Knowledge Networks as a Source of Knowledge Initiatives

and Innovation Activity in Small and Medium Enterprises

Regression Analysis for EU 27 Countries

Ján Papula, Jana Volná and Jaroslav Huľvej

Faculty of Management, Comenius University, Odbojárov 10, Bratislava, Slovak Republic

Keywords: Knowledge Networks, Intellectual Capital, Core Competences, Innovation Activity, Clusters, Small and

Medium Enterprises.

Abstract: Building-up the knowledge society through human capital and innovation activities, particularly generated

through SMEs are generally the driving force of economic development, are developing options for future

competitiveness in the form of new knowledge, and are increasing the efficiency of the economy and its

ability to act. Since countries like Finland, Germany, Denmark and Sweden reach highest innovation

performance among all EU countries, there are countries like Latvia, Lithuania, Romania, Bulgaria, Poland

or Slovakia which drag behind other European countries and rank among the countries with the weakest

innovative performance. The aim of this paper is to identify the enablers of innovation in European SMEs

by using the concept of intellectual capital. Through statistical analysis we have investigated how

knowledge networks, which can be considered as the source of knowledge initiatives in SMEs, contribute to

their innovation activities. According to conclusions of our analysis, creating knowledge network, which

secure knowledge circulation and spilling over partners consisting of universities, state or local governments

and SMEs, will increase knowledge base of the economy of a country, i.e. will grow the innovation activity

of enterprises, improve the quality of human resources, research and technology, which are considered as

key factors of European competitiveness.

1 INTRODUCTION

Innovation has become a major driver for economic

growth through the creation, use, and diffusion of

knowledge (OECD, 2002). As drafted in figure 1,

countries like Finland, Germany, Denmark and

Sweden reach highest innovation performance

among all EU countries.

Figure 1: EU Member States’ Innovation Performance

(European Commission, 2011).

On the other side, there are countries like Latvia,

Lithuania, Romania, Bulgaria, Poland or Slovakia

which drag behind other European countries and

rank among the countries with the weakest

innovative performance.

It is apparent, that states with lowest innovation

performance are all post-communist countries

entering the EU after 2004, of which the main

competitive advantage is the existing comparative

competitive advantage of low cost (low wages, low

taxes). In terms of the global economy, these

strategies are not further sustainable for mentioned

countries in the future. The growing competition of

countries having even cheaper labor quickly

devalues these temporary competitive advantages.

Based on the above, it is therefore clear that

mentioned countries must start focusing on value

added, knowledge-based resource advantages

instead of advantages originated from low cost. The

resource-based advantages are represented in the

knowledge base of the economy, specifically

growing innovation potential of enterprises, the

quality of human resources, research and

389

Papula J., Volná J. and Hul’vej J..

Knowledge Networks as a Source of Knowledge Initiatives and Innovation Activity in Small and Medium Enterprises - Regression Analysis for EU 27

Countries.

DOI: 10.5220/0004548703890396

In Proceedings of the International Conference on Knowledge Discovery and Information Retrieval and the International Conference on Knowledge

Management and Information Sharing (KMIS-2013), pages 389-396

ISBN: 978-989-8565-75-4

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

technology, which are considered as key factors of

European competitiveness.

In order to increase the innovation activity in the

lowest ranked countries according to their

innovation performance (Pilková et al., 2012), the

focus has to be put on identification of the enablers

of the creation, use, and diffusion of knowledge

especially within SMEs. One possibility to provide

the identification of these enablers is to use the

concept of intellectual capital of an organization

identifying and quantifying the knowledge, skills,

relationships, business processes, innovation and

other components of intangible assets in the

organization which together aim to build and

strengthen the organization's competitive advantage

and also which aim to activate and enhance their

innovation potential. The outcome of effective

management of intellectual capital in organizations

is their increased innovation activity through the

creation of new products and services with high

added value for the customers.

The business sector, especially by SMEs, is

generally considered to be the innovation holder. To

fulfill this task requires professionally trained,

educated and creative human resources. The priority

therefore has to be put on creating innovative

companies with creative human capital and effective

internal and external communication, which are able

to add value for customer by using their knowledge

based resources (intellectual capital).

