AN ARTIFICIAL STOCK MARKET

Martin Sewell

The Cambridge Centre for Climate Change Mitigation Research (4CMR), Department of Land Economy,

University of Cambridge, 16-21 Silver Street, Cambridge, CB3 9EP, United Kingdom

Keywords:

Artificial stock market, Technical analysis, Fundamental analysis, Behavioural finance, Multiagent systems.

Abstract:

To set the scene, fundamental analysis, technical analysis, behavioural finance and multiagent systems are

introduced and discussed. The work utilizes behavioural finance; the evolved heuristics and biases exhibited

by fundamental analysts and technical analysts, inducing underreaction and overreaction, are used to build an

agent-based artificial stock market. Results showed that whether a fundamental analyst, or a technical analyst,

it pays to be in a small majority of about 60 per cent, whilst being in a small minority is the least profitable

position to be in. As the number of technical analysts increases, the standard deviation of returns decreases,

whilst the skewness increases. Whilst kurtosis of market returns peaks with around 40 per cent technical

analysts, and rapidly declines as the number of technical analysts exceeds 90 per cent. The autocorrelation

of returns is close to zero with 100 per cent fundamental analysts, and approaches one as the proportion of

technical analysts approaches 100 per cent. The artificial stock market replicates mean returns, the standard

deviation of returns, the absolute returns correlation and the squared returns correlation of a real stock market,

but failed to accurately replicate the skewness, kurtosis and autocorrelation of returns.

1 INTRODUCTION

1.1 Objectives

The focus of this paper is modelling. The aim is to

build an agent-based artificial stock market and ex-

plore the effect of the ratio of fundamental analysts

to technical analysts, and whether and when the re-

sultant time series displays the statistical properties

exhibited by a real market.

1.2 Background

1.2.1 Fundamental Analysis

Fundamental analysis is a method of forecasting mar-

kets through the analysis of relevant news.

1.2.2 Technical Analysis

The second class of ‘actors’ employed in the model

are technical analysts. Technical analysts rely on the

assumption that markets discount everything except

information generated by market action, ergo, all you

need is data generated by market action. Let us for-

mally define technical analysis. If P is price, D is

data generated by the process of trading, and t is

time, then technical analysis is the art of inferring

E(P

t|t>0

|D

t|t<0

).

A taxonomy of the various methods of techni-

cal analysis applied by practitioners is provided by

the syllabus of the Society of Technical Analyst’s

Diploma.

1

However, the technician’s number one

rule is that they follow the trend. Quoting a best-

selling practitioner’s book on technical analysis (Mur-

phy, 1999, p. 49), ‘The concept of trend is absolutely

essential to the technical approach to market analy-

sis. All of the tools used by the chartist—support

and resistance levels, price patterns, moving averages,

trendlines, etc.—have the sole purpose of helping to

measure the trend of the market for the purpose of

participating in the trend. We often hear such famil-

iar expressions as “always trade in the direction of the

trend,” never buck the trend,” or “the trend is your

friend.”’

1.2.3 Behavioural Finance

The algorithms employed by the artificial stock mar-

ket are based on the behaviour of real market partic-

ipants, rather than the actions of the rational but hy-

1

http://www.sta-uk.org/sta diploma.html

293

Sewell M..

AN ARTIFICIAL STOCK MARKET.

DOI: 10.5220/0003687002930300

In Proceedings of the 4th International Conference on Agents and Artificial Intelligence (ICAART-2012), pages 293-300

ISBN: 978-989-8425-96-6

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

pothetical Homo economicus. Behavioural finance is

the study of the influence of psychology on the be-

haviour of financial practitioners and the subsequent

effect on markets. Behavioural finance is of interest

because it helps explain why and how markets might

be inefficient.

Consider some common heuristics and biases.

