An Investigation on the Simulation Horizon Requirement for Agent

based Models Estimation by the Method of Simulated Moments

Ricardo Giglio

Department of Ecomomics, University of Kiel, Kiel, Germany

Keywords: Agent based Models, Method of Simulated Moments, Simulation Horizon, Inactive Traders.

Abstract: The accurate estimation of Agent Based Models (ABM) by the method of simulated moments is possibly

affected by the simulation horizon one allows the model to run due to sample variability. This work presents

an investigation on the effects of this kind of variability on the distribution of the values of the objective

function subject to optimization. It is intended to shown that, if the simulation horizon is not sufficiently

large, the resulting distribution may present frequent extreme points, which can lead to inaccurate results

when one tries to compare different models. For doing so, a model contest is carried out using different

simulation horizons to assess the difference in goodness of fit when inactive traders are introduced in one of

the Structural Stochastic Volatility models proposed by Franke (2009).

1 STAGE OF THE RESEARCH

This is the report of an on-going investigation.

Although some experiments have been already

performed, and the necessary computational infra-

structure is built, the project still lacks important

methodological improvements, especially with

regard to model comparison.

2 OUTLINE OF OBJECTIVES

The accurate estimation of Agent Based Models

(ABM) by the method of simulated moments is

possibly affected by the simulation horizon one

allows the model to run due to sample variability.

The main objective is to investigate the effects of

this kind of variability on the distribution of the

values of the objective function subject to

optimization.

A second objective concerns the improvements

in goodness of fit brought by the inclusion of

inactive traders in one of the Structural Stochastic

Volatility models proposed by Franke (2009).

3 RESEARCH PROBLEM

As a working hypothesis, the following statement is

considered: if the simulation horizon is not

sufficiently large, the resulting distribution may

present frequent extreme points, which can lead to

inaccurate results when one tries to compare

different models.

In an attempt to answer to this quesiton, a model

contest is carried out using different simulation

horizons to assess the difference in goodness of fit

when inactive traders are introduced in one of the

Structural Stochastic Volatility models proposed by

Franke (2009).

4 STATE OF THE ART

The objective of this introduction is to briefly

overview Agent Based Model (ABM) methodology,

which is claimed to take into account the so-called

stylized facts to a great extent, and, thus, could be

viewed as an alternative to the Efficient Market

Hypothesis theoretical background (Lux, 2008).

In doing so, selected recent empirical findings

are highlighted, and a brief taxonomy for ABMs is

presented. Then, three specific ABMs are discussed

in greater detail while focusing on their ability to

explain some of the stylized facts.

The second section deals explicitly with the

estimation of ABMs by the method of simulated

moments, focusing on practical concerns one has to

20

Giglio R. (2013).

An Investigation on the Simulation Horizon Requirement for Agent based Models Estimation by the Method of Simulated Moments.

In Doctoral Consortium, pages 20-28

DOI: 10.5220/0004637600200028

Copyright

c

SciTePress

deal with when using derivative-free methods (in

particular, the Nelder-Mead Simplex Algorithm).

Finally, the last section presents an investigation on

the simulation horizon requirements by means of an

example of model contest assessing the difference in

goodness of fit of allowing inactive traders in one of

the Structural Stochastic Volatility models proposed

by Franke (2009).

4.1 Stylized Facts

Apart from the theoretical critiques developed by

Grossman et al. (1980), the Efficient Market

Hypothesis (EMH) seems to be misaligned with

some empirical features of financial markets. This

debate is presented by Lux (2008) by portraying

how various lines of research refer to these empirical

findings, each in its own different way. On the EMH

side, these findings were referred to as anomalies,

that is, there should be at least a few strange

empirical results in disagreement with the

established theoretical foundation. On the other

hand, recent studies have referred to these empirical

results as stylized facts, meaning that they can be

found quite regularly in financial markets and, thus,

they deserve proper theoretical explanation.

