Applications of the REST Framework to Test Technology Activation

in Different ICT Domains

Antonio Ghezzi, Andrea Cavallaro, Andrea Rangone and Raffaello Balocco

Department of Management, Economics and Industrial Engineering, Politecnico di Milano,

Via Lambruschini 4B, 20156 Milan, Italy

Keywords: REST Model, Application, Technology Activation.

Abstract: As innovations based on technology multiply, research on technology diffusion evolves both downstream –

i.e. covering adoption and use – and upstream – i.e. focusing on the antecedents of diffusion. In the latter

domain, the study from Ghezzi et al. (2013) proposed to revisit traditional technology diffusion theory to

include the concept of “technology activation”, which investigates the external determinants influencing the

introduction of technology-based innovations. Such determinants are included in the Regulation,

Environment, Strategy, Technology (REST) framework. This study aims at proposing an application of the

REST framework to the Mobile Video Calls and the MiniDisc industries. This application is meant to

further validate the framework and test the validity of the concept of technology activation in different ICT

domains.

1 INTRODUCTION

Technology diffusion as a process is inherently

multifaceted, and develops both horizontally along

time, and vertically along a number of diffusion

determinants affecting each of its steps (Abernathy

and Utterback. 1978; Antoniou and Ansoff, 2004).

While several studies (e.g. see Lanzolla and

Suarez, 2007) have focused on the analysis and

investigation of what occurs after technology is

adopted, discussing the determinants of technology

use, a literature gap is found with reference to what

comes before diffusion. Indeed, few studies have

focused on the preliminary determinants leading

technology-based innovations’ uptake (Loch and

Huberman, 1999).

The seminal work from Moore (1991) goes in

this direction, by modifying the traditional

technology adoption lifecycle to underscore a “stage

and gate” approach in the process of technology

diffusion: “crossing the chasm” from early adopter

to mass market requires a number of determinants to

be positively met. Recently, the work from Ghezzi et

al. (2013) puts forward the proposal that the

traditional technology diffusion theory should be

revisited, to explicitly include the concept of

“technology activation”, which investigates the

external, non-user determinants influencing the

introduction of technology-based innovations. Such

determinants are included in the Regulation,

Environment, Strategy, Technology (REST)

framework (Ghezzi et al. 2013), which is proposed

as a theoretical tool to integrate the benefits from

both diffusion theory and strategy analysis model

(Okazaki, 2005), and which is later applied to the

Mobile Location Based Services market to assess the

market’s activation status.

This study hence aims at proposing an

application of the REST framework to the Mobile

Video Calls and the MiniDisc industries. This

application is meant to further validate the

framework and test the validity of the concept of

technology activation in different ICT domains.

2 THE REGULATION-

ENVIRONMENT-STRATEGY-

TECHNOLOGY (REST)

MODEL

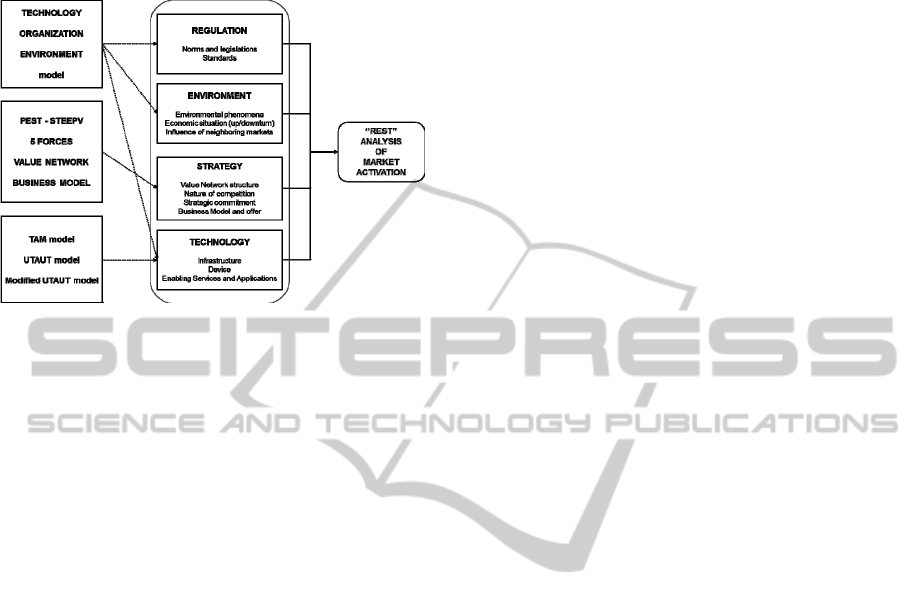

The REST model proposed in Ghezzi et al. (2013a)

assumes that market activation and technology

activation are influenced by four macro-

determinants: Regulation, Environment, Strategy,

and Technology (Figure 1).

