Stochastic Optimization Model of Fuel Procurement, Transportation

and Storage for Coal-Fired Thermal Plants in Hydrothermal Systems

A. Dias

1

, R. Kelman

1

, F. Thomé

1

, M. Pereira

1

, S. Binato

1

, E. Faria

2

and G. Ayala

2

1

PSR, Praia de Botafogo 228, 1701-A, Botafogo, Rio de Janeiro, 22250-145, Brazil

2

MPX, Praia do Flamengo 66, 8

th

floor, Rio de Janeiro, 22210-903, Brazil

Keywords: Stochastic Programming, Mixed Integer Optimization, Decision under Uncertainty.

Abstract: This work presents an optimal strategy of coal procurement for thermal plants, including transportation and

storage in order to guarantee continuous supply of the fuel. The stochastic programming model developed

takes into account the uncertainty associated with inflows in a hydrothermal system and other complex

logistics and commercial aspects related to the international coal market. Different study cases are analysed

and the results are presented through comparisons of different strategies applied to different scenarios of

dispatch.

1 INTRODUCTION

Three new coal-fired thermal plants are being built

in the Brazilian system: Porto do Pecém I and II

(720 MW/360 MW) and Porto do Itaqui (360 MW).

Projects were contracted in the energy auction of

2007/2008 “by availability”, i.e. each project will

receive:

(i) a fixed monthly revenue to guarantee the

investment returns;

(ii) a variable payment, proportional to the energy

production, to reimburse operational costs (fuel,

O&M, etc.).

Because the plants were contracted by availability,

an important problem is to guarantee continuous

supply of coal, since severe penalties are applied if

the plant is not able to meet the generation target due

to fuel shortages. This problem is complex because

time lengths comprising coal purchase and

transportation can be up to three months, while the

plant dispatch order by the operator can be placed

with one day in advance. Although considering the

coal storage capacity, the main challenge is

forecasting the medium/long term dispatch, which is

especially difficult in the case of the Brazilian

system, because of its hydro characteristic (high

volatility of energy spot prices).

Furthermore, in the international coal market,

long-term supply contracts are usually signed with

one year duration, pre-established prices and

delivery deadlines. This practice is a result of

unpredictability of coal prices and coal availability,

leading to longer delivery deadlines and long periods

of negotiation between parties.

For these reasons, coal procurement strategies

must be made under uncertainty, and must be

adequate to the storage capacity of thermal plants,

uncertainty of dispatch, and characteristics of both

coal and freight market. Uncertainties in the

forecasts may lead not only to generation outages

due to coal unavailability, but also to a surplus of

coal, that may be stored, used for inflexible

generation, or sold in the international market;

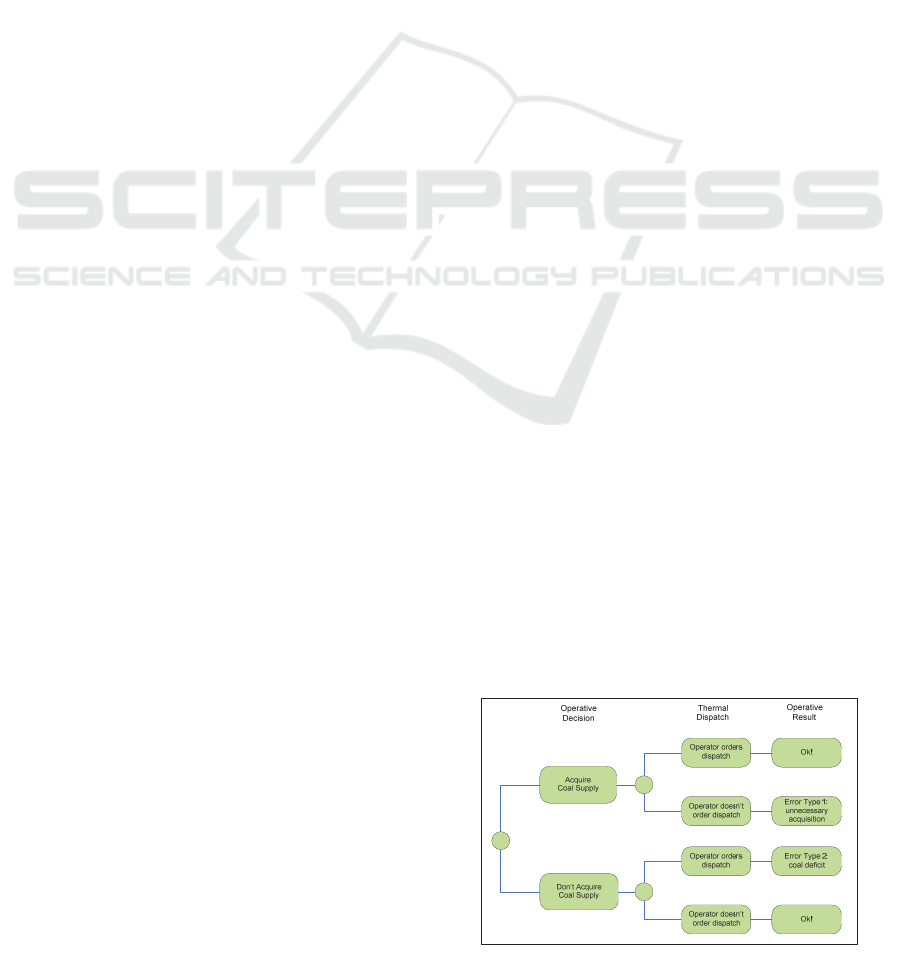

situations that can result in additional costs. Figure 1

illustrates the procurement decision process for coal

supply with respect to the dispatch uncertainties.

Figure 1: Coal procurement decision under uncertainty.

To summarize, the uncertainties of generation

135

Dias A., Kelman R., Thomé F., Pereira M., Binato S., Faria E. and Ayala G..