An extensive list of these stylized facts is

presented by Chen (2008) concerning several data

natures (such as returns and trading volume) and

frequencies (ranging from tick-by-tick order book

data to annual seasonality). Here, attention is only

focused on some of those data concerning daily

price returns, namely the absence of autocorrelation

in raw returns, fat tails of absolute returns, and

volatility clustering.

The absence of autocorrelation in raw returns has

never been referred to as an anomaly, because it is

an empirical finding in total agreement with the

EMH theoretical background. It is related to the

martingale property (Mandelbrot, 1966), which

states that markets behave similar to a random walk.

According to Lux (2008), this is the EMH’s most

important empirical finding, but the author also

points that a lot of attention was paid to it, thus

neglecting in consequence other relevant stylized

facts.

With regard to the tails of returns distributions, it

is expected by the EMH that they would behave

normally due to the arrival of purely random

information. However, even old empirical findings

(Mandelbrot, 1966) suggested that the normal

distribution is not well suited to financial returns,

because it has probability mass more concentrated

on its mean and extreme values than is expected in a

normally distributed process.

Since it is seen that kurtosis is not well suited for

evaluating such a statistical property, it is then

common to deal with the Hill estimator of tail index

α, calculated as follows: first, absolute daily returns

are sorted in a descending order so that a threshold

value which defines a tail

can be calculated as the

correspondent first (usually 5) returns, and

is defined as the number of returns labeled as

belonging to the tail. Finally, the Hill estimator is

given by the equation 1.

∑

ln

ln

(1)

Finally, volatility clustering deals with the fact that

directions of returns are hard to predict, but not their

magnitude. There seem to exist alternate moments of

financial fury and relaxation, printing clusters of

high and low volatility on empirical data that are not

at all accounted for by the EMH background. As

pointed out by Lux (2008), even though a great deal

of research on econometrics is focused on modelling

this fact (the ARCH methodology), very little

research has been done to explain it.

4.2 Taxonomy

According to an extensive survey conducted on the

topic dealt with by Chen (2008), during the 1990s,

the first attempts were made to explain some

observed regularities in financial data by means of

ABM. The main concern of these early works was to

artificially reproduce some of the so-called stylized

facts observed in real financial data. Hence, the

objective of the authors just mentioned was to

simulate and calibrate parameters of an artificial

financial market by ABM, and then apply standard

econometric techniques to evaluate how much of the

stylized facts (both quantitatively and qualitatively)

could be reproduced by their artificial generated

data.

Even though these early works share the goal of

matching stylized facts, their ABM formulations

may vary dramatically. For this reason, a taxonomy

was developed by Chen (2008) in an attempt to

classify recent work on ABM with regard to specific

aspects, namely agent heterogeneity, learning, and

interactions.

With regard to heterogeneity, agents can

basically be divided into two groups: N-types and

autonomous agents. In the former, all possible types

of behaviour are pre-defined in some sense by the

designer; whereas in the latter, new strategies (that

is, agent types) can emerge autonomously. We can

AnInvestigationontheSimulationHorizonRequirementforAgentbasedModelsEstimationbytheMethodofSimulated

Moments

21

consider the model by Lux et al. (1999) as an

example of N-type design, in which agents can be

fundamentalists (that is, their demands respond

proportionally to the current deviation from

fundamental price) or chartists (who try to

extrapolate the last trend observed).

Chartists’ strategy is also determined by a

sentiment index (pessimism or optimism) which

determines whether chartists believe that the last

trend observed will be maintained or reversed. On

the other hand, we can consider the Santa Fe

Artificial Stock Market (Arthur et al., 1997) as an

example of autonomous agent design. In this

context, agents are allowed to autonomously search

for profitable strategies that were usually not pre-

defined by the designer by means of genetic search

algorithms.

With regard to learning, Lux (2008) points out to

a branch of literature called Adaptive Belief Systems

(ABS), which, unlike some of the other less flexible

models, allows agents to dynamically switch

between different strategies. With regard to the N-

type models, this feature is most commonly

introduced by means of two approaches, namely

transition probabilities and discrete choice.

