NETWORKING BETWEEN LMS MOODLE AND EXTERNAL

APPLICATIONS

Mikuláš Gangur

Faculty of Economics, University of West Bohemia, Univerzitní 8, Pilsen, Czech Republic

Keywords: Prediction Market, LMS Moodle, SQL, PHP, Evaluation, Gradebook.

Abstract: The contribution introduces the use of a prediction market as a support tool in the educational process and

its networking with LMS Moodle. The prediction market FreeMarket has been running at the Faculty of

Economics as the part of the financial engineering courses. The quality of the predictions estimates depends

on the trade activity of the market participants. That’s why it’s necessary to motivate students to trade on

such a market. The paper presents one of the methods to increase the activity of students. The results of the

market trades form a supplement to the final students’ evaluation in the relevant courses in the form of

credits that are added to the total score of each student. FreeMarket points that students earn on the market

are transferred to the credits according to the declared rate. The interconnection between FreeMarket and

LMS Moodle is described together with the description of the process that transfers FreeMarket points to

LMS Moodle gradebook. These processes update the students’ assignment score automatically and

periodically. In the next the interconnection between LMS Moodle and application for exam report

generating is explained. Finally the technological solution of networking is described.

1 INTRODUCTION

The simulation game FreeMarket (FM) on the base

of virtual prediction market is presented in this

contribution. The main functionality of the system

consists mainly in predicting selected events or in

estimating parameters. A practical example of such a

market on the Faculty of Economics of University of

West Bohemia is introduced. The FM participants –

traders are especially students of the university. This

virtual market is a supplement to the financial

engineering courses at the faculty and it has become

one of the new approaches in education not only in

this type of courses.

LMS Moodle is not only system for management

and administration of education process, but it is

also very useful tool for student testing and student

evaluation (Cápay and Tomanová, 2010). LMS

allows evaluating of the assignments automatically

according to the tests results and manually by

teacher as evaluation of tasks in file uploaded by

students to LMS. LMS Moodle offers also the

offline activities of students. Teachers evaluate these

activities manually. The main purpose of this paper

is to describe the automation of this process on the

base of interconnection of LMS Moodle and external

application for student offline assignments.

The interconnection of the market with LMS

Moodle and students’ evaluation are described. This

motivation factor is very important as support of

students’ activities on the market and it is used for

improving the quality of predictions by increasing

the market liquidity. In the next the connection

between LMS Moodle and external application that

generates the exam reports with all relevant

information about activities of students is explained.

The problem of the networking between LMS

Moodle and external application is addressed in

(Sánchez and Bragós, 2007). The LMS Moodle is

used for access control, register and scheduling of

processes in remote experimental laboratories.

Similar problem is focused in (Sancristobal,Castro,

Harward, Baley, DeLong, Hardison, 2010) and

(Uran, Hercog, Jezernik, 2007). These works focus

on the use of LMS Moodle for access control or

booking to remote application. One contribution

solves the integrating of control mechanism of

remote application over web into LMS Moodle. The

mentioned contributions don’t solve the transfer of

the results from remote application to LMS Moodle

and their transformation to credits for student

271

Gangur M..

NETWORKING BETWEEN LMS MOODLE AND EXTERNAL APPLICATIONS.

DOI: 10.5220/0003958002710275

In Proceedings of the 4th International Conference on Computer Supported Education (CSEDU-2012), pages 271-275

ISBN: 978-989-8565-06-8

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

evaluation. This paper describes the solution of these

problems.

2 PREDICTION MARKET

Prediction markets are speculative markets created

for the purpose of making predictions. Assets are

created whose final cash value is linked to a

particular event (e.g., the winner of the Czech

Parliament election will be the Civic Democratic

Party) or a parameter (e.g., the close value of PX

index on Friday 19/1/2012). Other names for these

markets are predictive markets, information markets,

decision markets, idea futures, event derivatives, or

virtual markets. The current market prices can then

be interpreted as predictions of the probability of the

event or the expected value of a parameter. People

who buy low and sell high are rewarded for

improving the market prediction, while those who

buy high and sell low are punished for degrading the

market prediction (PM, 2011).

Many prediction markets are open to the public.

