GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER

EXCHANGE MODELING AND SIMULATION

Silvano Cincotti and Giulia Gallo

DIBE-CINEF, University of Genoa, Via Opera Pia 11A, 16145 Genoa, Italy

Keywords:

Agent-based computational economics, Electricity markets, Reinforcement learning, Multi-agent systems.

Abstract:

The paper presents an agent-based framework for modeling and simulating power exchanges, the Genoa Ar-

tificial Power Exchange (GAPEX). The framework is implemented in MATLAB using the OOP paradigm,

which allows one to define classes using a Java/C++ like syntax. GAPEX allows creation of artificial power

exchanges where what-if analysis can be performed. GAPEX also reproduces exactly the market clearing

procedure (e.g. by calculating Locational Marginal Prices based on the Italian high-voltage transmission net-

work with its zonal subdivision) and the generation plants modeled are in direct correspondence with the real

ones. Moreover, the presence of affine total cost functions for the generation plants results in payoff either

positive, negative and null. This has major implications as negative reward are not generally considered by re-

inforcement learning algorithms. In order to overcome such limitation, an enhanced version of the Roth-Erev

algorithm (i.e., that takes into account also negative payoffs) is presented and discussed. Results point out

effectiveness of the proposed enhanced learning algorithm. Moreover, computational experiments performed

within GAPEX point out a close agreement with historical real market data during both peak- and off-peak

load hours thus confirming the direct applicability of GAPEX to model and to simulate power exchanges.

1 INTRODUCTION

In the last decade, large efforts have been dedicated in

developing theoretical and computational approaches

for modeling deregulated electricity markets. Several

papers have appeared in the agent-based computa-

tional economics (hereafter ACE) literature on whole-

sale electricity markets and ACE has become a ref-

erence paradigm for researchers working on electric-

ity market topics (see as reference examples (Nico-

laisen et al., 2001), (Bower and Bunn, 2001), (Bunn

and Oliveira, 2001), (Bagnall and Smith, 2005), (Cin-

cotti et al., 2005), and (Sun and Tesfatsion, 2007)).

Generally speaking, these papers adopt a computer-

based modeling approach for studying the electric-

ity markets as result of the interactions between het-

erogenous market participants. In particular, the

AMES model (Agent-based Modeling of Electricity

Systems, (Sun and Tesfatsion, 2007)) comprised a

two-settlement system consisting of a day-ahead mar-

ket and a real-time one which are both cleared by

means of Locational Marginal Pricing. (Ruperez Mi-

cola et al., 2008) presented a model that consists of

three sequential oligopolistic energy markets repre-

senting a wholesale gas market, a wholesale elec-

tricity market and a retail electricity market. (Wei-

dlich and Veit, 2006) simulated two markets that are

cleared sequentially, a day-ahead electricity market

and a market for balancing power. (Cau and Ander-

son, 2002) developed a wholesale electricity market

model similar to the Australian National Electricity

Market. Detailed reviews on agent-based models ap-

plied to wholesale electricity markets can be found in

(Weidlich and Veit, 2008b) and (Guerci et al., 2010).

In this paper, we present the Genoa Artificial

Power Exchange (GAPEX), an agent-based frame-

work for modeling and simulating electricity mar-

kets. In particular, the general GAPEX framework

is presented that allows us to generalize the models

and to overcome some limitations and simplifications

that characterized preliminary version of the frame-

work ((Cincotti et al., 2005), (Guerci et al., 2007)

and (Rastegar et al., 2009)). In this paper, attention

is devoted to model design and developing within

GAPEX. This has direct implication on the features

of the intelligent agents (i.e. Gencos) as well as on

the mechanism of the power exchange. In particu-

lar, in order to properly model the decision process

of the economic agents, an enhanced version of the

classical Roth-Erev reinforcement learning algorithm

(Roth and Erev, 1995) is described so to apply rein-

forcement learning in case of negative payoffs. Fur-

33

Cincotti S. and Gallo G..

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION.

DOI: 10.5220/0003740300330043

In Proceedings of the 4th International Conference on Agents and Artificial Intelligence (ICAART-2012), pages 33-43

ISBN: 978-989-8425-96-6

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

thermore, due to its complex high-voltage transmis-

sion network, the Italian power exchange (IPEX) is

taken as case of study.

Results point out that GAPEX is an adequate

framework to model and to simulate power ex-

changes. In particular, the agent-based model of the

Italian Electricity Market is able to replicate market

historical results during both peak- and off-peak load

hours as well as to give insights on Genco behav-

iors. Moreover the proposed enhanced version of the

classical Roth-Erev reinforcement learning algorithm

points out effective learning properties with respect to

existent variants in the literature.

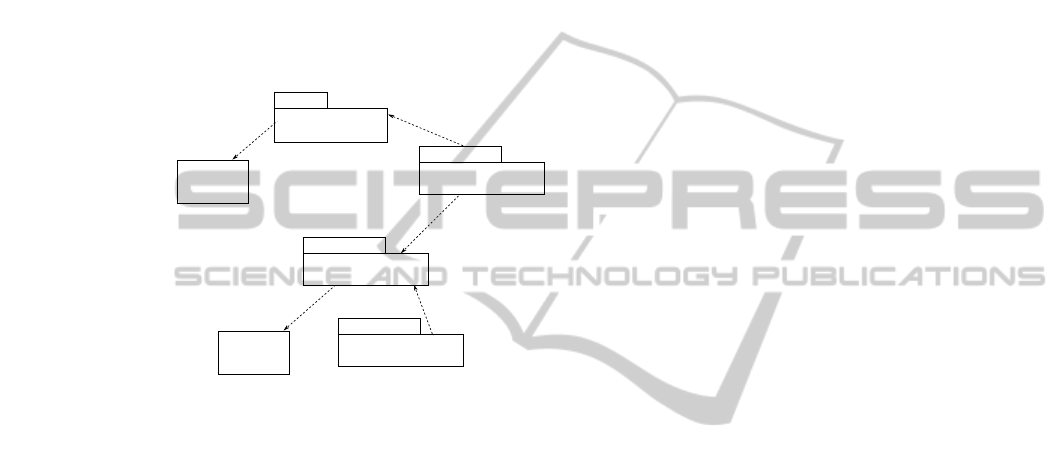

Agent Class

Electricity Market Class

Learning Algorithms

Interfaces

Offline Analysis

Module

Heap Memory Class

Session Management Class

Figure 1: GAPEX Class Architecture.

The structure of the paper is as follows. In the

next Section, the computational design and architec-

ture of the GAPEX framework is presented. In Sec-

tion 3 the Italian Electricity Day-Ahead Market agent-

based model is described. In Section 4 the enhanced

Roth-Erev reinforcement learning algorithm is pre-

sented and studied. In Section 5 we present main re-

sults of the agent-based model of the Italian Power

exchange, while Section 6 summarizes main results

and remarks.

