EXPLORING FIRMS FINANCIAL DECISIONS BY HUMAN AND

ARTIFICIAL AGENTS

Towards an Assessment of Minsky’s Financial Instability Hypothesis

Gianfranco Giulioni, Edgardo Bucciarelli and Marcello Silvestri

Department of Quantitative Methods and Economic Theory, University of Chieti-Pescara, Viale Pindaro 42, Pescara, Italy

Keywords:

Firms financial decision, Experimental economics, Heuristic optimization, Differential evolution.

Abstract:

In this paper we take the first step of a project aimed at assessing Minsky’s Financial Instability Hypothesis.

Differently from a number of existing studies, our aim is to tackle the issue by combining two approaches: ex-

perimental and computational economics. The main goal of this paper is in fact to build artificial agents whose

behavior mimic that of experimental agents. Two are the results worth to be mentioned. First, the heuristic

approach could provide for a valid alternative micro-foundation for the financial decisions of entrepreneurs.

Secondly, financial behaviors could mainly depend on the volatility of demand and on the accuracy of demand

forecasts instead of depending on the business cycle phases as usually pointed out by models inspired by

Minsky’s economic thought.

1 INTRODUCTION

This work is an effort toward the goal of assessing

if, under which conditions and in what extend the Fi-

nancial Instability Hypothesis (FIH) (Minsky, 1974;

Minsky, 1975; Minsky, 1982; Minsky, 1986) could be

judged as valid. It is only right to tell that this goal is

very ambitious due to the several “ingredients” used

in the FIH. This paper focuses on what we think to

be the essential ingredient: the entrepreneur behav-

ior. Our intention is to build artificial agents whose

behavior is similar to that of real agents. With artifi-

cial entrepreneurs in our hand, we intend to study in

future works the properties of aggregate variables de-

rived from a simulated economy populated by a high

number of such artificial entrepreneurs.

The paper is organized as follows. In section 2 we

build a simple microeconomic structure which ease

the monitoring of the financial aspects of the firm.

This structure is submitted to selected people in a set

of laboratory experiments described in section 3. In

section 4 we build an artificial agent whose behav-

ioral rules are economically grounded. The param-

eters of the artificial agents are endogenously estab-

lished in section 5 by using the differential evolution

algorithm. Section 6 gives conclusions and discusses

future research opportunities.

2 THEORETICAL BACKGROUND

The financial aspects of a firm are surveyed by a bal-

ance sheet in which debt (B) and equity (A) are lia-

bilities facing the capital endowment (K). To ease the

monitoring of the financial part, we use a very simple

production function: y = K.

The economic aspects of firms are described by

the economic result equation given by

π

j,t

= y

j,t

− c

p

j,t

− c

f

j,t

(1)

where y

j,t

is production of entrepreneur j at time t and

c

p

j,t

and c

f

j,t

denotes production and financing costs re-

spectively. Price are not involved because we assume

subjects have not “money illusion”.

We will now give details on the production and

financing costs.

Production Costs. The market value of a unit of in-

put is denoted by ˆw. However, the final cost for the

firm depends on adjustment costs as we explain here-

after.

In each period, the market gives a “spontaneous”

level of demand (y

∗

j,t

) for a firm. The production

must be made before the level of y

∗

j,t

is known.

1

The

1

This is how uncertainty, which is an essential element

in Minsky’s thought, is introduced in our framework.

184

Giulioni G., Bucciarelli E. and Silvestri M..

EXPLORING FIRMS FINANCIAL DECISIONS BY HUMAN AND ARTIFICIAL AGENTS - Towards an Assessment of Minsky’s Financial Instability

Hypothesis.

DOI: 10.5220/0003737401840189

In Proceedings of the 4th International Conference on Agents and Artificial Intelligence (ICAART-2012), pages 184-189

ISBN: 978-989-8425-96-6

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

task of an entrepreneur is that of making a good fore-

cast for the “spontaneous” level of demand. In fact,

wrong forecasts (both shortages and excesses) causes

a “fast” adaptation of quantities which in turn implies

additional costs (Bagliano and Bertola, 2004, p. 48).

2

It is common to model these adjustment costs using

convex functions (Koeva, 2009); in this paper we will

use a quadratic function: β((y

j,t

− y

∗

j,t

)/y

∗

j,t

)

2

. The

total cost of a unit of input for the entrepreneur is thus

w

j,t

= ˆw+ β

y

j,t

− y

∗

j,t

y

∗

j,t

!

