FUZZY CLASSIFIER BASED ON SUPERVISED CLUSTERING

WITH NONPARAMETRIC ESTIMATION OF LOCAL

PROBABILISTIC DENSITIES IN DEFAULT

PREDICTION OF SMALL ENTERPRISES

Maria Luiza F. Velloso, Nival N. Almeida, Thales Ávila Carneiro

Department of Eletronics, Rio de Janeiro State University, São Francisco Xavier 524, Rio de Janeiro, Brazil

José Augusto Gonçalves do Canto

Institute of Political Science and Economics, Candido MendesUniversity, Rio de Janeiro, Brazil

Keywords: Supervised clustering, Fuzzy modelling, Interpretability.

Abstract: The accuracy-complexity trade-off has been an important issue in system modeling. Parsimonious

modelling is preferred to complex modelling and, of course, accurate modelling is preferred to inaccurate

modelling. In system modelling with fuzzy rule-based systems, the accuracy-complexity tradeoff is often

referred as the interpretability-accuracy trade-off, and high interpretability is the main advantage of fuzzy

rule-based systems over other nonlinear systems. In many applications, gaining knowledge about the

system, in an understandable way, is as important as getting accurate results. The classical fuzzy classifier

consists of rules each one describing one of the classes. In this paper we use a fuzzy model structure where

each rule represents more than one class with different probabilities. The rules are extracted through

clustering and the probabilities are estimated in a local (cluster by cluster) non-parametric way. This

approach is applied to predict default in small and medium enterprises in Brazil, using indexes that reflect

the financial situation of enterprise, such as profitable capability, operating efficiency, repayment capability

and situation of enterprise’s cash flow. The preliminary results show a significant improvement in the

interpretability, without accuracy loss, compared with other approaches.

1 INTRODUCTION

Extracting a small set of rules to make an accurate

and efficient system is one of the most addressed

fuzzy modelling tasks. One basic motivation to

implement a fuzzy model lies in its transparency.

High interpretability is the main advantage of fuzzy

rule-based systems over other nonlinear systems.

The accuracy-complexity trade-off in general

modelling is often referred to as the interpretability-

accuracy trade-off in fuzzy modelling.

The aim of this work is to propose a modelling

using mechanisms to improve the accuracy of fuzzy

models based in supervised clustering (Abonyi,

2003) without loss of interpretability.

The classical fuzzy classifier consists of rules

each one describing one of the C classes. In

probabilistic fuzzy classifiers the consequent part is

defined as the probabilities that a given rule

represents the C classes, and one rule can represent

more than one class with different probabilities

(Abonyi, 2003; Roubos, 2003; Lee, 2008; Hengjie,

2011). In a probabilistic fuzzy classifier,

probabilities are assigned to all the class labels in the

consequent parts of the rules. In this paper we use a

fuzzy model structure where each rule represents

more than one class with different probabilities. A

supervised clustering algorithm is used for the

identification of this fuzzy model and a

nonparametric estimation of the probabilities of the

classes in the consequents of rules.

The issue of credit availability to small firms has

garnered world-wide concern recently. Small and

Medium Enterprises (SMEs) are almost 99% of the

total number of firms in Brazil, and they offer 78%

of the jobs in the country. But, around 80% of SMEs

509

F. Velloso M., N. Almeida N., Ávila Carneiro T. and Augusto Gonçalves do Canto J..

FUZZY CLASSIFIER BASED ON SUPERVISED CLUSTERING WITH NONPARAMETRIC ESTIMATION OF LOCAL PROBABILISTIC DENSITIES IN

DEFAULT PREDICTION OF SMALL ENTERPRISES.

DOI: 10.5220/0003675305090512

In Proceedings of the International Conference on Evolutionary Computation Theory and Applications (FCTA-2011), pages 509-512

ISBN: 978-989-8425-83-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

is shut down before one year of activity. Many

public and financial institutions launch each year

plans in order to sustain this essential player of

nation economies (Altman, Sabato, 2006).

Borrowing remains undoubtedly the most important

source of external SME financing.

Small firms may be particularly vulnerable

because they are often so informationally opaque,

and the informational wedge between insiders and

outsiders tends to be more acute for small

companies, which makes the provision of external

finance particularly challenging (Berger, Udell,

2002). Some financial ratios are used in the context

of default prediction in small and micro firms

operating in a state of Brazil and we choose some of

them, as described in Section 3. Although the

enterprise’s wish of returning loan, which is

represented by the rate of returning interests, we

often don’t have any information about the amount

of interests that has been repaid by enterprises that

are requiring a loan for the first time. In this case,

the prediction of default relies on information in the

balance sheet of these enterprises.

