A System for Enabling Facility Management to Achieve Deterministic

Energy Behaviour in the Smart Grid Era

Dejan Ili

´

c, Stamatis Karnouskos, Per Goncalves Da Silva and Sarah Detzler

SAP AG, Vincenz-Prießnitz-str. 1, D-76131, Karlsruhe, Germany

Keywords:

Energy Management, Smart Grid, Facility Management, Energy Forecast, Energy Storage, Energy Trading.

Abstract:

The vision of the Smart Grid empowers a variety of innovative approaches for flexible energy management

that fuse the business goals with the asset monitoring and control offered by the Internet of Things. The facility

management domain can benefit from these advances by building upon Smart Grid energy services thereby

realizing new business opportunities that make the best out of its assets. Due to the increasing integration of

highly dynamic assets in future buildings, short-term deterministic behaviour is difficult. However with the

availability of controlled variable storage, and futuristic services such as energy trading, errors in prediction

can be absorbed internally or traded with the ultimate aim of “making the best” out of the assets and situations.

The latter has the potential to enable facility managers to reach strategic objectives and potentially use assets

more effectively by seizing new business opportunities. In this work we propose an architecture, describe

its key components and depict in scenarios its usage with the goal of enabling facility management to take

informed business decisions by following enterprise strategies as well as considering the volatility of the

available energy excess or shortage.

1 MOTIVATION

The combination of deregulated energy markets and

prevalence of modern Information and Communica-

tion Technologies (ICT) on the electricity infrastruc-

ture is paving the way towards the Smart Grid (Euro-

pean Commission, 2012; BDI, 2010). According to

the Smart Grid vision (Yu et al., 2011), improved en-

ergy management may stem from the near real-time

bidirectional communication between, and within,

stakeholders. Today, several projects are under-way

(Giordano et al., 2013) that apply innovative concepts

to realize different aspects of this vision. The realisa-

tion of this vision heavily relies on the prevalence of

the Internet of Things (International Telecommunica-

tion Union, 2005), which introduces intelligent net-

worked devices (such as sensors and actuators) to ev-

eryday objects, house-hold appliances, industrial sys-

tems, etc. and leads to the fusion of the physical and

virtual worlds (acatech, 2011).

Among ongoing research and development

projects (Giordano et al., 2013), there are ef-

forts towards better grid management, integration

of smart-houses (Karnouskos, 2013) and smart-

buildings, accommodation of intermittent energy

resources including Electric Vehicles (EV), demand-

response schemes (Mathieu et al., 2011), local

energy markets for business interactions (Ili

´

c et al.,

2012), etc. Through the shift towards integration

of small, highly-distributed, energy production and

storage capabilities, not only will new stakeholders

will (European Commission, 2012), but even the

current ones may assume new roles. Combining

advanced information-driven services (Karnouskos

et al., 2012) with these new capabilities will give rise

to new infrastructures (Karnouskos, 2011) eager for

innovative business opportunities.

Future on-premise capabilities, such as on-site en-

ergy generation or EV fleets (Tomi

´

c and Kempton,

2007), will provide industrial facilities with new busi-

ness and management opportunities (Kanchev et al.,

2011). Since a typical industrial building can be seen

as an ecosystem (Carosio et al., 2013), its internal

(e.g. building infrastructure) as well as the new ex-

tended components (e.g. EVs, storage etc.) can coop-

erate to improve energy management (Palensky and

Dietrich, 2011). This in turn can enable new forms of

business interaction with other stakeholders that are

either currently impossible, or incur high integration

costs. Of particular interest is a facility’s ability to

keep-up with previously planned (Blank and Lehn-

hoff, 2013), or forecast (Vonk et al., 2012), levels of

170

Ili

´

c D., Karnouskos S., Goncalves da Silva P. and Detzler S..

A System for Enabling Facility Management to Achieve Deterministic Energy Behaviour in the Smart Grid Era.

DOI: 10.5220/0004861101700178

In Proceedings of the 3rd International Conference on Smart Grids and Green IT Systems (SMARTGREENS-2014), pages 170-178

ISBN: 978-989-758-025-3

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

energy consumption and/or production, and its flexi-

bly in adjusting to new situations while trying to min-

imize costs, or increase revenue for its owners (Kor-

paas et al., 2003). By providing a reliable prediction,

such a facility could generate revenue through effec-

tive participation in, for instance, local energy mar-

kets (Goncalves Da Silva et al., 2014), or demand re-

sponse programs (US DoE, 2006).

Forecasting the electricity consumption and/or

production behaviour of a building will of course lead

to errors (Mathieu et al., 2011) internally; however

these may not need to be propagated to external stake-

holders as it is done today. The challenge is on how to

leverage the facility’s capabilities (Teleke et al., 2009)

and external interactions in order to benefit the enter-

prise. More specifically, how the existing and new as-

sets that are under the control of the facility manage-

ment can be empowered with Smart Grid technolo-

gies and services, and be effectively used to address

any energy shortage or excess caused by the on-site

prediction errors (Pinson et al., 2009).

To address this problem, we propose a system

that takes advantage of existing (including temporal)

assets and Smart Grid services, and enables facility

management to actively adjust its energy consump-

tion/production behaviour as seen by external stake-

holders, while adhering to its internal goals and strate-

gies. The proposed system considers a stakeholder

with variable storage and energy trading capabilities,

which may be the norm in the years to come. We de-

scribe several management strategies that can be real-

ized with this system to demonstrate its capabilities.

Although individual aspects may exist in ongoing re-

search work, the proposed system combines several

of them together i.e. forecasting, storage and trading,

with clear applications in facility management (i.e.

buildings) and with a down to earth design that may

enable it to be productively used in the short-term.

