

(0.2406)

log(VC1(-1)) 0.058048

(0.2712)

0.049550

(0.3939)

log(RD2(-2) ) -0.113884

(0.1396)

log(VC1(-2) ) 0.090606

(0.0953)

R-squared 0.881717 0.898801 0.923015 0.904554 0.922629

Remarks: The numerals in()correspond to the statistics of t ,***, **, and * stand for respectively the statistical markedness at the

level of 1%, 5%, and 10%.

Table 4: The Regressive Result of Cross-sectional data –Taking P2 as the Induced Variable.

Model 6 Model 7 Model 8 Model 9 Model 10

Constant 5.550355**

*

(0.0000)

4.749733**

*

(0.0000)

5.759913**

*

(0.0000)

5.263685**

*

(0.0000)

5.248052**

*

(0.0000)

log(RD1) 0.829870**

*

(0.0000)

log(RD2) 0.687432**

*

(0.0000)

0.667913**

*

(0.0000)

0.688779**

*

(0.0000)

0.680393**

*

(0.0000)

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

626

Table 4: The Regressive Result of Cross-sectional data –Taking P2 as the Induced Variable. (cont.)

log (VC1) 0.164902**

(0.0021)

0.077226

(0.1923)

0.069328**

(0.0074)

0.188337**

(0.0016)

log (VC2) 0.264078***

(0.0001)

log (RD2(-1)) 0.166091

(0.3487)

0.058413

(0.3760)

log (VC1(-1)) 0.004273

(0.9321)

0.008879

(0.8579)

log (RD2(-2) ) -0.103049

(0.1227)

log (VC1(-2) ) 0.127898

(0.0105)

R-squared 0.897638 0.876635 0.924551 0.901270 0.936567

Remarks: The numerals in()correspond to the statistics of t,***, **, and * stand for respectively the statistical markedness at the

level of 1%, 5%, and 10%.

Table 5: Chow Test Result.

Chow Breakpoint Test: 16 41

F-statistic 0.490538 Probability 0.812323

Log likelihood ratio 3.374632 Probability 0.760568

Table 6: Result of Regressive Analysis of Panel data-Taking P1 as Induced Variable.

Model 1 Model 2 Model 3 Model 4 Model 5

Constant 5.950044***

(0.0000)

5.079356***

(0.0000)

6.213828***

(0.0000)

5.574505***

(0.0000)

5.882852***

(0.0000)

log(RD1) 0.923259*** (

0.0000)

log(RD2) 0.746766***

(0.0000)

0.698969*** (

0.0000)

0.727938***

(0.0000)

0.720048***

(0.0000)

log(VC1) 0.174491***

(0.0000)

0.052321

(0.1460)

0.146557***

(0.0003)

0.152016***

(0.0001)

log(VC2) 0.300614*** (

0.0000)

log(RD2(-1)) 0.074988

(0.1195)

0.044867

(0.4292)

log(VC1(-1)) 0.068612

(0.0817)

0.061908

(0.1117)

log(RD2(-2) ) -0.126244

(0.0260)

log(VC1(-2) ) 0.095440

(0.0128)

R-squared 0.856826 0.900252 0.898379 0.878299 0.893650

Remarks: the numerals in()correspond to the statistics of t,***, **, and * stand for respectively the statistical markedness at the

level of 1%, 5%, and 10%.

WHICH IS BETTER INNOVATIVE INVESTMENT - An Empirical Analysis of Statistics from Chinese Industrial

Undertakings

627

Table 7: Result of Regressive Analysis of Panel data-Taking P2 as Induced Variable.

Model 6 Model 7 Model 8 Model 9 Model 10

Constant 5.425997***

(0.0000)

4.726168***

(0.0000)

5.661210***

(0.0000)

5.091773***

(0.0000)

5.353154***

(0.0000)

log(RD1) 0.845256***

(0.0000)

log(RD2) 0.719684***

(0.0000)

0.681994***

(0.0000)

0.708854***

(0.0000)

0.695647***

(0.0000)

log(VC1) 0.160898***

(0.0000)

0.061134

(0.1256)

0.145119***

(0.0002)

0.147812***

(0.0001)

log(VC2) 0.267834***

(0.0000)

log(RD2(-1)) 0.079728

(0.1596)

0.041718

(0.4300)

log(VC1(-1)) 0.032460

(0.3898)

0.019042

(0.5952)

log(RD2(-2) ) -0.117535

(0.0261)

log(VC1(-2) ) 0.121967***

(0.0009)

R-squared 0.862644 0.864674 0.895622 0.874437 0.898560

Remarks: The numerals in()correspond to the statistics of t,***, **, and * stand for respectively the statistical markedness at the

level of 1%, 5%, and 10%.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

628