Agent-based Simulation of the German and French Wholesale

Electricity Markets

Recent Extensions of the PowerACE Model with Exemplary Applications

Andreas Bublitz, Philipp Ringler, Massimo Genoese and Wolf Fichtner

Chair of Energy Economics, Institute for Industrial Production (IIP), Karlsruhe Institute of Technology (KIT),

Hertzstraße 16, 76137 Karlsruhe, Germany

Keywords: Economic Agent Models, Auctions and Markets, Agent-based Simulation, Multi-agent Systems, Electricity

Markets.

Abstract: Given electricity markets’ complexity, model-based analysis has proven to be a valuable tool for decision

makers in related industries or politics. Among the different modelling techniques for electricity markets,

agent-based modelling offers specific advantages. In this paper, the detailed agent-based simulation model

for the wholesale electricity market, PowerACE, is presented with its latest extensions. The model integrates

the short-term perspective of daily electricity trading and long-term capacity expansion planning. Various

market elements are simulated including the day-ahead market as well as the coupling of different market

areas with limited interconnection capacities. Strategic behaviour of the main supply-side agents is taken

into account. The model has already been applied to various research questions regarding the development

of electricity markets and the behaviour of market participants. In this contribution, exemplary results for

the market coupling of the German and French wholesale electricity market are shown. In the future, due to

the current developments in the electricity markets, the PowerACE modelling framework is to be extended

by various aspects including the simulation of an intraday market and the integration of different aspects of

uncertainty which becomes necessary given current developments in the electricity markets.

1 INTRODUCTION

Today’s liberalized wholesale electricity markets are

generally considered to be highly complex systems.

This is due to, among other things, the specific

characteristics of the commodity electricity (e.g.

instantaneous balancing of supply and demand,

limited storability) and the fact that electricity can

only be transported by a transmission grid with

limited capacities. Other factors that increase the

complexity are the various interrelated markets

where electricity or related products can be traded

(e.g. day-ahead market, future market) and the

influence of other volatile markets such as the

market for carbon emission allowances.

One important aspect of electricity systems is the

reliability which should be ensured at all times. In

liberalized European markets electricity generation

companies are not obliged to invest in new power

plants. Consequently, electricity markets need to be

designed in such a way that there are sufficient

incentives for adequate investments. The currently

often discussed concept to ensure reliability in

Europe is called “energy only” because power plant

operators generate their profits mainly from the

produced energy but are not compensated for only

providing generation capacity that ensures

reliability.

In Germany and several other European

countries the spot market for electricity, in particular

the day-ahead market auctions organized by

electricity exchanges, plays an important role as it

provides a market place to sell or buy electricity and

its price serves as a reference for other markets (e.g.

future markets, bilateral contracts).

In addition,

reserve markets are implemented to ensure the short-

term reliability of the electricity system.

Two important developments currently altering

the economics of European electricity markets are

the increasing electricity generation from renewable

energy sources and the European market integration.

While for a long time mainly nuclear, coal and oil

power plants had been installed in Europe,

governments have recognized the decarbonisation

40

Bublitz A., Ringler P., Genoese M. and Fichtner W..

Agent-based Simulation of the German and French Wholesale Electricity Markets - Recent Extensions of the PowerACE Model with Exemplary

Applications.

DOI: 10.5220/0004760000400049

In Proceedings of the 6th International Conference on Agents and Artificial Intelligence (ICAART-2014), pages 40-49

ISBN: 978-989-758-016-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

potential of the electricity sector and there has been

a continuous trend to move towards renewables and

gas. Specifically, the introduction of the European

Union Emissions Trading System and the creation of

various policy programs to support the use of

renewable energy sources have contributed to this

development.

However, the feed-in of electricity generated

from photovoltaic and wind power poses challenges

to the electricity markets in their current form

because in comparison with thermal power plants

the generation from these sources is neither

projectable nor exactly predictable and typically

enjoys a guaranteed feed-in and compensation,

respectively. Consequently, operators of

conventional power plants are faced with another

source of uncertainty that needs to be considered

within the unit commitment problem, where an

optimal balance of demand and supply under the

various technical constraints of the power plants is

to be determined. After determining the day-ahead

operation schedule, the intraday market, where

electricity can be traded at short notice, offers a

possibility to adjust the schedule based on updated

information, e.g. forecast of renewable generation.

The intraday market is likely to gain importance in

the next years, as the generation from renewable

energy sources is expected to further increase.