Stochastic Optimization Model of Fuel Procurement, Transportation and Storage for Coal-Fired Thermal Plants in Hydrothermal Systems.

DOI: 10.5220/0004285102830291

In Proceedings of the 2nd International Conference on Operations Research and Enterprise Systems (ICORES-2013), pages 283-291

ISBN: 978-989-8565-40-2

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

dispatch and/or energy spot price (SRMC) can drive

decisions to two types of errors: (1) fuel is purchased

but the thermal plant is not dispatched; and (2) fuel

is not purchased but the thermal plant is dispatched.

In this context, it is important to establish a

methodology to determine a coal supply strategy for

all coal-fired thermal plants. The objective is to

minimize costs of procurement decisions under

uncertainties, taking into account the costs caused by

the corrective actions taken in case of errors (1) (2).

The corrective actions to mitigate errors (1) include:

a) Fuel storage for future use – in this case, there is

an opportunity cost of the coal purchased in

advance;

b) Thermal plant inflexible dispatch – the energy is

sold in the spot market with a loss (in this case

the spot price is lower that its variable cost,

unless it is dispatched by the operator); and

c) Resell the coal vessel in the international coal

market.

In the case of errors (2), the possible corrective

measures to avoid penalties due to fuel shortage are:

a) Buy energy from a thermal plant not dispatched

in the same week, for example, from an oil-fired

plant; and

b) Use “energy credits” stored in hydro reservoirs

resulted from previous inflexible generation.

An overview of the optimization system for coal

supply procurement is presented in the next section.

2 SYSTEM OVERVIEW

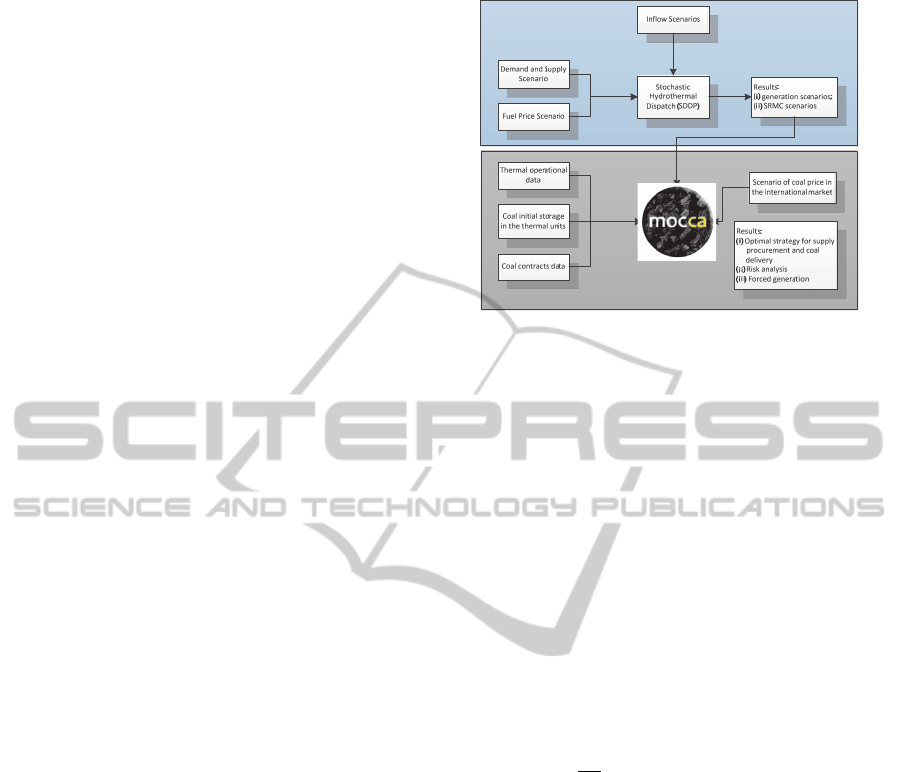

Figure 2 shows a schematic representation of the

coal procurement optimization system for thermal

plants operating in hydro-dominated systems,

composed by two blocks:

a) The first block (blue area) illustrates the module

responsible for the hydrothermal simulation. The

objective is to estimate scenarios of generation

dispatch and SRMC. Generation scenarios of

coal-fired thermal plants are converted into coal

consumption scenarios, which are used by the

procurement optimization module.

b) The second block (grey area) illustrates the coal

procurement optimization model (MOCCA),

which is responsible for evaluating an optimal

strategy for supply procurement and coal

delivery schedule for thermal plants.

Figure 2: Coal procurement optimization system.

As illustrated, besides thermal plants data (such

as heat rate, installed capacity, O&M costs),

MOCCA needs information about coal initial

storage, cargoes in transit, coal availability (prices,

quantities, and delivery conditions), coal price

projections (international market), coal consumption

scenarios and energy spot prices scenarios.

3 PROBLEM FORMULATION

In this section, the mathematical formulation of the

coal procurement optimization model is discussed.

The objective function of the model is given by the

sum of four shares:

1

|

|

∈

(1)

Where

|

|

represents the size of the set , that

represents the set of all hydrothermal dispatch

scenarios. is the number of stages (months or

weeks) of the study horizon. The first share 1/

|

|

∙

represents the expected payments of coal supply

procurement that will be shipped to the thermal plant

∆,

∙

∆

∙

∆,,

∈

∆

(2)

Where

represents the set of dispatch

scenarios in stage Δ that share the same

procurement decision (procurement cluster), Δ is the

required antecedence (in stages) for the supply

procurement;

,

represents the number of

dispatch scenarios in the procurement cluster ;

is the coal supply procurement unitary cost

(including transportation cost) and

∆,,

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

136

represents the amount of the coal procured in stage

Δ, cluster , that will be shipped to the thermal

plant using the cargo type .

