A Fuzzy Approach based on Dynamic Programming and Metaheuristics

for Selecting Safeguards for Risk Management for Information Systems

E. Vicente, A. Mateos and A. Jim

´

enez-Mart

´

ın

Decision Analysis and Statistics Group, Departamento de Inteligencia Artificial, Universidad Polit

´

ecnica de Madrid,

Campus de Montegancedo s/n, Boadilla del Monte, 28660 Madrid, Spain

Keywords:

Risk Analysis, Fuzzy Logic, Dynamic Programming, Simulated Annealing.

Abstract:

In this paper we focus on the selection of safeguards in a fuzzy risk analysis and management methodology

for information systems (IS). Assets are connected by dependency relationships, and a failure of one asset may

affect other assets. After computing impact and risk indicators associated with previously identified threats,

we identify and apply safeguards to reduce risks in the IS by minimizing the transmission probabilities of

failures throughout the asset network. However, as safeguards have associated costs, the aim is to select the

safeguards that minimize costs while keeping the risk within acceptable levels. To do this, we propose a

dynamic programming-based method that incorporates simulated annealing to tackle optimizations problems.

1 INTRODUCTION

There are several risk analysis and management

methodologies for information systems (IS) that con-

form to International Organization for Standardiza-

tion (ISO) standars, specifically the ISO 27000 fam-

ily of standars. Some examples of these method-

ologies are MAGERIT, by the Spanish Ministry of

Public Administrations (L

´

opez Crespo et al., 2006);

CRAMM (CCTA, 2003), by the Central Computing

and Telecommunications Agency (UK); or NIST SP

800-30 (Stoneburner and Gougen, 2002), by the Na-

tional Institute of Standard and Technology (USA).

These methodologies do not, however, consider

uncertain valuations, but use precise values on differ-

ent, usually percentage, scales. Boolean values are

sometimes even used to indicate whether or not assets

are dependent on each other regardless of the degree

of such dependency. In no case is vague or impre-

cise information about the input parameters allowed.

In our opinion, this is an important drawback of these

methodologies.

In (Vicente et al 2013a) we proposed an exten-

sion of the MAGERIT methodology based on clas-

sical fuzzy computational models. This methodology

includes the following milestones:

1. Identification and Valuation of Assets

An asset is anything that is of value to the or-

ganization and therefore requires protection. A

few data, information or business process assets

often account for the total value of an organiza-

tion’s assets. These assets are called terminal as-

sets. Other assets (support assets such as hard-

ware, software, personnel, facilities, ...) are valu-

able insofar as they are beneficial to the terminal

assets, and they inherit the terminal asset value,

according to the resulting benefit. Thus, support

assets have no intrinsic value; they take their value

from terminal assets.

The identified assets of the organization are then

valued. Some assets may have a monetary value

(how much money the organization would lose if

this asset stopped working), whereas others re-

quire a qualitative assessment (if an asset stops

working the losses would be very high, low,

medium...).

As mentioned above, the support assets inherit

their values from terminal assets depending on

how they influence each other. So, we have to de-

termine the dependency relationships of the termi-

nal assets with respect to support assets, and also

dependency relationships between support assets.

2. Threat Identification

A threat is an event that can trigger an incident

in the organization, causing damage or intangible

material loss to assets. Threats may be of natural

or human, accidental or deliberate origin. Some

threats can affect more than one asset. In such

35

Vicente E., Mateos A. and Jiménez-Martín A..

A Fuzzy Approach based on Dynamic Programming and Metaheuristics for Selecting Safeguards for Risk Management for Information Systems.

DOI: 10.5220/0004807800350045

In Proceedings of the 3rd International Conference on Operations Research and Enterprise Systems (ICORES-2014), pages 35-45

ISBN: 978-989-758-017-8

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

cases, threats can cause different impacts depend-

ing on what assets are affected. A detailed list of

threats is available in Annex C of ISO IEC 27005.

MAGERIT suggests two threat assessment mea-

sures: degradation, the damage that the threat can

cause to the asset, and frequency, how often the

threat materializes.

3. Identification and Valuation of impact and Risk

Indicators

It is then necessary to qualitatively identify the

consequences and establish impact and risk indi-

cators for the valued assets and threats. The im-

pact of a threat on an asset is the product of the

asset value multiplied by the respective degrada-

tion. Risk is the product of the impact of the threat

multiplied by the respective frequency.

4. Selection of Safeguards

Safeguards are measures for addressing threats.

They can be procedures, personnel policies, tech-

nical solutions or physical security measures at

the facilities. These safeguards can be preven-

tive, if they reduce the frequency of threats; or

palliative, if they reduce the degradation of assets

caused by threats (L

´

opez-Crespo et al., 2006).

As described below, experts use a linguistic term

scale (see Figure 1 and Table 1) to represent asset

values, their dependencies and the frequency and as-

set degradation associated with possible threats. Risk

analysis computations are then based on the trape-

zoidal fuzzy numbers associated with linguistic terms.

However, direct assignment based on a rigid lin-

guistic term scale is not always advisable since the

expert has no say in the number of linguistic terms

that the scale is to include and about the appearance of

their associate trapezoidal fuzzy numbers. In that case

we propose the use of the betting and lottery-based

method for fuzzy probability elicitation described in

(Vicente et al 2013c). Betting and lottery-based meth-

ods commonly used to assign probabilities can also

be used to assign fuzzy probabilities (Savage, 1954;

Finetti, 1964). In this section we briefly describe

these methods and show how a fuzzy number rep-

resenting the probability judgment can be extracted

from experts.

Betting Method. For two selected monetary values

x > y, the expert is given the option between either of

the two following gambles:

• b1: If event A happens, then you win x$. Other-

wise, you lose y$.

• b2: If event A does not happen, then you win y$.

Otherwise, you lose x$.

If the expert has no preference for either bet, the

respective expected utilities of both bets are equal,

and it follows that p(A) = x/(x + y). If the expert

chooses one of the two gambles, then the expected

utility of the selected gamble should be higher than

for the rejected gamble. Then, the analyst has to up-

date monetary values and offer the expert two new

gambles. Thus, an interactive process is enacted un-

til two alternative gambles are reached to which the

expert is indifferent.

Lottery-based methods. For a given probability

and monetary values x$ and y$, the expert is given

the choice between the following lotteries:

• l1: If event A happens, then you win x$. Other-

wise, you lose y$.

• l2: You win x$ with probability p, or y$ with

probability 1 − p.

If the expert has no preference for either of the lot-

teries, then the respective expected utilities are equal,

and it follows that p(A) = p. Otherwise, the expert

must readjust the value p, keeping the same mone-

tary values. This again generates an interactive pro-

cess, enacted until a couple of lotteries are reached to

which the expert is indifferent.

The betting and lottery-based methods assume

that the expert is able to provide a specific value for

the probability of an event. However, a more realis-

tic scenario is where experts have an imprecise and

vague idea of that value. Consequently, experts will

have an interval rather than a precise value in mind at

the point when they are indifferent to either bet or lot-

tery, that is, for the lottery-based method there will be

an interval [a,c] such that if p = [a,c], then the expert

has no preference for either lottery l1 or l2. Similarly,

the betting method can result in an interval of indif-

ference [b,d].