Another important development in the electricity

market is that the current borders of the national

markets are subject to change; there are ongoing

efforts to achieve a single European market. One

aspect thereof is the implementation of market-based

mechanisms to allocate limited cross-border

capacities between European countries. The Central

Western Europe (CWE) Market Coupling between

Germany, France, Belgium, the Netherlands and

Luxemburg serves as one of the most prominent

examples. Market coupling maximizes social

welfare, leads to price convergence and helps to

balance different supply and demand situation in the

interconnected market areas. The integration of

markets is a matter-of-fact, thus influencing market

prices and profitability of power plants in Europe.

Given the electricity system’s complexity the

relevant actors rely on different types of models for

decision support. For instance, models are used by

regulatory entities to analyse questions related to

market design which is necessary to guarantee

system reliability on different levels. Similarly,

generation companies rely on electricity market

models, for example, in order to examine investment

cases. Naturally, market changes need to be reflected

appropriately in modelling techniques.

In this paper, the main elements of the detailed

bottom-up agent-based simulation model PowerACE

are described and current extensions to adjust the

model to relevant electricity market developments

are presented. The aims of this paper are to present a

comprehensive overview of the PowerACE

modelling framework for electricity markets and

how it can be applied to different research questions.

The paper is organized as follows: section 2

provides a brief overview of the different types of

electricity market models and shows the general

suitability of agent-based simulation in the context

of electricity markets. In section 3, the model’s main

elements with a focus on agents and markets are

described. Exemplary results are presented in

section 4. Finally, section 5 concludes with a

summary and an outlook.

2 MODELS FOR ELECTRICITY

MARKETS

The models used for electricity markets can be

classified into several categories. Ventosa et al.

(2005) identify three major categories in electricity

market modelling: optimization models, equilibrium

models and simulation models. Distinguishing

features include the mathematical structure, market

representation, computational tractability and main

applications.

While in Europe the liberalization of electricity

markets started in 1996, electricity market models

developed beforehand had been mostly optimizing

models incorporating the perspective of a single

planner, i.e. the government. Through the

liberalization, the integration of a market perspective

in models has gained importance, which brought

forth the development of alternative models such as

agent-based models that are able to adequately

represent the current market situation where not one

central decision maker is found, but several market

players pursue their individual goals. In general,

agent-based models which have been developed in

quite different disciplines can provide a flexible

environment which allows considering inter alia

learning effects, imperfect competition including

strategic behaviour and asymmetric information

among market participants (Tesfatsion, 2006).

Nowadays, there exists a large number of agent-

based electricity market models. Depending on the

research focus, the models in the literature will differ

from each other with respect to various criteria.

Each agent-based model features a certain agent

Agent-basedSimulationoftheGermanandFrenchWholesaleElectricityMarkets-RecentExtensionsofthePowerACE

ModelwithExemplaryApplications

41

definition and architecture which can include

several dimensions. In the first place, it is essential

to define conceptually what the “agent” represents in

the model. In the field of Agent-based

Computational Economics (ACE) agents generally

are defined as having a set of data and pre-defined

behavioural rules within a computationally

constructed world (Tesfatsion, 2006). Agent

architecture includes the design of specific agent

decision models including adaptive learning

algorithms. Market modelling is another large

building block of agent-based models. Given the

complex nature of electricity wholesale markets and

the electricity supply chain, different types of

horizontally and vertically integrated markets exist.

In order to analyse the existing interrelations

between markets, one has to consider these markets

with respect to their specific clearing rules.

Depending on the spatial coverage of the model,

coupling of interconnected areas might be

considered as well. Similarly, agent-based models

differ with regard to the time resolution as well as

time scale of the simulation. The latter aspects

includes, for instance, whether short-term behaviour

(e.g. spot market bidding strategies) and long-term

aspects (e.g. investment decisions) are jointly

considered. Another important aspect of electricity

market models is the representation of the electricity

system’s technical constraints (e.g. techno-economic

aspects of generation units, grid constraints.

Three comprehensive review papers showing the

large body of agent-based models for electricity

markets and their distinctive features are provided

by Guerci et al. (2010), Weidlich and Veit (2008),

and Sensfuß et al. (2007). These literature reviews

contain a comparison of the different existing

models including the model presented in this paper.

Generally, having an integrated agent and market

perspective, as well as a high degree of flexibility,

agent-based simulation models can be used for

detailed analyses of electricity markets and

interactions therein. Potential applications include

market power analysis or market design studies

while considering the feed-in from renewable energy

sources and integrated markets with respect to

products, time and region.

3 POWERACE MODEL

3.1 Model Overview

The development of the PowerACE model started in

2004 and since then the model has been

continuously extended and applied to various

research questions.