Availability (Tversky and Kahneman, 1973) is a cog-

nitive heuristic in which a decision maker relies upon

knowledge that is readily available rather than exam-

ine other alternatives or procedures. Representative-

ness (Tversky and Kahneman, 1974) leads people to

predict future events by looking for familiar patterns

and taking a short history of data and assuming that

future patterns will resemble past ones. The status

quo bias (Samuelson and Zeckhauser, 1988) is a cog-

nitive bias for the status quo; in other words, people

tend to be biased towards doing nothing or maintain-

ing their current or previous decision. The status quo

bias can lead to another cognitive heuristic, known

as anchoring (Tversky and Kahneman, 1974), which

describes the common human tendency to make deci-

sions based on an initial ‘anchor’. We prefer relative

thinking to absolute thinking. Other observed consis-

tent but irrational behaviour includes overconfidence,

optimism and herding.

1.2.4 Multiagent Systems

A multiagent system is a system in which several in-

teracting, autonomous, intelligent agents pursue some

set of goals or perform some set of tasks.

The artificial stock market in this paper employs

a multiagent system. Two good books on multi-

agent system are (Weiss, 1999) and (Wooldridge,

2002). In a classic paper, (Arthur et al., 1997) pro-

posed a theory of asset pricing based on heteroge-

neous agents who continually adapt their expecta-

tions to the market that these expectations aggrega-

tively create, thus creating an artificial stock mar-

ket. (LeBaron, 2006) surveys research on agent-based

models used in finance. (Railsback, 2001) addresses

the problem of getting ‘results’—general principles

and conclusions—from multiagent systems and rec-

ommends a pattern-oriented approach.

1.3 Criticisms of Multiagent Systems

Agent-based modelling can stand accused of being

poor science. To do science, one needs ways to test

hypotheses and reach general conclusions. Some of

the problems with multiagent systems:

• Too many free parameters.

• In common with all empirical research, one can

always find evidence to support what one seeks

to prove. Too many possible explanations of the

results leads to the opportunity for story telling.

• No general theoretical way to know whether a

given simulation configuration is the only way to

get from some set of initial conditions to a result

or one of a family of hundreds or millions of ways

to get to a result.

• Model validation can be complicated.

• Difficult to verify that the models are consistent

enough to be useful.

Daniel Kahneman shared the Nobel Prize in Eco-

nomics in 2002 with Vernon Smith. Economists

once thought of their science as inherently non-

experimental, but Smith pioneered laboratory exper-

imental economics, and spearheaded ‘wind tunnel

tests’, where trials of new markets could be tried out

in the lab before being implemented in the real world,

giving policy makers a better understanding of how a

new market is likely to work in practice. Going one

step further, from the laboratory to the computer, on

balance I consider agent-based modelling to be an ef-

fective way of studying behavioural finance, because

empirical results derived from the laboratory can be

aggregated and modelled flexibly and at low cost.

2 HEURISTICS AND BIASES

From my work on the evolutionary foundations of

heuristics and biases (Sewell, 2011b), I identified the

following heuristics and biases in the modern day in-

vestor.

• Overconfidence is likely to lead investors to trade

too much, generally preferring actively man-

aged funds. Excess overconfidence among males

in particular explains the popularity of trading

among men.

• Optimism naturally creates a ‘bullish’ tendency

and can create asymmetry in the behaviour of

markets.

• Availability could, for example, cause us to pur-

chase shares in a company simply because it

comes to mind more readily.

• Herding can lead investors to focus only on a sub-

set of securities, whilst neglecting other securities

with near identical exogenous characteristics.

• Representativeness leads analysts to believe that

trends we observe are likely to continue. Repre-

sentativeness causes trend following by technical

analysts and overreaction among fundamental an-

ICAART 2012 - International Conference on Agents and Artificial Intelligence

294

alysts.

• Anchoring is likely to cause fundamental analysts

to underreact, for example to earnings announce-

ments.

Overconfidence leads to excess trading and helps cre-

ate a liquid market in the first place, optimism likely

increases market participation in general, whilst avail-

ability and herding will generally only effect a subset

of stocks so their impact would be diluted when ag-

gregated across stocks in general. So I only imple-

ment the final two points above, which are the most

relevant regarding market impact. In summary, fol-

lowing (Barberis et al., 1998) we expect underreac-

tion to news but an overreaction to a series of good

or bad news from fundamental analysts, and trend

following from technical analysts. We do not have

sufficient news data to test this hypothesis directly,

but would expect it to generate kurtosis and non-

linearities in market data, which are indeed found in

real markets (Sewell, 2011a).