Following the transition probability approach, a

majority index is defined as representing how much

one group dominates (or is dominated by) the other.

Each agent switches from one group to the other

according to time-varying transition probabilities

,

and

,

, which are functions of the current

state of the system, which is generally defined here

as

. According to Franke et al. (2009), it can be

demonstrated under some assumptions, that at the

macroscopic level, population shares are depicted by

and

1

whereas the transition probabilities are

given by

1,

, and

1,

can be viewed as a

flexibility parameter.

On the other hand, there is the discrete-choice

approach proposed by Brock et al. (1998), in which

the adjustment happens directly on the population

shares (and not on its rate of change) according to

the following equation

,

,

(2)

where is the intensity of choice, and the state of

the system is allowed to be different for each group.

The way the state of the system influences agent

choice significantly varies in literature. As

examples, one can consider the specification of a

herding

or a misalignment

component

∗

where

∗

is the

fundamental price. This will be pursued in greater

detail in the next section.

Finally, the way agents interact defines the

structure of the artificial financial market and its

price determination. When considering N-type

models, it is common to sum up demand of both

groups and to assume a market maker who holds a

sufficiently large inventory to supply any excess of

demand and to absorb any excess of supply. Then,

this market maker adjusts the price in the next period

to reflect this excess demand or supply. However, as

stated by LeBaron (2006), this is not a very realistic

assumption in the way that no actual market clearing

is taking place. In addition, a true market clearing

mechanism would be easier to be implemented in an

autonomous agent design by means of direct

numerical cleaning.

5 METHODOLOGY

In the remaining part of the section, two specific

agent-based models are described in greater detail,

namely the trading inactivity model proposed by

Westerhoff (2008) and the structural stochastic

volatility model proposed by Franke et al. (2009).

The idea is to present some practical issues

concerning the development of an agent-based

model, and also to introduce the task of estimating

its parameters that is the objective of the next

section.

5.1 Trading Inactivity Model

In an attempt to use simple agent based models to

illustrate the potential effects of regulatory policies

on financial markets, Westerhoff (2008) introduces a

modification on the chartists-fundamentalists

traditional scheme by allowing agents also to be

absent from markets, that is, they can be inactive.

This innovation may imprint models with more

reality and also is important for using agent based

models in the analyses of regulatory and taxing

policies. This section outlines this model by

focusing on this new device of trading inactivity and

also on the model’s power to reproduce some of the

stylized facts.

As it is common practice, the demands of

chartists and fundamentalists are respectively given

by

SIMULTECH2013-DoctoralConsortium

22

(3a)

(3b)

where stands for demand, the superscripts and

represents chartists and fundamentalists respectively,

is the time unit, is the log of price, is the log

of fundamental price, and are positive reaction

parameters for chartists and fundamentalists

respectively, and are I.I.D. random normal

process with zero mean and

and

are standard

deviations that capture intra-group heterogeneity

respectively for chartists and fundamentalists.

In this context, price formation is given by the

following price impact function

(4)

where denote population shares, is a positive

price adjustment coefficient and is an I.I.D.

random normal process with zero mean and standard

deviation

.

The determination of , that is, the choice

between the three available strategies, depends on

past performance and is given by the following

equations in the spirit of the discrete choice

approach:

(5a)

(5b)

0

(5c)

where the superscript stands for inactivity,

denotes each strategy attractiveness and is composed

by the sum a short run capital gain term and an

accumulated profits term which is weighted by the

memory parameter . is a percentage tax

applied both when buying and selling the asset.

Finally, defining as the so called intensity of

choice, population shares are represented by

1

(6a)

1

(6b)

1

1

(6c)

Even though the author does not carry on a

systematic estimation procedure, a set of benchmark

input parameters are presented and thus the

calibrated model is claimed to reproduce some of the

stylized facts (mainly volatility clustering and fat

tails) when no is applied. Figure 1 presents a

single simulation of the model with the following set

of input parameters presented by the author (1,

0.04, 0.04, 0.975, 300,

0.01,

0.05, and

0.01).