2 GAPEX FRAMEWORK

OVERVIEW

GAPEX is an agent-based framework developed in

MATLAB that is suitable for studying the dynamic

performances of many electricity markets. The sim-

ulator is implemented using OOP programming ca-

pabilities of MATLAB, which allows one to define

classes using a Java/C++ like syntax thus creating a

flexible and extensible ABM framework which can

run local simulation and also exploit the Parallel

Computing Toolbox provided with MATLAB.

Detailed computational models of the power

techno-socio economic systems can be realistically

simulated by means of the agent-based modeling

(hereafter ABM) approach. Agents can range from

entities with no cognitive function (e.g., transmission

grids) to sophisticated decision makers capable of

communication and learning (e.g., electricity traders).

According to this research paradigm, we designed

and implemented a versatile software framework for

studying electricity markets. Indeed, the philosophy

of the project and the modularity of its implementa-

tion provide a valuable computational framework for

easily implementing other critical infrastructure sys-

tems relevant to energy markets, e.g., a natural gas

market.

In order to properly address the agent behaviors

in different economic environments, we have used a

multi-agent learning (MAL) approach so to define ap-

propriate algorithms able to implement sophisticated

decision-making rules. This represents one of the

standards in the ACE literature and some common

features characterize the learning models.

The framework is composed by three main

classes:

• a heap class;

• a statistical off-line analysis module;

• several algorithms and market mechanisms li-

braries.

Figure 1 shows the GAPEX class architecture.

The Agent class is an abstract class which is extended

by all agents present in GAPEX Framework. It is

worth noting that the Agent class is directly extended

in order to define any new types of Electricity Market

Agents (e.g., Wholesalers, Energy Management Divi-

sions, etc).

As concerning the learning algorithms, they are

modeled as interfaces implemented by Gencos. Cur-

rent version of GAPEX is characterized by a library

of the main solutions for learning algorithms pro-

posed in the literature (e.g., Roth-Erev algorithm, Q-

Learning algorithm, Marimon-McGrattan algorithm,

EWA learning and GiGa WoLF algorithm). In partic-

ular, these algorithms have been extended so to con-

sider reward both positive, negative and null, and the

features of the enhanced Roth-Erev algorithm are dis-

cussed in Section 4.

The Electricity Market class allows one to define

the market clearing algorithms and it is based on the

Agent class. Currently, the GAPEX allows one to

simulate the Italian Day Ahead Market, the EEX spot

market linking DCOPFJ Package (Sun and Tesfatsion,

2007) and the Spanish Day Ahead Market. It is worth

nothing that all these algorithms are interfaces as well.

The Session class has a two-fold purposes. On the

ICAART 2012 - International Conference on Agents and Artificial Intelligence

34

one hand, it acts as a clearing house and allows one

to run several iteration of a particular simulation and

to call the statistical off-line module at the end of the

simulation. On the other hand, it stores all market

and agent information, thus acting as a repository for

all data related to energy prices and quantities both

at market and at agent level (e.g. choices, propen-

sities, etc). This feature is of crucial importance for

economics application as it allows the GAPEX frame-

work to be used as an artificial world where compu-

tational experiments can be performed. Indeed, such

computational experiments are mandatory so to eval-

uate reproducibility of stylized facts as well as statis-

tical properties of the self-adaptive complex system

under investigation (see (Ball, 2010)). Moveover, in

order to model the clearing house feature and charac-

teristics, the mechanism of Heap memory access has

been simulated and recreated into a MATLAB class.

This allows one to have an online repository both for

economic agents and for the electricity market agent.

Thus, at the end of every simulation run, the Clear-

ing House recall the Offline Statistical Module which

carry out statistical analysis as well as visualization of

the computational experiment results.

Finally, it is worth remarking that GAPEX allows

direct generalization, as it is possible to create differ-

ent types of agents, thus allowing the design of ex-

tremely realistic agent-based models.

3 AGENT-BASED MODELING OF

THE ITALIAN ELECTRICITY

DAY-AHEAD MARKET

As discussed in previousSection, GAPEX is designed

as a powerful and extensible agent-based framework

for electricity market modeling and simulation. Cur-

rent version of GAPEX allows one to simulate differ-

ent power exchange protocols, but due to its complex

structure, in this paper attention is dedicated to the

Italian power exchange.

It is worth remarking that a power exchange

strongly differs from a stock market from both struc-

tural and behavioral point of view. From a structural

point of view, the power exchange mechanism is a

uniform double auction whereas the stock market one

is continuous time limit order book. Furthermore, en-

ergy is not a storable good (i.e., buy&hold strategy are

not even possible) whose consumption is contempo-

rary to the production and is characterized by strong

seasonality (i.e., daily, weekly and yearly). Moreover,

from a behavioral point of view, the electricity sec-

tor is characterized by strong oligopoly (i.e., a lim-

ited and basically time-invariant number of market

traders) that repeat the same game on a daily based.

Theoretically speaking, such economic system seems

perfect for an analytical solution based on game the-

ory, but the dimension of the game is so high that it

practically impossible to study equilibria by means

of traditional game theory. Despite a first glance

on analytical solutions, all these elements lead to an

economic system that can be effectively studied by

means of a computational approach based on learning

agent, thus motivating the development of GAPEX

framework for the implementation of the model of the

wholesale Italian Electricity Market.

Making use of preliminary versions of GAPEX,

(Cincotti et al., 2005) described and implemented an

agent-based model of power exchange with a uniform

price auction mechanism and a learning mechanism

for the Gencos. Moreover, (Guerci et al., 2007) pro-

vided the first version of the Genoa Artificial Power

Exchange and compared the discriminatory and the

uniform price auction mechanism with heterogenous

agents. Finally, (Rastegar et al., 2009) firstly at-

tempted to create an agent-based model of the Italian

Electricity Market, with a reduced transmission net-

work grid and a simplified description of GenCos.

It is worth remarking that version presented and

discussed in this paper of both the GAPEX and the

agent-based model of the Italian electricity day-ahead

market are characterized by significant extensions.

Firstly, agent-based model incorporates now the ex-

act procedure employed by the Gestore Mercati Ener-

getici S.p.A. (hereafter GME) (Gestore et al., 2010b)

thus overcoming the limitation of previously adopted

formulation that resulted a constrained ill posed op-

timization procedure. Furthermore, the cognitive

agents in the GAPEX mke use of the Enhanced Roth-

Erev reinforcement learning algorithm (presented and

discussed in Section 4), developed so to take into ac-

count payoff of any sign. There are crucial features

that allowed us to calculate the energy prices based

on scenarios that correctly emulate real power plants,

real transmission limits and real bids.