2 SYSTEM ARCHITECTURE

2.1 Overview

The proposed system is modular and designed to

empower the collaboration of the independently op-

erating sub-systems, as well as the homogenization

of their functionalities in a mash-up end-user appli-

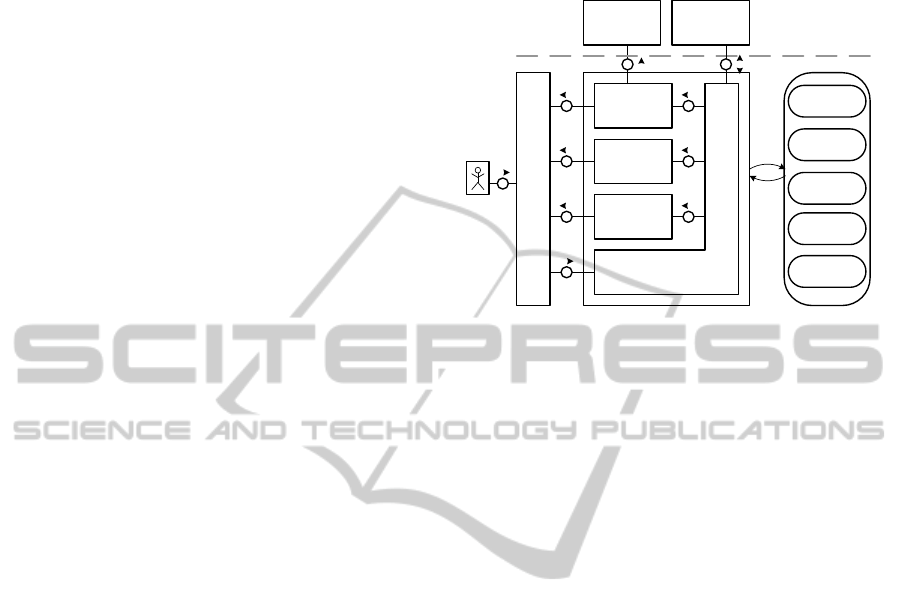

cation. As depicted in FMC notation (www.fmc-

modeling.org) in 1, we can distinguish the interac-

tions of the end-user via the cockpit, the main sys-

tems involved in the back-end i.e. energy load fore-

cast (ELF), variable energy storage (VES) and energy

trading (ET), as well as the reliance on external par-

ties such as an energy market or an external energy

stakeholder.

Energy Trading

Energy Load

Forecast

Variable Energy

Storage

Facility Management Cockpit

R

Energy Management

R

R

R

R R

R

R

Energy Market

R

External Energy

Stakeholder

R

Business

Data

Metering

Data

Prediction

Models

Trading

Strategies

Virtual Storage

Models

External Parties

Figure 1: System architecture overview.

The Energy Load Forecast (ELF) is the system re-

sponsible for forecasting the energy signature based

on historical smart metering data (residing in the me-

tering system) as well as real-time data acquired by

the infrastructure (Karnouskos et al., 2011). Its results

form the basis for the decision making process of how

to handle the excess or shortage of energy predicted.

The Variable Energy Storage (VES) consists of

managing the available “storage” in the enterprise

(Ili

´

c et al., 2013). The latter may include static as well

as dynamic energy storage (such as a fleet of EVs).

The VES is also envisioned to have the capability of

managing processes that could store or re-feed energy,

such as, the rescheduling of a process.

The Energy Trading (ET) is able to trade energy

on smart city marketplaces, that is, intelligently buy-

ing or selling energy depending on the needs of the

overall system (Goncalves Da Silva et al., 2013).

The Energy Management (EM) is a coordinating

entity which enables the collaboration among the dif-

ferent sub-systems, in our case ELF, VES and ET,

while in parallel taking the decisions on the actions

to be enforced. Based on the enterprise goals and

strategies set by the facility manager, it may dynam-

ically decide between the portions of energy that can

be “stored” in the VES or traded by ET in an electric-

ity market.

The Cockpit is the user interface (UI) that the end-

user, i.e. the facility manager dealing with the en-

ergy related aspects, interacts with. The cockpit is

envisioned as a mash-up application depicting key as-

pects of the status of the underlying infrastructure,

including enterprise related key performance indica-

tors. It can depict in real-time all information related

to the utilization of the storage, the energy forecast-

ASystemforEnablingFacilityManagementtoAchieveDeterministicEnergyBehaviourintheSmartGridEra

171

ing as well as the achieved energy accuracy, the en-

ergy traded and related costs, the currently available

and followed energy management strategies etc. The

cockpit is considered to be easily realised as a web

application hosted in the cloud, easily accessible via

the browser e.g. of a mobile device or laptop.

Finally, we have to note that the envisioned sys-

tem can communicate with external parties and ser-

vices such as an energy market and external energy

stakeholders in order to expand its capabilities. This

also implies the role of being part of a larger ecosys-

tem and the capability of being easily integrated in its

business processes; for instance the goals pursued by

the facility management could be adjusted to reflect

dynamically changing enterprise needs.

2.2 Energy Load Forecast (ELF)

Forecasting is a well known component of every en-

ergy management system. Imbalances provoked due

energy load forecast errors may result in a shortage

or excess of energy that must be accommodated, e.g.

in form of charging or discharging a battery. The

ELF requires the availability of the actual energy load

y[n] of a stakeholder (an interval n of size T ) in the

past, i.e. its smart metering data and potentially other

information such as weather data, asset specific be-

haviour or participation in processes, etc. With the

availability of y[n], an interval self-forecast ˙y[n] can

be reported with minimum offset of ∆, thus always

reporting ˙y[n − ∆] at interval n. The reporting as such

can be observed in 2.