3 MARKET PARTICIPANTS

The objective is to model a stock market using a mul-

tiagent system. The main criteria is to be as realistic

as possible; that is, the problem domain is mapped

onto the model. The only other criteria is to keep the

model as simple as possible (which is often at odds

with the quest for realism). In practice, traders are

essentially divided into two groups, fundamental an-

alysts (who tend to be longer term) and technical an-

alysts (who tend to be shorter term); the distribution

of agents in our model shall mirror this dichotomy

((Lux, 1995; Hong and Stein, 1999) took a similar

approach). Reviewing the existing literature, at one

extreme, some artificial markets employ agents with

zero intelligence (Gode and Sunder, 1993; Farmer

et al., 2005). Whilst in some implementations agents

are able to swap between technical analysis and fun-

damental analysis depending on their profits (they

have the ability to learn) (Lux, 1998; Lux and March-

esi, 1999; Lux and Marchesi, 2000). I reject the appli-

cation of zero intelligence agents, as in practice most

traders have a reasonably consistent strategy (which

may or may not work). I also reject the idea of agents

swapping between technical analysis and fundamen-

tal analysis, because in practice technical analysts and

fundamental analysts tend to be somewhat antagonis-

tic towards each other

2

. Finally, I reject the notion of

agents learning. Due to a combination of overconfi-

dence, a limited exposure to markets (at most one wo-

rking life) and noise, real traders do not learn how

to predict markets

3

(even if they did, as new traders

replaced the old, they would not improve ‘on av-

erage’); this stasis is trivially mirrored. Indeed,

(Martinez-Jaramillo, 2007; Martinez-Jaramillo and

Tsang, 2009) developed an artificial financial mar-

ket and investigated the effects on the market when

the agents learn, and, on average, their model without

learning replicated the stylized facts most accurately

(though not by much). In my model the technical ana-

lysts simply follow the technician’s number one rule:

they follow the trend, so the model fails to replicate

some of the more complex strategies that chartists fol-

low. The artificial market operates such that each time

step represents one trading day, and the stock price

may be interpreted as a daily closing price.

Below is a taxonomy of five groups of market par-

ticipants.

Fundamental Analysts

• Poor: Trade randomly—fundamental analysts

lacking sufficient skills or experience to analyse

a company will make mistakes at random.

• Real: Consistent, correlated and irrational—

Homo sapiens employed as fundamental analysts

will be susceptible to behavioural biases and make

systematic errors.

• Good: Rational—Skilled fundamental analysts

(Homo economicus) with the ability to accurately

analyse a company, and thus evaluate the value of

its stock.

Technical Analysts

4

• Poor: Trade randomly—those employed as tech-

nical analysts but lacking the ability or experience

to follow the rules of technical analysis.

• Good: Consistent, correlated and irrational—

experienced technical analysts able to trade in ac-

cordance with the rules of technical analysis.

Assuming that all five types of market participant

exist (they do), with imperfect arbitrage opportunities

2

There are two forms of analysis and the practitioners

of each tend to be somewhat antagonistic. Fundamental an-

alysts have referred to Technical analysts as indulging in

voodoo and shamanism and a technician once described the

former’s efforts as “fundamentally a waste of time”’ (Soci-

ety of Technical Analysts, 1999, p. 2).

3

Indeed, there is a negative relationship between the

tenure of a hedge fund manager and hedge fund returns

(Boyson, 2003).

4

Technical analysis is a behavioural bias (representative-

ness), here a ‘good’ technical analyst is one who accurately

and consistently trades according to the rules of technical

analysis.

AN ARTIFICIAL STOCK MARKET

295

and no 100 per cent rational traders, the resultant ef-

fect on the market is the aggregate effect of real fun-

damental analysts trading against good technical an-

alysts. A multiagent system with technical and fun-

damental agents is used to model price action. This

work employs a bottom-up approach and has been de-

veloped from first principles.

