COPING WITH LONG TERM MODEL RISK IN MARKET RISK

MODELS

Manuela Spangler

1

and Ralf Werner

2

1

Deutsche Pfandbriefbank AG, Risk Models & Analytics, Freisinger Str. 5, 85716 Unterschleissheim, Germany

2

Hochschule M¨unchen, Fakult¨at f¨ur Informatik und Mathematik, Lothstr. 64, 80335 M¨unchen, Germany

Keywords:

Model risk, Risk management.

Abstract:

The recent financial crisis has shown that most market risk models – even if they deliver sufficiently accurate

risk figures over short time horizons – are not able to provide reliable forecasts for risk figures over longer time

horizons like three, twelve or 36 months, which are the basis for both limit management and economic capital

planning. As a potential remedy the concept of potential future market risk can be used to deal with such long

term model risks in market risk measurement. Based on a toy example we will outline how this concept can

be applied for new business planning or for limit setting and capital buffer definitions.

1 DEFINITION OF MODEL RISK

In the context of market risk measurement, model risk

is usually understood as the risk that the model used

for market risk measurement is specified wrongly and

does therefore not or not fully capture the risks it was

designed to measure (Jorion, 2007), Section 21.2.6.

In the following, however, we focus on a different

point of view along the lines of (Jorion, 2007), Chap-

ter 9, and thus we need to distinguish between differ-

ent kinds of model risk.

Short Term Model Risk. Short term model risk arises

from the fact that model assumptions may be violated,

which also includes parameter uncertainty (i.e. esti-

mation risk). Taking the example of a delta-normal

VaR model, the linear impact of risk factor changes

on the portfolio value as well as the normal distribu-

tion assumption with constant volatility for risk fac-

tor changes are such assumptions. Short term model

risk is usually an issue for the daily risk measurement

process, see for example (Figlewski, 2003) or (Hen-

dricks, 1996). (Berkowitz and OBrien, 2002) anal-

yse the accuracy of VaR forecasts for banks’ trading

desks based on the models used in practice. There

is vast literature on how short term model risk can

be identified and controlled via back-testing proce-

dures, see e.g. (Kupiec, 1995), (Christoffersen et al.,

2001), (Christoffersen and Pelletier, 2004) or more

recently (Berkowitz et al., 2011); or how it can be

handled via more sophisticated models, see for in-

stance (Kamdem, 2005) for an extension to elliptical

distributions, (Alexander, 2001) for a non-parametric

linear historical or Monte-Carlo VaR or (Bams and

Wielhouwer, 2001) for adjustment factors for estima-

tion risk. (Alexanderand Sarabia, 2011) quantify VaR

model risk and derive an add-on factor for market

risk capital. Similarly, (Kerkhof et al., 2010) derive

an add-on to capital reserves which accounts for VaR

model risk and distinguishes between estimation and

misspecification risk.

Long Term Model Risk. This kind of model risk cov-

ers the risk that the reported daily risk figures change

in an adverse fashion over longer time scales, al-

though the portfolio itself remains unchanged. This

means that even if the risk is reasonably measured

and predicted for small time horizons by the model,

the market risk number might change on a daily basis

and, therefore, cannot be used for longer term plan-

ning. Delta-normal VaR figures, for example, are

highly impacted by (i) changing volatilities and cor-

relations, and (ii) changing portfolio sensitivities. Be-

fore the beginning of the financial crisis, long term

model risk was not considered to be an issue for banks

or financial institutions

1

, as any unwanted shift or in-

crease in VaR figures could be easily countered by

hedging or risk reduction actions. Since the second

half of 2007, however, significant parts of trading

1

As one of a few exceptions, let us mention the exposi-

tions by (Jorion, 2007), Section 9.5 or (Danielsson, 2002),

who point out that VaR figures are volatile and not reliable

in general.

239

Spangler M. and Werner R..

COPING WITH LONG TERM MODEL RISK IN MARKET RISK MODELS.

