Supporting Process Model Development

with Enterprise-Specific Ontologies

Nadejda Alkhaldi

1

, Sven Casteleyn

1,2

and Frederik Gailly

3

1

Vrije Universiteit Brussel, Pleinlaan 2, 1050 Brussels, Belgium

2

Universitat Jaume I, Av. De Vicent Sos Baynat s/n, 12071 Castellon, Spain

3

Ghent University, Tweekerkenstaart 2, 9000 Gent, Belgium

Keywords: Enterprise Modelling, Enterprise Ontology, Ontology-driven Modelling, BPMN.

Abstract: Within an enterprise, different models – even of the same type - are typically created by different modellers.

Those models use different terminology, are based on different semantics and are thus hard to integrate. A

possible solution is using an enterprise-specific ontology as a reference during model creation. This allows

basing all the models created within one enterprise upon a shared semantic repository, mitigating the need

for model integration and promoting interoperability. The challenge here is that the enterprise-specific

ontology can be very extensive, making it hard for the modeller to select the appropriate ontology concepts

to associate with model elements. In this paper we focus on process modelling, and develop a method that

uses four different matching mechanisms to suggest the most relevant enterprise-specific ontology concepts

to the modeller while he is creating the model. The first two utilize string and semantic matching techniques

(i.e., synonyms) to compare the BPMN construct’s label with enterprise-specific ontology concepts. The

other two exploit the formally defined grounding of the enterprise ontology in a core ontology to make

suggestions, based on the BPMN construct type and the relative position (in the model). We show how our

method leads to semantically annotated process models, and demonstrate it using an ontology in the

financial domain.

1 INTRODUCTION

When different models within an enterprise are

created by different modellers, integrating those

models is hard. This is known as the correspondence

problem (Fox and Grüninger, 1997). A possible

solution for this integration problem is providing

modellers with a shared vocabulary formalized in an

ontology (Bera et al., 2009). Over the last 30 years,

different domain ontologies have been developed

which describe the concepts, relations between

concepts and axioms of a specific domain. In a

business context, a particular type of domain

ontologies is so-called enterprise ontologies. They

describe the enterprise domain and consequently

provide enterprise domain concepts that can be

reused by different enterprises. Example of

enterprise ontologies include the Enterprise

Ontology (Uschold et al., 1998), TOVE (Fox, 1992)

and the Resource Event Agent enterprise ontology

(Gailly et al., 2008). Two different approaches have

been proposed to incorporate enterprise ontologies

into the modelling process. Some authors consider

enterprise ontologies to be reference models that

support the creation of different kind of models. For

instance, (Fox and Grüninger, 1997) suggests

developing the Generic Enterprise Model as an

ontology that is later used as a reference for creating

both data and process models. Other authors

developed an enterprise-specific modelling language

which is based on the concepts, relations and axioms

described in the enterprise ontology (Sonnenberg et

al., 2011). There are also works proposing a process

ontology to be used specifically for process models,

e.g., (Klein and Bernstein, 2001), (Schlenoff et al.,

1998) and (Haller et al., 2008). These works are

mainly concentrating on constructing those

ontologies, rather than supporting the modeller that

needs to use them.

In this paper we focus on using enterprise-

specific ontologies (ESO) during the development of

business process models. Enterprise-specific

ontologies are domain ontologies that differ from

enterprise ontologies in the fact that their Universe

236

Alkhaldi N., Casteleyn S. and Gailly F..

Supporting Process Model Development with Enterprise-Specific Ontologies .

DOI: 10.5220/0004899402360248

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 236-248

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

of Discourse is a specific enterprise, rather than the

enterprise domain. They may have their origin in an

established domain ontology or in an enterprise

ontology, but their main goal is describing the

concepts, relations and axioms that are shared within

a particular enterprise. Enterprise-specific ontologies

are getting increasingly important in the context of

Data Governance and knowledge representation

(Bera et al., 2011). Supporting tools, such as IBM

InfoSphere

1

or Collibra Enterprise Glossary

2

allow

enterprises to specify their own enterprise

glossary/ontology. Such an enterprise-specific

ontology, once available, can subsequently be

deployed to help enterprise modellers in creating

compatible, enterprise-specific models, such as

requirements, data or process models. This paper

focuses on business process models, and presents

mechanisms for assisting the business process

modeller by suggesting relevant terms while he is

constructing models, based on the enterprise-specific

ontology. Indeed, enterprise workers sometimes do

not know which knowledge they need to perform

their work (Bera et al., 2011), do not know all the

concepts they need to make their models and/or do

not know the agreed upon terminology. By

providing a limited set of relevant concepts to the

modeller, originating from the enterprise-specific

ontology, we effectively help him in his modelling

task, while promoting cross-model reuse of existing

concepts. The use of the enterprise-specific ontology

furthermore allows to semantically annotate

modelling elements in the resulting models, thereby

ensuring compatibility and integrateability of

different models.

The work described in this paper is part of a

larger framework for ontology-driven enterprise

modelling aimed to facilitate model construction

based on an enterprise-specific ontology on one

hand, and support enterprise-specific ontology

creation and evolution based on feedback from the

modelling process on the other hand. The framework

thus explores the symbiotic relationship between the

models and the ontology. This paper elaborates two

phases of the framework, namely the enterprise-

ontology-based model suggestion mechanisms, and

the model creation process. Other phases are not

elaborated here. To illustrate our work, we use the

Unified Foundational Ontology as core ontology,

OWL as ontology representation language and

BPMN as business process modelling language.