2

where β is a parameter which regulates the relevance

of adjustment costs. Consequently, production costs

can be written as

c

p

j,t

= y

j,t

w

j,t

= ˆwy

j,t

+ βy

j,t

y

j,t

− y

∗

j,t

y

∗

j,t

!

2

.

Financing Costs. They are given by

c

f

j,t

= r

B

B

j,t

+ r

A

A

j,t

where r

B

is the interest rate charged by the bank and

r

A

the reward for shares holders.

Making substitutions, using the definition of eq-

uity ratio (a := A/K = A/y) in equation (1) and divid-

ing by K

j,t

we obtain the return on investment (roi:

ρ

j,t

:= π

j,t

/K

j,t

which with our production function

is equal to π

j,t

/y

j,t

):

ρ

j,t

= 1− w− β

y

j,t

− y

∗

j,t

y

∗

j,t

!

2

+

−r

B

(1− a

j,t

) − r

A

a

j,t

. (2)

ρ

j,t

(as well as π

j,t

) reaches a maximum when y

j,t

=

y

∗

j,t

and it gets negative when y

j,t

greatly differs from

y

∗

j,t

.

Let us specify a number of aspects of financial

management. In our simplified model, the financial

aspects can be managed in two occasions within a

production cycle: when the production is set, and

when the economic result is obtained. Given the pro-

duction function we have assumed, changes in the

production capacity modify the financial structure due

to the balance sheet identity K

j,t

= B

j,t

+ A

j,t

. In par-

ticular, equity base is not allowedto change when K is

updated so that ∆K = ∆B at this stage. The movement

of the financial structure is more elaborate when the

2

In our case y

∗

j,t

adapts to y

j,t

. Examples of additional

costs are: opportunity cost due to the short supply when

y

j,t

< y

∗

j,t

and advertising costs to increase y

∗

j,t

when y

j,t

>

y

∗

j,t

.

economic result is obtained. Let us start from the ob-

servation that the economic result (π) can be positive

(profit) or negative (loss). When a profit is realized, it

can be used to refund the bank and reduce debt. The

entrepreneur decision in this case in to set the level

of ∆B in the range [−π,0] (that is −π ≤ ∆B ≤ 0).

The residual amount π + ∆B is withdrawn from the

enterprise and is employed in the entrepreneur’s pri-

vate purposes. In this case, K remains the same so that

∆A = −∆B. When a loss is suffered we have two cases

depending on the fact that π ≥ −A or π < −A. In both

cases, the loss wears out assets (∆K = π), however,

when π ≥ −A, equity base is enough to face the loss

and the firm survives: K and A are both reduced by π

and the balance sheet identity is still verified while A

is still positive. But, when π < −A, the equity base

is not enough to face the loss, and consequently the

bailout procedure is activated. In any case, when a

loss is suffered, the entrepreneur cannot reduce debt.

