Forecasting for Discrete Time Processes based on Causal Band-limited

Approximation

Nikolai Dokuchaev

Department of Mathematics & Statistics, Curtin University, GPO Box U1987, Perth, 6845 Western Australia, Australia

Keywords:

Band-limited Processes, Discrete Time Processes, Causal Filters, Low-pass Filters, Forecasting.

Abstract:

We study causal dynamic smoothing of discrete time processes via approximation by band-limited discrete

time processes. More precisely, a part of the historical path of the underlying process is approximated in Eu-

clidean norm by the trace of a band-limited process. We analyze related optimization problem and obtain some

conditions of solvability and uniqueness. An unique extrapolation to future times of the optimal approximating

band-limited process can be interpreted as an optimal forecast.

1 INTRODUCTION

We study causal dynamic smoothing of discrete time

processes via approximation by band-limited discrete

time processes. More precisely, a part of the historical

path of the underlying process is approximated in Eu-

clidean norm by the trace of a band-limited discrete

time process. Since an unique extrapolation to fu-

ture times of the optimal approximating band-limited

process can be interpreted as an optimal forecast, this

task has many practical applications. It is well known

that it is not possible to find an ideal low-pass causal

linear time-invariant filter. In continuous time setting,

it is known that the distance of the set of ideal low-

pass filters from the set of all causal filters is positive

(Almira and Romero, 2008) and that the optimal ap-

proximation of the ideal low-pass filter is not possible

(Dokuchaev, 2012c). Our goal is to substitute the so-

lution of these unsolvable problems by solution of an

easier problem in discrete time setting such that the

filter is not necessary time invariant. Our motivation

is that, for some problems, the absence of time in-

variancy for a filter can be tolerated. For example,

a typical approach to forecasting in finance is to ap-

proximate the known path of the stock price process

by a process allowing an unique extrapolation that can

be used as a forecast. This has to be done at current

time; at future times, forecasting rule can be amended

according to new data collected.

We suggest to approximate discrete time pro-

cesses by the discrete time band-limited processes.

More precisely, we suggest to approximate the known

historical path of the process by the trace of a band-

limited process. The approximating sequence does

not necessary match the underlying process at sam-

pling points. This is different from classical sampling

approach; see, e.g., (Jerry, 1977). Our approach is

close to the approach from (Ferreira, 1995b) and (Fer-

reira, 1995a), where the estimate of the error norm is

given. The difference is that, in our setting, it is guar-

anteed that the approximation generates the error of

the minimal Euclidean norm.

We obtain analyze existence and uniqueness of an

optimal approximation. The optimal process is de-

rived in time domain in a form of sinc series.The ap-

proximating band-limited process can be interpreted

as a causal and linear filter that is not time invari-

ant. The filter obtained is not time invariant; as a

consequence, the coefficients of these series and have

to be changed dynamically, to accommodate the cur-

rent flow of observations. An unique extrapolation

to future times of the optimal approximating band-

limited process can be interpreted as an optimal fore-

cast at any given time. This paper develops further the

approach suggested in (Dokuchaev, 2011) where the

continuous time setting was considered. We extend

now this approach on discrete time processes. Some

related results can be found in (Dokuchaev, 2012b)

and (Dokuchaev, 2012d) for discrete time processes

that are band-limited or close to band-limited.

2 DEFINITIONS

For a Hilbert space H, we denote by (·,·)

H

the cor-

280

Dokuchaev N..

Forecasting for Discrete Time Processes based on Causal Band-limited Approximation.

DOI: 10.5220/0004243700820085

In Proceedings of the 2nd International Conference on Operations Research and Enterprise Systems (ICORES-2013), pages 82-85

ISBN: 978-989-8565-40-2

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

responding inner product. We use notation sinc(x) =

sin(x)/x.

Let Z be the set of all integers, and let Z

+

be the

set of all positive integers. We denote by ℓ

r

the set

of all sequences x = {x(t)}

t∈Z

⊂ R, such that kxk

ℓ

r

=

∑

∞

t=−∞

|x(t)|

r

1/r

< +∞ for r ∈ [1, ∞) or for r = +∞.