2 KNOWLEDGE

AS A STRATEGIC TOOL

OF COMPETITIVENESS

AND INNOVATION ACTIVITY

OF SMALL AND MEDIUM

ENTERPRISES

2.1 Importance of Knowledge

Management

In companies based on knowledge, managing human

resources concentrates on increasing the so-called

organization intelligence and developing potential of

workers by means such as learning, participation,

co-operation and initiative. To know is an

advantage, to learn is necessity. This has always

been acknowledged. But these attributes are

gradually becoming the main comparative advantage

in a knowledge company now and they are the basis

for creating wealth.

Knowledge management is a term, which has

been currently appearing more and more often in

relation with the ambition of businesses to succeed

in the challenging competitive environment.

Knowledge management can be generally

understood as an effort to make know-how available

in an organization to those who need it, to where it is

needed, at the right time and in a form in which it is

needed in order to increase human and organization

performance. The main activities of knowledge

management are:

Acquiring knowledge and skills in the

organization;

Processing knowledge and skills within

organization;

Sharing knowledge and skills within organization;

Enhancement of knowledge and skills within

organization.

2.2 Intellectual Capital as Value

Adding Element of Knowledge

Management

In contrast to first understandings of knowledge

management which had been focused on knowledge

distribution among creative individuals in the

company, later evolution of knowledge management

understands the employees (human capital of the

company) in the context of other elements of

intellectual capital (structural and relational capital)

and the knowledge management is understood as

management of intellectual capital of the particular

company (figure 2). The idea is, that in reality it is

not possible to separate employees from the

company's internal and external relations. Individual

items of knowledge are always oriented towards

something outside the person and therefore the

object of knowledge management has been

broadened to all parts of intellectual capital

(Mouritsen and Larsen, 2005).

The aim is to justify the interaction of skills and

knowledge of employees among each other, with

technologies and processes as well as with

customers, resp. with external environment of a

company.

Intellectual capital, which incorporates skills and

knowledge at all levels of an organization, has

become the most important economic resource and

is replacing financial and physical capitals as the

most important source in the new economy.

Knowledge management including knowledge-based

activities, which build any of the components of

intellectual capital in the company, are nowadays

considered as the driving motor of sustainable

KMIS2013-InternationalConferenceonKnowledgeManagementandInformationSharing

390

competitive advantage of an organization.

Figure 2: Main Activities of Knowledge Management.

Effective management of intellectual capital requires

the ability to choose among all skills and knowledge

those ones, which contribute to creation of key

processes and activities of organization.

Organizations often miss these valuable knowledge

and skills, which bring innovative potential to them

in relation to dynamics of external environment.

3 KNOWLEDGE NETWORKS

AS THE SOURCE

OF KNOWLEDGE

INITIATIVES IN SMES

3.1 Definition and Characteristics

of Knowledge Networks

As written earlier, knowledge management is the

concept of modern management aimed at obtaining,

processing, distribution and multiplication of skills.

One possibility how small and medium companies

could use methods and tools of knowledge

management is creating knowledge networks.

Knowledge networking is the process by which

knowledge is transferred through collaboration,

coopfreration, and long-term network arrangements

(OECD, 2002). Knowledge networks usually engage

in three types of activities (Creech and Ramji, 2004):

• Collaborative research and information exchange:

the systematic investigation of the target issue or

problem, conducted jointly by two or more

members of the network, or by an individual

member with significant consultation with other

members.

• Engaging with stakeholders: moving the research

into policy and action, through improved

communications and interaction with those who

are in a position to put the research to use.

• Network management: setting up and running the

operating structure necessary to build the

relationships among the participants in order to

strengthen the research, communications and

engagement processes of individual members and

of the network as a whole.

In support of these objectives it is needed to

create and develop a culture of entrepreneurs who

will not be afraid to engage in knowledge initiatives.

Small and medium enterprises cannot consider

knowledge sharing as the act of giving off their own

valuable specific know-how to competition.

Participation in the knowledge network enables

knowledge sharing that helps all businesses in the

area and allows small and medium enterprises to

jointly build competitiveness to foreign and

multinational corporations.

Theory and practice reveal that the interactions

between different agents involved in the innovation

process is important when examining the

characteristics of successful innovation (Morgan,

1996). Companies are no longer self sufficient for

the creation, development and commercial

exploitation of their knowledge base and,

consequently, seek inter organizational networks in

order to succeed in their respective technological

fields (Pena, 2002).