3 HUMANS

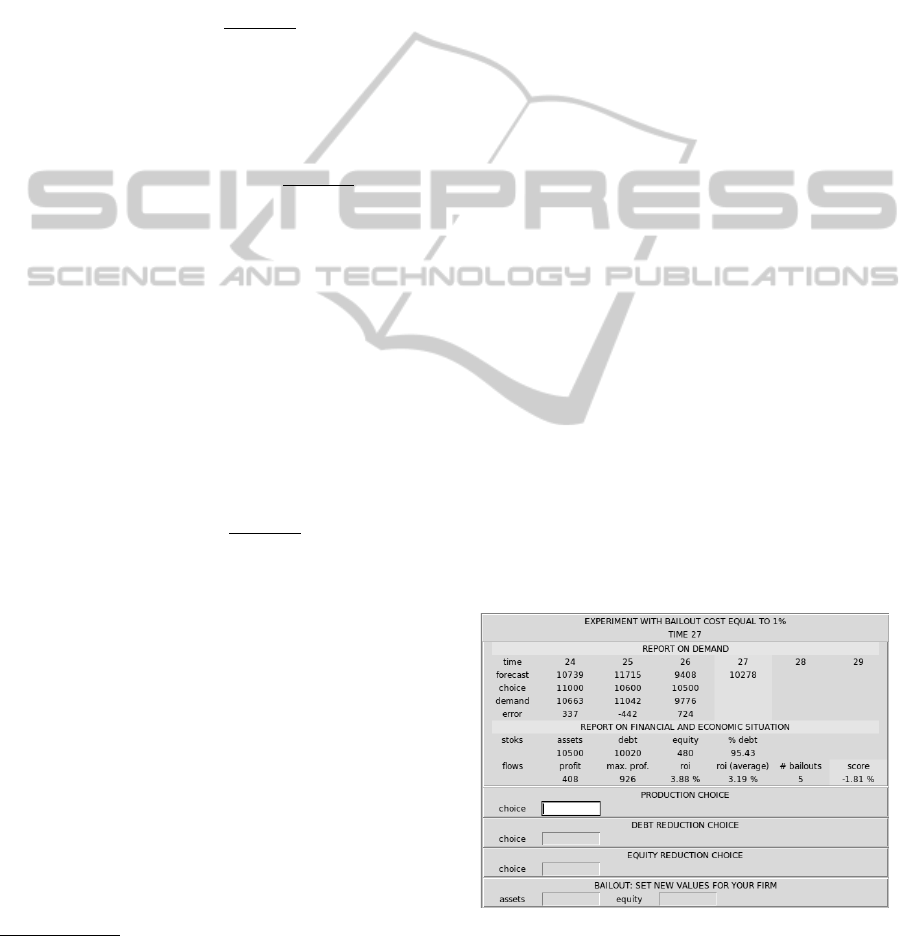

Our first step is to obtain data from humans. To this

aim we have written a computer code, which com-

putes values according to the microeconomic struc-

ture described in the previous section. The code also

generates a Graphical User Interface (see figure 1)

with which selected experimental subjects interacts.

The experimental subjects are endowed with a fore-

casting service whose reliability can change and must

be assessed by the decision makers. In other words

experimental subjects should evaluate when the fore-

casting service helps fighting the uncertainty of set-

ting y

j,t

before y

∗

j,t

is known.

Figure 1: The graphical user interface used by the experi-

mental subjects.

We assign to the agent the goal of maximizing a

score given by

EXPLORING FIRMS FINANCIAL DECISIONS BY HUMAN AND ARTIFICIAL AGENTS - Towards an Assessment of

Minsky's Financial Instability Hypothesis

185

score

j,t

= hρi

j,t

− O

j,t

c

O

(3)

where hρi

j,t

denotes the average roi up to time t, O

j,t

is the number of bailouts until time t and c

O

is a pa-

rameter representing the bailout cost. This goal takes

care of two aspects: i) maximize the entrepreneurs re-

ward and ii) minimize the number bailouts. This gives

a key role to the equity ratio. In fact, a high level of

the ratio favors the achievement of ii) while it makes

harder the achievement of i) because of r

A

> r

B

.

Table 1: Experiments standard deviations.

e σ

˜

σ

B1a 0.02 0.03

B1b 0.02 0.05

B1c 0.02 0.1

B2a 0.03 0.04

B2b 0.04 0.05

B2c 0.05 0.06

Experiments Settings. Being our main goal to un-

derstand agents’ behavior over the business cycle, we

generate an oscillating sequence of demand. We call

it the benchmark pattern of demand and we denote it

ˆy

t

. We obtain it as

ˆy

t

= (1+ cos(0.2t)0.25)10000 t ∈ {0,1,2,...}.

Each experiment (lower script e) is characterized

by a time series of demand generated as follows:

y

∗

e,t

= ˆy

t

(1+ x

e,t

σ

e,t

),

where x

e,t

is the realization of a standard gaussian ran-

dom variable and σ

e,t

denotes the standard deviation.

To diversify each experiment we extract sub-series of

length 60 changing in each experiment the starting

point. The forecast series is obtained as

˜y

e,t

= y

∗

e,t

(1+ ˜x

e,t

˜

σ

e,t

),

where ˜x

e,t

is again the realization of a standard gaus-

sian random variable. The standard deviation

˜

σ

e,t

reg-

ulates the accuracy of forecast. The latter is crucial for

the performance of agents. In fact, if

˜

σ

e,t

= 0 ∀t, the

experimental subjects shall set the production at the

same level of the forecast. In this way s/he will always

realize the maximum profit and the bailout procedure

will never be activated. At high levels of

˜

σ

e,t

, the stan-

dard deviation of demand (σ

e,t

) assumes a great im-

portance. In fact, if σ

e,t

is low, good guesses for the

future production could still be obtained extrapolating

the trend from past values. When both

˜

σ

e,t

and σ

e,t

are high, setting the production is a problematic task

because both the forward looking and the backward

looking conducts are not reliable. To ease the experi-

ments we use time independent standard deviations in

the proposed exercises. The parameters are as follow:

r

B

= 0.01, r

A

= 0.05, w = 0.9, β = 9, c

O

= 0.01.

