MFO—The Federated Financial Ontology for the MONNET Project

Hans-Ulrich Krieger, Thierry Declerck and Ashok Kumar Nedunchezhian

Language Technology Lab, German Research Center for AI (DFKI GmbH)

Stuhlsatzenhausweg 3, 66123 Saarbr

¨

ucken, Germany

Keywords:

Business Ontologies, Merging, Alignment & Integration, Representation of Temporally-changing Information.

Abstract:

This paper describes work carried out in the European project MONNET which deals in part with the ex-

traction of company data from stock exchange pages and its representation in a semantic repository on which

inferences and queries are carried out. The special focus of the paper lies on the construction of an integrated

ontology MFO—the MONNET Financial Ontology—that has been constructed from several independent on-

tologies which are brought together by an interface specification, expressed in OWL.

1 INTRODUCTION

Company data in MONNET is obtained by harvesting

stock exchange Web sites, such as DAX or Euronext.

This task is realized by “harvesters”, standalone Java

programs that produce ABox data, compliant with the

integrated ontology. The output of a harvester is a set

of quintuples, RDF triples that are “annotated” by two

further temporal arguments, expressing the temporal

extent in which an atemporal fact holds.

This paper shed some light on the company data

and the construction of the integrated ontology that

has been assembled from several independent ontolo-

gies which are brought together by an interface spec-

ification, expressed in OWL (McGuinness and van

Harmelen, 2004). We will also sneak a peek on

the temporal entailment rules (Krieger, 2012) that are

built into the semantic repository hosting the data and

which can be used to derive useful explicit informa-

tion. This includes identifying companies from dif-

ferent times, monitoring data for unusual events, etc.

2 COMPANY SNAPSHOTS

We have mainly focused on the Xetra pages that are

operated by Deutsche B

¨

orse and which include stock

market indices, such as DAX, MDAX, SDAX, and

TecDAX. The good thing with the representation of

titles in the different indices is that their HTML pages

have an identical layout, so that the Xetra harvester

that was originally implemented for DAX perfectly

works for the other Xetra indices as well.

Recently, indices from the NYSE Euronext have

also been investigated, e.g., from Euronext 100 or

Next 150. Again, the layout for these different indices

in Euronext is identical, but since Xetra and NYSE

Euronext are operated by different marketplace orga-

nizer which, in addition, offer differing information

about companies, the Euronext harvester had to be

reimplemented. Contrary to Xetra, Euronext seems

to provide much more information for a company,

e.g., a finer industry sector classification, but also fis-

cal/monetary data for the past three years.

Harvesting company Web pages not only means

to collect captions and their corresponding values, but

also to transform this data into a meaningful represen-

tation that is compliant with existing standards, such

as XSD, RDF, and OWL, but also compatible with the

ontology schema (see next section). This includes (i)

the proper use of class and property names, (ii) the in-

troduction of fresh URIs, (iii) the syntactical transfor-

mation of values, and (iv) the combination of values

from different places.

Let us give an example to highlight the four tasks

of the harvester. We focus here on data for the sport-

business company adidas that were obtained on the

6th of January, 2012:

dax:DE000A1EWWW0_1325848842055

dax:endOfBusinessYear

"--12-31"ˆˆxsd:gMonthDay

"2012-01-06T12:20:42"ˆˆxsd:dateTime

"2012-01-06T12:20:42"ˆˆxsd:dateTime .

dax:DE000A1EWWW0_1325848842055

dax:totalCapitalStock

"209216186EUR"ˆˆxsd:monetary

327

Krieger H., Declerck T. and Nedunchezhian A..

MFO—The Federated Financial Ontology for the MONNET Project.

DOI: 10.5220/0004107903270330

In Proceedings of the International Conference on Knowledge Engineering and Ontology Development (KEOD-2012), pages 327-330

ISBN: 978-989-8565-30-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

"2012-01-06T12:20:42"ˆˆxsd:dateTime

"2012-01-06T12:20:42"ˆˆxsd:dateTime .

For better readability, we have depicted the two

quintuples using five consecutive lines each.

dax:DE000A1EWWW0 1325848842055 is a brand new

URI for adidas at the moment the harvester was

invoked, generated from the so-called ISIN number

dax:DE000A1EWWW0 for adidas and the Unix epoch

time. dax:endOfBusinessYear and dax:totalCapi-

talStock are exactly the properties that are associated

with the captions Fiscal year end and Total stock

from adidas’ Web page. The end of business year

was originally given by 31/12, whereas we make use

of the XSD data type gMonthDay, yielding the XSD

atom "--12-31". The total stock value results from

a combination of an absolute value, a multiplication

factor of 1,000, and a currency abbreviation, resulting

in "209216186EUR", an atom of our own XSD data

type monetary. Finally, the starting and ending points

of these two relational fluents make use of the XSD

data type dateTime. Since the snapshot was obtained

in a moment of time, the starting and ending time is

the same here.