In this Section we present the agent-based model

of the Italian Electricity Day-Ahead Market (here-

after ABM IPEX Model). The Italian power exchange

(IPEX) started on 1st April 2004 and is currently ad-

ministrated by the Gestore Mercati Energetici S.p.A.,

the Italian market operator. IPEX market structure is

characterized by several subsequent market sessions

for both trading energy and managing critical ser-

vices (e.g., reserves and real-time balancing). These

are the Day-Ahead Market session - DAM, (Mer-

cato del Giorno Prima - MGP), the Adjustment Mar-

ket sessions and the Ancillary Services Market. The

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION

35

most important (i.e., liquid) session is the Day-Ahead

Market which is organized as a non-discriminatory

double-auction market where approximately 60 per-

cent of national production is traded. The main fea-

ture of the Italian Day-Ahead Market is related to the

complex high-voltage transmission network and re-

sults in a zonal splitting with both location and na-

tional energy prices.

L

Zonal Loads

L

L

Figure 2: ABM IPEX simulation flow-diagram.

The ABM IPEX simulation flow-diagram (i.e.,

static representation of the objects and their interac-

tions) is shown in Figure 2. It is worth remarking that

the ABM IPEX Model consists of three main building

blocks, i.e.:

• the agent-based representation of the Italian Elec-

tricity Market and the clearing mechanism regard-

ing the Day-Ahead Market;

• the representation of the Italian Electricity Net-

work;

• the agent-based representation of traders in the

Italian Electricity Market, i.e. Gencos.

These building blocks are discussed in the follow-

ing sub-sections.

3.1 Day-Ahead Market Model

GAPEX simulates Gencos bidding strategies through

a daily market session in the Italian Electricity DAM.

The exact market clearing procedure performed by

Italian Market Operator has been implemented (see

(Gestore et al., 2010a) for a detailed discussion). Fur-

thermore, the following agents are currently repre-

sented in the model:

• Gencos: They are the economic actors at the sup-

ply side of the electricity market. They submit

supply bids to the GME Market Operator and

(after the market clearing procedure) they access

the GME clearing house in order to retrieve mar-

ket results and to update their strategic decisions.

They extend GAPEX Agent class;

• Loads: They are aggregations of zonal loads and

represent the demand side of the electricity market

as inelastic;

• GME Market Operator: It clears the market and

sends information on awarded prices and quan-

tities to the GME clearing house. It extends

GAPEX Electricity Market class;

• GME Clearing House: It computes all payoffs

for the Gencos, updates their market accounts and

stores all market information. It extends GAPEX

Session class.

It is worth remarking that the aim of the proposed

model is to represent and to study the strategic behav-

ior of Gencos in the power exchange. Accordingly,

the Gencos are characterized by sophisticated deci-

sion process (i.e., the Enhanced Roth-Erev reinforce-

ment learning algorithm presented and discussed in

Section 4)) that accounts for the effect of a repeated

game. Furthermore, according to the hypothesis of

a competitive electricity market, the Gencos commu-

nicate directly only with the GME Market Operator

and GME Clearing House so to accounts that every

Genco is only aware of its own strategies and payoffs.

Finally, all the other agents in the model are passive

entities and they are not endowed with any cognitive

capability.

Figure 3 shows the UML class diagram for the

agents modeled in the ABM IPEX:

<<abstract>>

@agent

<<interface>>

IPEX solver

@Electricity Market

@Genco

<<interface>>

Roth-Erev Agent

<<interface>>

Extended Roth-Erev Agent

<<interface>>

Variant Roth-Erev Agent

@Load

@GME Clearing House

@GME DAM Market

<<abstract>>

@session

Figure 3: UML class diagram of agents in ABM IPEX.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

36

At each iteration step, each i

th

generator (i =

1, 2, ..., N) submits to the DAM a bidding curve shown

in Figure 4. The curve is described by the triple of P

i

([e/MWh]), Q

−

i

([MWh]),Q

+

i

([MWh]), i.e., the bid-

ding price, the minimum and the maximum produc-

tion power for i

th

generator, respectively.

Figure 4: Reference bidding curve for a Genco.

After receiving all generators’ bids, the DAM

clears the market by performing a social welfare max-

imization subject to the constraints on the zonal en-

ergy balance (Kirchhoff’s laws) and on inter-zonal

transmission limits (see (Gestore et al., 2010a) for de-

tails). The objective function takes into account only

the supply side of the market as the demand is as-

sumed to be price-inelastic.

The zonal splitting clearing mechanism (i.e., DC

optimal power flow procedure) allows one to deter-

mine both the unit commitment for each generator

and the Locational Marginal Price (LMP) for each

zone. To this aim, a graph representation of the

transmission grid (that defines the area with relevant

transmission constraints) is provided as input to the

GAPEX (see Section 3.2). However, with respect

to classical literature on power systems, the Italian

market introduces two modifications. Firstly, sellers

are paid at the zonal prices, i.e., Location Marginal

Price (LMP), whereas buyers pay a unique national

price (Prezzo Unico Nazionale - PUN) common for

the whole market and computed as a weighted aver-

age of the zonal prices with respect to the zonal loads.

Secondly, transmission power-flow constraints differ

according to the flow direction which results in dou-

bling the number of constraints related to the inter-

zonal transmission limits. According to the specific

features of the Italian market, the results of the power

exchange auction consist of a set of the active pow-

ers Q

∗

i

and of a set of Locational Accepted Marginal

Prices LMP

k

for each zone k ∈ {1, 2, ..., K}.

3.2 Transmission Grid Model

The market clearing procedure described in Section

3.1 requires the definition of a transmission network.

The grid structure adopted in this paper is shown in

Figure 5 and reproduces the exact zonal market struc-

ture and the relative maximum transmission capac-

ities between neighboring zones of the Italian grid

model as indicated by Terna S.p.A. the Italian trans-

mission system operator. The relevant areas of the

network correspond to physical geographic areas (e.g.

Northern Italy, Sicily, Sardinia, etc.) in which loads

and generators, virtual production areas (i.e. foreign

neighboring countries) or limited production areas

(e.g. Priolo Gargallo) are present. It is worth remark-

ing that each zone is represented as a bus to whom

generators and loads are connected. Furthermore,

the arches linking the zone represent the transmission

connections and account for the constraints in trans-

missions for the power flow. Finally, transmission

power-flow constraints differ according to the flow

direction, e.g., power flowing from Central-South to

Central-North is subject to a transmission limit that

is different from the one relates to the power flowing

from Central-North to Central-South. A detailed dis-

cussion of the Italian transmission grid can be found

in (TERNA S.p.A., 2008).

!

"!

Figure 5: The Italian grid model.

3.3 Genco Model

The supply side of the market is composed by Gen-

cos submitting bids for each of their power plants.

