An Agent-based Modeling for Price-responsive Demand Simulation

Hongyan Liu

1

and Jüri Vain

2

1

Department of Information Technologies, Åbo Akademi University, Turku Centre of Computer Science,

Joukahaisenkatu 3-5 A 20520, Turku, Finland

2

Department of Computer Science, Institute of Cybernetic, Tallinn University of Technology, Tallinn, Estonia

Keywords: Agent-Based Modeling, Computational Intelligence, Demand Response, Electricity Markets, Meta-model,

Multi-Agent Systems, Real-time Pricing, Smart Grids.

Abstract: With the ongoing deployment of smart grids, price-responsive demand is playing an increasingly important

role in the paradigm shifting of electricity markets. Taking a multi-agent system modeling approach, this

paper presents a conceptual platform for discovering dynamic pricing solutions that reflect the varying cost

of electricity in the wholesale market as well as the level of demand participation, especially regarding

household customers and small and medium sized businesses. At first, an agent-based meta-model

representing various concepts, relations, and structure of agents is constructed. Then a domain model can be

instantiated based upon the meta-model. Finally, a simulation experiment is developed for use case

demonstration and model validation. The simulation is for the supplier to obtain the profit-maximizing

demand curve which has such a shape that it follows the spot price curve in inverse ratio. The result

suggests that this multi-agent-based construct could contribute to 1) estimating the impacts of various time-

varying tariff options on peak-period energy use through simulation, before any experimental pilots can be

carried out; 2) modeling the electricity retail market evolving interactions in a systematic manner; 3)

inducing innovative simulation configurations.

1 INTRODUCTION

The deployment of Advanced Metering

Infrastructure (AMI) in many countries allows bi-

directional communications between electricity

consumers and suppliers. It is creating a platform for

demand-responsive load control within the smart

grids, which will shift the paradigm of electricity

markets in many ways. Foreseeably, consumers will

be able to manage and adjust their electricity

consumption in response to real-time information

and changing price signals. Accordingly, electric

utilities will be capable of altering the timing, level

of instantaneous demand, or the total electricity

consumption at times of high wholesale market

prices or when electric system reliability is

jeopardized (Albadi and El-Saadany, 2007). Such a

price-responsive interaction between demand and

supply (a.k.a. Demand Response) will in turn impact

the spot market prices directly as well as over time

(CEER, 2011), eventually, improve the link between

wholesale and retail power markets which to a great

extent are disconnected currently. The potential

benefits of full participation by demand include

flattening daily load patterns, optimizing the

production portfolio by mitigating the variability of

generation from renewable sources, and reducing the

investment in reserve capacity needed to maintain

resource adequacy and system reliability (Schuler,

2012), thus improving overall market efficiency.

However, in order for the above mentioned

demand responsive paradigm to be realized, the

understanding of the ever-evolving interaction

between the demand and the supply sides in the

electricity retail market is crucial. Agent-based

modeling (ABM), compared to traditional system-

modeling techniques, is one appealing approach for

studying how the market participants (e.g.,

consumers, suppliers, producers, prosumers, etc.)

might act and react to the complex economic,

financial, regulatory, and environmental

circumstances embedded in the electricity sector.

Agent-based modeling has been extensively

studied for the simulation of electricity markets in

recent decades, alongside with the electricity

industry restructuring and unbundling. Very often

the demand side is represented as a fixed and price-

436

Liu H. and Vain J..

An Agent-based Modeling for Price-responsive Demand Simulation.

DOI: 10.5220/0004417504360443

In Proceedings of the 15th International Conference on Enterprise Information Systems (ICEIS-2013), pages 436-443

ISBN: 978-989-8565-59-4

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

insensitive load (Weidlich and Veit, 2008). In this

paper, we will introduce a multi-agent-based meta-

model (MAMM) for systematically modeling the

price-responsive emergent behavior in the context of

demand response electricity retail market. The

proposed MAMM is to present a conceptual

platform for discovering dynamic pricing solutions

that reflect the varying cost of electricity in the

wholesale market as well as the level of demand

participation (e.g., demand responsiveness vs.

various rate designs), especially regarding household

customers and small and medium sized businesses.

Firstly, we introduce a MAMM that defines the

concepts, relations, and structure of utility-based

agents on abstraction level being independent of any

concrete domain. Secondly, instantiating the

MAMM with domain specific notions provides a

uniform abstract interpretation of all domain models

that conform to the MAMM. Thirdly, given a

MAMM, it supports systematic construction of

models that articulate different static, dynamic,

and/or interactive aspects relevant to specific

simulation experiment. Thus, our research objective

is to demonstrate how the MAMM guided domain

model construction can be exploited to address the

impacts analysis problems of various time-varying

tariff options by means of agent model simulation

experiments.