Let ℓ

+

r

be the set of all sequences x ∈ ℓ

r

such that

x(t) = 0 for t = −1,−2,−3,....

For x ∈ ℓ

1

or x ∈ ℓ

2

, we denote by X = Z x the

Z-transform

X(z) =

∞

∑

t=−∞

x(t)z

−t

, z ∈ C.

Respectively, the inverse Z-transform x = Z

−1

X is de-

fined as

x(t) =

1

2π

Z

π

−π

X

e

iω

e

iωt

dω, t = 0,±1,±2,....

If x ∈ ℓ

2

, then X|

T

is defined as an element of

L

2

(T).

Let θ,τ ∈ Z ∪ {+∞} and θ < τ. We de-

note by ℓ

2

(θ,τ) the Hilbert space of complex

valued sequences {x(t)}

τ

t=θ

such that kxk

ℓ

2

(θ,τ)

=

∑

τ

t=θ

|x(t)|

2

1/2

< +∞.

Let U

Ω,∞

be the set of all mappings X : T → C

such that X

e

iω

∈ L

2

(−π,π) and X

e

iω

= 0 for

|ω| > Ω. Note that the corresponding processes x =

Z

−1

X are said to be band-limited.

Let U

Ω,N

be the set of all X ∈ U

Ω,∞

such that

there exists a sequence {y

k

}

N

k=−N

∈ C

2N+1

such that

X

e

iω

=

∑

N

k=−N

y

k

e

ikω/Ω

I

{|ω|≤Ω}

, where I is the in-

dicator function.

We assume that we are given Ω ∈ (π/2,π), N ∈

Z

+

, s ∈ Z and q ∈ Z, such that q < s and s − q ≥

2N + 1.

Let T = {t ∈ Z : q ≤ t ≤ s}.

Let Z

N

be the set of all integers k such that |k| ≤ N.

Let Y

N

be the Hilbert space of sequences

{y

k

}

N

k=−N

⊂ C provided with the Euclidean norm, i.e.,

such that kyk

Y

N

=

∑

k∈Z

N

|y

k

|

2

1/2

.

Consider the Hilbert spaces of sequences X = ℓ

2

and X

−

= ℓ

2

(q,s).

Let X

Ω,N

be the subset of X

−

consisting of se-

quences {x(t)}|

t∈T

, where x ∈ X are such that x(t) =

(Z

−1

X)(t) for t ∈ T for some X

e

iω

∈ U

Ω,N

.

Up to the end of this paper, we assume that the

following condition is satisfied.

Condition 2.1. The matrix {sinc(kπ + Ωm)}

N

k,m=−N

is nondegenerate.

Lemma 1. Let Ω

0

∈ (π/2,π) be selected such that

there exists p ∈ (0,1) such that

min

k∈Z

N

|sinc(πk− Ωk)| ≥ p,

max

k,m∈Z

N

, t6=−k

|sinc(πk+ Ωm)| <

p

2N

for all Ω ∈ [Ω

0

,π). (1)

Then the matrix {sinc(kπ + Ωm)}

N

k,m=−N

is nonde-

generate for all Ω ∈ [Ω

0

,π).

Clearly, (1) holds for any Ω

0

that is close enough

to π, since sinc(x) → 1 as x → 0 and sinc(x) → 0 as

x → πm, where m ∈ Z, m 6= 0. Therefore, Condition

2.1 can be satisfied with selection of Ω being close

enough to π.

Lemma 2. For any any x ∈ X

Ω,N

, there exists an

unique X ∈ U

Ω,N

such that x(t) = (Z

−1

X)(t).

By Lemma 2, the future of even more ”smooth”

processes from X

Ω,N

is uniquely defined by a finite set

of historical values that has at least 2N + 1 elements

for any N < +∞ and Ω ∈ [Ω

0

,π).