The second share 1/

|

|

∙ represents the

expected fines which are imposed on the thermal

plant for not meeting the generation target

determined by the system operator:

∙

̃

,

∈

(3)

Where is the penalty value and ̃

,

is the

deficit related to the target in stage and scenario .

The third share 1/

|

|

∙ represents the expected

revenue due to the thermal production for meeting

the generation target, forced generation and energy

exportation:

∙

,

,

∙

,

∙

,

∈

(4)

Where

is the unitary reimbursement of the

thermal plant for meeting the generation target

,

in stage and scenario ;

,

and

,

are

respectively the energy spot price forecast and the

inflexible generation in stage and scenario and;

and

,

represent, respectively, the energy

exportation price and the energy exported amount.

The last share 1/

|

|

∙ represents the expected

revenues from the procured loading resale which is

redirected to the international market:

∆,

∙

∙

∈

∆

(5)

Where

is the forecasted coal resale price in

the international market and

is the redirected

coal amount.

The coal supply procurement optimization

process is subjected to a set of physical or logical

constraints which are briefly and discussed next.

The first constraint represents the energy supply

target set by the system operator, formulated as:

,

̃

,

,

,∀1,…,,1,…,

(6)

It means that the generation target

,

in stage

and scenario , is met by the sum of thermal

generation

,

and energy deficit ̃

,

, penalized in

the objective function.

The energy production in the thermal plant is

limited by its installed capacity, that is:

,

,

,

̅

,∀ 1,…,, 1,…,

(7)

The coal storage of the thermal plant is basically

modeled by two constraints:

Coal storage balance:

,

,

,

,

,

∀1,…,,1,…,

(8)

Coal storage capacity

,

̅

,∀1,…,

(9)

Where

,

represents the stored coal in the

thermal plant;

,

is the coal amount used for

energy production and

,

is the coal amount

delivered in the storage, all values in stage and

scenario .

The first of the two storage constraints is the coal

balance in each stage, which means, the stored coal

at the end of the stage is a function of the stored coal

at the beginning of the stage and the net difference

between the amount of coal used (to produce

energy) and the amount of coal unloaded in the

thermal plant during this stage. The second

constraint represents the coal storage physical limit

in the thermal plant yard.

The next constraint establishes the connection

between the amount of coal delivered

,

in the

plant at stage and scenario , with the amount of

procured coal

, with Δ being the required

antecedence to request the coal amount.

,

∆,

∆,

,

,

∀1,…,,1,…,

(10)

And the last set of constraints represents the

allocation of the procured coal to the ships:

∆,

∆,

,

Κ

∙

∆,

∆,

,

,

(11)

Where Κ

is the capacity of cargo type , and

∆,

∆,

,

is a binary variable that represents that

the cargo is being used to transport the amount of

the coal

∆,

∆,

,

in stage Δ.

4 TEST CASES

The results of the optimization model for coal

supply procurement are illustrated by the following

StochasticOptimizationModelofFuelProcurement,TransportationandStorageforCoal-FiredThermalPlantsin

HydrothermalSystems

137

test cases:

a) Case 1: Stochastic case considering 20 scenarios

of generation dispatch and spot price, obtained

from the studies with the hydrothermal Brazilian

system (considering the horizon from May 2011

to Dec 2015). The coal procurement decisions

for this case study was represented in a

deterministic way, i.e. supply decisions are the

same for all 20 scenarios;

b) Case 2: Case 1, but using a decision tree (instead

of a deterministic decision) to represent supply

procurement decisions.

c) Case 3: Case 2, but considering 200 scenarios

(instead of 20 scenarios) of generation dispatch

and spot price.

The main objective of the proposed studies is to

determine the coal amount to be procured in the long

term by the thermal plant. As mentioned before, the

long-term contracts have greater execution deadlines

(typically one year), but are associated to more

attractive prices than the short-term contracts. It

should be emphasized that the data used in the test

cases of this particular work, associated to thermal

plants, coal supply contracts, and others, have been

created in order to illustrate the optimization model

behavior and may be different from a real case data.

Thermal Plant Data

The model was applied in the procurement strategy

optimization of the Porto do Itaqui thermal plant,

located in the Northern region of the Brazilian

system, assuming the following basic data:

Installed capacity: 360 MW;

Efficiency (coal consumption): 4.84 × 10

-7

MWh/kcal (or 2 066 kcal/kWh);

Coal storage capacity: 210 000 tons

(equivalent to approximately 70 days of the

thermal plant nominal power operation);

O&M cost: 7.5 US$/MWh;

Losses and self-consumption are neglected;

Operational cost: 61.2 US$/MWh.

Scenarios

For the coal resale price scenario, a constant value of

105 US$/ton (FOB-Colombia, i.e. no shipping cost

is considered for the buying market) was adopted.

In order to represent thermal dispatch and spot

price scenarios, the results obtained from the studies

with the hydrothermal Brazilian system (May 2011)

using the SDDP dispatch model (PSR, 2011a, PSR,

2011b) were used.

Candidate Contracts Data

In each one of the test cases, 30 candidate contracts

were considered, where 8 of them are long-term

contracts and the rest are short-term contracts.

Parameters associated to the long-term contracts:

Availability: 500 000 tons;

Procurement cost (FOB): 110 US$/ton;

Shipping cost: 20 US$/ton (Handymax ships);

Antecedence in procurement decision: up to 1

year;

Time interval for boarding the procured amount:

3 months (travel time of 1 month).