87

Ghezzi A., Cavallaro A., Rangone A. and Balocco R..

Applications of the REST Framework to Test Technology Activation in Different ICT Domains.

DOI: 10.5220/0004889400870091

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 87-91

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

In the following paragraphs the four building blocks

of the R-E-S-T Model and their set of constitutive

core determinants are described.

Figure 1: The Regulation-Environment-Strategy-

Technology conceptual model.

2.1 Regulations

The Regulation macro-determinant deals with the

overarching framework of laws, policies,

recommendations, licenses (R1) and standards (R2)

(Farrell and Saloner, 1985; West, 2004) governing

the evolution of technology on an industry or

geographical basis. It affects the sphere of influence

and strategic choices regarding technologies made

by players both on the supply side,– i.e. firms

supplying the new technology – and the demand side

– i.e. consumer or business adopters of the new

technology.

2.2 Environment

The Environment macro-determinant consists of the

external, largely exogenous social, political,

economic and financial environment influencing the

new technology’s native business area. It includes

the following determinants.

Environmental phenomena (E1): the exogenous

phenomena and trends that impact market conditions

– e.g. the convergence of the IT,

Telecommunications and Media industries (Peppard

and Rylander, 2006). This factor can influence the

market structure, the players involved, and the

“technology pool” of products, services and

solutions that can be bundled, transformed or

developed to bring about a technology innovation.

Economic situation (E2): the overall economic

climate related to the new technology market. It

affects suppliers’ ability and intention to innovate

and launch a new technology, influencing cash flow,

R&D spending, advertising spending, etc., as well as

affecting users’ purchasing resources.

Influence of neighbouring markets (E3): the

impact of neighbouring – complementary or

substitutive – market trends on the new

technology’s market. A business area is influenced

and cross-fertilized by the conditions that

characterise related markets, which in turn can affect

technology activation status.

2.3 Strategy

Based on the widely-held assumption that strategy

design is intimately related to technology and

technological innovation (Brandenburger and

Nalebeuf, 1996), the Strategy macro-determinant

implies the Strategic landscape and structure that

characterise the market in which the technology-

based innovation is offered, and the Strategic

choices made by providers of the new technology’s

products or services. It is further divided into four

determinants.

Value Network structure (S1): the structure of

the industry, assessed in terms of a set of “static”

variables (i.e. network focal firm; critical network

influences; structural equivalence; structural holes;

revenue streams) and “dynamic” phenomena (lock-

in and lock-out effects; and learning races) (Gulati et

al., 2000; Dell’Era et al., 2013). It affects the way

value-creating activities related to technology

activation are allocated to different providers ,

responsible for organising and linking them in an

efficient and effective configuration.

Nature of competition (S2): the technology

innovation providers’ strategic attitude towards other

parties operating in the business area, which ranges

from aggressive contrast (Porter, 1980) to a hybrid

interaction process combining competition and

cooperation – or “co-opetition” (Shapiro and Varian,

1999). It influences the overall approach towards

technology innovation, whether it is consortium-led

or single entity-driven, and whether it enables or

inhibits technology activation.

Strategic Commitment (S3): the interest of

incumbent or challenger technology innovation

providers towards investing in the new technology’s

development and building a market – i.e. whether or

not innovation is perceived as a strategic priority. It

is a supply-side determinant that affects the pace of

technology evolution and commercialization.

Business Model and offer (S4): the way the

business configured around the new technology is

organised to create value for customers, and to

capture a share of such value, in terms of: the

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

88

efficiency and appeal of the technology and its

related services, and both direct and indirect

associated costs (Timmers, 1998; Teece, 2010;

Ghezzi, 2013). It is a further supply-side activation

determinant that in turn affects several modifiers of

technology diffusion as identified by TAM-derived

models (e.g. new technology’s price/performance

ratio, user and firm expected benefits, and user

experience).

2.4 Technology

The Technology macro-determinant addresses the

technology landscape in which the innovative

technology is embedded and derived, consisting of

the past and present technological choices made by

the players involved, and represented in the

following determinants.