Current protocols for probability elicitation like

the above recommend the use of several methods to

test the consistency of the expert and the existence

of bias. In this regard, the development of betting

and lottery-based methods meets this recommenda-

tion and establishes the following:

• If [a,c]∩[b,d] = ∅, then the expert’s probabilistic

judgment was inconsistent.

• If any of the intervals is contained in the other

[a,c] ⊆ [b, d] (or [b, d] ⊆ [a, c]), then we as-

sume that the trapezoidal fuzzy number (b, a, c,d)

(or (a,b,d,c)) designates the expert probabilistic

judgment.

• If [a, c] ∩ [b,d] 6= ∅, is uncountable, and none of

the intervals is contained in the other, then, as-

suming that a ≤ b ≤ c ≤ d,(a,b,c,d) designates

the expert probabilistic judgment.

Thus, we consider the set of trapezoidal fuzzy

numbers with support in [0,1], TF[0,1], i.e.,

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

36

Table 1: Linguistic term scale.

Term Trapezoidal fuzzy number

Very Low (VL) (0, 0, 0, 0.05)

Low (L) (0, 0.075, 0.125, 0.275)

Medium-Low (ML) (0.125,0.275, 0.325, 0.475)

Medium (M) (0.325, 0.475, 0.525, 0.675)

Medium-High (MH) (0.525, 0.675, 0.725, 0.875)

High (H) (0.725, 0.875, 0.925, 1)

Very High (VH) (0.925, 1, 1, 1)

Figure 1: Linguistic term scale.

e

A = (a,b,c, d) with 0 ≤ a ≤ b ≤ c ≤ d ≤ 1

and with a trapezoidal function in the vertices

(a,0),(b,1),(c,1),(d,0) (Chen, 1996; Chen and

Chen, 2003; Chen and Chen, 2009; Vicente et al.,

2013b). Note that R is a subset of TF[0,1] if we

consider the injection (Vicente et al 2013a) φ : R →

T F [0, 1] ; a ≈ φ(a) = (a, a, a,a) =

e

a.

Consequently, the following operators proposed in

(Xu et al 2010) accounting for trapezoidal fuzzy num-

bers will be used to make computations:

Given

e

A

1

= (a

1

,b

1

,c

1

,d

1

),

e

A

2

= (a

2

,b

2

,c

2

,d

2

) ∈

T F[0,1], then:

•

e

A

1

⊕

e

A

2

= (a

1

+ a

2

− a

1

a

2

,b

1

+ b

2

− b

1

b

2

,c

1

+

c

2

− c

1

c

2

,d

1

+ d

2

− d

1

d

2

) and

•

e

A

1

⊗

e

A

2

= (a

1

a

2

,b

1

b

2

,c

1

c

2

,d

1

d

2

).

⊕ and ⊗ are two internal composition laws in

TF[0,1] that verify the commutative and associative

properties and both have a neutral element.

The assets of an IS are elements of value to the

organization and therefore require protection (servers,

files, personnel, facilities, hardware, software,...).

As cited before, these assets are interrelated

(L

´

opez Crespo et al, 2006), forming an acyclic graph,

where just a few data, information items or business

process assets often account for the total value of an

organization’s assets. These assets are called termi-

nal assets. Other assets (support assets, such as hard-

ware, software, personnel, facilities,...) are valuable

insofar as they are beneficial to the terminal assets.

In other words, the support assets inherit their values

from terminal assets depending on how they influence

each other, i.e., depending on the probability of that

any failure in an asset being transferred to the termi-

nal assets.

In general, we say asset A

j

directly depends on

asset A

i

, denoted by A

i

→ A

j

, if a failure in asset A

i

causes a failure in the asset A

j

with any given prob-

ability. This probability is usually referred to as the

degree of direct dependency of A

j

with respect to A

i

.

Note that in this fuzzy adaptation the degrees of di-

rect dependency between assets will be represented

by linguistic terms, which have associated trapezoidal

fuzzy numbers. We denote these degrees of direct de-

pendency by

^

d(A

i

,A

j

).

These dependencies form a directed acyclic graph

(to terminal assets), so that there may be intermediate

assets between any asset A

i

and a terminal asset A

k

which can propagate a fault generated in A

i

through to

the terminal A

k

. Our aim then is to compute the trans-

mission probability between A

i

and A

k

. This proba-

bility is called degree of indirect dependency between

A

i

and A

k

, which is denoted by

^

D(A

i

,A

k

) and can be

computed as follows (Vicente et al 2013a).

We denote by P={P

1

,...,P

s

} the set of paths in the

network connecting A

i

with A

k

. These paths are a se-

quence of arcs connecting a sequence of vertices, such

that the start vertex and the last vertex are A

i

and A

k

,

respectively. Then,

A) If all assets, excluding A

i

and A

k

, in the paths in P

are influenced by only one asset, then

^

D(A

i

,A

k

) =

s

⊕

j=1

^

D(A

i

,A

k

|P

j

) (1)

where

^

D(A

i

,A

k

|P

j

) =

^

d(A

i

,A

j

1

) ⊗

^

d(A

j

1

,A

j

2

) ⊗ ... ⊗

^

d(A

j

n

,A

k

) and

P

j

: (A

i

→ A

j

1

→ A

j

2

→ ... → A

j

n

→ A

k

).

B) Otherwise, we assume that the first r paths in P

are formed by assets (excluding A

i

and A

k

) influ-

enced by only one asset, and the remaining s − r

paths include at least one asset simultaneously in-

fluenced by two or more assets. Then, for the r

first paths, we proceed as in A), and we denote by

S the set including the s − r remaining paths. We

proceed with S as follows:

(i) Consider the set of non-terminal assets in S in-

fluenced by two or more assets, denoted by I,

and the subset of I including assets uninflu-

enced by any other asset in I, denoted by NI.

(ii) We consider an asset A

r

in NI. Then, we sim-

plify the paths in S that include asset A

r

making

A

i

→ A

r

→ ... → A

k

, with

^

d(A

i

,A

r

) =

^

D(A

i

,A

r

)

(computed as in A).

AFuzzyApproachbasedonDynamicProgrammingandMetaheuristicsforSelectingSafeguardsforRiskManagementfor

InformationSystems

37

(iii) Remove repeated paths from S and keep only

one instance.

(iv) Build I and NI again from S.

(v) If NI is not empty, go to (ii). Otherwise, the

algorithm finishes.

Let us denote the resulting set of paths by S=

{P

0

1

,...,P

0

m

} with m ≤ s − r. Then, the degree of

dependency of A

k

regarding A

i

is

^

D(A

i

,A

k

) =

r

⊕

j=1

^

D(A

i

,A

k

|P

j

)

m

⊕

l=1

^

D(A

i

,A

k

|P

0

l

). (2)

Once we have computed the degree of indirect

dependency between all assets regarding the termi-

nal assets, we can compute the accumulated values

for non-terminal assets

e

v

l

. These values usually have

three components (ISO/IEC serie 27000):

1. Availability. How much damage would it cause if

the asset is not available or cannot be used? This

is a typical services inspection.

2. Confidentiality. How much damage would it

cause if the asset is disclosed to someone it should

not be? This is a typical data inspection.

3. Integrity How much damage would it cause if the

asset is damaged or corrupt? This a typical data

inspection. Data can be manipulated, be wholly

or partially false, or even missing.