There are several major benefits from the

involvement of the enterprise in the knowledge

network:

Strengthening innovation, by faster and more

efficient generating of creative ideas;

Reducing the risk of failure by the interaction with

network partners;

Accelerating innovation and lower costs of the

innovation process by knowledge and capacity

sharing at the network level;

Improving the efficiency of the mutual learning

and sharing of good practices;

Strengthening the trust and reputation outside the

network as well as between members of the

network.

3.2 Core Competencies of a Company

as the Determinant Factor

in Decisions of What to Share via

Knowledge Networks

In order to survive and, what is more challenging, to

enhance competitive advantage, firms must possess

a knowledge base and capabilities which add value

KnowledgeNetworksasaSourceofKnowledgeInitiativesandInnovationActivityinSmallandMediumEnterprises-

RegressionAnalysisforEU27Countries

391

to the firm; resources which are inimitable, no

substitutable and scarce (Pena, 2002). As early as in

1990, the authors C. K. Prahald and G. Hamel in

their article “The Core Competence of the

Corporation” developed the concept of Core

Competence of an organization. Key competencies

are only those skills that meet these following

criteria (Ireland et al., 2009):

1. They are valuable, so they contribute to value

creation for customers by exploiting new

opportunities or neutralizing threats.

2. They must be rare, so they are held by few if any

competitors.

3. It must be difficult to imitate them. They are

difficult to re-create because intangible resources

or their specific contribution to the capability

cannot be easily identified.

4. They should be no substitutable. No resources /

capabilities should exist that can complete the

tasks and provide the same value to customers.

If today a firm is basing its competitive

advantage on one single product innovation or on

the use of other material or on the purchase of the

new technology, it will be quickly realized and

imitate by others, especially if the change is

effective. Therefore now it is important to prepare

competitive advantages that are hard to detect and

hard to imitate (Papulova, 2012).

According to this concept, the key capabilities -

or core competencies of the company are the main

source of its competitive advantage and they allow

the organization to create a new level of products

and services. To create core competencies in a

company, the organization must possess abilities

which can be used to create something valuable for

the customer and which other organizations do not

have. At the same time it has to be difficult to

imitate and unable to substitute. Knowledge and

company resources, which form valuable, unique,

not imitable as well as irrecoverable abilities are

those, which should not be therefore managed

through knowledge networks. For all other

knowledge – or components of intellectual capital of

the company, knowledge networks may be

beneficial.

An integrated knowledge management approach

should mix together firm internal core competencies

with inter organizational extensions to absorb and

transfer knowledge beyond the boundaries of a firm

(Pena, 2002).

3.3 Clusters as a Form of Knowledge

Networks

A cluster can be characterized as a network of

interdependent firms, knowledge-producing

institutions (e.g., universities, research institutes, and

technology-providing firms), bridging institutions,

and customers, linked to each other in a value-

adding production chain (Roelandt et al.,, 1999). A

cluster is a form of network that occurs within a

geographic location, in which the proximity of firms

and institutions ensures certain forms of

commonality and increases the frequency and

impact of interactions (Porter, 1998). There exist

several research studies with evidence that actors in

clusters tend to be more innovative than those that

are not in clusters (Baptista, 2000).

4 RESEARCH METHODOLOGY

4.1 Research Setting

The present paper examines how knowledge

networks, which can be considered as the source of

knowledge initiatives in SMEs, contribute to their

innovation activities. In this paper we employ

regression analysis to estimate the quantitative effect

of an indicator reflecting the level of existing and

operating knowledge networks in particular EU 27

countries as the independent variable upon the

indicator reflecting innovation activity of SMEs in

these countries as dependent variable.

4.2 Definition of Measures and Data

Sources

Data have been collected from two different sources,

using the Innovation Union Scoreboard 2011

(European Commission, 2011) as the source of

innovation activity of EU 27 countries data and Star

Clusters reports (European Commission, 2011) as

the source of cluster involvement in specific EU 27

states.

4.2.1 Independent Variable

As an independent variable, we have been looking

for an indicator reflecting the level of knowledge

networks existing and operating in particular EU 27

countries. As a source for data collection we have

used Star Cluster reports (European Commission,

2011), which describe regional clusters in 30

European countries. According to Star Cluster

KMIS2013-InternationalConferenceonKnowledgeManagementandInformationSharing

392

reports (European Commission, 2011), the amount

and quality of knowledge circulating and spilling

over between firms, located in a cluster, is

dependent upon 3 characteristics:

1. The cluster's size;

2. The degree to which it is specialized;

3. The extent to which the locality (the region) is

focused upon production in the relevant

industries comprising the cluster.