Wh

n

n

0

n

0

-h

n

0

-Δ

measured

actual

reported

forecast (at n

0

)

Figure 2: Forecasting on different horizons and intervals to

improve the forecast accuracy.

ELF utilizes advanced forecasting algorithms that

continuously provide accurate predictions

b

y[n] over

smaller horizons. Its accuracy depends on multiple

conditions such as the applied forecast algorithm, the

required horizon etc. In this work, ELF provides a

forecast of the system for any horizon h in the future,

so the continuous load forecast is done for an interval

b

y[n − h]. It is expected that many components of the

system will require different horizons, as h ≈ ∆ might

not be of interest. 2 depicts the accuracy of

b

y[n] as

being higher than ˙y[n] (since h < ∆). The ELF con-

figuration is expected to be done internally based on

historic accuracy of the achieved performance.

2.3 Variable Energy Storage (VES)

The VES component combines both static and dy-

namic storage into one (virtual) unit of capacity. A

static storage has constant capacity if performance

degradation is not considered. In contrast, dynamic

storage is composed of multiple (potentially mobile)

units that are at some point in time connected to the

grid (e.g. EVs). While static storage can charge or

discharge in dependence to its actual state of charge

(SOC), these dynamic units are the actual energy-

flexible components, when of course connected to

the grid. This flexibility is gained by controlling the

amount of energy that they charge or discharge as well

as rescheduling such activities over an interval n of

length T . As it will not always be possible to com-

pensate the exact energy needed, e.g. due to techni-

cal restrictions, on every reschedule request, the er-

ror that should be absorbed ˙s[n], is not expected to

be fully addressed, but reduced to what is actually

stored s[n]. This gap can be however addressed within

the variable storage as a whole, since it is combined

from its dynamic and its static part (which does not

have the same temporal restrictions). A potential us-

age of the VES might be to use its dynamic part to

compensate the closest value possible, while the static

part can correct the uncompensated part of the er-

ror by charging or discharging the amount of energy

needed. However, the exact usage may depend on var-

ious other technical or financial constraints, and is out

of the scope of this work.

A stakeholder owned EV fleet (for which it is as-

sumed that the facility management has full control

over) is a good example of the dynamic part of a vari-

able storage, while it is limited by scheduling and

vehicle restrictions. For the rescheduling step, dif-

ferent priorities will need to be satisfied in order to

ensure that these EVs are always within the fleet re-

quirements. As such, any EV fleet can be used to cal-

culate the maximal shiftable load to positive ∆s

+

[n]

and negative ∆s

−

[n]. For this calculation it has to

be considered, that EVs can only vary their charg-

ing between the maximal and minimal power, or in-

terrupt the charging completely. Within these limits,

the fleet can react on energy shortage or surplus at

stakeholder’s premise, e.g. by interacting with an en-

ergy market or even compensating forecast errors by

rescheduling or shifting loads in an interval n. There-

fore in case of an energy demand change, discharging

of EVs would be a secondary option, while reschedul-

SMARTGREENS2014-3rdInternationalConferenceonSmartGridsandGreenITSystems

172

ing has precedence, since no losses are made due to

the storage efficiency.

2.4 Energy Trading (ET)

Local energy markets may emerge as a scalable

methodology for controlling the levels of consump-

tion and production on the grid (Ili

´

c et al., 2012;

Goncalves Da Silva et al., 2013), in particularly as a

response to the increasing deployment of distributed

energy resources (e.g. PV panels, wind farms, µCHP

generators, etc.). Within the proposed architecture,

a energy local market is considered as an opportu-

nity for a stakeholder not only to maintain its pre-

dictability, but to also, in some cases, better utilize

and capitalize on its storage facilities. With that in

mind, the ET system component interfaces with the

local market to buy/sell energy by applying different

trading strategies, such as (Cliff and Bruten, 2000;

Vytelingum et al., 2010).

The stakeholder calculates, on an interval basis,

the energy trading target

˙

τ[n] based on its internal

strategies and goals. For instance, the trading targets

could be based on the forecasting errors provided by

the ELF. A limit price, τ

p

[n],for either buying or sell-

ing is optionally set with each target to indicate the

maximum (minimum) buying (selling) price for inter-

val n. If the pricing information for a particular in-

terval is undefined, the ET will trade aggressively on

the market to ensure that the targets are met, so τ[n]

presents the net quantity traded by the ET with the in-

terval. Otherwise, each target can only be met within

the bounds of the its pricing constraints.

Current targets can be updated as new information

is made available to the stakeholder. In such cases, the

ET updates its market position to meet the new tar-

gets. For instance, if the target is set to

˙

τ[n] = 50 W h,

of which current trading is τ[n] = 20 W h, when a new

target of −30 W h is received, the ET should then sell

τ[n] = −50 W h to meet the new target. The perfor-

mance of the ET can be tracked by requesting the to-

tal traded quantities τ[n]. Furthermore, for purposes

of a cockpit (thus assistance to an operator), the ET

provides interfaces to access the overall market infor-

mation, as prices p[n] and trading volumes per time

interval.