Therefore,

e

v

i

(l)

=

n

∑

k=1

((

^

D(A

i,

A

k

) ⊗

e

v

k

(l)

) (3)

where l denotes the lth component.

Once assets have been valueted, the next step in

the risk analysis methodology is to identify possible

threats and compute the corresponding impact and

risk indicators for the IS.

Threats are characterized by how often the threat

materializes (frequency)

e

f and by the degradation

D = (

e

d

1

,

e

d

2

,

e

d

3

) that the threat can cause to the three

asset components. Note again that the frequency and

degradation levels will be selected by the expert from

the linguistic term scale and, consequently, a trape-

zoidal fuzzy number will be associated with each of

them.

Then, the impact of a threat on an asset A

j

is

e

I

i

(l)

=

e

d

l

⊗

e

v

i

(l)

, (4)

and the risk to the asset is

e

R

i

(l)

=

e

I

i

(l)

⊗

e

f . (5)

The results of these operations will be fuzzy num-

bers belonging to TF[0,1], which, generally, do not

match up with the fuzzy numbers associated with the

linguistic terms of the scale. Thus, a similarity func-

tion must be used to identify the most similar trape-

zoidal fuzzy number in the linguistic term scale to the

fuzzy number output from computations.

Different similarity functions have been proposed

by several authors (Chen and Chen 2003, Chen and

Chen 2009, Gomathi and Sivaraman 2012, Xu et al

2010, Zhu and Xu 2012). In (Vicente et al 2013b) a

new similarity function was proposed on the basis of

the geometric distance between both fuzzy numbers,

the distance between their centroids and/or the ratio

between the common area and the joint area under the

membership functions.

Following the risk analysis and management

methodologies for IS, Section 2 deals with the selec-

tion of safeguards that can be enforced to reduce the

transmission probability of a failure throughout the

IS. The aim is to minimize costs while keeping the

risk at acceptable levels. To do this, we propose a

mixed technique based on dynamic programming and

metaheuristics, specifically, simulated annealing.

2 SELECTION OF PREVENTIVE

SAFEGUARDS

From equations (3), (4) and (5) and the algorithm for

computing degrees of indirect dependency, we can de-

rive the risk for the IS in each component l given a

threat with frequency

e

f and degradation

e

D =

n

e

d

l

o

3

l=1

in the support asset

e

A

i

as

e

R

i

(l)

=

n

∑

k=1

^

DD(A

i,

A

k

) ⊗

e

v

k

(l)

⊗

e

f ⊗

e

d

l

,

e

v

k

(l)

being the value (constant) assigned to the termi-

nal asset

e

A

k

in the component l.

Safeguards are measures for addressing threats.

They can be procedures, such as incident manage-

ment and documentation; personnel policies, such as

training and awareness of employees operating on

the IS; technical solutions, such as identification and

authentication mechanisms based on biometrics; or

physical security measures of the facilities, such as

temperature control systems.

These safeguards can be preventive, if they reduce

the frequency of threats; or palliative, if they reduce

the degradation caused by threats on assets (L

´

opez

Crespo 2006). As the degree of dependence between

two assets is the transmission probability of failures,

a special type of preventive safeguard is that which

reduces dependencies between support and terminal

assets.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

38

In this section we propose a method for reducing

the degrees of dependency from all support assets to

terminal assets minimizing the costs for the company.

As mentioned above, the probability of transmis-

sion of failure

^

D(A

i

,A

k

) is the result of fuzzy opera-

tions with the probabilities of transmission of failure

through intermediate assets linking the attacked sup-

port asset with other asset.

In each of these intermediate assets, safeguards

can be enforced to reduce the probability of transmis-

sion of a failure. The effect induced for a safeguard

in the probability of transmission of failures between

two assets A

u

and A

v

can also be defined as a lin-

guistic term, which is represented by a fuzzy number

e

e

u,v

∈ T F[0,1], so that if the degree of direct depen-

dency between the assets A

u

and A

v

is

^

d(A

u

,A

v

), then,

when we implement a safeguard with effect

e

e

u,v

, the

degree of direct dependency is reduced to

^

d(A

u

,A

v

) ⊗ (

e

1

e

e

u,v

),

where denotes the usual subtraction op-

eration between trapezoidal fuzzy num-

bers, i.e., (a

1

,a

2

,a

3

,a

4

) (b

1

,b

2

,b

3

,b

4

) =

(a

1

− b

4

,a

2

− b

3

,a

3

− b

2

,a

4

− b

1

).

Note that is not an internal composition law in

TF[0,1], however,

•

e

A,

e

B ∈ T F[0,1] ⇒

e

A ⊗ (

e

1

e

B) ∈ T F[0,1],

•

e

A⊗(

e

1

e

B) ≤

e

A with the partial order of the trape-

zoidal fuzzy numbers (i.e.,

e

A ≤

e

B ⇔ a

1

≤ b

1

,a

2

≤

b

2

,a

3

≤ b

3

,a

4

≤ b

4

) and

•

e

A ⊗ (

e

1

e

B) decreases with

e

B.

We consider the set of safeguards that hinder the

direct transmission of failure between A

u

and A

v

, S

u,v

.

Each safeguard S

u,v

p

∈ S

u,v

has a monetary cost c

u,v

p

and an effect

e

e

u,v

p

over

^

d(A

u

,A

v

), which is reduced to

^

d(A

u

,A

v

) ⊗ (

e

1

e

e

u,v

p

).

The problem of keeping an acceptable level (low

or very low) for the failure transmission probabilities

among support and terminal assets with minimal costs

can be represented as follows:

min

∑

u,v

∑

p

c

u,v

p

x

u,v

p

s.t.

^

D(A

i

,A

k

) ≤

e

U

ik

∀i,k

x

u,v

p

∈

{

0,1

}

∀u,v, p

,

where i and k in the first set of constraints refer to

non-terminal and terminal assets, respectively,

e

U

ik

is a

residual value accepted by the experts, x

u,v

p

are the de-

cision variables (x

u,v

p

= 1 means that safeguard S

u,v

p

is

selected), and

^

D(A

i

,A

k

) is reassessed replacing values

^

d(A

u

,A

v

) by the affected values regarding the selected

safeguards:

^

d(A

u

,A

v

) ⊗

⊗

p

(

e

1

e

e

u,v

p

)

,

where A

u

and A

v

are two consecutive assets connected

by an arc in some path between A

i

and A

k

.

Note that the fact that the usual order in T F[0,1] is

a partial order constitutes a very restrictive constraint

in our optimization problem, so we will use the con-

cept of similarity function to relax this constraint.

If we define a threshold α ∈ [0, 1] and a similar-

ity function S, the constraint

^

D(A

i

,A

k

) ≤

e

U

ik

∀i,k can

be replaced by S(

^

D(A

i

,A

k

),

e

U

ik

) ≥ α. Thus, the re-

strictiveness of the constraint increases proportionally

to the threshold value and the feasible solution set

will be composed of solutions that verify these soft-

ened/relaxed constraints.

Remember that indirect dependencies are recur-

sively computed following the algorithm described in

Section 1. Thus, the degree of dependency of the

support assets further away from the terminals can

be computed from the degree of dependency of the

closest assets. Therefore, the problem can be solved

in stages, and the principle of optimality in dynamic

programming is verified: Given an optimal sequence

of decisions, every subsequence is, in turn, optimal.