Our approach is applied to predict default in

small and medium enterprises in Brazil, using

indexes that reflect the financial situation of

enterprise. The results show a significant

improvement in the interpretability, without

accuracy loss, compared with other approaches.

The paper is organized as follows. In Section 2,

the structure of the new fuzzy classifier is presented.

For the estimation of probability density functions

for each class in each cluster based on a

nonparametric method is presented in Section 3. The

proposed approach is studied for default prediction

in small and medium enterprises in Section 4.

Finally, the conclusions are given in Section 5.

2 FUZZY CLASSIFIER

STRUCTURE

2.1 The Classical Fuzzy Classifier

The classical fuzzy rule-based classifier consists of

fuzzy rules each one describing one of the C classes.

The rule antecedent defines the operating region of

the rule in the n-dimensional feature space and the

rule consequent is a crisp (nonfuzzy) class label

from the {

,

,

....,

} label set:

r

i

: If x

1

is

,

and . . . x

1

is

,

then =

(1)

where

,

; . . . ;

,

are the antecedent

fuzzy sets and w

i

is a certainty factor that represents

the desired impact of the rule.

The and connective is modelled by the

product operator. The output of the classical fuzzy

classifier is determined by the winner takes all

strategy, i.e. the output is the class related to the

consequent of the rule that gets the highest degree of

activation:

=

∗

,

∗

=max

(2)

To represent the

,

fuzzy set, we use

Gaussian membership functions.

2.2 Probabilistic Fuzzy Classifier

One of the possible extensions of the classical

quadratic Bayes classifier is to use mixture of

models for estimating the class-conditional densities.

In these solutions each conditional density is

modelled by a separate mixture of models. In

(Abonyi, 2003) the

|

posteriori densities are

modelled by R > C mixture of models (clusters). The

consequent of the fuzzy rule is defined as the

probabilities of the given rule represent the

,

,

....,

classes:

r

i

: If x

1

is

,

and . . . x

1

is

,

then

=

ℎ

|

,...,

=

ℎ

|

.

(3)

Classical fuzzy clustering algorithms are used to

estimate the distribution of the data. Hence, they do

not utilize the class label of each data point available

for the identification. Furthermore, the obtained

clusters cannot be directly used to build the

classifier. In the following a new cluster prototype

and the related distance measure will be introduced

that allows the direct supervised identification of

fuzzy classifiers. As the clusters are used to obtain

the parameters of the fuzzy classifier, the distance

measure is defined similarly to the distance measure

of the Bayes classifier:

1

,

,

=

=

−

1

2

,

−

,

,

×

=

ℎ

(4)

This distance measure consists of two terms. The

first term is based on the geometrical distance

between the

cluster centres and the x

k

observation

vector, while the second is based on the probability

FCTA 2011 - International Conference on Fuzzy Computation Theory and Applications

510

that the rith cluster describes the density of the class

of the kth data,

=

. The proposed

approach estimate the second term by non-

parametric estimation of the probability densities of

each class in each cluster (r

i

), described in the next

section.

3 PROBABILITY ESTIMATION

The estimation of local probability densities for each

class in each cluster is based on the original

Probabilistic Neural Network (PNN). PNN (Bishop,

1995) is a network formulation of probability

density estimation. A PNN consists of several sub-

networks, each of which is a Parzen window PDF

estimator for each of the classes. The input nodes are

the set of measurements. The second layer consists

of the Gaussian functions formed using the given set

of training data points as centres. The third layer

performs an average operation of the outputs from

the second layer for each class. The fourth layer

performs a vote, selecting the largest value. The

associated class label is then determined. The PNN

is a classifier version, which combines the Baye’s

strategy for decision-making with a non-parametric

estimator for obtaining the probability density

function (PDF).

4 DEFAULT PREDICTION

The sample data set comes from a state-owned

commercial bank. The original dataset contains 126

instances however 3 of these are omitted because

these are incomplete data, which is common with

other studies. The class distribution is 51% default

and 42% non-default. The 123 samples represent

Small and Medium Enterprises of only one state of

Brazil. Among these enterprises, the number of the

enterprises which could repay the loan is 60, the rest

63 are those which could not repay the loan.

Our model is an accounting based model. In this

kind of model, accounting balance sheets are used

and the input indexes include the enterprise’s

capability of returning loan and wish of returning

loan, and in this work the capability was analysed.