The subject of modelling is the electricity

wholesale market which is simulated for each hour

of a year. Originally, the model was designed for the

German market area. However, Europe’s electricity

markets are all liberalized and set up according to

the same fundamental principles. That is why

PowerACE can be used to simulate other European

market areas as well. Market areas are interpreted as

one “object” in the programming environment

featuring different market elements, agents and input

data. In order to simulate different market areas, the

respective object is instantiated repeatedly.

One of the key features of the model is the

integration of both short-term market developments

and long-term capacity expansion planning.

Thereby, interactions and feedback loops between

short-term and long-term output decisions are

considered. Decisions regarding the expansion of

capacity, i.e. whether to install a new power plant

are influenced by current and future developments in

the daily electricity trading as the main source of

income and vice versa.

The key modules are markets, electricity supply,

electricity demand and regulatory aspects. The main

players participating in the wholesale electricity

market are modelled individually; small companies

are represented in an aggregated form. Different

types of market participants are modelled as

different types of agents. Each agent takes over

certain roles, makes decisions based on specified

functions and either takes part in or sets rules for a

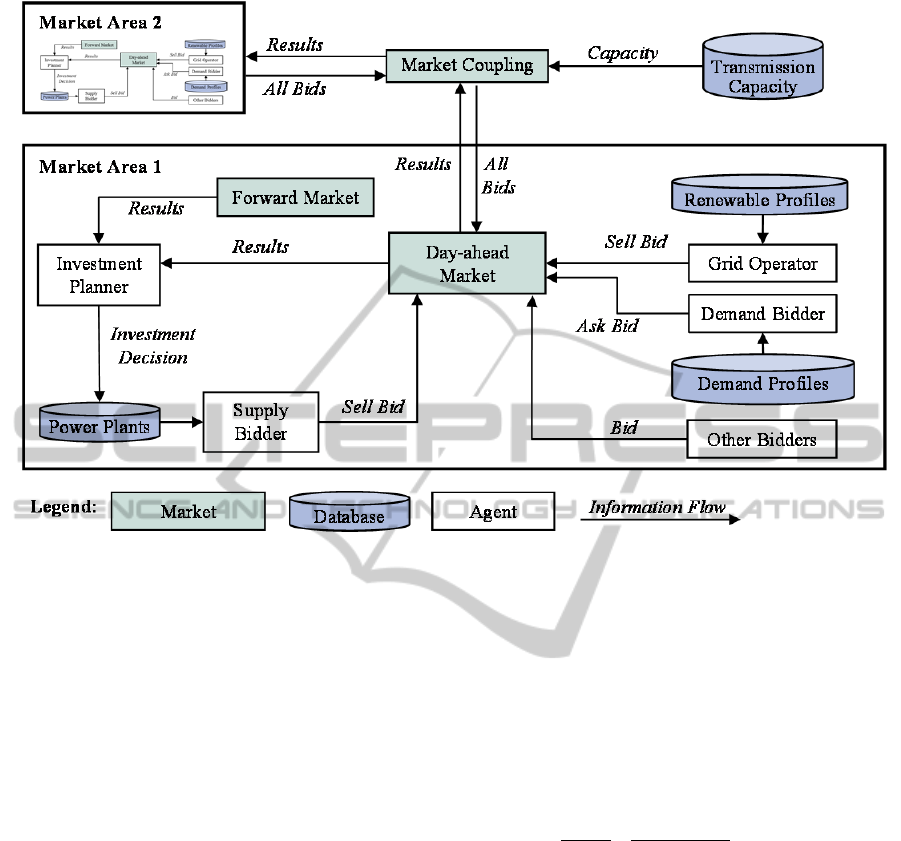

respective market. A simplified overview of the

model structure with two market areas is given in

Figure 1.

In the following sections, the focus is set on the

supply side, i.e. on generation companies which

have to decide on the short-term operation of their

existing power plants and on the investment in new

ones.

3.2 Short-term Bidding on Electricity

Markets

The short-term operation of power plants is

determined by the SupplyBidder agent. The agent

evaluates the different markets where energy or

capacity of thermal power plants can be offered and

determines the operation schedule and dispatch of

the plants. Within PowerACE the day-ahead market

is the main spot market. In accordance with the

current situation in Central Western Europe, every

SupplyBidder daily submits for each available power

ICAART2014-InternationalConferenceonAgentsandArtificialIntelligence

42

Figure 1: Simplified structure of the PowerACE model.

plant electricity supply bids to the day-ahead market.

Besides for thermal power plants, also supply bids

for generation from renewable energy sources, e.g.

wind or biomass, are regarded. Since pumped-

storage units can produce or consume electricity,

they submit either buy or sell bids. The same applies

to the electricity exchange with market areas which

are not explicitly modelled. After receiving the bids

the DayAheadMarketAuctioneer determines a

uniform price for each hour of the next day

considering all submitted supply and demand bids.