3 APPROXIMATION RESULTS

3.1 The Optimization Problem in the

Time Domain

Let x ∈ X be a process. We assume that the sequence

{x(t)}

t∈T

represents available historical data. Let

Hermitian form F : X

Ω,N

× X

−

→ R be defined as

F(bx,x) =

s

∑

t=q

|bx(t) − x(t)|

2

.

Theorem 1. (i) There exists an optimal solution bx of

the minimization problem

Minimize F(bx,x) over bx ∈ X

Ω,N

. (2)

(ii) If s− q ≥ 2N + 1, then the corresponding optimal

process bx is uniquely defined.

Remark 1. By Proposition 2, there exists an unique

extrapolation of the band-limited solution bx of prob-

lem (2) on the future times t > s, under the assump-

tions of Theorem 1. It can be interpreted as the opti-

mal forecast (optimal given Ω and N).

3.2 The Optimization Problem for

Fourier Coefficients

To solve problem (2) numerically, it is convenient

to expand Z-transform X

e

iω

on the unit circle via

Fourier series.

ForecastingforDiscreteTimeProcessesbasedonCausalBand-limitedApproximation

281

Consider the mapping Q : Y

N

→ X

Ω,N

such that

bx = Q y is such that bx(t) = (Z

−1

b

X)(t) for t ∈ (q,s],

where

b

X

e

iω

=

∑

k∈Z

N

y

k

e

ikω/Ω

I

{|ω|≤Ω}

. (3)

Clearly, this mapping is linear and continuous.

Let Hermitian form G : Y

N

× X

−

→ R be defined

as

G(y,x) = F(Q y, x) =

s

∑

t=q

|bx(t) − x(t)|

2

,

bx = Q y. (4)

Corollary 1. There exists an unique solution y of the

minimization problem

Minimize G(y,x) over y ∈ Y

N

. (5)

Problem (2) can be solved via problem (5); its so-

lution can be found numerically.

Let

b

X be defined by (3), where {y

k

} ∈ Y

N

. Let

bx = Z

−1

b

X. We have that

bx(t) =

1

2π

Z

Ω

−Ω

∑

k∈Z

N

y

k

e

ikωπ/Ω

!

e

iωt

dω

=

1

2π

∑

k∈Z

N

y

k

Z

Ω

−Ω

e

ikωπ/Ω+iωt

dω

=

1

2π

∑

k∈Z

N

y

k

e

ikπ+iΩt

− e

−ikπ−iΩt

ikπ/Ω + it

=

Ω

π

∑

k∈Z

N

y

k

sinc(kπ + Ωt).

Hence

G(y,x) =

s

∑

t=q

|bx(t) − x(t)|

2

=

s

∑

t=q

Ω

π

∑

k∈Z

N

y

k

sinc(kπ + Ωt) − x(t)

2

= (y,Ry)

Y

N

− 2Re(y,rx)

X

−

+ (ρx,x)

X

−

. (6)

Here R : Y

N

× Y

N

→ Y

N

is a linear bounded Hermi-

tian operator, r : X

−

→ Y

N

is a bounded linear opera-

tor, ρ : X

−

× X

−

→ X

−

is a linear bounded Hermitian

operator.

It follows from the definitions that the operator

R is non-negatively defined (it suffices to substitute

x(t) ≡ 0 into the Hermitian form).

3.3 The Explicit Solution of the

Optimization Problem

Since the space Y

N

is finite dimensional, the opera-

tor R can be represented via a matrix R = {R

km

} ∈

C

2N+1,2N+1

, where R

km

= R

mk

. In this setting,

(Ry)

k

=

∑

N

k=−N

R

km

y

m

.

Theorem 2. (i) The operator R is positively defined.

(ii) Problem (5) has a unique solution by = R

−1

rx.