3 ONTOLOGIES

Even though the ABox data, i.e., the company snap-

shots, do come with a temporal extent, the ontologies,

more exactly, the TBoxes and RBoxes, which pro-

vide class and property axioms are not equipped with

temporal information, thus still being represented as

triples. For instance, we do not state that an URI is

a class at a certain time and a property at a different

time. Or that a class is a subclass of another class

for only some amount of time. Thus TBox and RBox

of the integrated ontology represent universal knowl-

edge that is true at any time, so there is no need to

equip them with a fourth and fifth temporal argument.

This quality gives rise to the use of ontology editors

such as Prot

´

eg

´

e for manually constructing the TBoxes

and RBoxes of some of our ontologies.

Originally, we have started with company snap-

shots from the DAX index, resulting in the DAX on-

tology which has turned out to be universal for the

other Xetra indices. Later then, this ontology was ex-

tended in two ways: firstly, we incorporated axioms

to store parts of the annual XBRL company reports,

and secondly, we imported our own OWL version

of the NACE taxonomy for characterizing companies

against a classification of industry sectors.

At a later stage, further information came in, so

that we opted to separate independent information

from one another, not only by introducing different

namespaces, but also by locating this information in

distinct ontologies, so that they can be reused by other

projects and applications.

It is worth noting that the classification of compa-

nies against industry sectors is of utmost importance

in our domain. We have thus decided to view indus-

try sectors as subclasses of the class Company, both in

the DAX and Euronext ontology. Overall, we now

provide three, partly overlapping industry sector on-

tologies:

1. DAX comes up with a coarse and flat string-

based characterization of industry sectors. We

have manually turned these 11 values into direct

subclasses of class dax:Company. In early 2012,

Deutsche B

¨

orse restructured their pages, adding

more sectors and a further layer of subsectors.

2. In an older project, we have worked with the

four level deep NACE classification which covers

about 1,000 industry sectors. We have automati-

cally constructed our own OWL ontology NACE

that is hooked up to dax:Company in the interface

ontology IF (see below).

3. Euronext makes use of the four-layered ICB in-

dustry sector classification. We have automati-

cally transformed the latest ICB specification of

approx. 200 sectors into an OWL ontology ICB

which is interfaced as a subclass hierarchy for

en:Company in IF.

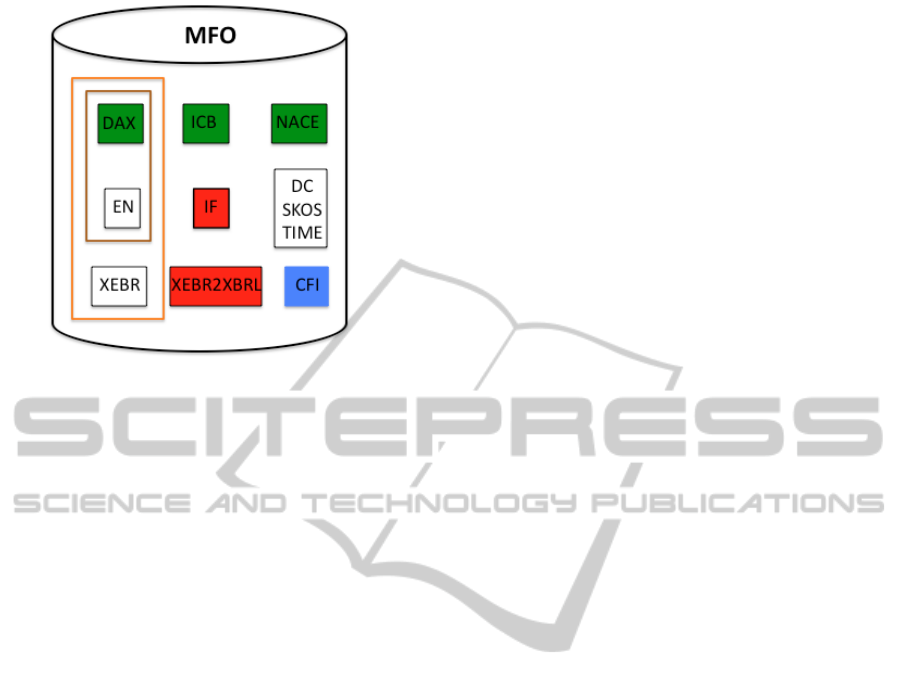

Overall, MFO consists of nine, truly indepen-

dent ontologies which do not have knowledge of

one another (see Figure 1). Two further ontolo-

gies, called IF and XEBR2XBRL bring them to-

gether through the use of interface axioms, using

axiom constructors, such as rdfs:subClassOf and

owl:equivalentProperty.