Experiments Composition. Experiments in this

paper are characterized by reversible and divisible in-

vestments, so that the production can be increased or

decreased by an arbitrarily chosen amount. At the

beginning, the experimental subjects are asked to go

through a training phase (labeled as A) with the goal

of discovering the mechanisms at work in the microe-

conomic structure. To this aim we turn the forecast

uncertainty off by setting

˜

σ = 0. When the subjects

becomes familiar with the proposed setting they are

admitted to the subsequent phase (labeled as B) where

forecasts are inexact. Our aim is to analyze two de-

cisions: 1) how experimental subjects set the produc-

tion and 2) how they set the equity base. Point 1)

is achieved by asking the experimental subject to ap-

ply in three exercises (labeled as B1a, B1b and B1c)

having an increasing

˜

σ. The level of the standard de-

viation of demand is kept low to avoid bailouts. Con-

cerning point 2) (the management of equity), the ex-

perimental subjects apply in three additional exercises

(labeled as B2a, B2b and B2c) where both

˜

σ and σ are

high so that bailouts can easily occur.

Standard deviations of the various experiments are

reported in table 1.

Results. Among the numerous subjects we have

contacted, at the time of writing this paper eight of

them have reached a good knowledge of the model

and consequently they have been admitted to the ex-

periments of phase B. Summary statistics from their

performances are reported in table 2. In line with the

notation above, in the table, j indexes experimental

subjects, e experiments, hρi denotes the average roi

and O the number of bailouts.

Looking at table 2 we can say that humans’ perfor-

mances gradually deteriorate when the standard devi-

ations increase. Except in a number of occasions, the

average roi decreases, while the number of bailouts

increases when standard deviations increase.

Replicating the humans’ performance by an artifi-

cial agent is a task addressed in the remainder of the

paper.

4 ARTIFICIAL AGENT

In this section we will discuss on how to built an arti-

ficial agent able to move in the same framework sub-

mitted to humans. Our aim is to make the perfor-

mances of the artificial agent as close as possible to

these of humans. We adopt in this paper the results of

recent studies which show how the heuristic approach

can be a solid foundation of the smartness and adapt-

ability of human decision making (Gigerenzer et al.,

ICAART 2012 - International Conference on Agents and Artificial Intelligence

186

Table 2: Results from experiments. j indexes experimental subjects, e experiments, hρi denotes the average roi (percentage)

and O the number of bailouts.

j = 1 j = 2 j = 3 j = 4 j = 5 j = 6 j = 7 j = 8

e hρi O hρi O hρi O hρi O hρi O hρi O hρi O hρi O

B1a 8.25 0 8.53 0 6.26 0 8.35 0 8.11 0 8.54 0 7.02 1 7.55 0

B1b 7.25 1 8.02 0 7.29 1 7.91 0 7.44 0 7.56 0 6.9 0 5.87 0

B1c 7.65 0 7.84 0 5.78 3 8.1 0 7.7 0 7.85 1 7.23 0 2.94 5

B2a 5.48 3 7.43 1 7.33 0 7.98 0 7.53 0 6.79 1 5.63 1 6.66 1

B2b 6.61 2 7.08 1 6.43 1 5.85 3 6.13 1 4.7 2 5.6 1 4.2 4

B2c 4.23 3 5.75 3 4.16 4 5.92 2 6.58 0 4.44 2 1.5 5 5.32 1

2011).

As pointed out above, in this paper agents move in

a context of reversible and divisible investments and

they take two decisions: 1) the amount of production,

and 2) the level of equity ratio. We analyze them in

the following sections. Before starting, let us give a

comment on the notation. To be rigorous, we should

use x

j,e,t

to denote agent’s j variable x at time t of

experiment e. However, we are building a prototype

artificial agent so that the j is dropped in what follows

and x

e,t

intend variable x of the artificial agent at time

t of experiment e.