SupplyBidders are faced with an economic

optimization problem, where the offered volume and

price of their power plants needs to be determined

and which is solved in several steps. Firstly, the

available capacity P

i,d

of a power plant i on a day d

needs to be determined. Power plants may not be

available at all for a given day due to unexpected

issues, e.g. start-up failure, or expected reasons, e.g.

maintenance. Since power plants act on other

markets (e.g. reserve market) as well, the reserved

capacity P

r,i,d

for these markets is not available

anymore for the day-ahead market bidding and

needs to be subtracted from the net electrical

capacity P

net,i

:

P

i,d

=

P

net,i

P

r,i,d

if plant i is available

on day d

0 otherwise

(1)

Secondly, the bid price is calculated. It consists of

three elements: variable costs, start-up costs and a

potential mark-up. Variable costs c

var,i,d

represent the

direct costs of producing one unit of electricity and

are determined by the fuel price p

fuel,i,d

, the power

plant’s net electrical efficiency η

i

, the price of CO

2

emission allowances p

CO2,d

, the CO

2

emission factor

of the fuel EF

fuel

and the costs for operation and

maintenance c

O&M,i

:

c

var,i,d

=

p

fuel,i,d

η

i

+

p

CO2,d

·EF

fuel

η

i

+c

O&M,i

(2)

Changing the mode of operation of power plants,

i.e. starting up or shutting down, causes additional

costs. Firstly, material is stressed mainly by

temperature changes reducing life expectancy;

secondly, for start-ups fuel is needed in order to

reach the operating temperature of a power plant.

When determining the bid price the costs from start-

up and shutdown processes as an intertemporal

restriction can be considered by power plant

operators. In the PowerACE model, this means that

for base load running power plants also lower

market prices are accepted in order to avoid shutting

down the power plant. In turn, start-up costs are

added to the bid price for peak load power plants in

order to earn start-up costs in hours where the plant

is expected to be running. To estimate start-up costs

Agent-basedSimulationoftheGermanandFrenchWholesaleElectricityMarkets-RecentExtensionsofthePowerACE

ModelwithExemplaryApplications

43

a price forecast for the next day is made by an agent.

The bid price p

i,h

including start-up costs in hour h is

defined as follows:

p

i,h

=

max c

var,i,d

c

s,i

t

u

if p

h

<

c

var,i,d

∧

i

∈

BL

c

var,i,d

c

s,i

t

s

if p

h

>

c

var,i,d

∧

i

∈

PL

c

var,i,d

otherwise

(3)

c

s

,i

start-up costs

t

u

number of continuous unscheduled

hours per day

t

s

number of continuous scheduled

hours per day

p

h

predicted price for hour h

M

set of all operation-ready power

plants

BL

⊂

M

set of base load power plants

PL

⊂

M

set of peak load power plants

In addition, SupplyBidders can increase the bid

price for their power plants by a mark-up value.

According to the standard economic model of

perfectly competitive markets, market prices for a

respective good are determined by marginal prices at

all times. However, in order to cover capital

expenditures and fixed costs market prices need to

rise above marginal costs of supply at least in some

periods. This reasoning is based on the peak-load

pricing concept (Boiteux, 1964). One potential

remedy is to include an additional mark-up factor in

the bid price of supply capacity, which is

implemented in the PowerACE model.

The value of the mark-up factor depends on the

relative scarcity in the market; a higher scarcity

induces a higher mark-up, which is added to the bid

price:

p

i,d

markup

=p

i,d

+ markup

h

(4)

After determining the offered volume and price

for each hour of the following day the bids are

submitted to the day-ahead market auctions. A

comprehensive and formal description of the

original short-term bidding algorithm can be found

in Genoese (2010).

3.3 Coupling of Interconnected

Markets

European electricity markets are interconnected via

high-voltage transmission lines. Since electricity

flows according to physical laws and interconnector

capacities are limited, these capacities have to be

allocated to market participants otherwise

transmission lines might get congested. Management

methods are required to avoid congestion and to

efficiently use cross-border transmission capacities.

Since 2010, a market coupling approach has been

implemented in Central Western Europe which

complies with the European Union’s general

principles of congestion management (e.g. non-

discriminatory, market-based). Market coupling

describes the implicit auctioning of interconnection

capacity through power exchanges for predefined

zones (market or bidding areas). The market

coupling operator clears the energy markets of the

participating market areas simultaneously and

determines implicitly the commercial flows between

markets areas as well as the prices. The market

coupling approach maximizes the social welfare by

optimizing the selection of bids while considering

limited transmission capacity. The transmission

capacity is determined up-front based on defined

rules (EPEX Spot, 2010).