DOI: 10.5220/0003712902390246

In Proceedings of the 1st International Conference on Operations Research and Enterprise Systems (ICORES-2012), pages 239-246

ISBN: 978-989-8425-97-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

portfolios became more and more illiquid, risks could

no longer be hedged adequately, and risk figures in-

creased in an unpredicted fast and threatening fash-

ion. Potential consequences were limit breaches, or in

worst case situations, additional capital requirements

to keep the financial institution solvent. In the follow-

ing, we therefore discuss long term model risk only,

with a special focus on the implications for limit man-

agement and economic capital planning.

As long term model risk is a rather novel issue,

there is not much literature available. (Christoffersen

and Goncalves, 2005) or (Jorion, 1996), who investi-

gate the statistical properties of VaR figures in detail,

propose confidence intervals around VaR estimates to

cover model risk. Their expositions are, however,

mainly centred around short term model risk. To

quantify long term model risk we are more interested

in the extent to which VaR figures may change in fu-

ture. Therefore, we need to take into account potential

future evolutions of market environments. Taking the

ideas by Christoffersen, Goncalves and Jorion further,

this immediately leads to the concept of potential fu-

ture value-at-risk (PFVaR), developed by (Spangler

and Werner, 2010). There, a detailed explanation of

the concept is given together with a specific example

on the computation of the corresponding risk figures.

Here, we briefly recall the main definitions of PFVaR

from (Spangler and Werner, 2010), before we focus

on the application of the concept in risk management.

2 THE CONCEPT OF

POTENTIAL FUTURE

VALUE-AT-RISK

For the proper definition of PFVaR, let us fix a static

portfolio, a reference time t

R

(i.e. today) and let us de-

note the future (random) VaR figure at time t > t

R

with

VaR

α

(t) for a given VaR level α.

2

Similarly to the po-

tential future exposure concept in counterparty credit

risk (see (Pykhtin, 2005) for more details), a few ver-

sions of PFVaR have been introduced by Spangler and

Werner:

• The expected VaR at time T > t

R

is the average of

the potential future VaR at time T:

EVaR

α

(T) := E[VaR

α

(T) | F

t

R

]. (1)

• The peak VaR at time T > t

R

is the maximum VaR

that is expected to occur at time T at a given con-

fidence level (quantile) β ∈ (0, 1):

PVaR

α,β

(T) := q

β

[VaR

α

(T) | F

t

R

]. (2)

2

As the VaR time horizon h is fixed throughout the fol-

lowing, we skip it for notational convenience.

• The maximum peak VaR until time T > t

R

is the

maximum VaR that is expected to occur in [t

R

, T]

at a given confidence level β ∈ (0, 1):

MPVaR

α,β

(T) := q

β

max

t∈[t

R

,T]

[VaR

α

(t) | F

t

R

]

.

(3)

All introduced quantities are conditional on the

information (i.e. the corresponding filtration F

t

R

)

given at the reference time t

R

, which means that

quantiles or expectations calculated at time t

R

only include information available up to time t

R

.

It has to be noted that for a one-to-one relation-

ship of PFVaR and the potential future exposure

concept in counterparty credit risk, the maximum

peak VaR would have to be defined by

MPVaR

α,β

(T) = max

t∈[t

R

,T]

PVaR

α,β

(t)

= max

t∈[t

R

,T]

q

β

(VaR

α

(t) |F

t

R

)

.

In the above definition (3), the order of maximiza-

tion and percentile has been switched as it is more

meaningful for practical applications: the maxi-

mum peak VaR is exceeded by VaR

α

(t) in the pe-

riod [t

R

, T] with a probability of 1− β.

The concept of potential future VaR can be easily gen-

eralized to potential future market risk when replac-

ing VaR by any arbitrary market risk measure. For

the calculation of the PFVaR figures an appropriate

model needs to be specified to project risk figures

forward in time. Analogously to risk modelling, the

choice of the appropriate methodology, i.e. the choice

between historical bootstrapping or Monte Carlo sim-

ulation (e.g. GARCH models or discretized SDEs),

has a strong impact on the resulting figures. Depend-

ing on the purpose and on the time horizon, Span-

gler and Werner suggested to either use a pure and

simplistic historical bootstrapping method similarly

to (Christoffersen and Goncalves, 2005) or, alterna-

tively to use a more sophisticated integrated economic

scenario generator,see (Davidson, 2008), which is es-

pecially designed for projections of the joint evolu-

tion of risk factors over longer time horizons. For the

specific calculation of the PFVaR figures and the con-

crete choice of the model, let us refer to (Spangler and

Werner, 2010).