1

http://www-01.ibm.com/software/data/infosphere/

2

http://www.collibra.com/

2 ENTERPRISE-SPECIFIC

ONTOLOGY AND

MODELLING META-METHOD

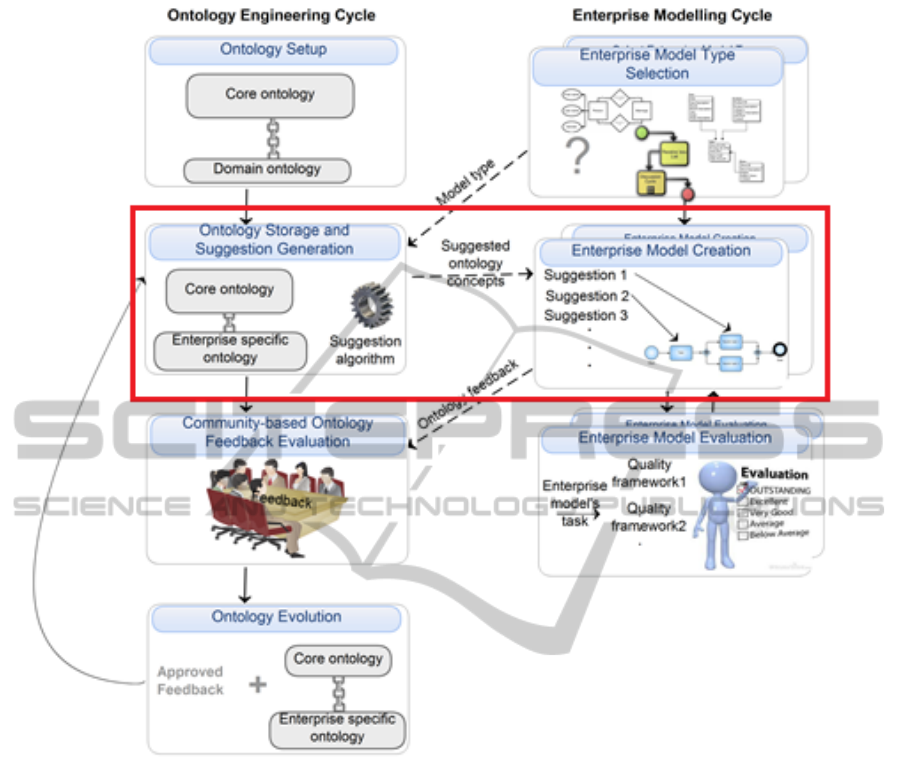

As displayed in Figure 1, the previously outlined

framework (i.e., a meta-model) consists of two

parallel cycles: an ontology engineering cycle and

enterprise modelling cycle. Before a model can be

created, the enterprise-specific ontology needs to be

set up (Ontology Setup Phase in Figure 1). More

specifically, if not yet previously done, the concepts

and relationships contained in the enterprise-specific

ontology

3

(ESO) are analysed using a core ontology.

A core ontology is an ontology that describes

universally agreed upon, high level concepts and

relations, such as objects, events, agents, etc.

Grounding the enterprise-specific ontology in a core

ontology provides well-founded semantics, and

facilitates the modelling suggestion mechanisms (see

further). Once the enterprise-specific ontology is set

up, the enterprise modelling cycle starts with the

modeller selecting a model type (Enterprise Model

Selection phase), such as i*, ER, BPMN, Petri net,

etc. In our method, modelling languages that were

previously analysed using the same core ontology as

the ESO are particularly useful, as these facilitate

particular modelling suggestions based on the

enterprise-specific ontology, and using the core

ontology as an intermediary (see section 3). While

creating constructs in the model (Enterprise Model

Creation phase), aided by suggestions generated

based upon the ESO (Ontology Storage and

Suggestion Generation phase), the model is

automatically annotated with ESO concepts/relations,

and the modeller reports feedback on ontology

content: missing concepts or relations, or inaccurate

ones. When the model is finished, model quality is

evaluated (Enterprise Model Evaluation phase) and

once it satisfies certain quality standards, the

reported feedback is presented to the enterprise

stakeholders (i.e., analysts, modellers, developers,

managers, etc.) for discussion (Community-based

Ontology Feedback Evaluation phase). If this

community decides the feedback is valuable within

the context of the enterprise, it is added to

the enterprise-specific ontology (Ontology Evolution

phase), thus representing the evolution of the

ontology in a new version that corresponds better to

the business reality of the enterprise.

The proposed meta-method is unique because we

3

If no ESO is available, it can either be constructed from scratch,

or an existing domain ontology covering the business domain of

the enterprise may serve as a starting point.

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

237

Figure 1: Enterprise-specific ontology and modelling meta-method.

do not focus on a specific modelling language, and

we furthermore aim to exploit the symbiotic

relationship between the enterprise modelling cycle

and the ontology engineering cycle. Nevertheless,

several researchers have already performed research

isolated in a single phase of the meta-method.

Relevant for this article, several researchers have

investigated how business process models can be

semantically annotated using ontologies. (Liao et al.,

2013) describe how processes and subprocesses can

be annotaed by sets of ontology concepts. In (Lin

and Krogstie, 2010) the authors perform different

kinds of annotation on process models, including

profile, meta-model, model and goal annotation. Of

these annotations, model annotations are

immediately relevant for our work, which are stored

in a Process Semantic Annotation Model, along with

the elements of that model. In both these works, the

proposed method seems to be manual, and does not

focus on providing suggestions while the model is

under construction. Next to business process model

annotation, different researchers have also

investigated how natural Language Processing

techniques can be used while creating business

process models. For an overview we refer to

(Leopold, 2013). The focus here mainly lies with

extracting information and adding semantic

annotations to exiting models, rather than assisting

the modeller during modelling as in our work.

This paper focuses on the second phase of both

the ontology engineering and enterprise modelling

cycles. More specifically, it explains the

mechanisms that provide suggestion for the labels of

modelling construct suggestions to the modeller,

based on the enterprise-specific ontology, and details

how models are created and annotated with

enterprise-specific concepts.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

238

3 SUGGESTION GENERATION

MECHANISMS

Our suggestion generation algorithm returns a

customized suggestion list of ESO concepts for (the

label of) every BPMN construct selected by the

modeller and placed on the canvas. Given the

potentially extensive amount of ESO concepts,

relevance ranking of suggestions is a critical feature.