Infrastructure (T1): the underlying enabling

technology infrastructure – e.g. traffic networks in

ICTs, Energy or Transport industries – and its core

functionalities and characteristics – e.g. capacity or

bandwidth, availability, reliability, localization

(Ghezzi et al., 2010).

Device (T2): the tools and instruments employed

by individual or business users to exploit the new

technology, and their key features – e.g. cost,

compatibility, interoperability, performance, user

experience.

Enabling services and applications (T3): the

constellation of systems, services and applications –

e.g. creation, integration and publishing tools,

management and delivery platforms, storage systems

– built on the infrastructure and enabling the new

technology’s stages of development, translation into

a set of services, and commercialization.

3 EMPIRICAL ASSESSMENT

The empirical assessment method chosen for this

study is historical analysis, i.e. the process of

assembling, critically examining, and summarizing

the records of the past (Gottschalk, 1969).

Information gathered from published sources about

the commercialization of the technological

innovations related to Mobile Video Calls was

analyzed and employed to test the importance of a

technology activation and market activation analysis

through the REST model.

In the first years of the 21

st

century, Mobile

Network Operators were looking for new revenue

generating value added services to make up for

market saturation and shrinking margins. Mobile

video calls soon became a paramount innovative

service among those tentatively launched by

Operators: some players, like H3G Italy, even made

this the core of their offer and market penetration

strategy. However, as the customer base and

revenues never took off, it became apparent that

such service and the related innovation had inherent

criticalities. Such criticalities could not have been

spotted by traditional models on technology

adoption, as they did not only refer to user

characteristics: they largely depended on the supply-

side surrounding ecosystem.

At the strategic level, the mobile value network

was neither structured not ready to support the

service, since the key players (e.g. device

manufacturers and content providers) lacked the

necessary commitment, as Operators provided them

with no incentive to craft a surrounding offer that

could have boosted the service demand; in addition

to this, the business model and revenue model built

around the service was too expensive or simply

unappealing. At the same time, technology

determinants were not activated: the network

infrastructure would have needed an expansion to

support the increased data traffic, but no player was

willing to overinvest in an innovation whose uptake

was far from being certain; the share of customers

owning a smartphone was too little at that time, and

even such devices of devices enabling video calls

had neither the characteristics nor the performance

to ensure a satisfactory customer experience. In

addition, no complementary application or service

were bundled to video-calls.

This report clearly shows that the market for

video calls was not activated when Operators first

launched their services: a lack of technology

activation hence determined the resounding market

failure they experienced.

A technology activation analysis employing the

REST model would have probably highlighted the

supply-side hurdles and pitfalls, thus sparing

Operators expensive investments.

Similar considerations and conclusions could be

drawn for other failed innovation such as MiniDisc

format, where a lack of market activation at multiple

sides covered by and unified in the REST model

(including: strategic agreements; value network;

business model; network of complementary

technology and products; ancillary services and

applications) prevented the rise of this potentially

interesting technology. At the strategic level, in fact,

there was no strategic agreement between two of the

main competitors (Sony and Philips). While Sony

introduced the MiniDisc technology, Philips focused

ApplicationsoftheRESTFrameworktoTestTechnologyActivationinDifferentICTDomains

89

on the digital compact cassette. Such choice created

marketing confusion. Moreover, MiniDisc had to

face the competition from substitutive products.

Initially when recordable compact disc (CD-R)

became more affordable to consumers, but later the

biggest competition for MiniDisc came from the

emergence of MP3 players.

Figure 2: Application of the REST framework to the

Mobile Video Calls industry.

Figure 3: Application of the REST framework to the

Minidisc industry.

Table 1 summarizes the distribution of

determinants. As can be easily seen, more than a half

of determinants in both industries caused a lack of

market activation.

Table 1: The distribution of determinants in the two

industries.

Enabling

Half-

way

Limiting

Mobile

Video

Calls

5 2 4

Minidisc 4 3 4

4 CONCLUSIONS

Innovation diffusion theory may significantly benefit

from an extension which explicitly considers uphill

determinants acting as a prerequisite or trigger of

adoption. Indeed, this extension would underscore

the inherent relationship existing between the

technological domain and the strategic, regulatory

and environmental ecosystems, where the latter may

severely influence the former’s performance.

Research on technology diffusion should hence be

more tightly connected to that on strategy: in turn,

this would create mutual opportunities for both

literature streams.