2.5 Energy Management (EM)

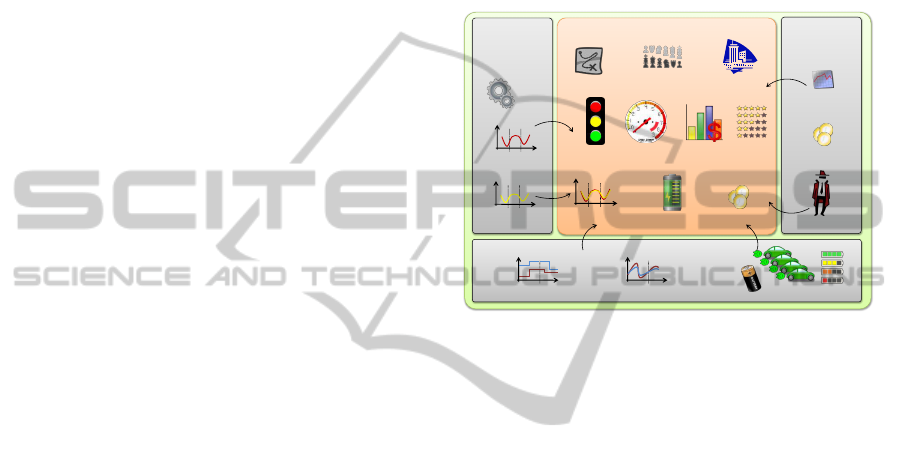

The facility manager, as illustrated in 1, interacts with

the system via a cockpit. An example of such a cock-

pit and information it offers is depicted in 3. The fa-

cility manager can consume the (real-time) informa-

tion depicted and by calibrating or setting the over-

all goals can exercise high-level control over the in-

frastructure. Such goals could be the optimization

of the infrastructure reaction to the energy surplus or

shortage reported by ELF towards economic objec-

tives such as minimization of cost, or other corpo-

rate social responsibility related ones, e.g. maximiza-

tion of usage of green electricity or even simpler ones

such as making sure that the EVs of the employees

are fully-charged by the end of their workday.

Variable Energy Storage (VES)

Energy Trading

(ET)

Energy Load

Forecast (ELF)

Facility Management Cockpit

Actual load

W

t

Forecast

W

t

Forecast Imbalance

W

t

Goals

Components

Strategies

Forecast

algorithms

Storage Constraints

Wh

t

Accommodated Energy

W

t

Marketplace

Electricity

Price

Available Storage

and Flexibility

Storage and Charging

Electricity Price

Trading Agent

System

Status

Performance

Monetary

Benefit

User

Evaluation

Figure 3: The envisioned system cockpit as a mash-up ap-

plication.

The transformation of user goals (calibrated via

the cockpit) to strategies are processed by the EM,

which takes into consideration all other constraints of

the system and takes the overall decision on the ap-

propriate strategies to be followed. EM acts also as

a communication broker among the different parts of

the system as it holds the system-wide knowledge that

is not available to the individual parts i.e. the ELF,

ET, VES, enabling the latter scaling or extension of

the system with other components or variations of the

existing ones.

EM acts as the coordinator and decision engine,

which communicates with ELF, ET and VES, and

provides them with the operational context info. As

an example, in a scenario where the EM is informed

about the energy surplus available due to a forecast er-

ror, it may decide to redirect part of it towards charg-

ing the EVs while another part may be redirected to

the ET (by charging schedule adjustment) in order to

be traded to the market (because the price is high or

can not be covered wholly by the VES). More exam-

ple scenarios will be depicted in 3.

ASystemforEnablingFacilityManagementtoAchieveDeterministicEnergyBehaviourintheSmartGridEra

173

3 ENERGY MANAGEMENT

STRATEGIES

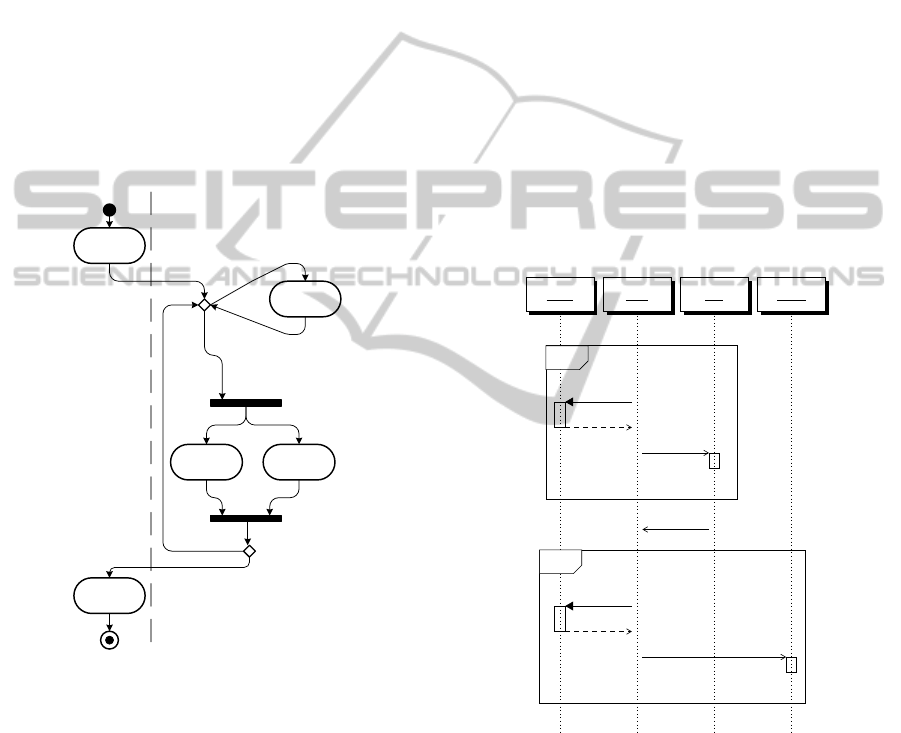

3.1 Overview

The system proposed, whose main components are

illustrated in 1, is flexible enough to accommodate

several envisioned scenarios, depending on the goals

set by the user, the available at time capabilities, and

actions to be enforced. The scenarios we will focus

upon, are in no way exhaustive, but serve to provide

some understanding of the potential strategies that

could be followed by the facility management. Our

aim is to showcase the system’s flexibility, which is a

key part of realizing agile enterprises in the future.