4.1 The Production Choice

The decision on production is made by taking into ac-

count some information from the past and the fore-

cast. We denote the information set on which the de-

cision is based with I

e,t

= {y

∗

e,t−N

...,y

∗

e,t−1

, ˜y

e,t

}. A

different way to pose the problem is to use growth

rates. The growth rate of a variable x at time t is

g

x

t

:= (x

t

− x

t−1

)/x

t−1

. The agent’s choice variable

is now g

y

e,t

, and s/he sets the production according to

y

e,t

= (1+ g

y

e,t

)y

∗

e,t−1

.

We assume g

y

e,t

to be set as a linear function of the

variables in I

e,t

:

g

y

e,t

= s

u

1,e,t

g

y

∗

e,t−N+1

+ s

u

2,e,t

g

y

∗

e,t−N+2

+ ···+ s

u

N,e,t

g

˜y

e,t

.

(4)

The agent’s problem has been transformedinto the

one of choosing the s

u

e,t

:= {s

u

n,e,t

} coefficients with

n ∈ {1, 2,...,N}.

In our model, the agent achieves the final decision

on y

e,t

by taking two steps:

• determine which one would have been the best

achievable solution s

∗

e,t

:= {s

∗

n,e,t

};

• use best solutions of the previous periods to de-

cide the s

u

e,t

in the current period.

We will go into details in the following para-

graphs.

The Best Achievable Solution (s

∗

e,t

). Once g

∗

y

e,t

is

known, s

∗

e,t

can be established. A systematic check

on all the combinations of s is not possible. We use

a greedy algorithm to identify a path in the coeffi-

cients space which realizes a sequence of improve-

ments bringing to the best achievable solution given

the available resources. The starting point of the algo-

rithm is chosen in a set of easily computable aritmetic

averages we will refer to as “focal points” (Schelling,

1960; Zuckerman et al., 2007).

Given a parameter called “difference” denoted

hereafter with d and the number of addends (N) of

the average in (4), we use the notation F

d

R×N

to iden-

tify the matrix containing the focal points. R here de-

notes the number of rows of this matrix. The latter is

implicitly chosen when the values of N and d are set.

If we set N = 2 and d = 0.5 we have for example

F

0.5

3×2

=

f

1×2,1

f

1×2,2

f

1×2,3

=

0 1

0.5 0.5

1 0

When N is higher, a software able to generate evenly

spaced points in the unit simplex (Giulioni, 2011) can

be used to obtain F.

Each row of this matrix gives the coordinates of a

focal point. We denote with i the row number of F at

which a given focal point (f

1×N,i

) can be found.

The first step consists in choosing one of the fo-

cal points. Remember this computation is done when

y

∗

e,t

is known. Let us denote the column vector of the

known growth rates with g

N×1,e,t

. The best perform-

ing focal point (i

∗

e,t

) is determined by

i

∗

e,t

= min

i∈{1,2,...,R}

g

y

∗

e,t

− f

1×N,i

g

N×1,e,t

where f

1×N,i

g

N×1,e,t

is the dot product.

Then, the local search starts by iterations which

have the following steps:

1. identify a set made up of the starting point and a

number of its neighbors;

2. select the best point in the set;

EXPLORING FIRMS FINANCIAL DECISIONS BY HUMAN AND ARTIFICIAL AGENTS - Towards an Assessment of

Minsky's Financial Instability Hypothesis

187

3. if the selected point is equal to the starting point

or if the number of iterations reaches a maximum

(Z), then stop the search;

else, set the selected point as the new starting

point and go to point 1).

Step 1) can be done in several ways. We take a real

number ψ and we build a neighborhood by permuting

with repetition the elements of {−ψ, 0, ψ} and taking

them N at a time. We arrange all these in a matrix

D

3

N

×N

= (d

1×N,l

) l ∈ {1,...,3

N

}.

If we denote with s

(z−1)

1×N

the point selected at iteration

z− 1, the neighbors to be considered in iteration z are

gathered in the matrix (s

(z−1)

1×N

+ d

1×N,l

). Iterations go

on until one of the stopping conditions at point 3) is

satisfied.

This process brings us to the best solutions s

∗

t

The Used Solution (s

u

t

). To let the agent learn and

evolve the most reliable focal point, we build a learn-

ing classifier system whose rules are the focal points.