Depending on the type of modelling construct that is

added, the position of the construct relevant to other

elements (i.e., its neighbourhood) in the model, and

the label entered by the modeller, the order of the

suggestion list is prioritized so that ontology

concepts with a higher likelihood to be relevant in

the current context appear first. To achieve this, four

different suggestion generation mechanisms are used

(Figure 2). These mechanisms are partly inspired by

ontology matching techniques, (Euzenat and

Shvaiko, 2013) but are specifically focused to fit

within our framework, where the semantics of the

modelling language (i.e., BPMN) meta-model can be

exploited. The first mechanism is the use of string

matching based on the BPMN element’s label

(partially or in full entered by the modeller). The

second is synonym matching, which retrieves

synonyms of the BPMN element’s label and verifies

whether there are syntactically equivalent concepts

in the ESO. The third mechanism derives

suggestions based on the relation between the

constructs of the modelling language (i.e. BPMN)

and the ESO concepts, using the core ontology (i.e.,

UFO) as intermediary. We call this “construct

matching”. The last suggestion generation

mechanism derives suggestions from the position of

a given BPMN construct relative to other elements

in the BPMN model. We call this “neighbourhood-

based matching”.

Every matching technique calculates a relevance

score (between 0 and 1) for each ESO concept,

which is stored. Subsequently, the overall relevance

score is calculated using a weighted average of all

individual scores. This corresponds to the formula

below:

Where:

: the score and weight of string match

: the score and weight of synonym match

: the score and weight of construct match

: the score and weight of neighbourhood based

match

The weights for each matching mechanism are

thus configurable. In our demonstration (see section

4), we assigned a higher weight to string matching

as we expect that, within a particular enterprise

context, a (quasi) exact string match has a high

possibility of representing the intended (semantic)

concept. The lowest weight is assigned to construct

matching, because it typically matches very broadly,

and thus delivers a large amount of suggestions.

Further experimentation with the distribution of

weights over the individual relevance scores should

be performed to determine an optimal overall score

calculation. This is considered future work. As a

final result, the suggestion list, a descending ordered

list of ESO concepts according to relevance, is

generated and presented to the modeller. In the next

four subsections the different mechanisms are

described in more detail. The implementation of the

mechanisms can be consulted via our Github

repository: https://github.ugent.be/MIS .

Figure 2: Suggestion generation algorithms.

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

239

final result, the suggestion list, a descending ordered

list of ESO concepts according to relevance, is

generated and presented to the modeller. In the next

four subsections the different mechanisms are

described in more detail. The implementation of the

mechanisms can be consulted via our Github

repository: [URL suppressed for blind review].

3.1 String Matching Mechanism

The goal of the string matching algorithm is to find

ESO concepts whose label is syntactically similar to

the label of BPMN elements entered by the modeller.

If these two strings are syntactically the same, there

is a high possibility that they have the same

semantics, especially as both reside within the same

enterprise and business context.

The string matching mechanism thus finds ESO

matches based on the text entered by the modeller as

label for a modelling (i.e., BPMN) element. There

are many ways to compare strings depending on

whether the string is seen as an exact sequence of

letters, an erroneous sequence of letters or a

substring of a set of words. Currently we use the

Jaro-Winkler distance (Winkler, 1990) to calculate

the edit distance between the given BPMN element

label, and the label of each concept in the enterprise-

specific ontology. The Jaro-Winkler distance was

chosen because this hybrid technique takes into

account that the text entered by the modeller can

contain spelling errors, and additionally favours

matches between strings with longer common

prefixes (i.e., a substring test, which is very useful in

our context because matching is executed each time

a character is added to the label).

Jaro-Winkler distances are between 0 (no

similarity) and 1 (exact match), and are thus

immediately useable as a relevance score. For some

modelling constructs, only a part of the label is

matched. For example, tasks’ names in process

models are often specified as a <verb> <noun>

combination (Dumas, La Rosa, Mendling and

Reijers, 2013), and our method only seeks to find

matching for the <noun> part of the label, as only

this part can correspond to a concept in the ontology.

In general, for the following BPMN constructs the

full label is being matched: pool, lane, message flow

and data object. Conversely, for the following

BPMN constructs, only partial matching is

performed: task, sub-process, event and conditional

gateway. The labels of these constructs are analysed

using standard natural language parsing techniques,

which allow identifying the nouns within the labels.

3.2 Synonym Matching Mechanism

The synonym matching mechanism aims to detect

synonyms of the given BPMN element label (or part

of it) in the ESO. To realize this, we use WordNet

(Miller, 1995), an online lexical database that

organises English nouns, verbs, adjectives and

adverbs into sets of synonyms (so-called synsets). It

is thus ideal to find synonyms. For each synonym of

the BPMN element label, the previously described

string matching algorithm is performed on all ESO

concepts, thereby generating a relevance score

between 0 (no match) and 1 (exact synonym match).

Synonym matching allows the modeller to find

concepts that are semantically similar, but for which

he used a different label. For example, while the

modeller enters the label “customer”, the concept

“client” might be available in the enterprise-specific

ontology, and should be given as a suggestion.

Synonyms are semantically equivalent words, but

their usage depends on a certain domain. Therefore,

this mechanism may generate false positives, in case

synonyms in a different context/domain are matched.

As we are operating within one particular domain,

namely that of the enterprise, the chance of false

positives is low.