The paper is organized as follows: the next

section will present the research method and related

research. The conceptual construct will be

introduced in Section 3&4. In Section 5, a use case

is used to demonstrate the simulation, in the

meantime, to validate the conceptual model. In the

final part of this paper, the conclusion will be drawn

and future research will be addressed.

2 METHODOLOGY

AND RELATED WORKS

Agent-based modeling for electricity markets

simulation has experienced increasing popularity in

recent decades. For instance, within the research

paradigm of Agent-Based Computational Economics

(ACE), agent-based simulation offers methods to

understand electricity market dynamics and to derive

advice for the design of appropriate regulatory

frameworks (Weidlich and Veit, 2008). Compared to

other electricity market modeling approaches, such

as optimization models or equilibrium models,

agent-based modeling as a bottom-up approach has

the advantage of integrating a high level of detail

and players’ interactions, which are necessary to

analyze short-term development in the electricity

markets (Sensfuß et al., 2007). Agent-based models

not only offered the possibility of realistically

describing relationships in complex systems, but

growing them in an artificial environment (Epstein

and Axtell, 1996), thus the evolving behavior can be

observed step by step (Holland and Miller, 1991).

A great deal of research in the field of agent-

based simulation of electricity markets has

concentrated on the analysis of market power and

market design in wholesale electricity trading.

Various wholesale electricity market simulation

models were developed, for instance, by Bower and

Bunn (2000) in England and Wales electricity

market, Bower et al. (2001) for German electricity

sector, Cau and Anderson (2002) for the Australian

National Electricity Market, and by the research

group at Iowa State University for the Wholesale

Power Market Platform proposed by the U.S.

Federal Energy Regulatory Commission

(Koesrindartoto et al., 2005); (Sun and Tesfatsion,

2007). In addition, different computational

algorithms were examined for the agent-based

electricity market modelling, including genetic

algorithms for representing the agents’ bidding

behavior (Nicolaisen et al., 2000); (Richter and

Sheblé, 1998), Erev-Roth reinforcement learning

algorithm (Nicolaisen et al., 2001; Petrov and

Sheblé, 2001), and rule-based learning mechanisms

combining reinforcement learning and genetic

algorithms (Bagnall and Smith, 2005). In the

meantime, an alternative body of agent-based

research modeled electricity consumer behavior at

the retail level. Zhou et al. (2011) studied the

consumption behavior of commercial buildings with

different levels of demand response penetration in

different market structures. Ehlen et al. (2007)

presented a simulation based on N-ABLETM, in

which they studied the effects of residential real-

time pricing contracts on demand aggregators’ load,

pricing, and profitability. Müller et al. (2007)

investigated the interdependencies between the

customer’s engagement and the suppliers’ pricing

strategies in the German retail market. In addition,

some agent-based studies focused on the Time of

Use (TOU) pricing for residential customers under

different context (Roop and Fathelrahman, 2003)

and (Hämäläinen et al., 2000).

The heterogeneity of agent-based electricity

market research, as discussed above, has led to that

the models are rarely comparable, and sometimes

cannot be described in all necessary detail,

especially in terms of electricity retail market

simulation. Therefore, it is necessary and relevant to

AnAgent-basedModelingforPrice-responsiveDemandSimulation

437

take an integral and systematic approach in this

regard.

The multi-agent-based conceptual model is

constructed with the deregulated European

electricity market structure in mind, in which the

electricity generation, transmission, distribution, and

supply business are legally unbundled, with the

generation and supply sectors open for free

competition while the transmission and distribution

business are subject to regulation due to their

monopolistic nature. Any producers can deliver

electricity to their respective common electricity

wholesale market - for example, the producers in

Nordic area can deliver electricity to Nord Pool

exchange. The electricity wholesale market consists

of power producers, power transmission and

distribution operators, suppliers, industry and other

large undertakings. The electricity retail market

includes all end-users equipped with hourly

measured smart meters, for instance, industries,

public/commercial buildings, households, small

businesses, and so on. These are the prerequisites for

the demand response under study.