Based on the previous experience, a score is associ-

ated to each rule and at each time step the rule with

the highest score is taken as basis to establish the s

coefficients to be used in t. We call it the “reference”

rule (or reference focal point).

Given a memory length m, the entrepreneur has

a set {(i

∗

t−m

,s

∗

t−m

),(i

∗

t−m+1

,s

∗

t−m+1

),...,(i

∗

t−1

,s

∗

t−1

)}

informing on which one was the best focal point in

the past.

The reference rule, denoted with i

u

t

, can be deter-

mined by maximizing a function defined on the set of

the best focal points. The function we use is

i

u

t

= max

i∈{1,2,...,R}

m

∑

z=1

δ(i,i

∗

t−z

)

where δ(◦,◦) denotes the Kronecker delta function.

Once the reference focal point has been deter-

mined, we select the best solutions which was ob-

tained starting from the reference focal point in the

previous m periods. The rule to be used in t, s

u

t

is

obtained as an average of such points:

s

u

t

=

∑

m

z=1

s

∗

t−z

δ(i,i

u

t−z

)

∑

m

z=1

δ(i,i

u

t−z

)

.

4.2 The Equity Ratio

From equation (2) one can see how the best strategy

concerning the level of equity ratio (a) is to keep it

at the minimum level (it is because we have assumed

r

A

> r

B

). However, as we did for humans, we assign

the artificial agent the goal of maximizing the score

(equation 3) which establish the trade off between the

level of roi and the probability of run up against the

bailout procedure.

Because we want the agent to be able to adapt

to changing economic conditions we let m

a

be the

memory length the agent has for the ρ values. At

time t, the agent considers the following set of val-

ues {ρ

t−m

a

− h,ρ

t−m

a

+1

− h,ρ

t−m

a

+2

− h,...,ρ

t−1

−

h,ρ

t

− h} where h is a precautionary parameter.

Now consider the sum

Θ

t

=

∑

i

δ(−,sign(ρ

t−i

− h))(ρ

t−i

− h);

we calculate the target level of the equity ratio (ˆa) as

ˆa

t

= 1− exp(λΘ

t

)

where λ is a parameter. If a

t−1

6= ˆa

t

, the agent man-

ages to reach the target level as fast as possible.

5 HUMANS AND ARTIFICIAL

AGENT

In this section we investigate the conditions under

which the artificial agent delivers results which are

comparable to those of humans.

The artificial agent’s behavior depends on the fol-

lowing parameters: Z, m, m

a

, h and λ. By using the

same framework submitted to humans (the same rules

and the same parameters), and assigning to the artifi-

cial agent the same task of humans, we let the behav-

ioral parameter of the artificial agent to be selected by

the differential evolution algorithm (Storm and Price,

1997). The final step to setup the artificial agent con-

cerns the F matrix which depends on N and d. Several

trials revealed the simplest choice (N = 2 and d = 1)

as the one which is most suitable to replicate the re-

sults of humans.

Table 3: Results from the differential evolution algorithm.

e hρi% O Z m m

a

h λ

B1a 8.27 0 1 1 ∀ ∀ ∀

B1b 7.37 0 1 5 ∀ ∀ ∀

B1c 7.4 0 1 9 5 4.96 0.6

B2a 6.7 0 1 1 10 5.65 0.75

B2b 6.62 1 7 13 7 2.65 9.31

B2c 4.89 0 4 27 5 3.13 5.02

Table 3 reports the results obtained from running

the differential evolution algorithm on the same ex-

periments carried out by humans. Concerning the

behavioral parameters of the artificial agent we can

divide them in two subsets. Z and m governing the

choice of production and m

a

, h and λ governing the

ICAART 2012 - International Conference on Agents and Artificial Intelligence

188

Table 4: Scores of Humans and Artificial Agent.