5.2 Structural Stochastic Volatility

Model

With regard to agent design, this is a two-group

model where agents can be fundamentalists or

chartists. The main difference is that fundamentalists

respond to deviations from fundamental price, and

chartists extrapolate the returns they just observed in

the previous period. Thus, their demand functions

,

are given by

Figure 1: Upper panel shows the log of price, middle panel

its percentage returns, and lower panel the shares of

fundamentalists (gray), chartists (black) and inactive

(white) traders.

∗

~0,

, 0

(7a)

~

0,

,0

(7b)

where the superscripts and denote agent

affiliation (fundamentalists and chartists,

respectively); the subscript represents time unit;

is the log of the price;

∗

is the log of the (fixed)

fundamental price;

,

are group-specific random

terms (with zero mean and

,

standard deviations)

that account for intra-group heterogeneity;

corresponds to the responsiveness of the

fundamentalists to the deviation from fundamental

price; and corresponds to the responsiveness of the

chartists to the last trend observed.

However, this model also accounts for learning,

in the sense that agents can dynamically change their

minds and move to the other group. Therefore, the

AnInvestigationontheSimulationHorizonRequirementforAgentbasedModelsEstimationbytheMethodofSimulated

Moments

23

shares of each group in the total population are

allowed to vary over time. Considering that

,

denotes their respective population shares, total

excess demand can be written as

. Seen

that this equation may not balance, a market maker

is assumed to hold a sufficiently large inventory for

supplying any excess of demand and for absorbing

any excess of supply. This is done by adjusting the

price in the next period by a fixed coefficient that is

inversely related to market liquidity. Considering

these specifications, price determination at each time

unit is given by

∗

(8)

where

~

0,

,

(9)

summarizes what the authors coined as Stochastic

Structural Volatility (SSV), and can be viewed as a

structural modelling approach to time-varying

variance.

What remains to be explained is the learning

mechanism that yields the dynamics of the

population shares. Even though the authors

presented two different technical approaches for this,

namely transition probabilities and discrete choice,

only the latter will be considered here, given its best

performance in a comparative study conducted by

the same authors Franke et al. (2011). It is worth

beginning with the definition of a switching index

, which attempts to measure the relative

attractiveness of the fundamentalist’s strategy in

comparison to that of the chartist, given by

∗

(10)

where

is a predisposition parameter to switch to

fundamentalism;