Then we proceed as follows:

• Let L

0

be the set of terminal assets.

• Consider L

1

including support assets whose chil-

dren belong to L

0

only (L

1

is not empty because

the graph is acyclic). Identify safeguards that min-

imize costs keeping the degrees of dependency

over their children at an acceptable level.

• Consider L

2

including support assets whose chil-

dren belong to L

0

∪ L

1

only. Identify safeguards

that minimize costs keeping the degrees of depen-

dency over L

0

under an acceptable level. Note that

the degrees of indirect dependency from the chil-

dren of L

2

to terminal assets have already been

computed in the previous stage, so we just need

to identify the direct degree of dependency over

assets in L

0

∪ L

1

.

• ...

• Consider L

i

including support assets whose chil-

dren belong to L

0

∪ L

1

∪ ... ∪ L

i−1

only. Iden-

tify safeguards that minimize costs keeping the

degrees of dependency over L

0

under an accept-

able level. Note that again we just need to iden-

tify the direct degree of dependency on assets of

L

0

∪ L

1

∪ ... ∪ L

i−1

.

• ...

AFuzzyApproachbasedonDynamicProgrammingandMetaheuristicsforSelectingSafeguardsforRiskManagementfor

InformationSystems

39

Simulated annealing (Kirkpartick et al 1983, Cerny

1985) is applied in each step of the algorithm to de-

rive the optimal selection of safeguards. It is a trajec-

torial metaheuristic which is named for and inspired

by annealing in metallurgy.

An initial feasible solution is randomly generated.

In each iteration a new solution y is randomly gen-

erated from the neighborhood of the current solution,

y ∈ N(x

i

). If the new solution is better than the cur-

rent one, then the algorithm moves to that solution

(x

i+1

= y), otherwise the movement to the worst solu-

tion is performed with certain probability.

Note that accepting worse solutions allows for a

more extensive search for the optimal solution and

avoids trapping in local optima in early iterations.

The probability of accepting a worse movement

is a function of both the temperature factor and the

change in the cost function.

The initial value of temperature (T ) is high, which

leads to a diversified search, since practically all

movements are allowed. As the temperature de-

creases, the probability of accepting a worse move-

ment falls. If the temperature is zero, then only better

movements will be accepted, which makes simulated

annealing work like hill climbing.

The pseudocode of simulated annealing for a min-

imization problem is as follows:

• Generate an initial feasible solution x

0

. Do x

∗

=

x

0

, f

∗

= f (x

0

), i = 0.

Select the initial temperature t

0

= T (t

i

tempera-

ture in the step i)

• Repeat until stopping criterion is satisfied:

– Randomly generate y ∈ N(x

i

)

∗ If f (y) − f (x

i

) ≤ 0, then

· x

i+1

= y

· If f (x

∗

) > f (y), then x

∗

= y, f

∗

= f (y)

∗ Else

· p ∼ U (0,1)

· If p ≤ e

−( f (y)− f (x

i

))/t

i

, then x

i+1

= y

· Else x

i+1

= x

i

– i = i + 1

– Update temperature

3 AN ILLUSTRATIVE EXAMPLE

Let us consider the IS shown in Figure 2 with the di-

rect degrees of dependency assessed by the experts

considering the linguistic terms of Table 1, which has

only one terminal asset, A

6

.

Figure 2: Direct dependencies in the IS.

The set of paths in the analysis of the influence of

A

1

over A

6

is P = {

• P

1

: (A

1

→ A

2

→ A

6

),

• P

2

: (A

1

→ A

2

→ A

3

→ A

6

),

• P

3

: (A

1

→ A

2

→ A

3

→ A

4

→ A

6

),

• P

4

: (A

1

→ A

3

→ A

6

),

• P

5

: (A

1

→ A

3

→ A

4

→ A

6

),

• P

6

: (A

1

→ A

4

→ A

6

),

• P

7

: (A

1

→ A

5

→ A

6

)}.

Asset A

3

is influenced by A

1

and A

2

, and A

4

is

influenced by A

1

and A

3

. Therefore, we proceed as in

B) of the algorithm described in Section 2, with r = 2

and S= {P

2

,P

3

,P

4

,P

5

,P

6

}, as follows:

(i) I = {A

3

,A

4

} and NI = {A

3

}.

(ii) Select A

3

, then simplify paths P

2

, P

3

, P

4

and P

5

to

– P

0

2

: (A

1

→ A

3

→ A

6

),

– P

0

3

: (A

1

→ A

3

→ A

4

→ A

6

),

– P

0

4

: (A

1

→ A

3

→ A

6

) and

– P

0

5

: (A

1

→ A

3

→ A

4

→ A

6

),

respectively, with

^

d(A

1

,A

3

) =

^

D(A

1

,A

3

) =

^

d(A

1

,A

2

)⊗

^

d(A

2

,A

3

)

⊕

^

d(A

1

,A

3

).

(iii) S=

P

0

2

,P

0

3

,P

6

since P

0

2

= P

0

4

and P

0

3

= P

0

5

.

(iv) I = {A

4

} and NI = {A

4

}.

(v) Go to (ii).

(ii) Select A

4

, then simplify paths P

0

3

and P

6

to

– P

00

3

: (A

1

→ A

4

→ A

6

), and

– P

0

6

: (A

1

→ A

4

→ A

6

),

respectively, with

^

d(A

1

,A

4

) =

^

D(A

1

,A

4

) =

^

d(A

1

,A

3

)⊗

^

d(A

3

,A

4

)

⊕

^

d(A

1

,A

4

).

(iii) S=

P

0

2

,P

00

3

since P

00

3

≡ P

0

6

.

(iv) I = ∅ y NI = ∅.

(v) The algorithm finishes since NI = ∅.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

40

Finally, S=

P

0

2

,P

00

3

and the degree of dependency

of A

6

regarding A

1

is

^

D(A

1

,A

6

) =

^

D(A

1

,A

6

|P

1

) ⊕

^

D(A

1

,A

6

|P

7

) ⊕

^

D(A

1

,A

6

|P

0

2

) ⊕

^

D(A

1

,A

6

|P

00

3

) =

(

^

d(A

1

,A

2

) ⊗

^

d(A

2

,A

6

)) ⊕ (

^

d(A

1

,A

5

) ⊗

^

d(A

5

,A

6

)) ⊕

(

^

d(A

1

,A

3

) ⊗

^

d(A

3

,A

6

)) ⊕ (

^

d(A

1

,A

4

) ⊗

^

d(A

4

,A

6

))

The degree of dependency of A

6

regarding A

1

is

D(A

1

,A

6

) = (0.980,0.999,0.999,1) if we consider

the linguistic terms of Table 1 show in Figure 3.

Let us consider a threat on asset A

1

with frequency

e

f = M and degradation

e

d = (H,H, H), then the risk

to asset A

1

is

e

R

1

(l)

= (0.23,0.415,0.485,0.675), l =

1,2,3.

We consider the asset network and the fuzzy direct

dependencies shown in Figure 2 corresponding to an

IS. Besides, the set of available safeguards of failure

transmission between support assets are shown in Ta-

bles 2-5.