In this paper attention is focussed on thermal power

plants strategic behavior, as the remaining national

production (i.e., hydro, geothermal, solar, wind) and

imported production can be generally modeled as bids

at zero price (Migliavacca, 2007).

A set of thermal power plants consisting of N =

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION

37

175 generating units is considered. These comprise

five different technologies (i.e., Coal-Fired (CF), Oil-

Fired (OF), Combined Cycle (CC), Turbogas (TG)

and Repower (RP)) and in the model a learning agent

is associated to each generating unit.

The constant marginal costs of the i

th

generator is

assumed to be given by:

MC

i

= π

i

[e/MWh] (1)

The coefficients π

i

has been selected using an

econometric analysis on real historical bids. The total

cost function of i

th

generator is assumed to be given

by:

TC

i

(Q

i

) = a

i

· Q

i

+ b

i

[e/h] (2)

The coefficients a

i

([e/MWh]) and b

i

([e/h]) are

assumed constants. a

i

depends mainly on the class of

efficiency and on the technology of the power plant,

whereas b

i

(which is specific for each power plant) ac-

counts for investment and other quasi-fixed costs that

must be recovered and that are not negligible for cap-

ital intensive industry such as the electricity one. As

a consequence, the coefficients a

i

have been evalu-

ated on the basis of MC

i

(Q

i

) with fuel costs, technol-

ogy and efficiency as exogenous variables, whereas

the coefficients b

i

have been determined by the liter-

ature on technological business cases (Kirschen and

Strbac, 2004).

Stated the cost functions of the Gencos, it is nec-

essary to define the decision process that drives the

bidding strategy. In this respect, we assume that the

bidding price P

i

of the i

th

generator (see Section 3.1)

is a mark-up µ

i

applied to the marginal cost MC

i

in

equation 1, i.e.,

P

i

= (1+ µ

i

) ·MC

i

(3)

As a consequence, the decision variable of the i

th

generator is the mark-up µ

i

and the learning process

should individuate a profitable value for µ

i

as results

of the interaction (throughthe energy market) with the

other Gencos. In particular, the profit R

i

(h) depends

on the market clearing at hour h. Assuming that the

i

th

Genco belongs to zone k, R

i

(h) is given by

R

i

(h) = LMP

k

(h) ·Q

∗

i

(h) − TC

i

(Q

∗

i

(h)) [e/h] (4)

where TC

i

is i

th

Genco total-cost, LMP

k

(h) is the

Location Marginal Price of zone k at hour h and Q

∗

i

(h)

is the awarded quantity to the i

th

Genco at hour h.

Finally, it is worth remarking that the marginal

cost is the reference parameter for the bids (see equa-

tion 3), whereas the total costs are crucial in order to

evaluate the real profitability of the bids (see equation

4).

4 ENHANCED ROTH-EREV

REINFORCEMENT LEARNING

ALGORITHM

Electricity markets are characterized by inherent

complexity and repeated games that requires adequate

modeling of strategic behavior of traders. This is usu-

ally achieved by endowing the Gencos with learning

capability. The literature on agent-based electricity

market models points out three major kind of learn-

ing algorithms: zero-intelligence algorithms (Gode

and Sunder, 1993),(Gode and Sunder, 2004), rein-

forcement and belief-based models (Camerer and Ho,

1999) and evolutionary approach (Nicolaisen et al.,

2000).

In this paper, the strategic agent behavior is mod-

eled by means of a reinforcement learning approach.

It is worth remarking that the solutions proposed in

the literature generally account for positive and null

payoffs (e.g., (Nicolaisen et al., 2000) represented a

first modification of the original work proposed by

Roth and Erev (Roth and Erev, 1995) so to account for

null payoffs). Unfortunately, this is a severe limitation

in order to determine profitable strategy for economic

agents in real a economic context. Indeed, the pres-

ence of fixed-costs in the cost function (see equation

2) together with market awarded quantity Q

∗

i

(h) ≥ 0

for the i

th

Genco at hour h leads to payoffs that are

either positive, negative or null. This opens a ques-

tion for a reinforcement learning approach that is able

to cope with payoffs of any sign and to this aim we

have developed an enhanced version of the Roth and

Erev algorithm that is able to cope with both positive,

negative and null payoffs.

The original Roth and Erev learning model (here-

after referred to as RE algorithm) considers three psy-

chological aspects of human learning:

• the power law of practice, i.e., learning curves

are initially steep and tend to progressively flatten

out;

• the recency (or forgetting) effect, i.e., players re-

cent experience plays a larger role than past expe-

rience in determining his behavior;

• the experimentation effect, i.e., not only experi-

mented strategy but also similar strategies are re-

inforced.

For each strategy a

j

∈ A

j

(i = 1, .., M), at every

round t, propensities S

j,t−1

(a

j

) are updated according

to:

S

j,t

(a

j

) = (1 − r) · S

j,t−1

(a

j

) + E

j,t

(a

j

) (5)