3 APPLICATIONS OF PFVAR

PFVaR as such represents an add-on to existing mar-

ket risk frameworks without the need to amend a

bank’s current market risk systems. For instance,

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

240

based on the algorithm presented by Spangler and

Werner, a bank’s market risk system can be re-used

to calculate the corresponding PFVaR figures without

much additional effort. The requirements on the com-

putational capabilitites of the market risk (and front

office) system are actually the same as for CVA (coun-

terparty value adjustment) or counterparty credit risk

calculations, which are nowadays already in place for

most banks.

From a management perspective, PFVaR provides

a consistent framework to measure and handle long

term model risk within a bank’s planning and man-

agement processes:

• Taking the expected VaR at certain time horizons

T

1

, .. . ,T

n

yields precise information on how fast

risk will decay on average, especially compared to

traditional time-to-maturity or duration concepts.

The expected VaR not only covers the ageing ef-

fect of the portfolio, but can also account for ex-

pected increases in volatility or correlation. Thus,

the sustainability of hedging activities over longer

time horizons can easily be analyzed based on the

expected VaR.

It is furthermore well-suited for the planning

process, and especially suitable for planning of

new business. In general, new business volumes

should be chosen in such a way that the expected

future risk fits to the overall planning figures for

future time horizons. In such a context, time hori-

zons from one to three years are usually consid-

ered by banks. These longer time horizons there-

fore require the same models for the evolution of

the risk factors as in long term counterparty credit

risk modelling. However, in contrast to scenar-

ios calibrated for counterparty credit risk purposes

based on historical data, the focus on planning

usually requires that the expected risk factor evo-

lution coincides with some best estimate planning

scenario provided by a bank’s strategic planning

department.

• The future VaR distribution, and especially the

peak VaR, provides additional valuable insights

for the limit management process, as for a fixed

portfolio it shows by how much future market risk

figures may fluctuate. To avoid limit breaches due

to changes in volatilities and correlation, these

fluctuations should be taken into account when

setting limits based on reasonable levels of β.

Whereas any new trade should be considered

against limits derived from the expected future

VaR, the size of capital buffers in risk capital plan-

ning should be based on the excess of the peak

VaR against the expected VaR. Then, assuming a

limit breach of the expected VaR limit is not due

to new business or trading activities, the excess

of the risk against the limit can be absorbed by

the additional buffer. Only when this buffer is ex-

hausted, a limit breach is reported.

• Further, economic capital models under going-

concern assumptions do not only need to model

trading losses at some future point in time, but

also need to forecast the future VaR consump-

tion.

3

Given the obvious ambiguity about the

future market risk exposure, the peak VaR pro-

vides guidance on how (a maybe downscaled ver-

sion of) the current portfolio would behave in

a stressed environment as assumed by economic

capital models. Thus, in going-concern economic

capital models, market risk capital should be suf-

ficient to cover both severe losses (i.e. decreases

in market value) plus a stressed market risk level.

Taking the stress test point of view, peak VaR

also represents a good choice for VaR figures

within stress scenarios used in macro-economic

integrated stress tests. The peak VaR therefore

can act as a supplement to usual risk figures, if

β is chosen in accordance to the severity of the

applied stress test.

• Finally, the maximum peak VaR represents the

maximum VaR figure which may be observed in a

stress scenario where markets become completely

illiquid and risks cannot be reduced by hedging

activities. Given the maximum peak VaR, both

the likelihood as well as the amount of a potential

limit breach can be derived, which can, for exam-

ple, be used in contingency planning.