Betfair is the world's biggest prediction exchange,

with around $28 billion traded in 2007. Intrade is a

for-profit company with a large variety of contracts

not including sports. The Iowa Electronic Markets

(I.E.M) is an academic market examining elections

where positions are limited to $500. This market was

opened in 1988 (IEM, 2011). The I.E.M. routinely

outperforms the major national polls. In the last four

presidential elections the I.E.M.’s election-eve

predictions were off by an average of just 1.37 per

cent.

Other prediction market, the Hollywood Stock

Exchange, which allows people to speculate on the

box-office returns, opening-weekend performance,

and the Oscars, has also been prescient. Traders’

predictions of the opening-weekend returns are more

accurate than the movie industry’s forecasts, and the

Exchange has done a good job of foreseeing

nominations as well. Last year, its traders correctly

predicted thirty-five of the forty Oscar nominees in

the top eight categories. The participants of these

markets also “decided” the results of the Iraq war

and the Sadam Hussain’s destiny. (Surowiecki,

2003)

Why do decision markets work so well? They are

extremely efficient at aggregating information and

tapping into the collective wisdom of a group of

traders, and groups are almost always smarter than

the smartest people in them. As in financial markets,

the incentive to get the better of others (whether the

reward is profit or mere satisfaction) causes traders

to seek out good information. The absence of

hierarchy - markets don’t have vice-presidents -

insures that no single person has too much influence

and that diverse viewpoints don’t get shut out.

(Surowiecki, 2003)

2.1 FreeMarket – Prediction Market

on University of West Bohemia

An electronic prediction market under the name of

FreeMarket (FM) has been running at the Faculty of

Economics, UWB in Pilsen, since November 2007

(FM, 2012). To this time 1600 users are registered

and around 450 of them, participants of financial

courses, are registered in each of the fall semesters

2009/2010, 2010/2011, 2011/2012. The shares are

divided into 4 areas:

• Politics

• Sport

• Entertainment

• Economics

The portfolio of each of the participants was

composed by an endowment of 5,000 credits (money

units, points) when registering or 10,000 credits

when he/she passes the final exam to become an FM

broker and receives an FM broker concession

number. The applicant can pass the exam together

with practical training of trading in an e-learning

course that is a supplement to the FM system.

The login to FM runs under the common

university single sign-on system. This system

ensures the creation of just one trading account for

each student and this way it prevents students from

creating the “black” trading. In the past this system

was not used and the control mechanism detected

several students that had created “black” accounts to

receive more starting points from each of those

accounts and then they transferred the points to their

official account with the help of illegal trade.

3 NETWORKING BETWEEN FM

AND LMS MOODLE

From fall semester 2009/2010 the FM system was

interconnected with the LMS Moodle. The reasons

for this connection are to increase student motivation

and to prevent some students from “black” trade

realization. The connection to LMS belongs to the

incentives of FreeMarket, proposed and

implemented by the author of this paper.