The capability of returning loan is measured by

several indexes that reflect the financial situation of

enterprise, such as profitable capability, operating

efficiency, repayment capability and situation of

enterprise’s cash flow, etc. Four accounting financial

ratios were chosen (these are the most common used

indexes). These are as follows:

X1 = Earnings before taxes / Average total assets

X2 = Total liabilities / Ownership interest

X3 = Operational cash flow / Total liabilities

X4 = Working capital / Total assets.

Each index represented the average of three

periods before the prediction period.

We limited the number of clusters in 5, in order

to maintain good interpretability. The best results are

obtained using three clusters. Therefore, our rule

base has three rules.

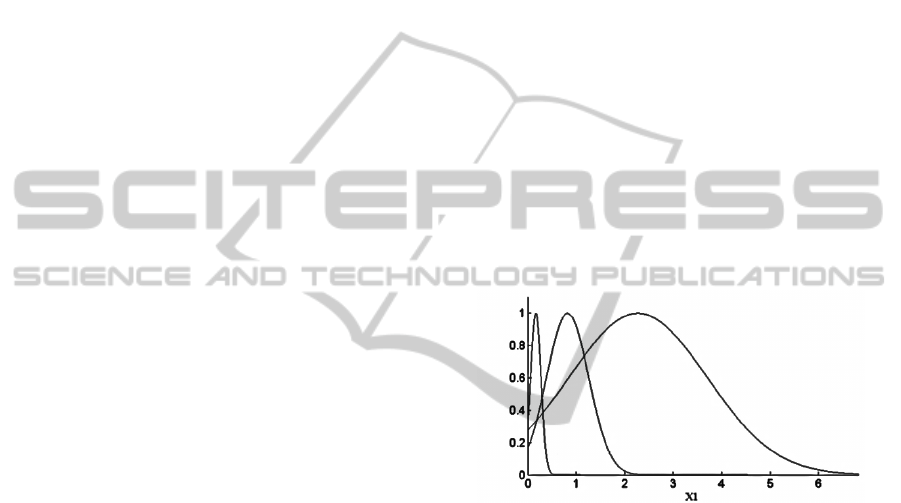

Some membership functions, related to variable

X1, obtained by fuzzy clustering are illustrated in

Figure 1. Clusters have different covariance

matrices, and they are diagonal matrices, in order to

project memberships on original variables. The

algorithm did not optimize clustering based on

interclass separability.

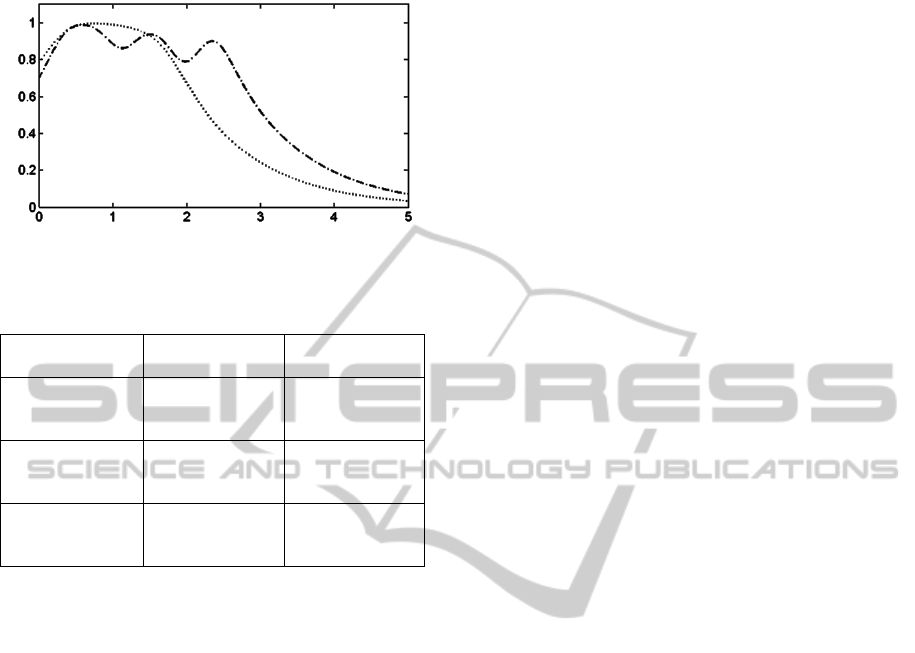

The estimated densities projected on the original

input variable X1 are illustrated by Figure 2. This

figure shows the densities related to variable X1 for

the two classes related to one cluster.