4 EXAMPLE: TWO-FACTOR

DELTA-NORMAL VAR

FRAMEWORK

Let us consider a hypothetical portfolio consisting of

Greek and Spanish floating rate government bonds

with different maturities. Since the portfolio consists

of floating rate bonds only, interest rate risk plays

a minor role and will therefore be neglected in the

following examinations. The remaining details of

the setup are the same as in Spangler and Werner:

for credit spread risk measurement, we use a two-

factor delta-normal VaR approach; credit spread mar-

ket movementsare explained by two credit spread risk

factors (zero spreads) which are assumed to havea flat

3

Under a going-concern point of view, it cannot be

reasonably assumed that all market risks are completely

hedged.

COPING WITH LONG TERM MODEL RISK IN MARKET RISK MODELS

241

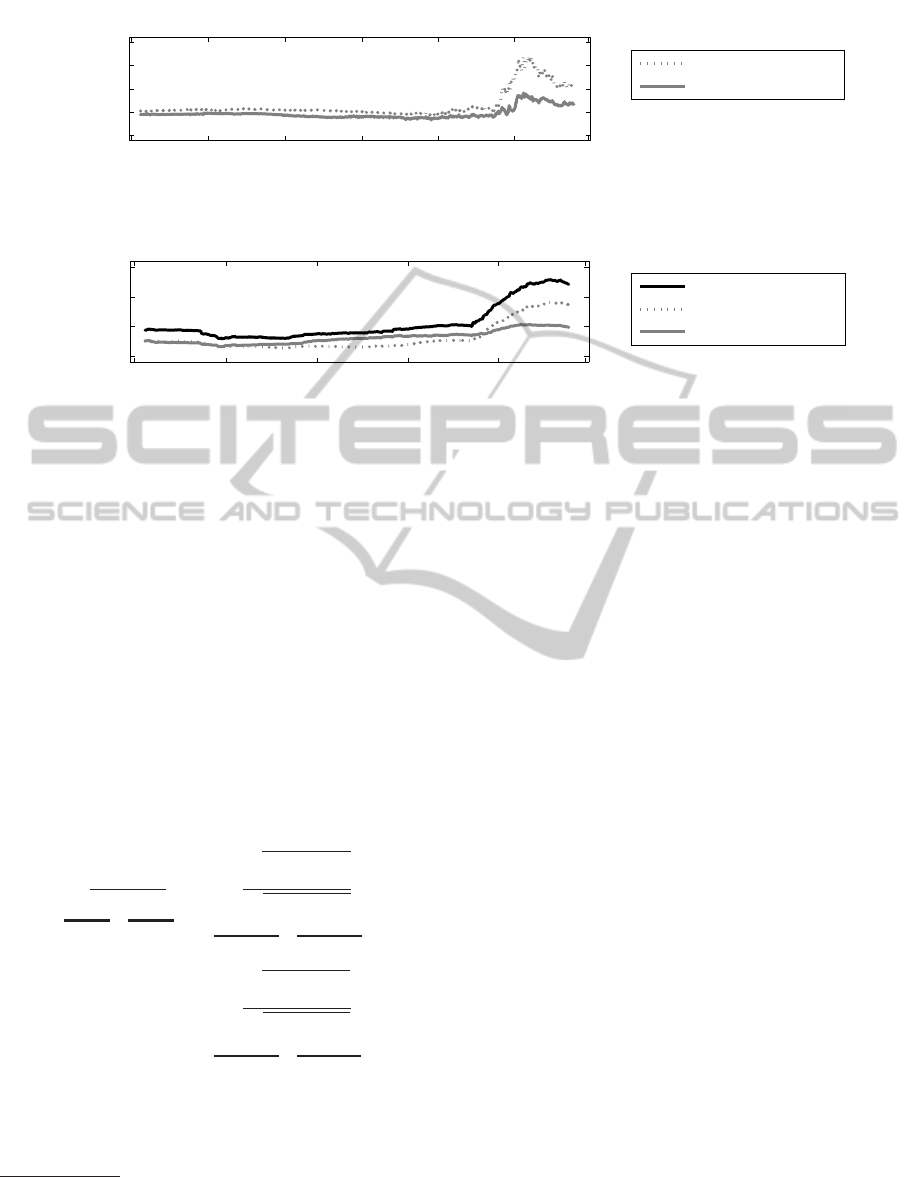

2004 2005 2006 2007 2008 2009 2010

−100

0

100

200

300

Time

Spread (bp)