In accordance with the CWE Market Coupling

architecture, market coupling is implemented within

PowerACE for the day-ahead market and market

participants submit their bid curves to the local

power exchanges based on the described method in

section 3.2.

In PowerACE the MarketCouplingOperator

takes over all processes related to the market

coupling. For that purpose, the operator receives all

day-ahead bids from the local power exchanges.

Market coupling itself can be formulated as an

optimization problem with the objective to

maximize social welfare. Since PowerACE currently

only considers hourly bids with a fixed price, the

original COSMOS algorithm used for the CWE

Market Coupling (APX-ENDEX et al., 2010) can be

simplified and the mathematical problem is

formulated as follows (e.g. Meeus et al., 2009):

max

q

P

b,d

Q

b,d

q

b,d

d

- P

b,s

Q

b,s

q

b,s

s

b

(5)

subject to

q

b,d

, q

b,s

≤ 1

(6)

P

b,d

Q

b,d

q

b,d

d

P

b,s

Q

b,s

q

b,s

s

+ Cap

b,b

to

b

to

Cap

b

from

,b

b

from

=

0

(7)

Cap

b(from),b(to)

≤ Cap

b(from)

,

b(to)

max

(8)

ICAART2014-InternationalConferenceonAgentsandArtificialIntelligence

44

where the indices d and s indicate demand and

supply variables, respectively. b denotes the market

(bidding) area, P

i

the bid prices and Q

i

the bid

volumes. q

b,d

and q

b,s

are the acceptance rates of the

corresponding demand and supply bids.

Cap

b(from),b(to)

equals the determined capacity

between two market areas. Cap

b(from),b(to)

max

denotes the

upper limit for the transmission capacity between to

market areas and is given exogenously based on

current values from the European Network of

Transmission System Operators for Electricity

(ENTSO-E).

The constraints ensure that supply and buy bids

do not exceed their maximum volume (6), that

supply and demand including exports as well as

imports in market areas are balanced (7) and that the

limitation on the transmission capacity (8) is not

violated. In this form, the problem is linear and can

be solved with common solvers.

Optimization results are the acceptance rates for

each submitted bid and the commercial utilization of

transmission capacity. Furthermore, the algorithm

determines the market prices of electricity one day-

ahead of delivery in the coupled bidding areas and

the implicit prices for transmission capacities, which

are only different from zero if lines are congested.

Prices are sent to the local market areas and

processed by the supply agents.

3.4 Long-term Investment Planning

In the model generation companies can also make

decisions regarding their long-term capacity

extension through investments in new power plants.

The responsible agent is called InvestmentPlanner.

The basic methodology is based on a discounted-

cash flow valuation of predefined technology

options. For that purpose the InvestmentPlanner

makes a forecast of the expected hourly electricity

prices during the investment period and calculates

the expected yearly gross profit. After accounting

for fixed costs and capital expenditures, the net

present value is calculated. A formal description is

provided in Genoese (2010).

The quantity of the installed capacity is based on

the expected development of market shares within

the following five years taking future demand and

electricity generation from renewable energy sources

into account. As long as the net present value of the

investment options is positive and there is need for

new capacity, new power plants are built by the

InvestmentPlanner. After the construction phase,

whose length depends on the technology option, the

new power plants can generate electricity that can

then be sold in the markets.

3.5 Input Data and Technical

Implementation

For the considered market areas each thermal power

plant with a capacity of at least 10 Megawatt is

stored together with its main relevant techno-

economic characteristics (e.g. net electrical

efficiency, variable and fixed costs, yearly

availability) in the database of the model.

The model database includes investment options

for different power plant technologies with its

relevant characteristics and the electricity feed-in

from renewable energy sources. The electricity

demand is represented by the aggregated

consumption of all consumers connected to the

public power supply.

For market coupling, transmission capacities

between interconnected market areas are required.

Since not all neighbouring countries are always part

of a simulation, the electricity exchange with these

countries is based on historical values. Prices for

fuel and CO

2

emission allowances are required for

the calculation of the variable generation costs. Most

time series data is stored with hourly values, but

sometimes only less detailed values, e.g. for lignite

prices, are available.

The model’s results include the hourly spot

market prices in the simulated wholesale markets,

the investments in new capacity and the commercial

flows between interconnected market areas. Since

the model considers the wholesale day-head market

as the only trading place for electricity, bilateral day-

ahead contracts are not part of model’s results.

PowerACE is implemented in the object–

oriented programming language Java and can

simulate each hour of recent historical years as well

as future years up to 2050. The simulation runs are

comparatively quick in terms of computing time.