(iii) The components of the matrix R can be found from

the equality

R

km

=

Ω

2

π

2

s

∑

t=q

sinc(mπ + Ωt)sinc(kπ + Ωt). (7)

(iv) The components of the vector rx = {(rx)

k

}

N

k=−N

can be found from the equality

(rx)

k

=

Ω

π

s

∑

t=q

sinc(kπ + Ωt)x(t). (8)

Corollary 2. Let by be the vector calculated as in The-

orem 2, by = {by

k

}

N

k=−N

. The process

bx(t) = bx(t,q,s) =

Ω

π

∑

k∈Z

N

y

k

sinc(kπ + Ωt)

represents the output of a causal filter that is linear

but not time invariant.

The proofs of results given above can be found in

the working paper (Dokuchaev, 2012a).

4 NUMERICAL EXPERIMENTS

In the numerical experiments described below, we

have used MATLAB.

The experiments show that some eigenvalues of R

are quite close to zero despite the fact that, by The-

orem 2, R > 0. Respectively, the error for the MAT-

LAB solution of the equation Rby = rx does not vanish.

Further, in our experiments, we found that the error E

can be decreased by the replacing R in the equation

bx = R

−1

rx by R

ε

= R + εI, where I is the unit matrix

and where ε > 0 is small. We have used ε = 0.001.