The European Cluster Observatory shows the

extent to which clusters have achieved this

specialized critical mass by employing measures of

these three factors as described below, and assigning

each cluster 0, 1, 2 or 3 stars depending on how

many of the below criteria are met. For our analysis

we have used data about clusters, which received at

least one star (also 1, 2 or 3 stars) in this assessment.

Deeper insight into methodology of star

apportioning is described below (European

Commission, 2011):

1. A cluster has received the “size star”, if

employment reaches a sufficient share of total

European employment, it is more likely that

meaningful economic effects of clusters will be

present. The size measure shows whether a

cluster is in the top 10% of all clusters in Europe

within the same cluster category in terms of the

number of employees.

2. A cluster has received the “specialization star”, if

a region is more specialized in a specific cluster

category than the overall economy across all

regions. This is likely to be an indication that the

economic effects of the regional cluster have

been strong enough to attract related economic

activity from other regions to this location, and

that spillovers and linkages will be stronger. The

specialization measure compares the proportion

of employment in a cluster category in a region

over the total employment in the same region, to

the proportion of total European employment in

that cluster category over total European

employment. The measure needs to be at least 2

to receive a star.

3. A cluster has received the “focus star”, if a

cluster accounts for a larger share of a region's

overall employment, it is more likely that spill-

over effects and linkages will actually occur

instead of being drowned in the economic

interaction of other parts of the regional

economy. The focus measure shows the extent to

which the regional economy is focused upon the

industries comprising the cluster category and

relates employment in the cluster to total

employment in the region. The top 10% of

clusters, which account for the largest proportion

of their region's total employment, receive a star.

National statistical offices of participating EU

countries have been picked up as data sources for

Star cluster reports and data in these reports reflect

the situation in years 2001 – 2008, where in majority

of countries with reference year 2008. For the

purposes of our analysis, we have calculated

indicator consisting of Nr. of people employed in

clusters that had received at least one star through

Star Cluster assessment, divided with the Nr. of

inhabitants for every EU 27 country (later in text

marked as % CLU). The values of % CLU indicator

for EU 27 countries are shown in table 1. European

Countries are divided in the table into two groups,

first group consisting of 15 member countries in the

European Union prior to the accession of ten

candidate countries on 1st May, 2004 (labeled as

EU15) and countries entering into EU after 1st May,

2004 (labeled as EU new).

Table 1: Values of % CLU indicator for EU 27 countries

divided into EU 15 and EU new.

EU 15 EU new

Belgium BE 7.5 Bulgaria BG 10

Denmark DK 14.5 Czech Rep. CZ 9.9

Germany DE 8.1 Estonia EE 10.1

Ireland IE 8.6 Cyprus CY 9.3

Greece GR 8.3 Latvia LV 6.7

Spain ES 10.4 Lithuania LT 7.3

France FR 6.9 Hungary HU 7.7

Italy IT 10.6 Malta MT 11.7

Luxembourg LU 16 Poland PL 5.5

Netherlands NL 7.3 Romania RO 10.0

Austria AT 11.7 Slovenia SI 10.9

Portugal PT 10.7 Slovakia SK 7.9

Finland FI 8.5

Sweden SE

8

UK

7.8

4.2.2 Dependent Variables

As a dependent variable, we have been looking for

an indicator reflecting the level of innovation

activity of SMEs in EU 27 countries. For the

purposes of our analysis we have decided to use the

Innovation Union Scoreboard 2011 (European

Commission, 2011) as a source. Specifically, we

have used two indicators from this report:

1. The indicator 3.1.1 - SMEs introducing product

or process innovations as % of SMEs (later in

text labeled as % PPI), since technological

innovation, as measured by the introduction of

new products (goods or services) and processes,

KnowledgeNetworksasaSourceofKnowledgeInitiativesandInnovationActivityinSmallandMediumEnterprises-

RegressionAnalysisforEU27Countries

393

is a key ingredient to innovation in

manufacturing activities and higher shares of

technological innovators should reflect a higher

level of innovation activities (European

Commission, 2011).

2. The indicator 3.1.2 - SMEs introducing

marketing or organizational innovations as % of

SMEs (later in text labeled as % MOI), as the

indicator of non-technological innovation

activity of EU 27 countries.