Yearly runs for one market area last only a few

minutes, which is a small fraction of the several

hours that optimization models with a similar

amount of details may take.

4 EXEMPLARY APPLICATIONS

The PowerACE model has been used for various

research analyses in the past. For instance, Sensfuß

et al. (2008) find a considerable impact of the

subsidised renewable electricity generation in the

short run on spot market prices in Germany. The

Agent-basedSimulationoftheGermanandFrenchWholesaleElectricityMarkets-RecentExtensionsofthePowerACE

ModelwithExemplaryApplications

45

impact of emissions trading on electricity prices is

explored by Genoese et al. (2007). The authors find

for the years under consideration that a large part but

not the totality of the CO

2

emission allowance price

is added by the generation companies to the variable

costs during the bidding process. A thorough

analysis of the model’s capacity to adequately

reproduce the main characteristics of the German

electricity market can be found, for example, in

Genoese (2010).

In the following sections, additional recent

analyses are presented.

4.1 Market Coupling between

Germany and France

Based on the algorithm described in section 3.3,

effects from a market coupling between the German

and French day-ahead electricity markets are

analysed. Both markets represent the two largest in

Europe in terms of electricity consumption and are

part of the CWE Market Coupling. To the authors’

best knowledge this is the first agent-based approach

that includes the coupling of different market areas

based on the current market situation.

The simulation of the model coupling is

performed for the year 2012. In the Single Markets

scenario, there is no coupling of the two markets, i.e.

no exchange between Germany and France is

considered. The Model Coupling scenario uses the

optimization routine for the coupling of the German

and French market areas. The electricity exchange

with other countries (e.g. between France and Spain,

Germany and Poland) is in both scenarios given

exogenously based on historical data.

The Model Coupling scenario shows lower

average prices than the Single Market scenario,

while the price decrease is stronger in France than in

Germany. The more pronounced effect for France

can be explained, to some extent, by the supply

curves’ shapes of the two market areas. The French

supply curve has only a gentle slope for a large part

of the country’s capacity because of the low variable

operating costs of nuclear power stations. However,

the small part of the remaining capacity consists of

notably more expensive fossil fuel-fired units. These

units are often called upon in the Single Markets

scenario. When coupling the markets, the expensive

units in France are less frequently used because

cheaper electricity can be imported from Germany.

The change in market prices does not imply that

all market participants, buyers and sellers, benefit.

The results in this simulation indicate that mainly

the consumers benefit from the market coupling

which is consistent with expectations given a lower

average price. The social welfare (sum of consumer

surplus, producer surplus and congestion revenue)

increases with market coupling, which could be

expected, as the clearing algorithm tries to maximize

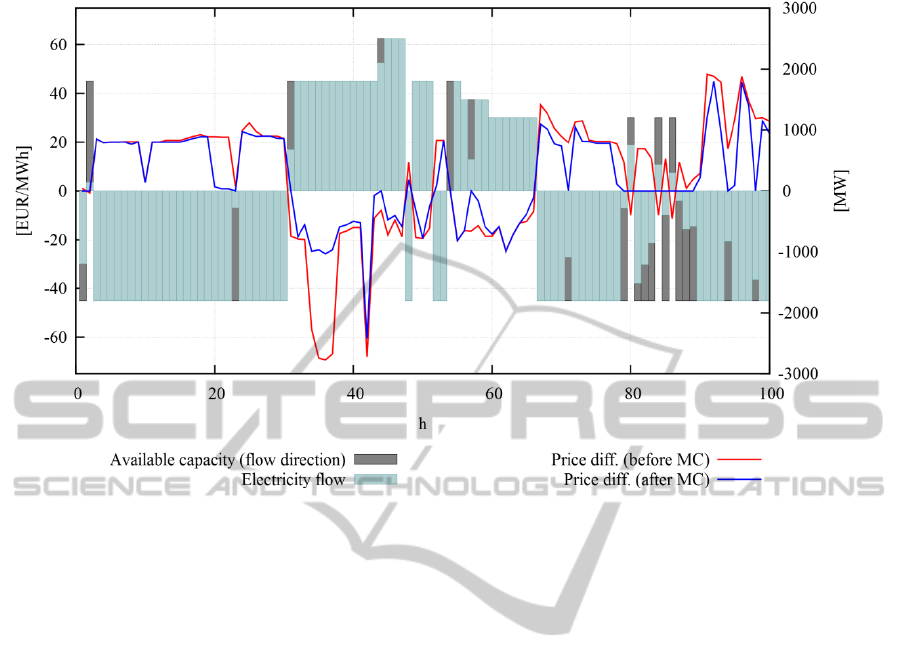

this value.

In the Model Coupling scenario the available

transfer capacity is fully used in 65% of the cases.