Set Goals

(via Cockpit

Acquire

forecast error

Facility Manager Facility Management System

Energy to be

stored (VES)

Energy to be

traded (ET)

Report

current status

Decision

Making

Result

Assessment

Figure 4: General view of the activity involving the archi-

tecture components.

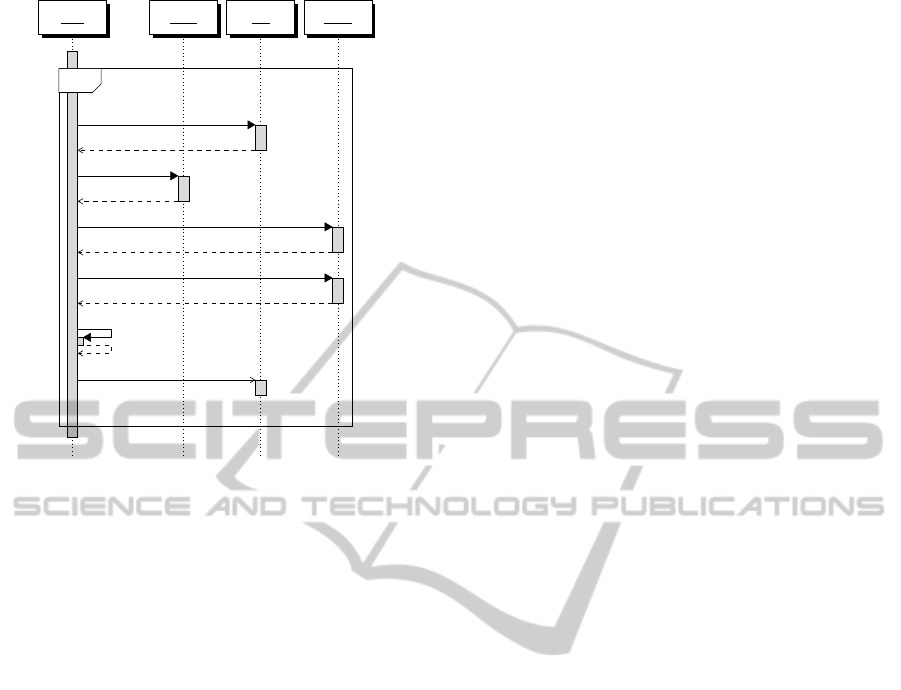

A general view of the workflow is depicted in

4. The user input is acquired, which together with

the forecast error and the underlying status and con-

straints of the subsystems, are used to reach a decision

for either trading or storing of energy (or both). Some

key strategies will be discussed in more detail i.e. 3.2,

3.3, and 3.4.

Generally, each envisioned strategy may not in-

volve all parts of the system, as this depends on the

actual constraints imposed at the time of the decision

making. This also signals that an organization does

not have to wait until all of the architecture parts are

deployed and become operational to start realising (a

limited set of) energy management strategies. As an

example, the ELF and the VES could be realized to-

day, while the ET could be realized some years later

when energy markets are available at smart city level

and it makes economic sense for the facility managers

to participate in them. Hence, the system architecture

accommodates the “migration” i.e. incremental evo-

lution of the infrastructure towards the fully-fledged

Smart Grid vision.

3.2 Storing Energy not Traded by ET

The decision making process (as depicted in 4) may

consider a strategy that is described as follows: after

the estimation of the energy error within an interval

by the ELF, try to trade the difference via the ET and

differ any non-traded energy to the VES for storage.

The workflow of such strategy is illustrated in 5. ET

accommodated τ[n] for the interval in question (po-

tentially even at different prices p), and VES is con-

tacted in order to absorb the remaining ˙s[n].

ELF EM ET VES

get forecast

˙y,

b

y

error (

˙

τ = ˙y −

b

y)

LoopLoop

traded(τ)

forecast update

b

y

remaining ( ˙s = ˙y −

b

y + τ)

LoopLoop

Figure 5: Strategy activity: 3.2.

The actual outcome of the trading done by ET de-

pends on the real-market conditions (law of demand

and supply) and hence strategy adaptation might be

needed over time e.g. acting alone or as part of a

larger group (Goncalves Da Silva et al., 2014). As

the ET might not be able to fully trade the energy

needed to balance the forecast error

˙

τ[n] = ˙y[n]−

b

y[n],

a part of it remained non-traded. The traded quan-

tity τ[n] is then communicated back to the EM, which

instructs VES to accommodate the remaining ˙s[n] =

˙y[n] − y[n] + τ[n] energy. This process leads to a new

SMARTGREENS2014-3rdInternationalConferenceonSmartGridsandGreenITSystems

174

state where the error is minimized as a “best effort”

procedure is followed by ET (interaction with exter-

nal stakeholders) and VES (internal stakeholder) to

minimize its impact.

Depending on the business motivation, this strat-

egy may be followed when the return of investment

(ROI) by selling the energy on the marketplace is

high. This may be a result of high prices on the energy

market, inability or no need of storing the energy in-

ternally, etc. The actual decision-making process will

be dynamic and the exact fine-tuning is not consid-

ered here.