4 ARTIFICIAL STOCK MARKET

4.1 Fundamental Analysis

News, by definition, is unpredictable (otherwise it

would have been reported yesterday), so let us assume

that the cumulative impact of relevant news on a stock

follows a geometric random walk. Fundamental an-

alysts calculate the intrinsic value of a stock by the

analysis of relevant news. Let the exogenous variable

V

t

be the perceived fundamental value at time t, where

logV follows a random walk. Note that V is not di-

rectly observable, but changes in the variable are ob-

servable in the form of news, and the model assumes

that V may be calculated. If V increases, this corre-

sponds to good news, if it decreases, this corresponds

to bad news. The fundamental analysts trade on the

basis of this perceived fundamental value alone (they

do not consider historical prices). At each time step,

if the price of a stock is below (above) the perceived

fundamental value of the stock, fundamental analysts

will take a long (short) position in proportion to the

logarithm of the perceived fundamental value over the

price. In other words, the fundamental analysts trade

in such a way that they always move the price towards

the fundamental value. Formally,

log

V

t

V

t−1

> 0 represents good news, and

log

V

t

V

t−1

< 0 represents bad news.

Let n

f

be the proportion of the total number of trades

made by fundamental analysts and P

t

the price at time

t. The idea is to model an underreaction to news,

but an overreaction to a series of good or bad news.

Therefore, the fundamental agents overreact to three

or more successive good (or bad) news items, are

neutral towards exactly two successive good (or bad)

news items and underreact otherwise. In a market

populated entirely by fundamental analysts, the log

return of the price between time t and time t +1 would

be F

t

. The values for the reaction variable, r, below,

are chosen with reference to (Theobald and Yallup,

2004)’s direct measures of the degrees of overreac-

tion and underreactions in financial markets, but the

figures used here are subject to significant uncertainty.

F

t

= r log

V

t

P

t

(1)

where

r =

1.1 if V

t

> V

t−1

> V

t−2

> V

t−3

or

V

t

< V

t−1

< V

t−2

< V

t−3

; else

1 if V

t

> V

t−1

> V

t−2

or V

t

< V

t−1

< V

t−2

;

else

0.9.

(2)

4.2 Technical Analysis

The technical analysts follow the trend, i.e. display

momentum; they consider the historical price of a

stock, and nothing else. At each time step, they ex-

hibit persistence by trading in such a way that the

price is biased towards continuing in the same direc-

tion as the recent past.

Let n

t

be the proportion of trades made by techni-

cal analysts. The technical analysts’ trend-following

strategy looks back three days and weights the price

changes by recency. In this model if the market were

populated entirely by technical analysts, the log re-

turn of the price between time t and time t + 1 would

be T

t

.

T

t

= c

3

log

P

t−2

P

t−3

+ c

2

log

P

t−1

P

t−2

+ c log

P

t

P

t−1

, (3)

where the coefficients c

3

, c

2

and c form an increasing

geometric sequence so that more recent price changes

have a greater impact on T , and sum to one. Solving

c

3

+ c

2

+ c = 1, which has one real root, gives us c =

0.544.

4.3 Stock Price Returns

Changes in price are determined by the following

equation:

log

P

t+1

P

t

= n

f

F

t

+ n

t

T

t

. (4)

By way of example, if P

t

> V

t

, the fundamental ana-

lyst believes that the stock is overvalued. Those who

hold the stock may sell it, those who don’t may either

do nothing or short the stock. Or the fundamental an-

alyst may publish a recommendation that the stock is

a sell. The point is that on aggregate the actions of the

fundamental analysts will put pressure on the stock

price to fall. If, however, the technical analysts put

even greater selling pressure on the stock, the funda-

mental analysts will become net buyers.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

296

Table 1: Statistics of daily stock log returns (Taylor, 2005).