where r ∈ [0, 1] is the recency parameters which

contributes to decrease exponentiallythe effect of past

ICAART 2012 - International Conference on Agents and Artificial Intelligence

38

α+1

γ

1

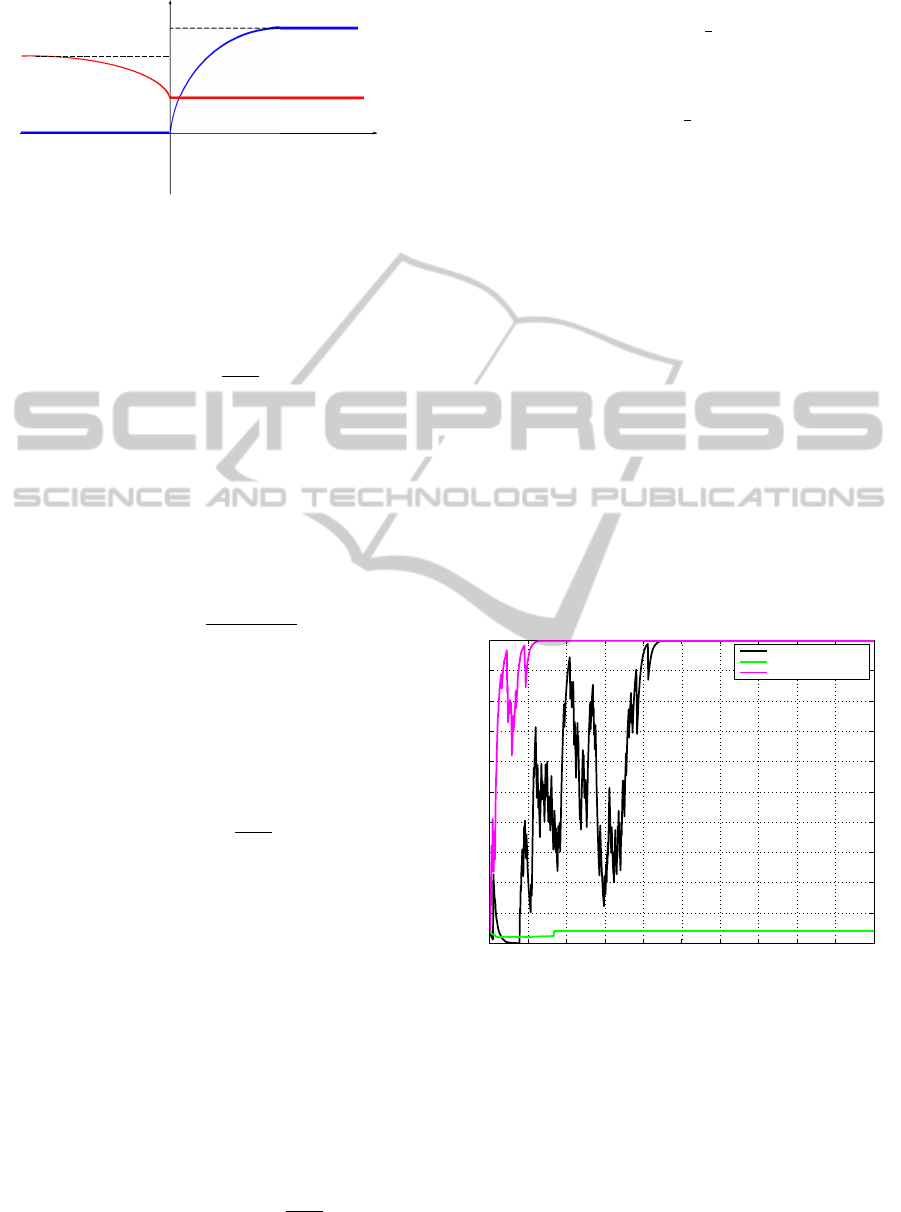

Figure 6: Functions involved in ERE. The red line shows

F[x], the blue one G[x].

results. The second term of equation 5 is called the

experimentation function and is given by:

E

j,t

(a

j

) =

(

Π

j,t

( ˆa

j

) ·(1− e) a

j

= ˆa

j

Π

j,t

( ˆa

j

) ·

e

M−1

a

j

6= ˆa

j

(6)

where e ∈ [0, 1] is the experimentation parameter

which assigns different weights between the played

strategy and the non-played strategies and Π

j,t

( ˆa

j

) is

the reward obtained by playing strategy ( ˆa

j

) at round

t.

Propensities are then normalized so to deter-

mine the probability for the strategy selection policy

π

j,t+1

(a

j

) for the next auction round as:

π

j,t+1

(a

j

) =

S

j,t

(a

j

)

∑

a

j

S

j,t

(a

j

)

(7)

The modified Roth and Erevlearning model (here-

after referred to as MRE algorithm) by (Nicolaisen

et al., 2000) proposed a solution for the case of zero

payoffs by modifying the experimentation function in

equation 6 according to:

E

j,t

(a

j

) =

(

Π

j,t

( ˆa

j

) ·(1− e) a

j

= ˆa

j

S

j,t−1

(a

j

) ·

e

M−1

a

j

6= ˆa

j

(8)

It is worth remarking that MRE and RE are iden-

tical for a positive reward Π

j,t

( ˆa

j

), whereas for null

payoff MRE introduces an implicit premium for non-

played strategies with respect to the ineffective (i.e.

with negative Π

j,t

( ˆa

j

)) played strategy. MRE repre-

sents a first but not final extension of the Roth and

Erev algorithm as neither MRE algorithm nor the

later VRE algorithm proposed by (Sun and Tesfatsion,

2007) are able to cope with negative payoffs.

In order to overcome such limitation of the Roth-

Erev algortihm, we propose to extend the MRE algo-

rithm by enhancing the experimentation mechanism

for non-played strategies according to:

E

j,t

(a

j

) =

(

G[Π

j,t

( ˆa

j

)] ·(1− e) a

j

= ˆa

j

F[Π

j,t

( ˆa

j

)] ·S

j,t−1

(a

j

) ·

e

M−1

a

j

6= ˆa

j

(9)

where

G[x] =

(

−γ· tanh(

x

2

) x ≥ 0

0 x ≤ 0

(10)

and

F[x] =

(

α· tanh(

x

2

) + 1 x ≤ 0

1 x ≥ 0

(11)

Figure 6 shows functions G[...] and F[...]. It is

worth noting that the proposed enhanced version rep-

resents an extension of the MRE. In particular, in the

case of negative payoff, the experimentation function

for the played strategies is calculated as in MRE pro-

posed by (Nicolaisen et al., 2001) for the case of null

payoffs, whereas the experimentation function of the

non-played strategies is enhanced by a larger amplifi-

cation the more negative is the payoff Π

j,t

( ˆa

j

). This

leads to an Enhanced Roth and Erev algorithm (here-

after referred to as ERE algorithm).

In the simulations discussed hereafter, we have

adopted the values of 0.12 and 0.20 for the parame-

ters e and r, respectively. Moreover, the value of 3.0

and 10.0 have been chosen for the parameters α and

γ, respectively. It is worth noting that the values for

e, r, α, ad γ have been chosen so to guaranty stabil-

ity of the difference equations involved in the learning

process (i.e., equations 5 and 9).

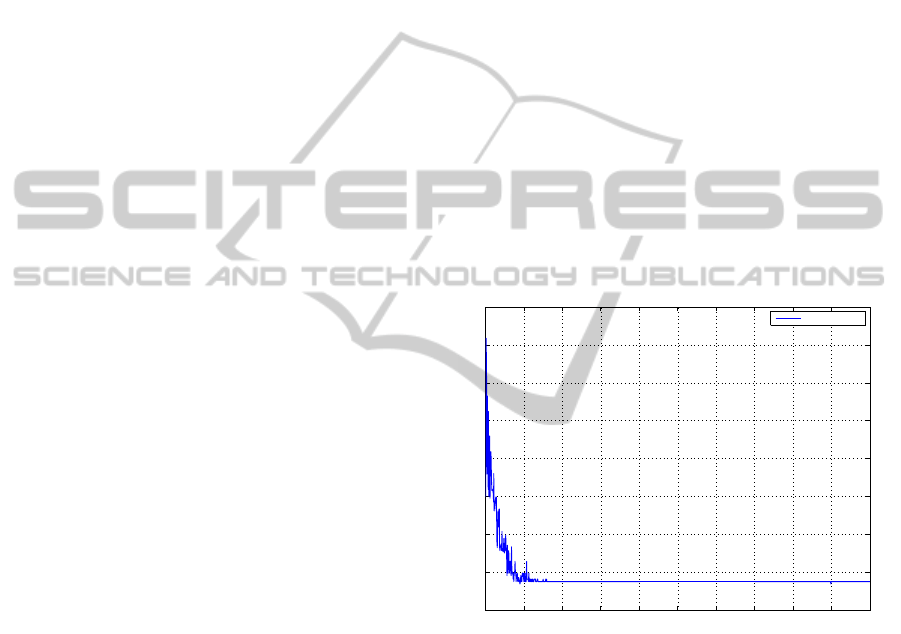

0 100 200 300 400 500 600 700 800 900 1000

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

Iterations

Probability Value

Extended Roth−Erev Algorithm

Price−Taker Agent

Out−of−the−Market Agent

Price−Maker Agent

Figure 7: Convergence time-path for the different groups of

interacting agents in ABM IPEX.