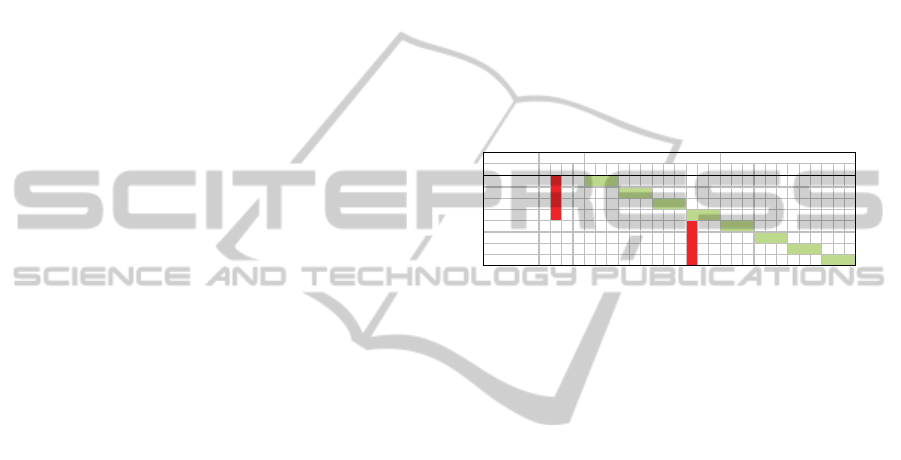

The following figure illustrates the eight long-term

contracts, emphasizing the intervals that define their

procurement decision and shipping:

Figure 3: Long-term contract data.

The green blocks illustrate, for each candidate

contract, the period in which the procured coal can

be shipped from the origin port (in Colombia), being

the loading available for the thermal plants one

month after boarding (expedition time).

The red blocks illustrate the procurement

decision date of each contract. Note that all long-

term contracts for a specific year should be decided

up to October of the previous year.

Parameters associated to the short-term contracts:

Availability: 500 000 tons;

Procurement cost (FOB): 115 US$/ton;

Shipping cost: 20 US$/ton (Handymax ships);

Antecedence in procurement decision: 3 months:

Time interval for boarding the procured amount:

4 months (travel time of 1 month).

In the same way as the long-term contracts, Figure 4

illustrates the required antecedence for a short-term

contract. Note that, in this case, the antecedence is of

four months, because loading acceptance must be

informed one month in advance regarding long-term

contracts (due to an additional period of

negotiation).

Also, short-term contracts don’t require the

procurement decision to be taken too long in

advance (October of the previous year), which

makes them more attractive from the point of view

of the uncertainties of generation dispatch and spot

Contractname SOND J FMAMJ J A S OND J F MAMJ J A S OND

Q1‐2012

Q2‐2012

Q3‐2012

Q4‐2012

Q1‐2013

Q2‐2013

Q3‐2013

Q4‐2013

2010 2011 2012

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

138

prices. However, the coal supply procurement cost is

around 5% greater than the long-term contracts.

Figure 4: Short-term contract data.

General Data

The following execution options were considered:

Stage type: monthly

Horizon: 09/2011 – 12/2012 (+ 1 Year)

Annual discount factor: 12 %

Maximum number of ships unloading coal by

stage (one month): 3 ships

Penalty for not meeting generation target: 382

US$/MWh.

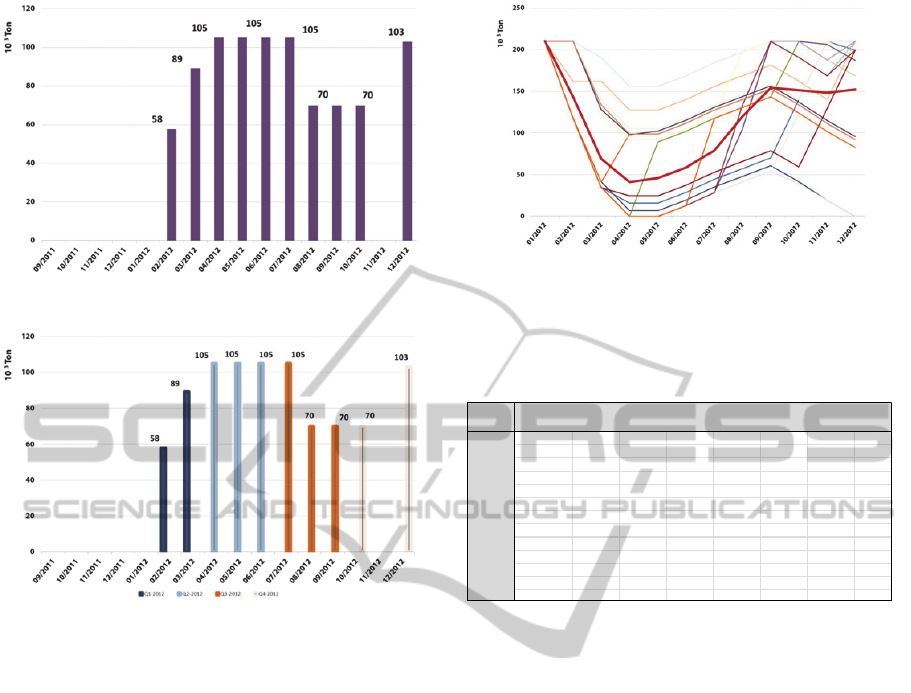

4.1 Case 1: Deterministic Decision

In this case, there has been used a subset of 20

dispatch and spot price scenarios extracted from the

original dispatch case (PMO from May 2011). The

next figure illustrates the variability of generation

dispatch of the thermal plant Porto do Itaqui.