In parallel, revisiting the technology diffusion

process to include the activation phase has insightful

implications for entrepreneurs or managers dealing

with technology-based innovations.

Managers could employ the REST framework to

assess a number of issues possibly affecting the

successful launch of their innovation, ranging from

regulation, to external environment, external and

internal strategy analysis, and technological

infrastructure and applications. Thanks to the

analysis of resounding market failures like that of

Mobile Video Calls and the MiniDisc format, this

study shows how a detailed analysis of those

market’s activation status would have spared

significant amounts of resources to the companies

involved. Their poorly planned and short-sighted

eagerness to rush towards a fascinating innovation

led several managers and their companies to

commercial disasters.

This study’s contribution is to provide further

evidence of the REST framework’s validity in

additional ICT industries, thus confirming the REST

framework’s descriptive and normative power.

The study’s limitations mostly lead back to the

methodological approach taken to perform the

empirical analysis, where historical analysis might

show shortcomings in both the recollection and in

the gathering and interpretation of past events.

Future research opportunities lies in the

validation of the framework under scrutiny with

quantitative methodologies, by means of a proper

operationalization of each of its constituting

variables.

REFERENCES

Abernathy, W. J., J. M. Utterback. 1978. Patterns of

industrial innovation. Technology Review 80: 97–107.

Antoniou, P. H., H. B. Ansoff. 2004. Strategic

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

90

Management of Technology. Technology Analysis and

Strategic Management 16, no. 2: 275-291.

Lanzolla, G., F. F., Suarez. 2007. The Role of User

Bandwagon in Information Technology Use, Paper

presented at Università di Bologna, in Bologna, Italy,

April 30th, 2007.

Loch, C. H., B. A., Huberman. 1999. A punctuated

equilibrium model of technology diffusion.

Management Science 45, no. 2: 160 – 177.

Moore, G. A. 1991. Crossing the Chasm: Marketing and

Selling High-Tech Products to Mainstream

Customers. Harper Business Essentials, HarperCollins.

New York, NY.

Ghezzi, A., A. Rangone, R. Balocco. 2013. Technology

diffusion theory revisited: a regulation, environment,

strategy, technology model for technology activation

analysis of mobile ICT. Technology Analysis &

Strategic Management, 25, no. 10: 1223-1249.

Okazaki, S. 2005. New Perspectives on M-Commerce

Research. Journal of Electronic Commerce Research

6, no. 3: 160 – 165.

Farrell, J., G., Saloner. 1985. Standardization,

compatibility, and innovation. Rand Journal of

Economics 16: 70-83.

West, J. 2004. The Role of Standards in the Creation and

Use of Information Systems. Paper presented at the

Workshop on Standard Making: A Critical Research

Frontier for Information Systems, Seattle, WA, 2004,

pp. 314-326.

Peppard, J. R., Rylander. 2006. From Value Chain to

Value Network: an Insight for Mobile Operators.

European Management Journal 24, no. 2: 57–68.

Brandenburger A. M., and B. J., Nalebeuf. 1996. Co-

opetition. New York, NY: Currency.

Gulati R., N., Nohria, A., Zaheer. 2000. Strategic

Networks. Strategic Management Journal 21: 203-

215.

Dell’Era C., Frattini F., Ghezzi A., 2013. The Role of the

Adoption Network in the Early market survival of

Innovations: the Italian Mobile VAS Industry.

European Journal of Innovation Management, Vol. 13,

Issue 1, pp. 118-140.

Porter ME. 1980. Competitive Strategy: Techniques for

Analyzing Industries and Competitors. Free Press:

New York.

Shapiro, C., and H. R., Varian. 1999. Information rules. A

strategic guide to the network economy. Harvard

Business School Press. Boston, MA.

Timmers P. 1998. Business models for electronic

commerce. Electronic Markets 8, no.2: 3-8.

Teece J. 2010. Business Models, Business Strategy and

Innovation. Long Range Planning. 43, no.2-3:172-

194.

Ghezzi A. 2013. Revisiting Business Strategy Under

Discontinuity. Management Decision, Vol. 51, Issue 7,

1326-1358.

Ghezzi A., Balocco R., Renga F., Pescetto P. 2010.

Mobile Payment Applications: offer state of the art in

the Italian market. Info. 12(5): 3-22.

Gottschalk, L. R. 1969. Understanding history: a primer

of historical method. Knopf, New York.

ApplicationsoftheRESTFrameworktoTestTechnologyActivationinDifferentICTDomains

91