Risk factor time series

10Y Greek spread

10Y Spanish spread

2005 2006 2007 2008 2009 2010

0

50,000

100,000

150,000

Time

VaR

Credit spread risk figures

Total portfolio

Greek subportfolio

Spanish subportfolio

Figure 1: Risk factors and corresponding portfolio credit spread risk figures over time.

term structure that can change over time

4

. As risk fac-

tor proxies we have chosen 10-year asset swap spread

time series for Greek and Spanish government bonds,

cf. Figure 1, upper part. The lower part of Figure 1

shows the historical 1-day 99% credit spread VaR of

the assumed portfolio.

4.1 Portfolio VaR Decomposition

In order to identify the impact of changing volatili-

ties and correlations, changes in risk factor levels and

ageing effects on VaR figures let us consider Figure 2

which shows the decomposition of logarithmic VaR

changes from initial time t

I

to time T according to

(4), decomposed into changes caused by shifts in the

covariance matrixC

t

and changes in the sensitivity S

t

.

ln

VaR

α

(T)

VaR

α

(t

I

)

| {z }

Total impact

=ln

q

S

⊤

T

·C

T

· S

T

q

S

⊤

T

·C

t

I

· S

T

| {z }

Impact of covariance

(4)

+ln

q

S

⊤

T

·C

t

I

· S

T

q

S

⊤

t

I

·C

t

I

· S

t

I

| {z }

Impact of sensitivity

(5)

Although the influence of sensitivities on VaR figures

is considerable – VaR is reduced by up to ≈ 50%

of the original value – the impact of the covariance

4

As rather similar results are obtained if a more general

framework (i.e. varying term structures) is considered, we

focus on this simplified setting for the brevity and clarity of

presentation.

matrix is even stronger: it accounts for a factor

of ≈ 570%. Although the effects tend to cancel

out to a certain extent, a once feasible portfolio

(i.e. within market risk limits) can easily exceed its

limit over time by a large or actually economic capital

threatening amount. For a further analysis, Figure 2

also details the effects of the sensitivities and the

covariance matrix, which shows that for the given

portfolio, ageing dominates level effects. Further,

changes caused by covariance shifts are mainly due

to (Greece) volatilities, not correlation.

Looking at a rolling one-year horizon instead of

the complete VaR history, Figure 3 displays a

rather constant influence of ageing, leading to an

annual risk reduction of about 15% per annum

(VaR

α

(t) ≈ 0.85 · VaR

α

(t − 1Y)) compared to a

maximum increase of 270% over one year caused by

rising volatilities. From Figure 3 it can be seen that

VaR increases steadily from 2007 to 2009 and then

explodes from the beginning of 2009 onwards.

4.2 PFVaR Analysis

To illustrate the concept of PFVaR, Figure 4 shows

a sample of 100 bootstrapped scenarios of length

250 days against the actual historical evolution of the

Spanish credit spread risk factor.

As can be seen from Figure 5 (upper part), the

concept of potential future works well before Septem-

ber 2008.