We also consider the fuzzy threshold

e

U =

(0,0,0.1,0.2) below which the degree of dependency

between all assets and terminal assets will be accept-

able, and let α = 0.95. In other words, the similar-

ity of the degree of dependency after applying the se-

lected safeguards for the given

e

U must be at least 0.95.

The set of solutions in each stage is represented

by binary matrices, in which each row represents the

safeguards of S

uv

p

, which prevents the failure transmis-

sion from asset u to v considered in that stage.

We use the similarity function proposed by (Chen

1996): Given two trapezoidal fuzzy numbers

e

A =

(a

1

,a

2

,a

3

,a

4

) and

e

B = (b

1

,b

2

,b

3

,b

4

),

S(

e

A,

e

B) = 1 −

4

∑

i=1

| a

i

− b

i

|

4

.

Although other similarity functions have been pro-

posed in the literature (Chen and Chen 2003, 2009,

Sridevi and Nadarajan 2009, Xu et al 2010, Hejazi et

al 2011, Gomathi and Sivaraman 2012, Zhu and Xu

2012, Vicente et al 2013b), we have decided to use

the geometric distance between both fuzzy numbers

due to its low computational cost.

Dynamic programming is then executed as fol-

lows:

First, note that L

0

= {A

6

}, since the only terminal

asset in the IS in Figure 2 is A

6

.

• Stage 1: L

1

= {A

4

,A

5

}. We adjust the degrees of

dependency

^

D(A

4

,A

6

) =

^

d(A

4

,A

6

) ⊗

10

⊗

p

(

e

1

e

e

4,6

p

x

4,6

p

)

=

V H ⊗

10

⊗

p

(

e

1

e

e

4,6

p

x

4,6

p

)

and

^

D(A

5

,A

6

) =

^

d(A

5

,A

6

) ⊗

15

⊗

p

(

e

1

e

e

5,6

p

x

5,6

p

)

=

Table 2: Safeguards for A

1

.

Tag Effect Cost Tag Effect Cost

S

1,2

1

L 100 S

1,3

1

MH 356

S

1,2

2

M 300 S

1,3

2

H 324

S

1,2

3

MH 550 S

1,3

3

L 110

S

1,2

4

M 430 S

1,3

4

ML 345

S

1,2

5

ML 125 S

1,3

5

VL 87

S

1,2

6

L 240 S

1,3

6

MH 345

S

1,2

7

VL 100 S

1,3

7

M 200

S

1,2

8

MH 324

S

1,2

9

VH 570

S

1,4

1

M 209 S

1,5

1

M 230

S

1,4

2

M 267 S

1,5

2

M 345

S

1,4

3

MH 342 S

1,5

3

L 187

S

1,4

4

VH 789 S

1,5

4

M 321

S

1,4

5

M 234 S

1,5

5

MH 345

S

1,4

6

M 356 S

1,5

6

H 543

S

1,4

7

M 276 S

1,5

7

MH 356

S

1,4

8

M 200 S

1,5

8

M 206

S

1,4

9

H 467 S

1,5

9

M 342

S

1,4

10

H 342

S

1,4

11

L 127

S

1,4

12

M 207

Table 3: Safeguards for A

2

.

Tag Effect Cost Tag Effect Cost

S

2,3

1

M 356 S

2,6

1

M 348

S

2,3

2

L 87 S

2,6

2

L 187

S

2,3

3

ML 267 S

2,6

3

ML 254

S

2,3

4

M 320 S

2,6

4

ML 367

SS

2,3

5

ML 156 S

2,6

5

ML 567

S

2,3

6

M 320 S

2,6

6

M 390

S

2,3

7

M 256 S

2,6

7

ML 256

S

2,3

8

M 300 S

2,6

8

M 307

S

2,3

9

L 200 S

2,6

9

L 235

S

2,6

10

ML 124

S

2,6

11

M 400

S

2,6

12

L 278

S

2,6

13

ML 260

H ⊗

15

⊗

p

(

e

1

e

e

5,6

p

x

5,6

p

)

,

such that S

^

D(A

4

,A

6

),

e

U

≥ 0.95 and S

^

D(A

5

,A

6

),

e

U

≥

0.95,

e

e

4,6

p

being the effect induced for the safeguard

S

4,6

p

, p = 1, ...,10,

e

e

5,6

p

the effect induced for the

safeguard S

5,6

p

, p = 1,...,15, x

4,6

p

= 1 or x

4,6

p

= 0 if

the safeguard S

4,6

p

, p = 1,...,10, is selected or not,

AFuzzyApproachbasedonDynamicProgrammingandMetaheuristicsforSelectingSafeguardsforRiskManagementfor

InformationSystems

41

Table 4: Safeguards for A

3

.

Tag Effect Cost Tag Effect Cost

S

3,4

1

M 345 S

3,6

1

M 267

S

3,4

2

H 650 S

3,6

2

M 356

S

3,4

3

M 200 S

3,6

3

M 378

S

3,4

4

M 367 S

3,6

4

M 324

S

3,4

5

M 388 S

3,6

5

M 345

S

3,4

6

H 453 S

3,6

6

M 231

S

3,4

7

L 189 S

3,6

7

MH 453

S

3,4

8

L 256

S

3,4

9

M 345

Table 5: Safeguards for A

4

and A

5

.

Tag Effect Cost Tag effect Cost

S

4,6

1

M 260 S

5,6

1

M 200

S

4,6

2

M 245 S

5,6

2

M 210

S

4,6

3

ML 170 S

5,6

3

L 120

S

4,6

4

M 256 S

5,6

4

ML 234

S

4,6

5

M 367 S

5,6

5

M 267

S

4,6

6

M 289 S

5,6

6

MH 367

S

4,6

7

M 278 S

5,6

7

MH 366

S

4,6

8

M 345 S

5,6

8

M 254

S

4,6

9

M 240 S

5,6

9

ML 145

S

4,6

10

MH 435 S

5,6

10

L 206

S

5,6

11

M 306

S

5,6

12

M 345

S

5,6

13

M 280

S

5,6

14

L 178

S

5,6

15

MH 377

respectively, and x

5,6

p

= 1 or x

5,6

p

= 0 depending

on whether or not the safeguard S

5,6

p

, p = 1,...,15,

minimizing the cost.

As L

1

contains two elements, two optimization

problems must be solved in this stage, associated

with A

4

and A

5

, respectively.

Regarding asset A

4

, solutions are represented by

the vector x

4,6

= (x

4,6

1

,x

4,6

2

,...,x

4,6

10

), see Table 5,

where x

4,6

p

= 1 if the safeguard S

4,6

p

is selected.

The respective optimization problem to be solved

using simulated annealing is:

min c

4,6

1

x

4,6

1

+ ... + c

4,6

10

x

4,6

10

s.t.

