THE ANALYSIS OF IT OUTSOURCING RISK IDENTIFICATION

ON PRINCIPAL-AGENT THEORY

Lin Qu and Zhongliang Guan

School of Economics and Management, Beijing Jiaotong University, Haidian District, Beijing 100044, China

Keywords: IT, Outsourcing, Risk.

Abstract: IT outsourcing as a strategic business innovation has been adopted by more and more enterprises. The

essence of IT outsourcing service is the Principal-agent relationship between enterprise and agent. As

between enterprise and agent, there is information asymmetry, information distortion, coupled with the

uncertainty of the market and the macroeconomic environment, resulting in IT outsourcing companies in the

implementation encounter various risks existing in the process. This paper discusses the causes of IT

outsourcing risk, and analyzes the losing control risk, uncertainty risk, cost risk and flexibility risk, and base

on this, combined with the comprehensive COSO risk management framework, proposes a model of IT

outsourcing risk identification.

1 INTRODUCTION

In 1989, the data center, network and computer

operations of Kodak which is the world famous

Image processing were outsourced to IBM, Digital

Equipment, and DEC (Zhang Yuanlin, 2008). Thus,

IT outsourcing industry is rapidly developing. So far,

IT outsourcing has become an essential systems

strategy of information field. However, there are

some risks during IT outsourcing. In the empirical

study, about one-third of IT outsourcing cases were

failed in the end (Christine Koh, 2007)

From late 1980s and early 1990s, the study for the

IT outsourcing has gone through several stages, in

the early stages, mainly for IT outsourcing motives

and decision-making analysis. With the further

development of IT outsourcing, more empirical

research for IT outsourcing management focus on

explaining the results of IT outsourcing,

summarizing the experiences of IT outsourcing, and

the study for risk of IT outsourcing is one of the hot

spot.

2 THE LITERATURE REVIEW

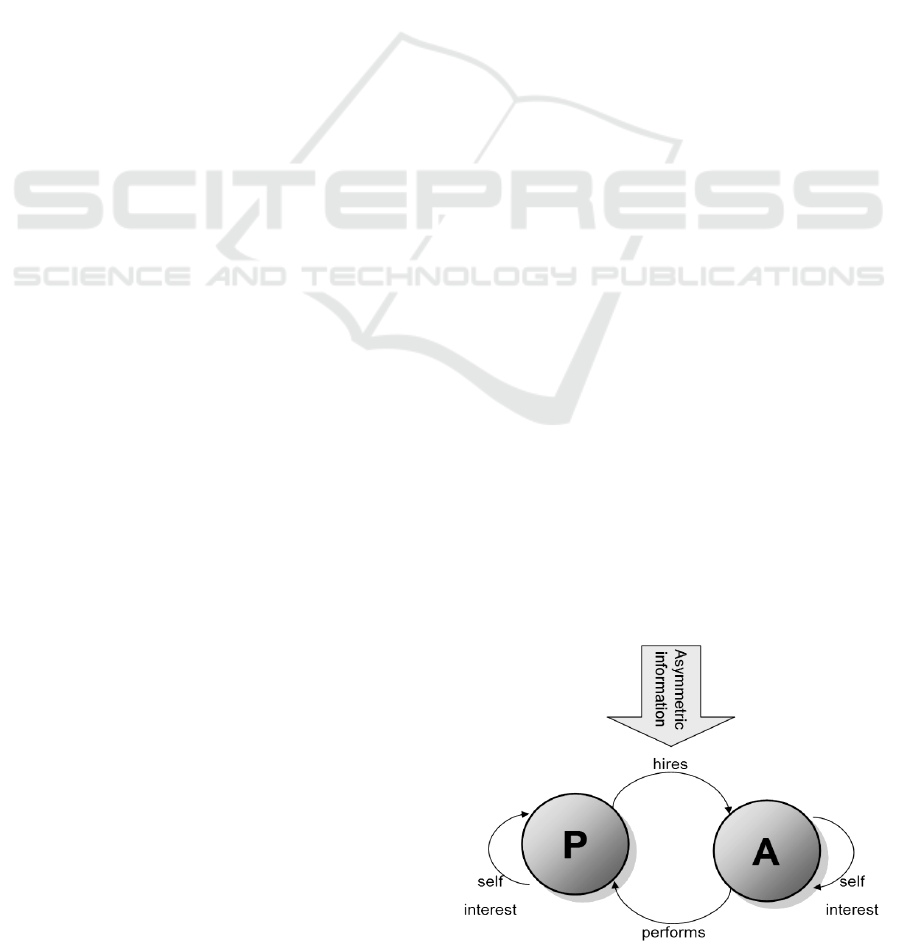

2.1 Principal-agent Theory

Principal-agent theory is the main part of the

contract theory in Institutional Economics. The main

research agency relationship is that one or more

actors, according to a ostensive or implied contract,

appoint or hire other actors, At the same time grant

certain right to the latter, and give the payment to the

latter as per quantity and quality of services

provided by latter.