3 THE CONCEPTUAL

FRAMEWORK

We propose a customized version of utility-based

agents meta-model introduced by Russell and

Norvig (2003). Our MAMM contains abstract

concepts interrelated via abstract relations. Each

domain model that refines MAMM is considered as

its instantiation. To give some intuition about the

notions of MAMM we describe them informally by

showing their relationships in the form a semantic

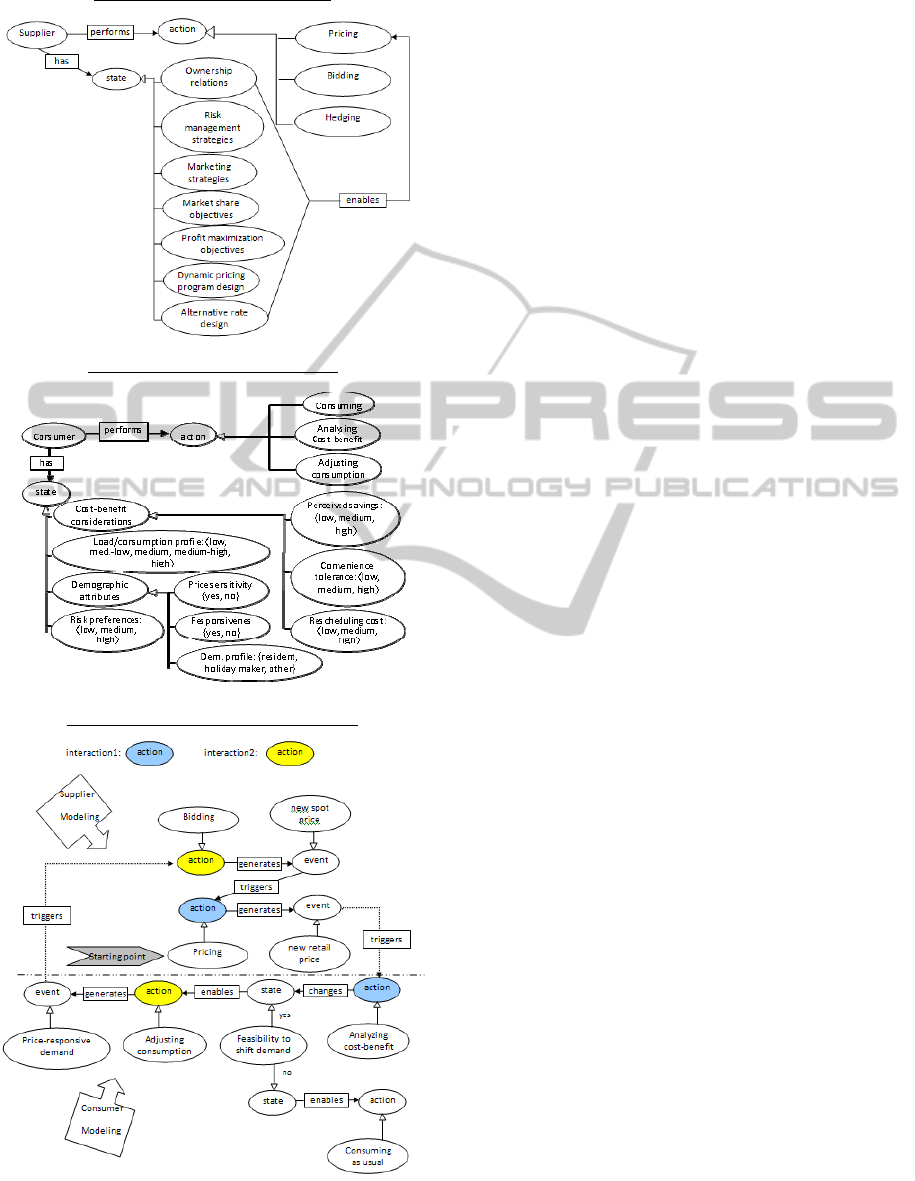

network depicted in Figure 1.

An agent has one or more roles; each of these

roles determines one or more goals. The way how an

agent reacts to the environment (to other agents)

with different actions depends on the mode and its

goal. A mode includes a set of agent's states. To

fulfil its role an agent performs actions that are

triggered by some event. The actions, in turn, can

generate new events when terminating (atomic

actions) or in the course of execution (non-atomic

actions). Event is a notion related to both - time and

state. Event reflects the instant of time when some

change of state occurs. A state is defined as a

valuation of agent attributes. State is changed by

actions. Action may have non-zero extent in time.

Since each action describes only a subset of state

changes, the action is enabled only in certain states.

Figure 1: Semantic network of the meta-model.

For the clarity of further presentation we introduce

some meta-notions that refine MAMM but are still

domain independent. We call a set of actions to

interaction if the agents' actions on shared states are

in the changes and depends relations.