S

^

D(A

4

,A

6

),

e

U

≥ 0.95

x

4,6

p

∈

{

0,1

}

, p = 1, ..., 10

. (6)

The optimal solution and the associated costs are

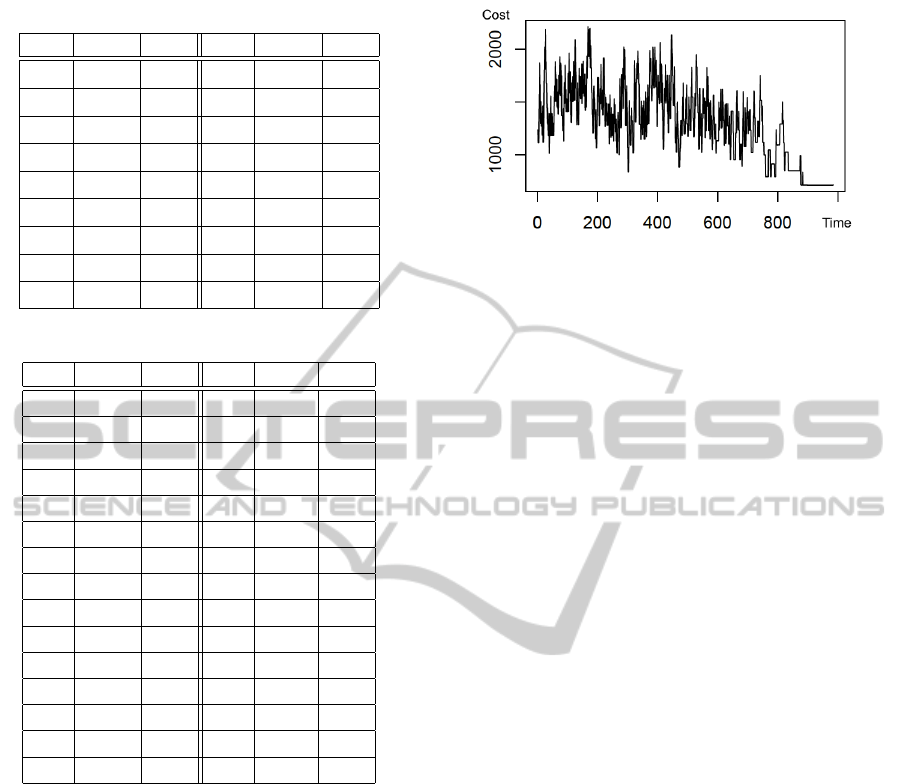

Figure 3: Objective function evolution in the optimum set-

ting of

^

D(A

5

,A

6

).

shown in the second row of Table 6, correspond-

ing to vector x

4,6

∗

= (0,1,1,1,0,0, 0, 0, 1,0).

Regarding asset A

5

, solutions are now represented

by the vector x

5,6

= (x

5,6

1

,x

5,6

2

,...,x

5,6

15

), see Table

5. The optimization problem to be solved is:

min c

5,6

1

x

5,6

1

+ ... + c

5,6

15

x

5,6

15

s.t.

S

^

D(A

5

,A

6

),

e

U

≥ 0.95

x

5,6

p

∈

{

0,1

}

, p = 1, ..., 15

. (7)

The evolution of the objective function over time

for the best solution found is shown in Figure 3.

The optimal solution and the associated costs are

shown in the first row of Table 6, corresponding to

vector x

5,6

∗

= (1,0,0,0,0,0, 1, 0, 1,0,0,0,0,0,0).

The new degrees of dependency after the applica-

tion of the selected safeguards and the respective

similarity to the fixed threshold,

e

U, are shown in

the first two rows of Table 7.

The purpose of this paper is to describe how a

mixture of dynamic programming techniques and

metaheuristics can efficiently solve the problem

and not to detail or compare the applied meta-

heuristic (simulated annealing) with others. How-

ever, we do think it is worthwhile to describe some

parameters used in the implementation and to re-

port a sensitivity analysis analyzing the effects

caused by the changes to these parameters.

– We randomly generate a sequence with binary

values and check if the similarity constraint is

verified to derive the initial solution. The length

of the binary sequence depends on the problem

(15 when dealing with x

5,6

, 10 when dealing

with x

4,6

...).

– The neighborhood of a solution is composed of

any solutions that can be derived by changing

the value of one of the binary elements of the

solution, selected at random. If the resulting

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

42

solution is not feasible (does not verify the sim-

ilarity constraint), then it is discarded and an-

other solution is generated in the neighborhood

until a feasible solution is found.

– The initial temperature assures acceptance

probabilities of worse solutions close to 0.9 in

the initial iterations of the algorithm. The ini-

tial temperature is computed to obtain a high

probability of acceptance (≥ 0.9) of any neigh-

bor of the initial solution, i.e., given the initial

solution x

0

, the minimum value T is computed

such that

e

−( f (y)− f (x

0

))/T

≥ 0.9, ∀y ∈ N(x

0

) and feasible,

with:

f (y) − f (x

0

) > 0.

In other words,

T = max

y∈N(x

0

)

f easible

−( f (y) − f (x

0

))

ln(0.9)

because if we have T ≥

−( f (y)− f (x

0

))

ln(0.9)

∀y ∈

N(x

0

) and feasible, with f (y) − f (x

0

) > 0,

then ln(0.9) ≤

−( f (y)− f (x

0

))

T

∀y ∈

N(x

0

) and feasible, with f (y) − f (x

0

) >

0, and since e

x

is an increasing

function, 0.9 ≤ e

−

(

f (y)−f (x

0

)

)

T

∀y ∈

N(x

0

) and feasible, with f (y) − f (x

0

) > 0.

The pseudocode, starting from x

0

=

(x

0

[1],...,x

0

[n]), as follows:

∗ y = x

0

, T = 0, i = 1.

∗ While i ≤ n. Do y[i] = 1 − y[i].

· If y is a feasible solution then, if

−( f (y)− f (x

0

))

ln(0.9)

> T , we have

T =

−( f (y) − f (x

0

))

ln(0.9)

.

· y = x

0

, i = i + 1.

The solution x

0

has at most n feasible neigh-

boring solutions. We have evaluated all neigh-

boring solutions that are worse than the initial

solution in those n steps.

In the unfortunate event that the initial solu-

tion is the worst of its neighborhood, the initial

value of the resulting T is null. Therefore we

must start from another initial solution. This

does not degrade the algorithm, because it can

return to the neighborhood of the discarded so-

lution at any time.

Thus the initial temperature that leads to the op-

timal solution over A

5

(for optimization prob-

lem (7)) is 3578.191.

Table 6: Optimal solutions and costs for each asset.

Asset Solution Cost

A

5

S

5,6

1

, S

5,6

7

, S

5,6

9

711

A

4

S

4,6

2

, S

4,6

3

, S

4,6

4

,S

4,6

9

911

A

3

S

3,6

1

, S

3,6

4

, S

3,6

6

, S

3,6

7

1275

A

2

S

2,3

7

, S

2,6

1

, S

2,6

5

, S

2,6

7

,S

3,6

10

1551

A

1

S

1,2

1

, S

1,3

2

, S

1,4

10

1236

Total cost 5684

The temperature is maintained constant for L =

20 iterations and then it decreases after multi-

plying by 0.95, so that, after h∗L iterations, the

temperature is t

h∗L

= 0.95

h

t

0

.

– The algorithm stops if f has not improved in

the last 100 iterations.

Table 7 shows the best solutions reached after run-

ning the algorithm with different values for α to

minimize

^

D(A

5

,A

6

). Note that if the constraint is

more restrictive, allowing only minor differences

with the threshold

e

U, the set of safeguards for im-

plementation will be larger. The same effect oc-

curs when we use a more accurate (with a smaller

support) threshold

e

U. Therefore, experts must

choose lower or higher levels of acceptable ac-

curacy regarding the dependency between assets,

i.e., the accepted risk considering this fact.