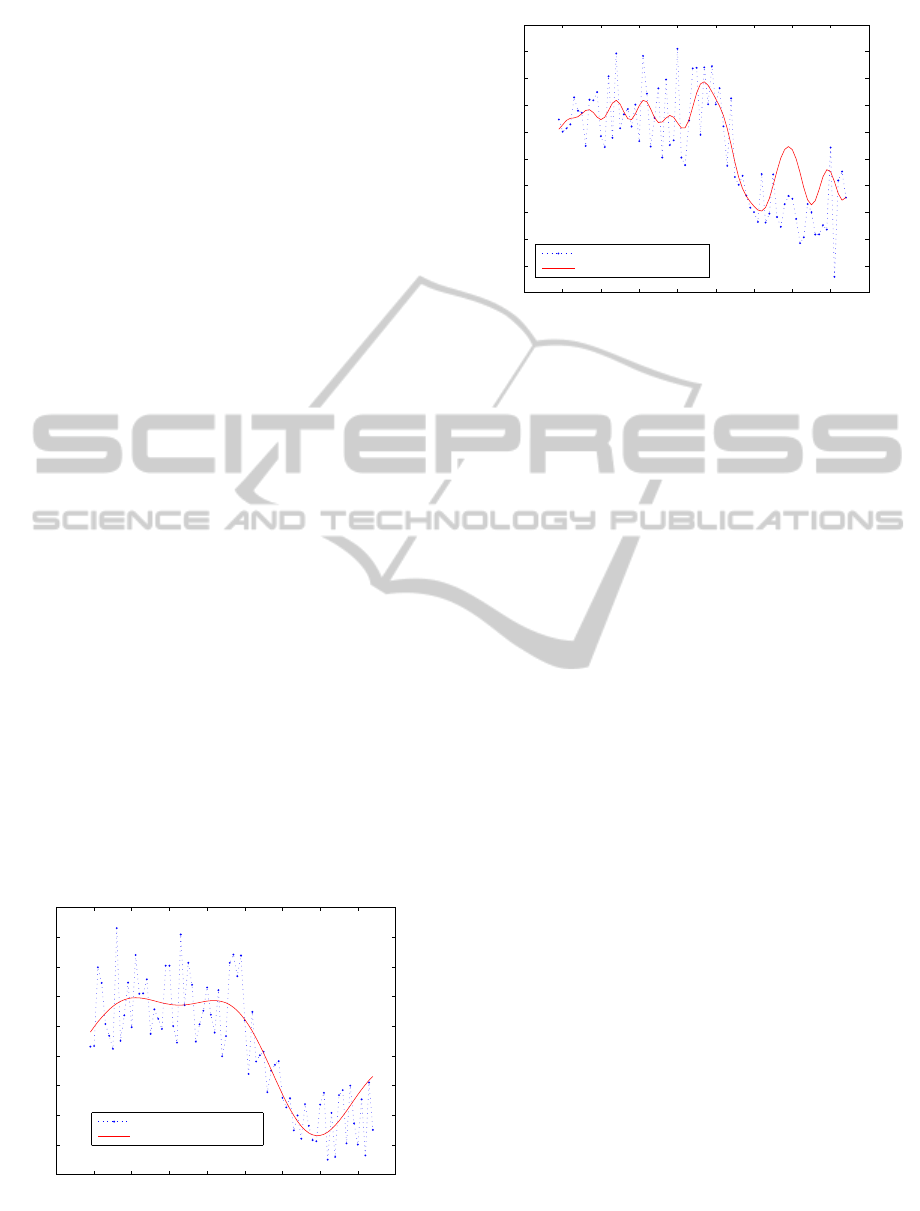

Figures 2 show examples of processes x(t) and

the corresponding band-limited processes bx(t) with

approximating x(t) with N = 15 at times t ∈

{−25, ...,15} (i.e., with q = −25, s = 15). The values

of bx(t) for t > 15 were calculated using { x(s)}

s≤15

and can be considered as an optimal forecast of x(t).

Figure 2 shows the result for Ω = 0.2; Figure ??

shows the result for Ω = 0.9.

We have verified numerically that the matrix

{sinc(kπ + Ωm)}

N

k,m=−N

is nondegenerate. There-

fore, Condition 2.1 is satisfied. In fact, we found that

this matrix was nondegenerate in all experiments for

all kinds of Ω and N.

By Remark 1, the extrapolation of the process bx ∈

X

Ω,N

to the future times t > s can be interpreted as the

optimal forecast (optimal given Ω and N).

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

282

ACKNOWLEDGEMENTS

This work was supported by ARC grant of Australia

DP120100928 to the author.

REFERENCES

Almira, J. and Romero, A. (2008). How distant is the ideal

filter of being a causal one? In Atlantic Electronic

Journal of Mathematics. 3 (1) 46–55.

Dokuchaev, N. (2011). On causal band-limited

mean square approximation. In Working paper.

http://arxiv.org/abs/1111.6701.

Dokuchaev, N. (2012a). Causal band-limited approxima-

tion and forecasting for discrete time processes. In

Working paper. http://lanl.arxiv.org/abs/1208.3278.

Dokuchaev, N. (2012b). On predictors for band-limited and

high-frequency time series. In Signal Processing. 92,

iss. 10, 2571-2575.

Dokuchaev, N. (2012c). On sub-ideal causal smoothing fil-

ters. In Signal Processing. 92, iss. 1, 219-223.

Dokuchaev, N. (2012d). Predictors for discrete time pro-

cesses with energy decay on higher frequencies. In

IEEE Transactions on Signal Processing. 60, No. 11,

6027-6030.

Ferreira, P. G. S. G. (1995a). Approximating non-band-

limited functions by nonuniform sampling series. In

SampTA’95.

Ferreira, P. G. S. G. (1995b). Nonuniform sampling of non-

bandlimited signals. In IEEE Signal Processing Let-

ters. 2, Iss. 5, 89–91.

Jerry, A. (1977). The shannon sampling theorem - its vari-

ous extensions and applications: A tutorial review. In

Proc. IEEE. 65, 11, 1565–1596.

APPENDIX

−40 −30 −20 −10 0 10 20 30 40 50

−0.6

−0.4

−0.2

0

0.2

0.4

0.6

0.8

1

1.2

t

original process

band−limited approximation

Figure 1: Example of x(t) and band-limited process bx(t)

approximating x(t) for t ∈ {−25,.., 15}, with Ω = 0.2, and

N = 15.

−40 −30 −20 −10 0 10 20 30 40 50

−0.8

−0.6

−0.4

−0.2

0

0.2

0.4

0.6

0.8

1

1.2

t

original process

band−limited approximation

Figure 2: Example of x(t) and band-limited process bx(t)

approximating x(t) for t ∈ {−25,..,15}, with Ω = 0.9, and

N = 15.

ForecastingforDiscreteTimeProcessesbasedonCausalBand-limitedApproximation

283