Figure 1: Basic idea of Principal-agent Theory.

488

Qu L. and Guan Z..

THE ANALYSIS OF IT OUTSOURCING RISK IDENTIFICATION ON PRINCIPAL-AGENT THEORY.

DOI: 10.5220/0003617104880491

In Proceedings of the 13th International Conference on Enterprise Information Systems (EIT-2011), pages 488-491

ISBN: 978-989-8425-55-3

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

In the traditional Arrow-Debreu system, the

enterprise is regarded as a "black box", which

absorbs all kinds of factor and take

profit-maximizing behavior within the budget

constraints. This view is too simple, which ignores

the internal information asymmetry and incentive

problems, and can not explain many behaviors of the

modern enterprise. Principal-agent theory goes deep

into the "black box" to research enterprise’s

information asymmetry and incentive problems,

together with transaction cost theory as an integral

part of modern business theory. Principal-agent

relationship is defined as a person or persons (the

client) commission others (agents) according to the

client’s interests and give agents grant to engaging

in certain activities and the corresponding decision,

which is also in IT outsourcing business. In IT

outsourcing, there are many inconsistencies in the

objectives between the agent and the principal.

Agency cost is the important aspect to be considered

of the outsourcing decision. As the complexity of IT

outsourcing, many scholars tried to build a

decision-making model by principal-agent theory for

IT outsourcing.

(

Zhang Mengjun

,

2005

)

2.2 IT Outsourcing Risk Analysis

(1) Hiding Information: it corresponds to the

"principal-agent" model of another very important

concept –“adverse selection”. It is before signing the

contract, the agent has already got some information

which clients do not know, and may be the principal

disadvantage for clients. Therefore, the agents

signed contracts with their advantage, while the

clients are in position against themselves because

they can not get the information, so vulnerable to

damage their own interests. This is opportunistic

behavior during the stage of signing a contract.

Hiding information problems is very universal in

process of outsourcing service provider selection.

Due to asymmetric information, agents understand

their credit and the real technical ability better than

clients, and to provide inadequate or false

information to clients (Yang, 2001).

(2) Hiding Action: it corresponds to another very

important concept of the "principal-agent" model-

"moral hazard", which means: Assuming the

information owned by the principal and the agents

can basically be considered as symmetrical, when

they sign the contract, but after reached a contract,

the client can not observe certain behavior, or

changes in the external environment can been

observed only by agent. In this case, under the

protection of the contract, the agent may take some

action against the client, to the detriment of the

client's interests. This is the opportunistic behavior

during the contract implementation phase. Hidden

action problem is also very universal in the

enterprise contract management process. Once the

outsourcing relationship between providers and

enterprises is fixed in the form of contract, the

enterprises can not understand the operation of the

whole process outsourcing sector as much as before.

When the internal information technology operations

and resources managed by external service providers,

enterprises can not control the outsourced content

directly, not get service from the outsourcer's direct

reports. If the rights and obligations of both parties

are not clearly defined in the contract, the risk of

loss of control is obvious. Such as service quality,

provide efficiency, flexibility to changes in demand

for services, cost control, business trade secrets and

inside information, as well as intellectual property

rights may be at risk (Yang, 2001).

3 CASE STUDY

AND SUGGESTION

3.1 Case Study

(1) The risk of Losing Control: Include, outsourcing

may lead to lose control of providing services on

time and guarantee quality of service; agent and its

staff may be permitted to access to confidential

information; intellectual property protection may be

at risk; any changes on demand must be permitted

by outsourcing agent; outsourcing agent cut its ways

of learning the latest information technology

development and application.(Wen Shaoguo, 2005)

(2) Uncertainty Risk, Include: If outsourcing the

system, companies are able to continue learning and

improving information technology to meet business

needs or not; the relation between software,

hardware, network and application is close and

interdependent, so that outsourcing any one of them

will lead to extreme confusion and uncertainty.

(3) The Cost Risk, Include: information systems

outsourcing may not reduce the cost, unforeseen and

unspecified changes usually bring about higher cost;

agent inherently focused more on profits from its

own interests, of course, want to do less; the

corporate culture between client and agent is

THE ANALYSIS OF IT OUTSOURCING RISK IDENTIFICATION ON PRINCIPAL-AGENT THEORY

489

different , which leads to conflict and inefficiency,

and increases costs (Lu Hong, 2007).