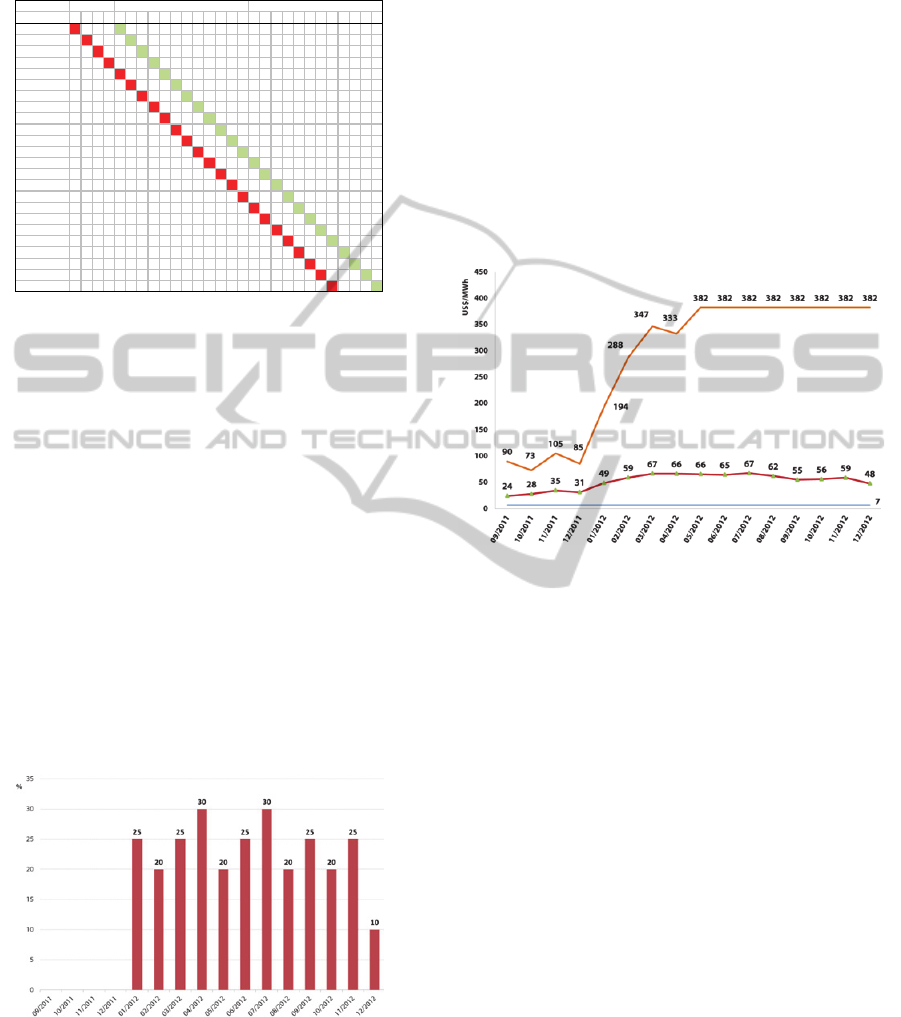

Figure 5: Probability of dispatch of Porto to Itaqui.

From the figure above, one can see that the

average dispatch probability for the first year for the

thermal plant is around 20%. However, it is

interesting to see that in the operating month, (Jan-

2012 – 25% probability) the dispatch scenarios

labeled 2-10-14-16-20 (from the sample of 20

scenarios) are the ones with non-null generation; and

in Jun-2012 the scenarios are 7-12-13-16-19; that

means, although there is a reasonable probability

that the thermal plant will be used in any month of

2012, the probability of continual generation for

several months is much lower. This level of

uncertainty in the dispatch scenarios is typical in the

Brazilian system, because the high dependence of

reservoir inflow conditions.

In order to represent the variability of the SRMC

of the Brazilian system, the next figure shows the

range for the SRMC of the same sample of 20

scenarios used for generation dispatch.

Figure 6: Variability of SRMC.

As one can see, average values for SRMC

(illustrated in red) are closer to the minimum values

(in blue) than to maximum values (in orange),

indicating that the number of low-SRMC scenarios

is greater than the number of high-spot price

scenarios. This high volatility of SRMC is also a

characteristic of the Brazilian system.

The purpose of this first test case is to determine

a coal supply procurement decision which is valid

for all 20 dispatch and spot price scenarios, in other

words, to seek for a single procurement sequence

that optimizes the coal trade results for the thermal

plant. Just for complementary information, the

optimization model for this problem contains 138

600 constraints and 24 065 decision variables, where

4 400 of them are binary variables.

The results in terms of the delivery schedule in

the thermal plant and the contracts acceptance are

illustrated in the following figures:

Contractname S OND J FMAMJ J A S OND J F MAMJ J A S OND

SPOT‐01‐2012

SPOT‐02‐2012

SPOT‐03‐2012

SPOT‐04‐2012

SPOT‐05‐2012

SPOT‐06‐2012

SPOT‐07‐2012

SPOT‐08‐2012

SPOT‐09‐2012

SPOT‐10‐2012

SPOT‐11‐2012

SPOT‐12‐2012

SPOT‐01‐2013

SPOT‐02‐2013

SPOT‐03‐2013

SPOT‐04‐2013

SPOT‐05‐2013

SPOT‐06‐2013

SPOT‐07‐2013

SPOT‐08

‐2013

SPOT‐09‐2013

SPOT‐10‐2013

SPOT‐11‐2013

SPOT‐12‐2013

2010 2011 2012

StochasticOptimizationModelofFuelProcurement,TransportationandStorageforCoal-FiredThermalPlantsin

HydrothermalSystems

139

Figure 7: Deliveries in Porto do Itaqui (case 1).

Figure 8: Acceptances of candidate contracts (case 1).

The figures above show that the optimal solution

indicates the coal procurement through long-term

contracts only (more economic). The solution is

coherent to the fact that it is not possible to adjust

the procurement decision according to the dispatch

and spot price uncertainties.

The first loading acceptance, approximately 60

thousand tons (Q1-2012), occurs on Feb-2012, and

the associated coal amount is available to be used by

the thermal plant on Mar-2012 (expedition time). In

summary, the result of the supply procurement

optimization model indicates the procurement of

approximately 900 thousand tons in long-term

contracts over a price of almost 100 million dollars.

It is important to emphasize that this procurement

policy is based on negotiating all coal amount at the

beginning of the study horizon – because long-term

contracts must be decided up to October of the

previous year of the delivery date.