e j = 1 j = 2 j = 3 j = 4 j = 5

B1a 8.25 8.53 6.26 8.35 8.11

B1b 6.25 8.02 6.29 7.91 7.44

B1c 7.65 7.84 2.78 8.1 7.7

B2a 2.48 6.43 7.33 7.98 7.53

B2b 4.61 6.08 5.43 2.85 5.13

B2c 1.23 2.75 0.16 3.92 6.58

e j = 6 j = 7 j = 8 artificial agent

B1a 8.54 6.02 7.55 8.27

B1b 7.56 6.9 5.87 7.37

B1c 6.85 7.23 -2.06 7.4

B2a 5.79 4.63 5.66 6.7

B2b 2.7 4.6 0.2 5.62

B2c 2.44 -3.5 4.32 4.89

choice of financial position. Table 3 shows how Z

and m increases with the standard deviations. The be-

havior of the parameters which regulate the financial

decision also changes with the level of standard devi-

ations. For low levels of σ and

˜

σ (experiments B1a

and B1b) the values of these parameters are irrelevant

(∀ symbol). When the standard deviations have inter-

mediate levels (experiments B1c and B2a) the value

of h is high while that of λ is low. h decreases and

λ increases at high levels of the standard deviations

(experiments B2b and B2c).

To give a summary of the work done in this pa-

per, we report the scores (equation 3) of humans and

artificial agent in Table 4. The performance of the

artificial agent is in line with the average score of hu-

mans in the initial four experiments. In experiments

B2b and B2c, the artificial agent performs better than

humans, however a number of the latter still perform

similarly (or better) than the artificial agent.

6 CONCLUSIONS

In this paper we take the first step of a project aimed at

assessing Minsky’s FIH. Our aim is to create avatars

whose behavior mimic that of humans.

Here we focus on entrepreneurs whose behavior is

the cornerstone of FIH. A result of our analysis is that,

beside the traditional approach which assumes ratio-

nal maximizing subjects, the heuristic approach could

also provide for a valid alternative micro-foundation

for the financial decisions of entrepreneurs. A sec-

ond point worth to be mentioned probably provides

an element of novelty in the interpretation of Min-

sky’s thought: financial behaviors could mainly de-

pend on the volatility of demand and on the accuracy

of demand forecasts instead of depending on the busi-

ness cycle phases as usually pointed out by models

inspired by Minsky’s economic thought

The potential future developments of our model

are many. First of all, the agents’ choice under dif-

ferent assumptions on divisibility and reversibility of

investment could be analyzed. Second, a statistical

analysis of experimental data could lead us to iden-

tify a number of heterogeneous avatars. The third ex-

tension concerns interaction. It could be investigated

how the results change when selected information on

the other subjects are given to each experimental sub-

ject, and how the situation evolves when credit de-

mands are selected by a real life banker.

The final goal of our project is to build a multi-

agent artificial system made up of a large number of

different types of avatars interacting with each other

and with banks. The model could be used for mon-

itoring how the situation evolves at macroeconomic

level and to verify in what extend the FIH could be

judged as valid.

REFERENCES

Bagliano, F.-C. and Bertola, G. (2004). Models for Dynamic

Macroeconomics. Oxford University Press.

Gigerenzer, G., Hertwig, R., and Pachur, T., editors (2011).

Heuristics: The Foundations of Adaptive Behavior.

Oxford University Press, New York.

Giulioni, G. (2011). A Software to Generate Evenly Spaced

Points on the Unit N-Simplex. SSRN eLibrary. Avail-

able at

http://ssrn.com/paper=1822002

.

Koeva, P. (2009). Time-to-build and convex adjustment

costs. International Monetary Fund. Working Paper

n. 1.

Minsky, H. P. (1974). The modeling of financial instabil-

ity: an introduction. In Modelling and Simulation.

Proceedings of the 5th Annual Pittsburg Conference,

pages 267–272.

Minsky, H. P. (1975). John Maynard Keynes. Columbia

University Press, New York.

Minsky, H. P. (1982). Can ‘It’ Happen Again? Essays on

Instability and Finance. M.E. Sharpe, New York.

Minsky, H. P. (1986). Stabilizing an Unstable Economy.

Yale University Press, New Haven and London.

Schelling, T. C. (1960). The Strategy of Conflict. Harvard

University Press.

Storm, R. and Price, K. (1997). Differential evolution - a

simple and efficient heuristic for global optimization

over continuous spaces. Journal of Global Optimiza-

tion, 11(4):341–359.

Zuckerman, I., Kraus, S., and Rosenschein, J. S. (2007). Us-

ing focal point learning to improve tactic coordination

in human-machine interactions. In IJCAI’07, pages

1563–1569.

EXPLORING FIRMS FINANCIAL DECISIONS BY HUMAN AND ARTIFICIAL AGENTS - Towards an Assessment of

Minsky's Financial Instability Hypothesis

189