captures the idea of herding

behaviour; and

can be understood as a measure

of the influence of price misalignment (that is, the

larger the gap, the higher the attractiveness of

switching to fundamentalism). Thus, in the spirit of

the discrete-choice approach, the shares of the total

population in each group can be written as

11

⁄

and

1

where is the

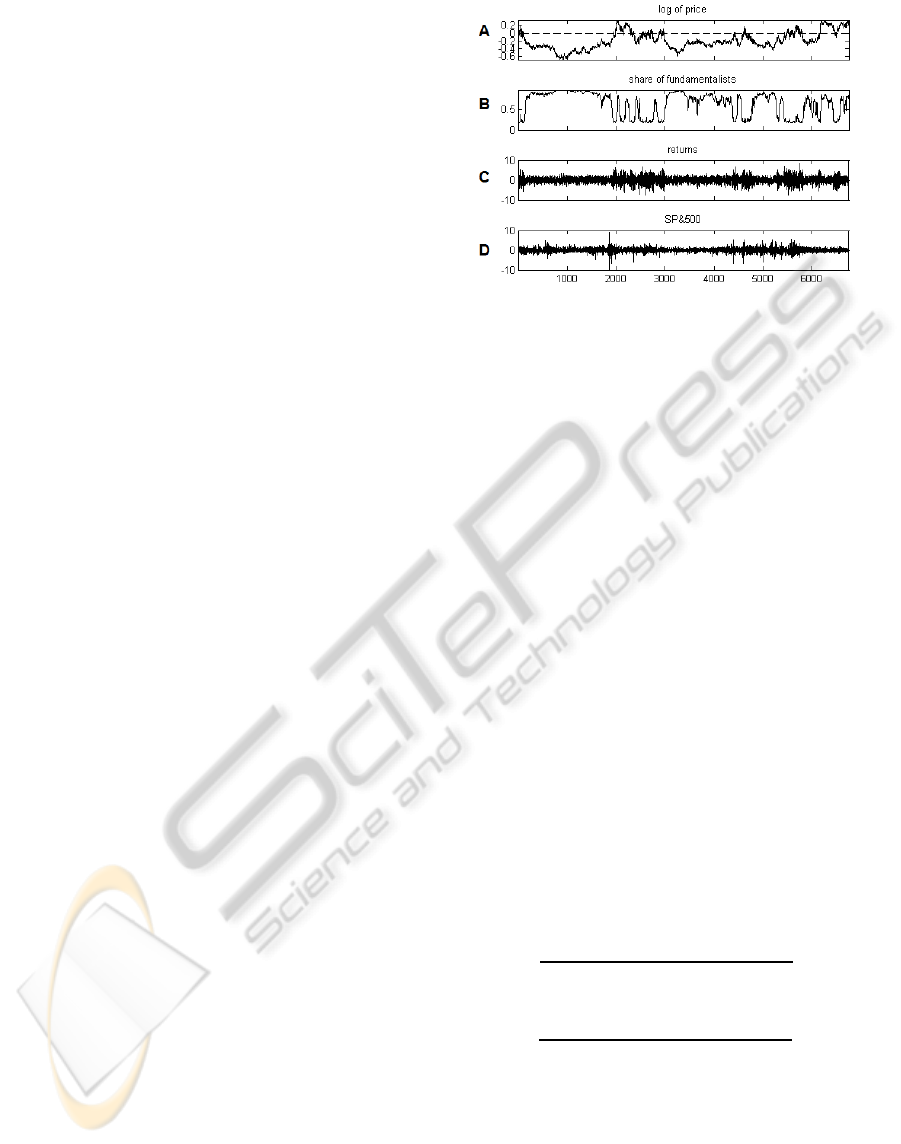

intensity of choice. Figure 2 compares outputs from

a single run of the model with returns of S&P500 as

a benchmark.

Figure 2: 6750 observations of (A) log of price, (B)

share of fundamentalists, and (C) returns from a simple

run of the model and (D) daily returns from S&P500 from

January 1980 to March 2007. Inputs to the model are as

follows: 0.0728, 0.0896, 0.01,

0.327,

1.815,

9.6511,

1.0557,

2.9526,

∗

0, and 1.

5.3 Introducing Inactivity to SSV

Models

This section described the exact same model from

last section, but augmented to allow agents to be

absent (inactive) from the market. Hence, it is now a

three-group model (fundamentalists, chartists, and

inactive), with demand functions

,,

given by

∗

(11a)

(11b)

0

(11c)

where the subscript denotes the inactive group, and

all the other variables remain the same from

equation 7. Another modification required from the

two-group model described in the last section

concerns the shares of the total population in each of

the three group, which is now described as

1

1

(12a)

1

1

(12b)

1

(12c)

5.4 Estimation

In this section, the Method of Simulated Moments is

applied to the model (SSV augmented with inactive

traders) just described. In order to follow this

SIMULTECH2013-DoctoralConsortium

24

method of estimation, one has to first select the

moments of interest. Following the approach

developed by the authors just mentioned (Franke and

Westerhoff, 2011), only four stylized facts that have

received more attention in the literature are

considered here, namely the absence of

autocorrelation in raw returns, fat tails of returns

distribution, volatility clustering, and long memory.

Therefore, it is argued that the following set of nine

moments is enough to account for these four stylized

facts, namely the Hill estimator of tail index of

absolute returns , mean of the absolute returns

̅, first-order autocorrelation of the raw returns

, and six different lags from the

autocorrelation function of the absolute returns

,

,

,

,

,

and

. Each single run of the model will then

be compared with a specific empirical data set with

regard to this vector of selected moments.