3.3 Construct Matching Mechanism

The construct matching algorithm finds ESO

suggestions based on the type of modelling

constructs the modeller choses. To do so, the

algorithm exploits the grounding of (i.e., mappings

between) ESO concepts and a core ontology on one

hand, and mappings between the constructs of the

modelling language (i.e., BPMN) meta-model and

the (same) core ontology on the other hand. The core

ontology thus acts as an intermediary between the

ESO and (the meta-model of) the chosen modelling

language. The core ontology that we used in this

paper is the Unified Foundational Ontology (UFO),

for three reasons: 1/ the benefits of grounding

domain ontologies in UFO are well motivated

(Guizzardi, Falbo and Guizzardi, 2008), and several

such UFO-grounded domain ontologies are available,

e.g., (Barcellos, Falbo and Moro, 2010) 2/ UFO is

specifically developed for the ontological analysis of

modelling languages, and 3/ an analysis of BPMN

using UFO is available in literature (Guizzardi and

Wagner, 2011), and can thus be re-used. No claim is

made here that UFO alone is sufficient to find the

match. However, using UFO’s predefined

categories, according to which ESO concepts and

BPMN constructs are classified, allows to guide

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

240

construct-based matching and narrow down the

relevant suggestions. UFO has different layers of

which we here only use UFO-U (represented in

Figure 2), as this is sufficient for finding construct-

based matches between BPMN and ESO. Our

demonstration supports this claim; however, it can

be further investigated if using (full) UFO is

beneficial to refine our algorithm. Additionally,

other modelling languages might require more

specialized UFO concepts, in which case (full) UFO

will be needed. The top level element in UFO-U is a

Universal. It represents a classifier that classifies at

any moment of time a set of real world individuals

and can be of four kinds: Event type, Quality

universal, Relator universal and Object type.

Grounding the enterprise ontology in the UFO

ontology is either done manually, as shown in our

demonstration in section 5, or given when an

existing domain ontology that was previously

grounded, is re-used as initial enterprise ontology.

This effort is thus domain- or even enterprise-

specific. On the other hand, the mapping between

the modelling language’s meta-model and the UFO

ontology is generally applicable, and several

mappings are available in literature, e.g., UML

(Guizzardi and Wagner, 2008), BPMN (Guizzardi

and Wagner, 2011).

We can thus re-use the mapping provided by

(Guizzardi and Wagner, 2011) for UFO - BPMN.

However, in (Guizzardi and Wagner, 2011), the aim

was to perform an in depth ontological analysis of

BPMN, thus providing the mapping between UFO

and BPMN. As we limited the used core ontology to

UFO-U, which is sufficient to find matches between

BPMN and the ESO, we need to adjust the mappings

provided by (Guizzardi and Wagner, 2011). Once

Figure 3: UFO-U.

Figure 4: BPMN meta-model.

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

241

Table 1: Mappings between BPMN constructs and UFO-U.

BPMN construct UFO-U BPMN construct UFO-U

Pool Object type End event Event Type

Lane Object type Event noun Base type, Mixin type,

Relator universal

Task Noun Relator universals or

quality universal

Condition Exclusive

Gateway

Quality universal

Noun Sub Process Relator universals or

quality universal

Data object Relator universal,, Base

type

Start event Event Type Message flow label Relator universal

Intermediate event Event Type

given, this adjusted mapping is re-usable by any

subsequent BPMN modelling efforts. The BPMN

meta-model that is used in this paper is shown in

Figure 4 and is based on the original OMG BPMN

standard.

Table 1 represents the mappings between the

constructs of the BPMN meta-model and UFO-U.

Limiting the match to UFO-U concepts means that

for instance both the Pool and Lane constructs are

mapped to UFO Object types whereas in (Guizzardi

and Wagner, 2011) they are mapped to Agents,

which is a special type of UFO-U Object type. In

(Guizzardi and Wagner, 2011) a task is mapped to

an Action Event Types, which is a special kind of

Event. In this paper we extend this mapping based

on the observation that a lot of well-known BPMN

textbooks such as (Dumas, La Rosa, Mendling and

Reijers, 2013) suggests BPMN modellers to follow

the pattern “verb noun” when specifying the name of

task. The noun that is used corresponds to a UFO-U

relator or quality universal. The mappings of a

subprocess are identical to those of the Task

construct.

The different types of BPMN Events are all

mapped to UFO-U Event Type. It is important to

notice that in most cases the ESO will not contain

UFO-U events, as ESOs most often focus on the

static part of the vocabulary of the enterprise, i.e.,

similar to the view on domain specific ontologies in

(Lin et al., 2006). However, for every BPMN model,

we can search for UFO-U objects that participate in

these events. Gateways are not mapped directly to

UFO-U concepts but for an exclusive data-based

gateway we can expect that the condition that is

evaluated will use properties of UFO Object Types

or UFO Relator Types which in UFO-U correspond

to qualities. Data objects and message flow objects

are most likely to be relators, such as contract, or

base types such as technical documentation of some

software. The association and sequence flow

connectivity objects of the BPMN meta-model are

not mapped to UFO-U, but they will be used

extensively in the construct neighbourhood-based

mechanism (see section 3.4).

To formalize these mappings, we first

transformed both UFO-U and the BPMN meta-

model into OWL ontologies

4

, using the

transformations provided by OMG’s Ontology

Definition Meta-model (OMG, 2006), and

subsequently formalized the mappings between the

constructs of these ontologies using a third OWL

ontology

5

. Using OWL for both representing the

ontologies and the mappings has some advantages: 1)

OWL supports different approaches for specifying

the mapping (OWL equivalent classes, SWRL rules),

2) OWL supports reasoning which will be used to

generate the list of suggestions based on the

provided mappings and 3) OWL uses URIs to

identify the concepts which will be used during the

annotations of the models.

The actual mappings in the OWL mapping

ontology are specified using the OWL equivalent

class construct. The mapping ontology consists of

the UFO-U to BPMN mappings and the UFO-U to

ESO mappings, both of which are specified

separately and subsequently imported. Next, a

reasoner is used to create an inferred class hierarchy

of ESO concepts that are matched to a given BPMN

construct. For instance, when a BPMN pool is

created the inferred class hierarchy is used to

determine all subclasses of BPMN pool (i.e., UFO-U

concepts). Subsequently, all ESO concepts related to

these subclasses (using the UFO-U to ESO mapping)

will receive the relevance score of 1.0, while all the

other ESO concepts will be considered irrelevant

and will receive a relevance score of 0. This

mechanism has been implemented using the OWL

Java API and is available from the GitHub

repository.