• Stage 2: L

2

= {A

3

}. The degrees of dependency

^

d(A

3,

A

6

) and

^

d(A

3,

A

4

) are adjusted by minimiz-

ing costs and incorporating the soft constraint

S

^

D(A

3

,A

6

),

e

U

≥ 0.95, where

^

D(A

3

,A

6

) =

^

d(A

3

,A

6

) ⊗

7

⊗

p=1

(

e

1

e

e

3,6

p

x

3,6

p

)

⊕

^

d(A

3,

A

4

) ⊗

9

⊗

p=1

(

e

1

e

e

3,4

p

x

3,4

p

)

⊗

^

D(A

4

,A

6

)

.

Note that

^

D(A

4

,A

6

) was computed

in Stage 1,

^

D(A

4

,A

6

) = V H ⊗

h

(

e

1

e

e

4,6

2

) ⊗ (

e

1

e

e

4,6

3

) ⊗ (

e

1

e

e

4,6

4

) ⊗ (

e

1

e

e

4,6

9

)

i

=

(0.016,0.072,0.104,0.269). The optimization

problem to be solved in this stage is

min c

3,6

1

x

3,6

1

+ ... + c

3,6

7

x

3,6

7

+

c

3,4

1

x

3,4

1

+ ... + c

3,4

9

x

3,4

9

s.t.

S

^

D(A

3

,A

6

),

e

U

≥ 0.95

x

3,6

p

∈

{

0,1

}

, p = 1, ..., 7

x

3,4

q

∈

{

0,1

}

,q = 1,...,9

.

The optimal solution and the associated cost is

AFuzzyApproachbasedonDynamicProgrammingandMetaheuristicsforSelectingSafeguardsforRiskManagementfor

InformationSystems

43

Table 7:

^

D(A

5

,A

6

) and associated costs for different α levels.

α

^

D(A

5

,A

6

) Similarity Cost

0.8 (0.05,0.23,0.27,0.46) 0.81 554

0.9 (0.02,0.09,0.12,0.30) 0.93 653

0.95 (0.01,0.07,0.11,0.28) 0.95 711

0.98 (0.00,0.03,0.06, 0.20) 0.98 1021

shown in the third row of Table 6, correspond-

ing to vectors x

3,6

∗

= (1,0,0,1,0, 1, 1) and x

3,4

∗

=

(0,0,0,0,0,0, 0, 0, 0). The new degree of depen-

dency after the application of the selected safe-

guards and the corresponding similarity to the

fixed threshold,

e

U, are shown in the third row of

Table 7.

• Stage 3: L

3

= {A

2

}. The degrees of depen-

dency

^

d(A

2

,A

3

) and

^

d(A

2

,A

6

) are adjusted mini-

mizing costs and incorporating the soft constraint

S

^

D(A

2

,A

6

),

e

U

≥ 0.95, where

^

D(A

2

,A

6

) =

^

d(A

2

,A

6

) ⊗

13

⊗

p=1

(

e

1

e

e

2,6

p

x

2,6

p

)

⊕

^

d(A

2,

A

3

) ⊗

7

⊗

p=1

(

e

1

e

e

2,3

p

x

2,3

p

)

⊗

^

D(A

3

,A

6

)

.

Note that

^

D(A

3

,A

6

) was computed in Stage

2,

^

D(A

3

,A

6

) = [

^

d(A

3

,A

6

) ⊗ (

e

1

e

e

3,6

1

) ⊗ (

e

1

e

e

3,6

4

) ⊗ (

e

1

e

e

3,6

6

) ⊗ (

e

1

e

e

3,6

7

)] ⊕ [

^

d(A

3,

A

4

)) ⊗

^

D(A

4

,A

6

)] = (0.008,0.059,0.096,0.301).

The optimal solution and the associated cost are

shown in the fourth row of Table 6, correspond-

ing to vectors x

2,3

∗

= (0,0,0,0,0, 0, 1, 0,0) and

x

2,6

∗

= (1, 0, 0,0,1,0,1,0,0, 1, 0, 0,0). The new

degree of dependency and similarity to

e

U, are

shown in the fourth row of Table 8.

• Finally, L

4

= {A

1

}. The degrees of dependency

^

d(A

1

,A

2

),

^

d(A

1

,A

3

),

^

d(A

1

,A

4

) and

^

d(A

1

,A

5

) are

adjusted minimizing the cost and considering the

soft constraint S

^

D(A

1

,A

6

),

e

U

≥ 0.95, where

^

D(A

1

,A

6

) =

^

d(A

1

,A

2

) ⊗

9

⊗

p=1

(

e

1

e

e

1,2

p

x

1,2

p

)

⊗

^

D(A

2

,A

6

)

⊕

^

d(A

1,

A

3

) ⊗

7

⊗

p=1

(

e

1

e

e

1,3

p

x

1,3

p

)

⊗

^

D(A

3

,A

6

)

⊕

^

d(A

1

,A

4

) ⊗

12

⊗

p=1

(

e

1

e

e

1,4

p

x

1,4

p

)

⊗

^

D(A

4

,A

6

)

⊕

^

d(A

1

,A

5

) ⊗

9

⊗

p=1

(

e

1

e

e

1,5

p

x

1,5

p

)

⊗

^

D(A

5

,A

6

)

.

Note that

^

D(A

2

,A

6

),

^

D(A

3

,A

6

),

^

D(A

4

,A

6

) and

Table 8: New degrees of dependency after applying safe-

guards.