Both indicators have used the statistics from

Eurostat from the reference year 2008 as the data

source. Values for these two indicators are shown in

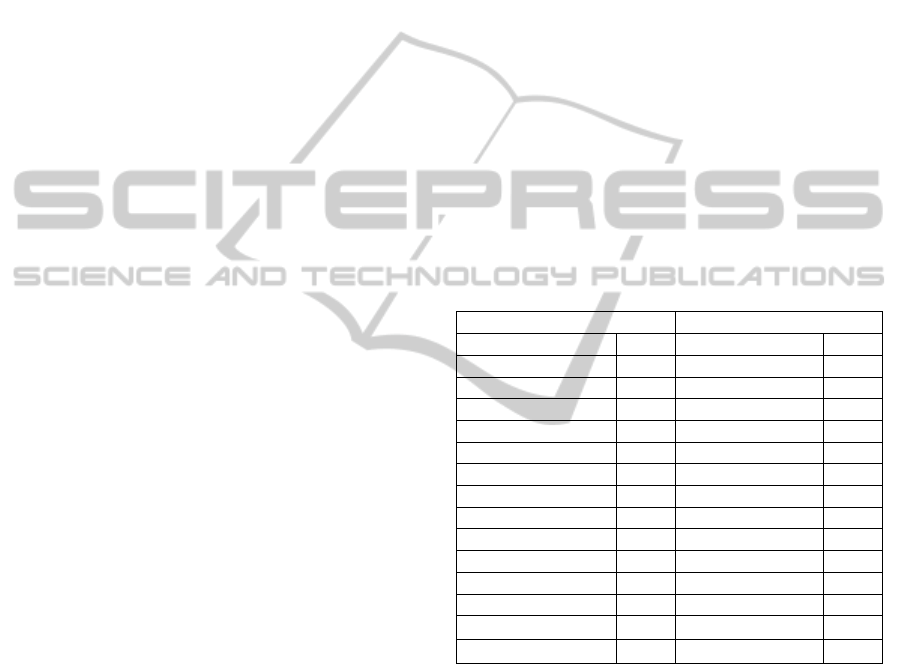

table 2.

Table 2: Values of % PPI and % MOI indicator for EU 27

countries divided into EU 15 and EU new.

EU 15

EU new

State % PPI % MOI State % PPI % MOI

BE 44.0 44.1 BG 20.7 17.3

DK 37.6 40.0 CZ 34.9 45.9

DE 53.6 62.6 EE 43.9 34.1

IE 27.3 41.6 CY 42.2 47.3

GR 37.3 51.3 LV 17.2 14.0

ES 27.5 30.4 LT 21.9 21.4

FR 32.1 38.5 HU 16.8 20.5

IT 36.9 40.6 MT 25.9 25.6

LU 41.5 53.0 PL 17.6 18.7

NL

31.6

28.6 RO 18.0 25.8

AT

39.6

42.8 SI 31.0 39.4

PT

47.7

43.8 SK 19.0 28.3

FI

41.8

31.5

SE 40.6

36.7

UK 25.1

31.1

4.3 Data Analysis

Data in this paper are presented and analyzed

through descriptive statistics using histograms, box

and whisker plots, and statistics summaries such as

average, median, standard deviation, and kurtosis

and skewness. Then, normality tests have been

provided. After that, we have continued with

correlation and regression analysis and analysis of

variance, which have allowed us to analyze the

relationships among selected data. Data have been

executed in Microsoft Excel and Statgraphics Plus

software programs.