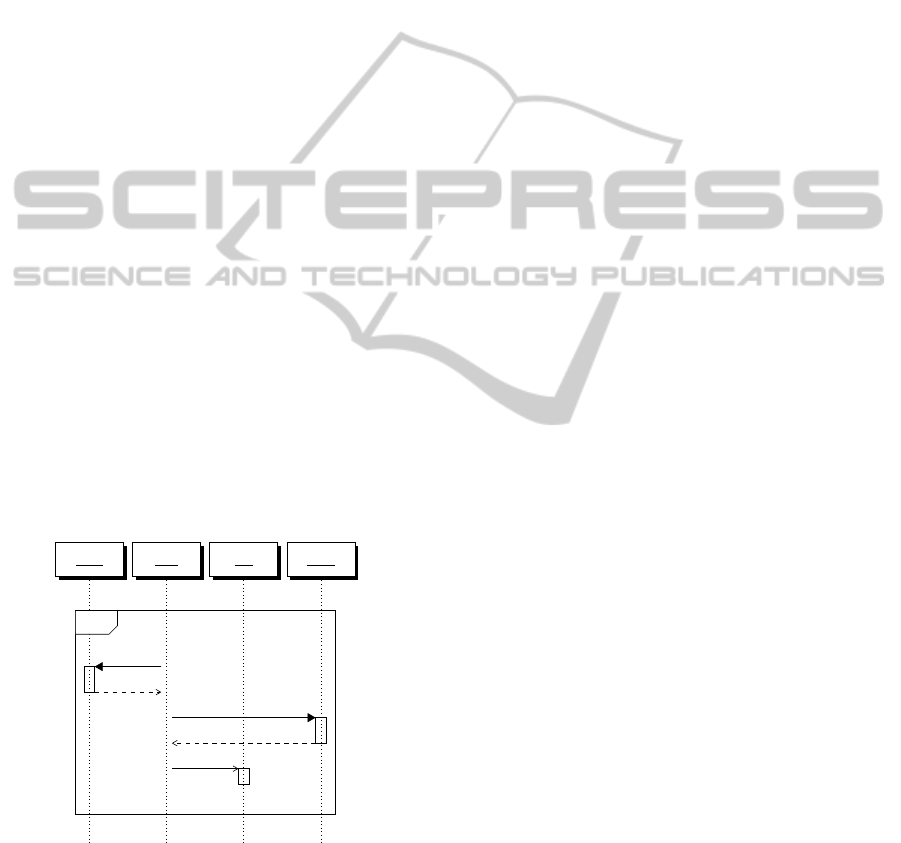

3.3 Trading Energy not Accommodated

by VES

In compliance with the decision making process de-

picted in 4, here we focus on a strategy that can be

described as follows: after calculation of the energy

due to the incurring error by ELF, try to accommo-

date the excess or shortage of energy via the VES (by

charging/discharging) and for the remaining part not

accommodated by the VES, use the ET. In this strat-

egy, the ET acts as a mitigating agent for any part

of the error that could not be absorbed by the VES,

which is shown in 6. In detail, the EM acquires the

forecasting error ( ˙s = ˙y−

b

y) from the ELF and informs

the VES, which attempts to accommodate the imbal-

ances introduced by the errors, and informs the EM of

any amount that could not be accommodated due to its

internal constraints (s). These amounts are then given

to the ET to be mitigated on the market (

˙

τ = ˙y−y+s).

ELF EM ET VES

get forecast

˙y,

b

y

error ( ˙s = ˙y −

b

y)

absorbed (s)

remaining (

˙

τ = ˙y −

b

y + s)

LoopLoop

Figure 6: Strategy activity: 3.3.

This strategy is expected to be used when the en-

terprise has the capability to store energy extensively

for its own use. For instance a significant number of

EVs at the disposal of facility management, means

that the VES can rely on storing energy there and ac-

quiring it back again when needed. Even if the energy

is not needed during the day for tackling imbalances,

the EVs are charged and the energy can be used for the

enterprise’s processes in the future; an action that en-

hances better planning of energy-relevant actions. If

a local marketplace is available, the ET tries to trade

the remaining energy (or acquire in case of shortage)

in order to make ends meet.

3.4 Trading Available VES Capacity

Independent of the strategies followed by the facility

management, the available assets might not be fully

utilized. Hence additional actions can be run, in com-

pliance to the decision making process as depicted in

4 and in parallel to the existing strategies. As an ex-

ample, consider a strategy that is described as follows:

check the available of VES flexibility and trade the ad-

ditional shiftable energy with the help of the ET in the

local energy market.

This example goes beyond the traditional process

of trying to cover the energy imbalances and targets

clearly the optimization area of the available assets.

The VES might be underutilized while trying to cover

the occurring imbalances, and that “unused” capacity

could be transformed into economic benefit for the

company. The VES may have its own models for es-

timating capacity that will not be used, and hence can

“release” it for further usage. Then the EM may con-

sider this capacity and buy or sell energy with the help

of ET in order to generate additional revenue for the

company. The system is flexible enough to accommo-

date such actions. However, to avoid conflicts or side-

effects, additional analysis on the resource utilization

is needed which is not part of the investigation pre-

sented here.

Since the VES is trying to compensate the er-

ror produced by the ELF, a certain state of charge

(SOC) will be achieved. Based on the actual flexi-

bility levels with consideration of SOC, the VES can

offer a certain capacity within an interval n for charg-

ing/discharging in order to increase the enterprise’s

revenue. Instead of only offering the capacity which

is left from the error compensation, the VES may

calculate the maximal and minimal shiftable energy

∆s

+

[n] and ∆s

−

[n]. This offered capacity can be then

traded and benefit from current price p. In another

twist, the VES may decide that the economic benefits

of trading the capacity are greater than that of being

used a storage and act accordingly, which is blending

the borders of the other two strategies discussed.

ASystemforEnablingFacilityManagementtoAchieveDeterministicEnergyBehaviourintheSmartGridEra

175

EM ELF ET VES

get actual status

p, τ

get forecast

˙y,

b

y

error ( ˙s = ˙y −

b

y)

absorbed (s)

get flexibility

∆s

+

, ∆s

−

opportunity (∆s

+

, ∆s

−

, p)

opportunity targets (τ)

LoopLoop

Figure 7: Strategy activity: 3.4.

4 DISCUSSION

Several considerations on the main components i.e.