4

Download from: https://github.ugent.be/MIS/Ontology

BasedSuggestionAlgorithms

5

Download from: https://github.ugent.be/MIS/ Ontology

BasedSuggestionAlgorithms

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

242

3.4 Neighbourhood-based Mechanism

Before the element neighbourhood-based

mechanism is described, we first explain how

ontology annotations are stored, as existing

annotations are used by this mechanism. In order not

to jeopardize the re-usability of our suggestion

generation mechanism among different tools, we

choose not to extend the BPMN meta-model with

annotation elements. Instead, we opted to create, for

every BPMN model, an OWL ontology that contains

instantiations of the BPMN OWL classes. When a

modeller decides to annotate a newly created

element with an ESO concept, a URI of the

corresponding OWL ESO concept is added to the

OWL BPMN individual using the OWL annotation

mechanism. In this way, it is always possible to refer

from the BPMN model elements to the reference

ESO concepts.

With the annotation mechanism explained, we

now detail the element neighbourhood-based

mechanism, which calculates relevance scores for

ESO concepts based on the location of the BPMN

element that is added to the model, the type of

construct that is added, and the relationships

between the ESO concepts. The neighbourhood of a

BPMN element is determined by the connectivity

objects (i.e. sequence flow, message flow,

association), and the lanes recursive relationship of

the BPMN meta-model. In other words, for every

element we can determine which pool or lane it is a

part of, and which other element(s) is/are connected

to this element using either a sequence, message

flow or association. Next, the relationships (which

are specified in terms of the UFO-U relationships

through the ESO-UFO-U mappings) between the

ESO concepts are exploited. According to

(Guizzardi and Wagner, 2008) there are two types of

relations: formal and material. Formal relation

holds between entities directly without any further

intervening individuals. Material relation has

material structure on its own. Entities related by this

type of relation are mediated by individuals called

relators. In section 4 we will demonstrate how the

UFO-U relators can be used to specify the material

relations between the ESO concepts.

Finally, using both the relative position of the

new element and the material relations between the

ESO concepts, the element neighbourhood-based

mechanism can now derive relevance scores for

ESO concepts in relation to some BPMN model

construct (for examples, see section 4):

1. To create a pool construct when another pool

already exists, the suggestions (relevance score 1)

are UFO-U object types that are related by a

material relationship with the ESO concept with

which the existing pool(s) was/were annotated

(i.e., the ontology annotations of the pool(s)).

2. To create a lane construct within a pool, the

suggestions (relevance score 1) are UFO-U

object types that are related by a material

relationship with the ontology annotation of the

pool(s)

3. To create a message construct that results in

transmitting a message between a task or event

of a pool and another pool, the suggestions

(relevance score 1) are UFO-U relators

mediating material relations connecting objects

that annotate respectively the noun of the task

and the ontology annotation of the pool.

4. To create a conditional gateway, there are two

ways to derive suggestions (both receive

relevance score 1):

ESO concepts annotated by the task label

preceding the gateway. This can work very

well for tasks that are performing evaluation

or calculation, after which the gateway is

used to make a decision based on the results.

In this case, the condition on the gateway will

use the same concept as used in the task.

This concept is most likely to be a quality,

especially if the task at hand is performing

calculations. Nevertheless, it can also be a

relator, such as for example verifying if the

contract is ok or not.

Qualities associated with the UFO-U object

type annotation of the pool where the

gateway is located. Or UFO-U qualities

associated with UFO-U object types

participating in material relations with Object

type annotation of the pool where the

gateway is located.

5. For creation of a task construct, the suggested

concepts are most likely to be related through

material relations to the pool where the task is

located. The suggestions can be either object

types or relators mediating those material

relations.

The implementation of this mechanism is more

complex because the algorithm needs to not only

know the location (relative to other elements) of the

new element but also the annotations of the

modelling elements to which the modeller plans to

connect the new element. As mentioned in the

beginning of this section, an OWL ontology file is

created for every model; it contains individuals that

instantiate the BPMN OWL classes. This file, in

particular the instantiations of connectivity concepts,

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

243

is used to determine the position of the newly

created element. Next for selected connected

element (i.e., those satisfying one of the previous 5

rules) the algorithms checks whether it contains an

ESO ontological annotation. In case the surrounding

element is annotated, the algorithm uses a SPARQL

query to identify to which ESO concepts the

ontological annotation is related. The ESO concepts

that are returned by this query consequently receive

a weight of 1.

4 DEMONSTRATION

This section illustrates the method explained in the

previous sections by means of a lab demonstration in

which the modeller constructs a process model in the

Table 2: Mappings between ESO concepts and UFO.

ESO concept UFO-U ESO concept UFO-U

AddedValue Quality_Universal Liability Relator Universal

Mediates Customer and

mediates Branch

Adminstrative Role_Type Loan Relator Universal

Mediates some X and

mediates some X

Asset Mixin Type MortgageLoan Relator Universal

Mediates some X and

mediates some X

Branch Base_Type Payment Relator Universal

Mediates some X and

mediates some X

Channel Relator Universal

Mediates some

Customer and

mediates some Bank

Person Base_Type

Collection Quality_Universal Product Mixin_Type

Commercial Role_Type ProductRateApplication Quality_Universal

Company Base_Type ProductRateApplication

Fixed

Quality_Universal

Corporative Base_Type ProductRateApplication

Fixed

Quality_Universal

Currency Base_Type ProductRateApplication

Variable

Quality_Universal

CurrentMortgageLoan Relator Universal

Mediates some X and

mediates some X

Quota Quality_Universal

Customer Mixin_Type SME Base_Type

Department Base_Type SOHO Base_Type

Employee Role_Type SavingsAccount Base_Type

FutureMortgageLoan Relator Universal

Mediates some X and

mediates some X

Service Mixin_Type

Individuals Base_Type ServiceContractBy

Customer in Chanel

Mixin_Type

InvestmentAccount Base_Type Staff Role_Type

InvestmentFund Base_Type User Mixin_Type

Invoice Relator Universal

Mediates some X and

mediates some X

vBanking Base_Type

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

244

financial domain using an existing financial domain

ontology

6

as enterprise-specific ontology. This

ontology contains static concepts related to finance,

such as Branch, Customer, Loan, Insurance, etc.,

which can be used as a reference for models

constructed in the financial domain. As a first step,

the ESO needs to be mapped to the UFO-U core

ontology. This classification is part of the ontology

engineering cycle of our method and is performed

during the ontology setup phase. Table 2 represents

the mapping, which is formalized in OWL and can

be downloaded from our repository. Important to

notice is that in our mapping, when an ESO concept

is classified as a Relator we also link this Relator to

the Object Types it connects. For example, a relator

Loan is relating Branch and Customer entities. The

ESO also contains OWL data properties, which are

all considered to be quality universals because they

depend on the universals they are related to. For

example, Expiration Date of a Product is a quality

universal because it depends on the universal

Product.