Let us give a few examples to see how this works.

As we said above, we have interfaced NACE with

DAX. This is realized through the following obvious

axiom (IndustrySector is the synthetic superclass of

all NACE sectors). We use Description Logics syntax

below to state the interface axioms:

dax:Company ≡ nace:IndustrySector

Let us present further examples. E.g., an XEBR report

is a special form of a Dublin Core resource:

xebr:Report v dc:Resource

The free-text company information in DAX corre-

sponds to something similar in Euronext:

dax:portrait ≡ en:activity

XEBR reports are linked to DAX companies through

property if:hasReport:

> v ∀ if:hasReport

−

. dax:Company

KEOD2012-InternationalConferenceonKnowledgeEngineeringandOntologyDevelopment

328

Figure 1: The MONNET Financial ontology MFO consists

of 11 sub-ontologies overall. The color encoding refers to

ontologies focussing on models of industry sector classi-

fication (green), stock exchange (brown), reporting (or-

ange), financial instruments (blue), and interface (red). As

can be seen from the picture, some of the ontologies even

model several aspects of our domain; e.g., DAX alone deals

with industry sector classification, reporting, and the de-

scription of stock exchange-listed information.

> v ∀ if:hasReport . xebr:Report

It is worth noting that across the ontologies, each

property has been cross-classified as being either syn-

chronic (i.e., property instances staying constant) or

diachronic (changing over time). This property char-

acteristic can be used, amongst other things, to check

the consistency of a temporal ABox or as a distin-

guishing mark in an entailment rule (cf. section 5).

4 SEMANTIC REPOSITORY

The integrated ontology as well as ABox data from

company snapshots, XEBR reports (annual financial

reporting documents) and other sources are uploaded

to OpenLink’s Virtuoso, hosted by one of our part-

ners in this projects. No inference rules are applied

here at the moment, thus only explicit knowledge can

be obtained through SPARQL (Prud’hommeaux and

Seaborne, 2008) queries. This can often be sufficient,

since SPARQL is a quite expressive query language.

Attentive readers of this paper, however, will ask

themselves how this goes together with the represen-

tation of company snapshot data, as explained in sec-

tion 2. We demonstrated that snapshot data is encoded

via quintuples, whereas ordinary semantic reposito-

ries (such as Virtuoso or OWLIM) always assume a

triple-based representation.

In order to make the snapshots accessible in Vir-

tuoso, we perform a quintuple-to-triple conversion

which is compatible with W3C’s N-ary Relations Best

Practice proposal (Hayes and Welty, 2006). A de-

scription of further possible representation schemes

can be found in (Krieger et al., 2008).

The idea behind the reduction is quite simple: all

arguments lying in the range of a relation instance

are hidden in a “container” object. The hidden ar-

guments, in our case the actual value of the atemporal

binary fact, the starting and the ending time can be

obtained through pre-defined properties. Thus a quin-

tuple

subj pred obj start end .

might equivalently be represented through 5 RDF

triples:

subj pred cont .

cont rdf:type nary:RangePlusTime .

cont nary:value obj .

cont nary:starts start .

cont nary:ends end .

Note that cont, the container object, is a brand-new

individual, usually an RDF blank node, that needs to

be introduced for each quintuple.

Given such a representation, we can now query

useful information, say, the evolution of the total cap-

ital stock for adidas, the company on which we fo-

cussed in section 2:

SELECT ?v ?s

WHERE {

?c dax:isin ?i .

?i nary:value "DE000A1EWWW0" .

?c dax:totalCapitalStock ?t .

?t nary:value ?v .

?t nary:starts ?s .

}

5 ENTAILMENT RULES

Due to space requirements, we can not focus here

on the temporal extension of the set of domain-

independent entailment rules for RDFS (Hayes, 2004)

and OWL (ter Horst, 2005); see (Krieger, 2012) for

the complete picture. The extension becomes neces-

sary, since the harvested ABox data presented in sec-

tion 2 is equipped with a temporal extent. Not only

do such domain-independent rules uncover inconsis-

tencies, they also make implicit consistent knowledge

explicit.