The distance between the moments vector

generated by a single run of the model (with set of

inputs , sample size , and random seed ) and the

vector of empirical moments

is defined by a

weighted quadratic loss function in the following

form

,,

,,

,,

(13)

where is a weighting matrix that intends to

capture both correlation between individual

moments and sampling variability.

Among several options for choosing a proper

weighting matrix , here the inverse of the

estimated variance-covariance matrix of the

moments Σ

is used. In order to estimate such a

matrix, the following bootstrapping method was

applied. For the two first moments ( and ̅),

10

random resamples with replacement were

constructed from the original series, and the

respective moments were calculated. However, since

the other moments deal with autocorrelations, such a

procedure would be inadequate due to the

destruction of long-term dependencies by the

sampling procedure. Therefore, for these moments,

an index-bootstrapping method was used by

randomly selecting (with replacement) set of time

indexes

,

,…,

from indexes and then

calculating the correlation coefficient regarding time

lag as

1/

∑

̅

̅

∈

where ̅ is the mean value of

over , and

̅ if 0.

Considering

as the vector of moments of

each of these bootstrapped resamples and as the

vector of their moment specific means, the variance-

covariance matrix was, thus, estimated as Σ

∶ 1/

∑

.

5.4.1 Avoiding Local Minima

Finally, the minimization problem

,,

min

! was performed by the Nelder-Mead simplex

algorithm to estimate the set of parameters that

minimizes the loss function . Here, only seven

parameters were allowed to vary, namely , ,

,

,

,

, and where the remaining were fixed at

0.01,

0.327, and 1. Starting from

an initial set of parameters

, the algorithm returns

an estimated set of parameters and a value for the

objective function . To avoid getting trapped in a

local minima, this obtained set of estimated

parameters was re-introduced in the algorithm

here as the initial set of parameters (that is,

),

and this procedure was carried out as many times it

was necessary until no improvement higher than

0.001 was achieved in the objective function.

5.4.2 Experiment on Simulation Horizon

Requirements

In order to reduce sample variability, Franke et al.

(2011) points that a model simulation horizon ten

times bigger than the empirical size (that is,

10) was considered sufficient for their model

comparison purposes. The main objective of this

study is to assess how such results change when one

increases simulation horizon beyond this value. For

doing so, first it will be described in more detail how

a model specific p-value is calculated by means of

Monte Carlos runs, and then the comparison of these

p-values calculated using both 10 and

100 will be presented.

5.4.2.1 Definition of a Model Specific

P-value

Apart from providing the variance-covariance

matrix, the bootstrap procedure of empirical data

described in the previous section can also be used to

assess the fit of different model simulations to real

data. This idea, presented by Franke et al. (2011),

consists of calculating the value of the objective

function for each of the vector of moments

obtained by bootstrapping empirical data 5000

times, and then finding a critical value

which

represents the 95% quantile of the distribution of the

AnInvestigationontheSimulationHorizonRequirementforAgentbasedModelsEstimationbytheMethodofSimulated

Moments

25

objective function values. This critical value was

found to be

.

17.228. In this sense, if a

simulation run from a given model presents a value

of the objective function higher than

.

, this run

cannot be said to have a good fit to empirical data.

Finally, the p-value of a model is given by the

proportion of Monte Carlo runs which lies below

this critical value. Figure 3 presents the distribution

of objective function values obtained by

bootstrapping empirical data, and its correspondent

critical value.

5.4.3 Model Fit for Different Simulation

Horizons

To begin with, table 1 shows, for a given random

seed, and considering the simulation horizon of

10, the set optimal parameters obtained by a

single run of the model, and their correspondent

value of .

Table 2 shows the moments obtained with this

optimized set of parameters in this specific run of

the model, and compares them with the empirical

moments for S&P500 and their bootstrapped

statistics. It can be seen that, at least with regard to

this specific random seed, the moments obtained

with the optimal set of inputs rely inside the bands

provided by bootstrapping empirical data.