Coca Cola General Electric General Motors Glaxo Marks & Spencer Shell Mean Standard deviation

Mean 0.001167 0.000742 0.000558 0.001473 0.000725 0.000763 0.000905 0.000344

Standard deviation 0.0169 0.0151 0.0176 0.0179 0.0166 0.0130 0.0162 0.0018

Skewness 0.08 0.03 0.13 0.33 0.03 0.23 0.14 0.12

Kurtosis 5.68 5.43 4.56 6.93 4.40 5.18 5.36 0.91

Returns autocorrelation -0.035 -0.023 -0.003 0.08 0.034 0.045 0.016 0.044

Absolute returns autocorrelation 0.329 0.224 0.204 0.247 0.155 0.196 0.226 0.059

Squared returns autocorrelation 0.545 0.303 0.398 0.414 0.288 0.293 0.374 0.100

(Taylor, 2005) includes various statistics on

stocks, repeated in Table 1. In order to determine the

mean and standard deviation of the Gaussian random

variable log

V

t

V

t−1

, first, a realistic ratio of 50% fun-

damental trades and 50% technical trades (n

f

= 0.5

and n

t

= 0.5) was chosen. Then the mean and stan-

dard deviation space was discretised, an exhaustive

enumeration of return sequences generated, one for

each discrete parameter setting pair, and the pair for

which the mean and standard deviation of the simu-

lated stock returns most closely matched those of the

empirical data in Table 1 was chosen. This resulted

in a mean of 0.0013 and a standard deviation of 0.023

for the Gaussian random variable log

V

t

V

t−1

. The model

was run over 50,000 days twenty times, and averages

of various statistics calculated.

5 RESULTS

Recall that P

t

is the price of a stock at time t, and

V

t

is the perceived fundamental value of the stock

at time t. Note that (Shiller, 1981) calculated that

stock market volatility is five to thirteen times too

high to be attributed to new information, so we should

not expect the standard deviation of P log returns

to equal the standard deviation of V log returns (al-

though perhaps surprisingly, in this model, the latter

is slightly greater). Table 2 (p. 6) lists various statis-

tics of the returns generated by the model as the pro-

portion of technical analysts to fundamental analysts

varies. Figure 1 shows the mean return per analyst,

as the proportion technical analysts/fundamental ana-

lysts varies. Figure 2 shows the mean, standard devia-

tion and skewness of market log returns as the propor-

tion technical analysts/fundamental analysts varies.