Before delving into MAMM-based construction

of DM we summarize the key properties of agents

that constitute our further space of discourse:

autonomy (capable of operating and making

decision on its own), sociability (capable of

interacting with other agents), reactivity (capable of

responding to a change of environment), proactivity

(capable of acting on its own initiative in order to

achieve certain goals/utilities), and adaptivity (with

sophisticated learning capabilities) (Müller et al.,

2007); (Wooldridge and Jennings, 1995).

4 DOMAIN MODEL

FOR PRICE-RESPONSIVE

DEMAND ANALYSIS

The agent is to represent the market actors in the real

world and act on behalf of them. In the context of

electricity markets, it includes producers,

transmission and distribution operators, suppliers,

consumers, prosumers, and other load servicing

entities (e.g., demand aggregators). Even though the

environment is external and largely uncontrollable, it

is necessary to be simulated also as an agent to make

explicit the way how it will affect production and

consumption activities of the market actors.

For price-responsive demand modeling, a

domain instantiation can be characterized as in

Figure 2. Since the consumer and the supplier are

the focal market players in this context, the focus of

the DM is on their roles, actions and interactions.

The supplier’s major business activities include (1)

pricing in the retail market (i.e., offering various

retail electricity rates to different consumer groups)

according to the supplier’s market share and profit

maximization objectives; (2) bidding in the

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

438

Supplier’s Action-State Diagram

Consumer’s Action-State Diagram

Supplier-Consumer Interaction Diagram

Figure 2: Instantiation of MAMM with domain specific

concepts.

wholesale market, which will generate the following

day’s hourly spot price; and (3) hedging in the

financial market in order to avoid the risk caused by

energy price volatility.

The consumer’s activities in relation to

electricity consumption include (1) consuming

electricity according to their business nature and

living needs; (2) analyzing the possible saving from

choosing the demand response tariff, and the

feasibility and the cost/the inconvenience of

rescheduling electricity consuming activities in order

to respond to changing price signals (i.e., cost-

benefit analyzing when facing time-varying price or

demand response tariff); (3) adjusting timing and

level of consumption based on the real-time

information and price signals.

The supplier’s initial pricing action is determined

by their state. Various ownership relations, different

marketing and risk management strategies, the

supplier’s market share and profit maximization

objectives, and the supplier’s rate portfolio and

dynamic pricing program design have decided the

supplier’s state. The varying state, in turn, will have

influence on the supplier’s pricing practice.

Similarly, the consumer’s state will determine

the consumer’s actions in terms of electricity

consuming and the possibility to respond to dynamic

pricing. The varying demographic attributes (e.g.,

price sensitivity, risk preferences, and the

composition of electric appliances), the feasibility to

shift certain electricity usage to off-peak time, the

perceived saving, the rescheduling cost, the

tolerance towards inconvenience, and so on will all

affect the consumer’s price responsiveness when the

consumer is facing new pricing offer.

The adjusted electricity consumption is the

consumer’s price-responsive demand, which will

have impact on the supplier’s bidding activities in

the next day. Accordingly, the new spot price

resulted from the current interaction will trigger the

next round interaction between the supplier’s pricing

activity and the consumer’s cost-benefit analyzing

and electricity usage adjusting (if possible)

activities.

5 USE CASE

Based on the domain model described above,

simulation experiments can be carried out. In this

section, we will demonstrate a use case, in order to

validate the conceptual construct. The simulation

model is formalized and run on the UPPAAL

AnAgent-basedModelingforPrice-responsiveDemandSimulation

439

environment (Bengtsson and Yi, 2004), which is an

academic-free modeling, simulation, and model-

checking tool.

As mentioned earlier, one of the potential

benefits of demand response is to flatten daily load

patterns. Therefore, the specific theoretical

simulation scenario is for the supplier to obtain the

ideal demand curve which has such a shape that it

follows the spot price curve in inverse ratio

(Belonogova et al., 2011).

5.1 Simulation Design

The simulation setup consists of 1 supplier and N

consumers. The consumers belong to high

consumption cluster (HCC), which makes steering

their demand according to the spot price a priority in

relation to the supplier’s goal of profit maximization.

The spot price is based on the Nord Pool Spot

published system price for Estonia during the 2

nd

week of January, 2013 (www.nordpoolspot.com).

The consumption pattern of HCC depends on the day

of the week and also on external factors, e.g. outdoor

temperature. To be able to compare the simulation

results of different days we take two consecutive

days in the middle of the week Wednesday and

Thursday being closest in their energy consumption,

and calculate the hourly price of Thursday based on

the spot price on Wednesday and show how the

hourly price influences the consumption. We assume

that the difference between contextual factors on

Wednesday and Thursday is insignificant.