In the first case thanks to this connection the

students could transfer their earned points to

engineering courses credits in announced rate

CSEDU2012-4thInternationalConferenceonComputerSupportedEducation

272

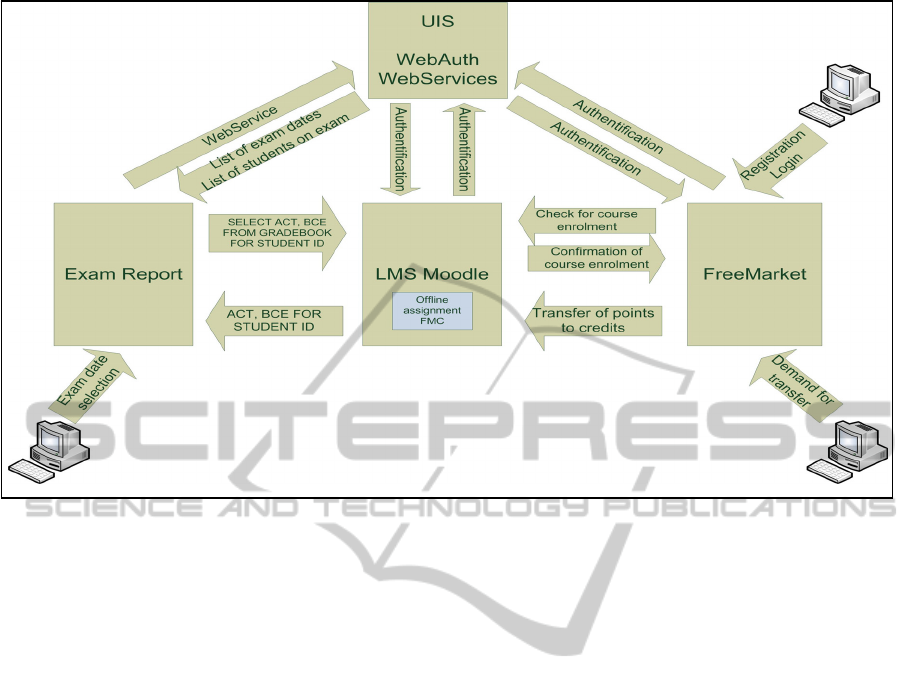

Figure 1: Interconnections between LMS Moodle and external applications. (Source: own)

(1:5000 for inclusion and 1:10000 for exam). The

credits are put as evaluation of offline assignment in

the course. These points help to students to reach

inclusion and also were added to final result of exam

as additional credit. The students can set the amount

of transfer points in any time during semester. The

whole process is automatic without any intervention

of course teacher.

The connection to LMS Moodle with the

relevant courses allows also control the number of

created account. Every participant of FM has to be

enrolled in selected courses in LMS Moodle and

then can create only one account. The connection

between FM and LMS Moodle is shown in Figure 1

together with interconnection LMS Moodle and

external application for summarizing information

about students for exams reports.

3.1 A Practical Example of Credits

Calculations

In the relevant LMS Moodle courses two artificial

offline assignments were created

• FreeMarket credits FMC

• Bonus credits to exam BCE

The following formulas calculate the

Aggregation Course Total (ACT) of all the course

assignments credits and Bonus credits to exam

(BCE). It uses one of the useful features of LMS

Moodle consisting in defining calculation for the

gradebook by means of a math formula. The formula

follows the pattern of formulas/functions in popular

spreadsheet programs. The process of evaluating the

whole course with respect to the values of all the

course assignments (AS-n) and FMC is proposed

and implemented in LMS Moodle.

ACT=sum([[AS1]];….;[[AS-n]]; [[FMC]])

/200*100

(1)

BCE=max([[FMC]]-max(180- max(180-sum

([[AS1]];…;[[AS-n]]);0);0) *5000/10000

(2)

180 credits out of 200 credits is the minimum

amount of credits for students to become eligible for

the course. 5000 is the transfer rate for the bonus

inclusion credits and 10000 is the transfer rate for

the bonus exam credits. The ACT and BCE are parts

of the final course report of each student and serve

as basic documentation for the final course exam.

They are processed automatically by another

application (exam_report, ER) activating by teacher

that selects demanded exam term. This application

first of all connects to university information system

(STAG) and generates the list of students on

demanded exam term. Then ER connects to

gradebook of relevant courses in LMS Moodle (see

Figure 1) and it reads ACT and BCE values for

every student on generated exam list. According to

these values the ER determines information about

NETWORKINGBETWEENLMSMOODLEANDEXTERNALAPPLICATIONS

273

students’ inclusions and calculates bonus points for

exam.

3.2 Technological Solution of

Applications Networking

The transfer of credits from FM participants’

accounts to gradebook of LMS Moodle is realized in

two steps.

In first steps student determines the amount of

points (money) that has to be transferred to LMS

Moodle. He/she fills the web form with the number

of credits and by this way activates the process that

controls student’s money account and rounds the

points with respect to ratio 1:5000. Then this process

saves the points to database table fm_users with all

information about participants and adds it to the total

amount of all previous transferred student points.

Finally it sets up the flag for transfer to 1.

The second step is processed by php script

points2moodle that is activated in cron process one

time per day. The script selects all users’ profiles

with transfer flag equal to 1 and then transfers total

amount all transferred points to student gradebook of

relevant course as a value of offline assignment

FMC. (see section 3.1).

Described transfer is processed with help of SQL

commands Select, Insert and Update. First of all the

Select command selects assignment id for relevant

course id and assignment name ‘FMC’ in Moodle

table grade_items. Next Select command finds the

gradebook of given user from the table

grade_grades according to the user id and

assignment id. Then the new record is inserted to the

table grade_grades if it is processed for the first

time and the gradebook record doesn’t exist for the

user and assignment or the existing record is updated

by new FMC value. In both described cases the new

record is inserted to the table grade_grades_history

that archives information about grade changes.