Figure 3: Distribution of objective function values

obtained by bootstrapping empirical data, and its

correspondent critical value.

Table 1: Estimated parameters for a given random seed,

considering a simulation horizon of 10.

11.744 0.914 2.077 0.992 0.89 1.359 2.049 0.548

In order to check whether these results depend on

the given pseudo-random number sequence, a

similar estimation procedure to the one just

described was carried on while considering 1,000

Table 2: Moments obtained with optimized parameters for

10, the empirical moments for S&P500 and their

bootstrapped bound values.

run 2.5% mean 97.5%

3.448 3.155 3.484 3.891

̅

0.706 0.690 0.706 0.723

0.006 -0.018 0.006 0.030

0.154 0.128 0.154 0.182

0.184 0.163 0.184 0.205

0.166 0.148 0.166 0.185

0.142 0.125 0.143 0.161

0.126 0.107 0.126 0.147

0.089 0.075 0.090 0.106

different random seeds. Table 3 summarizes this

Monte Carlo experiment by presenting the average

and 5% bounds for the obtained optimized

parameters and values of the objective function .

The p-value for this model and simulation horizon,

calculated as described previously, is 0.290.

Table 3: Mean and bound values for parameters estimated

for 1,000 different random seeds, considering a simulation

horizon of 10.

6.210 0.750 1.759 0.988 0.711 1.212 1.885 0.491

18.833 0.948 1.962 0.993 0.964 1.328 2.075 0.538

62.944 1.160 2.184 0.998 1.098 1.538 2.178 0.597

Similarly, table 4 presents the same statistics as table

3, but now considering a longer simulation horizon

of 100. It can be seen that, although there is a

larger variability for some of the estimated

parameters, the resulting distribution of the values of

the objective function presents much less extreme

values. Figure 4 depicts this result, by showing the

distribution of both for a simulation horizon of

10 (solid) and of 100 (dashed). The

obtained p-value for the longer case is 0.021, which

is significantly smaller than for the shorter.

Table 4: Mean and bound values for parameters estimated

for 1,000 different random seeds, considering a simulation

horizon of 100.

7.595 0.597 1.559 0.990 0.669 1.116 1.871 0.474

10.702 0.961 1.952 0.991 0.928 1.379 2.030 0.546

16.268 1.301 2.217 0.992 1.184 1.642 2.218 0.609

5.4.4 Assessing the Introduction of Inactive

Traders

It was shown in the last section that a great extent of

the inability of the model to reproduce the stylized

facts (that is, large values o ) was in fact a sort of

SIMULTECH2013-DoctoralConsortium

26

noise introduced by a not sufficiently large

simulation horizon. Then, the present section

introduces a p-value based model contest, as

proposed by Franke et al. (2011), in order to check

whether the introduction of inactive traders improve

or not the goodness of fit of this class of models to

empirical data.

Table 5 presents two versions of a model contest,

one for each simulation horizon 10 and

100. It can be seen that the introduction of

inactive traders improve the goodness of fit in both

versions. Figure 5 depicts this result, by showing the

distribution of for each pair model-horizon.

Although a significant reduction sample variability

is obtained by using larger simulation horizons, it

can be seen that the central tendencies of each

distribution of do not change widely in respect to

.

Figure 4: Comparison of the distributions of objective

function values for simulation horizons of 10 and

100.

Table 5: Model contest to asses the improvement in

goodness of fit when allowing inactive traders in SSV

models using different simulation horizons.

p-value

DCA

10

2.5% 10.175

0.349

mean 16.451

97.5% 27.151

DCA

100

2.5% 13.362

0.051

mean 15.518

97.5% 17.530

DCA-I

10

2.5% 6.210

0.290

mean 18.833

97.5% 62.944

DCA-I

100

2.5% 7.595

0.021

mean 10.702

97.5% 16.268

6 EXPECTED OUTCOME

There are two main expected outcomes from the

PhD thesis. First, and most important, is to shed

light on the simulation horizon requirements one

allows a model to run when performing estimations

by the method of simulated moments.