ELF, VES, ET need to be adequately addressed. Fore-

casting done by the ELF, cannot only be based solely

on historical data, but needs to include real-time in-

formation. To this end, the Internet of Things coupled

with the Cloud (Curry et al., 2013; Karnouskos, 2013)

and the vast resources for analytics will help. Addi-

tionally, more specific knowledge of the processes in-

volved, their scheduling at enterprise level, as well as

their potential interdependencies may lead to better

forecasting and planning. For our environment this

assumes access to the building processes per se, the

impact of the employee usage of its facilities (which

extends to the EV usage), as well as potentially exter-

nal factors such as weather conditions etc. The appro-

priate combination of such intelligent algorithms with

(real-time) fine-grained data may enable the better ad-

justment of the infrastructure behaviour prediction.

Another key part of the system, the VES, demon-

strates that the temporal storage availability e.g. com-

ing from an EV fleet, can be used to acquire addi-

tional benefits for the enterprise. Although charg-

ing/discharging EV batteries or even rescheduling

their charging may sound promising, at the moment

few, if any, companies have fleets large enough for

these envisioned concepts to be practically applica-

ble. Furthermore, the communication protocols of the

EVs or the charging stations might also pose chal-

lenges as they might not allow a secondary actor to

set the charging schedule for them and always try to

charge as fast as possible.

Such constrains would tremendously lower the

possibility of interaction with other components in

a smart way. The latter gives some indication that

company-controlled fleets are the right target group

for such concepts as the one presented here. Even

then, due to constraints (physical or otherwise), fleets

might not always provide the exact flexibility that is

needed. The latter can me mitigated through the ad-

dition of static storage, or another buffer-like compo-

nent, that can compensate the missing flexibility.

The ET demonstrates how interacting with other

local stakeholders can not only aid the facility in re-

ducing its forecast error, but also create additional op-

portunities though energy and storage capacity trad-

ing. Although local energy markets are a hot topic

(Ili

´

c et al., 2012; Lamparter et al., 2010; Ding et al.,

2013) in Smart Grid research, how to effectively make

use and interact with them is still unclear. As no

such market currently exists, operational assumptions

were made; however in a real-world assessment the

underlying trading behaviour must be anchored in a

clear understanding of the market’s rules and proto-

cols. Additionally, in order for the ET to meet the a

wide range of strategies, such as the ones described in

3, it must be able to adequately handle dynamically

changing trading goals in conjunction with market-

forecasts and enterprise’s needs.

Generally, we consider that there is added value

if such systems are operational and would assist to-

wards informed and automated decision-making pro-

cesses in facility management domain. Their realiza-

tion however, will need to be assessed and fine-tuned

in real-world trials once the necessary Smart Grid ser-

vices envisioned are mainstream.

5 CONCLUSION

The ability to capitalize on new business opportunities

is vital for the survival of modern enterprises. To that

extent, fully utilizing all the capabilities offered by its

assets is pivotal. In the Smart Grid era, the facility

management can take sophisticated decisions related

to energy management, by including innovative tech-

nologies and concepts. The system we have presented

builds upon the orchestration (by the the EM) of three

key independent components (i.e. ELF, VES, ET). We

have provided insights on its basic components, their

operation as well as their usage in a variety of strate-

gies. In the latter we have also discussed the benefits

for the enterprise as well as the roadblocks that might

hinder their realization. Ultimately, the proposed sys-

SMARTGREENS2014-3rdInternationalConferenceonSmartGridsandGreenITSystems

176

tem enables on-the-fly decision-making that empow-

ers the facility managers to better meet their goals in

the emerging Smart Grid era.

ACKNOWLEDGEMENTS

The authors would like to thank the European

Commission, the German Federal Ministry of Eco-

nomics and Technology, and the partners of the

projects SmartKYE (www.SmartKYE.eu) and iZEUS

(www.izeus.de) for their support and fruitful discus-

sions.

REFERENCES

acatech (2011). Cyber-Physical Systems: Driving force for

innovation in mobility, health, energy and production.

Technical report, acatech – National Academy of Sci-

ence and Engineering.

BDI (2010). Internet of Energy: ICT for energy markets

of the future. Federation of German Industries (BDI)

publication No. 439.

Blank, M. and Lehnhoff, S. (2013). Assessing reliability

of distributed units with respect to the provision of

ancillary services. In IEEE 11

th

International Con-

ference on Industrial Informatics (INDIN), Bochum,

Germany.

Carosio, S., Hannus, M., Mastrodonato, C., Delponte, E.,

Cavallaro, A., Cricchio, F., Karnouskos, S., Pereira-

Carlos, J., Rodriguez, C. B., Nilsson, O., Sepp

¨

a, I. P.,

Sasin, T., Zach, J., van Beurden, H., and Anderson,

T. (2013). ICT Roadmap for Energy-Efficient Build-

ings – Research and Actions. EU Project ICT4E2B

Consortium.

Cliff, D. and Bruten, J. (2000). Less than human: Simple

adaptive trading agents for CDa markets. In Holly, S.,

editor, Computation in Economics, Finance and Engi-

neering: Economic Systems, pages 117–122, Oxford.

Pergamon.

Curry, E., O’Donnell, J., Corry, E., Hasan, S., Keane, M.,

and O’Riain, S. (2013). Linking building data in

the cloud: Integrating cross-domain building data us-

ing linked data. Advanced Engineering Informatics,

27(2):206 – 219.

Ding, Y., Alexander Neumann, M., Goncalves da Silva, P.,

Beigl, M., and Zhang, L. (2013). A control loop ap-

proach for integrating the future decentralized power

markets and grids. In IEEE International Conference

on Smart Grid Communications (SmartGridComm).

European Commission (2012). SmartGrids SRA 2035 –

Strategic Research Agenda. Technical report, Eu-

ropean Technology Platform SmartGrids, European

Commission.