As a result of this procurement policy, the coal

average stored volume is shown in red in the

following figure containing the stored coal for all 20

scenarios considered.

It is important to highlight that average volume

illustrated above is not an indication of the optimal

coal storage level of the thermal plant.

Figure 9: Scenarios of storage in Porto do Itaqui (case 1).

The financial result for the coal trade is

illustrated in the following table:

Table 1: Financial result for the coal trade (case 1).

As one can see in the previous table (column

“Penalty”), no fuel shortages were estimated for

meeting the generation target dispatch scenarios, as

a result of the procurement model. Another

observation can be made about the coal resale on the

international market, which hasn’t been

economically attractive (column “Resale” of the

table). A low resale level against a high forced

generation level is explained by the difference

between the resale price and the forced generation

refund value given by the spot prices.

The result of the coal trading operations, as can

be seen, is negative in US$ 24 million dollars, which

was already expected since the single procurement

for all generation and spot price scenarios implies in

significant losses due to the coal acquisition needed

for scenarios with thermal generation and also due to

the coal inefficient usage in forced generation for

scenarios without thermal generation, which may be

required because of storage limitations.

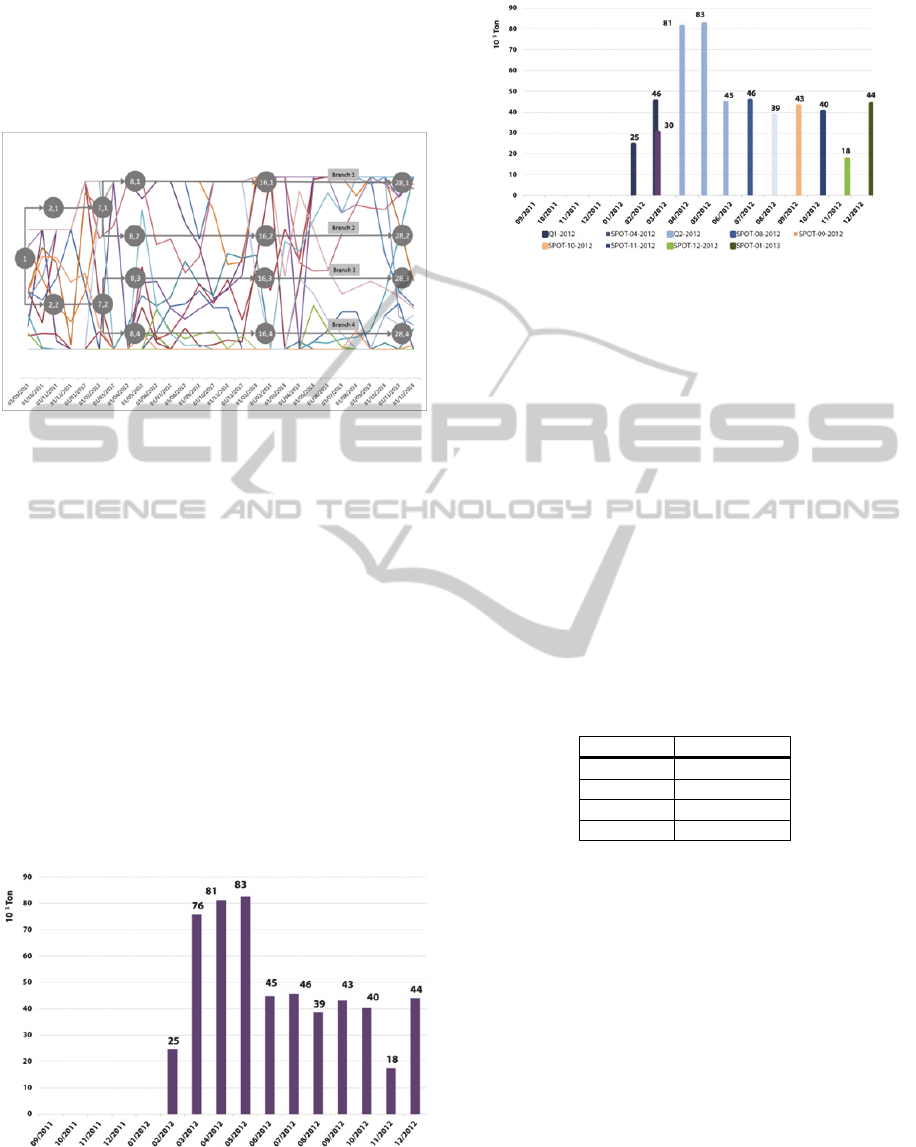

4.2 Case 2: Decision Tree for Coal

Supply Procurement

The objective of this case is to determine a

procurement policy (not deterministic), which means

that the procurement decisions can be adjusted

St a g e

Ca r g o s

acceptance Freight

O&M

costs Penalty

En e rg y

reemb.

Co a l

resell Total

Net

value

01/2012 00-209076.5

02/2012 -6-1-2080-2-1.6

03/2012 -10 -2 -2 0 11 0 -3 -3.1

04/2012 -12 -2 -2 0 10 0 -6 -5.3

05/2012 -12 -2 -2 0 11 0 -5 -4.3

06/2012 -12-2-2090-6-5.4

07/2012 -12 -2 -2 0 10 0 -5 -4.6

08/2012 -8-1-2090-1-1.3

09/2012 -8-1-2090-2-2.0

10/2012 -8-1-2080-2-2.0

11/2012 00-209065.3

12/2012 -11-2-1060-7-6.4

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

140

according to the dispatch and spot prices scenario

uncertainties. In order to accomplish that, the

procurement policy has been modeled by a binary

decision tree, with openings in stages 2 (Oct-2010)

and 8 (Apr-2012), as illustrated in the next figure:

Figure 10: Decision tree – coal procurement policy.