Figure 1: Membership functions related to variable X1 in

the three clusters (rules).

The performance of the obtained classifiers was

measured by leave-one-out cross validation As the

name suggests, leave-one-out cross-validation

(LOOCV) involves using a single observation from

the original sample as the validation data, and the

remaining observations as the training data. This is

repeated such that each observation in the sample is

used once as the validation data.

The results are summarized in Table 1. We

report the mean values of the error. For the proposed

approach, Model 1, the number of rules is equal to

the number of clusters. The grid partition approach,

Model 3, has 20 rules, and the other approach that

uses clustering and probabilities, Model 2 (Abonyi,

2003), has three rules. The proposed approach is

much more compact (in terms of the number of

rules) than the grid approach and more accurate.

Although the proposed approach requires more

memory (training data must be available in

FUZZY CLASSIFIER BASED ON SUPERVISED CLUSTERING WITH NONPARAMETRIC ESTIMATION OF

LOCAL PROBABILISTIC DENSITIES IN DEFAULT PREDICTION OF SMALL ENTERPRISES

511

classification mode), it is more accurate.

Figure 3: Probability densities of two classes related to X1

in cluster 1.

Table 1: Results.

Model Rule Number Overall

accuracy

Model 1

(proposed

approach)

3 92%

Model 2

(supervised

clustering)

3 80%

Model 3

(traditional grid

partition)

20 95%

5 CONCLUSIONS

In this paper we use a fuzzy model structure where

each rule represents more than one class with

different probabilities. The rules are extracted

through clustering and the probabilities are

estimated in a local (cluster by cluster) non-

parametric way. This approach is applied to predict

default in small and medium enterprises in Brazil,

using indexes that reflect the financial situation of

enterprise, such as profitable capability, operating

efficiency, repayment capability and situation of

enterprise’s cash flow. In this work, we can see that

clusters do not present enough separability, specially

related to X4. We intend conduct research in order

to extract rules with improved interpretability,

combining with feature reduction. Estimation of

PDFs can be experimented without crisp boundaries.

Others comparisons could be experimented. In spite

of the simplicity adopted, the preliminary results

show a significant improvement in the

interpretability, without accuracy loss, compared

with other approaches.

ACKNOWLEDGEMENTS

The financial support from Brazilian research

agency Carlos Chagas Filho Foundation for

Research Support of Rio de Janeiro State (FAPERJ)

is gratefully acknowledged.

REFERENCES

Abonyi, J, Szeifert, F., 2003. Supervised fuzzy clustering

for the identification of fuzzy classifiers, Pattern

Recognition Letters 24, pages 2195–2207

Altman1, Edward I., Sabato, Gabriele, 2007. Modelling

Credit Risk for SMEs: Evidence from the U.S. Market.

Abacus, Volume 43, Issue 3, pages 332–357.

Behr, P. and Güttler, A. (2007), Credit Risk Assessment

and Relationship Lending: An Empirical Analysis of

German Small and Medium-Sized Enterprises.

Journal of Small Business Management, 45, pages

194–213.

Bishop, C. M., 1995. Neural Networks for Pattern

Recognition. Oxford University Press, Oxford.

Casillas, J.; Cordón, O.; Herrera Triguero, F.; Magdalena,

L. (Eds.), 2003. Accuracy Improvements in Linguistic

Fuzzy Modelling Series: Studies in Fuzziness and Soft

Computing, Vol. 129 , Springer.

Gath, I., Geva, A.B., 1989. Unsupervised optimal fuzzy

clustering. IEEE Trans. Pattern Anal. Machine Intell

7, pages 773–781.

Lee, Hyong-Euk, Park, Kwang-Hyun, and Bien,

Zeungnam Zenn, 2008. Iterative Fuzzy Clustering

Algorithm With Supervision to Construct Probabilistic

Fuzzy Rule Base From Numerical Data, IEEE

Transactions On Fuzzy Systems, Vol. 16, No. 1, pages

263- 277.

Roubos, Johannes A, Setnes, Magne, Abonyi, Janos, 2003.

Learning fuzzy classification rules from labeled data.

Information Sciences—Informatics and Computer

Science: An International Journal - Special issue on

recent advances in soft computing Volume 150 Issue

1-2, Publisher Elsevier Science Inc. New York, NY,

USA

FCTA 2011 - International Conference on Fuzzy Computation Theory and Applications

512