The high usage of the full capacities and the price

effect of the coupling can be seen for a period of

100 hours in figure 2. Expanding (e.g. doubling) the

capacity amplifies the price reduction in both

countries; while the additional effect is smaller in

France than in Germany, the total price reduction is

still stronger in France. In case of sufficient capacity

there are identical prices in all hours, which is equal

to the situation of having one completely integrated

market.

Regarding only market coupling between two

countries, in this case Germany and France, while

the exchange with other country is based on

historical values, is, of course, a simplification.

Germany, for instance, has interconnections with

nine countries while France is connected to seven

countries. Amongst those countries are some that

take part in the market coupling as well, e.g.,

Austria, Belgium or the Netherlands. Hence, the

effects from the market coupling between Germany

and France in this paper might be overstated, since

either country would exchange electricity with other

countries, if this as well is no longer static and less

costly than the exchange with Germany or France,

respectively.

The presented results also depend on information

which is not publicly available and therefore needs

to be estimated, such as the operation and

maintenance costs of power plants. Deviations

between estimated and real world values could, of

course, alter the results of the simulation.

4.2 PowerACE LAB

Besides the computational model, there exists a

laboratory version, “PowerACE LAB”, where real-

life participants can assume the tasks of software

agents. Thus, the core agent-based simulation model

is supplemented by elements from experimental

economics and role-playing games (Genoese and

Fichtner, 2012).

In literature, two approaches are distinguished in

combining agent-based models and role playing

games. Barreteau (2001) proposes a parallel

existence of agent-based models and role playing

games. Hence, the model is rebuilt in a simplified

ICAART2014-InternationalConferenceonAgentsandArtificialIntelligence

46

Figure 2: Simulated electricity flow and price difference (before and after market coupling) between Germany and France

for a period of 100 hours in 2012.

version as a game. The main goal of this approach is

to increase the acceptance of the model. Guyot and

Honiden (2006) develop an agent-based

participatory approach, where real participants are

integrated into the model by (partly) controlling the

agents’ actions. For this, user interfaces have to be

developed. In the PowerACE Lab version, the agent

based participatory approach is used.

Currently, in PowerACE Lab two modules exist

where human participants can interact. The

participants either simulate the power trading or the

investments in new generation capacity. In the

trading module, the participants receive the same

information as the computer agents. Each participant

has a list of daily available power plants with all the

relevant technical and economic data, e.g. installed

capacity, fuel costs and efficiency. In addition, a

forecast of the day-ahead prices is presented. Based

on this information, the participants submit their

bids. When all players have successfully completed

their task, the market clearing price is computed

analogously to the computational model. The players

have the possibility to adopt their strategies in each

round in order to maximize profits.

In the investment module, the players can carry

out investments according to the power and fuel

price forecast and by taking into account the

decreasing capacities due to the limited technical

lifetime of existing power plants.

The players’ decisions and chosen strategies can

be used to improve the behaviour of the computer

agents. Computer agents and real participants can

coexist as well in the simulations.

5 CONCLUSIONS AND

OUTLOOK

Agent-based simulation in general and the

PowerACE model in particular are useful means to

analyse different aspects of electricity markets. The

market and agent perspective as well as the

flexibility of agent-based simulation models allows

us to thoroughly analyse electricity markets and

interactions therein. The PowerACE model is a

detailed bottom-up simulation model which

integrates short-term market operations and long-

term capacity planning while the most important

market participants are represented by different

agents. The model has been successfully used for

various analyses in the context of electricity

markets.

Given the continuously changing economic and

regulatory environment in the power sector, several

enhancements to the model are currently in progress.

Agent-basedSimulationoftheGermanandFrenchWholesaleElectricityMarkets-RecentExtensionsofthePowerACE

ModelwithExemplaryApplications

47

In order to reflect the European market integration,

the model scope is extended to several market areas

which can be simultaneously run and coupled.

Model coupling clears the energy and capacity

markets simultaneously and determines an optimal

solution to the plant dispatch in the interconnected

market areas considering limited commercial

transfer capacities. The model coupling routine

presented in this paper offers a socially beneficial

opportunity to interconnect electricity markets

compared to a situation where no market coupling

occurs. The results for Germany and France show

that the average market price is lower in both

countries, while the price decrease is stronger in

France than in Germany.

The methodological approach of PowerACE has

nonetheless some limitations. Regarding the supply

of electricity, additional technical constraints

concerning the operation of power plants (e.g.

minimum downtimes or partial efficiency levels)

could further improve the model. Furthermore, the

perspective is limited to the supply of electricity,

which differs from the real world situation where

also the heat demand influences the usage of

combined heat and power plants.