To determine the dispatch/spot price scenarios

allocation in coal procurement decision clusters a

standard k-means clustering algorithm was used

(Hartigan and Wong, 1979), where the clusterization

criteria used to determine which generation

dispatch/spot price scenarios share the same

procurement decision, was the minimum value

between the spot prices, which varies by scenario,

and the thermal unitary cost.

One of the consequences of representing the

supply procurement by a decision tree is that the

optimization model dimensionality grows with

respect to the problem variables. In this case, the

optimization model has 142 800 constraints and 54

100 variables, where 5 640 of them are binary.

The results in terms of the average procured

amount are illustrated in the next figure:

Figure 11: Deliveries in Porto do Itaqui (case 2).

Figure 12: Acceptances of candidate contracts (case 2).

The first important result to be highlighted is that

the procurement representation by a decision tree

encourages the short-term procurement. As it can be

seen in the figure, the coal supply procurement

solution is a combination of both long- and short-

term contracts. Moreover, the total acquisition

(calculated by the average of the branches of the

procurement decision tree) is approximately half of

the amount indicated in the previous case, that is,

537 thousand tons. However, it should be clear that

this value is the average of the 4 branches of the

tree, which means that for clusters associated to the

series with high generation level, the procurement is

greater and, otherwise, it should be lower. The total

procurement for each branch of the decision tree is

shown in the following table:

Table 2: Total procurement coal for each branch.

Branch Tons

1 229256

2 868926

3 328513

4 897975

It is also observed that approximately half of the

average amount of procured coal (278 thousand

tons) is associated to long-term contracts, which

must be negotiated one year in advance. Therefore,

the total amount that should be immobilized in long-

term contracts is around 32 million dollars (almost

70% less than the amount estimated in the previous

case). The additional amount of coal supply is

associated to the short-term contracts, which are

only negotiated in the future, when there is more

information about the thermal dispatch conditions.

The implementation of the supply procurement

policy leads to a distribution of the stored coal

variable illustrated in the next figure:

StochasticOptimizationModelofFuelProcurement,TransportationandStorageforCoal-FiredThermalPlantsin

HydrothermalSystems

141

Figure 13: Scenarios of storage in Porto do Itaqui.

The financial result for the coal trading

operations is illustrated in the following table:

Table 3: Financial result for the coal trade (case 2).

From this table, it is interesting to highlight that

no outages in the generation target due to fuel

shortages were reported – according to column

“Penalty” of the table. Another interesting result that

can be seen in the column “Coal resell”, is that coal

was redirected for resale in the international market

in June 2012, while no resale was observed in the

previous case. This behavior is also explained by the

procurement strategy formulated as a decision tree,

since the resale price was more attractive than forced

generation refunding for the scenarios that share the

cluster where resale occurred.

Finally, the financial result of the trading

operations, when using a procurement strategy

represented by a decision tree, is positive in almost

10 million dollars.

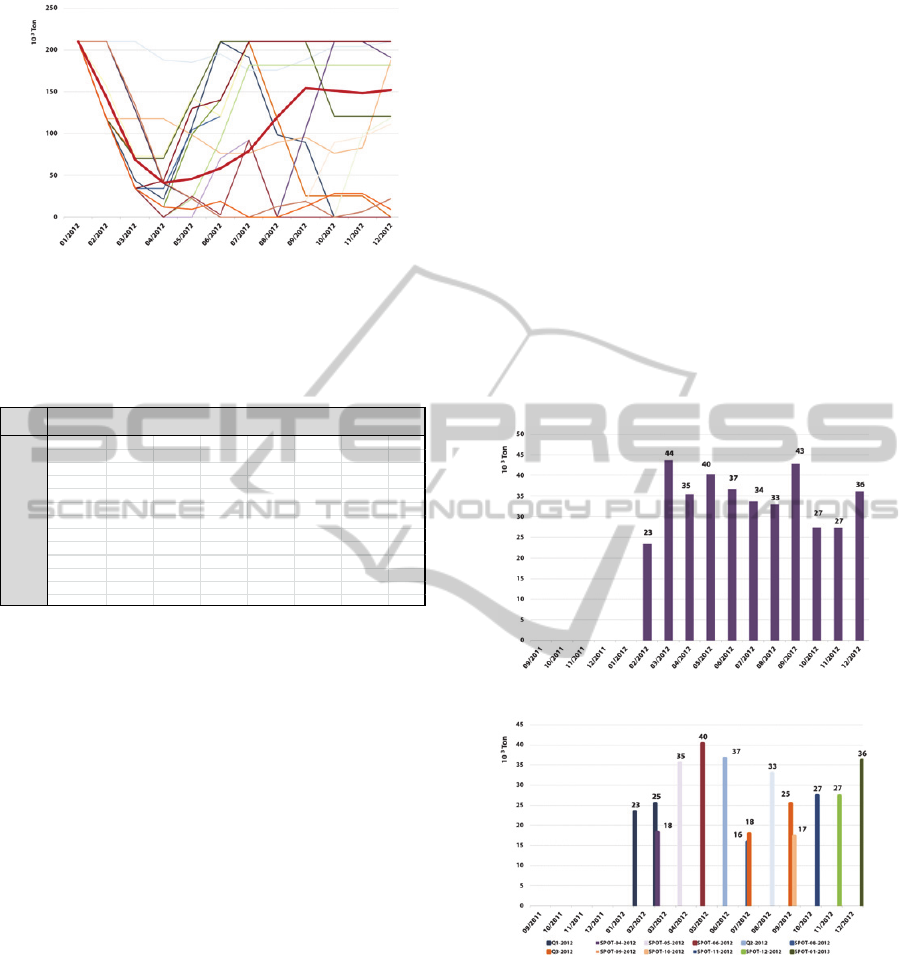

4.3 Case 3: Stochastic Case

Considering All 200

Dispatch/SRMC Scenarios

The purpose of this test case is to show the results of

the supply procurement model considering the

complete set of generation dispatch and spot price

scenarios, obtained from the simulations of the

operation scheduling case study.