Figure 3 shows the kurtosis of market log returns

as the proportion technical analysts/fundamental ana-

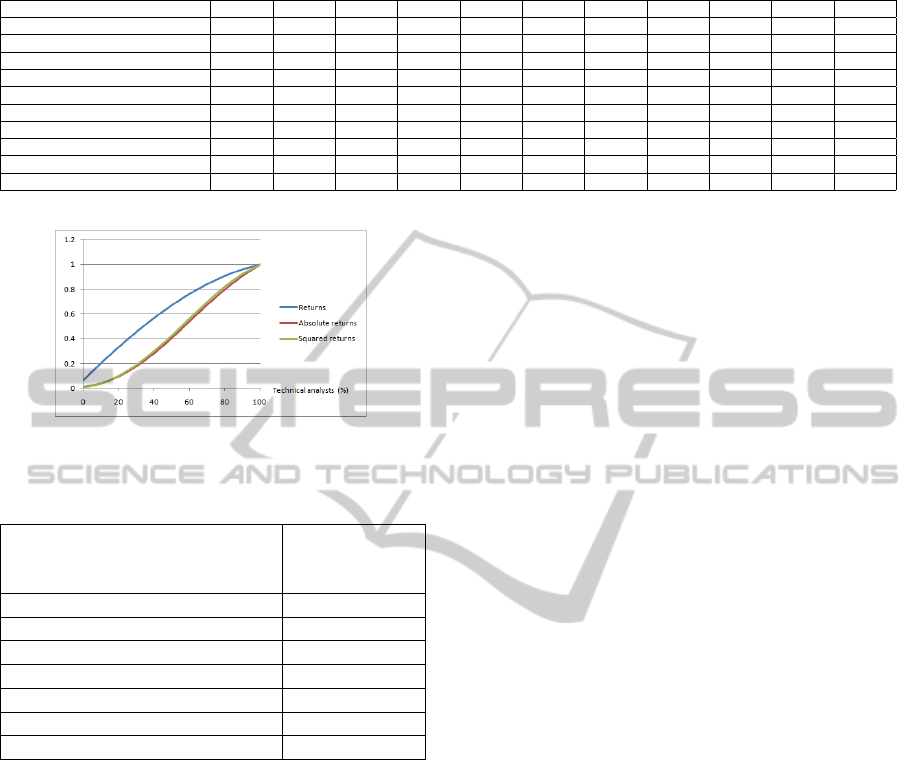

lysts varies. Figure 4 (page 6) shows the autocorrela-

tions of returns, absolute returns and squared returns

as the proportion technical analysts/fundamental an-

alysts varies. Table 3 (p. 6) shows that with a real-

istic proportion of technical and fundamental trades,

the artificial stock market replicates mean returns, the

standard deviation of returns, the absolute returns cor-

relation and the squared returns correlation of a real

stock market. However, the artificial stock market

failed to accurately replicate the skewness, kurtosis

and autocorrelation of returns.

Figure 1: Mean log return (P&L) per analyst.

Figure 2: Statistics of price log returns.

Figure 3: Kurtosis of price log returns.

6 DISCUSSION

The results show that whether a fundamental ana-

lyst, or a technical analyst, it pays to be in the ma-

jority, ideally of about 60 per cent, whilst being in

a small minority is the least profitable position to be

AN ARTIFICIAL STOCK MARKET

297

Table 2: Statistics generated by the artificial stock market.

Fundamental analysts (%) 100 90 80 70 60 50 40 30 20 10 0

Technical analysts (%) 0 10 20 30 40 50 60 70 80 90 100

Mean fundamental analyst return 0.0011 0.0012 0.0012 0.0015 0.0017 0.0000 -0.0026 -0.0033 -0.0053 -0.0103

Mean technical analyst return -0.0107 -0.0049 -0.0034 -0.0026 0.0000 0.0017 0.0014 0.0013 0.0011 0.0010

Mean return 0.0011 0.0011 0.0010 0.0010 0.0010 0.0010 0.0010 0.0010 0.0011 0.0010 0.0010

Returns standard deviation 0.0226 0.0208 0.0194 0.0182 0.0172 0.0163 0.0155 0.0149 0.0143 0.0138 0.0108

Returns skewness -0.0552 -0.0533 -0.0503 -0.0434 -0.0348 -0.0393 -0.0201 -0.0136 -0.0178 -0.0043 0.0025

Returns kurtosis 0.0822 0.1512 0.2010 0.2350 0.2476 0.2371 0.2073 0.1348 0.1100 0.0394 -1.4268

Returns autocorrelation 0.0658 0.2038 0.3338 0.4566 0.5690 0.6710 0.7627 0.8423 0.9088 0.9617 1.0000

Absolute returns autocorrelation 0.0093 0.0364 0.0931 0.1750 0.2803 0.4045 0.5403 0.6730 0.7984 0.9083 1.0000

Squared returns autocorrelation 0.0088 0.0401 0.1029 0.1899 0.3021 0.4259 0.5650 0.6974 0.8226 0.9244 1.0000

Figure 4: Autocorrelations of price log returns.

Table 3: Range of proportions of technical analysts in the

artificial stock market that replicate stylized facts.

Statistic Proportion of

technical ana-

lysts

Mean return 0–100%

Returns standard deviation 40–70%

Returns skewness none

Returns kurtosis none

Returns autocorrelation none

Absolute returns autocorrelation 30–40%

Squared returns autocorrelation 40–50%

in. Mean stock returns are low and positive regard-

less of the relative proportions of analysts, this is con-

sistent with a real market. As the number of tech-

nical analysts increases, the standard deviation of re-

turns decreases, whilst remaining realistic, whilst the

skewness increases. The model exhibited slight neg-

ative skewness, whilst real markets exhibit significant

positive skewness. The kurtosis of returns peaks at

around 0.25 with around 40 per cent technical ana-

lysts, and rapidly declines as the number of technical

analysts exceeds 90 per cent. In contrast, the kurtosis

of daily stock returns in real markets is around 5. The

autocorrelation of returns is close to zero with 100 per

cent fundamental analysts, and approaches one as the

proportion of technical analysts approaches 100 per

cent. Unsurprisingly, the trend-following technical

analysts created positive autocorrelations in returns in

the model, but autocorrelations of returns are close to

zero in real markets. The autocorrelation of absolute

and squared returns is realistic only around the region

of 30%–50% technical analysts. How has the model

fared in light of the criticisms of multiagent systems

that were highlighted in Section 1.3 (p. 2)? The main

concern, that one can vary any free parameter until

one obtains the result that one desires, i.e. high kurto-

sis, was mitigated by keeping the number of varying

parameters to a minimum, by using realistic assump-

tions. (Martinez-Jaramillo, 2007; Martinez-Jaramillo

and Tsang, 2009) investigated the different conditions

under which the statistical properties of an artificial

stock market resemble those of a real financial mar-

ket. Their approach replicated the stylized facts of

a financial market far more accurately than my own;