Given the flexible modelling framework future

model extensions could include the development of

a generally scalable model version in order to

simulate micro-systems as well as larger systems

(e.g. Europe) with additional market elements (e.g.

intraday market). Concerning the decision making

process of agents, the refinement of the investment

module and the integration of different aspects of

uncertainty is another possibility to extend the

model. Regarding the design of electricity markets,

the remuneration of power plants by capacity

mechanisms in order to ensure system reliability is

another topic of research that is currently explored

within the model.

ACKNOWLEDGEMENTS

Recent extensions of the PowerACE model have

been partly funded by ESA². ESA² is a consortium

of universities and research institutions from five

European countries providing qualified decision

support for public and private clients in areas related

to energy and environmental policy. ESA² originated

from KIC InnoEnergy at the European Institute of

Innovation and Technology (EIT). More information

is available at www.esa2.eu.

REFERENCES

APX-ENDEX; Belpex; EPEX Spot (2010): COSMOS

description - CWE Market Coupling algorithm.

Retrieved from http://static.epexspot.com/document/2

0015.

Barreteau, O.; Bousquet, F.; Attonaty, J. (2001): Role-

Playing Games for Opening the Black Box of Multi-

Agent Systems: Method and Lessons of Its

Application to Senegal River Valley Irrigated

Systems, In: Journal of Artificial Societies and Social

Simulation 4 (2).

Boiteux, M. (1964): Marginal Cost Pricing in Practice.

London: Prentice-Hall.

EPEX Spot (ed.) (2010): Project Document – A report for

the regulators of the Central West European (CWE)

region on the final design of the market coupling

solution in the region, by the CWE MC Project.

Retrieved from http://static.epexspot.com/document/7

616/01_CWE_ATC_MC_project_documentation.pdf.

Genoese, M. (2010): Energiewirtschaftliche Analysen des

deutschen Strommarkts mit agentenbasierter

Simulation. Baden-Baden: Nomos.

Genoese, M.; Fichtner W. (2012): PowerACE LAB:

Planspiel Energiewirtschaft. In: WiSt 41 (6), pp. 335-

339.

Genoese, M.; Sensfuß, F.; Möst, D.; Rentz, O. (2007):

Agent-Based Analysis of the impact of CO

2

Emission

Trading on Spot Market Prices for Electricity in

Germany. In: Pacific Journal of Optimization 3 (3);

pp. 401-424.

Guerci, E.; Rastegar, M. A.; Cincotti, S. (2010): Agent-

based Modeling and Simulation of Competitive

Wholesale Electricity Markets. In: Handbook of

Power Systems II. Berlin, Springer, pp. 241–286.

Guyot, P.; Honiden, S. (2006): Agent-based Participatory

Simulations: Merging Multi-Agent Systems and Role-

Playing Games. In: Journal of Artificial Societies and

Social Simulation 9 (4).

Meeus, L.; Vandezande, L.; Cole, S.; Belmans, R. (2009):

Market Coupling and the importance of price

coordination between power exchanges. In: Energy

Economics 34 (3), pp. 228–234.

Sensfuß, F. (2007): Assessment of the impact of

renewable electricity generation on the German

electricity sector: An agent-based simulation approach.

Retrieved from http://digbib.ubka.uni-karlsruhe.de/

volltexte/documents/188330.

Sensfuß, F.; Genoese, M.; Ragwitz, M.; Möst, D. (2007):

Agent-based Simulation of Electricity Markets - A

Literature Review. In: Energy Studies Review 15 (2).

Sensfuß, F.; Ragwitz, M.; Genoese, M. (2008): The merit-

order effect: A detailed analysis of the price effect of

renewable electricity generation on spot market prices

in Germany. In: Energy Policy 36 (8), pp. 3086–3094.

Tesfatsion, L. (2006): Agent-Based Computational

Economics: A Constructive Approach to Economic

Theory. In: Judd, K. J.; Tesfatsion, L. (eds.).

Handbook of Computational Economics, Volume 2.

ICAART2014-InternationalConferenceonAgentsandArtificialIntelligence

48

Agent-Based Computational Economics. North-

Holland.

Ventosa, M.; Baı

́

llo, Á.; Ramos, A.; Rivier, M. (2005):

Electricity market modeling trends. In: Energy Policy

33 (7), pp. 897–913.

Weidlich, A.; Veit, D. (2008): A critical survey of agent-

based wholesale electricity market models. In: Energy

Economics 30 (4), S. 1728–1759.

Agent-basedSimulationoftheGermanandFrenchWholesaleElectricityMarkets-RecentExtensionsofthePowerACE

ModelwithExemplaryApplications

49