A straightforward consequence of increasing the

number of scenarios is the dimension growth of the

procurement optimization model which happens to

be formulated by a programming problem of 1.4

million constraints and 260 thousand variables,

where 45 thousand of them are binary. This increase

in the number of variables and constraints are also

the result of the binary decision tree adopted for this

problem, which has more openings (branches)

compared to those used in the previous case – the

new decision tree is composed by 16 branches with

openings in stages 2 (Oct-2011), 5 (Jan-2012), 8

(Apr-2012) and 11 (Jul-2012). For the series

allocation in the decision clusters, the same k-means

clustering algorithm of the previous case has been

used.

The results for the coal deliveries (average

values) are illustrated in the following figures:

Figure 14: Delivers in Porto do Itaqui (case 3).

Figure 15: Acceptances of candidate contracts (case 3).

From the above figures, it can be seen that the

average level of coal supply procurement is lower

(379 thousand tons) than in the case 2, where a

subset of 20 generation dispatch/spot price scenarios

were used. But, as in the case of 20 scenarios, there

is an encouragement for short-term acquisitions

(66% of the total procured amount, that means,

250 thousand tons come from this type of contract),

since this type of contract allows greater flexibility

and, consequently, fits better the uncertainties of

St a g e

Ca r g o s

acceptance Freight

O&M

costs Penalty

En e rg y

reemb.

Co a l

resell Total

Net

value

01/2012 00-208066.1

02/2012 -30-208032.6

03/2012 -8-2-1090-2-1.9

04/2012 -9-2-1090-3-2.4

05/2012 -9-2-2 010 0-2-2.0

06/2012 -11-1-109611.2

07/2012 -5-1-2 010 0 21.7

08/2012 -4-1-108021.7

09/2012 -5-1-107000.3

10/2012 -5-1-107010.8

11/2012 -20-107043.1

12/2012 -5-1-1050-1-1.0

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

142

thermal plant dispatch. Regarding long-term

contracts, in the first year there was a procured

amount of 129 thousand tons (33% of the total

amount), which requires an investment of

approximately 14 million dollars.

The next figure illustrates the result of the

procurement model for the variable “stored coal in

the thermal plant” (red curve shows the average

value for the 200 scenarios).

Figure 16: Scenarios of storage in Porto do Itaqui.

Once again a low average level is observed for the

coal stored amount, nevertheless, the average level is

not an indication for the optimal level since it varies

accordingly to each one of the generation

dispatch/spot price scenarios associated to coal

supply procurement decision tree of the thermal

plant.

The financial result for the coal trading operation

is illustrated in the following table:

Table 4: Financial result for the coal trade (case 3).

Regarding the table results, the case with 200

dispatch scenarios presents some supply outages on

the generation target (column “Penalty”). It is also

noted a higher level of coal resale on the

international market, this behavior was already

expected in both because of the increase in the

number of dispatch scenarios as well as because of

the number of branches in the decision tree, which

leads to a greater number of clusters in which the

forced generation refund at energy spot price is less

than coal redirection price to the international

market. As for the final result, a positive value of

almost 14 million dollars is observed for the coal

trading operation.

5 CONCLUSIONS

This paper presents an optimization model for coal

supply procurement strategy of coal-fired thermal

plants operating in the Brazilian system, which is

hydro dominated and characterized to have a high

volatility of its energy spot prices.

The results of three test cases for the coal

procurement model were presented and discussed.

These results showed the efficiency of the model,

especially when coal procurement strategy is

represented by a decision tree, which allows a better

adjustment of the coal procurement decisions to the

uncertainties of generation dispatch and energy spot

prices (variables that present a high volatility in the

Brazilian system because of its hydro dominancy).

ACKNOWLEDGEMENTS

The authors would like to thank UTE Porto do Itaqui

Geração de Energia S/A for sponsoring this project

as part of the Research and Development Program of

ANEEL, the Brazilian Regulatory Agency.

REFERENCES

Hartigan, J. A.; Wong, M. A., 1979. Algorithm AS 136: A

K-Means Clustering Algorithm, Journal of the Royal

Statistical Society, Series C (Applied Statistics) 28 (1):

100–108.

PSR, 2011a. Model SDDP: Methodology Manual.

PSR, 2011b. Model SDDP: User Manual.

Pereira, M. V. F., Pinto, L. M. V. G., 1991. Multi-stage

stochastic optimization applied to energy planning,

Mathematical Programming.

PSR, 2011. Sistema de Otimização do Suprimento de

Carvão para Centrais Térmicas – Relatório R1:

Especificação Funcional – P&D Project, internal

report, PSR/MPX (in Portuguese).

World Coal Association, 2012. http://www.worldcoal.org/

coal/.

BP Statistical Review, 2012. http://www.bp.com/section

bodycopy.do?categoryId=7500&contentId=7068481.

Schernikau L., 2010. Economics of the International Coal

Trade: The Renaissance of Steam Coal, Springer, 1

st

edition.

St a g e

Ca r g o s

acceptance Freight

O&M

costs Penalty

En e rg y

reemb.

Co a l

resell Total

Net

value

01/2012 00-2-18065.8

02/2012 -3-1-107022.1

03/2012 -11-2-2076-2-1.7

04/2012 -4-1-107010.5

05/2012 -5-1-108010.8

06/2012 -12-1-108711.1

07/2012 -4-1-107010.9

08/2012 -5-1-107211.2

09/2012 -10-1-10750-0.3

10/2012 -3-1-107022.2

11/2012 -3-1-107021.6

12/2012 -4-1-1050-1-0.6

StochasticOptimizationModelofFuelProcurement,TransportationandStorageforCoal-FiredThermalPlantsin

HydrothermalSystems

143