The current stage of the research has already

shown that a great deal of sample variability can be

avoided by longer simulation horizons, but it is still

an open question whether this implies major

problems when performing estimations.

Figure 5: Comparison of the distributions of objective

function values for simulation horizons of 10 and

100, and for inclusion/exclusion of inactive traders.

A second expected outcome is the definition of a

model contest procedure able to determine goodness

of fit of different models, hence allowing one to

compare models and decide for the best performing

one. In addition to this second objective, it is also an

expected outcome to assess the improvement in

goodness of fit when allowing inactive traders in one

of the Structural Stochastic Volatility models

proposed by Franke (2009).

7 CONCLUSIONS

From the current stage of the research, two initial

conclusions can be drawn. First, the introduction of

inactive traders in the Structural Stochastic

Volatility (SSV) model proposed by Franke (2009)

yields better goodness of fit when compared to the

standard two agent types model, as pointed by the

smaller values of the objective function shown in

figure 5. By allowing agents to be inactive for some

periods of time, the model gains a more realistic

feature, and, hence, is able to better reproduce the

AnInvestigationontheSimulationHorizonRequirementforAgentbasedModelsEstimationbytheMethodofSimulated

Moments

27

stylized facts represented by the selected moments

of interest.

The second conclusion deals with the simulation

horizon requirements one allows the model to be

run. From figure 5 it is clear that a great deal of

sample variability is reduced when the simulation

horizon is extended from 10 to 100 times the size of

the empirical time series used as reference in the

estimations. However, it can also be seen in figure 5

that the centroids of the distributions do not change

(that is, the mean locations remain the same) when

the model is simulated for a longer time horizon. In

this sense, the relevance of the longer simulation

horizon with respect to the estimation procedure still

requires further investigation.

REFERENCES

Arthur, W., Holland, J., LeBaron, B., Palmer, R., and

Tyler, P., 1997. Asset Pricing Under Endogenous

Expectations in an Artificial Stock Market. In Arthur,

W., Durlauf, S., and Lane, D. (eds.), The Economy as

an Evolving Complex System. Reading, Mass.:

Addison-Wesley, 15-44, 1997.

Brock, W., and Hommes, C., 1998. Heterogeneous beliefs

and routes to chaos in a simple asset pricing model.

Journal of Economic dynamics and Control,

22.89:1235-1274.

Chen, S., 2008. Computational intelligence in agent-based

computational economics. In: Fulcher, J., Jain. L.

(eds.), Computational intelligence: a compendium,

Springer, 517-594.

Franke, R., and Westerhoff, F., 2008. Validation of a

Structural Stochastic volatility Model of Asset Pricing.

Christian-Albrechts-Universitat zu Kiel, Department

of Economics, Working Paper.

Franke, R., and Westerhoff, F., 2011. Structural Stochastic

Volatility in Asset Pricing Dynamics: Estimation and

Model Contest. Christian-Albrechts-Universitat zu

Kiel, Department of Economics, Working Paper.

Grossman, S., and Stiglitz, J., 1980. On the impossibility

of informationally efficient markets. The American

Economic Review, 70.3:393-408.

LeBaron, B., 2006. Agent-based Computational Finance.

Handbook of Computational Economics, 2:1187-1233.

Lux, T., and Marchesi, M., 1999. Scaling and criticality in

a stochastic multi-agent model of a financial market.

Nature, 387:498-500.

Lux, T., 2008. Stochastic Behavioral Asset Pricing Models

and the Stylized Facts. Christian-Albrechts-Universitat

zu Kiel, Department of Economics, Working Paper N.

1426.

Mandelbrot, B., 1966. Forecasts of future prices, unbiased

markets, and martingale models. Journal of Business,

1:242-25.

Westerhoff, F., 2008. The use of agent-based financial

markets to test the effectiveness of regulatory policies.

Journal of Economics and Statistics, 228:195-227.

SIMULTECH2013-DoctoralConsortium

28