5 RESULTS

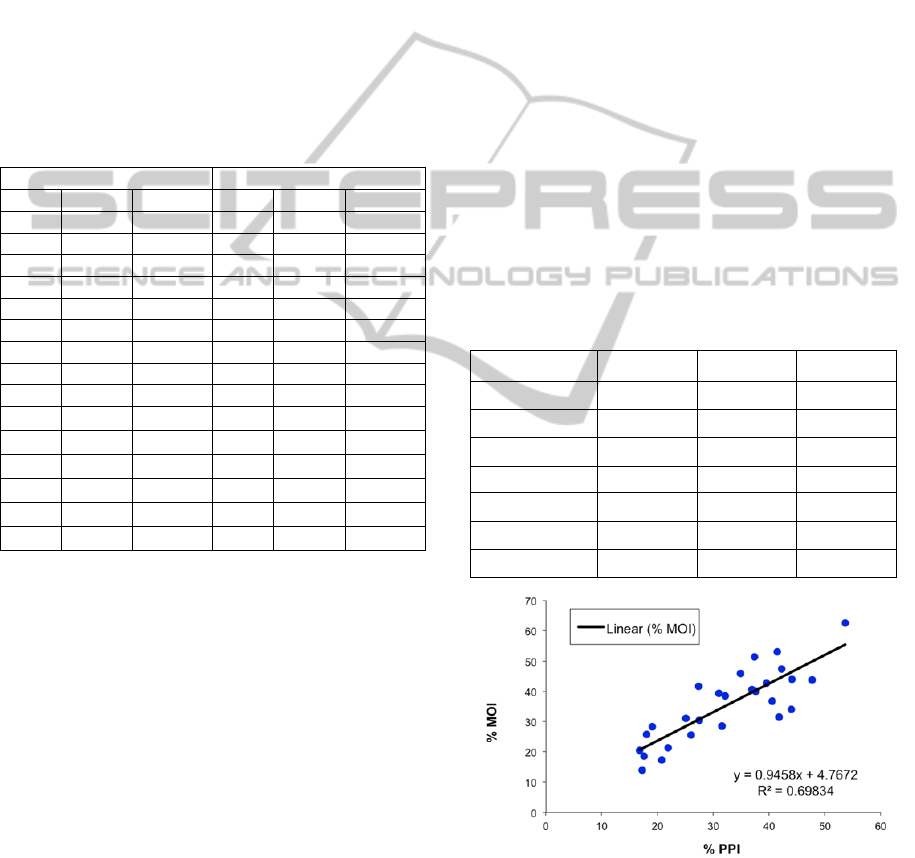

The main statistics summaries for all three variables,

%PPI, %MOI and %CLU are presented in table 3.

As seen in the table, all statistics summaries are very

similar for both, %PPI and %MOI. Figure 3 shows

the results of fitting a linear model to describe the

relationship between %MOI and %PPI. The

equation of the fitted model is:

%MOI = 4.76719 + 0.945769*%PPI (1)

Since the P-value is less than 0.01, there is a

statistically significant relationship between %MOI

and %PPI at the 99% confidence level. The R-

Squared statistic indicates that the model as fitted

explains 69.83% of the variability in %MOI. The

correlation coefficient equals 0.84, indicating a

moderately strong relationship between the

variables.

All these facts mean that the portion of SMEs

introducing product or process innovations in a

country is similar to the portion of SMEs

introducing marketing or organizational innovations.

Both, average and median is slightly higher for

%MOI reflecting the marketing or organizational

innovations than for %PPI reflecting product or

process innovations.

Table 3: Statistics summaries.

Indicator % PPI % MOI % CLU

Average 32.35 35.37 9.35

Median 32.09 36.73 8.60

St. Deviation 10.54 11.93 2.36

Kurtosis -1.03 -0.35 1.52

Skewness 0.03 0.14 1.07

Minimum 16.82 13.95 5.50

Maximum 53.61 62.63 16.00

Figure 3: Correlation Analysis for %MOI and %PPI.