• The expected VaR shows that VaR reducing age-

ing effects are expected to be compensated by an

increase in volatility (due to the moving estima-

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

242

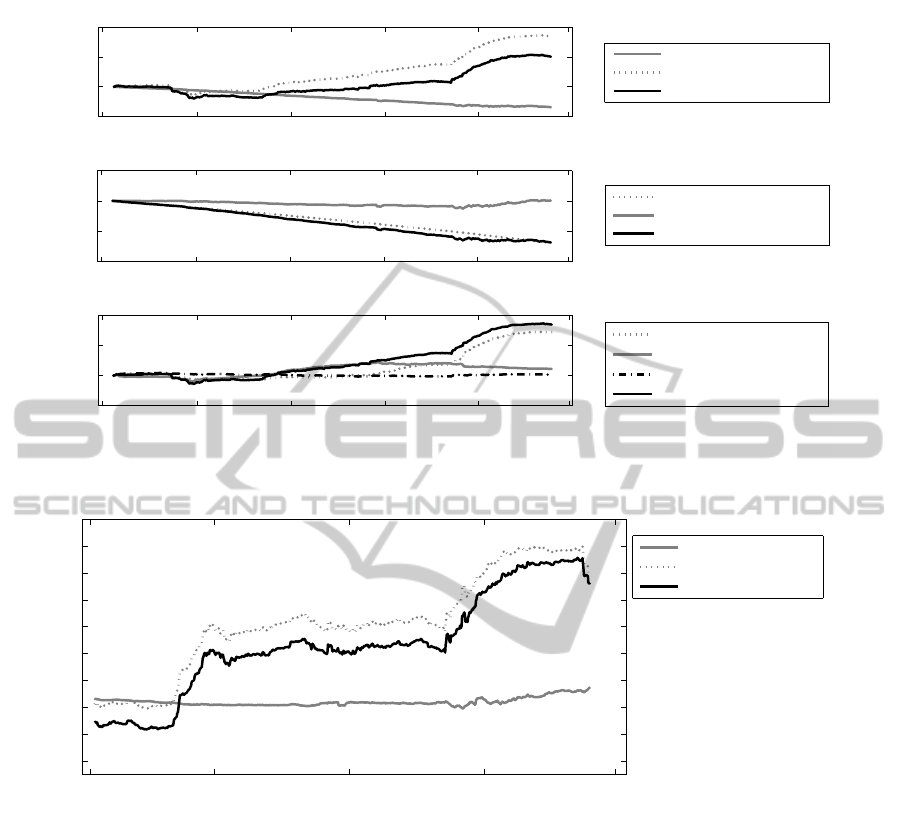

Impact of sensitivity

Impact of covariance

Total impact

2005 2006 2007 2008 2009 2010

−1

0

1

2

Time

Logarithmic

impact

Decompositon of total impact

2005 2006 2007 2008 2009 2010

−1

−0.5

0

0.5

Decompositon of sensitivity impact

Time

Logarithmic

impact

Impact of aging

Impact of level

Total impact of sensitivity

2005 2006 2007 2008 2009 2010

−1

0

1

2

Decompositon of covariance impact

Time

Logarithmic

impact

Impact of volatility (GR)

Impact of volatility (ES)

Impact of correlation

Total impact of covariance

Figure 2: Impact of sensitivity and covariance parameters on portfolio VaR.

2006 2007 2008 2009 2010

−0.6

−0.4

−0.2

0

0.2

0.4

0.6

0.8

1

Time

Logarithmic Impact

1Y rolling decomposition of total impact

Impact of sensitivity

Impact of covariance

Total impact

Figure 3: Impact of sensitivity and covariance parameters on portfolio VaR over a rolling one-year time horizon.

tion window), resulting in relatively stable VaR

figures on average. The (maximum) peak VaR

gives a reasonable upper bound on VaR, as long

as there is no regime switch in the market.

• Without additional capital, no new business can

be planned for, as the expected VaR remains on

the same level as the initial VaR of January 2008.

This is in contrast to the maturity or duration pro-

file which would have indicated a potential for

new business around 5% to 15%. The gap is

mainly due to increasing volatilities as a very calm

period at the beginning of 2007 is dropped from

the rolling 250-day time window for the historical

data used for VaR calculations.

• While the VaR limit can be fixed at the current

level and no new business is possible, an addi-

tional limit or capital buffer for market risk of

around 30% is indicated by the model. The peak

VaR figure signals that such a buffer might be-

come necessary due to rising volatilities.

However, as can also be clearly seen in the upper

part of Figure 5, the whole approach would have only

worked until autumn 2008; the regime switch due to

the financial crisis in September 2008 could not have

been predicted by pure historical bootstrapping. Now,

taking the possibility of regime shifts into account (for

instance, a 1% probability to switch to an unstable

economy with tripled volatilities), the picture dramat-

ically changes, cf. the lower part of Figure 5.