Once the ESO is grounded in the core ontology

(as mentioned, this only needs to be done once, and

can subsequently be re-used for any model created

within the enterprise), the modeller can start creating

the process model. He selects a construct to be

added, places it on the canvas and starts typing the

construct’s desired name. As he selects the construct,

and as he is typing, the mechanisms described in the

previous section derive suggestions from the ESO

and present them to the modeller. If an ESO concept

in the suggestion list appropriately corresponds to

the intention of the modeller for this particular

BPMN construct, he selects this concept, and the

BPMN construct is (automatically) annotated with

the chosen ESO concept.

The process model to be created in our lab

demonstration represents the loan application

assessment process in a bank, and is taken from

(Dumas, La Rosa, Mendling and Reijers, 2013). By

using an existing specification, we avoid bias

towards our method. The process starts when the

loan officer receives a loan application from one of

the bank’s customers. This loan application is

approved if it passes two checks: the first check is

the applicant’s loan risk assessment, which is done

automatically by the system after a credit history

check of the customer is performed by a financial

officer. The second check is a property appraisal

check performed by the property appraiser. After

both checks are completed, the loan officer assesses

6

http://dip.semanticweb.org/documents/D10.2eBankingCaseStudy

DesignandSpecificationofApplicationfinal.pdf

the customer’s eligibility. If the customer is found to

be not eligible, the application is rejected. Otherwise,

the loan officer starts preparing the acceptance pack.

He also checks whether the applicant requested a

home insurance quote. If he did, both the acceptance

pack and the home insurance quote are sent to the

applicant. If the insurance was not requested, only

the acceptance pack is sent. The process finally

continues with the verification of the repayment

agreement

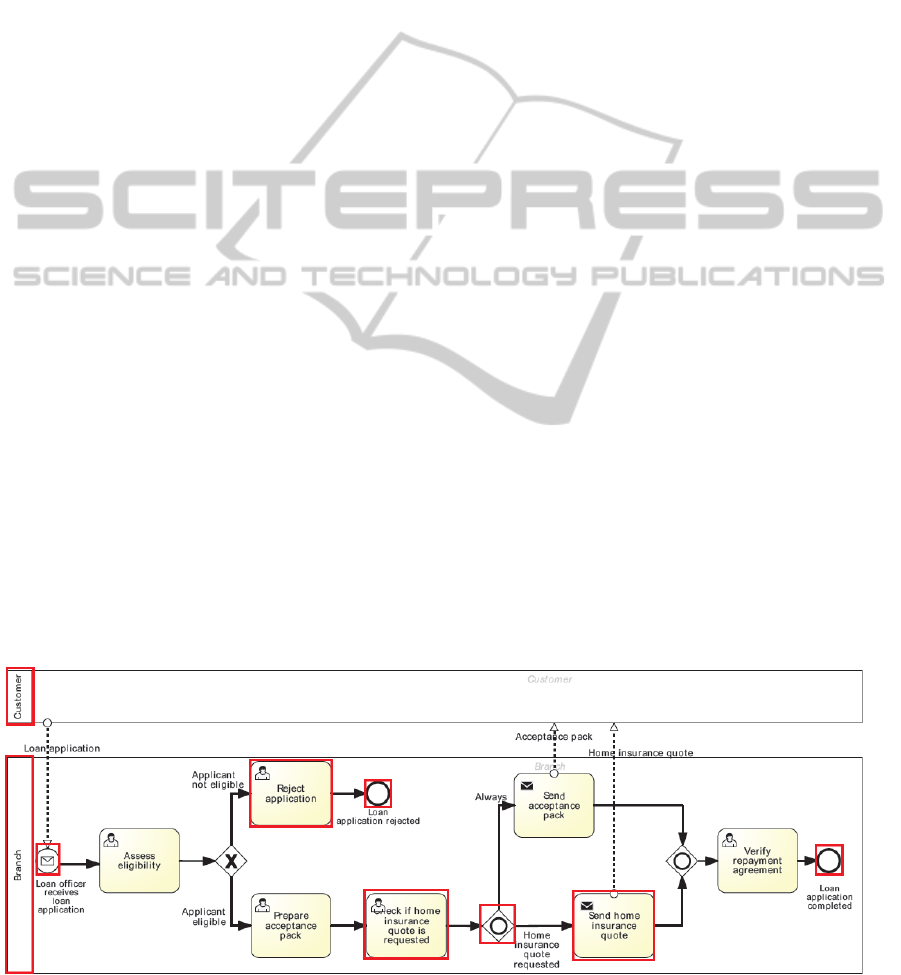

Figure 5 represents the BPMN model of the loan

application process. Constructs that are surrounded

by a thick red square are annotated with ESO

concepts. At this stage, a full visual BPMN

modelling tool that implements the suggestion

generation algorithms is still under development.

However, the suggestion algorithm itself, including

all four suggestion mechanisms, is implemented as a

stand-alone engine, and available from the

repository (i.e., the BPMNSuggestionEngine class).

In the remainder of this section the suggestion

generation algorithms described in section 3 is

demonstrated for the different illustrative scenarios.

Adding Branch Pool: the modeller selects the

pool construct to be created. Based on the construct

matching mechanism all ESO concepts

corresponding to UFO-U object type are given a

relevance score of 1 for this matching mechanism.