In order to understand effectiveness of the pro-

posed Enhanced Roth and Erev algorithm and the

interrelation between learning convergence and eco-

nomic results, we firstly studied the behavior and the

convergence of the learning in the power exchange

model. We have assumed the initial (i.e., at t = 0)

propensities S

j,t

(a

j

in equation 5 to be uniformly dis-

tributed among the possible strategies in the strategy

space. Furthermore, as discussed in Section 3.3, the

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION

39

strategy space is related to the mark-up variables. In

all computational experiments discussed hereafter we

have considered a uniformly spaced grid for µ

i

in the

range [0.8, 2.3] with step 0.05. This results in a set of

31 possible strategies for each of the N = 175 genera-

tors.

Stated this simulation contest, the evolution of

the strategy probabilities pointed out three groups of

agents:

• those whose bids are lower than clearing prices

and are always accepted by the market. We denote

them as price-takers agents and are characterized

by a convergence of the strategy probabilities;

• those whose bids are higher than clearing prices

and are always rejected by the market. We denote

them as out-of-the-market agents and are gener-

ally characterized by randomly chosen strategies,

as they do not participate to the market price for-

mation and accordingly receive always negative

payoffs;

• those whose bids are able to set the Locational

Marginal Price. We denote them as price-maker

agents and are characterized by the faster conver-

gence time in the learning process.

Figure 7 shows an example of reference conver-

gence time-path. For the sake of representativeness,

the strategy characterized by the largest final proba-

bility (i.e., the action most willing to be played ) of

three reference Gencos is considered and their proba-

bilities plotted as function of the simulation iterations.

Figure 7 points out that both price-taker and price-

maker are characterized by a learning process that se-

lect the preferred action strategy (i.e., the one whose

probability convergeto 1). Conversely, it is worth not-

ing that only some of the out-of-the-marketagents are

characterized by a convergence of the strategy proba-

bilities. Indeed, those agents whose bids are slightly

higher than the LMP tend to converge even if their

bids are always rejected by the market. This can be in-

terpreted as a result of an almost complete exploration

process of their strategy spaces that allows them to

conclude that the strategies played by the near com-

petitors (i.e., the price maker agents) were character-

ized by a bidding price lower enough to keep them out

of the market. In this exploration process, they are

characterized by the slower convergence time, thus

corroborating such conclusion.

5 COMPUTATIONAL

EXPERIMENTS

Learning algorithms and agent-based models should

stick to empirical criteria in order to demonstrate that

they are able to reproduce reality. In particular, at the

micro-level, learning algorithms should converge to-

ward a price during the experiments, whereas, at the

macro-level, practitioners should be able to observe

stylized facts and economic emergent behaviors.

Completed the learning convergence (see Section

4), we focussed our attention to a set of computa-

tional experiments in order to understand the ability

of the framework to reproduce the emergent proper-

ties shown by the IPEX DAM at macro-level.

Firstly, we have chosen a reference power ex-

change setting (i.e., Gencos and loads). In this re-

spect, the scenario has been based on a real off-peak

hour (i.e., hour 5 AM of Wednesday 16th Decem-

ber 2009) as during off-peak hour competition among

producers is generally limited and thus limiting the

impact on the level of prices. For the reference power

exchange setting, we have performed 100 computa-

tional experiments with different random seeds in or-

der to analyze the ensemble results of the same re-

peated game.

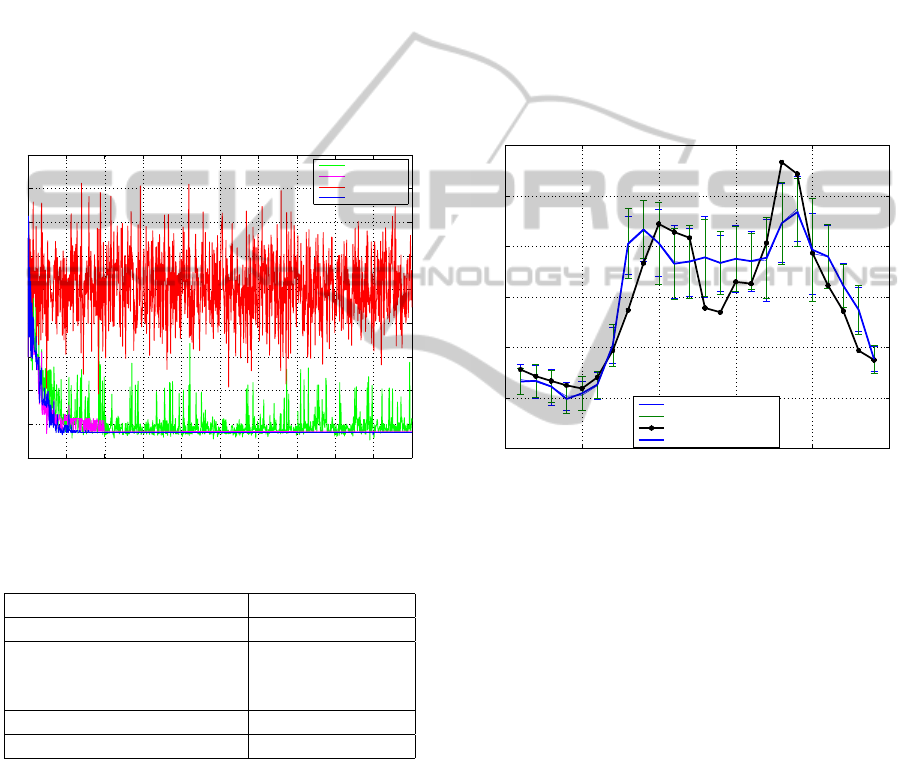

0 100 200 300 400 500 600 700 800 900 1000

45

50

55

60

65

70

75

80

85

Iteration

PUN [Euro/MWh]

Extended Roth−Erev Algorithm

Simulated PUN

Figure 8: Convergence time-path of PUN in ABM IPEX

with Enhanced Roth-Erev learning.