• The MPVaR ratio increases from 130% to almost

200%, which means that the capital buffer should

have been set around 100% of the initial market

COPING WITH LONG TERM MODEL RISK IN MARKET RISK MODELS

243

Jan 07 Apr 07 Jul 07 Oct 07 Jan 08 Apr 08 Jul 08 Oct 08 Jan 09

−150

−100

−50

0

50

100

Time

Credit spread (bp)

Simulated Spanish credit spread path

True path

Simulated path

Figure 4: Spanish credit spread paths obtained by historical bootstrapping.

Jan 08 Mar 08 May 08 Jul 08 Sep 08 Nov 08 Jan 08

0.5

1

1.5

2

2.5

Time

VaR / Original VaR

Potential future portfolio credit spread VaR (no stress)

True VaR

EVaR

PVaR

MPVaR

Jan 08 Mar 08 May 08 Jul 08 Sep 08 Nov 08 Jan 09

0.5

1

1.5

2

2.5

Time

VaR / Original VaR

Potential future portfolio credit spread VaR (stress)

True VaR

EVaR

PVaR

MPVaR

Figure 5: Potential future credit spread VaR (α = β = 99%) and actual credit spread VaR evolution under no stress and in a

stressed scenario.

risk capital instead of only 30%. Interestingly,

due to the low probability of moving to such a

stressed regime such a capital buffer is not neces-

sary for the near future, however, becomes much

more likely for longer time horizons.

• As an alternative to such a large capital buffer for

a volatility increase, alternative measures could

be considered in contingency planning, for exam-

ple so called crash puts, i.e. far out-of-the-money

CDS options or redemption options on the origi-

nal bonds.

This analysis demonstrates that an over-reliance on

historical data might lead to an underestimation of fu-

ture risk. Instead, severalregimes should be taken into

account, and, preferably be linked to stress test con-

cepts. For example, one could use assumptions from

stress test concepts (which are nowadays mandatory

due to Basel II and Basel III) and incorporate these

into potential stress regimes in the simulation of fu-

ture market conditions. In addition, counteracting

measures identified as potential remedies in stress sit-

uations should be included in the simulation of the

potential future market risk. In such a way, current

stress testing efforts can be accompanied by an ad-

ditional quantitative analysis based on the concept of

PFVaR.

This analysis furthers shows that the correct esti-

mation of the future evolution has a significant impact

on the resulting risk figures. Although the whole ap-

proach is applicable in a rather general context, i.e.

it is not restricted to multivariate normal distribution

or linear dependence of instrument prices on risk fac-

tors, any difference of the simulated future from the

true future distribution results in a deviation of the es-

timated figures from realized figures later on.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

244

4.3 Application in Portfolio

Optimization

In principle, the concept of PFVaR can also be used

in a portfolio optimization context. Technically, it is

quite simple to generalize traditional risk-return op-

timization approaches to the newly suggested PFVaR

measures. However, although the replacement of or-

dinary risk measures like VaR by PFVaR measures

looks quite simple on first glance, it has to be noted

that the interpretation changes quite significantly: In

traditional approaches, the expected return from time

t

R

to t

R

+ h, i.e. E[V

t

R

+h

− V

t

R

], is compared against

a risk measure applied to the profit-and-loss distribu-

tion of the net asset valuesV

t

R

+h

−V

t

R

(here, h denotes

the time horizon of the risk measure). If the risk mea-

sure is now replaced by a potential future risk mea-

sure, then the risk of the profit-and-loss distribution of

V

T+h

−V

T

for some future time T is compared against

the return from time t

R

to T (or T +h), which does not

represent a meaningful setup.

Instead, it is much more meaningful to introduce

additional constraints based on PFVaR measures in

traditional portfolio optimization. For example, one

might consider the situation that the expected re-

turn from time t

R

to T should be maximized (usually

T − t

R

represents one year), while risk capital – rep-

resented by the VaR of the profit-and-loss distribution

of V

T

−V

t

R

– is limited by the available capital of the

bank. In such a case, it would be meaningful to intro-

duce additional PFVaR constraints for smaller time

horizons, which would guarantee that a short term

VaR on a time horizon of h does not exceed a certain

much smaller limit throughout the whole time period

from t

R

to T.