Finally the script regrade is activated to

recalculate ACT value (see section 3.1) for course

and every student. The script selects the values of all

assignments for user id and course id from the table

grade_grades and grade_items. Some of

assignments are calculated items (ACT, BCE). In

case of these items the process has to evaluate the

item value according to the calculation prescription

that is saved in the table grade_items. At the end the

values of all assignments are summarized according

to the final grade ACT calculation prescription and

the ACT value is set in the table grade_grades. This

value is important for next generation of exam report

in such it shows the student course inclusion.

The exam report generation is implemented as

connection to the university information system via

web service and as a connection to LMS Moodle

table grade_items and grade_grades. The

exam_report script determines the list of exam dates

via web service from university IS. Teacher can

select demanded exam term and the process requests

the list of students enrolled on exam again via web

service from IS. Then the script connects to LMS

Moodle database and it finds out ACT and BCE

assignment id for every student on list from

grade_items table and the ACT and BCE values are

determined from grade_grades table. The final

output of whole process is a table of all students on

exam term with collected information and empty

fields for exam results. This table is generated in

HTML code and it is published on web page or it is

generated as CSV file for importing to spreadsheet

application.

4 CONCLUSIONS

LMS Moodle offers several types of assignments.

One of them is offline assignment that is evaluated

and the credits are set manually by teacher. The

contribution shows the possibility of the networking

between external application, where students process

their assignments, and LMS Moodle. The functional

transfer of credits from external application to

gradebook of LMS Moodle is described as well as

the networking between reporting application that

utilizes information from LMS Moodle, is presented.

This online interconnection between applications

and every day possibility to watch results in LMS

Moodle supports students’ activities.

The interconnection and networking are realized

with straight access to LMS Moodle database tables.

The transfer of credits can be realized with import

utilities that are implemented in LMS Moodle. But

in such case it is needed to load Moodle libraries to

external host and application. Another solution is

development of universal web service server as the

part of LMS Moodle (Al-Ajlan and Zedan, 2008),

(Casany, Alier, Conde, 2009). The external

application code for credits transferring would be

simpler than current solution.

REFERENCES

Al-Ajlan, A., Zedan, H., 2008 The extension of web

services architecture to meet the technical

requirements of virtual learning environments

CSEDU2012-4thInternationalConferenceonComputerSupportedEducation

274

(moodle). 2008 International Conference on

Computer Engineering and Systems, ICCES 2008 , art.

no. 4772960 , pp. 27-32

Cápay M., Tomanová, J., 2010 Enhancing the quality of

administration, teaching and testing of computer

science using learning management system, WSEAS

Transactions on Information Science and Applications

7 (9), 2010, pp. 1126-1136

Casany G.M. J., Alier F.M., Conde G.M.A., et al., 2009

SOA initiatives for eLearning. A Moodle case.

International conference on advanced information

networking and applications workshops: WAINA, vols

1 and 2 Pages: 750-755 DOI: 10.1109/

WAINA.2009.196 Published: 2009

Sánchez, B., Bragós, R., 2007 Modular workbench for In-

situ and remote laboratories, Conference Record -

IEEE Instrumentation and Measurement Technology

Conference , art. no. 4258465

Sancristobal, E., Castro, M., Harward, J., Baley, P.,

DeLong, K., Hardison, J., 2010 Integration view of

web labs and learning management systems, 2010

IEEE Education Engineering Conference, EDUCON

2010 , art. no. 5492363 , pp. 1409-1417

Surowiecki, J., 2003 Decisions, decisions, The New

Yorker, March 24. 2003 ISSN 0028-792X

Uran S., Hercog D., Jezernik K., 2007 Remote control

laboratory with moodle booking system. IEEE

International symposium on industrial electronics,

Proceedings. vols 1-8 Pages: 2978-2983 DOI:

10.1109/ISIE.2007.4375089 Published: 2007

IEM, 2011 Iowa Electronic Markets [online]. Wikipedia,

the free encyclopedia. [cit. 2011-07-10]. Available at:

<http://www.wikipedia.org>

PM,,2011 Prediction Market – Wikipedia, the free

encyclopedia. [online] [cit. 2011-03-11] Available at:

<http://en.wikipedia.org/wiki/Prediction_market>

FM,,2012 FreeMarket [online] [cit. 2012-01-21] Available

at: <http://freemarket.zcu.cz>

NETWORKINGBETWEENLMSMOODLEANDEXTERNALAPPLICATIONS

275