Both agent convergence and system convergence

have been observed. While the former has been dis-

cussed in Section 4 and used as a validation proof of

the enhanced Roth-Erev learning algorithm, we now

concentrate on the system convergence. This type of

convergence (or its lack) can be defined with respect

to the convergence of the PUN time path (i.e. the

clearing price converge to a value after a specific time

which depends only from the participating agents).

Indeed, the PUN is a weighted-average of the Loca-

tional Marginal Prices by means of the inelastic loads

and an adequate representative of the market clearing

and its convergence a good proxy that the system has

reached an equilibrium.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

40

Figure 8 shows a reference time-path for the PUN

and it points out a convergence at the aggregate. It is

worth remarking that due to the proportional update

mechanism of the strategy selection probability (see

Section 4), this is a real system convergence and not

a fictitious one induced by a cooling parameter. We

also observe that at the aggregate the learning pro-

cess achieves an equilibrium that corresponds to a lo-

cal optimum rather than to a global one, as the PUN

and LMP dependent both on profits (i.e. payoffs) and

on strategy spaces.

In order to assess the performance of the proposed

Enhanced Roth-Erev algorithm, we compared it with

major examples found in the literature. These are

summarized in Table 1.

0 100 200 300 400 500 600 700 800 900 1000

45

50

55

60

65

70

75

80

85

90

Iteration

PUN [Euro/MWh]

Roth and Erev reinforcement learning algorithms convergence comparison

RE Algorithm

MRE Algorithm

VRE Algorithm

ERE Algorithm

Figure 9: Convergence time-path of PUN in ABM IPEX

using the learning algorithms in Table 1.

Table 1: Roth and Erev reinforcement learning algorithms.

Authors Formulation

(Roth and Erev, 1995) RE

(Nicolaisen et al., 2000)

and (Weidlich and Veit,

2008a)

MRE

(Rastegar et al., 2009) VRE

Proposed Algorithm ERE

In this contest, we searched for the ”best perform-

ing” economic-learning algorithm, i.e. the selection

of the algorithm should have lead both to learning

convergence and to economic meanings.

Figure 9 shows the results. Beside the conver-

gence at the aggregate level of the proposed ERE al-

gorithm, results point out a convergence of the PUN

only in the cases of MRE. Moreover, while ERE

shows a smooth slope toward the convergence (see

Figure 8), MRE points out a typical ”freezed” con-

vergence. It is worth remarking that this is a quite

”artificial” convergence as probabilities are updated

using a simulated annealing technique. Similar ficti-

tious results have been already discussed for the Roth-

Erev algorithm in a simplified agent-based electric-

ity model (see (Jing et al., 2009)) as well as for Q-

Learning (see (Watkins and Dayan, 1992)). Further-

more, in the case of VRE learning algorithm the shape

of the curve suggests that although the probabilities of

strategy spaces of the agents have been updated dur-

ing the simulation, prices at the beginning of the sim-

ulation are the same as at the end. This directly points

out that agents have not learnt any preferred strategy

(i.e. there is no convergence) and leads to a ”random

noise shape” of the prices, as discussed in (Jing et al.,

2009).

0 5 10 15 20 25

20

40

60

80

100

120

140

Hour

Euro/MWh

PUN

Error Bar

Error Bar

GME Real PUN

Simulated PUN With GAPEX

Figure 10: 24 hours GAPEX simulated PUNs vs. real GME

PUNs.

It is worth remarking that these results further

point out effectiveness of the proposed Enhanced

Roth and Erev algorithm (with the respect to the other

state-of-the-art version proposedby the literature) and

its direct applicability to economic and financial con-

text characterized by positive, null and negative re-

wards.

Finally, the complete 24 hours PUNs of Wednes-

day 16th December 2009 have been simulated. Again,

we have performed 100 computational experiments

(each with a length of 5,000 steps) with different ran-

dom seeds in order to analyze the ensemble results of

the same repeated game. It is worth remarking, that

the energy market is characterized by a strong season-

ality (i.e., daily, weekly, and yearly). Thus, the strate-

gic behavior of Gencos can be properly studied on a

daily base, that is the basic component of the power

exchange results.

Figure 10 compares the GAPEX simulated PUNs

to the GME real PUNs. Figure 10 points out that the

simulated results are in good agreement throughout

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION

41

the whole 24 hours. Indeed, most of the GME real

PUNs fall within the 95 percent (i.e., 2*σ) confidence

band evaluated over the 100 computational experi-

ment whereas the outliers are howver quite close to

the limit of the 95 percent confidence band. This fur-

ther states the quality and importance of the proposed

methodology that is able to mostly replicate the ag-

gregate results by means of the strategic interactions

of the Gencos rather than of a black-box forecast.

It is worth remarking that these understanding the

origin of the market results is a crucial element from

an economics point of view as it allows us to deter-

mine the drivers and model of the power exchange.

Every policy measure, antitrust action and market de-

sign requires a clear understanding of these elements

in order to be effective. Furthermore, it is worth not-

ing that in the case of the computational experiments,

the generation universe is kept fixed with cost func-

tions unchanged for the whole 24 hours. This has

been assumed in order to evaluate the ability of the

learning algorithm for selecting the most profitable

strategy in different condition of demands. However,

such condition is not present in the real GME mar-

ket sessions as the generation plants are characterized

by outages. The absence of outages in the compu-

tational experiments can explain the small difference

between GAPEX simulated PUNs to the GME real

PUNs and it is worth noting that including outages

in the GAPEX is easily and direct. However, such

an interesting scenario for computer science results

of limited interest from an economics perspective. In-

deed, it is characterized by such a large ex− ante in-

formation (the exact information of the hourly par-

ticipation of the Gencos to the power auction) that it

results practically irrelevant and for this reason it has

not been considered.

Finally, the good agreement between the GAPEX

simulated PUNs and the GME real PUNs achieved

by the strategic computational experiments remarks

the importance of including the fixed costs in the

decision-making process of Gencos. Indeed, results

point out a strong relationship between fixed-costs

and profits that the Enhanced Roth-Erev algorithm

was able to incorporate thus improving realism of the

model.

6 CONCLUSIONS

In this paper, an agent-based electricity market frame-

work has been presented. The framework has been

implemented in MATLAB using the OOP paradigm

and it allows creation of artificial power exchanges

characterized by real market mechanisms and by eco-

nomic agent with learning capability. In order to over-

come limitation in the sign of payoff typical of rein-

forcement learning algorithms proposed in the litera-

ture, an enhanced version of the Roth-Erev algorithm

(i.e., that takes into account positive, null and negative

payoffs) has been presented and discussed. Further-

more, due to its complex high-voltage transmission

network, the Italian power exchange (IPEX) has been

taken as case of study. This resulted in replicating the

exact market clearing procedure (i.e., by calculating

Locational Marginal Prices and National Price based

on the Italian high-voltage transmission network with

its zonal subdivision) and in considering generation

plants in direct correspondence with the real ones.