5.2 Simulation Assumptions

and Constraints

We introduce the simulation model representing the

Supplier-Consumer interaction where the only

interaction observables are hourly price and hourly

consumption by HCC. Thus, the main agents in the

simulation model are Consumer and Supplier. The

third agent - Environment serves to demonstrate the

flexibility and scalability of the model for different

time scales and contexts. It allows us to take into

account the dynamics of long term factors - outdoor

temperature, hours of daylight, etc. - that all have

impact on the consumption.

The pricing algorithm. When designing the

pricing function for hourly price we aim at getting

the driving effect that smoothens sharp fluctuations

in consumption without alternating HCC's total

consumption and possibly increasing supplier's

profit. Also we set an upper limit

TL

to hourly price

change to avoid overshoots and instability of

consumption.

The basis of next day hourly price P'(T) at hour T

is the spot price P(T) of the previous day at T. Let

Q(T) be the consumption at T on previous day. Then

the next day hourly price P'(T) at hour T is

calculated in our simulation by formula (1).

P

'(

T

) =

P

(

T

) (1 +

(

T

)/100), where (1)

where

is parameter to amplify or suppress the effect of

calculated price correction;

TL

is acceptable price change (%);

sign((T)) is the sign function with co-domain {-1,

1} showing if the price correction is positive or

negative comparing to previous day spot price.

The hourly price calculated by (1) is proportional

to the difference P(T)·Q(T) - avg(P(T)·Q(T)), where

avg(P(T)·Q(T)) is arithmetic mean of P(T)·Q(T)

over 24 hours. The formula (2) guarantees that the

calculated change of hourly price never exceeds the

limit set by

TL

. That is needed for keeping the

stability of price response.

Consumer's behaviour. All consumers of HCC

are modeled with the same model template. The

template is parameterized with cluster specific

attributes that allow modeling variations in cluster

consumption patterns.

The consumption pattern includes consumption

activities, e.g. ironing, room heating, water heating,

etc. Each activity is characterized by following

attributes: enabling condition and consumption

interval or function. When consumption dependency

is well-defined it is specified by means of explicit

function. When non-determinism is presented in the

consumption pattern the consumption interval is

specified instead so that random value from that

interval is generated for variable Q'(T) update.

Since our simulations are approximating we

abstract away from exact prices and use price

intervals called Price Sensitivity Zones (PSZs)

instead. PSZs approximate the price intervals

acceptable for a customer for his/her consumption

activities. PSZs may be different for different

consumer clusters. For instance, PSZs of HCC are

following: Z

1

= [

, 34], Z

2

= [35, 39], Z

3

= [40, 44],

Z

4

= [45, 49], Z

5

= [50,

T

] (EUR/MWh). The zones

·[P(T)·Q(T)-avg(P(T)·Q(T))] , if (T)

avg(P(T) ·Q(T)) P(T)

(2)

sign((T)) ·

TL

·

· , otherwise

<

TL

(T) =

P

(T)

100

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

440

define the factor space of hourly price, where

and

T

denote respectively the bottom and top element of

the price domain.

Table 1: Descriptive attributes of HCC’s consumption.

Action

Enabling condition(s)

Consumption

interval/

func. (W/h)

Time

interval

Price

zone

Outdoor

temp.

Laundry,

dish-

washing

00 - 24

P Z

1

- [C

1

,C

2

]

Ironing 19 - 22

P

Z

1

Z

2

- [C

3

,C

4

]

Water

heating

06 - 23

P

Z

1

Z

2

- [C

4

,C

5

]

Cooking

07 - 08;

18 - 19

P

i=1

,

5

Z

i

- [C

6

,C

7

]

Lighting

07 - 09;

18 - 24

P

i=1

,

5

Z

i

- [C

8

,C

9

]

Space

heating

00 - 24

P

i=1

,

3

Z

i

T < T

crit

a

E

b

(T

crit

-T)

Note:

a. T

crit

is the highest outdoor temperature when the space heating

is activated (e.g., T

crit

= 16

o

C);

b. E is the amount of energy needed for space heating in order to

compensate the decrease of outdoor temperature by one degree

(e.g., E = 50 W/

o

C).