this was possible by including and adjusting a much

larger number of parameters.

7 CONCLUSIONS

Those heuristics and biases which contribute to be-

havioural finance were identified, and used to build

a theoretical model of market action which simulates

the aggregates of many interacting agents. The arti-

ficial market exposed the effect of varying the pro-

portion of technical analysts to fundamental analysts.

It pays to be among the majority, whether a funda-

mental analyst, or a technical analyst. The artificial

stock market replicates mean returns, the standard de-

viation of returns, the absolute returns correlation and

the squared returns correlation of a real stock market,

but failed to accurately replicate the skewness, kurto-

sis and autocorrelation of returns. This implies that

the model has failed to capture some of the dynamics

underlying the process of price formation.

ACKNOWLEDGEMENTS

Thanks to David Barber, Edward Tsang and the

anonymous reviewers for various suggestions.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

298

REFERENCES

Arthur, W. B., Holland, J. H., LeBaron,

B., Palmer, R., and Tayler, P. (1997).

http://www.santafe.edu/research/publications/wpabst

ract/199612093 Asset pricing under endogenous

expectations in an artificial stock market. In Arthur,

W. B., Durlauf, S. N., and Lane, D. A., editors,

The Economy as an Evolving Complex System II,

volume XXVII of Santa Fe Institute Studies in the

Sciences of Complexity, pages 15–44, Reading, MA.

Addison-Wesley.

Barberis, N., Shleifer, A., and Vishny, R. (1998).

http://dx.doi.org/10.1016/S0304-405X(98)00027-0 A

model of investor sentiment. Journal of Financial

Economics, 49(3):307–343.

Boyson, N. M. (2003). http://www.edhec-risk.com/site ed

hecrisk/public/research news/choice/RISKReview10

74252964311707089 Why do experienced hedge fund

managers have lower returns? Working paper, Purdue

University.

Farmer, J. D., Patelli, P., and Zovko, I. I. (2005).

http://www.pnas.org/content/102/6/2254.abstract The

predictive power of zero intelligence in financial mar-

kets. Proceedings of the National Academy of Sci-

ences of the United States of America, 102(6):2254–

2259.

Gode, D. K. and Sunder, S. (1993).

http://www.jstor.org/stable/2138676 Allocative

efficiency of markets with zero-intelligence traders:

Market as a partial substitute for individual rationality.

Journal of Political Economy, 101(1):119–137.

Hong, H. and Stein, J. C. (1999).

http://www.afajof.org/journal/abstract.asp?ref=0022-

1082&vid=54&iid=6&aid=184&s=-9999 A unified

theory of underreaction, momentum trading, and

overreaction in asset markets. The Journal of

Finance, 54(6):2143–2184.

LeBaron, B. (2006). http://dx.doi.org/10.1016/S1574-

0021(05)02024-1 Agent-based computational finance.

In Tesfatsion, L. and Judd, K. L., editors, Handbook

of Computational Economics: Agent-Based Computa-

tional Economics, Volume 2, chapter 24, pages 1187–

1233. Elsevier/North-Holland, Amsterdam.

Lux, T. (1995). http://www.jstor.org/stable/2235156 Herd

behaviour, bubbles and crashes. The Economic Jour-

nal, 105(431):881–896.

Lux, T. (1998). http://dx.doi.org/10.1016/S0167-

2681Socio-economic dynamics of speculative

markets: Interacting agents, chaos, and the fat tails of

return distributions. Journal of Economic Behavior &

Organization, 33(2):143–165.