5 RESUMEE

We have shown that VaR figures cannot be expectedto

be constant, but may vary overtime due to severalrea-

sons, such as changes in covariance parameters and

sensitivities. We have further observed that all effects

might be similarly important and need to be taken into

account. As a remedy against model risk arising from

these changes, the new concept of potential future

market risk has been introduced and motivated and

it has been argued how this can be incorporated into

a bank’s planning cycle. Although PFVaR numbers

themselves depend on the simulated risk factors, i.e. a

certain dependence on models and assumptions is al-

ways inherent, we have illustrated that this concept

has several powerful applications, especially in new

business planning and economic capital buffer plan-

ning. Still, a careful selection of the simulation as-

sumptions is key to a successful application of the PF-

VaR concept. Eventually, we believe that the PFVaR

concept can also be successfully applied in a portfo-

lio optimization context, but we leave this for future

research, as this needs much more detailed technical

considerations.

REFERENCES

Alexander, C. (2001). Market Models – A Guide to Finan-

cial Data Analysis. John Wiley & Sons, Chicago.

Alexander, C. and Sarabia, J. M. (2011). Value-at-Risk

Model Risk. SSRN eLibrary.

Bams, D. and Wielhouwer, J. L. (2001). Empirical Issues

in Value-At-Risk. Astin Bulletin, 31(2):299–315.

Berkowitz, J., Christoffersen, P., and Pelletier, D. (2011).

Evaluating Value-at-Risk models with desk-level data.

Management Science.

Berkowitz, J. and OBrien, J. (2002). How accurate are

Value-at-Risk models at commercial banks? Journal

of Finance, (55):1093–1111.

Christoffersen, P. and Goncalves, S. (2005). Estimation

Risk in Financial Risk Management. Journal of Risk,

7(3):1–28.

Christoffersen, P., Hahn, J., and Inoue, A. (2001). Testing

and comparing Value-at-Risk measures. Journal of

Empirical Finance, (8):325–342.

Christoffersen, P. and Pelletier, D. (2004). Backtesting

Value-at-Risk: a duration-based approach. Journal of

Financial Econometrics, 1(2):84–108.

Danielsson, J. (2002). The Emperor has no Clothes: Limits

to Risk Modelling. Journal of Banking and Finance,

26:1273–1296.

Davidson, C. (2008). The best scenario. Risk Magazine,

June.

Figlewski, S. (2003). Estimation Error in the Assessment of

Financial Risk Exposure. Working Paper.

Hendricks, D. (1996). Evaluation of Value-at-Risk Mod-

els Using Historical Data. Economic Policy Review,

Federal Reserve Bank of New York, April:39–69.

Jorion, P. (1996). Risk

2

: Measuring the Risk in Value at

Risk. Financial Analysts Journal, Nov/Dec:47–56.

Jorion, P. (2007). Value At Risk: The New Benchmark for

Managing Financial Risk. McGraw-Hill, New York,

3rd edition.

Kamdem, J. S. (2005). Value-At-Risk And Expected Short-

fall For Linear Portfolios With Elliptically Distributed

Risk Factors. International Journal of Theoretical and

Applied Finance, 8(5):537–551.

Kerkhof, J., Melenberg, B., and Schumacher, H. (2010).

Model risk and capital reserves. Journal of Banking

and Finance, (34):267–279.

Kupiec, P. (1995). Techniques for Verifying the Accuracy

of Risk Measurement Models. Journal of Derivatives,

3:73–84.

Pykhtin, M. (2005). Counterparty Credit Risk Modelling.

Risk Books, London.

COPING WITH LONG TERM MODEL RISK IN MARKET RISK MODELS

245

Spangler, M. and Werner, R. (2010). Potential Future Mar-

ket Risk. In R¨osch, D. and Scheule, H., editors, Model

Risk – Identification, Measurement and Management,

pages 315–337. Risk Books.

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

246