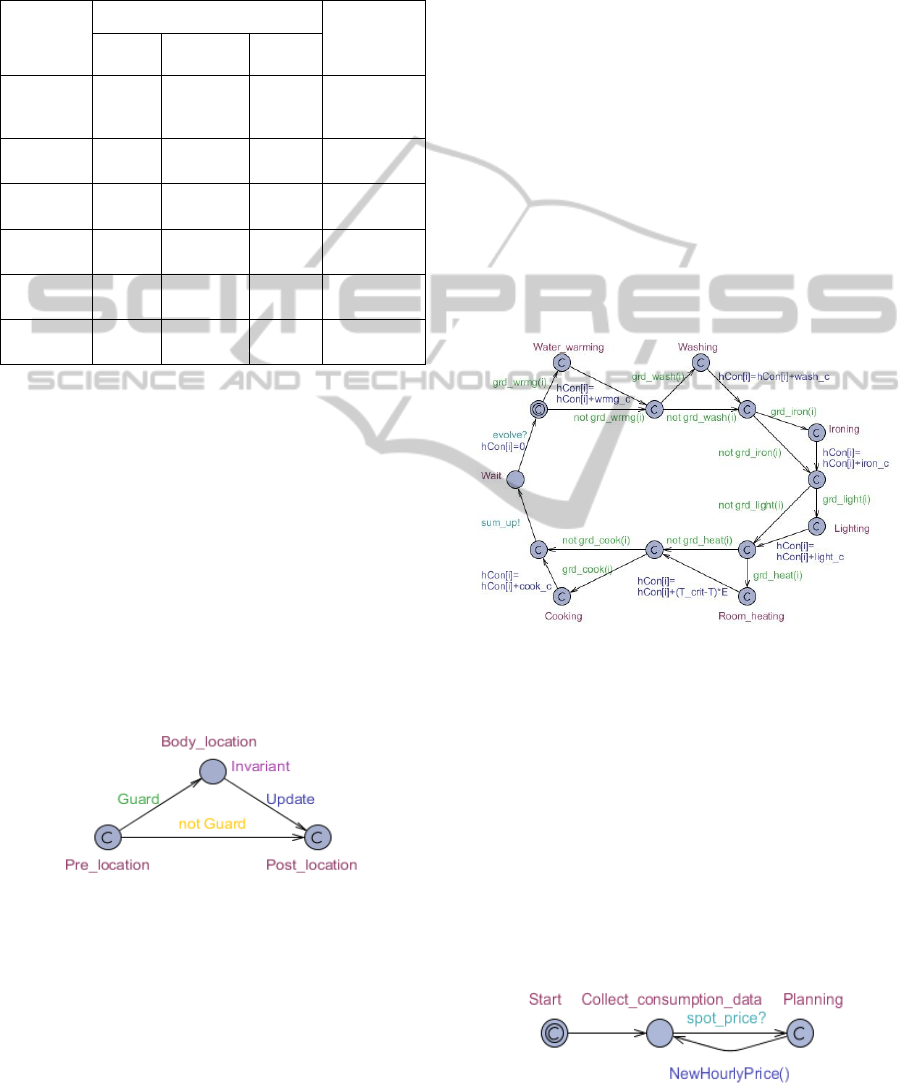

5.3 Formalization Preliminaries

Model constructs. We formalize the agent as a

template of UPPAAL timed automaton (UPTA).

An atomic action is represented in UPTA as a

model fragment consisting of pre-location, post-

location and body-location connected via edges (see

Figure 3). Pre- and post- locations are for composing

aggregate actions from the atomic ones

.

Figure 3: The model fragment of an atomic action.

Having two actions a

i

and a

j

with post- and pre-

locations Post(a

i

) and Pre(a

j

), their sequential

composition a

i

; a

j

is constructed by merging Post(a

i

)

and Pre(a

j

) into one location. The pre- and post-

locations are of type “committed”, meaning that

their execution is instantaneous.

Consumer template. The template modeling

Consumer is depicted in Figure 4. The guards and

updates of each action are defined in Table 1 and

implemented by using the function programming

language of UPPAAL.

To avoid the overloading of model templates with

technical details we model time counting and energy

metering functions in separate templates that have

joint actions synchronized via channels 'evolve',

'sum_up', and 'spot_price' with the templates

Consumer, Supplier, and Environment.

Supplier template. As in Figure 5, it has two

actions 'Collect_consumption_data' and

'Planning'. The later is joint action with implicit

template Meter. Supplier waits until the metering of

daily consumption is completed which triggers the

action 'Planning' that calculates the next day

hourly prices by function 'NewHourlyPrice'

(following formula (1) and (2)). Recall that the

consumer's choice of consumption actions depends

on that hourly price.

Figure 4: Consumer template.