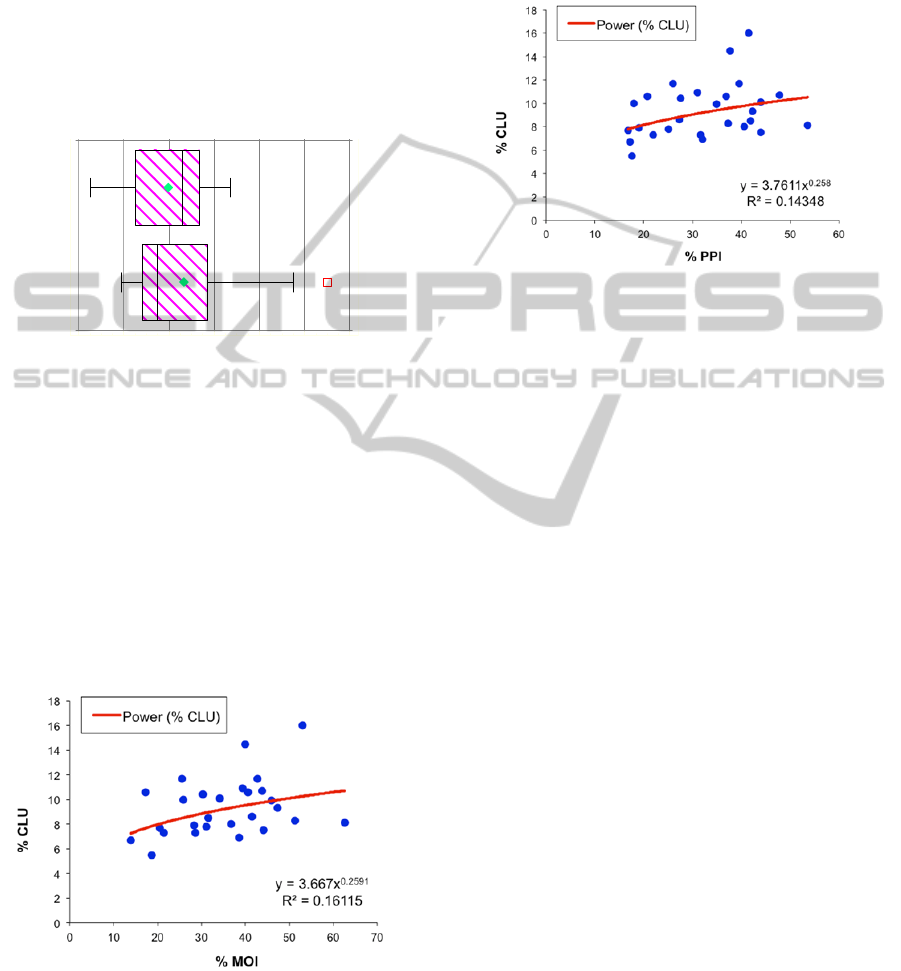

As seen in table 3 describing main statistics

summaries, minimum and maximum value for

%CLU reflecting the level of knowledge networks

existing and operating in European Union countries

KMIS2013-InternationalConferenceonKnowledgeManagementandInformationSharing

394

is 5.5 as minimum and 16 as maximum. It is very

interesting, that the portion of knowledge networks

is so similar for all EU27 countries and the data

range is only 10.5 points (where the maximum of

16% represents Luxembourg, which is a country

with the lowest population and higher percentage of

cross-border workers, thus it is feasible that the

%CLU indicator is affected by this fact). Figure 4

shows the box and whisker plot for %CLU data

divided into two groups, EU 15 and the rest

countries, entering the EU since 2004 (EU new).

Figure 4: Box and Whisker Plot for %CLU Data for EU

15 and EU New States.

To describe the relationship between the level of

knowledge networks operating in EU27 countries

and the innovation activity of SMEs in them,

regression analysis has been provided between these

variables. Figure 5 shows the results of fitting a

multiplicative model describing the relationship

between %CLU and %MOI. The equation of the

fitted model is:

%CLU = 3.66701*%MOI^0.259078 (2)

Figure 5: Relationship between %CLU and %MOI.

Since the P-value in the analysis of variance table is

less than 0.05, there is a statistically significant

relationship between %CLU and %MOI at the 95%

confidence level. The R-Squared statistic indicates

that the model as fitted explains 16.11% of the

variability in %CLU after transforming to a

logarithmic scale to linearize the model. The

correlation coefficient equals 0.40, indicating a

relationship between these variables.

Figure 6: Relationship between %CLU and %PPI.

Figure 6 shows the results of fitting a multiplicative

model to describe the relationship between %CLU

and %PPI. The equation of the fitted model is:

%CLU = 3.76108*%PPI^0.258029 (3)

Since the P-value is less than 0.10, there is a

statistically significant relationship between %CLU

and %PPI at the 90% confidence level. The R-

Squared statistic indicates that the model as fitted

explains 14.35% of the variability in %CLU after

transforming to a logarithmic scale to linearize the

model. The correlation coefficient equals 0.38,

indicating a relationship between the variables.

6 DISCUSSION

AND CONCLUSIONS

The activity of SMEs within EU27 countries in

knowledge networks or clusters is a clear

demonstration of their efforts to strengthen

competitiveness. At the country level, there is the

clear evidence of the relationship between the level

of existing and operating knowledge networks and

the innovation activity of SMEs in EU countries.