(4) Flexibility risk. The capacity of resource

reorganization, and the adaptability for changes in

business environment; the ability of reengineering

the business process and strategic, also includes

information technology (Lu Hong, 2007)

3.2 Analysis and Advices

The current theory of IT outsourcing risk analysis

and classification has been more perfect, but there is

no good solution for IT outsourcing risk

identification problems in the outsourcing process.

In view of this, the introduction of risk identification

framework is very important; COSO's

comprehensive risk management framework covers

the risk space of business operations better in three

dimensions, and able to do identify risks qualitative

analysis effectively. For some characteristics of IT

outsourcing risk, I modify the ERM framework:

Figure 2: Framework of COSO Risk Management.

The first dimension is the enterprise objectives of IT

outsourcing, including the strategic level objectives,

management level objectives and operational level

objectives; the second dimension is all the enterprise

levels, including the entire enterprise, the various

functional departments, business lines and

subsidiaries; the third dimension is the seven factors

in the IT outsourcing risk management, including

the internal environment, goal setting, risk

assessment, risk response, control activities,

information and communication, monitoring.

This paper modifies the third dimension of COSO,

and redefines the seven factors according to the IT

outsourcing characteristics and objectives to be

achieved; the following is the main content:

Figure 3: Framework of IT Outsourcing Risk

Identification.

1. Business ethics and staff competence, staff

training, management business model, distribution

of authority and the way responsibilities of IT

outsourcing agent, also includes the corporate

culture.

2. IT outsourcing business managers determine the

strategic business objective, identify relevant

sub-goals down to every level in the enterprise and

the implementation

。

3. Risk assessment can enable enterprises to

understand how the potential issues affect goals of

IT outsourcing. Managers should assess risk from

two aspects – the likelihood and impact of risk.

4. IT outsourcing managers can develop different

risk response schemes, consider how each scheme

impact the likelihood of matters and issues the

impact on enterprise under the risk tolerance and

cost-effective premise. Management should also

design and implement of risk response schemes.

5. Control activities are relevant policy and

procedure to help to ensure the correct

implementation of risk response programs, including

procedures and policies of approval, authorization,

adjustment and evaluation between IT contractor

and subcontractor which are used to execute the

program successfully. Control activity is part of the

process to achieve business goals, usually consists of

two elements: a policy to determine what should be

done and a series of processes influencing this

policy

6. Enterprise and IT contractors can communicate

effectively or not.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

490

7. Monitoring of enterprise risk management is a

process of assessing the content of risk management

elements, operation, and implementation quality for

a period. Enterprises have two ways to monitor risk

management - continuous monitoring and individual

assessment. Continuous monitoring and individual

assessments are used to ensure that enterprise risk

management continues to be implemented in the

enterprise management level and within the various

departments.

4 CONCLUSIONS

There are various risks during the cooperation

between the enterprise and subcontractor, due to

information asymmetry, information distortion,

outsourcing market maturity, the competitive

environment of uncertainty, technology updates,

political, economic, and legal and other factors. In

order to enable enterprises and contractor to achieve

win-win cooperation, both sides should take certain

measures to avoid risks, such as the establishment of

monitoring mechanisms, optimization the contract,

information sharing. The theoretical framework of

risk identification and control during the cooperation

between the enterprise and contractor is of great

significance, is also the focus of future research. In

this paper, combined with COSO comprehensive

enterprise risk management framework, I give the

idea that how to identify the IT outsourcing risk.

Combined with the framework, to identify the risk of

IT outsourcing from qualitative analysis to

quantitative analysis and continuous improvement is

the future work to be performed.

REFERENCES

Zhang Yuanlin (2008) "A Review in IT Outsourcing

Research", China Management Informationization,

2,75-80

Christine Koh, (2007) Does IT Outsourcing Create

Firm Value

Liang Xinhong (2004) "The Cause and Risk Prevention of

IT Outsourcing", Science and Technology

Management Research, 1,64-69

Wang Chun (2008) " The Study Review of IT Outsourcing

Risk", Science and Technology Management

Research, 1,64-69

Zhang Mengjun (2005) " Avoid the IT Outsourcing Risk",

Software Engineer,8,45-46

Zhang Qin (2008) "The Review of Risk Management

Theory and Study", Financial Theory and

Practice,8,45-46

COSO,(2004b)Enterprise Risk Management-Intergrated

Framework,1-16

Yang Ying (2001) " IT Outsourcing in Enterprises and Its

Risk Analysis ", China Soft Science, 3,98-107

Wen Zhaoguo (2005) " The Risk and Control of IT

Outsourcing ", Economic Tribune,16,57-59

Lu Hong (2007) "The Risk and Solution of IT

Outsourcing", Enterprise Economics,6,49-52

THE ANALYSIS OF IT OUTSOURCING RISK IDENTIFICATION ON PRINCIPAL-AGENT THEORY

491