Among those concepts the modeller can find Branch

which is classified as UFO-U base type. If there is

already a “Customer” pool, based on the construct

neighbourhood matching mechanism, this case

corresponds with rule 1. As the already existing pool

is the Customer pool, the mechanism looks for ESO

concepts related to the Customer concept through

material relationships. There is only one concept

satisfying this requirement: Branch. As a result, the

Branch concept is listed in the beginning of the

suggestion list, as it scored for both the construct

and neighbourhood matching mechanisms (and no

other concept scored equal or higher). Note that in

this scenario, string and synonym matching cannot

contribute to the overall relevance score yet, as the

modeller did not (yet) type any label.

Adding Message flow “loan Application”:

According to the construct matching mechanism,

message flow corresponds to the relator universal.

Therefore, all ESO concepts corresponding to the

UFO-U relator universal will be selected. Those

concepts are: Channel, loan, mortgage loan, current

mortgage loan, future mortgage loan, invoice,

liability, payment. For the element neighbourhood-

based matching technique this situation resolves

under rule 2.

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

245

In our enterprise-specific ontology, all relator

universals are mediating the same two concepts

Branch and Customer. Therefore, the results

delivered by this suggestion generation technique

are the same as the results delivered by construct

matching. In this case, the previously mentioned

suggestions all have equal overall score, and can

thus not be prioritized. We therefore present them

alphabetically. The modeller may select a concept

from the list (i.e., “loan”), or, in case the list is too

long, start typing any desired label (e.g., “loan” or

“credit”). This triggers the string- and synonym-

based matching mechanisms, both of which

prioritize the concept Loan, which consequently

appears on top of the suggestion list, and is selected

by the modeller to annotate the loan application

message flow.

Adding Reject Application Task: The modeller

selects the BPMN task construct, and subsequently

the construct matching mechanism assigns a high

relevance score to all ESO concepts that correspond

to UFO-U quality and relator universals as

suggestions for the task noun. A list of relator

universals is mentioned in the previous example; a

list of quality universals is very exhaustive and is

thus not mentioned here. The second mechanism,

element neighbourhood based matching, applies rule

3: the task at hand is located in the Branch pool, so

this matching mechanism suggests all the ESO

concepts corresponding to UFO-U relator universals

related to Branch concept in the ESO, and UFO-U

object types mediated by those relators (all with

relevance score 1). The Loan concept is a relator

universal, and therefore received relevance score of

both matching mechanisms; it therefore appears on

the top of the suggestions list.

Adding “Home Insurance Quote is Requested”

Gateway: In the last scenario, the modeller draws an

inclusive decision gateway on the canvas. Based on

construct matching mechanism, all quality

universals will be assigned a priority score of 1. The

element neighbourhood-based mechanism classifies

this situation under rule 4, which suggests ESO

concepts that were used to annotate a task construct

preceding the gateway. In this case it is the “check if

home insurance quote is requested” task, which is

annotated with the Home Insurance concept. This

concept thus receives relevance score 1 for the

gateway, and is prioritized in the suggestion list. It

perfectly matches our needs.

To start the discussion, we note that the scenarios

elaborated here were chosen to illustrate the more

complicated cases. As a result, string- and synonym-

based matching mechanism are underrepresented.

Evidently, when no or few BPMN elements are

already on the canvas, neighbourhood-based

matching will be unable to sufficiently differentiate

between potential suggestions (as in scenario 2), and

string- and synonym-matching will become

important. Equally, when the modeller has a certain

label already in mind, string- and synonym matching

will dominate the suggestion list, as the modeller is

typing the label he had in mind. Having made this

comment, we note that in general, it was possible to

derive suggestions based on the construction and

element neighbourhood matching mechanisms for

all model constructs for which the related concepts

existed in the ontology. In fact, as can be seen in the

scenarios, construct and neighbourhood based

matching complement each other well. The majority

of the concepts required by the model, but missing

from the ontology were also correctly classified

under the assumptions of neighbourhood-based

matching mechanism, and would have been assigned

Figure 5: BPMN model describing loan application.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

246

a high relevance score if they would have been

present in the ontology. However, there was one

case where the neighbourhood-based matching

mechanism was not very accurate. While creating

the last message flow “Home insurance quote”,

based on the second assumption of the

neighbourhood-based matching mechanism and the

construct matching mechanism, relator universals

must be suggested. But in reality, it was annotated

with a quality universal HomeInsurance, instead of a

relator. Further fine-tuning of the suggestion

generation mechanism should avoid this type of

mismatches.

The lab demonstration was used here to

demonstrate viability of our method, to detail the

different steps and provide a concrete case. It shows

that the suggestion generation algorithm indeed

provides useful suggestions to the modeller, and

allows (automatic) annotations of the model, thereby

semantically grounding them and facilitating model

integration. It needs to be mentioned that the lab

demonstration was done using a single modeller, and

that therefore the aforementioned positive

indications of using our method cannot be

statistically proven. We are currently performing a

more elaborate empirical validation, where a group

of 30 test users is divided in three different groups:

one group is given an ESO and our method, the

second group is only given the ESO but without

support of our method, and the last group is not

given an ESO and thus needs to model without any

ontology or method support. The experiment is

specifically designed to show the impact of our

model on modelling efficiency, consistency in the

use of terminology, and the semantic grounding of

the resulting models.

5 CONCLUSIONS AND FUTURE

WORK

In this paper, we detail a suggestion generation

algorithm for BPMN modelling based on an

enterprise-specific ontology (ESO), and showed how

using our modelling approach allows to

automatically annotate the BPMN models with

ontology concepts. This work is part of a larger

ongoing project, which aims to explore the

symbiotic relationship between ontology modelling

on one hand, and business modelling on the other

hand. The suggestion generation algorithm utilizes

four matching mechanisms to derive suggestions

from an ESO. Two of them, the string and synonym

matching mechanisms, are based on the label of the

newly created BPMN element, which is

systematically compared with concepts in the ESO.