This should be a motivating factor for businesses

to seek and engage in knowledge networks or

clusters. This is important especially for small and

medium-sized enterprises, where the ability to

multiply and enhance knowledge by their own is

strictly limited. For new knowledge needed to

support innovation, they must also search in the

external environment. Maintaining the pace of

innovation requires to find the right partners to

5 7 9 11131517

D

D 15

KnowledgeNetworksasaSourceofKnowledgeInitiativesandInnovationActivityinSmallandMediumEnterprises-

RegressionAnalysisforEU27Countries

395

achieve the appropriate synergies through joint

action in the knowledge network, but also to focus

on correct settings in the internal environment.

Without adequate organizational culture, internal

processes and support of employee development

towards the search and usage of knowledge, the

involvement to the knowledge network could be

ineffective and without the desired results.

To ensure a sustainable competitive strategy,

there is necessary to activate the processes of

knowledge management by effective inclusion of

own knowledge-based resources (intellectual

capital) of company. Here occurs the importance of

intellectual capital management point of view to

secure the necessary enablers to support knowledge

management activities at the level of knowledge

networks. The concept of intellectual capital allows

managers to align resources and activities with

regard to the strategic objectives of the organization,

but also to measure and evaluate the activities

leading to the effective participation in knowledge

networks or clusters.

Regular monitoring and evaluation can help to

maintain activities and thus to promote a sustainable

innovation capability of enterprises. This is relevant

especially for countries that today do not achieve the

desired results in innovation activity (Latvia,

Lithuania, Romania, Bulgaria, Poland or Slovakia).

These countries should focus on comprehensive

management of activities, not just the obvious

process of knowledge management, but also at

building enablers consisting of the sources of

intellectual capital.

Limitations of our research: The research is

focused on analyzing the relationship between

engagement in knowledge networks represented by

clusters and innovation activity of companies,

especially small and medium enterprises. We didn't

analyze the level of activity within knowledge

networks or clusters, neither to analyze the structure

of intellectual capital with regard to the effective

usage of the possibilities of knowledge networks or

clusters. On these areas we plan to focus in our

future research.

ACKNOWLEDGEMENTS

This paper has been funded by project Vega

1/0920/11.

REFERENCES

Baptista R. 2000. Do innovations diffuse faster within

geographical clusters? In International Journal of

Industrial Organization Elsevier Science 18, 3.

pp.515–35

Creech, H. – Ramji, A. 2004. Knowledge Networks:

Guidelines for Assessment. International Institute for

Sustainable Development.

European Commission, Innovation Union Scoreboard

2011, European Union.

Ireland, R. D. – Hoskisson, R. E. – Hitt, M. A. 2009.

Understanding Business Strategy: Concepts and

Cases.South-Western, 2nd Edition

Mouritsen, J. – Larsen, L. T. 2005. The 2nd wave of

knowledge management: The management control of

knowledge resources through intellectual capital

information. In Management Accounting Research.

Frederiksberg, Denmark: Elsevier. pp. 371–394

Morgan K. 1996. Learning-by-interacting: inter-firm

networks and enterprise support. In: OECD, editor.

Networks of enterprises and local development. Paris:

OECD. p. 53–66.

OECD. 2002. Dynamising national innovation systems.

Paris: OECD

Papulova, Z. 2012. Strategické analýzy s podporou

strategického myslenia. Aktuálny trend v strategickom

manažmente. Kartprint. Bratislava

Pena, I., 2002. Knowledge networks as part of an

integrated knowledge management approach. In:

Journal of Knowledge management. Vol. 6, N. 5, pp.

469-478.

Pilková, A. – Kovačičová, Z., Holienka, M., Rehák, J.

2012. Podnikanie na Slovensku: vysoká aktivita, nízke

rozvojové ašpirácie. Univerzita Komenského v

Bratislave.

Porter, M. E.,1998. Clusters And The New Economics Of

Competition .In Harvard Business Review,

November–December, pp. 77–90.

Prahald, C. K. – Hamel.G. 1990. The Core Competence of

the Corporation, Harvard Business Review. Maj-Jun

Roelandt T. J. A. , den Hertog P., van Sinderen J., van den

Hove N. 1999. Cluster analysis and cluster-based

policy in the Netherlands. In: OECD, editor. Boosting

innovation: the cluster approach. Paris: OECD. p. 9–

26.

European Cluster Observatory. Star Cluster reports.

online:http://www.clusterobservatory.eu/index.html#!v

iew=scoreboard;url=/scoreboard/

KMIS2013-InternationalConferenceonKnowledgeManagementandInformationSharing

396