Asset

^

D(A

j

,A

6

) Similarity

e

U

A

5

(0.015,0.077,0.114,0.280) 0.953

A

4

(0.016,0.072,0.104,0.269) 0.959

A

3

(0.008,0.059,0.096,0.301) 0.956

A

2

(0.008,0.057,0.094,0.316) 0.953

A

1

(0.005,0.045,0.082,0.327) 0.951

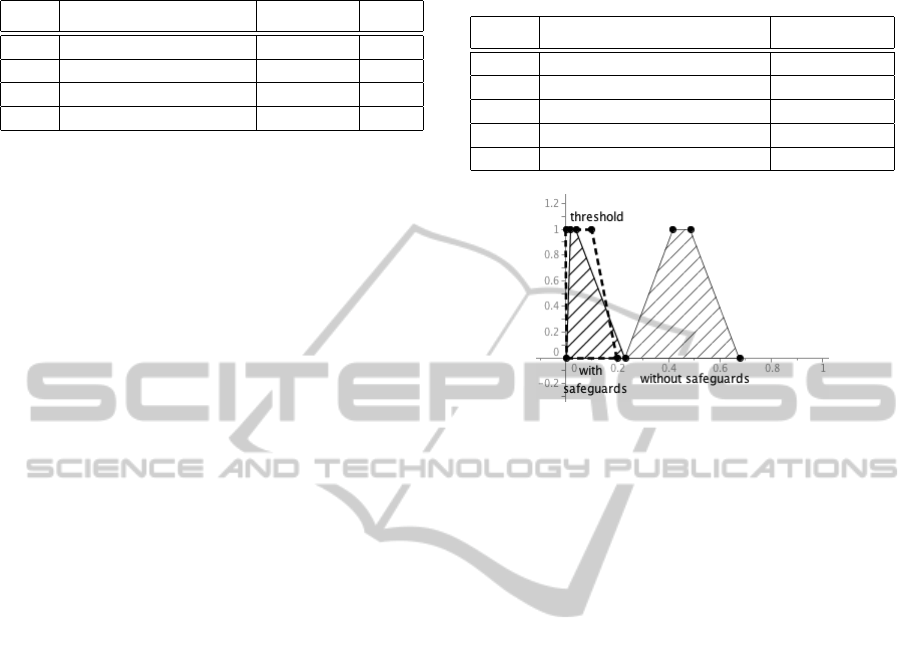

Figure 4: Risk in each component of A

1

before and after

implementation of optimal safeguards

^

D(A

5

,A

6

) were computed in previous stages,

^

D(A

2

,A

6

) = [

^

d(A

2

,A

6

) ⊗ ((

e

1

e

e

2,6

1

) ⊗

(

e

1

e

e

2,6

5

) ⊗ (

e

1

e

e

2,6

7

) ⊗ (

e

1

e

e

2,6

10

))] ⊕

[

^

d(A

2,

A

3

) ⊗

(

e

1

e

e

2,3

7

)

⊗

^

D(A

3

,A

6

)] =

(0.008,0.057,0.094,0.316),

^

D(A

3

,A

6

) = (0.008,0.059,0.096,0.301),

^

D(A

4

,A

6

) = (0.016,0.072,0.104,0.269) and

^

D(A

5

,A

6

) = (0.01,0.07,0.11,0.28).

The optimal solution in this stage is shown in the

last row of Tables 6 and 7.

After implementing the best safeguards, the

risk caused by the previously considered

threat over asset A

1

in each component is

e

R

1

(l)

= (0.001,0.018,0.039,0.22), l = 1,2,3.

The risks associated with this threat before and af-

ter implementation of safeguards are illustrated along

with the risk threshold in Figure 4.

4 CONCLUSIONS

We propose a model for selecting safeguards to re-

duce risks in information systems based on the reduc-

tion of the degree of dependency between support as-

sets and terminal assets. As safeguards have associ-

ated costs, our aim is to select safeguards that mini-

mize costs while keeping the risk with acceptable lev-

els.

ICORES2014-InternationalConferenceonOperationsResearchandEnterpriseSystems

44

Although a metaheuristic could be used to solve

this optimization problem, dynamic programming

combined with simulated annealing was used because

of the special structure of the constraint set. This leads

to a more computationally efficient solution to the

safeguard selection problem. Also the fuzzy environ-

ment allows experts to provide imprecise and vague

failure propagation probabilities.

Another way to reduce system risk is to act on the

probability of threats to each asset materializing or re-

ducing the degradation of assets caused by threat ma-

terialization. This is a multiobjective problem (degra-

dation has three components), which will be consid-

ered in future research.

ACKNOWLEDGEMENTS

The paper was supported by Madrid Regional Gov-

ernment project S-2009/ESP-1685 and Spanish Min-

istry of Science and Innovation project MYTM2011-

28983-C03-03.

REFERENCES

Cerny, V. (1985). Thermodynamical Approach to the Trav-

eling Salesman Problem: An Efficient Simulation Al-

gorithm, Journal of Optimization Theory and Appli-

cations, 45, 41-51.

Chen, S.-M. (1996). New Methods for Subjective Mental

Workload Assessment and Fuzzy Risk Analysis, Cy-

bernetics Systems, 27, 449-472.

Chen, S.-J. and Chen, S.-M. (2003). Fuzzy Risk Analysis

Based on Similarity Measures of Generalized Fuzzy

Numbers. IEEE Transactions on Fuzzy Systems, 11,

45-56.

Chen, S.-J. and Chen, S.-M. (2009). Fuzzy Risk Analy-

sis Based on the Ranking of Generalized Trapezoidal

Fuzzy Numbers. Applied Intelligence, 26, 1-11.

CCTA Risk Analysis and Management Method (CRAMM),

Version 5.0. London: Central Computing and

Telecommunications Agency (CCTA), 2003.

Finetti, B. (1964). Foresight: its Logical Laws, its Sub-

jective Sources. In: H.E. Kyburg and H.E. Smokler

(eds.), Studies in Subjective Probability. New York:

Wiley.

Gomathi, V.L. and Sivaraman, G. (2012). A Novel Simi-

larity Measure between Generalized Fuzzy Numbers.

International Journal of Computer Theory and Engi-

neering, 4, 448-450.

ISO/IEC Serie 27000 International Organization for Stan-

dardization.

Hejazi, S. R., Doostparast, A. and Hosseini, S.M. (2011).

An Improved Fuzzy Risk Analysis based on a New

Similarity Measures of Generalized Fuzzy Numbers.

Expert Systems with Applications, 38, 9179-9185.

Kirkpatrick, S., Gelatt., C.D. and Vecchi, M. P. (1983).

Optimization by Simulated Annealing. Science, 220

(4598), 671-680.

L

´

opez Crespo, F., Amutio-G

´

omez, M.A., Candau, J. and

Ma

˜

nas, J.A. (2006). Methodology for Information Sys-

tems Risk. Analysis and Management (MAGERIT ver-

sion 2). Book I, Book II and Book III. Madrid: Minis-

terio de Administraciones P

´

ublicas.

Savage, L. J. (1954). The Foundations of Statistics. New

York: Wiley.

Sridevi, B. and Nadarajan, R. (2009). Fuzzy Similarity

Measure for Generalized Fuzzy Numbers. Interna-

tional Journal of Open Problems in Computer Science

and Mathematics, 2, 111-116.

Stoneburner, G. and Gougen, A. (2002). NIST 800-30 Risk

Management. Guide for Information Technology Sys-

tems. Gaithersburg: National Institute of Standard and

Technology.

Vicente, E., Jim

´

enez, A. and Mateos, A. (2013a). A Fuzzy

Approach to Risk Analysis in Information Systems.

Proceedings of the 2nd International Conference on

Operations Research and Enterprise Systems, 130-

133.

Vicente, E., Mateos, A. and Jim

´

enez, A. (2013b). A

New Similarity Function for Generalized Trapezoidal

Fuzzy Numbers. Lecture Notes on Computer Science,

7894, 400-411.

Vicente, E., Jim

´

enez, A. and A. Mateos, A. (2013c). An in-

teractive method of fuzzy probability elicitation in risk

analysis, Intelligent Systems and Decision Making for

Risk Analysis and Crisis Response, New York: CRC

Press, 223-228.

Xu, Z., Shang, S., Qian, W. and Shu, W. (2010). A Method

for Fuzzy Risk Analysis based on the New Similarity

of Trapezoidal Fuzzy Numbers. Expert Systems with

Applications, 37, 1920-1927.

Zu, L. and R. Xu (2012). Fuzzy risk analysis based

on similarity measure of generalized fuzzy num-

bers. Fuzzy Engineering and Operations Research.

Berlin/Heidleberg: Springer, 569-587.

AFuzzyApproachbasedonDynamicProgrammingandMetaheuristicsforSelectingSafeguardsforRiskManagementfor

InformationSystems

45