Results on the convergence of the enhanced Roth-

Erev learning algorithm pointed out effectiveness of

the proposed solution. In particular, the evolution of

the strategy probabilities pointed out different groups

of agents characterized by different convergencerates

that strongly depend on the role of the agent in the

market. This confirms the direct applicability of the

proposed EnhancedRoth-Erev learining algorithm for

economic and financial applications. Moreover, com-

putational experiments of the ABM IPEX model per-

formed within the GAPEX pointed out a close agree-

ment with historical data during both peak- and off-

peak load hours. Thus this confirm the direct applica-

bility of the GAPEX to model and to simulate power

exchanges in particular for what-if analysis and mar-

ket design.

ACKNOWLEDGEMENTS

E. Guerci and M.A. Rastegar collaborated to the de-

sign and the development of the GAPEX framework.

This work has been partially supported by the Univer-

sity of Genoa, by the Italian Ministry of Education,

University and Research (MUR) under grant PRIN

2007, by the European Social Fund (ESF) and by Re-

gione Liguria, Italy.

REFERENCES

Bagnall, A. and Smith, G. (2005). A multi-agent model of

the uk market in electricity generation. IEEE Transac-

tions on Evolutionary Computation 9 (5), pages 522–

536.

Ball, P. (2010). The earth simulator. New Scientist,

2784:48–51.

Bower, J. and Bunn, D. W. (2001). Experimental analysis of

the efficiency of uniform-price versus discriminatory

auctions in the england and wales electricity market.

ICAART 2012 - International Conference on Agents and Artificial Intelligence

42

Journal of Economic Dynamics & Control, 25:561–

592.

Bunn, D. W. and Oliveira, F. (2001). Agent-based simula-

tion: an application to the new electricity trading ar-

rangements of england and wales. IEEE Transactions

on Evolutionary Computation,, 5(5):493–503. Special

issue: Agent Based Computational Economics.

Camerer, C. and Ho, T. (1999). Experience-weighted attrac-

tion learning in normal-form games. Econometrica,

67:827–74.

Cau, T. D. H. and Anderson, E. J. (2002). A co-evolutionary

approach to modelling the behaviour of participants

in competitive electricity markets. IEEE Power Engi-

neering Society Summer Meeting, 3:1534–1540.

Cincotti, S., Guerci, E., and Raberto, M. (2005). Agent-

based simulation of power exchange with heteroge-

neous production companies. Computing in Eco-

nomics and Finance 2005, Society for Computational

Economics, 334.

Gestore, dei, Mercati, and Ener-

getici (2010a). Official web site.

http://www.mercatoelettrico.org/En/Default.aspx.

Gestore, del, Mercati, and Energetici (2010b). Uppo auc-

tion module user manual, appendix a - market splitting

auction algorithm). Technical report, GME.

Gode, D. D. K. and Sunder, S. (2004). Double auction dy-

namics: structural effects of non-binding price con-

trols. Journal of Economic Dynamics and Control,

28(9):1707–1731.

Gode, D. K. and Sunder, S. (1993). Allocative efficiency

of markets with zero intelligence traders. market as

a partial substitute for individual rationality. J Polit

Econ, 101(1):119–137.

Guerci, E., Ivaldi, S., Raberto, M., and Cincotti, S. (2007).

Learning oligopolistic competition in electricity auc-

tions. Computational Intelligence, 23(2):197–220.

Guerci, E., Rastegar, M., and Cincotti, S. (2010). Agent-

based modeling and simulation of competitive whole-

sale electricity markets. Handbook of Power Systems,

3(2):241–286.

Jing, Z., Ngan, H., Wang, Y., Zhang, Y., and Wang, J.

(2009). Study on the convergence property of roth-

erev learning model in electricity market simulation.

In Advances in Power System Control, Operation

and Management (APSCOM 2009), 8th International

Conference on, pages 1 –5.

Kirschen, D. S. and Strbac, G. (2004). Fundamentals of

Power System Economics. Wiley.

Migliavacca, G. (2007). Srems: a short-medium run elec-

tricity market simulator based on game theory and in-

corporating network constraints. In Power Tech, 2007

IEEE Lausanne, Switzerland, pages 813–818.

Nicolaisen, J., Petrov, V., and Tesfatsion, L. (2001). Mar-

ket power and efficiency in a computational electric-

ity market with discriminatory double-auction pric-

ing. IEEE Transactions on Evolutionary Computa-

tion, 5(5):504–523.

Nicolaisen, J., Smith, M., Petrov, V., and Tesfatsion, L.

(2000). Concentration and capacity effects on elec-

tricity market power. In Proceedings of the 2000

Congress on Evolutionary Computation, La Jolla,

USA,, volume 2, pages 1041–1047.

Rastegar, M., Guerci, E., and Cincotti, S. (2009). Agent-

based model of the Italian wholesale electricity mar-

ket. In Proceedings of the 6th International Confer-

ence on the European Energy Market EEM 09.

Roth, A. E. and Erev, I. (1995). Learning in extensive

form games: Experimental data and simple dynamic

models in the intermediate term. Games Econ Behav,

8(1):164–212.

Ruperez Micola, A., Banal Estaol, A., and Bunn, D. W.

(2008). Incentives and coordination in vertically re-

lated energy markets. Journal of Economic Behavior

and Organization, 67:381–393.

Sun, J. and Tesfatsion, L. (2007). Dynamic testing of

wholesale power market designs: An open-source

agent-based framework. Comput Econ, 30:291–327.

TERNA S.p.A. (2008). Individuazione della rete rilevante -

italian version only. Technical report, TERNA S.p.A.

Watkins, C. and Dayan, P. (1992). Q-learning. Machine

Learning, 8(3-4):279–292.

Weidlich, A. and Veit, D. J. (2006). Bidding in interrelated

day-ahead electricity markets: Insights from an agent-

based simulation model. In Proceedings of the 29th

IAEE International Conference, Potsdam.

Weidlich, A. and Veit, D. J. (2008a). Analyzing interrelated

markets in the electricity sector - the case of wholesale

power trading in Germany. IEEE Power Engineering

Society General Meeting, pages 1–8.

Weidlich, A. and Veit, D. J. (2008b). A critical survey of

agent-based wholesale electricity market models. En-

ergy Economics, 30:1728–1759.

GAPEX: AN AGENT-BASED FRAMEWORK FOR POWER EXCHANGE MODELING AND SIMULATION

43