The other two, namely construct matching and

neighbourhood-based matching, depend on the type

of the BPMN construct and the position (relative to

other modelling elements) where it is added. A core

ontology, in which the ESO is grounded and with

which the modelling language (BPMN) was

analysed, proves invaluable for these techniques.

Every matching mechanism assigns a relevance

score to every ESO concept; the final relevance

score is calculated based on the weighted average of

scores assigned by every mechanism. This final

relevance score forms the basis for prioritizing ESO

concepts in the suggestion list, which is offered to

the modeller as he is modelling.

Offering the modeller with ESO-based

suggestions aids the modeller, facilitates the

modelling process, promoted cross-model re-use of

ESO concepts, allows model annotation and

ultimately, facilitates model integration.

Future work will follow different directions. First,

we are currently performing further empirical

validation of the benefits of our method. Second,

suggestions towards the ontology (e.g., missing

concepts) based on the modelling process, and

subsequent community-based ontology evolution,

needs to be explored. Finally, we also plan to apply

the meta-method for other modelling languages (i.e.

i*, KAOS), and using other core ontologies.

REFERENCES

Barcellos, M. P. Falbo, R., Dal Moro, R., 2010. A well-

founded software measurement ontology. 6

th

International Conference on Formal Ontology in

Information Systems (FOIS 2010), (vol. 209, pp. 213-

226).

Becker, J., Rosemann, M., Uthmann, C. 2000. Guidelines

of business process modeling. In W. Aalst, J. Desel, &

A. Oberweis (Eds.), Business Process Management

SE - 3 (Vol. 1806, pp. 30–49). Springer Berlin

Heidelberg.

Bera, P., Burton-Jones, A., & Wand, Y., 2011. Guidelines

for designing visual ontologies to support knowledge

identification. Mis Quarterly, 35(4), pp. 883–908.

Euzenat, J., Shvaiko, P., 2013. Ontology Matching. Berlin,

Heidelberg: Springer Berlin Heidelberg.

Fox, M. S., 1992. The TOVE Project: Towards a common-

sense model of the enterprise. (F. Belli & F. J.

Radermacher, Eds.) Industrial and Engineering

Applications of Artificial Intelligence and Expert

Systems. Berlin, Germany: Springer-Verlag.

Fox, M., Gruninger, M., 1997. On ontologies and

SupportingProcessModelDevelopmentwithEnterprise-SpecificOntologies

247

enterprise modelling. Enterprise Engineering and

Integration. pp 190-200. Springer Berlin Heidelberg.

Francescomarino, C., Tonella, P., 2009. Supporting

ontology-based semantic annotation of business

processes with automated suggestions. In T. Halpin, J.

Krogstie, S. Nurcan, E. Proper, R. Schmidt, P. Soffer,

& R. Ukor (Eds.), Enterprise, Business-Process and

Information Systems Modeling SE - 18 (Vol. 29, pp.

211–223). Springer Berlin Heidelberg.

Gailly, F., Laurier, W., Poels, G., 2008. Positioning and

formalizing the REA enterprise ontology. Journal of

Information Systems, 22(2), 219.

Guizzardi, G., Wagner, G., 2008. What’s in a relationship:

An ontological analysis. Lecture Notes in Computer

Science, 5231, pp. 83–97.

Guizzardi, G., Wagner, G., 2011. Can BPMN be used for

making simulation models? In J. Barjis, T. Eldabi, &

A. Gupta (Eds.), Enterprise and Organizational

Modeling and Simulation SE - 8 (Vol. 88, pp. 100–

115). Springer Berlin Heidelberg.

Haller, A., Gaaloul, W., Marmolowski, M., 2008. Towards

an XPDL compliant process ontology. Services - Part

I, 2008. IEEE Congress on.

Klein, M., Bernstein, A., 2001. Searching for services on

the semantic web using process ontologies. In

Proceedings of the International Semantic Web

Working Symposium (pp. 1–16).

Leopold, H., 2013. Natural Language in Business Process

Models. Springer Berlin / Heidelberg.

Liao, Y., Lezoche, M., Loures, E., 2013. Semantic

enrichment of models to assist knowledge

management in a PLM environment. On the Move

toMeaningful Internet Systems, pp. 267–274.

Lin, Y., Krogstie, J., 2010. Semantic annotation of process

models for facilitating process knowledge

management. International Journal of Information

System Modeling and Design, 1(3), pp. 45–67.

Lin, Y., Strasunskas, D., Hakkarainen, S., Krogstie, J.,

Solvberg, A., 2006. Semantic annotation framework to

manage semantic heterogeneity of process models. (E.

Dubois & K. Pohl, Eds.)Advanced Information

Systems Engineering, 4001, pp. 433–446.

Miller, G., 1995. WordNet: a lexical database for English.

Communications of the ACM, 38(11), 39–41.

OMG., 2006. Ontology definition metamodel: OMG

Adopted Specification (ptc/06-10-11). Object

Management Group.

Schlenoff, C., Ivester, R., Knutilla, A., 1998. A robust

process ontology for manufacturing systems. In

Proceedings of 2 nd International Conference on

Engineering Design and Automation.

Sonnenberg, C., Huemer, C., Hofreiter, B., Mayrhofer, D.,

Braccini, A., 2011. The REA-DSL: A domain specific

modeling language for business models advanced

information systems engineering. In H. Mouratidis &

C. Rolland (Eds.), Lecture Notes in Computer Science

6741 (Vol. LNCS 6741, pp. 252–266). Springer Berlin

/ Heidelberg.

Uschold, M., King, M., Moralee, S., Zorgios, Y., 1998.

The enterprise ontology. The Knowledge Engineering

Review: Special Issue on Putting Ontologies to Use,

13(1), pp. 31–89.

Winkler, W., 1990. String comparator metrics and

enhanced decision rules in the Fellegi-Sunter model of

record linkage. In Proceedings of the Section on

Survey Research Methods, American Statistical

Association.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

248