Before we go on, we like to mention that the tem-

poral entailment rules in (Krieger, 2012) as well as the

custom rule and the query below have been fully im-

plemented within our own semantic repository HFC,

an extended rule-based forward chainer that we have

MFO—TheFederatedFinancialOntologyfortheMONNETProject

329

developed over the last years and which is compara-

ble to other popular engines. Rules in HFC consist of

a left-hand side and a right-hand side of clauses, sepa-

rated by ->. A sequence of clauses is interpreted con-

junctively. Rules can make use of LHS tests (@test)

which need to be fulfilled to successfully instantiate a

RHS. Rules might also be equipped with an action

section (@action) that binds RHS-only variables to

values returned by functions. These two last points

distinguish HFC from other forward engines, and ex-

actly further lightweight tests and actions are needed

to address temporal entailment properly (see section

5.2). HFC is used in the working examples below.

Contrary to Jena, OWLIM, or Virtuoso, HFC is fur-

thermore able to operate directly over arbitrary (flat)

tuples, i.e., n-ary relations, without sticking to con-

tainer individuals (see last section).

5.1 Domain-independent Rule

The rule below implements the temporal extension of

Pat Hayes’ version of universal instantiation in RDFS,

called rdfs9 (Hayes, 2004):

?i rdf:type ?c ?start ?end

?c rdfs:subClassOf ?d

->

?i rdf:type ?d ?start ?end

Names starting with ? in the above rule indicate logic

variables. Recall that the TBox axiom pattern (second

line) must not be equipped with time, since it is used

to express a universal truth in our ontology. Thus,

if an instance ?i is of class ?c within the temporal

interval given by ?start and ?end, then ?i is also of

class ?d for [?start, ?end], since ?c is a subclass of

?d. However, before and after [?start, ?end], it is no

longer guaranteed that ?i is also of class ?d.

5.2 Domain-dependent Rule

This rule turns two quintuples which coincide in sub-

ject, predicate, and object position and which share

a non-empty temporal intersection into a larger unit.

Since only diachronic properties (see section 3) are

supposed to change over time, we add a further typ-

ing constraint here. Note that the below HFC rule

even quantifies over the property position ?p and uses

a lightweight LHS test and two lightweight RHS ac-

tions:

?p rdf:type time:DiachronicProperty

?c ?p ?v ?s1 ?e1

?c ?p ?v ?s2 ?e2

->

?c ?p ?v ?s ?e

@test

IntersectionNotEmpty ?s1 ?e1 ?s2 ?e2

@action

?s = Min2 ?s1 ?s2

?e = Max2 ?e1 ?e2

5.3 Custom Query

The mapping of industry sectors from different sub-

ontologies, as described in section 3, allows us

to find “rivals” of a company across stock ex-

changes. Assuming that dax:Banks, icb:ICB8300, and

nace:nace 64.1 all denote the same set of individ-

uals (viz., banks/financial institutions), the rivals of

Deutsche Bank can be easily obtained:

SELECT DISTINCT ?rival

WHERE ?db dax:name "Deutsche Bank" ?s ?e &

?db rdf:type ?type ?s ?e &

?rival rdf:type ?type ?s2 ?e2

FILTER ?db != ?rival

We note here that the query language in HFC slightly

differs from SPARQL and can make direct use of

quintuples, instead of applying the “triplification”

step, as described in section 4.

ACKNOWLEDGEMENTS

The research described here has been financed

by the European Integrated project Monnet

(www.monnet-project.eu) under contract number

FP7 ICT 248458.

REFERENCES

Hayes, P. (2004). RDF semantics. Technical report, W3C.

Hayes, P. and Welty, C. (2006). Defining N-ary relations on

the semantic web. Technical report, W3C.

Krieger, H.-U. (2012). A temporal extension of the

Hayes/ter Horst entailment rules and an alternative to

W3C’s n-ary relations. In Proceedings of the 7th In-

ternational Conference on Formal Ontology in Infor-

mation Systems (FOIS 2012).

Krieger, H.-U., Kiefer, B., and Declerck, T. (2008). A

framework for temporal representation and reasoning

in business intelligence applications. In AAAI 2008

Spring Symposium on AI Meets Business Rules and

Process Management, pages 59–70. AAAI.

McGuinness, D. L. and van Harmelen, F. (2004). OWL

Web Ontology Language Overview. Technical report,

W3C.

Prud’hommeaux, E. and Seaborne, A. (2008). SPARQL

query language for RDF. Technical report, W3C.

W3C Recommendation.

ter Horst, H. J. (2005). Completeness, decidability and

complexity of entailment for RDF Schema and a

semantic extension involving the OWL vocabulary.

Journal of Web Semantics, 3:79–115.

KEOD2012-InternationalConferenceonKnowledgeEngineeringandOntologyDevelopment

330