Giordano, V., Meletiou, A., Covrig, C. F., Mengolini,

A., Ardelean, M., Fulli, G., Jim

´

enez, M. S., and

Filiou, C. (2013). Smart Grid projects in Europe:

Lessons learned and current developments 2012 up-

date. Joint Research Center of the European Commis-

sion, JRC79219.

Goncalves Da Silva, P., Ilic, D., and Karnouskos, S. (2014).

The impact of smart grid prosumer grouping on fore-

casting accuracy and its benefits for local electricity

market trading. IEEE Transactions on Smart Grid,

5(1):402–410.

Goncalves Da Silva, P., Karnouskos, S., and Ilic, D. (2013).

Evaluation of the scalability of an energy market for

smart grid neighbourhoods. In IEEE 11

th

Interna-

tional Conference on Industrial Informatics (INDIN),

Bochum, Germany.

Ili

´

c, D., Goncalves Da Silva, P., Karnouskos, S., and Griese-

mer, M. (2012). An energy market for trading elec-

tricity in smart grid neighbourhoods. In 6th IEEE

International Conference on Digital Ecosystem Tech-

nologies – Complex Environment Engineering (IEEE

DEST-CEE), Campione d’Italia, Italy.

Ili

´

c, D., Karnouskos, S., and Goncalves Da Silva, P. (2013).

Improving load forecast in prosumer clusters by vary-

ing energy storage size. In IEEE Grenoble PowerTech

2013, Grenoble, France.

International Telecommunication Union (2005). ITU Inter-

net Report 2005: The Internet of Things. Technical

report, (ITU).

Kanchev, H., Lu, D., Colas, F., Lazarov, V., and Francois, B.

(2011). Energy management and operational planning

of a microgrid with a PV-based active generator for

smart grid applications. Industrial Electronics, IEEE

Transactions on, 58(10):4583–4592.

Karnouskos, S. (2011). Demand side management via

prosumer interactions in a smart city energy market-

place. In IEEE International Conference on Innova-

tive Smart Grid Technologies (ISGT 2011), Manch-

ester, UK.

Karnouskos, S. (2013). Smart Houses in the Smart Grid

and the search for value-added services in the Cloud

of Things era. In Industrial Technology (ICIT), 2013

IEEE International Conference on, pages 2016–2021.

Karnouskos, S., Goncalves Da Silva, P., and Ili

´

c, D.

(2011). Assessment of high-performance smart me-

tering for the web service enabled smart grid. In Sec-

ond ACM/SPEC International Conference on Perfor-

mance Engineering (ICPE’11), Karlsruhe, Germany.

Karnouskos, S., Goncalves Da Silva, P., and Ili

´

c, D. (2012).

Energy services for the smart grid city. In 6th IEEE

International Conference on Digital Ecosystem Tech-

nologies – Complex Environment Engineering (IEEE

DEST-CEE), Campione d’Italia, Italy.

Korpaas, M., Holen, A. T., and Hildrum, R. (2003). Op-

eration and sizing of energy storage for wind power

plants in a market system. International Journal of

Electrical Power & Energy Systems, 25(8):599–

606. 14th Power Systems Computation Conference.

Lamparter, S., Becher, S., and Fischer, J.-G. (2010). An

agent-based market platform for smart grids. In Pro-

ceedings of the 9

th

International Conference on Au-

tonomous Agents and Multiagent Systems: Industry

track, AAMAS ’10, pages 1689–1696, Richland, SC.

ASystemforEnablingFacilityManagementtoAchieveDeterministicEnergyBehaviourintheSmartGridEra

177

International Foundation for Autonomous Agents and

Multiagent Systems.

Mathieu, J., Price, P., Kiliccote, S., and Piette, M. (2011).

Quantifying changes in building electricity use, with

application to demand response. Smart Grid, IEEE

Transactions on, 2(3):507–518.

Palensky, P. and Dietrich, D. (2011). Demand side manage-

ment: Demand response, intelligent energy systems,

and smart loads. Industrial Informatics, IEEE Trans-

actions on, 7(3):381–388.

Pinson, P., Papaefthymiou, G., Klockl, B., and Verboomen,

J. (2009). Dynamic sizing of energy storage for hedg-

ing wind power forecast uncertainty. In Power Energy

Society General Meeting, 2009. PES ’09. IEEE, pages

1–8.

Teleke, S., Baran, M., Huang, A., Bhattacharya, S., and An-

derson, L. (2009). Control strategies for battery en-

ergy storage for wind farm dispatching. Energy Con-

version, IEEE Transactions on, 24(3):725–732.

Tomi

´

c, J. and Kempton, W. (2007). Using fleets of electric-

drive vehicles for grid support. Journal of Power

Sources, 168(2):459–468.

US DoE (2006). Benefits of demand response in electric-

ity markets and recommendations for achieving them.

Technical report, US Department of Energy.

Vonk, B. M. J., Nguyen, P., Grond, M., Slootweg, J., and

Kling, W. (2012). Improving short-term load fore-

casting for a local energy storage system. In Univer-

sities Power Engineering Conference (UPEC), 2012

47

th

International, pages 1–6.

Vytelingum, P., Ramchurn, S. D., Voice, T., Rogers, A., and

Jennings, N. R. (2010). Trading agents for the smart

electricity grid. In 9th International Conference on

Autonomous Agents and Multiagent Systems (AAMAS

2010), Toronto, Canada, pages 897–904.

Yu, X., Cecati, C., Dillon, T., and Sim

˜

oes, M. (2011). The

new frontier of smart grids. Industrial Electronics

Magazine, IEEE, 5(3):49–63.

SMARTGREENS2014-3rdInternationalConferenceonSmartGridsandGreenITSystems

178