Lux, T. and Marchesi, M. (1999).

http://www.nature.com/nature/journal/v397/n6719/ab

s/397498a0.html Scaling and criticality in a stochastic

multi-agent model of a financial market. Nature,

397(6719):498–500.

Lux, T. and Marchesi, M. (2000).

http://www.worldscinet.com/ijtaf/03/0304/S0219024

900000826.html Volatility clustering in financial mar-

kets: A microsimulation of interacting agents. Inter-

national Journal of Theoretical and Applied Finance,

3(4):675–702.

Martinez-Jaramillo, S. (2007). http://cswww.essex.ac.uk/

Research/CSP/finance/papers/Martinez-PhD2007.pdf

Artificial Financial Markets: An Agent Based Ap-

proach to Reproduce Stylized Facts and to Study the

Red Queen Effect. PhD thesis, University of Essex,

Colchester.

Martinez-Jaramillo, S. and Tsang, E. P. K. (2009).

http://ieeexplore.ieee.org/xpls/abs all.jsp?arnumber=

4769014 An heterogeneous, endogenous and coevo-

lutionary GP-based financial market. IEEE Transac-

tions on Evolutionary Computation, 13(1):33–55.

Murphy, J. J. (1999). http://www.amazon.com/Technical-

Analysis-Financial-Markets-Comprehensive/dp/0735

200661 Technical Analysis of the Financial Markets:

A Comprehensive Guide to Trading Methods and Ap-

plications. New York Institute of Finance, New York.

Railsback, S. F. (2001). http://rmmc.asu.edu/abstracts/nrm/

vol14-3/rail.pdf Getting “results”: The pattern-

oriented approach to analyzing natural systems with

individual-based models. Natural Resource Modeling,

14(3):465–475.

Samuelson, W. and Zeckhauser, R. (1988).

http://www.springerlink.com/content/h1548722q126

n043/ Status quo bias in decision making. Journal of

Risk and Uncertainty, 1(1):7–59.

Sewell, M. (2011a). http://www-typo3.cs.ucl.ac.uk/fileadm

in/UCL-CS/images/Research

Student Information/R

N 11 01.pdf Characterization of financial time series.

Research Note RN/11/01, University College London,

London.

Sewell, M. (2011b). http://www.springerlink.com/content/n

3k66780q6107653/ The evolution of entrepreneurs

and venture capitalists. In Yazdipour, R., editor, Ad-

vances in Entrepreneurial Finance: With Applications

from Behavioral Finance and Economics, chapter 11,

pages 205–217. Springer, New York.

Shiller, R. J. (1981). http://www.jstor.org/stable/1802789

Do stock prices move too much to be justified by sub-

sequent changes in dividends? The American Eco-

nomic Review, 71(3):421–436.

Society of Technical Analysts (1999). Analysis. STA

Diploma Course.

Taylor, S. J. (2005). http://press.princeton.edu/titles/8055.

html Asset Price Dynamics, Volatility, and Prediction.

Princeton University Press, Princeton, NJ.

Theobald, M. and Yallup, P. (2004).

http://dx.doi.org/10.1016/S1386-4181%2802%2900

068-X Determining security speed of adjustment co-

efficients. Journal of Financial Markets, 7(1):75–96.

Tversky, A. and Kahneman, D. (1973).

http://dx.doi.org/10.1016/0010-0285(73)90033-9

Availability: A heuristic for judging frequency and

probability. Cognitive Psychology, 5(2):207–232.

Tversky, A. and Kahneman, D. (1974).

http://www.sciencemag.org/cgi/content/abstract/185/

4157/1124 Judgment under uncertainty: Heuristics

and biases. Science, 185(4157):1124–1131.

AN ARTIFICIAL STOCK MARKET

299

Weiss, G., editor (1999). http://mitpress.mit.edu/catalog/

item/default.asp?ttype=2&tid=8273 Multiagent Sys-

tems: A Modern Approach to Distributed Artificial In-

telligence. The MIT Press, Cambridge, MA.

Wooldridge, M. (2002). http://eu.wiley.com/WileyCDA/

WileyTitle/productCd-047149691X.html An Introduc-

tion to Multiagent Systems. Wiley, Chichester.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

300