Environment template. To keep the simulation model

tractable for given use case we model the dynamics

of only one observable state component -

'OutDoorTemperature' as in Figure 6. Changing

fuel prices and macro-economic factors are assumed

to be constants. Modeling the temperature changes

allows to simulate the consumers' responses in

broader variety of contexts, e.g., at very low winter

temperatures, at sharp changes of day and night

temperatures, etc. In our simulations, the actual

outdoor temperatures during 09-10 Jan., 2013 did not

change considerably and have minor effect.

Figure 5: Supplier template.

AnAgent-basedModelingforPrice-responsiveDemandSimulation

441

Figure 6: Environment template.

5.4 Simulation Results

The simulation results show that in the presence of

HCC consumption patterns the implemented pricing

strategy allows to smoothen the demand peak in

relation to the spot price.

Figure 7: Price-responsive demand.

Figure 7 shows the dynamics of pricing-demand

interplay: P is the curve of spot price of Jan. 09,

2013, and P' represents the hourly price curve

generated by the model as described in formula (1).

If the price is lowered from 44 to 42 EUR/MWh at

off-peak time period (11-17hrs), it will encourage

considerable demand shifting to this period (from

500 to 1000 MWh). On the contrary, if the price is

increased during the spikes of Q from 40 to 44

EUR/MWh at 19hrs and from 34 to 38 EUR/MWh at

22hrs, it will cut down the demand to Q' (from 2600

and 2800 to 2200 MWh).

The pricing strategy specified in Supplier model

demonstrates the effect of flattening the daily load.

The standard deviation of the demand Q' decreases

about 57 % in comparison to demand Q.

It is important to note that the simulation is based

on a theoretical scenario. It does not take into

account the impact of other market actors' activities

such as the producer’s actions and other

environmental factors except the outdoor temperature

caused spot price change and demand adjustment. In

addition, the agent capacity of learning and

adaptation is not considered in the simulation due to

short time range.

5.5 Discussion

Based on the domain model and its formalized

representation described above, also other

simulation experiments can be developed. In this

section, we show that the DM is rich enough in order

to validate the conceptual construct and these

constructs provide a set of model patterns that are

easy to handle when formalizing the domain model.

We have chosen UPPAAL timed automata to

formalize the domain model and UPPAAL tool to

run the simulation experiments, but we do not limit

the approach with UPPAAL tool only. Large

simulations presume highly scalable modeling

environments, hence we consider NetLogo as likely

environment for our future work.

6 CONCLUDING REMARKS

We present a conceptual platform for modeling the

price-responsive demand, in order to discover the

dynamic pricing solutions that reflect the varying

cost of electricity in the wholesale market as well as

the level of demand participation. We took an agent-

based modeling approach, in the attempt to capture

and observe the emergent behavior in the electricity

demand and supply interactions.

We hope that the proposed construct will

contribute to both the real-world practice and the

agent-based research community by allowing 1) to

estimate the impacts of various time-varying tariff

options on peak-period energy use through

simulation, before any experimental pilots can be

carried out; 2) to model the electricity retail market

evolving interactions in a systematic manner; 3) to

induce innovative simulation configurations. Going

without saying, the applicability and scalability of

this construct need to be further examined.

Additionally, the agent capacity of learning and

adaptation needs to be included in future research.

ACKNOWLEDGEMENTS

The authors gratefully acknowledge the financial

support by the Fortum Foundation, the Academy of

Finland (Grant No. 127592), ELIKO and European

ICEIS2013-15thInternationalConferenceonEnterpriseInformationSystems

442

Social Fund’s Doctoral Studies and

Internationalization Programme DoRa.

REFERENCES

Albadi, M. H. and El-Saadany, E. F., 2007. Demand

Response in Electricity Markets: An Overview. In:

Proceedings of IEEE PES General Meeting (GM' 07),

Tampa, FL, USA, June 24-28, 2007, pp. 1-5.

Bagnall, A., Smith, G., 2005. A multi-agent model of the

UK market in electricity generation. IEEE Trans. on

Evolutionary Computation 9 (5), 522–536.

Belonogova, N., Kaipia, T., Lassila, J., Partanen, J., 2011.

Demand Response: Conflict Between Distribution

System Operators and Retailer. In: Proceedings of 21

st

International Conference on Electricity Distribution

(CIRED 2011), p 1085, June 6-9, Frankfurt, Germany.

Bengtsson, J., Yi, W., 2004. Timed Automata: Semantics,

Algorithms and Tools. Lecture Notes on Concurrency

and Petri Nets. W. Reisig and G. Rozenberg (eds.),

LNCS 3098, Springer-Verlag, 2004, pp. 87-124.

Bower, J., Bunn, D.W., 2000. Model-based comparisons

of pool and bilateral markets for electricity. Energy

Journal 21 (3), 1–29.

Bower, J., Bunn, D.W., Wattendrup, C., 2001. A model-

based analysis of strategic consolidation in the german

electricity industry. Energy Policy 29 (12), 987–1005.

Cau, T. D. H., Anderson, E. J., 2002. A co-evolutionary

approach to modelling the behaviour of participants in

competitive electricity markets. IEEE Power

Engineering Society Summer Meeting 3, 1534–1540.

CEER Advice on the take-off of a demand response

electricity market with smart meters, Ref: C11-RMF-

36-03 (December 2011).

Ehlen, M. A., Scholand, A. J., Stamber, K. L., 2007. The

effects of residential real-time pricing contracts on

transco loads, pricing, and profitability: Simulations

using the N-ABLE™ agent-based model. Energy

Economics 29 (2), Elsevier, March 2007, pp. 211–227.

Epstein, J. M., Axtell, R. L., 1996.

Growing Artificial

Societies: Social Science from the Bottom Up.

The MIT Press.

Holland, J. H.,Miller, J. H., 1991. Artificial adaptive

agents in economic theory. American Economic

Review 81 (2), 365–370.

Hämäläinen, R. P., Mäntysaari, J., Ruusunen, J., and

Pineau, P. O., 2000. Cooperative consumers in a

deregulated electricity market — dynamic

consumption strategies and price coordination. Energy

25 (9), Elsevier, September 2000, pp. 857–875.

Koesrindartoto, D., Sun, J., Tesfatsion, L., 2005. An

Agent-Based Computational Laboratory for Testing

the Economic Reliability of Wholesale Power Market

Desings. Proceedings of the IEEE Power Engineering

Society General Meeting, vol. 3, pp. 2818–2823.

Müller, M., Sensfuß, F., and Wietschel, M., 2007.

Simulation of current pricing-tendencies in the

German electricity market for private consumption.

Energy Policy 35 (8), Elsevier, August 2007, pp.4283–

4294.

Nicolaisen, J., Smith, M., Petrov, V., Tesfatsion, L., 2000.

Concentration and capacity effects on electricity

market power. Proc. 2000 Congress on Evolutionary

Computation, vol. 2. La Jolla, USA, pp. 1041–1047.

Nicolaisen, J., Petrov, V., Tesfatsion, L., 2001. Market

power and efficiency in a computational electricity

market with discriminatory double-auction pricing.

IEEE Trans. on Evolutionary Computation

5 (5), 504–

523.

Petrov, V., Sheblé, G., 2001. Building electric power

auctions with improved Roth-Erev reinforced learning.

Proc. of the North American Power Symposium, Texas,

USA.

Richter, C.W., Sheblé, G.B., 1998. Genetic algorithm

evolution of utility bidding strategies for the

competitive marketplace. IEEE Transactions on

Power Systems 13(1) (1), 256–261.

Roop, J. M., Fathelrahman, E., 2003. Modeling electricity

contract choice: an agent-based approach. In:

Proceedings of the ACEEE Summer Study Meeting,

Rye Brook, New York.

Russell, S., Norvig, P., 2003. Artificial Intelligence: A

Modern Approach (2nd ed.), Upper Saddle River,

New Jersey: Prentice Hall, pp 46 - 54.

Schuler, R. E., 2012. Planning, Markets and Investment in

the Electric Supply Industry. In: Proceedings of 45

th

Hawaii International Conference on System Sciences

(HICSS 2012), Maui, Hawaii, USA, January 4-7,

2012, pp. 1923-1930.

Sensfuß, F.; Ragwitz, M.; Genoese, M.; Möst, D., 2007.

Agent-based simulation of electricity markets: a

literature review. Working paper sustainability and

innovation No. S5/2007

Sun, J., Tesfatsion, L., 2007. Dynamic testing of

wholesale power market designs: an open-source

agent-based framework. Computational Economics 30

(3), 291–327.

Weidlich, A. and Veit, D., 2008. A critical survey of

agent-based wholesale electricity market models.

Energy Economics (30), Elsevier, 2008,

pp. 1728-1759.

Wooldridge, M., Jennings, N. R., 1995. Intelligent agents:

theory and practice. Knowledge Engineering Review

10 (2), 115-152.

Zhou, Z., Zhao, F., and Wang, J. 2011 Agent-Based

Electricity Market Simulation With Demand Response

From Commercial Buildings. IEEE Transactions on

Smart Grid, vol.2, no.4, pp.580-588.

AnAgent-basedModelingforPrice-responsiveDemandSimulation

443